Global Cargo Transportation Insurance Market Size, Share, Industry Analysis Report By Coverage (All Risks, Named Perils, General Average, Contributory Negligence), By Commodity Type (Manufactured Goods, Perishables, Dangerous Goods, Electronics), By Cargo Value(Low Value Cargo, High Value Cargo, Ultra-High Value Cargo), By Form of Transport (Domestic, International), By Mode of Transportation (Air, Sea, Road, Rail), By Policy Type (Open Cover Cargo Policy, Contingency Insurance Policy, Specific Cargo Policy, Others), By Application (Import & Export Trade Enterprises, Processing Trade Enterprises, Logistics Companies, Others), By Region, Global Opportunity Analysis, Future Outlook and Industry Trends Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 158068

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- US Market Size

- Role of Generative AI

- Investment Opportunities

- Government-led investments

- Business Benefits

- Emerging Trends

- Growth Factors

- By Coverage Analysis

- By Commodity Type

- By Cargo Value

- By Form of Transport

- By Mode of Transportation

- By Policy Type

- By Application

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

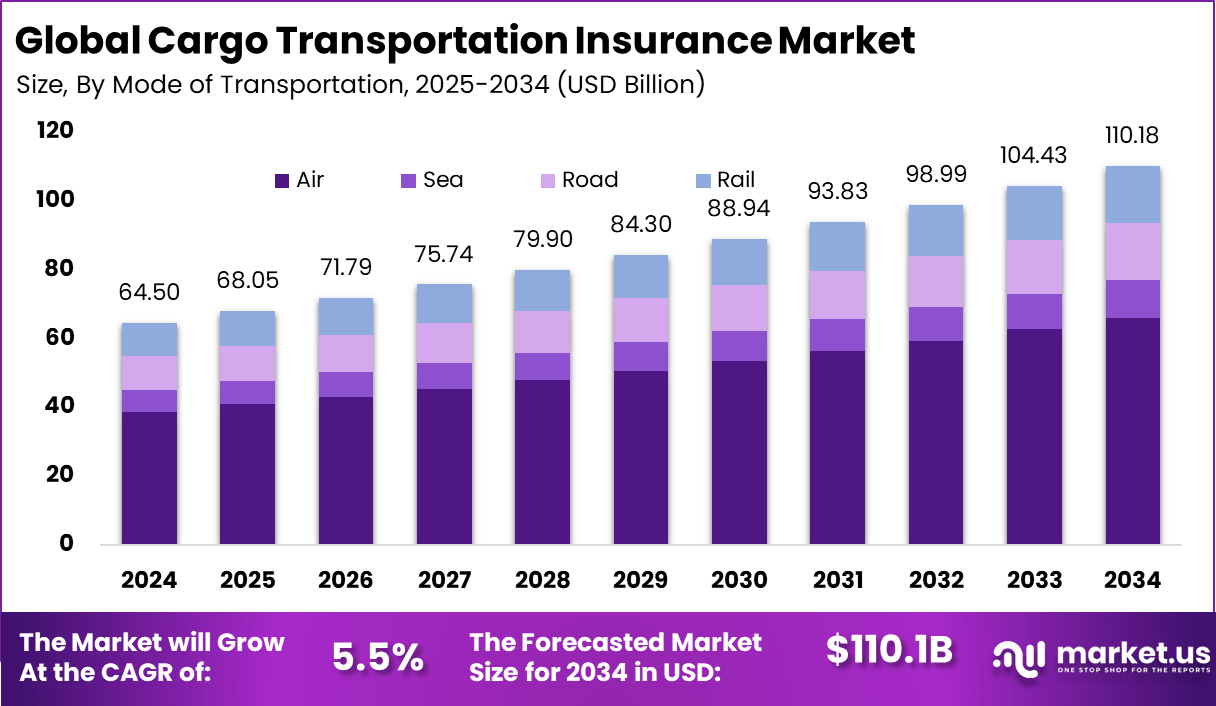

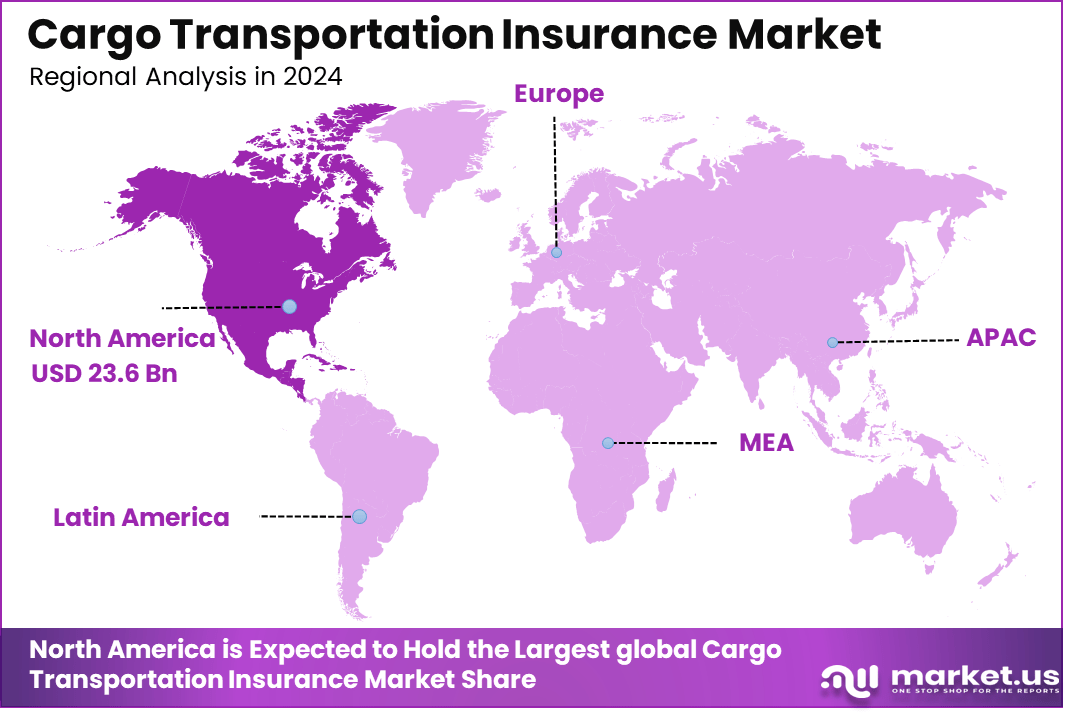

The Global Cargo Transportation Insurance Market size is expected to be worth around USD 110.18 Billion By 2034, from USD 64.5 billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 36.6% share, holding USD 23.6 Billion revenue.

