Global Calcium Silicate Market Size, Share, And Business Benefits By Grade (Industrial Grade, Food Grade, Pharma Grade, Cosmetic Grade), By Product Type (Low Density, Medium Density, High Density), By End-Use (Construction, Pharmaceutical, Food and Beverages, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151330

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

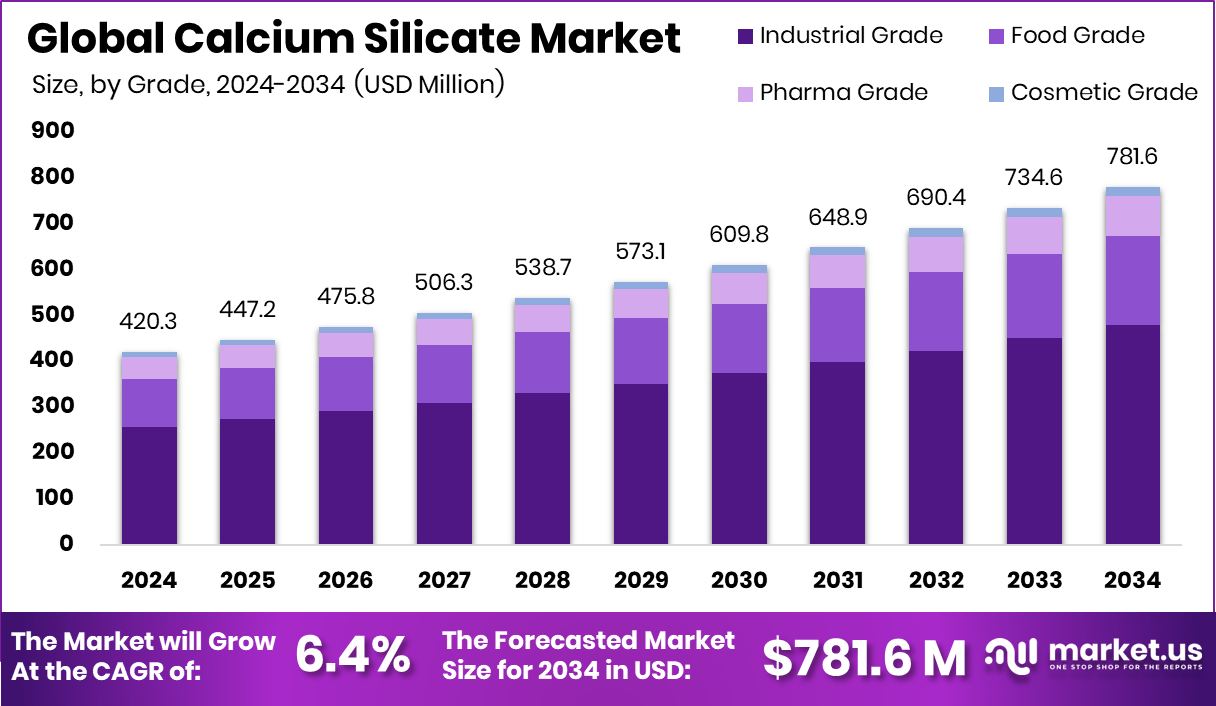

The Global Calcium Silicate Market is expected to be worth around USD 781.6 million by 2034, up from USD 420.3 million in 2024, and grow at a CAGR of 6.4% from 2025 to 2034. Strong construction demand boosted North America’s market value to USD 184.09 million.

Calcium silicate is an inorganic compound typically derived from limestone and diatomaceous earth. It is widely known for its excellent insulation properties, high-temperature resistance, and low thermal conductivity. Commonly used in construction, fireproofing, and industrial insulation, calcium silicate appears in various forms such as blocks, boards, and powders.

The calcium silicate market is experiencing steady growth due to increasing demand across diverse construction, manufacturing, and energy industries. As urban infrastructure expands and industrial activities rise globally, the need for high-performance insulation materials is growing. Calcium silicate’s fire-resistant nature makes it especially valuable in commercial and residential building applications, further fueling market interest.

