Global Calcium Fortified Foods Market Size, Share, And Enhanced Productivity By Nature (Organic, Conventional), By Product Type (Bakery and Confectionery, (Bread and Baked Products, Cookies and Biscuits, Cakes and Pastries, Confectioneries), Dairy and Dairy Alternatives, Infant Formula, Others), By Source (Calcium Carbonate, Calcium Citrate, Calcium Phosphates, Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Specialty Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174719

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

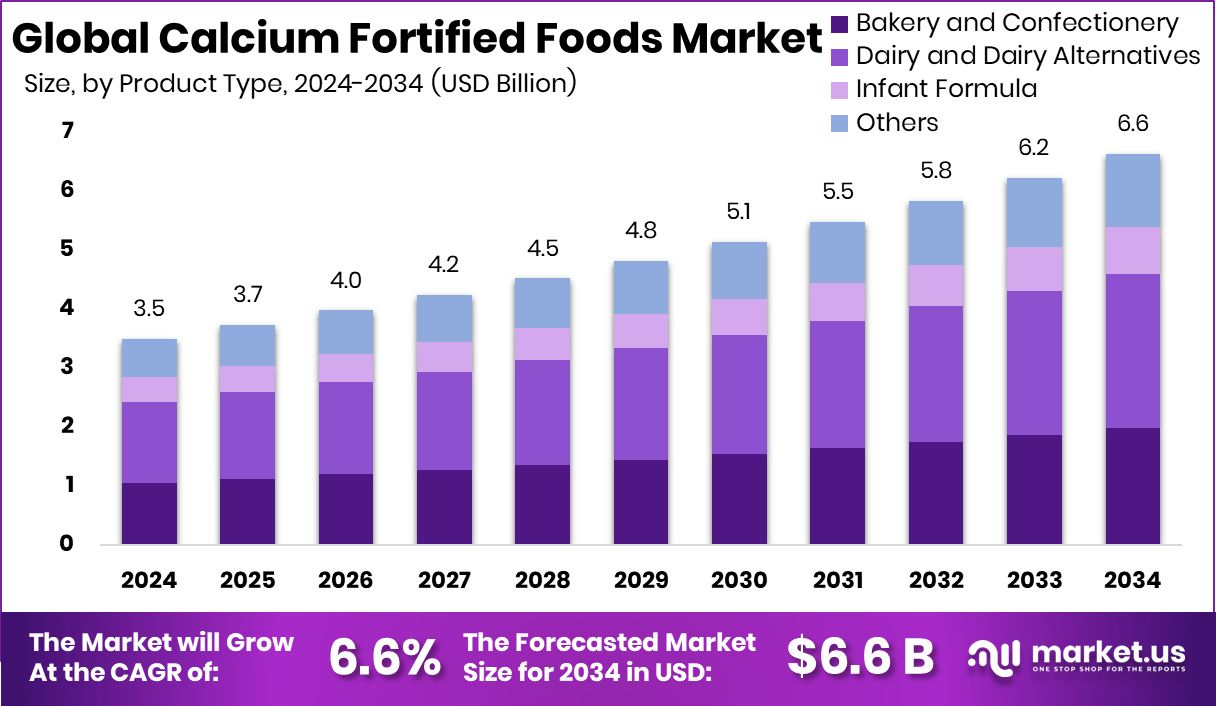

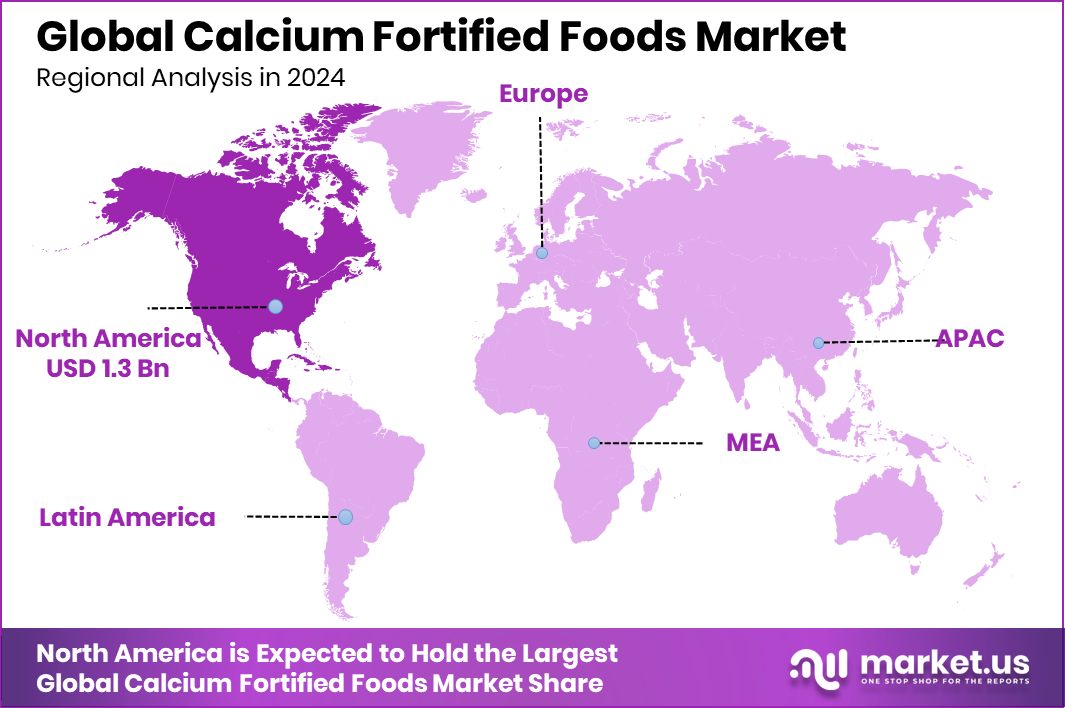

The Global Calcium Fortified Foods Market is expected to be worth around USD 6.6 billion by 2034, up from USD 3.5 billion in 2024, and is projected to grow at a CAGR of 6.6% from 2025 to 2034. North America’s growth at 38.1% and USD 1.3 Bn shows sustained market leadership.

Calcium-fortified food refers to everyday food products that have extra calcium added to them to support bone strength and overall health. These foods include staples such as milk alternatives, bakery items, cereals, snacks, and confectionery. Fortification helps people meet daily calcium needs, especially when natural intake from regular diets is insufficient due to lifestyle or dietary restrictions.

The Calcium Fortified Food Market includes the production, distribution, and sale of foods enhanced with calcium across mass and premium categories. This market focuses on improving nutrition through commonly consumed products. It serves children, adults, and aging populations seeking convenient ways to support bone health without changing eating habits drastically.