The Cargo Transportation Insurance Market refers to the industry that provides insurance coverage for goods being transported by sea, air, rail, or road. This insurance protects cargo owners, freight forwarders, and logistics companies against risks such as theft, damage, loss, natural disasters, and accidents during transit.

The market includes marine cargo insurance, inland transit insurance, air cargo insurance, and multimodal transport insurance. Coverage is essential in global trade, where goods are moved across multiple jurisdictions and subject to complex risks.

Accoridng to Market.us, The Cargo Insurance Market is projected to expand from USD 38,208 mn in 2024 to nearly USD 65,405.6 mn by 2034, registering a CAGR of 5.6% between 2025 and 2034. The growth of this market is supported by the rising complexity of global trade, higher risks of cargo loss and damage, and the increasing adoption of insurance solutions by logistics operators and exporters seeking greater financial protection.

The market is driven by the continuous expansion of international trade and the increasing complexity of global supply chains. Rising cargo volumes, especially in e-commerce and cross-border trade, are creating greater demand for cargo insurance. Frequent disruptions caused by natural disasters, piracy, accidents, and geopolitical tensions further highlight the need for reliable insurance coverage.

Key Insight Summary

- By commodity type, Manufactured Goods dominated with 35.6% share.

- By cargo value, High Value Cargo held the leading position at 45.6% share.

- By form of transport, Domestic shipments accounted for a strong 78.6% share.

- By mode of transportation, Air cargo led the market, securing 60.0% share.

