Capsule Endoscopy Market By Product (Small Bowel Capsule, Colon Capsule and Esophageal Capsule), Component (Camera Capsule, Workstation, and Data Recorder),Type (Wireless Capsule Endoscopy, Receiver Capsule Endoscopy, and Others), Application (OGIB (obscure GI tract bleeding), Crohn’s Disease, Small Intestine Tumor and Others), End-use (Hospitals, Ambulatory Surgery Centers/Clinics and Other End-use), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140944

- Number of Pages: 371

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

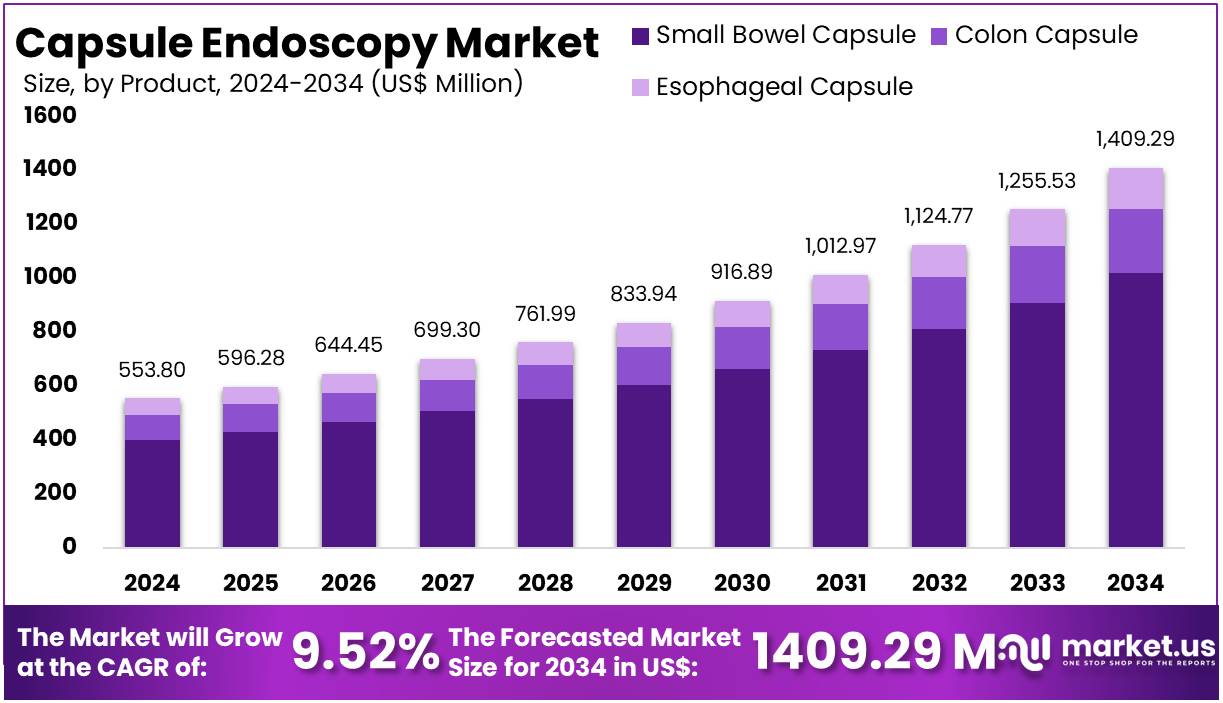

The Global Capsule Endoscopy Market size is expected to be worth around US$ 1409.29 Million by 2034, from US$ 553.8 Million in 2024, growing at a CAGR of 9.52% during the forecast period from 2025 to 2034.

The global capsule endoscopy market is witnessing significant growth, driven by the increasing prevalence of gastrointestinal (GI) diseases, technological advancements, and the growing adoption of minimally invasive diagnostic techniques. Capsule endoscopy is a revolutionary diagnostic method that allows for non-invasive visualization of the digestive tract, particularly the small intestine, which is difficult to access with traditional endoscopic procedures.

- In 2019, digestive diseases accounted for approximately 2,276.27 million prevalent cases (95% UI: 2,151.23–2,398.06) and 2.56 million deaths (range: 2.39–2.72 million). This represents 32.04% of the global prevalence of non-communicable diseases and 6.08% of all deaths related to non-communicable diseases.

