Global Casein Derivatives Market Size, Share, And Enhanced Productivity By Type (Sodium Caseinate, Calcium Caseinate, Potassium Caseinate, Casein Hydrolysates, Others), By Source (Bovine Milk, Sheep Milk, Goat Milk, Others), By Form (Powder, Liquid), By Application (Food and Beverages, Pharmaceuticals, Cosmetics and Personal Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 172539

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

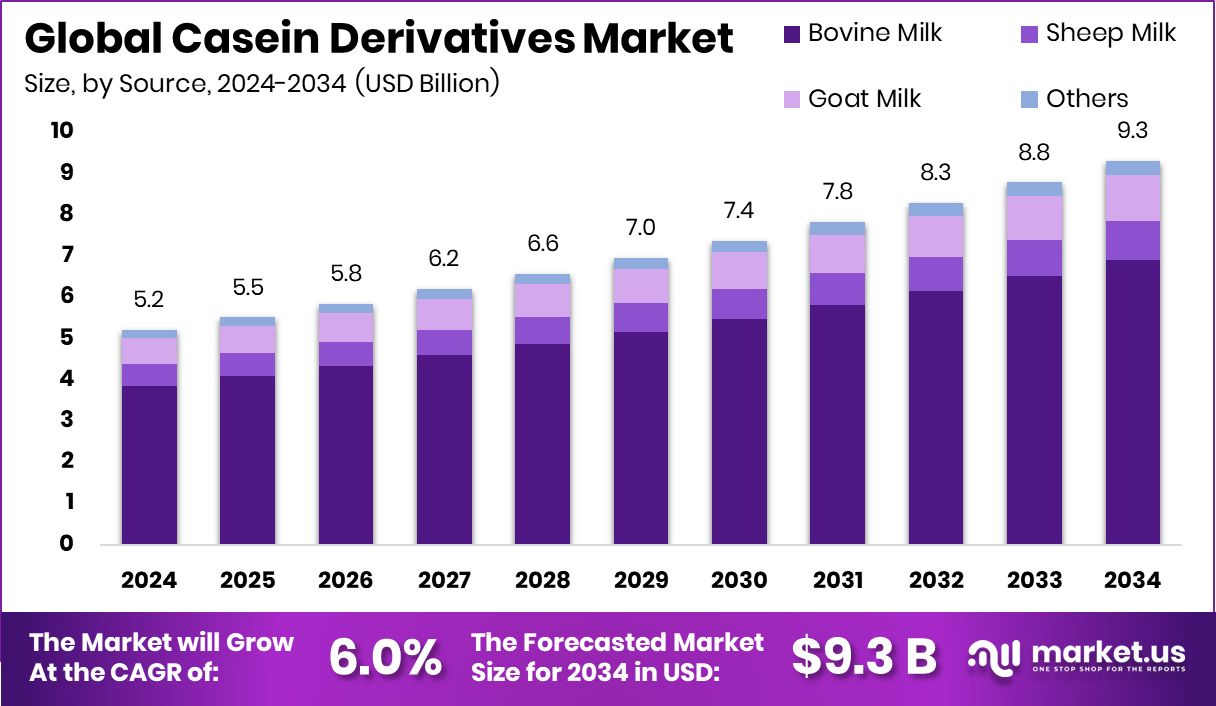

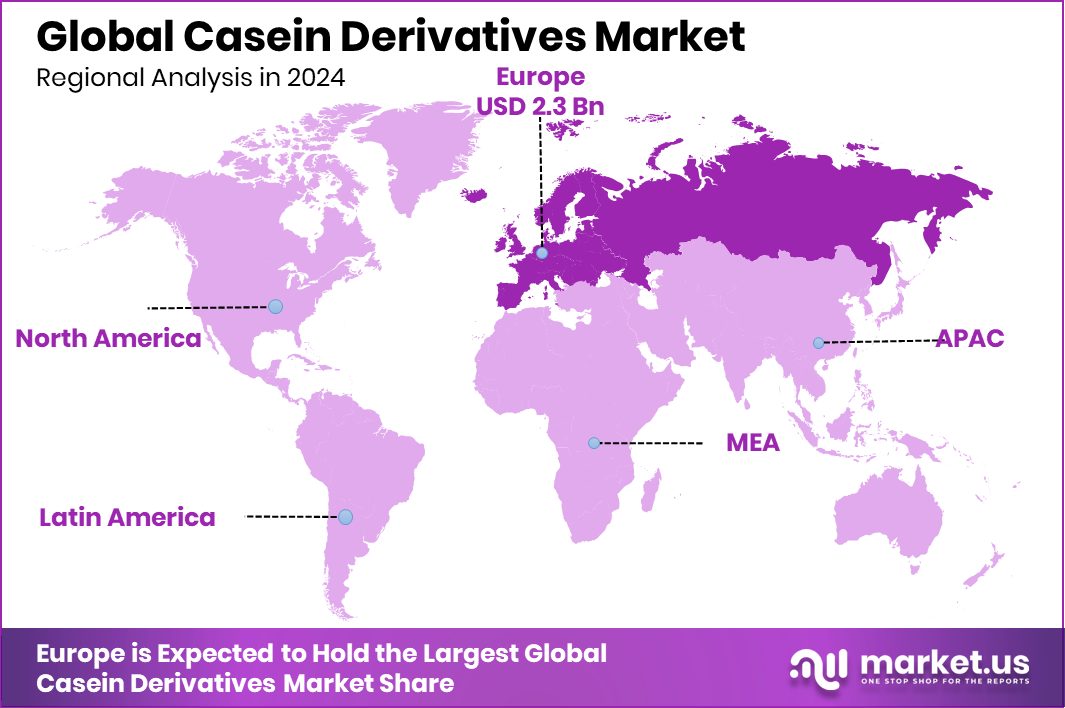

The Global Casein Derivatives Market is expected to be worth around USD 9.3 billion by 2034, up from USD 5.2 billion in 2024, and is projected to grow at a CAGR of 6.0% from 2025 to 2034. Europe’s strong dairy industry supported the casein derivatives market at 45.90%, USD 2.3 Bn.

Casein derivatives are functional dairy-based proteins produced by modifying natural casein extracted from milk. These derivatives, such as caseinates and hydrolyzed casein, are valued for their emulsifying, stabilizing, and protein-enriching properties. They are widely used to improve texture, nutrition, and consistency in foods, beverages, and specialized nutrition products, while also supporting controlled digestion and sustained protein release.

The Casein Derivatives Market refers to the global ecosystem involved in producing, processing, and supplying these modified casein ingredients for commercial use. The market is evolving beyond traditional dairy extraction, as fermentation-based and animal-free approaches begin to complement conventional supply. This shift is reshaping how casein derivatives are produced, sourced, and positioned across food and nutrition systems.