Market growth is supported by innovation in fortified snacks, sweets, and functional foods. Investments such as Fireside Ventures leading INR 20 Cr funding in Oroos Confectionery, Candytoy Corporate securing INR 110 Cr Series A funding, and Khoya Mithai raising over Rs 6 Cr pre-seed highlight rising interest in nutritionally enhanced indulgent foods.

Demand is increasing as consumers seek healthier versions of familiar treats and convenience foods. Doughlicious, gaining a $5 million funding boost, reflects the growing demand for enriched dessert and snack options that combine taste with nutrition, including calcium fortification for broader daily intake.

Strong opportunities exist in dairy alternatives and protein-based foods. Support such as The Protein Brewery receiving a $2.7M EU grant, Itz Nutz securing $535K, and Taaleri Bioindustry investing €10m shows momentum in calcium-fortified plant-based products, expanding access for lactose-intolerant and vegan consumers.

Key Takeaways

- The Global Calcium Fortified Foods Market is expected to be worth around USD 6.6 billion by 2034, up from USD 3.5 billion in 2024, and is projected to grow at a CAGR of 6.6% from 2025 to 2034.

- Conventional products dominate Calcium Fortified Foods Market, holding 87.2% share due to affordability and availability.

- Dairy and dairy alternatives lead the Calcium Fortified Foods Market by product type, capturing 39.3% demand.

