Global Charcoal Market Size, Share, And Enhanced Productivity By Type (Lump Charcoal, Charcoal Briquettes, Japanese Charcoal, Sugar Charcoal, Others), By Sustainability (Sustainable Charcoal, Conventional Charcoal, Others), By Source (Bamboo, Coconut Shells, Hardwood, Softwood, Others),By Application (Metallurgical Fuel, Barbeque, Filtration, Healthcare, Construction, Others), By End User (Residential, Commercial, Industrial), By Distribution Channel (Supermarkets, Convenience Stores, Specialty Stores, Online Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 178806

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Type Analysis

- By Sustainability Analysis

- By Source Analysis

- By Application Analysis

- By End User Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

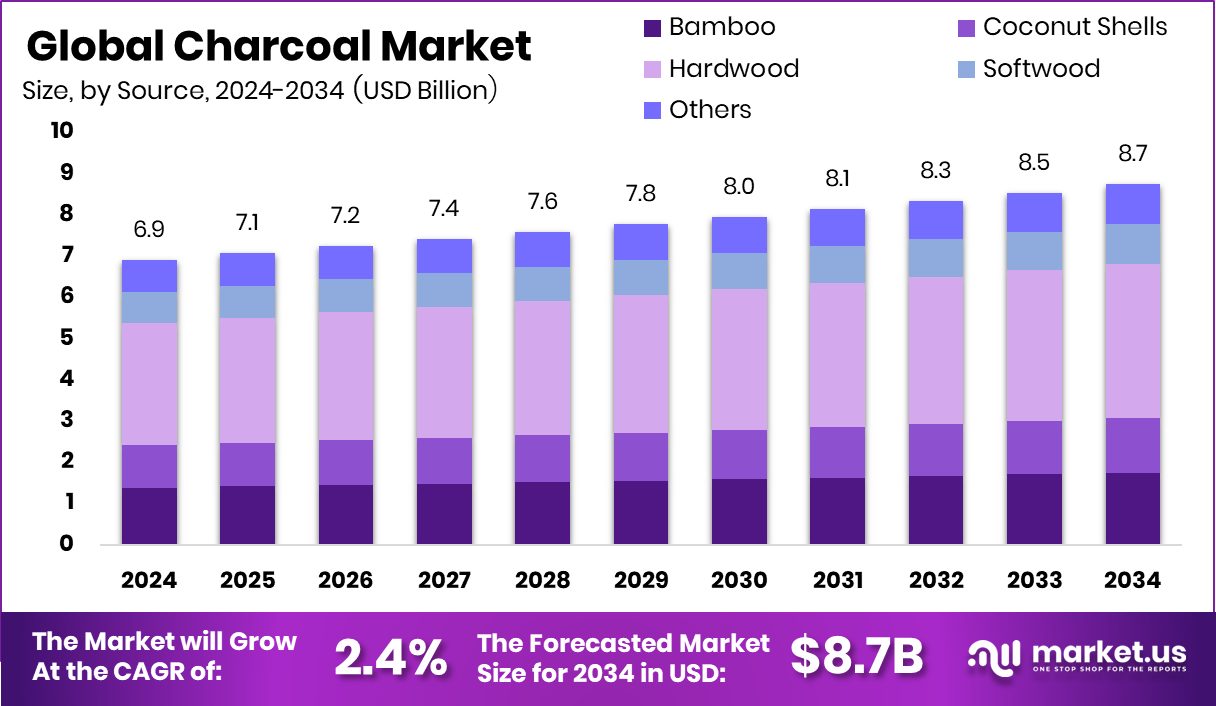

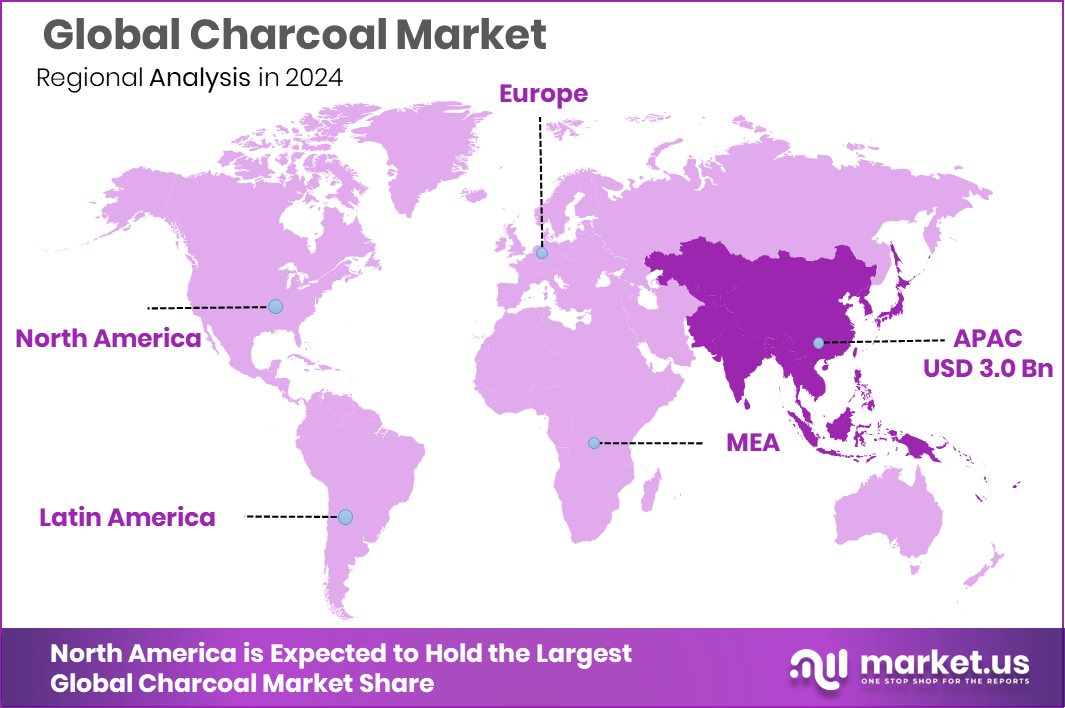

The Global Charcoal Market is expected to be worth around USD 8.7 billion by 2034, up from USD 6.9 billion in 2024, and is projected to grow at a CAGR of 2.4% from 2025 to 2034. The region Asia Pacific recorded 44.6% market share totaling USD 3.0 Bn.

The charcoal market covers a wide range of product types, including lump charcoal, charcoal briquettes, Japanese charcoal, sugar charcoal, and several specialty forms used across households and industries. Within sustainability, the market spans both sustainable and conventional charcoal options, reflecting different production methods and environmental considerations.

Charcoal is sourced from bamboo, coconut shells, hardwood, softwood, and other organic materials that undergo controlled carbonization. Its uses stretch across metallurgical fuel, barbeque, filtration, healthcare, and construction, supported by demand from residential, commercial, and industrial users. Distribution takes place through supermarkets, convenience stores, specialty stores, and online platforms.