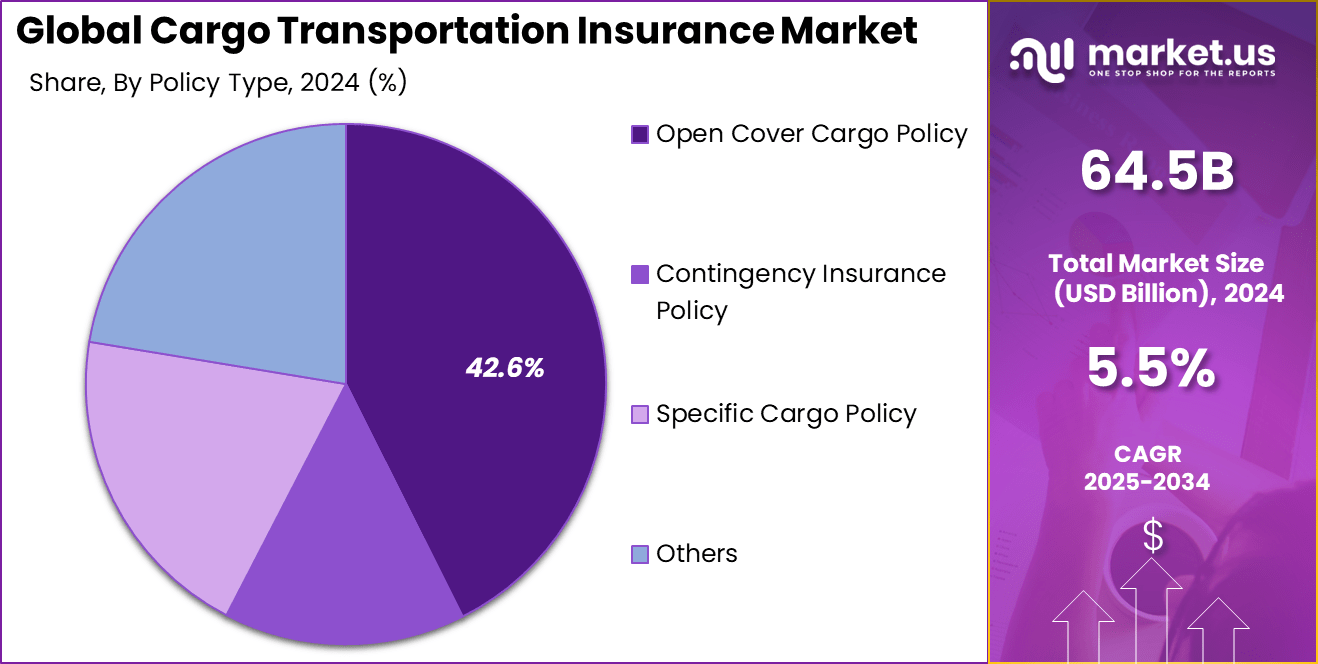

- By policy type, the Open Cover Cargo Policy segment captured 42.6% share.

- By application, Import & Export Trade Enterprises were the main users, representing 38.7% share.

Analysts’ Viewpoint

Demand for cargo transportation insurance is strong among shippers, freight forwarders, and logistics operators. Small and medium-sized enterprises are increasingly purchasing cargo insurance as they expand into international markets. E-commerce businesses are also contributing to rising demand due to high volumes of small, frequent shipments that require coverage.

In addition, industries with high-value or fragile cargo, such as electronics, pharmaceuticals, and chemicals, are particularly reliant on comprehensive insurance protection. Demand is rising in emerging economies where infrastructure challenges and security risks increase the likelihood of cargo loss.

The market is adopting digital platforms, blockchain, and data analytics to improve risk assessment and claims processing. Blockchain is being used to provide greater transparency in cargo tracking and contract management. Predictive analytics powered by artificial intelligence is enabling insurers to better assess risks by analyzing weather patterns, route data, and cargo characteristics.

Shippers and logistics operators adopt cargo transportation insurance to reduce financial exposure, comply with regulations, and improve business continuity. Insurance provides a safety net against unpredictable losses, enabling companies to operate confidently in global markets. It also helps build trust with trading partners and customers by ensuring accountability in the event of cargo loss or damage.

