Global Carbon Disulfide Market Size, Share, And Business Benefit By Type (Sulfur Solvent, Phosphorus Solvent, Selenium Solvent, Bromine Solvent, Others), By Purity (Pure, Impure), By Application (Rubber, Cleaning Carbon Nanotubes, Rayon, Fibers, Perfumes, Cellophane and Packaging, Others), By End-use (Chemical and Pharmaceutical, Transportation, Personal Care and Cosmetic, Food and Beverages, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 163955

- Number of Pages: 335

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

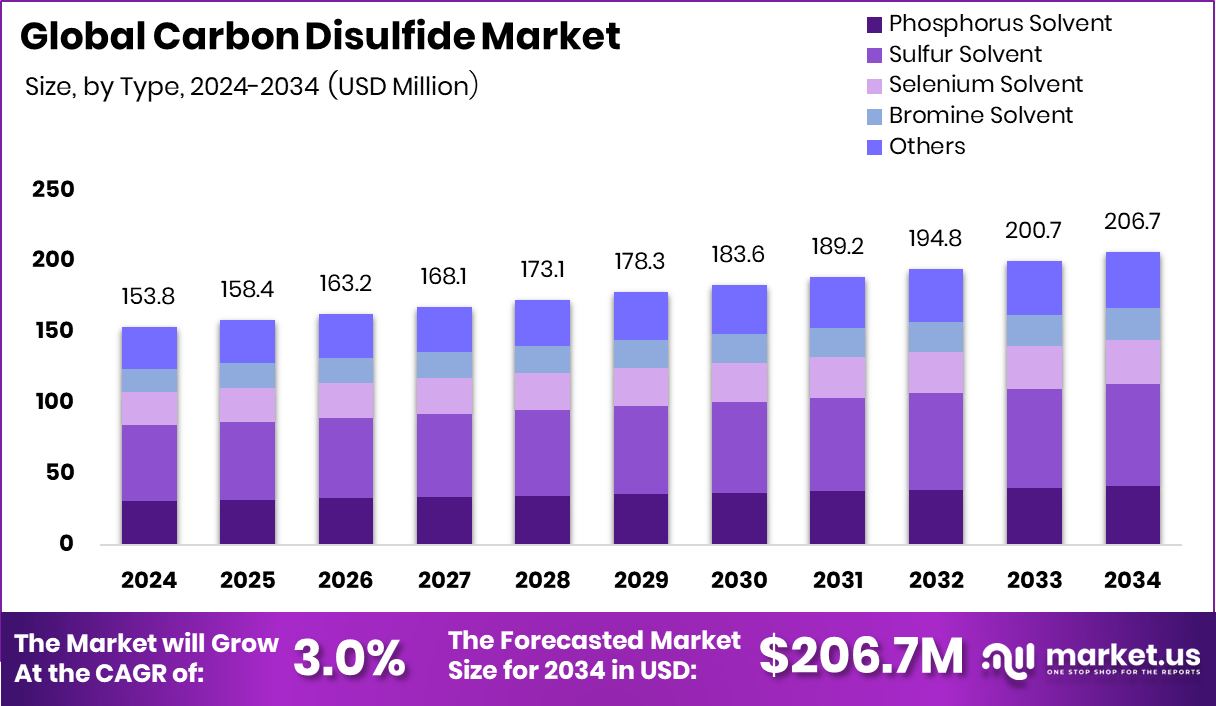

The Global Carbon Disulfide Market is expected to be worth around USD 206.7 million by 2034, up from USD 153.8 million in 2024, and is projected to grow at a CAGR of 3.0% from 2025 to 2034. The expanding textile and chemical sectors in the Asia Pacific 44.90% significantly boosted demand for carbon disulfide.

Carbon Disulfide (CS₂) is a volatile, colourless to faintly yellow liquid with a distinct ether- or chloroform-like odour in its pure form, though industrial samples often smell much worse. With molecular formula CS₂, it is denser than water and highly flammable, boiling at around 46°C. Industrially, it serves as a chemical intermediate and solvent in the manufacture of viscose/rayon, cellophane, rubber-chemistry additives, and mining flotation agents.

The “carbon disulfide market” refers to the global production, consumption, trading, and end-use demand for CS₂. It covers supply from manufacturers, consumption across industries like textiles (e.g., viscose fibers), chemical intermediates (e.g., xanthates), mining, and other specialty uses, plus regional production trends, price dynamics, regulatory influences, and future growth drivers.

One key growth factor is the increasing demand for regenerated cellulose fibers such as viscose and lyocell in the apparel and home-textile sectors in emerging economies. As manufacturers expand capacity, especially in Asia, the requirement for chemical intermediates like CS₂ rises. Also, upstream expansions of sulphur- and carbon-feedstock capacity support this growth.