- According to a report by United European Gastroenterology (UEG), an estimated 332 million people in the European region are living with a digestive disorder.

- According to the Canadian Cancer Society, colorectal cancer is projected to be the fourth most diagnosed cancer in Canada in 2024. An estimated 25,200 Canadians will receive this diagnosis. This figure represents 10% of all new cancer cases in the country. The data signals a growing need for early screening and prevention. Stakeholders may see increased demand for healthcare services and innovation.

The global capsule endoscopy market is driven by the rising prevalence of gastrointestinal (GI) disorders such as Crohn’s disease, celiac disease, obscure GI bleeding, and colorectal cancer. According to the World Cancer Research Fund, colorectal cancer is among the top three most common cancers worldwide, highlighting the need for advanced diagnostic tools like capsule endoscopy. Additionally, there is a growing preference for minimally invasive procedures due to their reduced discomfort, lower risk of infections, and faster recovery times.

Capsule endoscopy provides a non-invasive alternative to traditional endoscopic methods, eliminating the need for sedation or hospital stays. Technological advancements, including AI-assisted image analysis, higher-resolution imaging, longer battery life, and improved data transmission, are enhancing diagnostic accuracy and efficiency. Furthermore, the increasing geriatric population, which is more susceptible to GI disorders, along with rising healthcare expenditures in developed regions, is further driving the adoption of capsule endoscopy as a crucial diagnostic solution.

The capsule endoscopy market is witnessing key trends, including the integration of AI-powered image analysis, which enhances diagnostic accuracy by helping healthcare professionals detect abnormalities more efficiently. Additionally, innovations in wireless capsule endoscopy (WCE) are enabling real-time monitoring, remote data transmission, and even drug delivery, expanding the scope of capsule-based diagnostics.

Another significant trend is the increasing adoption in emerging markets, particularly in Asia-Pacific and Latin America, driven by rising healthcare investments and growing awareness of non-invasive diagnostic solutions. These advancements are transforming capsule endoscopy into a more effective, accessible, and versatile tool for gastrointestinal diagnostics.

The capsule endoscopy market presents significant growth opportunities, particularly in expanding applications beyond gastrointestinal diagnostics. Companies are exploring its potential for targeted drug delivery and imaging of other internal organs, broadening its clinical utility. Additionally, the growing healthcare infrastructure in developing regions, supported by government initiatives and increased investments, is driving wider adoption of advanced diagnostic technologies.

Emerging markets are witnessing improvements in healthcare accessibility, enabling more patients to benefit from non-invasive diagnostic solutions like capsule endoscopy. These developments position capsule endoscopy as a versatile and increasingly essential tool in modern medical diagnostics.

Key Takeaways

- The Capsule Endoscopy market generated a revenue of US$ 553.80 Million and is predicted to reach US$ 1,409.29 Million, with a CAGR of 9.52%.

- Based on the product, the Small Bowel Capsule segment generated the most revenue for the market with a market share of 72.30%.

- Based on the Component, the Camera Capsule segment generated the most revenue for the market with a market share of 30.2%.

- Based on the Type, the Wireless Capsule Endoscopy segment generated the most revenue for the market with a market share of 36.9%.