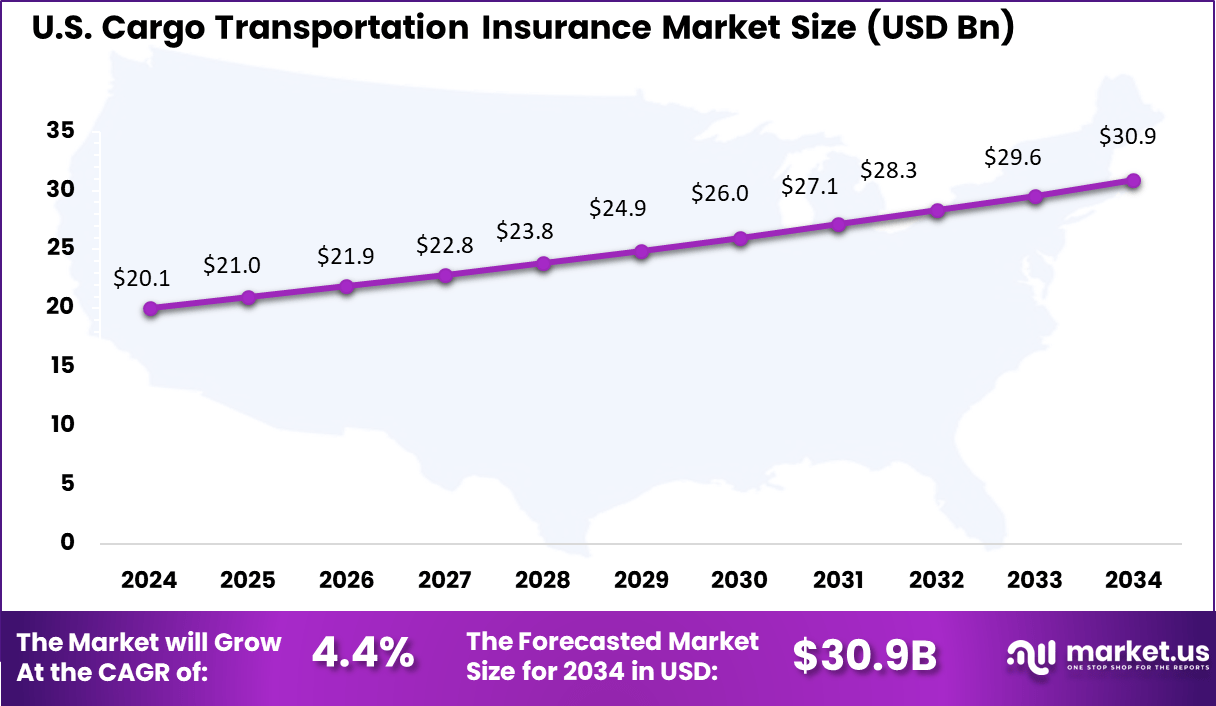

US Market Size

The U.S. Cargo Transportation Insurance Market was valued at USD 20.1 Billion in 2024 and is anticipated to reach approximately USD 30.9 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 4.4% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than 36.6% share and generating USD 23.6 billion in revenue in the cargo transportation insurance market. The region’s leadership is strongly influenced by its extensive trade networks, high-value shipments, and well-developed logistics infrastructure.

With the United States serving as one of the largest importers and exporters globally, the demand for comprehensive cargo insurance solutions has surged to mitigate risks related to transit damage, theft, and supply chain disruptions. Canada further adds to this momentum with its expanding cross-border trade and growing reliance on marine and air cargo transport.

The dominance of North America is also supported by stringent regulatory frameworks and the presence of leading insurance providers offering specialized cargo policies. Businesses in the region are increasingly aware of the financial impact of delays and losses, driving strong uptake of advanced insurance coverage tailored for multimodal transportation.

Role of Generative AI

The role of generative AI in cargo transportation insurance is becoming increasingly significant. It helps automate and speed up key processes like risk assessment and claim handling by analyzing vast amounts of data quickly and with high accuracy. This technology reduces delays in underwriting by drafting initial risk evaluations and detecting fraudulent claims through pattern recognition.

