Global Chlor-Alkali Market Size, Share Analysis Report By Product (Caustic Soda, Chlorine, Soda Ash), By Production Process (Membrane Cell, Diaphragm Cell, Others), By Application (Pulp and Paper, Organic Chemical, Inorganic Chemical, Soap and Detergent, Alumina, Textile, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153197

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

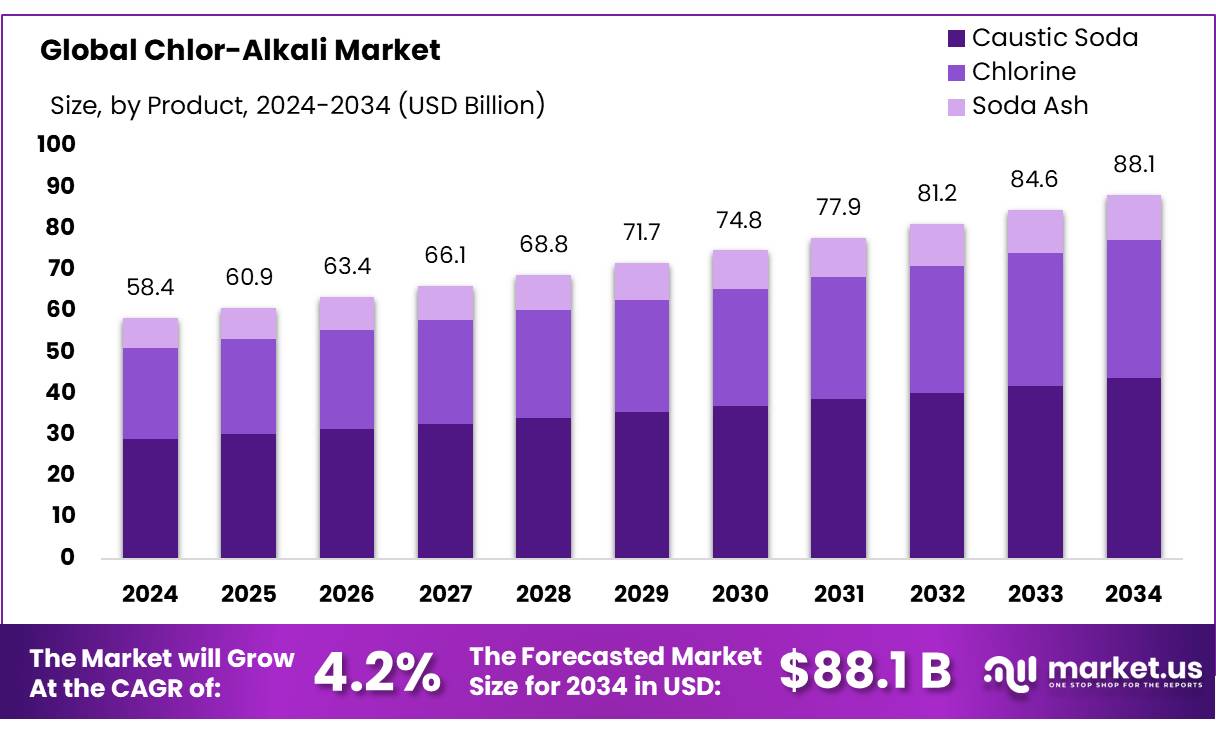

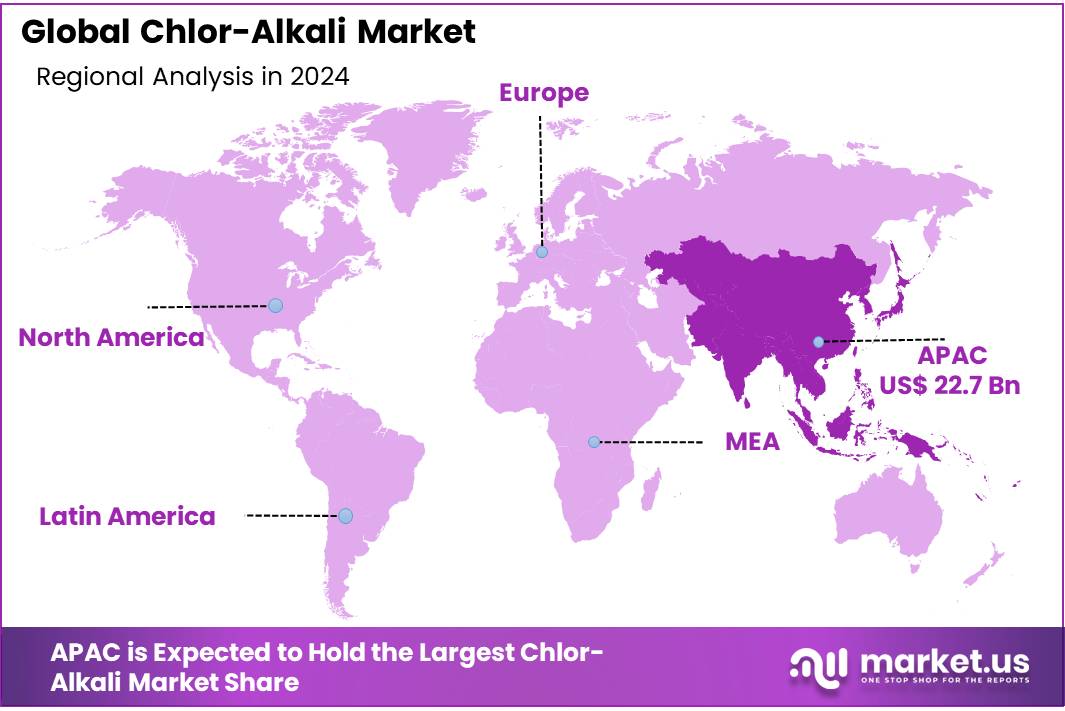

The Global Chlor-Alkali Market size is expected to be worth around USD 88.1 Billion by 2034, from USD 58.4 Billion in 2024, growing at a CAGR of 4.2% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific (APAC) held a dominant market position, capturing more than a 38.9% share, holding USD 22.7 Billion revenue.

The chlor-alkali process involves the electrolysis of sodium chloride brine to produce chlorine (Cl2), caustic soda (NaOH), and hydrogen (H2). These outputs serve as foundational raw materials for a wide range of industries, including water treatment, pulp and paper, textiles, chemicals, pharmaceuticals, and the production of PVC, detergents, and bleach. In 2022, global chlorine production via this method reached approximately 97 million tonnes, illustrating its monumental scale. Industrial-scale operations typically consume around 2,500 kWh of electricity per tonne of NaOH, highlighting the process’s energy intensity.