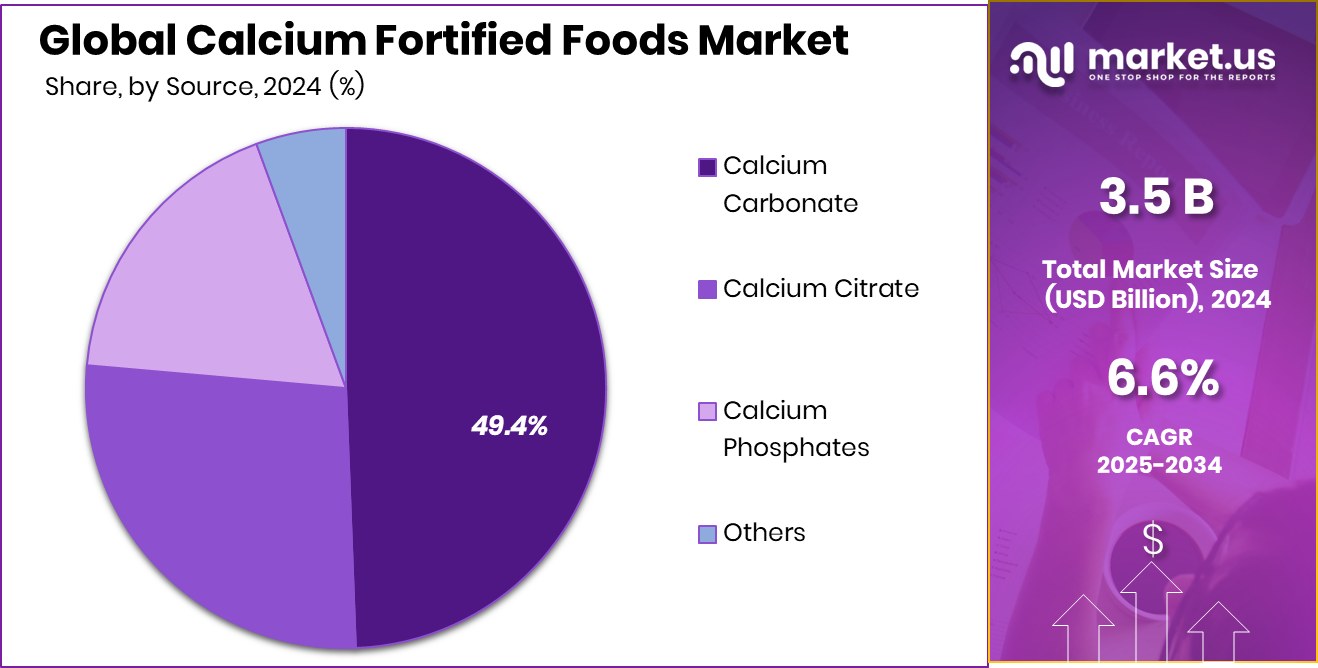

- Calcium carbonate remains the primary source in the calcium-fortified foods market, accounting for 49.4% usage.

- Hypermarkets and supermarkets dominate distribution in the Calcium Fortified Foods Market, contributing 41.8% overall sales globally.

- North America reached USD 1.3 Bn, driven by fortified dairy beverages demand growth.

By Nature Analysis

Conventional products dominate Calcium Fortified Foods Market with 87.2% consumer preference.

In 2024, the Calcium Fortified Foods Market continued to be strongly driven by the dominance of conventional products, which accounted for 87.2% of overall consumption. This segment maintained leadership as consumers preferred familiar ingredients, affordable pricing, and wide retail availability. Conventional calcium-fortified foods, including beverages, cereals, snacks, and bakery items, benefited from ongoing demand from middle-income households seeking accessible nutrition.

Food manufacturers expanded conventional formulations with improved calcium absorption and cleaner labels to meet evolving dietary expectations. Increased health awareness, especially among aging populations and women, also reinforced the preference for safe, regulated, and cost-effective conventional fortified foods across both developed and emerging markets worldwide.

By Product Type Analysis

Dairy and dairy alternatives lead the calcium-fortified foods market, holding 39.3%.