Charcoal is a solid, carbon-rich material created by heating wood or other biomass in the absence of oxygen. This process removes moisture and volatile compounds, leaving behind a dense fuel that burns hotter and cleaner than raw wood. It has been used for centuries in cooking, metallurgy, water filtration, and traditional medicine. Modern production methods allow charcoal to be made from agricultural waste, shells, and sustainable forest residues.

The charcoal market represents the global trade and consumption of charcoal products used for heating, cooking, industrial operations, and specialized applications. It includes raw charcoal, briquettes, premium varieties, and specialized charcoal types designed for filtration, metallurgy, and construction. Market activity is shaped by consumer lifestyles, industrial requirements, agricultural practices, and an increasing focus on cleaner, renewable forms of solid fuel.

Charcoal demand is strengthened by steady use in household cooking and barbecue culture, along with its role in metal processing, cement operations, and water treatment. Growth is supported by new projects encouraging sustainable charcoal production. For example, three regions stand to benefit from a Sh2.6 billion rice husk charcoal project, which highlights the shift toward using agricultural waste instead of natural forests. Such initiatives create new supply sources and improve long-term sustainability.

Funding also plays a role in shaping opportunities. Lincoln was awarded $400,000 for a biochar initiative, supporting research into advanced carbon materials and their environmental uses. In Nigeria, FUNAAB received a £300,000 grant from the UK to study charcoal-induced cancer risks, drawing attention to safe production and healthier practices. These efforts guide the future direction of regulated charcoal industries.