One key growth factor is innovation in animal-free dairy proteins. In 2024, Standing Ovation raised €3.75M in a Series A+ round to begin animal-free casein sales in 2025, while Eden Brew secured $24.5M to scale animal-free casein micelles and dairy proteins. These developments support sustainable production and reduce reliance on traditional dairy farming.

Rising demand is driven by nutrition, health, and functional food needs. Protein fortification trends extend beyond sports nutrition into everyday foods. Supporting this shift, Mileutis raised $20M, while All G raised $6.6M and formed a joint venture with Armor Protéines to scale lactoferrin, reinforcing broader protein ingredient ecosystems.

Looking at opportunities, fermentation-led scale-up is accelerating. Future Cow raised R$4.85M to expand animal-free dairy proteins via fermentation, highlighting long-term potential for resilient, scalable, and sustainable casein derivative supply across global food systems.

Key Takeaways

- The Global Casein Derivatives Market is expected to be worth around USD 9.3 billion by 2034, up from USD 5.2 billion in 2024, and is projected to grow at a CAGR of 6.0% from 2025 to 2034.

- In Casein Derivatives Market, Sodium Caseinate dominates by type, holding a 32.8% share globally in 2024.

- Within the casein derivatives market, bovine milk leads sources, accounting for 74.2% of overall consumption globally today.

- Powder form remains dominant in the casein derivatives market, representing 72.6% of the total volume worldwide demand.

