Global Catechin Market Size, Share, And Business Benefits By Type (Epicatechin, Epicatechin Gallate (ECG), Epigallocatechin (EGC), Epigallocatechin Gallate (EGCG), Others), By Source (Green Tea Catechins, Cocoa Catechins, Grape Catechins, Others), By Function (Antioxidants, Cardiovascular health, Weight management, Skin health, Anti-inflammatory, Brain health, Others), By Application (Functional Beverages, Functional Foods, Cosmetics and Skincare, Nutraceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152742

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

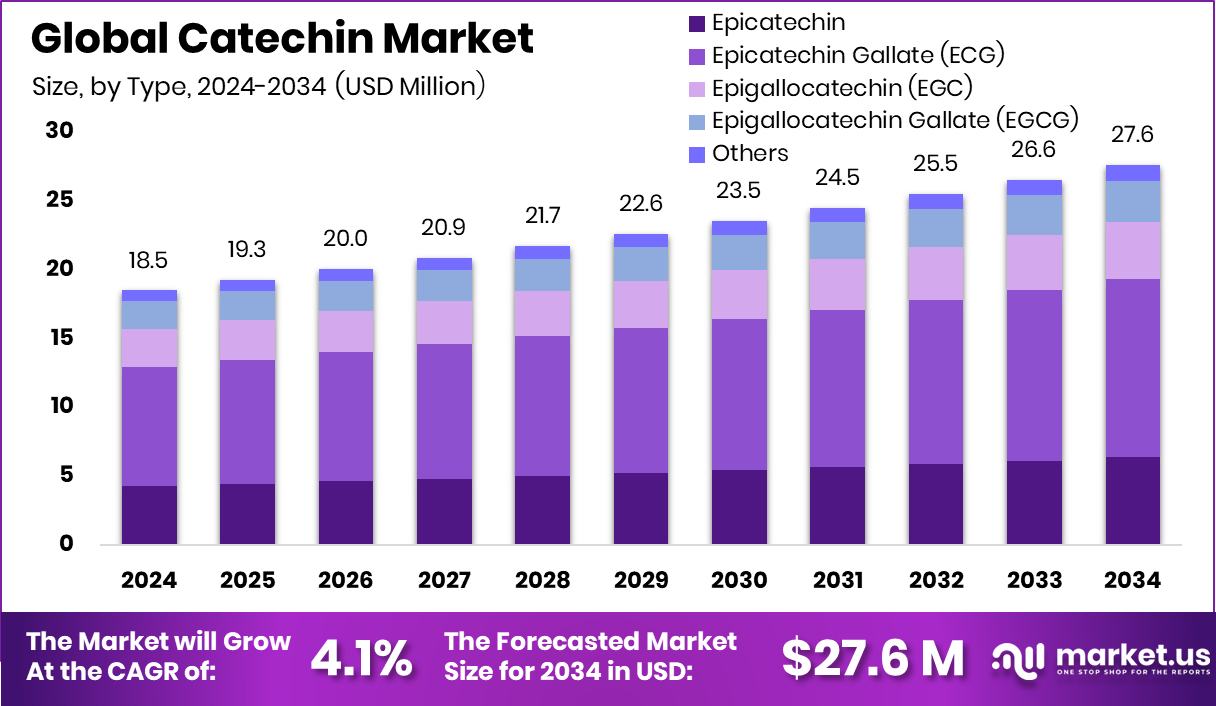

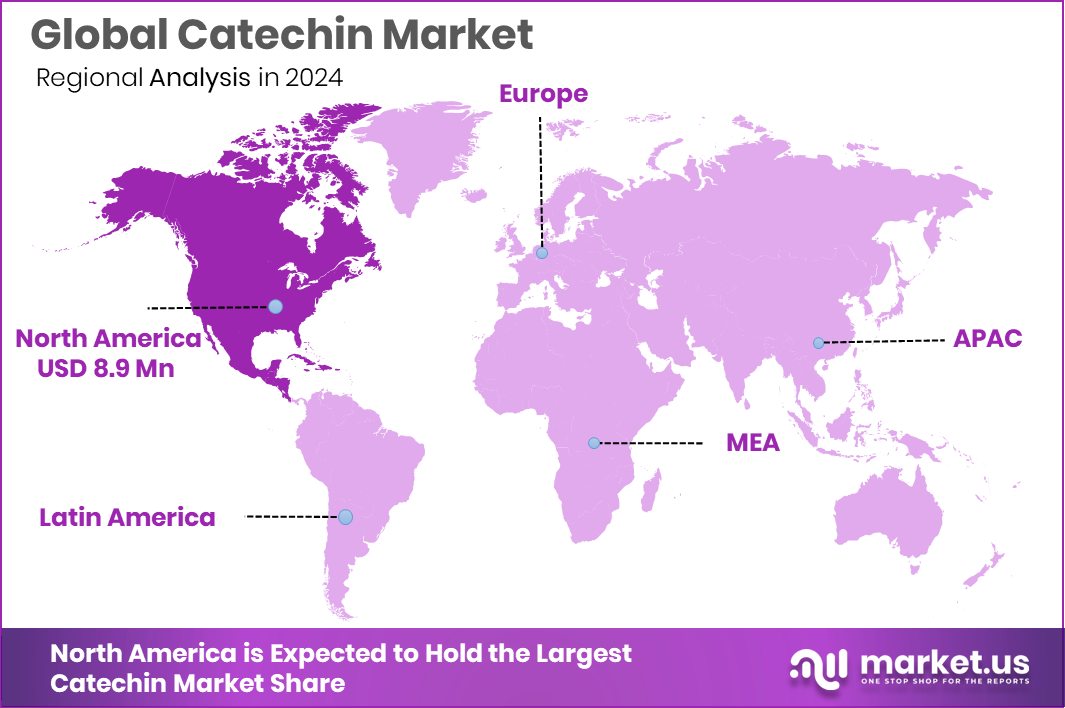

Global Catechin Market is expected to be worth around USD 27.6 Million by 2034, up from USD 18.5 Million in 2024, and grow at a CAGR of 4.1% from 2025 to 2034. Strong demand for natural antioxidants supported growth in North America’s USD 8.9 Mn catechin industry.

Catechin is a type of natural flavonoid compound widely found in tea leaves, cocoa, berries, and various fruits. It belongs to the group of polyphenols and is known for its potent antioxidant properties. Catechins are primarily associated with green tea, where they occur in high concentrations and contribute to its health-promoting qualities. These compounds play a crucial role in neutralizing free radicals, reducing oxidative stress, and supporting cardiovascular and metabolic health. Their presence also influences the flavor and astringency of certain beverages and foods.

The catechin market refers to the global trade and production of catechin-based ingredients used in food, beverages, pharmaceuticals, cosmetics, and dietary supplements. This market has witnessed consistent expansion due to rising consumer awareness about natural and functional ingredients. As health consciousness grows worldwide, catechins are being increasingly incorporated into various wellness products owing to their anti-inflammatory, anti-aging, and immune-supportive benefits.

Growth factors for the catechin market include the rising preference for natural antioxidants over synthetic additives. As more consumers turn toward organic and botanical alternatives, catechin-based ingredients have gained traction in functional foods, teas, and health supplements. Regulatory approvals and favorable research highlighting catechins’ health benefits also support market expansion.

Demand is being driven by lifestyle changes, especially in urban areas where stress, pollution, and poor dietary habits have increased interest in preventive healthcare. Catechins’ role in weight management, skin care, and cognitive function continues to attract attention, particularly among younger consumers and fitness-focused demographics seeking plant-derived wellness solutions.

Key Takeaways

- Global Catechin Market is expected to be worth around USD 27.6 Million by 2034, up from USD 18.5 Million in 2024, and grow at a CAGR of 4.1% from 2025 to 2034.