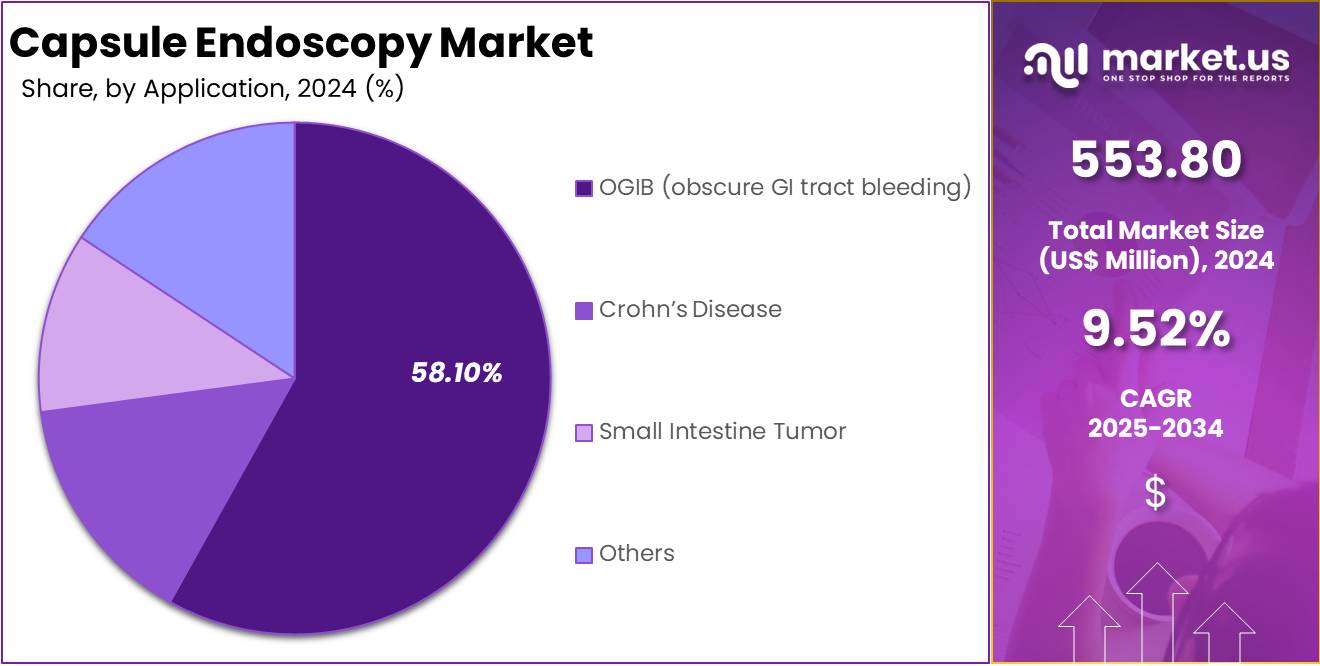

- Based on the Application, the OGIB (obscure GI tract bleeding) segment generated the most revenue for the market with a market share of 58.10%.

- Based on the End-use, the Hospitals segment generated the most revenue for the market with a market share of 47.80%.

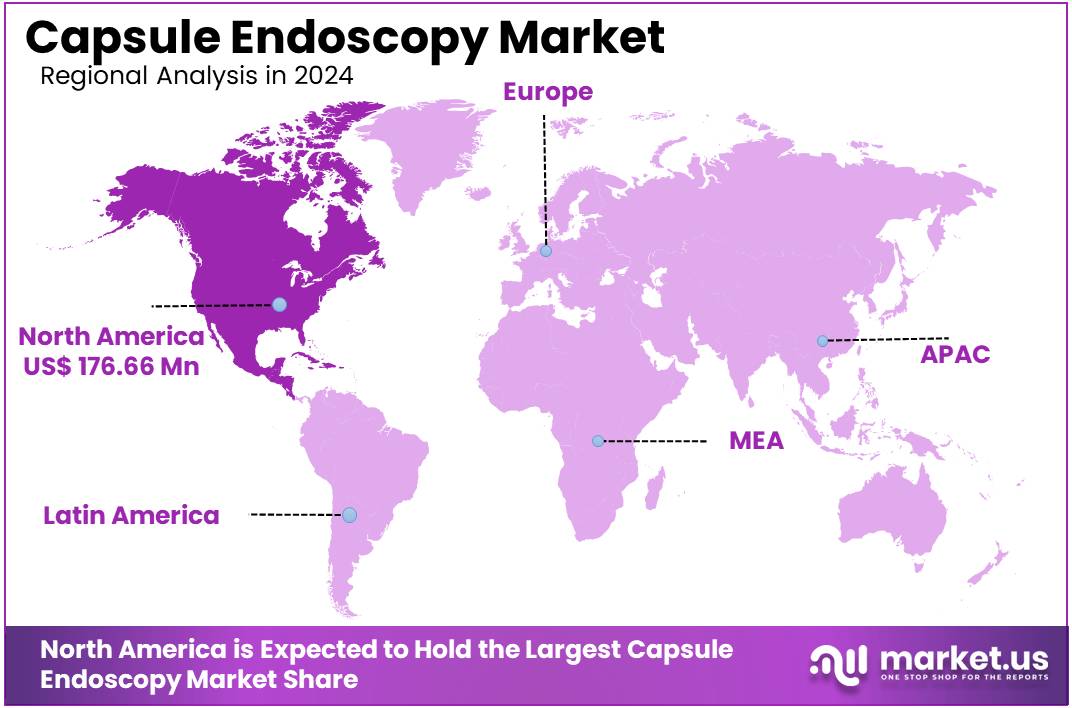

- Region-wise, North America remained the lead contributor to the market, by claiming the highest market share, amounting to 31.90%.