Large-scale development programs also encourage stronger charcoal alternatives. An ambitious fund aimed at connecting 300 million Africans to reliable, cleaner energy by 2030 indirectly boosts demand for sustainable charcoal and biochar as transitional fuels. Together, these developments create opportunities in alternative raw materials, improved kilns, higher-value applications, and cleaner fuel solutions that complement evolving energy needs.

Key Takeaways

- The Global Charcoal Market is expected to be worth around USD 8.7 billion by 2034, up from USD 6.9 billion in 2024, and is projected to grow at a CAGR of 2.4% from 2025 to 2034.

- Charcoal Market is dominated by Lump Charcoal at 34.7%, reflecting strong consumer preference.

- In the Charcoal Market, Conventional Charcoal leads with 67.1% share, indicating its widespread global usage.

- The Charcoal Market shows Hardwood as the dominant source at 42.9%, driven by premium fuel quality.

- Charcoal Market demand is highest in Barbeque applications with 48.4%, showcasing strong outdoor cooking trends.

- Within the Charcoal Market, Residential users dominate with 63.6%, fueled by a rising household grilling culture.

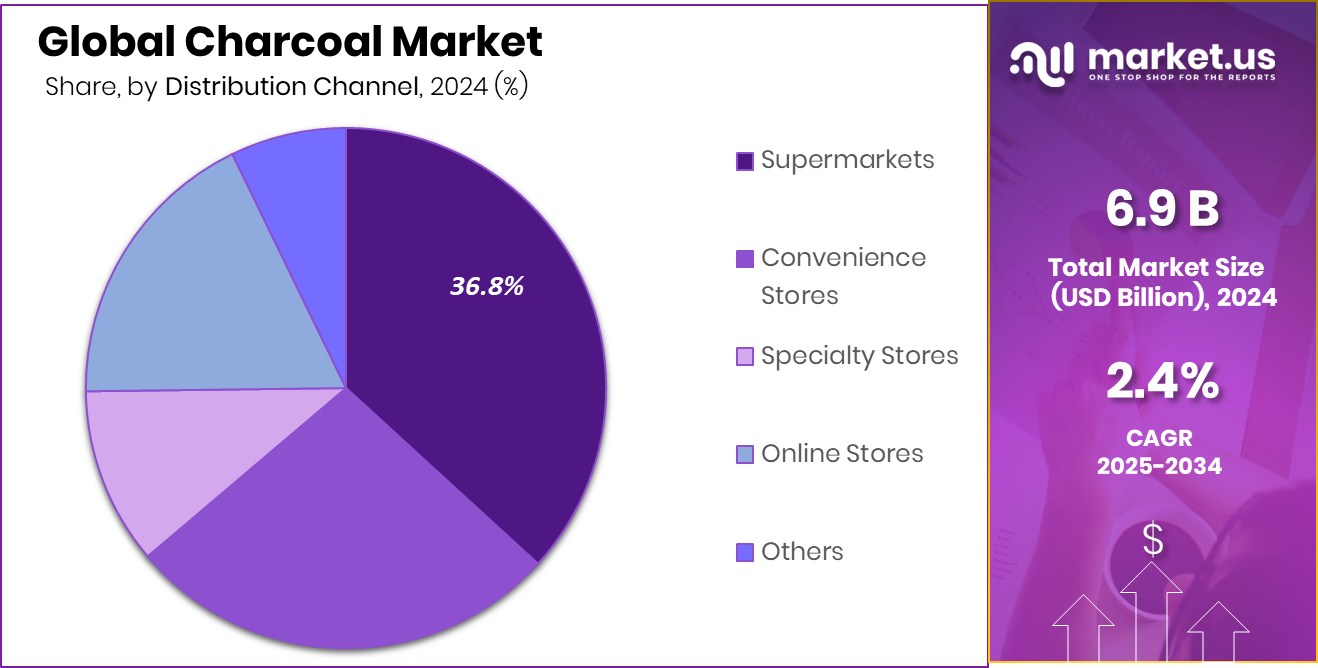

- Charcoal Market distribution is led by Supermarkets, holding 36.8%, emphasizing retail accessibility for consumers.

- In Asia Pacific, the Charcoal Market reached USD 3.0 Bn, capturing 44.6%.