Driving factors underpinning growth include rapid urbanization, increased focus on potable water and wastewater treatment, and expanding demand in downstream industries such as PVC, alumina, textiles, and disinfectants. In India, sectors like pulp & paper, textiles, and alumina are growing at CAGRs of approximately 8–9%, directly boosting caustic soda consumption.

Governments globally have enacted policies to phase out mercury based production methods and incentivize safer, more efficient membrane technologies. The European Union and United States Environmental Protection Agency (EPA) have imposed strict mercury regulations, while incentive programs like India’s National Programme on Use of Membrane Cells offer tax credits and reduced tariffs to modernize chlor-alkali plants. India’s chemical sector contributed around 7% to GDP in 2022 and ranked as the world’s sixth largest chemical producer, underscoring national importance.

Environmental and safety regulations have accelerated the phase-out of mercury-cell technology. In the U.S., by 2020 nearly all facilities transitioned to membrane or diaphragm cells, with mercury cells reduced to 0.5% of capacity. This conversion aligns with national initiatives to phase out mercury, such as the Mercury Monitoring and Mitigation Act aiming to eliminate mercury-cell chlor-alkali by 2012, and a 92% reduction in mercury use from 1990–2006 amid voluntary industry commitments.

Key Takeaways

- The global chlor-alkali market is projected to grow from USD 58.4 billion in 2024 to USD 88.1 billion by 2034, registering a CAGR of 4.2% during the forecast period.

- Caustic soda led the product segment, holding a 49.6% share of the total chlor-alkali market in 2024, due to its wide industrial usage.