In 2024, the Calcium Fortified Foods Market observed robust growth within the dairy and dairy alternatives category, which held a significant 39.3% share. This segment benefited from rising consumer interest in bone health, lactose-free diets, and plant-based nutrition. Calcium-enriched milk, yogurt, cheese, and oat or almond beverages continued to be popular choices, especially among younger consumers and fitness-oriented individuals.

Manufacturers focused on offering clean-label, sustainably sourced, and low-sugar fortified dairy options to match evolving preferences. The rise of vegan and flexitarian lifestyles further boosted demand for dairy alternatives, helping this product type maintain strong influence across retail channels, including supermarkets and online platforms.

By Source Analysis

Calcium carbonate sources support the Calcium Fortified Foods Market, accounting for 49.4%.

In 2024, calcium carbonate remained the leading fortification source in the Calcium Fortified Foods Market, capturing 49.4% of the segment. Its dominance was supported by high bioavailability, affordability, and ease of formulation across dry and liquid food products. Calcium carbonate was widely used in fortified beverages, baked goods, cereals, and nutritional supplements due to its stability and neutral taste.

Food manufacturers preferred it for providing effective calcium levels without significantly altering product characteristics. As consumers increasingly sought preventive nutrition for bone strength and overall wellness, calcium carbonate–fortified foods continued to expand across mass-market and premium categories, supporting broader accessibility in global regions.

By Distribution Channel Analysis

Hypermarkets and supermarkets drive the Calcium Fortified Foods Market distribution with 41.8%.

In 2024, hypermarkets and supermarkets remained the primary distribution channel for the Calcium Fortified Foods Market, holding 41.8% of total sales. These retail formats benefited from their extensive product variety, competitive pricing, and strong consumer trust. Shoppers preferred purchasing fortified beverages, cereals, snacks, and dairy items in physical stores where they could compare labels and explore new brands.

Retailers expanded shelf space for health-oriented foods and private-label fortified products, driving further adoption. Promotional campaigns, in-store nutrition guidance, and attractive bundled offers also contributed to higher sales. Despite growth in online shopping, large-format stores continued to offer unmatched visibility and convenience for fortified food categories.

Key Market Segments

By Nature

- Organic

- Conventional

By Product Type

- Bakery and Confectionery

- Bread and Baked Products

- Cookies and Biscuits

- Cakes and Pastries

- Confectioneries

- Dairy and Dairy Alternatives

- Infant Formula

- Others

By Source

- Calcium Carbonate

- Calcium Citrate

- Calcium Phosphates

- Others

By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

Driving Factors

Rising Shift Toward Plant-Based Dairy Alternatives

In the Calcium Fortified Foods Market, one major driving factor is the fast-growing shift toward plant-based dairy alternatives as consumers look for healthier, lactose-free options enriched with calcium. This shift is strongly supported by recent investments that are helping plant-based dairy producers scale faster.

For example, Turkey’s Itz Nutz raised $535,000 to expand its cashew-based dairy alternatives, which are ideal carriers for added calcium. Similarly, the Finnish Food Factory secured €10M from Taaleri Bioindustry to boost plant-based dairy production, creating more fortified milk, yogurts, and creams for the global market. These investments fuel innovation and create a wider variety of calcium-fortified plant-based choices for everyday use.

Restraining Factors

High Production Costs of Alternative Dairy Bases

One major restraining factor for the Calcium Fortified Foods Market is the high production cost of alternative dairy bases used for calcium fortification. Producing items like plant-based milk, creams, and dairy substitutes requires advanced technology and specialized ingredients, increasing overall costs. This challenge is illustrated by companies that rely heavily on funding to scale operations.

For example, the Dutch-based Time-Travelling Milkman secured €2M to roll out its sunflower-based dairy cream alternative, highlighting the financial pressure behind innovation. Similarly, Imagindairy reaching $28M in funding shows how expensive it can be to develop animal-free milk products. High costs often limit affordability and slow adoption in price-sensitive markets.

Growth Opportunity

Expanding Investment in Next-Gen Dairy Alternatives

A promising growth opportunity for the Calcium Fortified Foods Market lies in expanding investments in next-generation dairy alternatives that naturally pair well with calcium fortification. These investments support the development of plant-based milks, fats, and creams that deliver both taste and nutrition.