- Epicatechin Gallate (ECG) leads the Catechin Market by type, holding a 46.8% share.

- Green tea catechins dominate the market by source, contributing 62.1% of the global share.

- Antioxidant function drives demand, accounting for 33.9% of the catechin market’s functional segment.

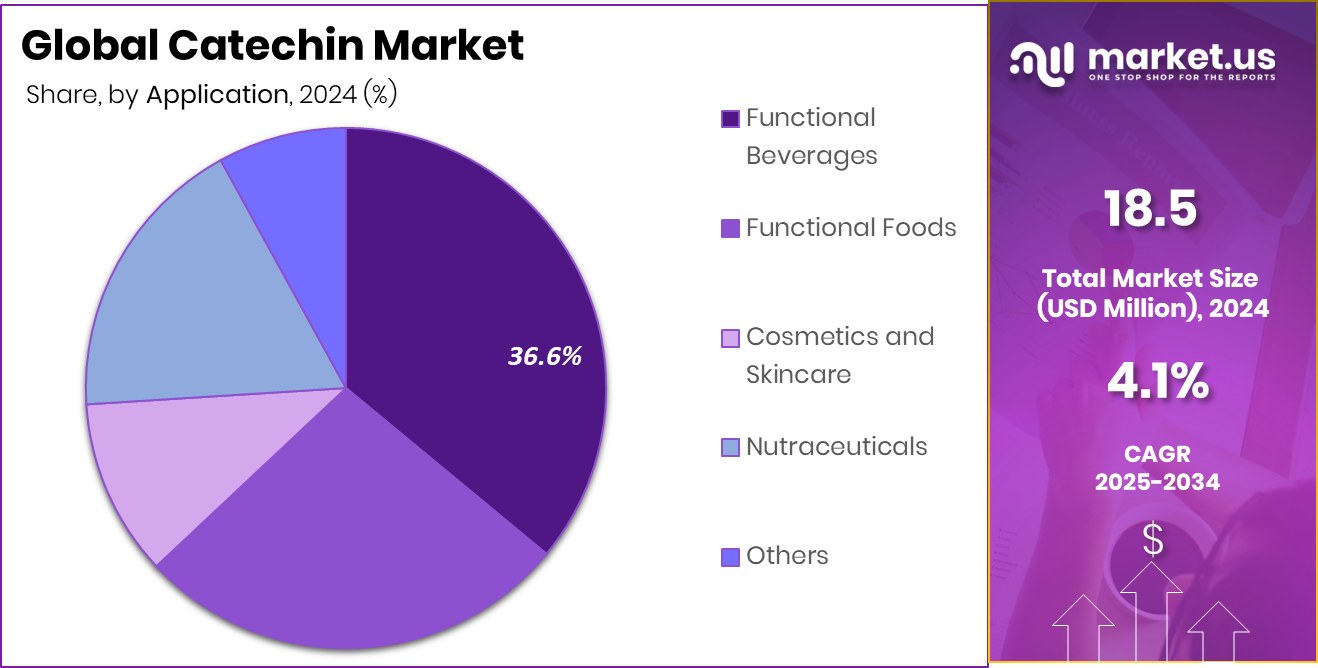

- Functional beverages lead application use, representing 36.6% of the total catechin market consumption.

- The North American catechin market reached a total value of USD 8.9 million.

By Type Analysis

Epicatechin Gallate dominates the Catechin Market with a 46.8% share.

In 2024, Epicatechin Gallate (ECG) held a dominant market position in the By Type segment of the Catechin Market, with a 46.8% share. This significant share can be attributed to the compound’s strong bioactive properties and wide applicability in health-oriented formulations.

ECG, a naturally occurring catechin found primarily in green tea, is known for its high antioxidant capacity, which has been widely recognized in the nutraceutical and functional food sectors. Its effectiveness in supporting cardiovascular health, reducing inflammation, and aiding in cellular protection has increased its adoption in dietary supplements and wellness products.