Product Analysis

In 2024, the Small Bowel Capsule segment held a dominant market position in the Product Segment of the Capsule Endoscopy Market, capturing more than a 72.30% share. The Small Bowel Capsule dominates the product type segment in the Capsule Endoscopy Market, primarily due to its effectiveness in diagnosing small intestine disorders such as Crohn’s disease, obscure gastrointestinal bleeding (OGIB), and small bowel tumors. This dominance is driven by the rising prevalence of gastrointestinal (GI) disorders and the increasing preference for minimally invasive diagnostic procedures.

According to industry reports, OGIB accounts for approximately 5% of all GI bleeding cases, making capsule endoscopy a critical diagnostic tool. Small bowel capsules offer superior imaging capabilities compared to traditional methods, with a diagnostic yield of 60-80% for detecting small bowel diseases. The market is also expanding due to advancements such as AI-powered image analysis and longer battery life, improving diagnostic accuracy and efficiency.

Despite high costs, the growing incidence of GI disorders and rising preference for non-invasive procedures are expected to sustain the dominance of the small bowel capsule segment in the coming years.

Component Analysis

In 2024, the Camera Capsule segment held a dominant market position in the Component Segment of the Capsule Endoscopy Market, capturing more than a 30.2% share. The Camera Capsule dominates the component segment in the Capsule Endoscopy Market due to its crucial role in capturing high-resolution images for diagnosing gastrointestinal (GI) disorders. This dominance is driven by technological advancements, including higher frame rates, improved battery life, and AI-assisted image analysis, which enhance diagnostic accuracy for conditions like Crohn’s disease, obscure gastrointestinal bleeding (OGIB), and small bowel tumors.

Camera capsules, integrated with features like 360-degree panoramic imaging and real-time data transmission, offer superior visualization of the GI tract compared to traditional endoscopic methods. Reports indicate that capsule endoscopy has a diagnostic yield of up to 80% for small bowel diseases, further driving its adoption.

Type Analysis

In 2024, the Wireless Capsule Endoscopy (WCE) segment held a dominant market position in the Type Segment of the Capsule Endoscopy Market, capturing more than a 36.9% share. Wireless Capsule Endoscopy (WCE) is the leading segment in the Capsule Endoscopy Market due to its non-invasive nature, patient comfort, and advanced imaging capabilities. WCE enables direct visualization of the gastrointestinal (GI) tract, particularly the small intestine, which is difficult to assess using traditional endoscopy methods. The technology provides high-resolution images, aiding in the early detection of conditions such as Crohn’s disease, gastrointestinal bleeding, and tumors.

Key factors driving WCE’s dominance include increasing prevalence of GI disorders, growing adoption of minimally invasive diagnostics, and advancements in wireless technology. Unlike conventional endoscopy, WCE does not require sedation, reducing patient discomfort and recovery time. Additionally, improvements in battery life, image resolution, and artificial intelligence integration for automated lesion detection further enhance its clinical efficiency. As healthcare providers and patients increasingly prefer non-invasive diagnostic tools, WCE continues to gain traction, reinforcing its strong position in the global Capsule Endoscopy Market.

Application Analysis

In 2023, the Obscure Gastrointestinal Bleeding (OGIB) segment held a dominant market position in the application Segment of the Capsule Endoscopy Market, capturing more than a 36.9% share. OGIB refers to gastrointestinal bleeding of unknown origin, which is not detected through conventional endoscopy or colonoscopy. Wireless Capsule Endoscopy (WCE) plays a crucial role in diagnosing OGIB, as it provides a comprehensive, non-invasive visualization of the small intestine, where traditional diagnostic methods often fall short.