- Membrane cell technology dominated the production process category, accounting for more than 59.5% share of global chlor-alkali output, driven by its energy efficiency and environmental safety.

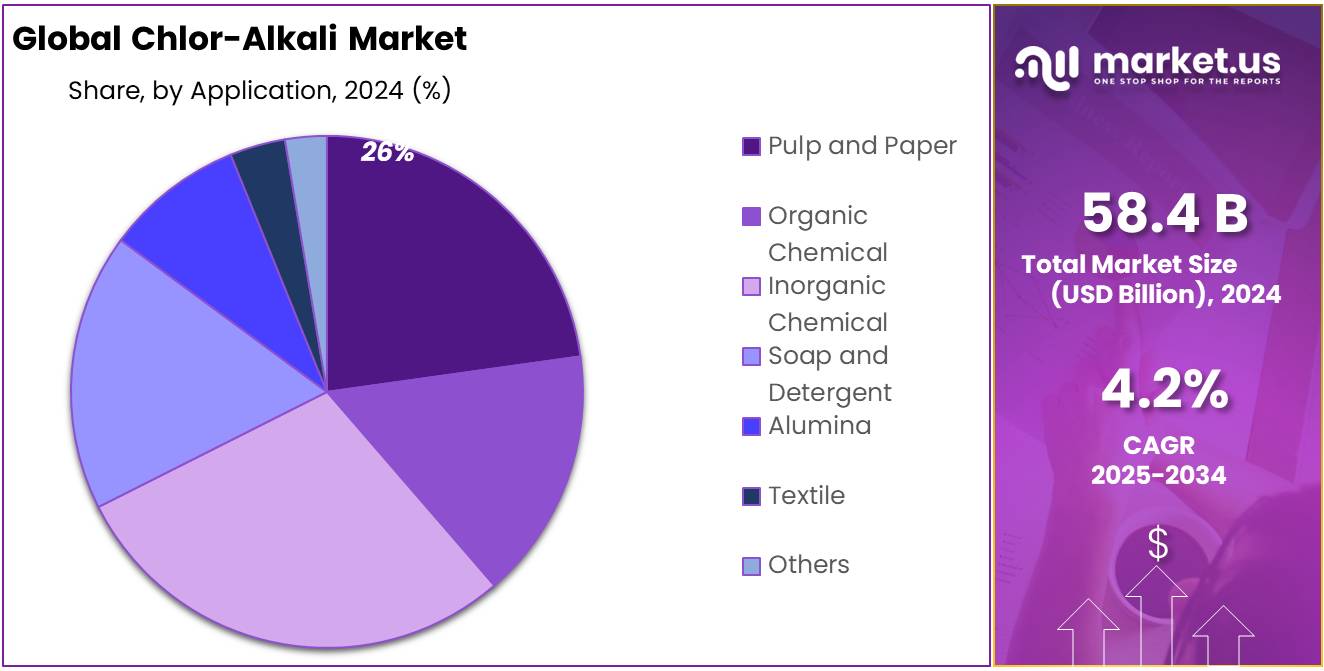

- Pulp and paper applications remained the largest end-use segment, with a 26.7% market share, reflecting consistent demand for caustic soda and chlorine in the paper-making process.

- Asia-Pacific (APAC) emerged as the dominant regional market in 2024, representing 38.9% of global share and reaching a market size of approximately USD 22.7 billion, supported by strong industrial and infrastructure development.

By Product Analysis

Caustic Soda dominates with 49.6% share due to its wide industrial demand.

In 2024, Caustic Soda held a dominant market position, capturing more than a 49.6% share of the total chlor-alkali market. This strong performance is largely due to its extensive usage across various industries, including paper and pulp, textiles, water treatment, soaps and detergents, and alumina production. Its role as a key chemical base in numerous manufacturing processes has ensured steady demand from both mature and emerging economies.

The product’s reliability in neutralizing acids, refining petroleum, and processing food products further contributes to its industrial importance. With increasing investments in infrastructure, water sanitation, and basic chemicals manufacturing—particularly in Asia-Pacific—the demand for caustic soda is expected to remain high through 2025, supporting its sustained leadership in the chlor-alkali market.