It also enhances customer service by offering 24/7 support in multiple languages, improving retention rates and satisfaction. In essence, generative AI shifts the focus of insurance professionals from repetitive tasks toward making better-informed decisions faster, which strengthens operational efficiency and risk management.

Investment Opportunities

There are strong investment opportunities in technology-driven insurance platforms that integrate cargo tracking, claims management, and customer services. Insurtech firms offering digital-first solutions for small and medium-sized businesses are attracting attention.

Emerging markets with growing trade flows, such as Asia-Pacific, Africa, and Latin America, offer significant potential for insurers to expand coverage. Investment in specialized policies, such as those covering high-value goods, temperature-sensitive cargo, or just-in-time deliveries, also represents an area of opportunity.

Government-led investments

In India, for example, the government is significantly boosting infrastructure with a record budget allocation of about ₹3 tn for railways in 2025, supporting rail freight improvements, expansion of over 68,000 kilometers of railway track, and deployment of 400 high-speed trains by 2027.

Additionally, the Indian government has introduced a Maritime Development Fund with a corpus of ₹25,000 crore (approximately $3.4 billion), with nearly half the funding coming from the government and the rest mobilized from ports and the private sector. This fund targets shipbuilding modernization, fleet expansion, and port infrastructure upgrades.

Such investments improve the maritime cargo transportation ecosystem, reducing risks such as vessel damage or delays and creating conditions for more tailored and cost-effective cargo insurance products. The government also plans large-scale investments up to ₹70,000 crore to scale this fund and drive further growth in maritime infrastructure.

Business Benefits

Businesses benefit from cargo transportation insurance through reduced risk exposure, greater financial stability, and improved supply chain resilience. Insurance coverage helps minimize disruptions to operations by ensuring compensation in case of cargo loss or damage.

Companies that insure their shipments also enhance their reputation by demonstrating commitment to customer satisfaction and reliability. Over time, effective insurance strategies can reduce overall logistics costs by mitigating the financial impact of unforeseen events.

Emerging Trends

Emerging trends in cargo transportation insurance include the integration of real-time data from IoT devices for monitoring cargo conditions such as temperature and location. This helps insurers refine risk assessments dynamically. Blockchain is also gaining traction to increase transparency and reduce fraud by providing secure, immutable records of contracts and claims.

Customized and modular insurance policies are becoming more popular, allowing businesses to purchase coverage tailored specifically to their cargo and shipping needs. Additionally, there is a growing focus on business interruption coverage to address disruptions beyond physical damage, reflecting the challenges faced by complex global supply chains.

Growth Factors

Several growth factors are driving the cargo transportation insurance market. The expansion of international trade and the logistics sector increases the volume and value of goods being transported, boosting the need for insurance protections. Regulatory mandates requiring cargo insurance in many regions also promote market growth.

Technological advances such as AI-driven underwriting, big data analytics, and IoT-enabled monitoring improve risk management capabilities, making insurance products more reliable and cost-effective. The rising transport of perishable goods demands specialized coverage solutions, further broadening market scope.

By Coverage Analysis

In 2024, the all risks segment accounts for 40.5% of the cargo transportation insurance market and represents the most widely adopted coverage option among businesses. This type of policy provides extensive protection against physical loss or damage caused by common external factors during transit.

Companies that rely heavily on the movement of fragile, valuable, or sensitive goods prefer this coverage type because it helps mitigate uncertainties across multiple stages of transportation. The growing complexities in supply chains and rising volumes of international trade have made enterprises more cautious about potential disruptions.

As a result, shippers and logistics operators are increasingly leaning toward comprehensive protection to cover scenarios such as mishandling, theft, accidents, or unforeseen damage during long transit periods. This trend is particularly strong among global traders and e-commerce suppliers where timely and safe delivery is critical for business continuity.

By Commodity Type

In 2024, Manufactured goods hold the largest share in cargo transportation insurance, accounting for 35.6% of the total market. This segment covers machinery, electronics, automobiles, and consumer products which are transported globally in high volumes. With rising global trade activities and expanding production bases in Asia, the demand for insuring manufactured goods during transit has become critical.

Frequent risks such as accidental damage, theft, and handling-related losses make this category a key contributor to insurance premiums. The growth of global supply chains further strengthens the requirement for coverage, since manufactured goods often pass through multiple transit points before reaching buyers.