Growth in the market is primarily driven by the rising awareness around energy efficiency and workplace safety. Industries are adopting calcium silicate for its ability to reduce heat loss and prevent fire hazards. Additionally, government regulations supporting safe and sustainable construction materials are pushing manufacturers toward calcium silicate-based solutions.

Demand is also increasing from the food and pharmaceutical sectors, where calcium silicate is used as an anti-caking agent and carrier. Its compatibility with food-grade standards opens up niche yet promising application areas. According to an industry report, Brimstone secured $55 million in Series A funding, with the round led by Breakthrough Energy Ventures and DCVC. The company specializes in cement production.

By End-Use Analysis

Key Takeaways

- The Global Calcium Silicate Market is expected to be worth around USD 781.6 million by 2034, up from USD 420.3 million in 2024, and grow at a CAGR of 6.4% from 2025 to 2034.

- Industrial-grade calcium silicate holds 61.3%, driven by insulation demand in manufacturing and energy sectors.

- Low-density calcium silicate accounts for 47.1% and is favored for lightweight, efficient thermal insulation applications.

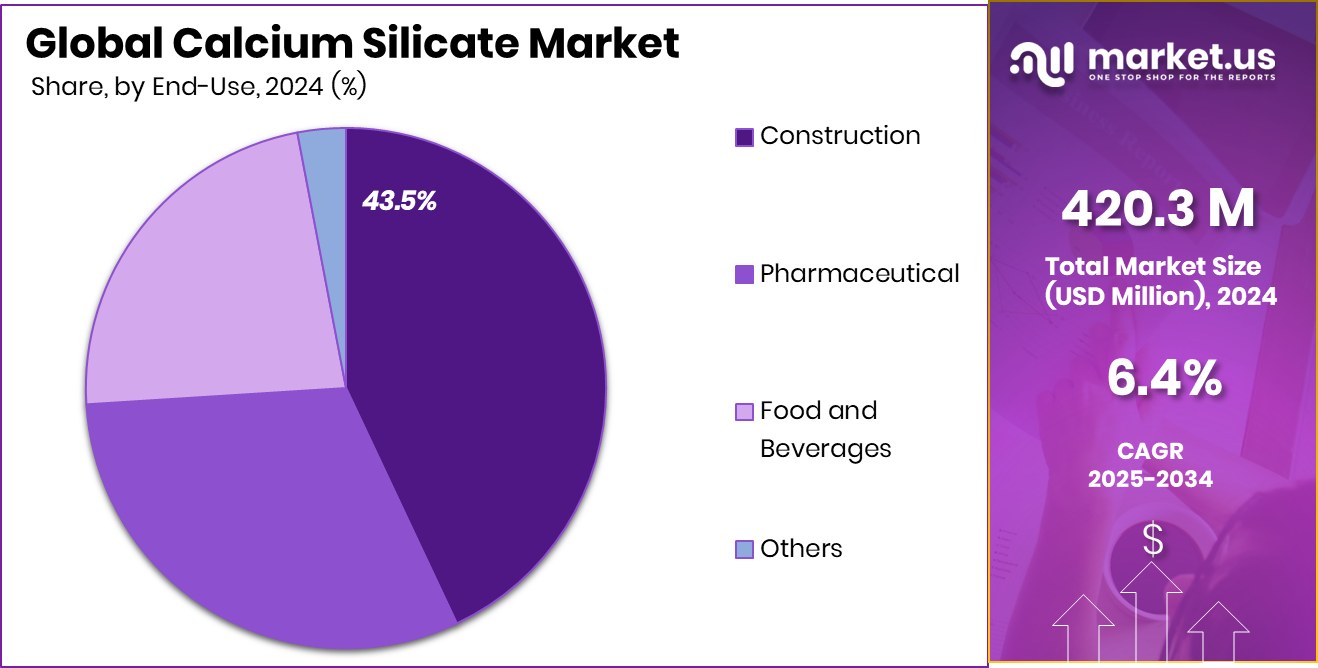

- Construction dominates with 43.5%, as calcium silicate supports fireproofing, durability, and energy-efficient building practices.