By Production Process Analysis

Membrane Cell leads with 59.5% share due to its energy efficiency and cleaner output.

In 2024, Membrane Cell held a dominant market position, capturing more than a 59.5% share of the global chlor-alkali market by production process. This leadership is mainly driven by the method’s lower energy consumption, environmental benefits, and ability to produce high-purity caustic soda without mercury or asbestos contamination.

As industries across the world move towards more sustainable and eco-friendly technologies, membrane cell systems have increasingly replaced older diaphragm and mercury-based methods. Governments have also supported this shift through energy efficiency mandates and environmental regulations that discourage harmful emissions. In 2025, the adoption of membrane technology is expected to grow even further, especially in regions focused on clean manufacturing, keeping it at the forefront of chlor-alkali production processes.

By Application Analysis

Pulp and Paper dominates with 26.7% share driven by strong industrial demand and chemical use.

In 2024, Pulp and Paper held a dominant market position, capturing more than a 26.7% share of the global chlor-alkali market by application. This leadership reflects the large-scale use of caustic soda and chlorine in pulp bleaching, paper processing, and fiber treatment. As global demand for paper-based packaging and hygiene products continues to grow—especially in Asia-Pacific and North America—the consumption of chlor-alkali products in this sector remains strong.

The ongoing shift toward recyclable and biodegradable packaging materials further supports the steady growth of the pulp and paper industry. Moving into 2025, this segment is expected to retain its top position as manufacturers focus on cleaner production techniques and chemical efficiency to meet environmental regulations and rising consumer demand.

Key Market Segments

By Product

- Caustic Soda

- Chlorine

- Soda Ash

By Production Process

- Membrane Cell

- Diaphragm Cell

- Others

By Application

- Pulp and Paper

- Organic Chemical

- Inorganic Chemical

- Soap and Detergent

- Alumina

- Textile

- Others

Emerging Trends

Shift Toward Sustainable, Low Carbon Chlor-Alkali Production

A major trend reshaping the chlor-alkali industry is the rapid move toward sustainable, low-carbon production methods—driven not only by environmental concerns but also by demand from food and packaging industries. Companies are adopting greener technologies that reduce carbon emissions and ensure safer inputs in food contact applications.

In 2024, global chlorine volumes reached an estimated 90–100 million metric tons, with a market size of about USD 40–45 billion. Analysts forecast steady annual growth of 4–6% over the coming decade, largely due to increased water treatment, sanitation, and specialty material needs. But what stands out is not just growth—it’s how chlorine is produced.

Besides corporate initiatives, governments are stepping up. The European Green Deal and the U.K.’s Net Zero Strategy both offer incentives for cleaner chemical manufacturing. In India, facilities upgrading to membrane cell technology—commonly powered by renewable energy—now receive reduced energy tariffs and faster clearances. This reflects a global push: by 2030, over 50% of new chlor-alkali plants are expected to use low-carbon membrane electrolysis instead of older diaphragm or mercury cells.

Leading companies, like INEOS Inovyn, are rolling out Ultra Low Carbon (ULC) caustic soda and chlorine, cutting CO2 emissions by up to 70% compared with traditional methods by using renewable energy sources. This aligns with stricter food industry expectations—especially in hygiene-sensitive sectors like fresh produce and packaged foods—where active chlorine is used under FAO/WHO guidelines to reduce pathogens while maintaining safety and minimizing harmful by products.

Drivers

Rising Demand from the Food Processing Industry Driving Chlor-Alkali Market Growth

One of the biggest forces behind the increasing demand for chlor-alkali chemicals—especially caustic soda (sodium hydroxide)—is the expanding food and beverage processing sector. Caustic soda plays a critical role in food manufacturing processes, such as peeling fruits and vegetables, cocoa processing, poultry cleaning, and soft drink production. As food safety standards become more stringent, the need for effective cleaning and sanitation chemicals continues to grow—creating a dependable demand for caustic soda.