By Type Analysis

Charcoal Market dominates in lump charcoal type with a strong 34.7% share.

In 2024, the Charcoal Market showed strong growth momentum as Lump Charcoal secured a leading 34.7% share, driven by rising consumer interest in natural and minimally processed fuel sources. Its higher heat output, low ash generation, and clean-burning properties helped it outperform alternative charcoal forms across household and commercial uses.

Growing global participation in outdoor grilling and premium barbecue culture also contributed to its dominance, especially in North America and Europe. Producers continued expanding supply chains to meet demand from eco-aware customers who prefer sustainably sourced hardwood variants. The expanding restaurant sector, along with rising lifestyle cooking trends, kept Lump Charcoal firmly ahead in the type segment, reinforcing its position as the most influential product category.

By Sustainability Analysis

Charcoal Market sees conventional charcoal leading sustainability preferences with 67.1% share.

In 2024, the Charcoal Market remained largely driven by Conventional Charcoal, which dominated with a substantial 67.1% share. This strong presence reflects its affordability, wide availability, and deep-rooted usage patterns across residential and small commercial sectors. Many households in developing regions continued to rely on traditional charcoal due to limited access to cleaner or premium fuel alternatives.

Despite the rising push for sustainable options, conventional production methods retained their hold, particularly in rural economies where charcoal remains a primary cooking fuel. Market players focused on improving kiln efficiency and sourcing practices to address environmental concerns. The continued reliance on established supply chains ensured that Conventional Charcoal maintained its commanding position within the sustainability segment.

By Source Analysis

Charcoal Market records hardwood as the dominant source segment at 42.9% share.

In 2024, the Hardwood segment led the Charcoal Market by Source, capturing a dominant 42.9% share as demand grew for high-density charcoal with superior burning characteristics. Hardwood-derived charcoal remained preferred among barbecue enthusiasts and professional chefs due to its consistent heat, longer burn time, and aromatic smoke profile. The segment benefited from rising international imports and expanding forestry management programs that ensured stable raw material availability.

Manufacturers increasingly promoted hardwood variants as premium choices for both domestic and hospitality applications. Regions with active outdoor cooking traditions, such as the U.S., Brazil, and parts of Europe, significantly boosted consumption. This sustained preference enabled Hardwood to remain the most influential and value-driven source category in the market.

By Application Analysis

Charcoal Market highlights barbeque applications dominating usage with a notable 48.4% share.

In 2024, the Barbeque segment dominated Charcoal Market applications with a notable 48.4% share, supported by the global surge in outdoor cooking, weekend grilling, and social dining experiences. Growing urban lifestyles and the popularity of backyard barbecue setups boosted retail charcoal sales, especially in developed markets. Restaurants specializing in grilled cuisine further expanded demand, selecting charcoal for its authentic flavor and high-heat performance.

Seasonal events, tourism, and rising participation in recreational cooking also strengthened segment growth. Manufacturers focused on offering eco-friendly packaging and quick-light variants tailored to barbecue users. With consumer preferences shifting toward experiential cooking, the barbeque segment continued to be the primary driver of charcoal consumption worldwide.

By End User Analysis

Charcoal Market shows residential end users leading consumption patterns with 63.6% share.

In 2024, Residential users held a commanding 63.6% share of the Charcoal Market, highlighting the importance of household cooking and leisure grilling in overall demand. Families increasingly adopted charcoal for flavor-rich barbecue meals, while many regions, particularly in Africa and Asia, continued using it as a daily cooking fuel due to affordability and easy accessibility. Rising interest in home-based outdoor activities strengthened consumption in suburban and rural markets.

At the same time, producers expanded product varieties—from traditional briquettes to premium hardwood lumps—to cater to varied household needs. Packaging innovations, portability, and growing online distribution also supported this segment’s dominance, solidifying residential consumption as the backbone of global charcoal demand.

By Distribution Channel Analysis

Charcoal Market features supermarkets as the dominant distribution channel, holding a 36.8% share.

In 2024, Supermarkets emerged as the leading distribution channel in the Charcoal Market with a 36.8% share, supported by higher product visibility, wide assortments, and consumer trust in organized retail. Shoppers preferred supermarkets for convenient access to multiple charcoal formats, quality-assured brands, and promotional deals.