The dominance of OGIB in this segment is driven by the increasing prevalence of gastrointestinal disorders, particularly in the aging population. Conditions such as angiodysplasia, vascular abnormalities, and small bowel ulcers often contribute to OGIB, making capsule endoscopy an essential diagnostic tool. The demand for early and accurate detection has further fueled its adoption among healthcare providers.

In addition to its superior diagnostic accuracy, capsule endoscopy offers significant advantages such as patient comfort, minimal risk, and real-time image transmission. Technological advancements, including artificial intelligence (AI) integration for automated lesion detection, have enhanced the effectiveness of WCE in detecting OGIB sources. As the global burden of gastrointestinal diseases rises, and as more medical institutions adopt minimally invasive diagnostic techniques, OGIB is expected to maintain its dominance in the Capsule Endoscopy Market.

End-use Analysis

Hospitals held the dominant share in the end-use segment of the Capsule Endoscopy Market due to their advanced healthcare infrastructure, availability of specialized medical professionals, and high patient influx. As primary centers for diagnosis and treatment, hospitals are well-equipped with cutting-edge technologies, ensuring accurate and efficient detection of gastrointestinal disorders using capsule endoscopy.

The rising prevalence of conditions like Obscure Gastrointestinal Bleeding (OGIB), Crohn’s disease, and small intestine tumors has driven hospitals to adopt capsule endoscopy for non-invasive diagnostics. Additionally, hospitals have better reimbursement policies and access to skilled gastroenterologists, making them the preferred choice for both patients and healthcare providers.

Furthermore, ongoing advancements in AI-assisted image analysis and improved wireless technology have enhanced diagnostic accuracy, reinforcing hospitals’ dominance in this market. With the increasing adoption of minimally invasive diagnostic tools, hospitals are expected to continue leading the Capsule Endoscopy Market’s end-use segment.

Key Market Segments

By Product

- Small Bowel Capsule

- Colon Capsule

- Esophageal Capsule

By Component

- Camera Capsule

- Workstation

- Data Recorder

By Type

- Wireless Capsule Endoscopy

- Receiver Capsule Endoscopy

- Others

By Application

- OGIB (obscure GI tract bleeding)

- Crohn’s Disease

- Small Intestine Tumor

- Others

By End-use

- Hospitals

- Ambulatory Surgery Centers/Clinics

- Other End-use

Drivers

Rising Prevalence of Gastrointestinal (GI) Disorders

The rising prevalence of gastrointestinal (GI) disorders is a significant driver of the global capsule endoscopy market, as an increasing number of patients require non-invasive and highly effective diagnostic solutions. The growing incidence of conditions such as obscure GI bleeding (OGIB), Crohn’s disease, celiac disease, small intestine tumors, and colorectal cancer is fueling the demand for capsule endoscopy worldwide.

According to estimates, over 3.5 million people globally suffer from Crohn’s disease, with cases rising due to genetic and environmental factors, particularly in North America and Europe. OGIB accounts for nearly 5% of all GI bleeding cases, often requiring capsule endoscopy for accurate diagnosis. Additionally, colorectal cancer affects over 1.9 million people annually, making early detection crucial. The global prevalence of celiac disease is around 1%, further supporting the need for effective diagnostic tools.

Capsule endoscopy has gained popularity due to its non-invasive nature, improved patient comfort, and superior imaging capabilities, offering a diagnostic yield of 60-80% for small bowel disorders. The integration of AI-powered image analysis, longer battery life, and enhanced wireless communication technology has further improved the efficiency of capsule endoscopy.

Restrains

Severe Side Effects of Treatments

The high cost of capsule endoscopy is a significant barrier to the Global Capsule Endoscopy Market, limiting its widespread adoption, particularly in low- and middle-income countries. The average cost of a capsule endoscopy procedure ranges from $500 to $2,500, depending on the healthcare facility, geographic location, and additional diagnostic requirements. The capsule itself, manufactured with advanced imaging and wireless transmission technologies, can cost between $300 and $600 per unit, making it an expensive alternative to traditional endoscopic procedures.