In parallel, several fragrance and beauty-tech firms are raising funds—Courtney Cox’s fragrance brand Homecourt secured US$8 million in funding; Fraganote raised US$1 million (with the founder emphasizing India’s need for its iconic perfume house); Nirmalaya raised US$800,000 in seed funding; Perfume Lounge raised US$250,000 in seed funding; and Proven raised US$12.2 million to grow AI-powered personalized beauty and fragrance solutions—such investment signals rising activity in downstream industries such as fragrances and specialty chemicals, which can tie back into demand for intermediates like CS₂.

Demand for carbon disulfide is driven by its use as a precursor in xanthate manufacture (used in mining flotation) and dithiocarbamates (used in rubber/vulcanisation and agrochemicals). With mining activity growing in certain regions and rubber & tyre consumption rising in developing markets, the chemical demand for CS₂ climbs. Moreover, packaging films and cellophane still consume CS₂ in some geographies. Its role as a solvent in niche chemical syntheses also contributes to a steady baseline demand.

An opportunity for the carbon disulfide market lies in applications transitioning towards more sustainable or higher-value derivatives. For example, new specialty fibres, advanced mining reagents, or high-performance rubber additives offer higher margins and less substitution risk. Also, as downstream industries such as fragrances, specialty chemicals, and AI-driven personalization (illustrated by the funding rounds above) grow, there is scope for CS₂ to serve as a building block for novel sulfur-chemistry platforms.

Key Takeaways

- The Global Carbon Disulfide Market is expected to be worth around USD 206.7 million by 2034, up from USD 153.8 million in 2024, and is projected to grow at a CAGR of 3.0% from 2025 to 2034.

- In 2024, sulfur solvent led the carbon disulfide market, securing a 34.9% share with broad industrial applications.

- By purity, the Pure segment dominated the carbon disulfide market, capturing a 76.3% share across major manufacturing sectors.

- Within applications, rubber held a significant 23.4% share in the carbon disulfide market, supporting tire and elastomer production.

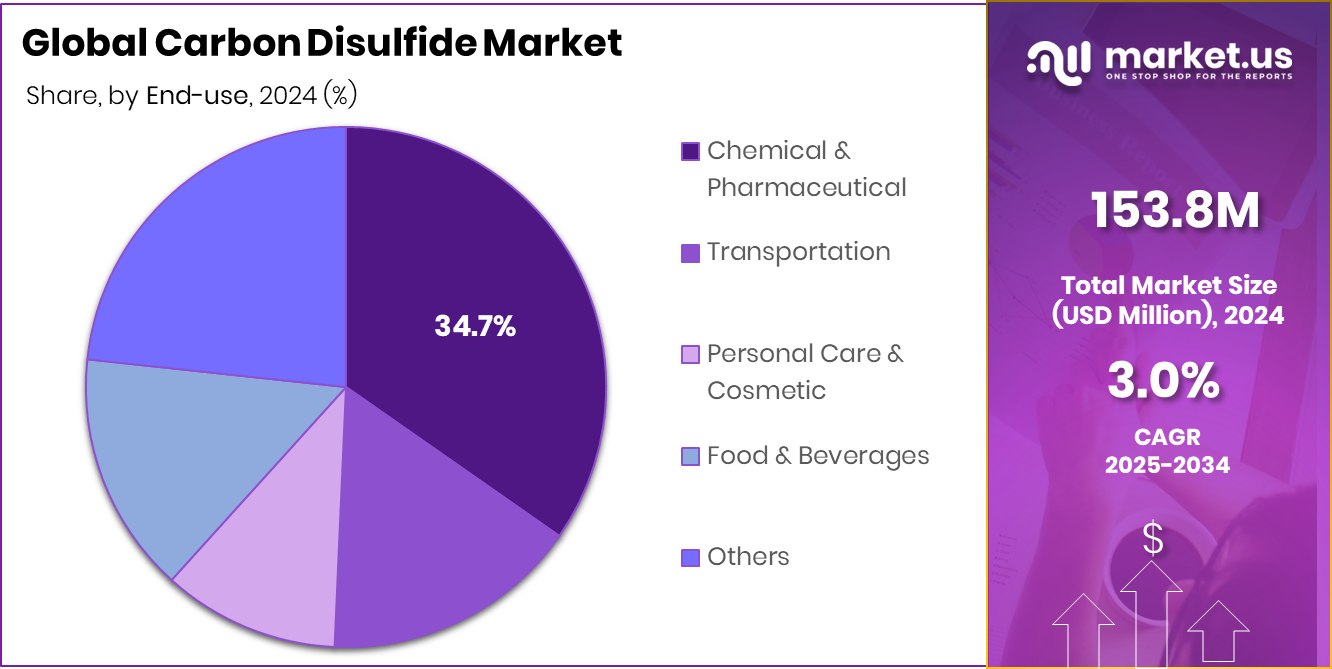

- In terms of end-use, the chemical and pharmaceutical industries commanded a 34.7% share of the carbon disulfide market globally.