According to data from the U.S. Department of Agriculture (USDA), the value of U.S. food industry shipments reached US$1.19 trillion in 2022, a 9.8% increase from the previous year. The same report also highlights significant growth in food manufacturing, especially processed foods, which often rely on chlor-alkali chemicals during production and cleaning stages. As countries like India and China ramp up food production to meet the demands of growing urban populations, their use of caustic soda and chlorine in food processing is also seeing an upward trend.

Furthermore, the Food and Agriculture Organization (FAO) notes that global food consumption is expected to rise by 70% by 2050, driven by rising incomes, population growth, and urbanization. This growth will directly impact the demand for chlor-alkali inputs across multiple points in the food value chain—from raw ingredient cleaning to packaging sanitation.

Government bodies in regions like the European Union and North America are also encouraging better hygiene practices and sustainability in food production. These regulations, such as the EU’s hygiene package and the FDA’s Food Safety Modernization Act (FSMA), indirectly push the industry toward chemicals that support clean and compliant operations—again highlighting the importance of chlor-alkali derivatives.

Restraints

Environmental and Health Concerns Surrounding Mercury-Based Chlor-Alkali Production

One of the biggest challenges facing the chlor-alkali industry is the environmental impact of traditional production methods, particularly the mercury cell process. Although newer technologies like membrane cells are gaining traction, many older facilities—especially in developing countries—still use mercury-based methods that release toxic byproducts. These emissions pose serious health risks to workers and surrounding communities, and they contaminate food chains, freshwater systems, and agricultural lands.

According to the United Nations Environment Programme (UNEP), industrial processes, including mercury-based chlor-alkali production, contribute to approximately 1,960 tonnes of global mercury emissions annually. Of this, mercury cell chlor-alkali plants were responsible for nearly 40 tonnes in 2021. These emissions have been linked to mercury contamination in seafood, which directly impacts the food industry. For example, the World Health Organization (WHO) warns that over 70% of mercury exposure in humans comes from eating contaminated fish, raising public health concerns and prompting stricter controls on chemical use in food-related industries.

Governments around the world are responding with strong regulatory actions. Under the Minamata Convention on Mercury, more than 140 countries—including the U.S., EU members, and China—have pledged to phase out mercury-based chlor-alkali production. The European Commission enforced a complete ban on mercury cell technology by the end of 2017, and similar policies are being adopted across Asia and Latin America.

Opportunity

Rising Demand for Food-Grade Packaging Materials Opens Growth Path for Chlor-Alkali

One promising growth opportunity for the chlor-alkali industry lies in the surging demand for food-grade packaging. Chlorine, one of the core outputs of the chlor-alkali process, is vital in the production of polyvinyl chloride (PVC), a material widely used in food packaging due to its excellent barrier properties and flexibility. As food safety standards tighten and shelf-life expectations rise, the global need for safe, durable packaging continues to grow—driving demand for chlorine-based materials.

According to the Food and Agriculture Organization (FAO), global food loss due to inadequate packaging and storage is a critical concern, especially in low- and middle-income countries. FAO data estimates that roughly 14% of food produced globally is lost between harvest and retail, and improved packaging is one of the key strategies suggested to reduce this waste. This urgency opens a window for chlorine-derived materials to play a larger role in safer, longer-lasting packaging solutions that comply with international standards.

Meanwhile, government bodies are stepping up investments and reforms to promote hygienic packaging, especially post-COVID. For example, the Indian Ministry of Food Processing Industries (MoFPI) launched the PMFME Scheme (Pradhan Mantri Formalisation of Micro Food Processing Enterprises) to modernize food processing units, which includes upgrading packaging materials to safer, food-grade standards. In turn, this has increased the domestic demand for packaging films, containers, and linings made using PVC and other chlorine-based derivatives.

Regional Insights

In 2024, the Asia-Pacific (APAC) region emerged as the leading market for chlor-alkali products, accounting for a dominant 38.9% share and reaching a market value of approximately USD 22.7 billion. This strong regional performance is primarily driven by rapid industrial growth, expanding manufacturing activities, and robust demand from key end-use sectors such as textiles, paper and pulp, construction, and chemicals.