Urbanization and growing retail chains across Asia, Europe, and the Americas further strengthened supermarket dominance. These stores also expanded shelf space for premium and eco-friendly charcoal variants as barbecue culture gained traction. Their role in offering consistent availability during peak grilling seasons made them the most influential sales channel. This steady consumer footfall ensured that supermarkets continued to drive bulk and impulse purchases in the global charcoal industry.

Key Market Segments

By Type

- Lump Charcoal

- Charcoal Briquettes

- Japanese Charcoal

- Sugar Charcoal

- Others

By Sustainability

- Sustainable Charcoal

- Conventional Charcoal

- Others

By Source

- Bamboo

- Coconut Shells

- Hardwood

- Softwood

- Others

By Application

- Metallurgical Fuel

- Barbeque

- Filtration

- Healthcare

- Construction

- Others

By End User

- Residential

- Commercial

- Industrial

By Distribution Channel

- Supermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

Driving Factors

Rising demand for natural sweeteners globally

The charcoal market continues to grow as barbeque cooking gains popularity in households, restaurants, and outdoor leisure spaces across many regions. This rise in culinary interest keeps charcoal in steady demand, especially in places where grilling is viewed as a weekend or social activity. At the same time, investment flows into emerging consumer platforms indirectly strengthen purchasing power and broader consumption activity.

A notable example is the funding where Tiger Global and Greycroft backed the Nigerian investment app Bamboo with a $15M round, improving financial access for young consumers and increasing household spending capacity. As disposable income improves in developing markets, demand for barbecue fuel products, including various charcoal types, continues to expand.

Restraining Factors

Limited sourcing of premium date varieties

Although demand remains healthy, the charcoal market faces pressure from environmental concerns, especially deforestation linked to uncontrolled wood harvesting. Many countries have tightened regulations on forest use, limiting raw material availability for charcoal manufacturers. Community-based restrictions, certification requirements, and forest protection rules slow production in some regions. Funding directed toward community programs and organizations also shows the growing attention to environmental balance.

For instance, Blue Bamboo will get $900,994 from Orange County, a project that indirectly highlights the increasing focus on sustainability and responsible resource management. This wider support for ecological protection adds further scrutiny to charcoal production practices, making regulatory compliance an ongoing restraining factor.

Growth Opportunity

Expanding use in functional food formulations

Opportunities for the charcoal market are widening as producers shift toward sustainable charcoal technologies and alternative raw materials. There is growing interest in bamboo charcoal, coconut-shell charcoal, rice-husk charcoal, and other agricultural waste-based options. These reduce pressure on natural forests while offering good burning performance. The interest in eco-friendly materials is supported by new funding in related sectors.

A strong example is Amwoodo raising $1 Mn from Zerodha-backed Rainmatter, a move that strengthens bamboo-based product development and signals rising investor confidence in natural material processing. Such investments open doors for charcoal producers to innovate, adopt cleaner kilns, diversify raw material sources, and reach markets looking for greener fuel options.

Latest Trends

Increasing shift toward instant date powder

A noticeable trend in the charcoal market is the shift toward eco-friendly and premium alternatives. Consumers increasingly look for products that offer clean burn, reduced smoke, and responsible sourcing. Bamboo-based charcoal, compressed briquettes from agricultural waste, and sustainably certified hardwood blocks are gaining stronger interest. The trend is reinforced by global initiatives promoting greener materials, such as gaming brand Razer launching a $50M green fund and backing a bamboo startup, which reflects investor interest in sustainable biomass solutions.

As funds flow into green product development, charcoal producers explore improved production techniques, innovative packaging, and low-carbon fuel options. These movements are shaping a modern charcoal market focused on responsible and performance-driven products.

Regional Analysis

Asia Pacific dominated the Charcoal Market with 44.6% share worth USD 3.0 Bn.

In 2024, the Charcoal Market showed distinct regional patterns, with Asia Pacific emerging as the dominant region, accounting for 44.6% of overall demand and generating USD 3.0 Bn in market value. This leadership reflects the region’s high population density, strong barbecue culture in emerging economies, and continued reliance on charcoal for household cooking in several developing nations.