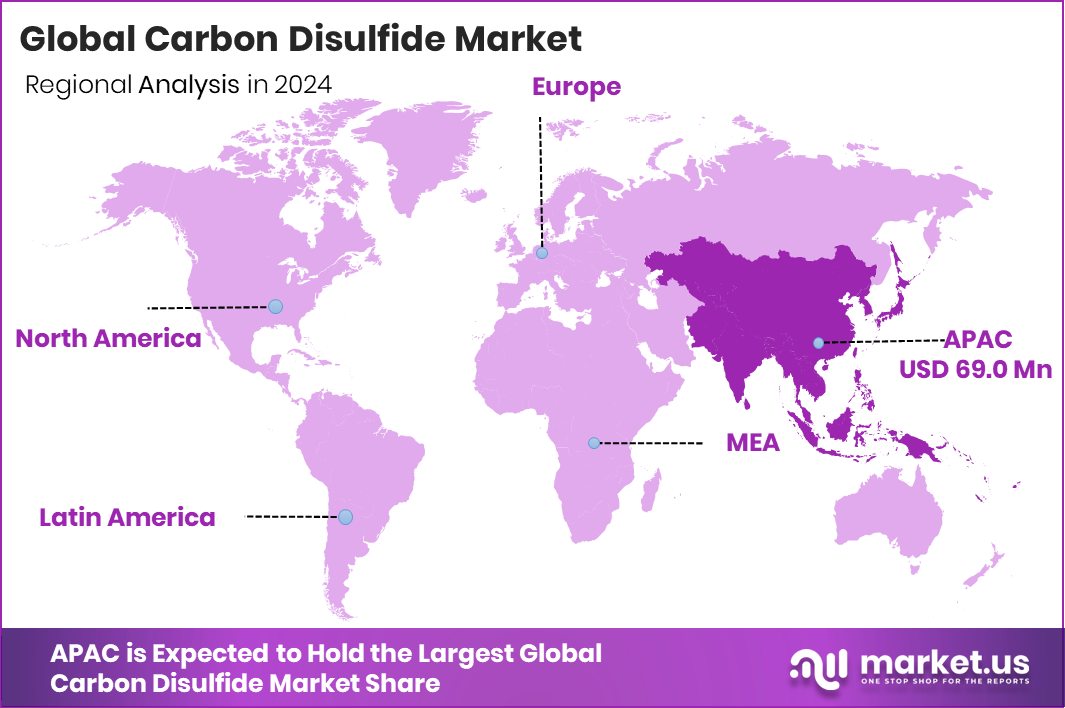

- The Asia Pacific market value reached approximately USD 69.0 million, reflecting strong industrial growth.

By Type Analysis

In 2024, Sulfur Solvent held a dominant market position in the By Type segment of the Carbon Disulfide Market, capturing a 34.9% share. This dominance was largely attributed to its extensive application in industrial chemical synthesis, particularly in the production of viscose fibres, cellophane films, and rubber processing additives. The solvent’s high reactivity and ability to dissolve sulfur and phosphorus compounds make it indispensable across multiple manufacturing sectors.

Growing industrial activities in the textile and rubber industries further supported its leading role. Additionally, investments and funding in the fragrance and specialty chemical sectors indirectly strengthened demand, as they rely on sulfur-based intermediates. Consequently, Sulfur Solvent remained a critical component within the overall carbon disulfide market landscape in 2024.

By Purity Analysis

In 2024, Pure held a dominant market position in the By Purity segment of the Carbon Disulfide Market, accounting for a 76.3% share. This high share reflects its extensive utilization in industries requiring superior chemical purity, such as pharmaceuticals, specialty chemicals, and textile production.

The pure grade is preferred for manufacturing viscose rayon and cellophane due to its consistent quality and minimal impurities, ensuring process stability and product uniformity.

Growing demand for premium chemical formulations and improved solvent quality further reinforced its dominance. Additionally, advancements in purification technologies and the increasing adoption of high-grade inputs across industrial processes supported the sustained leadership of the Pure segment in 2024.