The rising consumer inclination toward natural health enhancers has further supported the demand for ECG, especially as consumers seek alternatives to synthetic ingredients. The inclusion of ECG in clean-label and plant-based products aligns with evolving consumer preferences, particularly in the Asia-Pacific and North American markets, where green tea consumption is already culturally embedded.

Additionally, ongoing product development efforts across health drinks, fortified foods, and skincare have bolstered its commercial relevance. The strong scientific foundation supporting ECG’s health claims, coupled with growing awareness of natural antioxidants, has positioned it as the most preferred type in the catechin segment, maintaining its lead through consistent demand across multiple applications.

By Source Analysis

Green Tea Catechins lead the market at 62.1%.

In 2024, Green Tea Catechins held a dominant market position in the By Source segment of the Catechin Market, with a 62.1% share. This commanding share reflects the strong global reliance on green tea as the primary and most concentrated natural source of catechins.

Green tea catechins, especially epigallocatechin gallate (EGCG), are highly regarded for their potent antioxidant and anti-inflammatory properties, which have positioned them as essential ingredients in health-focused products. The widespread traditional and contemporary use of green tea has significantly contributed to the commercial viability of this source.

The dominance of green tea catechins is further supported by increasing consumer interest in natural health boosters, particularly in the context of preventive wellness. The ease of extraction, standardized quality, and existing infrastructure for green tea cultivation and processing have enhanced its appeal as a consistent and reliable catechin source.

Moreover, green tea’s long-standing association with metabolic, cardiovascular, and cognitive benefits has helped maintain consumer trust and industry preference for this source. The 62.1% share held by green tea catechins in 2024 is indicative of their sustained demand across nutritional supplements, functional beverages, and cosmetic formulations, affirming their critical role in shaping the dynamics of the catechin market.

By Function Analysis

Antioxidants represent 33.9% of the total Catechin Market value.

In 2024, Antioxidants held a dominant market position in the By Function segment of the Catechin Market, with a 33.9% share. This leading share highlights the widespread application of catechins as natural antioxidants across multiple health and wellness products.

Catechins, particularly in the antioxidant role, are valued for their ability to neutralize free radicals and reduce oxidative stress, which contributes to various chronic conditions. The growing consumer preference for natural ingredients with proven health benefits has strengthened the positioning of catechins as antioxidant agents.

The demand for antioxidant functions in food, beverages, supplements, and personal care products has been rising steadily, as manufacturers seek to enhance product efficacy and shelf stability using plant-based compounds. The 33.9% share held by the antioxidant function indicates the high level of trust and adoption of catechins in this role, especially in clean-label and functional formulations.

Furthermore, increasing awareness about lifestyle-related health concerns and aging has led to greater interest in antioxidants derived from natural sources. Catechins’ multifunctional health-supportive properties, combined with scientific validation of their antioxidant activity, have ensured their continued dominance within this functional segment, reinforcing their value proposition in the evolving global wellness and nutrition space.

By Application Analysis

Functional Beverages account for 36.6 of % market consumption globally.

In 2024, Functional Beverages held a dominant market position in the By Application segment of the Catechin Market, with a 36.6% share. This substantial share reflects the growing integration of catechins into health-oriented drinks that cater to consumers seeking natural ingredients with scientifically supported benefits. Functional beverages enriched with catechins have gained popularity due to their antioxidant, metabolism-boosting, and detoxification properties, aligning with consumer preferences for convenient wellness solutions.

The strong market position of this segment is driven by increased demand for beverages that provide more than basic hydration. Catechin-infused teas, energy drinks, and fortified waters have seen rising acceptance, particularly among health-conscious individuals and urban populations. The familiarity of consumers with green tea-based drinks has also eased the path for catechin incorporation into a broader range of functional beverage formats. The 36.6% share held by functional beverages in 2024 underscores their central role in driving catechin consumption globally.