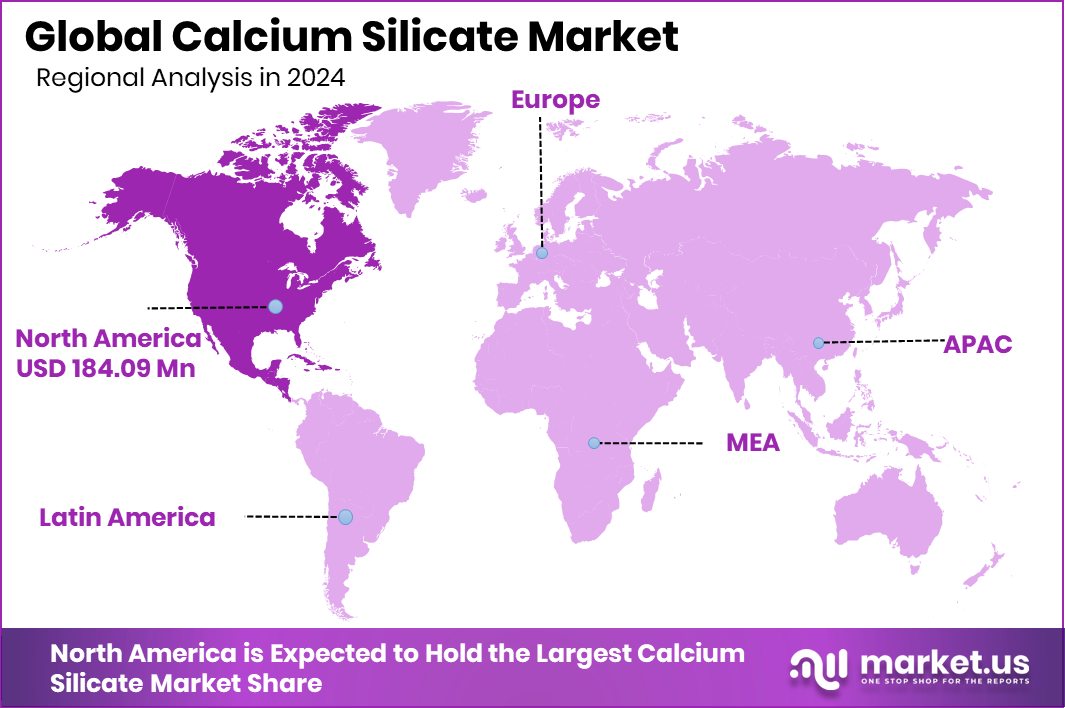

- North America held a dominant 43.8% share in the global calcium silicate market.

By Grade Analysis

Calcium Silicate Market by Industrial Grade holds 61.3%, showing dominant industrial preference.

In 2024, Industrial Grade held a dominant market position in the By Grade segment of the Calcium Silicate Market, with a 61.3% share. This leading position is largely attributed to its widespread usage in high-temperature insulation applications across power plants, petrochemical facilities, and heavy manufacturing industries.

Industrial Grade calcium silicate is valued for its exceptional thermal stability, corrosion resistance, and long-term durability under extreme conditions. These characteristics make it the preferred choice for insulating piping systems, boilers, and equipment operating in demanding environments.

The strong performance of this grade is also linked to the ongoing emphasis on workplace safety and energy efficiency in industrial settings. With rising operational standards, industries are increasingly shifting toward materials that enhance performance while meeting regulatory safety norms, further solidifying the dominance of Industrial Grade calcium silicate.

Its application in fireproofing systems and thermal insulation panels has seen consistent growth, particularly in regions with expanding industrial infrastructure and energy-intensive sectors. The high adoption rate of this grade highlights its critical role in supporting structural integrity and minimizing heat loss, positioning it as a key contributor to the market’s overall expansion.

By Product Type Analysis

Low-density calcium Silicate Market captures 47.1%, favored for insulation and lightweight applications.

In 2024, Low Density held a dominant market position in the By Product Type segment of the Calcium Silicate Market, with a 47.1% share. This segment’s leadership is driven by its lightweight structure, ease of handling, and effectiveness in applications requiring thermal and acoustic insulation without adding significant load. Low-density calcium silicate is especially suitable for construction and industrial use where weight constraints are a concern, such as wall panels, false ceilings, and insulating linings.