By Application Analysis

In 2024, Rubber held a dominant market position in the By Application segment of the Carbon Disulfide Market, capturing a 23.4% share. This leadership stemmed from its crucial role in producing rubber accelerators, vulcanization agents, and performance additives that enhance elasticity and durability.

The compound’s chemical compatibility makes it vital for manufacturing tyres, seals, and industrial rubber goods. With continuous expansion in the automotive and construction sectors, the need for high-quality rubber materials grew steadily, strengthening its market share.

Additionally, innovations in sulfur-based rubber processing and the adoption of efficient formulations supported the segment’s growth. Thus, the Rubber segment maintained a strong foothold in the overall carbon disulfide application landscape during 2024.

By End-use Analysis

In 2024, Chemical and Pharmaceutical held a dominant market position in the end-use segment of the Carbon Disulfide Market, capturing a 34.7% share. This dominance was driven by the compound’s vital role as a chemical intermediate in producing active pharmaceutical ingredients, agrochemicals, and specialty solvents. Its ability to react with organic and inorganic compounds makes it indispensable in fine chemical synthesis and drug formulation.

The growing focus on developing advanced medicines and high-purity intermediates further strengthened demand from the pharmaceutical sector. Additionally, ongoing investments in chemical manufacturing and process innovation supported its extensive use. As a result, the Chemical and Pharmaceutical segment maintained its strong leadership in the global carbon disulfide market during 2024.

Key Market Segments

By Type

- Sulfur Solvent

- Phosphorus Solvent

- Selenium Solvent

- Bromine Solvent

- Others

By Purity

- Pure

- Impure

By Application

- Rubber

- Cleaning Carbon Nanotubes

- Rayon

- Fibers

- Perfumes

- Cellophane and Packaging

- Others

By End-use

- Chemical and Pharmaceutical

- Transportation

- Personal Care and Cosmetic

- Food and Beverages

- Others

Driving Factors

Rising Demand from Fragrance and Specialty Chemical Industries

One of the major driving factors for the Carbon Disulfide Market is the rising demand from fragrance and specialty chemical industries. Carbon disulfide plays a key role in producing sulfur-based intermediates used in fragrances, solvents, and chemical formulations. The fragrance industry is witnessing growing innovation and funding, as seen when an Honest Company Alum raised $8 million for a ‘natural’ perfume startup.

Such investments are creating strong momentum for sustainable and nature-inspired fragrance production, indirectly boosting demand for key raw materials like carbon disulfide. With expanding consumer interest in clean beauty and high-quality aromatic products, manufacturers are increasing their use of pure-grade carbon disulfide. This trend continues to drive industrial production, supporting overall market growth through 2024 and beyond.

Restraining Factors

Health and Environmental Concerns Limiting Industrial Expansion

One of the key restraining factors for the Carbon Disulfide Market is the growing concern over its health and environmental impact. Carbon disulfide is highly toxic and flammable, and prolonged exposure can harm the nervous system and surrounding ecosystems. These safety issues have led to stricter regulations on its manufacturing and handling, increasing operational costs for producers.

Many industries are now exploring safer chemical alternatives to reduce environmental risks. Meanwhile, innovation is shifting toward eco-friendly fragrance formulations, as shown when niche fragrance start-up Elorea landed a $2 million seed round to promote sustainable perfume creation. Such moves highlight a shift toward greener solutions, which may limit the industrial expansion of conventional carbon disulfide usage globally.

Growth Opportunity

Expanding Fragrance Investments Creating New Market Opportunities

A major growth opportunity for the Carbon Disulfide Market lies in the rising global investments in luxury and premium fragrance brands. Carbon disulfide is used as a chemical intermediate in producing sulfur-based compounds essential for perfume formulations. The luxury fragrance industry’s expansion, supported by major acquisitions, is boosting downstream chemical demand.

Recently, Gucci-owner Kering paid $3.8 billion for the French fragrance label Creed, signaling a strong commitment to high-end perfume production. Such large-scale deals increase the need for raw materials like carbon disulfide, which play a role in creating aromatic and specialty chemicals. As fragrance companies grow and innovate, suppliers of pure and industrial-grade carbon disulfide are well-positioned to capture emerging opportunities across global markets.

Latest Trends

Growing Shift Toward Sustainable and Personalized Fragrances

One of the latest trends in the Carbon Disulfide Market is the growing shift toward sustainable and personalized fragrance formulations. Carbon disulfide serves as a key raw material in producing various sulfur-based compounds used in fragrance chemistry. As consumers demand more natural and customizable scents, manufacturers are investing in cleaner processes and high-purity chemical inputs.