Additionally, product innovation and flavor diversification within the beverage industry have created more opportunities for catechin use, reinforcing their appeal. The ability to deliver both health benefits and refreshing taste profiles has helped this segment maintain its lead in the catechin market, with a promising outlook for continued growth.

Key Market Segments

By Type

- Epicatechin

- Epicatechin Gallate (ECG)

- Epigallocatechin (EGC)

- Epigallocatechin Gallate (EGCG)

- Others

By Source

- Green Tea Catechins

- Cocoa Catechins

- Grape Catechins

- Others

By Function

- Antioxidants

- Cardiovascular health

- Weight management

- Skin health

- Anti-inflammatory

- Brain health

- Others

By Application

- Functional Beverages

- Functional Foods

- Cosmetics and Skincare

- Nutraceuticals

- Others

Driving Factors

Rising Demand for Natural Antioxidants in Wellness

One of the main factors driving the growth of the catechin market is the increasing global demand for natural antioxidants. As people become more aware of the harmful effects of synthetic additives and preservatives, there is a clear shift toward natural health-supportive ingredients.

Catechins, known for their strong antioxidant properties, are gaining attention for their ability to reduce oxidative stress, support heart health, and improve immunity. Consumers today are looking for products that promote long-term wellness, and catechin fits perfectly into this trend.

Whether used in dietary supplements, teas, or functional beverages, catechins are being preferred for their clean-label appeal. This growing awareness and preference for natural antioxidant solutions continue to support the strong demand for catechins worldwide.

Restraining Factors

High Extraction Cost Limits Large-Scale Catechin Production

One of the major restraining factors for the catechin market is the high cost involved in its extraction and processing. Obtaining catechins, especially in pure and concentrated form, requires advanced extraction techniques and strict quality control, which significantly increase production costs.

These higher costs often lead to expensive end products, limiting their accessibility to a broader consumer base, particularly in price-sensitive regions. Additionally, maintaining the bioactive properties of catechins during processing and formulation adds to manufacturing challenges.

As a result, smaller companies or those with limited budgets may struggle to adopt catechin ingredients in their product lines. This cost-related barrier continues to restrict the wider market penetration and adoption of catechins across industries.

Growth Opportunity

Expansion in the Functional Foods and Beverage Industry

A major growth opportunity for the catechin market lies in its expanding use in the functional foods and beverage industry. As consumers increasingly look for food and drinks that offer health benefits beyond basic nutrition, catechins are being added to a wide range of products such as energy drinks, teas, fortified juices, and even snacks.

Their natural origin and proven health-supporting qualities make them ideal for clean-label and wellness-focused formulations. The growing popularity of healthy lifestyles and preventive healthcare is driving innovation in functional product development, creating more room for catechin-based ingredients.

This rising demand, especially in urban and health-conscious markets, provides a strong opportunity for companies to expand their offerings and tap into the evolving health food segment.

Latest Trends

Nano-Encapsulated Catechins for Better Absorption

A prominent trend in the catechin market is the use of nano-encapsulation technology to enhance absorption and stability. Nano-encapsulation involves packaging catechin molecules within tiny carriers, such as liposomes or polymer shells, which protect them from degradation during digestion.

This process improves bioavailability, meaning the body can absorb and utilize more of the catechins’ beneficial properties, like antioxidant and anti-inflammatory effects. As a result, manufacturers can offer products with stronger health benefits even at lower doses.

This trend is gaining momentum in dietary supplements, functional beverages, and skincare items, where enhanced delivery is a key selling point. The improved effectiveness and efficiency of catechins through nano-encapsulation are driving product innovation and influencing market preferences.

Regional Analysis

In 2024, North America dominated the catechin market with a 48.30% share.

In 2024, North America held the leading position in the global catechin market, accounting for 48.30% of the total share, with a market valuation of USD 8.9 million. This dominant share is primarily driven by the region’s strong consumer demand for natural, plant-based antioxidants and a growing preference for functional health products. The market in North America benefits from an advanced nutraceutical sector, high consumer awareness regarding preventive health, and the widespread popularity of catechin-rich products such as green tea beverages and dietary supplements.