The high market share reflects the increasing preference for materials that balance performance with convenience in installation and transportation. Its insulating properties, combined with good fire resistance, make it an attractive choice in sectors where safety, efficiency, and material flexibility are prioritized. Additionally, low-density calcium silicate is often used in areas that require frequent modifications or retrofitting, further boosting its adoption rate.

The strong uptake of this product type is supported by infrastructure development activities and ongoing demand for cost-effective insulation solutions. Its role in meeting thermal management and fire safety needs, while offering installation advantages, has positioned it as the leading category within the product type segment.

The construction sector leads the Calcium Silicate Market at 43.5%, driven by fireproofing needs.

In 2024, Construction held a dominant market position in the By End-Use segment of the Calcium Silicate Market, with a 43.5% share. This leading share is largely driven by the growing demand for fire-resistant and thermally insulating materials in both commercial and residential construction projects. Calcium silicate, known for its non-combustible nature and excellent thermal insulation, has become a preferred choice in modern building practices that emphasize safety, energy efficiency, and durability.

The construction sector’s strong reliance on calcium silicate products—such as boards, panels, and insulation blocks—has supported this segment’s growth. These materials are commonly used in partitions, ceilings, and wall linings, helping to enhance fire protection and reduce energy loss in buildings. The increasing focus on sustainable and long-lasting construction materials has further fueled the adoption of calcium silicate in this sector.

In addition, the rise in urban development and infrastructure projects has contributed to the steady demand, as builders and contractors seek materials that comply with strict fire safety and environmental standards. The construction segment’s 43.5% share reflects its continued trust in calcium silicate as a reliable and efficient solution for meeting both regulatory requirements and performance expectations in a variety of building applications.

Key Market Segments

By Grade

- Industrial Grade

- Food Grade

- Pharma Grade

- Cosmetic Grade

By Product Type

- Low Density

- Medium Density

- High Density

By End-Use

- Construction

- Pharmaceutical

- Food and Beverages

- Others

Driving Factors

Rising Demand for Fire-Resistant Building Materials

One of the top driving factors of the calcium silicate market is the increasing demand for fire-resistant materials in construction. Builders and engineers are focusing more on safety and durability, especially in commercial and residential buildings. Calcium silicate is highly valued because it does not catch fire, can withstand very high temperatures, and prevents the spread of flames.

These features make it ideal for use in ceilings, wall panels, and partitions. As fire safety regulations become stricter around the world, more construction companies are choosing calcium silicate-based materials. This growing awareness and responsibility toward safe building practices is boosting the use of calcium silicate, making it a key driver of market growth in the coming years.

Restraining Factors

High Production Cost Limits Wider Market Growth

One of the major restraining factors for the calcium silicate market is its high production cost. Manufacturing calcium silicate involves energy-intensive processes and the use of raw materials that may not be easily available or affordable in all regions.

These costs get passed on to the end-users, making the final product more expensive compared to alternative materials. This price difference can discourage small to mid-sized businesses or projects with tight budgets from choosing calcium silicate.

In some markets, cheaper substitutes are preferred despite offering lower performance. The cost factor also makes it difficult for calcium silicate products to penetrate developing economies, where cost-effective materials are often prioritized over advanced safety and insulation benefits.

Growth Opportunity

Growing Green Building Projects Boost Market Demand

A key growth opportunity for the calcium silicate market lies in the rising trend of green and sustainable building projects. As more countries focus on reducing carbon emissions and improving energy efficiency, builders are turning to eco-friendly construction materials. Calcium silicate fits well into this trend because it is non-toxic, long-lasting, and helps in thermal insulation, which lowers energy use in buildings.

It also meets many environmental safety standards, making it a preferred choice for green certifications. With governments and private developers investing in sustainable infrastructure, the demand for materials like calcium silicate is expected to grow. This shift toward environmentally conscious construction is opening up new opportunities for calcium silicate across both developed and developing regions.

Latest Trends

Use of Calcium Silicate in Prefab Buildings

One of the latest trends in the calcium silicate market is its increasing use in prefabricated (prefab) buildings. These are structures built in parts at a factory and then assembled on-site. Builders prefer materials that are lightweight, strong, and easy to install—qualities that calcium silicate offers. It is commonly used in prefab wall panels, ceilings, and insulation layers.