Increasing export of electronic devices from China, automobiles from Germany, and machinery from Japan highlights the need for comprehensive cargo insurance. As global trade continues to diversify, insurers are offering tailored policies for manufactured goods depending on risk exposure, storage conditions, and transportation methods.

By Cargo Value

In 2024, High-value cargo accounts for 45.6% of cargo insurance demand, driven by shipments involving luxury goods, specialized machinery, pharmaceuticals, and fine art. These commodities face higher risk exposures not only due to their value but also because of strict handling and storage requirements.

A single incident, such as product damage or theft, can lead to significant financial losses, which makes insurance coverage essential. Rising exports of semiconductors, luxury automobiles, and pharmaceutical products from developed economies significantly contribute to this segment.

The demand for specialized insurance solutions has increased, with underwriters offering coverage against risks such as temperature fluctuations in pharmaceuticals, or theft protection for jewelry and electronics. The surge in cross-border e-commerce has also added momentum, as companies transporting high-value consumer electronics require secure policies to protect their global trade operations.

By Form of Transport

In 2024, Domestic shipments dominate with 78.6% share in cargo transportation insurance, reflecting strong demand for coverage in country-level trade and supply networks. Growth of e-commerce and regional logistics has increased domestic freight volumes across road and rail transport.

Many businesses rely on regular and short-haul deliveries to sustain operations, which raises the importance of insuring against common risks such as transit accidents, road mishaps, and theft. Large consumer markets such as the United States, India, and China drive substantial domestic freight traffic, creating opportunities for insurers to expand coverage solutions.

For companies involved in daily distribution of food items, industrial equipment, or retail goods, insurance offers protection from unpredictable losses. Regional governments promoting transport infrastructure upgrades also indirectly support this segment by enabling higher freight activity requiring insurance coverage.

By Mode of Transportation

In 2024, Air cargo accounts for 60.0% share of cargo insurance due to its use in transporting time-sensitive and high-value products. Electronics, medical supplies, and luxury items commonly rely on air freight given its speed and reliability, which also elevates the need for insurance.

The higher cost per shipment and stricter handling requirements make insurance indispensable to mitigate risks of damage, delays, or loss. With global supply chains increasingly dependent on fast transport for critical components, the use of air freight continues to expand.

Pharmaceutical companies transporting temperature-sensitive vaccines and high-tech firms delivering devices worldwide are key end users of insurance in this category. Growing international trade routes and expansion of cargo aviation networks in Asia-Pacific further support the dominance of air transportation in insurance demand.

By Policy Type

In 2024, Open cover cargo policies represent 42.6% of the market, making them one of the most widely adopted forms of coverage. These policies cater to businesses that make regular shipments throughout the year, providing continuous protection without the need to purchase separate insurance for each consignment.

This reduces administrative burden and ensures uninterrupted coverage, particularly for firms involved in ongoing exports and imports. Such policies benefit industries like textiles, electronics, and manufacturing which ship goods frequently over different routes.

The popularity of open cover arrangements reflects the growing trend among enterprises to simplify operational processes while reducing the risks associated with multiple shipments. Flexibility in coverage options and long-term cost efficiency make this segment a preferred choice for mid to large-sized enterprises engaged in global trade.

By Application

In 2024, Import and export enterprises contribute 38.7% to cargo insurance demand, underlining their importance in global trade activities. These companies face higher risk exposure since goods often travel across long distances and pass through customs and multiple transit hubs.

The complexity of international trade makes insurance essential to safeguard against losses caused by mishandling, piracy, political instability, or natural disasters during transit. Rising cross-border trade volumes and reliance on global suppliers are fueling the need for tailored insurance products for exporters and importers.

Companies shipping agricultural products, industrial equipment, and consumer goods account for a large share of this demand. The increasing participation of small and medium enterprises in international trade has also boosted this segment, as insurance coverage provides security that supports expansion into new markets.