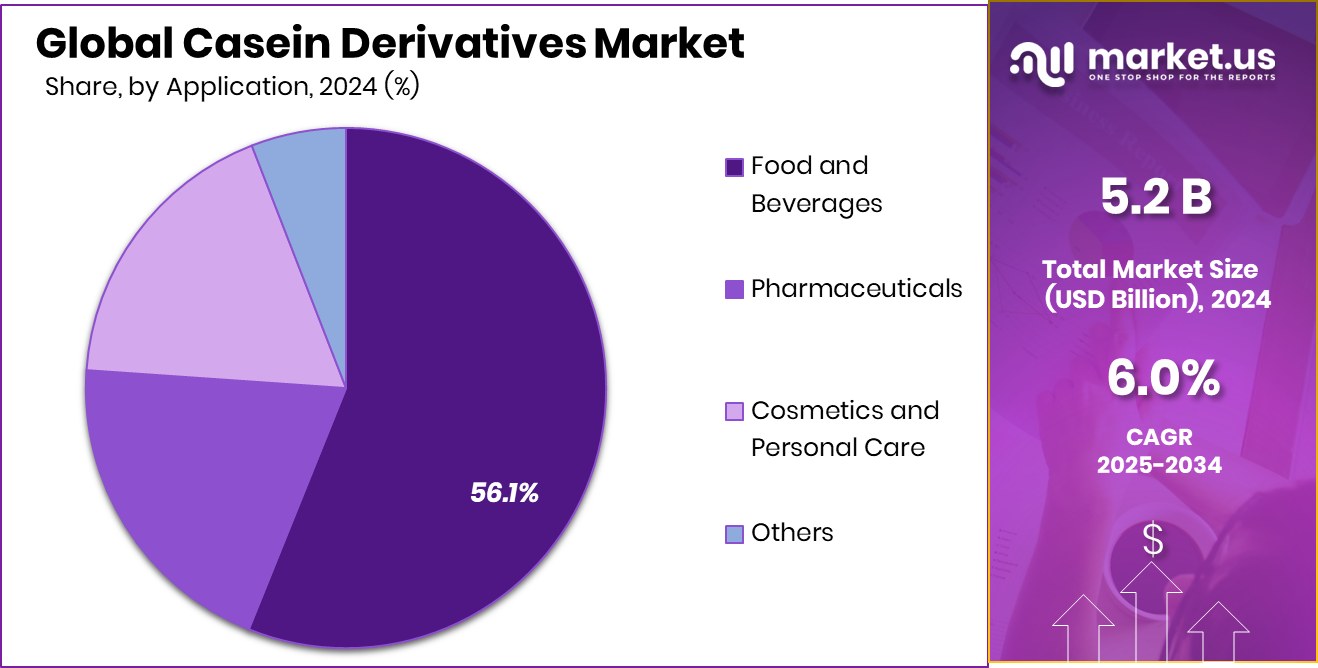

- Food and beverages applications drive the casein derivatives market, capturing 56.1% demand across industries globally, sustained.

- Europe maintained dominance in the casein derivatives market, holding 45.90% and USD 2.3 Bn.

By Type Analysis

In Casein Derivatives Market, Sodium Caseinate leads by type with 32.8% share.

In 2024, Sodium Caseinate held a dominant position in the Casein Derivatives Market by type, accounting for 32.8% share. Sodium caseinate is widely used due to its excellent emulsifying, stabilizing, and water-binding properties, making it highly suitable for processed foods, nutritional products, and industrial formulations.

Food manufacturers prefer sodium caseinate because it improves texture, enhances mouthfeel, and supports protein fortification without altering flavor. Its strong heat stability also supports usage in bakery fillings, beverages, and meat products. In addition, rising demand for high-protein and functional foods continues to strengthen its adoption. Compared to other casein derivatives, sodium caseinate offers better solubility, which simplifies processing and reduces formulation complexity for manufacturers across food and beverage, pharmaceutical, and cosmetic applications.

By Source Analysis

By source, Bovine Milk dominates the Casein Derivatives Market with 74.2% share.

In 2024, Bovine Milk dominated the Casein Derivatives Market by source, representing 74.2% share. Bovine milk remains the primary raw material due to its high availability, established dairy infrastructure, and cost-efficient protein extraction processes. Large-scale dairy farming supports a consistent supply of bovine milk casein, enabling stable production volumes for global manufacturers.

Moreover, bovine-derived casein derivatives meet regulatory standards across major markets, supporting widespread commercial use. The nutritional profile of bovine casein, including slow-digesting proteins and essential amino acids, further strengthens its demand in sports nutrition, clinical nutrition, and infant formulations. As dairy processing technologies advance, yield efficiency from bovine milk continues to improve, reinforcing its leadership as the preferred source.

By Form Analysis

Powder form holds dominance in the Casein Derivatives Market, accounting 72.6% share.

In 2024, Powder form led the Casein Derivatives Market by form, capturing 72.6% share. Powdered casein derivatives are favored due to their longer shelf life, ease of storage, and simplified transportation compared to liquid forms. This format supports bulk handling and flexible dosing, which is essential for large food processors and nutraceutical manufacturers. Powder form also offers better stability during formulation, especially in dry mixes, protein supplements, and bakery ingredients.