China continues to lead the regional chlor-alkali production, fueled by its strong PVC, water treatment, and aluminum industries. The country’s large-scale infrastructure investments and its dominant position in global manufacturing make it a consistent consumer of chlorine and caustic soda. India, on the other hand, has witnessed notable growth due to rising consumption from the textile and detergent sectors, alongside policy-driven expansions in the water treatment industry. The government’s push through programs like the Jal Jeevan Mission, which aims to provide clean drinking water to rural households, has significantly boosted chlorine demand for disinfection and purification processes.

In Southeast Asia, increasing investment in food processing, packaging, and urban sanitation infrastructure is further supporting regional chlor-alkali consumption. Moreover, the widespread shift from mercury cell to membrane cell technology, promoted by both regulatory frameworks and energy efficiency goals, has strengthened production efficiency in key markets across APAC.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Olin Corporation remains a key player in the global chlor-alkali market, leveraging its integrated production capabilities across North America. The company is one of the largest producers of chlorine and caustic soda, supplying critical volumes to sectors like water treatment, pulp and paper, and plastics manufacturing. Olin operates multiple membrane cell-based facilities to meet growing demand while reducing environmental impact. Its strategic partnerships and consistent reinvestment in technology enable it to maintain a strong competitive position across global markets.

Tata Chemicals Limited is a leading player in India’s chlor-alkali market, with a strong focus on caustic soda and soda ash production. Its key facilities in Mithapur and other parts of India support domestic industries such as textiles, detergents, and water treatment. The company has invested in green energy and advanced membrane technologies to improve operational efficiency. Backed by Tata Group’s broad industrial presence, Tata Chemicals continues to expand its footprint in both domestic and international markets through product innovation and capacity expansion.

Occidental Petroleum Corporation, through its subsidiary OxyChem, is a major chlor-alkali producer in the United States. The company serves a broad range of end-use sectors, including pharmaceuticals, food processing, and plastics. OxyChem operates one of the largest membrane cell systems in North America and focuses on producing chlorine and caustic soda with reduced environmental impact. Occidental’s scale, combined with a focus on safety, regulatory compliance, and operational excellence, supports its long-term presence and influence within the chlor-alkali industry.

Top Key Players Outlook

- Olin Corporation

- Westlake Chemical Corporation

- Tata Chemicals Limited

- Occidental Petroleum Corporation

- Formosa Plastics Corporation

- Solvay SA

- Tosoh Corporation

- Hanwha Solutions Corporation

- AGC, Inc.

- Dow Inc.

- Xinjiang Zhongtai Chemical Co. Ltd.

- INOVYN

- Wanhua-Borsodchem

Recent Industry Developments

In 2024, Olin Corporation derived 55% of its total revenue from its Chlor-Alkali Products & Vinyls segment, translating into approximately USD 3.5–4 billion in sales.

In FY 2023–24, Tata Chemicals Limited reported consolidated revenue of ₹14,887 Cr, marginally lower than ₹15,421 Cr in the previous fiscal year, with ₹479 Cr profit from continuing operations.

Report Scope

Report Features Description Market Value (2024) USD 58.4 Bn Forecast Revenue (2034) USD 88.1 Bn CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Caustic Soda, Chlorine, Soda Ash), By Production Process (Membrane Cell, Diaphragm Cell, Others), By Application (Pulp and Paper, Organic Chemical, Inorganic Chemical, Soap and Detergent, Alumina, Textile, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Olin Corporation, Westlake Chemical Corporation, Tata Chemicals Limited, Occidental Petroleum Corporation, Formosa Plastics Corporation, Solvay SA, Tosoh Corporation, Hanwha Solutions Corporation, AGC, Inc., Dow Inc., Xinjiang Zhongtai Chemical Co. Ltd., INOVYN, Wanhua-Borsodchem Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Olin Corporation

- Westlake Chemical Corporation

- Tata Chemicals Limited

- Occidental Petroleum Corporation

- Formosa Plastics Corporation

- Solvay SA

- Tosoh Corporation

- Hanwha Solutions Corporation

- AGC, Inc.

- Dow Inc.

- Xinjiang Zhongtai Chemical Co. Ltd.

- INOVYN

- Wanhua-Borsodchem