Key Market Segments

By Coverage

- All Risks

- Named Perils

- General Average

- Contributory Negligence

By Commodity Type

- Manufactured Goods

- Perishables

- Dangerous Goods

- Electronics

By Cargo Value

- Low Value Cargo

- High Value Cargo

- Ultra-High Value Cargo

By Form of Transport

- Domestic

- International

By Mode of Transportation

- Air

- Sea

- Road

- Rail

By Policy Type

- Open Cover Cargo Policy

- Contingency Insurance Policy

- Specific Cargo Policy

- Others

By Application

- Import & Export Trade Enterprises

- Processing Trade Enterprises

- Logistics Companies

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Growth of International Trade and E-commerce

The cargo transportation insurance market is strongly driven by the growth of international trade and the rapid expansion of e-commerce. Increasing shipment volumes and cross-border trade have amplified the demand for insurance to safeguard goods in transit. With e-commerce platforms shipping a wide variety of products, from electronics to perishables, there is a rising need for customized insurance policies that accommodate diverse cargo types.

This driver is further supported by advancements in technology such as real-time cargo tracking, AI-driven risk assessment, and automated claims processing, which enhance the effectiveness, speed, and transparency of insurance services. Countries with robust logistics infrastructure, especially in North America, have seen accelerated adoption of these technological solutions.

Restraint Analysis

Fluctuating Freight Costs

One significant restraint on the cargo transportation insurance market is the fluctuating costs of freight, which create uncertainty for both shippers and insurers. Variability in ocean freight rates and other shipping costs complicate long-term pricing strategies and premium setting for insurance providers. When freight rates rise sharply, it can lead to increased premiums for shippers, which in turn may reduce the appetite for purchasing insurance or restrict the types of coverage sought.

This fluctuation discourages customers from committing to long-term insurance contracts, limiting market growth potential. Moreover, supply chain disruptions and trade tensions, such as tariffs impacting key cargo monitoring technologies, further add to the unpredictability. These factors collectively constrain steady market expansion despite underlying growth drivers in global trade volumes.

Opportunity Analysis

Advanced Technology Integration

The cargo transportation insurance market holds substantial opportunity through the integration of advanced technologies including Internet of Things (IoT), blockchain, and artificial intelligence (AI). IoT-enabled devices offer real-time cargo monitoring that not only reduces risk but also streamlines claims management by providing transparent and accurate data on cargo conditions during transit.

Blockchain technology enhances transaction transparency and efficiency, reducing fraud and administrative costs. AI applications are improving underwriting accuracy and accelerating claim settlements, making insurance products more attractive and user-friendly. The growing demand for tailored insurance solutions for perishable goods and specialized cargo also opens avenues for innovative policies.

Challenge Analysis

Impact of Trade Tensions and Tariffs

A key challenge faced by the cargo transportation insurance market is the ongoing impact of global trade tensions and tariffs. Rising tariffs, particularly those implemented by the U.S. against various countries, affect not only the cost of shipping but also the availability and pricing of high-tech cargo monitoring equipment.

Supply chain disruptions due to geopolitical conflicts and reciprocal trade restrictions increase operational risks and uncertainty for insurers and insured parties alike. These trade challenges raise insurance premiums and create a less predictable environment for risk assessment, undermining market stability.

The consequences extend beyond the direct cost to insurers by influencing global trade volumes and patterns, which are critical for market growth. Managing these geopolitical risks requires insurers to adapt their underwriting and risk evaluation models rapidly, which can be resource intensive and complex.

Competitive Analysis

In the cargo transportation insurance market, global leaders such as AIG, Liberty Mutual Insurance, Chubb, Berkshire Hathaway Specialty Insurance, and The Hartford hold strong positions. Their dominance is supported by wide underwriting capacity, global reach, and diversified product portfolios. These companies provide tailored coverage for multimodal cargo movements, addressing risks from marine to air and road transport.

Major European and Asian insurers including Allianz Global Corporate & Specialty, AXA XL, Zurich Insurance Group, Lloyd’s of London, RSA Insurance Group, HDI Global SE, Tokio Marine Holdings, Mitsui Sumitomo Insurance, and Samsung Fire & Marine Insurance contribute significantly. Their strong regional networks and expertise in marine and specialty insurance enable them to cover complex global supply chains.