Unlike conventional endoscopy, which is often covered by insurance, reimbursement policies for capsule endoscopy vary across regions, restricting patient accessibility. Many healthcare systems do not fully cover the procedure, increasing out-of-pocket expenses for patients. Additionally, the need for specialized software and trained professionals to analyze capsule endoscopy images further adds to operational costs, posing a challenge for small healthcare facilities.

Moreover, capsule retention in patients with strictures or obstructions can lead to additional medical interventions, increasing overall expenses. The high cost also affects hospitals and diagnostic centers, slowing adoption rates despite its non-invasive benefits.

To overcome this restraint, technological advancements aimed at reducing manufacturing costs and expanding insurance coverage are essential. Increased government funding and private investments in healthcare infrastructure could help make capsule endoscopy more accessible worldwide.

Opportunities

Wireless and Smart Capsule Innovations

Technological advancements in wireless and smart capsule endoscopy are revolutionizing gastrointestinal diagnostics by enhancing data transmission, real-time monitoring, and diagnostic accuracy. Traditional capsule endoscopy provides high-resolution images of the gastrointestinal (GI) tract, but newer innovations integrate real-time data transmission, allowing physicians to monitor a patient’s condition instantly rather than waiting for capsule retrieval.

One key advancement is the development of bi-directional communication in smart capsules, enabling controlled movement and targeted imaging of specific GI areas. Companies are also integrating multi-sensor technology to measure parameters such as pH, temperature, and pressure, providing a more comprehensive assessment of GI health. Furthermore, AI-powered image analysis is improving lesion detection, reducing diagnostic errors, and minimizing the need for manual interpretation.

Innovations in wireless power transmission and extended battery life are allowing capsules to function longer, increasing their effectiveness in detecting conditions such as Obscure GI Bleeding (OGIB), Crohn’s disease, and small intestine tumors. Additionally, researchers are developing biodegradable smart capsules, which dissolve naturally after completing their diagnostic function, reducing the risk of capsule retention.

With increasing investments in medical robotics and nanotechnology, wireless and smart capsule innovations are expected to drive market expansion, improving accessibility, efficiency, and patient outcomes worldwide.

Impact of Macroeconomic / Geopolitical Factors

The Capsule Endoscopy Market is significantly influenced by macroeconomic and geopolitical factors, including economic slowdowns, trade policies, healthcare investments, and global conflicts. Rising global inflation, which peaked at 8.8% in 2022 (IMF), has increased manufacturing and healthcare costs, limiting affordability in low-income regions where capsule endoscopy procedures range between $500 and $2,500.

Additionally, supply chain disruptions caused by the COVID-19 pandemic and the Russia-Ukraine war have delayed the production and distribution of essential medical components, including semiconductor chips vital for wireless capsule technology. U.S.-China trade tensions have further impacted medical device manufacturing, affecting availability and pricing.

However, increasing healthcare investments, such as the U.S. allocating $1.7 trillion for healthcare in 2023, are driving demand for advanced diagnostics. Meanwhile, strict EU MDR 2021 regulations have slowed product approvals, delaying market expansion. Regional conflicts in the Middle East and Eastern Europe have disrupted healthcare services, while government initiatives in emerging economies, such as India’s $6.4 billion Ayushman Bharat scheme, are improving access to advanced medical diagnostics.

Despite economic and geopolitical uncertainties, growing healthcare infrastructure, AI-powered diagnostics, and innovations in smart capsule technology continue to fuel market growth, positioning capsule endoscopy as a key tool in non-invasive gastrointestinal diagnostics.

Trends

The global capsule endoscopy market is witnessing significant advancements driven by AI-powered image analysis, which enhances automated lesion detection and diagnostic accuracy, reducing physician workload. Innovations in battery technology and wireless communication are extending capsule operational time, improving real-time monitoring and data transmission. The integration of telemedicine allows remote diagnostics, benefiting rural and underserved areas.

Additionally, the development of ultra-miniature capsules with 3D imaging and enhanced sensors is increasing diagnostic precision. While the market has traditionally focused on small bowel disorders, capsule endoscopy is expanding into esophageal and colon examinations, offering a non-invasive alternative to traditional endoscopy. With continuous technological advancements and increasing healthcare adoption, capsule endoscopy is transforming early disease detection and patient outcomes worldwide.