Its fire-resistant and moisture-proof properties make it ideal for modular construction, where safety and speed are top priorities. As prefab buildings grow in popularity due to their cost-effectiveness and quicker construction time, the demand for calcium silicate products is rising. This trend is helping the material gain attention in modern construction practices across urban and industrial projects.

Regional Analysis

In North America, the Calcium Silicate Market reached USD 184.09 million in 2024.

In 2024, North America emerged as the leading region in the Calcium Silicate Market, accounting for a dominant 43.8% share with a market value of USD 184.09 million. This strong regional performance is driven by advanced construction standards, stringent fire safety regulations, and increased adoption of energy-efficient insulation materials across industrial and commercial sectors.

The region continues to benefit from stable infrastructure investments and widespread use of calcium silicate in building applications. Europe also shows steady market growth, supported by regulations favoring fire-resistant and sustainable materials in residential and public infrastructure. Meanwhile, Asia Pacific is witnessing rising demand due to rapid urbanization and ongoing industrial expansion, although its market share remains lower than North America.

The Middle East & Africa and Latin America represent emerging markets, with gradual adoption of calcium silicate products as awareness of fire safety and thermal insulation grows. However, these regions currently hold smaller shares due to limited large-scale infrastructure development compared to developed markets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players such as American Elements, Promat International NV, and Morgan Advanced Materials have continued to play vital roles in shaping the global calcium silicate market. These companies are recognized for their technical expertise, product quality, and consistent innovation in developing calcium silicate solutions for thermal insulation and fire protection applications.

American Elements has maintained its position through a strong focus on advanced material science and a broad product offering. The company’s ability to cater to both standard and customized industrial-grade calcium silicate products has strengthened its presence across multiple industries, especially in the construction and manufacturing sectors. Its commitment to material purity and scalable production makes it a dependable supplier.

Promat International NV remains a prominent name in fire protection and insulation solutions. The company continues to serve global infrastructure and construction needs with a wide range of calcium silicate boards and panels. Promat’s focus on building safety and its widespread application expertise have reinforced its reputation in both developed and emerging markets.

Morgan Advanced Materials leverages its rich heritage in high-performance engineered materials to deliver robust calcium silicate products. Its strength lies in manufacturing thermal insulation materials capable of withstanding extreme conditions. The company’s commitment to performance, innovation, and safety has kept it relevant in demanding industrial applications.

Top Key Players in the Market

- American Elements

- Promat International NV

- Morgan Advanced Materials

- Prochem Inc.

- Spectrum Chemical Manufacturing Corp.

- Materion Corporation

- Associated Ceramics and Technology Inc.

- Mil-Spec Industries Corporation

- Pyrotek

- Skamol

- ZIRCAR CERAMICS

Recent Developments

- In May 2025, Materion, a leader in advanced materials for semiconductors, aerospace, defense, energy, automotive, and industrial markets, bought tantalum sputtering-target manufacturing assets in Dangjin City, South Korea. It adds a modern facility to boost the production of materials used in semiconductor chips for AI and high-performance computing.

Report Scope

Report Features Description Market Value (2024) USD 420.3 Million Forecast Revenue (2034) USD 781.6 Million CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Industrial Grade, Food Grade, Pharma Grade, Cosmetic Grade), By Product Type (Low Density, Medium Density, High Density), By End-Use (Construction, Pharmaceutical, Food and Beverages, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape American Elements, Promat International NV, Morgan Advanced Materials, Prochem Inc., Spectrum Chemical Manufacturing Corp., Materion Corporation, Associated Ceramics and Technology Inc., Mil-Spec Industries Corporation, Pyrotek, Skamol, ZIRCAR CERAMICS Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- American Elements

- Promat International NV

- Morgan Advanced Materials

- Prochem Inc.

- Spectrum Chemical Manufacturing Corp.

- Materion Corporation

- Associated Ceramics and Technology Inc.

- Mil-Spec Industries Corporation

- Pyrotek

- Skamol

- ZIRCAR CERAMICS