Regional insurers such as Ping An Insurance, China Pacific Insurance (CPIC), QBE Insurance, Oman Insurance Company, Qatar Insurance Company (QIC), AXA Gulf, Jubilee Insurance, Porto Seguro, Bradesco Seguros, and Sura Insurance play vital roles in local markets. Their presence strengthens cargo insurance adoption in Asia-Pacific, the Middle East, and Latin America.

Top Key Players in the Market

- AIG

- Liberty Mutual Insurance

- Chubb

- Berkshire Hathaway Specialty Insurance

- The Hartford

- Allianz Global Corporate & Specialty

- AXA XL

- Zurich Insurance Group

- Lloyd’s of London

- RSA Insurance Group

- HDI Global SE

- Tokio Marine Holdings

- Mitsui Sumitomo Insurance

- Samsung Fire & Marine Insurance

- Ping An Insurance

- China Pacific Insurance Company – CPIC

- QBE Insurance

- Oman Insurance Company

- Qatar Insurance Company – QIC

- AXA Gulf

- Jubilee Insurance

- Porto Seguro

- Bradesco Seguros

- Sura Insurance

- Other Major Players

Recent Developments

- In May 2025, Tokio Marine launched TMGX, a specialized unit focused on low-carbon transition insurance. TMGX aims to generate $1 billion in revenue by 2030 by providing coverage for sustainable sectors including green hydrogen and electric vehicles. This aligns with a growing trend of insuring climate-conscious cargo and transport technologies.

- In March 2025, Chubb announced an agreement to acquire Liberty Mutual’s Property & Casualty insurance businesses in Thailand and Vietnam, which produced around $275 million in net premiums written in 2024. This acquisition will enhance Chubb’s regional footprint and allows Liberty Mutual to focus on other Asia-Pacific markets.

- In February 2024, Loadsure launched a Motor Truck Cargo and Logistics Services Insurance product called Columbia™, powered by data analytics and tailored for the logistics community. This covers a critical niche and highlights the increased use of technology to improve risk assessment and insurance accuracy for cargo in transit by road.

Report Scope

Report Features Description Market Value (2024) USD 64.50 Bn Forecast Revenue (2034) USD 110.18 Bn CAGR(2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage (All Risks, Named Perils, General Average, Contributory Negligence), By Commodity Type (Manufactured Goods, Perishables, Dangerous Goods, Electronics), By Cargo Value(Low Value Cargo, High Value Cargo, Ultra-High Value Cargo), By Form of Transport (Domestic, International), By Mode of Transportation (Air, Sea, Road, Rail), By Policy Type (Open Cover Cargo Policy, Contingency Insurance Policy, Specific Cargo Policy, Others), By Application (Import & Export Trade Enterprises, Processing Trade Enterprises, Logistics Companies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AIG , Liberty Mutual Insurance, Chubb , Berkshire Hathaway Specialty Insurance , The Hartford, Allianz Global Corporate & Specialty, AXA XL, Zurich Insurance Group, Lloyd’s of London, RSA Insurance Group, HDI Global SE, Tokio Marine Holdings, Mitsui Sumitomo Insurance, Samsung Fire & Marine Insurance , Ping An Insurance, China Pacific Insurance Company – CPIC, QBE Insurance, Oman Insurance Company, Qatar Insurance Company – QIC, AXA Gulf, Jubilee Insurance, Porto Seguro, Bradesco Seguros, Sura Insurance, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cargo Transportation Insurance MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Cargo Transportation Insurance MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AIG

- Liberty Mutual Insurance

- Chubb

- Berkshire Hathaway Specialty Insurance

- The Hartford

- Allianz Global Corporate & Specialty

- AXA XL

- Zurich Insurance Group

- Lloyd's of London

- RSA Insurance Group

- HDI Global SE

- Tokio Marine Holdings

- Mitsui Sumitomo Insurance

- Samsung Fire & Marine Insurance

- Ping An Insurance

- China Pacific Insurance Company – CPIC

- QBE Insurance

- Oman Insurance Company

- Qatar Insurance Company – QIC

- AXA Gulf

- Jubilee Insurance

- Porto Seguro

- Bradesco Seguros

- Sura Insurance

- Other Major Players