Regional Analysis

North America Dominates the Capsule Endoscopy Market

North America dominates the global capsule endoscopy market due to its advanced healthcare infrastructure, high adoption of minimally invasive diagnostic technologies, and increasing prevalence of gastrointestinal (GI) disorders such as Crohn’s disease, colorectal cancer, and obscure gastrointestinal bleeding. The region benefits from strong government support, favorable reimbursement policies, and significant healthcare expenditure, which drive the demand for innovative diagnostic solutions.

Leading market players, including Medtronic, Olympus Corporation, and CapsoVision, Inc., contribute to the region’s market dominance by continuously advancing capsule endoscopy technology with improved imaging capabilities, longer battery life, and enhanced AI-driven analysis. The U.S. holds the largest market share within North America, supported by a high incidence of GI disorders, a strong presence of research institutions, and a well-established regulatory framework promoting medical innovations. Canada also plays a crucial role, with increasing awareness and adoption of advanced diagnostic techniques.

The integration of artificial intelligence (AI) and machine learning into capsule endoscopy is further improving diagnostic accuracy and efficiency, enhancing the region’s leadership in the market. As the demand for non-invasive diagnostic procedures continues to rise and technological advancements progress, North America is expected to maintain its dominance in the global capsule endoscopy market in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global capsule endoscopy market is led by prominent companies such as Medtronic, Olympus Corporation, CapsoVision, Inc., IntroMedic Co., Ltd., and Jinshan Science & Technology. These key players focus on enhancing their products with innovative features like improved imaging, extended battery life, and AI-driven diagnostics. Their efforts aim to increase the efficiency and accuracy of diagnostics, making procedures less invasive for patients.

North America holds the largest share of the capsule endoscopy market. This dominance is due to high healthcare expenditure, technological advancements, and an increasing number of gastrointestinal disorder cases. The market benefits from strategic mergers, acquisitions, and partnerships that strengthen the positions of leading companies.

The Asia-Pacific region is witnessing rapid growth in the capsule endoscopy market, driven by rising healthcare awareness, increasing disposable incomes, and expanding medical infrastructure. Europe also maintains a significant market share, supported by government healthcare initiatives and advanced medical systems. The integration of AI in capsule endoscopy is pushing the boundaries of competition, prompting further investment in smart diagnostic solutions and setting the stage for substantial market expansion.

Top Key Players in the Capsule Endoscopy Market

- CapsoVision

- Shangxian Minimal Invasive Inc.

- INTROMEDIC

- Medtronic

- Olympus

- AnX Robotics

- JINSHAN Science & Technology (Group) Co., Ltd.

- Check-Cap

- RF Co., Ltd.

- BioCam

Recent Developments

- In January 2025: CapsoVision obtained U.S. FDA clearance for its CapsoCam Plus, now approved for pediatric patients aged two and older. This milestone provides a comfortable, noninvasive diagnostic option for children, minimizing the stress typically associated with traditional capsule endoscopy procedures.

- In January 2024: AnX Robotics gained U.S. FDA approval for expanded indications of its NaviCam Small Bowel Video Capsule Endoscopy (SB), enabling its use in both adults and children aged two and above.

Report Scope

Report Features Description Market Value (2024) US$ 553.80 Million Forecast Revenue (2033) US$ 1,409.29 Million CAGR (2024-2033) 9.52% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product- Small Bowel Capsule, Colon Capsule and Esophageal Capsule, Component- Camera Capsule, Workstation, and Data Recorder, Type- Wireless Capsule Endoscopy, Receiver Capsule Endoscopy, and Others, Application-OGIB (obscure GI tract bleeding), Crohn’s Disease, Small Intestine Tumor and Others, End-use -Hospitals, Ambulatory Surgery Centers/Clinics and Other End-use. Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape CapsoVision, Shangxian Minimal Invasive Inc., INTROMEDIC, Medtronic, Olympus, AnX Robotics, JINSHAN Science & Technology (Group) Co., Ltd., Check-Cap, RF Co., Ltd., BioCam and other key players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- CapsoVision

- Shangxian Minimal Invasive Inc.

- INTROMEDIC

- Medtronic

- Olympus

- AnX Robotics

- JINSHAN Science & Technology (Group) Co., Ltd.

- Check-Cap

- RF Co., Ltd.

- BioCam