Additionally, powdered casein derivatives dissolve efficiently under controlled conditions, ensuring consistent product performance. The rising use of protein powders, meal replacements, and fortified foods further supports demand for powdered formats, as manufacturers prioritize convenience, reduced wastage, and extended product usability.

By Application Analysis

Food and Beverages lead applications in the Casein Derivatives Market with 56.1%.

In 2024, Food and Beverages emerged as the leading application segment in the Casein Derivatives Market, holding 56.1% share. Casein derivatives are extensively used to enhance protein content, texture, and stability in dairy products, beverages, bakery items, confectionery, and processed foods. Growing consumer interest in high-protein diets and functional nutrition is driving adoption across everyday food products.

In beverages, casein derivatives help maintain consistency and prevent separation, while in bakery and meat products, they improve structure and moisture retention. Additionally, clean-label reformulation and demand for natural dairy-based proteins are supporting the long-term growth of casein derivatives within the food and beverages industry.

Key Market Segments

By Type

- Sodium Caseinate

- Calcium Caseinate

- Potassium Caseinate

- Casein Hydrolysates

- Others

By Source

- Bovine Milk

- Sheep Milk

- Goat Milk

- Others

By Form

- Powder

- Liquid

By Application

- Food and Beverages

- Pharmaceuticals

- Cosmetics and Personal Care

- Others

Driving Factors

Animal-Free Dairy Innovation Drives Casein Derivatives Growth

In the Casein Derivatives Market, one major driving factor is the rapid shift toward animal-free dairy proteins produced using biotechnology. Food manufacturers are increasingly exploring precision fermentation to secure stable, ethical, and scalable protein supplies. This transition is strongly supported by recent investments. In 2024, Zero Cow Factory raised $4M from Green Frontier Capital, Pi Ventures, and other investors to accelerate the development of animal-free dairy ingredients, including casein alternatives.

Similarly, a bioengineered animal-free dairy products startup in India secured $4 million in funding to scale fermentation-based dairy protein production. These investments highlight growing confidence in non-animal casein technologies, which reduce dependence on traditional dairy farming while supporting sustainability goals. As food and beverage companies seek reliable protein inputs with consistent quality, animal-free casein derivatives are becoming a practical solution, directly driving market expansion and long-term innovation.

Restraining Factors

High Costs Delay Animal-Free Casein Commercialization

One key restraining factor in the Casein Derivatives Market is the high cost and long timelines required to commercialize animal-free casein at scale. Although innovation is strong, fermentation infrastructure, regulatory approvals, and pilot-to-commercial scale transitions remain expensive. In 2024, Nutropy raised $8M to develop animal-free cheese, but the company targets a 2027 market launch, showing how long commercialization can take.

Similarly, Eden Brew secured $5 million to scale cow-free dairy proteins and ice cream, yet large-scale production remains capital-intensive. These examples highlight that while funding supports innovation, high production costs and delayed returns can slow wider adoption. Until costs decline and scaling becomes faster, traditional casein derivatives may continue to dominate near-term market demand.

Growth Opportunity

Alternative Milk Proteins Unlock New Casein Opportunities

A major growth opportunity in the Casein Derivatives Market is the expansion of alternative milk protein sources beyond conventional cow milk. In 2024, Imagindairy closed a $13m seed round to commercialize cow-free milk proteins, supporting scalable production of casein-like ingredients without animal farming. Alongside this, a £4.7m investment was announced to drive sheep milk innovation and rural growth in North Wales, highlighting growing interest in diversified dairy protein sources.

Further strengthening this trend, Spring Sheep acquired a 12% stake in Melody Dairies, signaling confidence in sheep milk–based protein development. Together, these initiatives create opportunities for casein derivatives made from novel and animal-free milk sources, helping the market expand into premium, sustainable, and regionally diversified dairy protein segments.

Latest Trends

Policy Support Strengthens Milk-Based Casein Supply Chains

A key latest trend in the Casein Derivatives Market is rising public and regional support for milk producers, which helps stabilize raw material supply for casein processing. In 2024, a €130,000 LEADER funding boost supported Mountbellew Shearfest, strengthening rural dairy-linked activities and community-level milk value chains.

Alongside this, AIPA disbursed 103 million lei in direct payments to support milk producers, improving farm-level income stability and production continuity. These initiatives reduce supply-side risks by helping farmers manage costs, maintain herd quality, and sustain milk output.

As casein derivatives depend heavily on consistent milk availability, such policy-backed financial support is becoming a critical trend. Stronger producer economics ultimately improve reliability, quality, and long-term scalability of casein derivative production for food and nutrition applications.