A notable example of this evolving landscape is the funding of innovative fragrance services—fragrance subscription provider Scentbird raised $2.8 million while launching a new personalized scent service. Such developments highlight the industry’s move toward tailored, eco-conscious solutions. This trend not only boosts specialty chemical innovation but also drives demand for controlled and sustainable use of carbon disulfide in modern perfumery production.

Regional Analysis

In 2024, the Asia Pacific dominated the Carbon Disulfide Market with a 44.90% share.

In 2024, Asia Pacific held a dominant position in the global Carbon Disulfide Market, accounting for a 44.90% share, valued at approximately USD 69.0 million. The region’s leadership is driven by strong industrial activity across China, India, and Southeast Asia, supported by the growing textile, rubber, and chemical sectors. Increasing production of viscose rayon and specialty chemicals further strengthened regional consumption.

North America maintained steady growth due to its well-established chemical manufacturing base and consistent demand from the pharmaceutical and mining industries. Europe witnessed moderate expansion, led by advanced environmental compliance and rising adoption of high-purity carbon disulfide in specialty applications.

Meanwhile, Latin America and the Middle East & Africa showed emerging potential, supported by expanding industrial investments and the gradual rise in rubber and solvent applications. Collectively, these regions contribute to a balanced global market, though Asia Pacific remains the clear leader owing to its strong production base, cost efficiency, and accelerating demand from downstream industries.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Akzo Nobel N.V. focused on chemical formulations that enhanced industrial efficiency while maintaining environmental safety. Its expertise in sulfur-based intermediates positioned it as a key supplier for downstream applications in textiles, rubber, and specialty chemicals.

Merck KGaA, leveraging its strong background in high-purity chemical manufacturing, concentrated on supplying carbon disulfide suitable for laboratory and pharmaceutical applications, emphasizing quality and precision.

Meanwhile, GFS Chemicals Inc. maintained its presence through its specialized chemical solutions, serving educational and industrial markets with consistent product reliability and safety standards. Together, these companies demonstrated strategic leadership by focusing on purity optimization, safe handling technologies, and research-based product enhancement.

Top Key Players in the Market

- Akzo Nobel N.V.

- Merck KGaA

- GFS Chemicals Inc.

- PPG Industries, Inc.

- Alfa Aesar

- Univar Solutions Inc.

- Jiangsu Jinshan Chemical Co. Ltd.

- Arkema

- Shikoku Chemicals Corporation

- Zhuzhou Jinyuan Chemical Industry Co.,Ltd.

- Shanghai Baijin Chemical Group Co., Ltd.

- Jiaonian Ruixing Chemical

- Tedia

Recent Developments

- In April 2025, Merck announced its agreement to acquire U.S. biotech firm SpringWorks Therapeutics for around US$3.9 billion. The move is meant to bolster Merck’s presence in rare diseases and strengthen its global innovation engine in life sciences and specialty chemistry.

- In May 2024, Akzo Nobel announced the closure of three manufacturing sites (in the Netherlands, Ireland, and Zambia) and planned to transfer production to other locations. This move is part of a multi-year plan to streamline operations and reduce costs by 2026.

Report Scope

Report Features Description Market Value (2024) USD 153.8 Million Forecast Revenue (2034) USD 206.7 Million CAGR (2025-2034) 3.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Sulfur Solvent, Phosphorus Solvent, Selenium Solvent, Bromine Solvent, Others), By Purity (Pure, Impure), By Application (Rubber, Cleaning Carbon Nanotubes, Rayon, Fibers, Perfumes, Cellophane and Packaging, Others), By End-use (Chemical and Pharmaceutical, Transportation, Personal Care and Cosmetic, Food and Beverages, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Akzo Nobel N.V., Merck KGaA, GFS Chemicals Inc., PPG Industries, Inc., Alfa Aesar, Univar Solutions Inc., Jiangsu Jinshan Chemical Co. Ltd., Arkema, Shikoku Chemicals Corporation, Zhuzhou Jinyuan Chemical Industry Co.,Ltd., Shanghai Baijin Chemical Group Co., Ltd., Jiaonian Ruixing Chemical, Tedia Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Carbon Disulfide MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Carbon Disulfide MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Akzo Nobel N.V.

- Merck KGaA

- GFS Chemicals Inc.

- PPG Industries, Inc.

- Alfa Aesar

- Univar Solutions Inc.

- Jiangsu Jinshan Chemical Co. Ltd.

- Arkema

- Shikoku Chemicals Corporation

- Zhuzhou Jinyuan Chemical Industry Co.,Ltd.

- Shanghai Baijin Chemical Group Co., Ltd.

- Jiaonian Ruixing Chemical

- Tedia