North America displayed stable growth, supported by rising outdoor grilling activities and increased consumption of hardwood-based charcoal across the U.S. and Canada. Europe followed with steady demand driven by recreational barbeque usage and a preference for premium-quality charcoal products. In the Middle East & Africa, charcoal remained an essential household fuel, sustaining consistent market volumes across rural and semi-urban communities.

Latin America contributed steadily, benefiting from established barbecue traditions in countries like Brazil and Argentina, which supported regional consumption. Across all regions, shifting lifestyle trends and the continued relevance of charcoal for both traditional and leisure cooking reinforced overall market stability, with Asia Pacific maintaining a clear lead in both share and value.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Gryfskand sp. z o.o. continued to strengthen its role in the global charcoal landscape through its focus on consistent product quality and a structured production approach. The company’s long-standing experience in manufacturing industrial and consumer-grade charcoal positions it as a stable supplier for multiple downstream sectors. Analysts note that its emphasis on uniform briquette performance and controlled carbonization processes supports predictable output, which remains crucial for buyers who prioritize reliability. Gryfskand’s market perception is largely tied to its ability to maintain steady volumes and meet specifications in regions where industrial charcoal is still essential.

Jumbo Charcoal (Pty) Ltd showcased a strong operational stance in 2024 as one of the notable charcoal producers in Southern Africa. The company benefits from access to regional biomass resources and established export capability, enabling it to participate actively in both domestic and international supply channels. Analysts observe that Jumbo Charcoal’s business model is shaped around scalability and dependable sourcing, allowing it to serve markets that require consistent shipments. Its foothold in export-oriented demand aligns with global buyers seeking cost-efficient supply options.

Sagar Charcoal and Firewood Depot remained an important supplier within India’s charcoal ecosystem in 2024, supported by its wide product handling across charcoal and firewood categories. The company’s operations cater to household, commercial, and small-industrial users, reflecting broad utility in a market that still relies on traditional fuel forms. Analysts highlight that its strength lies in distribution reach and responsiveness to varied customer requirements. With stable domestic demand for heating, cooking, and small-scale industrial applications, Sagar Charcoal and Firewood Depot continued to maintain relevance as a flexible supplier capable of serving diverse end-use needs.

Top Key Players in the Market

- Gryfskand sp. z o.o.

- Jumbo Charcoal (Pty) Ltd

- Sagar Charcoal and Firewood Depot

- Ignite International, Ltd

- The Clorox Company

- Paraguay Charcoal

- Vina Global Imex Co., LTD

- Duraflame, Inc

- Royal Oak Enterprises, LLC

- Timber Charcoal Company LLC

Recent Developments

- In February 2025, Clorox’s Kingsford brand announced a new charcoal briquet product called “Beercoal”, created in partnership with Miller Lite. This product mixes real beer into the charcoal briquets to deliver a unique flavour and grilling experience for barbecue users. This launch reflects Clorox’s innovation within its charcoal fuel segment and its attempt to appeal to barbecue enthusiasts.

Report Scope

Report Features Description Market Value (2024) USD 6.9 Billion Forecast Revenue (2034) USD 8.7 Billion CAGR (2025-2034) 2.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Lump Charcoal, Charcoal Briquettes, Japanese Charcoal, Sugar Charcoal, Others), By Sustainability (Sustainable Charcoal, Conventional Charcoal, Others), By Source (Bamboo, Coconut Shells, Hardwood, Softwood, Others),By Application (Metallurgical Fuel, Barbeque, Filtration, Healthcare, Construction, Others), By End User (Residential, Commercial, Industrial), By Distribution Channel (Supermarkets, Convenience Stores, Specialty Stores, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Gryfskand sp. z o.o., Jumbo Charcoal (Pty) Ltd, Sagar Charcoal and Firewood Depot, Ignite International, Ltd, The Clorox Company, Paraguay Charcoal, Vina Global Imex Co., LTD, Duraflame, Inc, Royal Oak Enterprises, LLC, Timber Charcoal Company LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Gryfskand sp. z o.o.

- Jumbo Charcoal (Pty) Ltd

- Sagar Charcoal and Firewood Depot

- Ignite International, Ltd

- The Clorox Company

- Paraguay Charcoal

- Vina Global Imex Co., LTD

- Duraflame, Inc

- Royal Oak Enterprises, LLC

- Timber Charcoal Company LLC