Regional Analysis

Europe led the casein derivatives market with a 45.90% share at USD 2.3 Bn.

Europe dominated the Casein Derivatives Market, holding a leading share of 45.90%, valued at USD 2.3 Bn, supported by its mature dairy processing industry, strong milk production base, and well-established food manufacturing ecosystem. The region benefits from advanced protein extraction technologies and consistent demand for functional dairy ingredients across processed foods, sports nutrition, and medical nutrition products.

North America represents a well-developed market driven by strong consumption of protein-enriched foods, widespread use of casein derivatives in beverages and bakery products, and stable dairy supply chains.

Asia Pacific continues to expand due to rising urbanization, increasing dairy consumption, and growing awareness of protein nutrition, particularly in emerging economies where food processing capacities are scaling steadily. The Middle East & Africa market shows gradual growth, supported by improving cold-chain infrastructure, rising demand for packaged foods, and increasing use of dairy proteins in foodservice applications.

Latin America demonstrates steady adoption, backed by expanding dairy farming activities, improving food manufacturing capabilities, and growing interest in value-added dairy ingredients.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Lactalis Ingredients continues to play a strategic role in the global casein derivatives landscape through its deep integration with upstream milk sourcing and dairy processing expertise. The company benefits from strong control over raw material quality, which is critical for producing consistent casein and caseinate solutions. Its focus on functional dairy proteins positions it well to serve food, nutrition, and industrial applications requiring reliable performance. From an analyst perspective, Lactalis Ingredients’ strength lies in its ability to align technical formulation support with large-scale production capabilities, enabling long-term partnerships with food manufacturers seeking stable, dairy-based protein ingredients.

Kerry Group plc brings a differentiated value proposition to the casein derivatives market by combining dairy protein expertise with broader taste, nutrition, and functional ingredient know-how. The company’s strong application-focused approach allows it to position casein derivatives not just as proteins, but as performance-enhancing components in complex formulations. Analysts view Kerry’s strength in its customer-centric innovation model, which supports tailored solutions for beverages, nutrition products, and processed foods. Its global footprint and technical service capabilities enhance its competitiveness in meeting evolving formulation and clean-label requirements.

AMCO Proteins is recognized for its specialization in dairy proteins, including casein derivatives designed for functionality and nutritional performance. The company’s focused portfolio enables agility in addressing specific customer needs, particularly in food and nutrition applications. From an analyst standpoint, AMCO Proteins benefits from operational focus, technical consistency, and close customer collaboration, allowing it to compete effectively by emphasizing quality, reliability, and application-driven product development in the casein derivatives market.

Top Key Players in the Market

- FrieslandCampina Ingredients

- Fonterra Co-operative Group Ltd.

- Arla Foods Ingredients Group P/S

- Lactalis Ingredients

- Kerry Group pic

- AMCO Proteins

- Erie Foods International Inc.

- Tatua Co-operative Dairy Company

- Saputo Inc.

Recent Developments

- In October 2025, Tatua reported that the 2024/25 financial year delivered record production volumes for its bulk ingredients, including caseinate and whey protein concentrate. The company processed more milk solids than ever before, supported by strong milk supply from its shareholders, driving increased output of protein ingredients used in food and nutrition products.

- In June 2025, Saputo Inc. announced its fourth quarter and full-year fiscal 2025 financial results, reporting adjusted net earnings of USD 128 million for the quarter. This development reflects the company’s overall performance and market conditions affecting its ingredients business, including dairy proteins that include casein derivatives.

Report Scope

Report Features Description Market Value (2024) USD 5.2 Billion Forecast Revenue (2034) USD 9.3 Billion CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Sodium Caseinate, Calcium Caseinate, Potassium Caseinate, Casein Hydrolysates, Others), By Source (Bovine Milk, Sheep Milk, Goat Milk, Others), By Form (Powder, Liquid), By Application (Food and Beverages, Pharmaceuticals, Cosmetics and Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape FrieslandCampina Ingredients, Fonterra Co-operative Group Ltd., Arla Foods Ingredients Group P/S, Lactalis Ingredients, Kerry Group pic, AMCO Proteins, Erie Foods International Inc., Tatua Co-operative Dairy Company, Saputo Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Casein Derivatives MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Casein Derivatives MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- FrieslandCampina Ingredients

- Fonterra Co-operative Group Ltd.

- Arla Foods Ingredients Group P/S

- Lactalis Ingredients

- Kerry Group pic

- AMCO Proteins

- Erie Foods International Inc.

- Tatua Co-operative Dairy Company

- Saputo Inc.