Europe and Asia Pacific also contribute significantly to the global market, supported by traditional consumption patterns and growing interest in natural wellness solutions. Meanwhile, the Middle East & Africa and Latin America regions represent emerging markets, gradually increasing their catechin usage, particularly in urban areas with rising health awareness.

However, these regions still account for a relatively smaller share of the global revenue. The continued dominance of North America highlights the region’s early adoption of clean-label trends and the presence of supportive infrastructure for research, product development, and distribution.

With rising focus on healthy lifestyles and increasing integration of catechins in everyday consumables, North America is expected to maintain its leading role in the catechin market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global catechin market featured several specialized suppliers—Biosynth, Botaniex, Caymanchem, and Chengdu Wagott Bio-tech—each contributing distinct strengths that reinforce industry dynamics.

Biosynth has established a reputation for consistent quality and regulatory compliance. The company’s rigorous control in sourcing and manufacturing ensures high-purity catechin extracts, catering effectively to nutraceutical and pharmaceutical demand. Its concentration on innovation and analytical traceability supports catechin customers in meeting stringent safety and efficacy standards.

Botaniex, with its emphasis on botanical sourcing and plant-derived bioactives, leverages agricultural partnerships to ensure stable green tea harvest channels. This vertical integration enables competitive pricing and supply chain resilience. Botaniex’s focus on sustainable sourcing aligns well with current market demand for eco-conscious ingredients, reinforcing their market positioning.

Caymanchem offers a scientific edge by providing research-grade catechin standards and reference materials. These are essential tools for academic institutions and quality control laboratories. Caymanchem’s specialized offerings support the preclinical and clinical research ecosystem, adding value to catechin’s applications in drug discovery and functional ingredient validation.

Chengdu Wagott Bio-tech Co., Ltd. brings scalable industrial production capabilities, particularly in high-yield extraction technologies. Catering to large-scale beverage and supplement manufacturers, Chengdu Wagott provides cost-effective bulk catechin. The company’s focus on yield optimization and process efficiency supports downstream manufacturers’ needs for stable, high-volume supply.

Top Key Players in the Market

- Biosynth

- Botaniex

- Caymanchem

- Chengdu Wagott Bio-tech Co., Ltd.

- Hangzhou Qinyuan Natural Plant High-tech Co., Ltd.

- Indena

- INDOFINE Chemical Company

- Taiyo Green Power Wxee

- Vital-Chem

Recent Developments

- In February 2024, Botaniex, known for its plant-based extracts, moved forward with a patent application for its “DeCaf-EAFree Catechins” — a green tea extract made without ethyl acetate. This development supports safer, cleaner catechin production for health supplements.

Report Scope

Report Features Description Market Value (2024) USD 18.5 Million Forecast Revenue (2034) USD 27.6 Million CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Epicatechin, Epicatechin Gallate (ECG), Epigallocatechin (EGC), Epigallocatechin Gallate (EGCG), Others), By Source (Green Tea Catechins, Cocoa Catechins, Grape Catechins, Others), By Function (Antioxidants, Cardiovascular health, Weight management, Skin health, Anti-inflammatory, Brain health, Others), By Application (Functional Beverages, Functional Foods, Cosmetics and Skincare, Nutraceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Biosynth, Botaniex, Caymanchem, Chengdu Wagott Bio-tech Co., Ltd., Hangzhou Qinyuan Natural Plant High-tech Co., Ltd., Indena, INDOFINE Chemical Company, Taiyo Green Power Wxee, Vital-Chem Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Biosynth

- Botaniex

- Caymanchem

- Chengdu Wagott Bio-tech Co., Ltd.

- Hangzhou Qinyuan Natural Plant High-tech Co., Ltd.

- Indena

- INDOFINE Chemical Company

- Taiyo Green Power Wxee

- Vital-Chem