For instance, Ikea invested $8.6M to become the majority owner of a plant-based milk producer, signaling growing commercial interest in fortified alternatives. Additionally, the Time-Travelling Milkman secured $2.3M to launch a new dairy-fat alternative, opening space for improved fortified formulations. Such funding accelerates product quality, affordability, and accessibility, making calcium-fortified foods more appealing to health-conscious and lactose-intolerant consumers.

Latest Trends

Rise of Novel Fat Technologies in Fortified Foods

A leading trend in the Calcium Fortified Foods Market is the rise of novel fat and ingredient technologies that enhance the texture, nutrition, and stability of fortified foods. Producers are increasingly adopting innovative, sustainable fats and plant-based bases that improve taste while supporting calcium enrichment. Recent investments emphasize this shift.

For example, the Finnish Food Factory received $11.8M to expand its plant-based dairy manufacturing capacity, strengthening future fortified product lines. Similarly, Melt&Marble raised $8.5M to develop animal-free fats for food and personal care, enabling better nutritional profiles in fortified dairy alternatives. These advancements help brands create cleaner, tastier, and more functional calcium-fortified foods.

Regional Analysis

North America leads the Calcium Fortified Foods Market with 38.1% share, reflecting nutrition awareness.

The North America region dominated the Calcium Fortified Foods Market with a strong 38.1% share, valued at USD 1.3 billion, supported by high consumer awareness of bone health and widespread adoption of fortified dairy, beverages, and cereals. The region’s well-established retail networks and preference for functional foods further strengthened its leadership position.

In Europe, demand grew steadily as consumers increasingly incorporated calcium-fortified foods into daily diets, encouraged by rising interest in preventive nutrition and aging population needs.

The Asia Pacific region showed expanding consumption driven by urbanization and shifting dietary habits toward convenient fortified options. Meanwhile, the Middle East & Africa market experienced gradual adoption as fortified staples gained visibility among health-conscious consumers. Latin America continued to develop its market presence as local manufacturers introduced fortified food products catering to nutritional gaps and rising wellness trends.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Danone continued to strengthen its position in the global calcium-fortified foods market through its wide portfolio of fortified dairy and nutritional products. The company’s strong brand presence and focus on health-centric offerings allowed it to meet rising consumer preferences for calcium-enriched foods, especially in regions prioritizing bone health and balanced nutrition. Danone’s emphasis on quality, accessibility, and reformulation of dairy products helped reinforce its competitive edge.

Arla Foods amba maintained steady momentum by expanding its fortified dairy range rooted in cooperative-driven production standards. The company’s focus on natural ingredients and high-quality milk enabled Arla to align with consumers seeking trustworthy, nutrient-enriched dairy choices. Its commitment to bringing fortified products to mainstream retail channels supported wider market penetration.

Nestlé S.A. leveraged its global scale and diverse food portfolio to support broad adoption of calcium-fortified products. Its strong distribution networks and focus on family nutrition helped the company remain influential across multiple fortified categories, particularly dairy, beverages, and cereals. Nestlé’s ability to innovate within widely consumed food segments offered consistent market advantages.

Lucerne Foods played a relevant role by offering accessible fortified dairy options across retail chains. Its focus on affordability and everyday nutrition made it a practical choice for households seeking reliable calcium-enriched foods within standard grocery formats.

Top Key Players in the Market

- Danone

- Arla Foods amba

- Nestlé S.A.

- Lucerne Foods

- Kellogg’s

- Clif Bar & Company

- Abbott Laboratories

- Hain Celestial Group

Recent Developments

- In January 2025, Clif Bar & Company introduced a new brand platform called “Raise Your Bar” along with a new Cookies & Creme flavored energy bar designed to inspire consumers and fuel activity. This integrated campaign combines motivational messaging, athlete collaborations, and an expanded product lineup aimed at active and fitness-oriented shoppers. The new flavor features organic ingredients and protein to support energy needs throughout the day.

- In January 2024, WK Kellogg Co launched a new cereal brand called Eat Your Mouth Off, a better-for-you cereal aimed at health-conscious consumers, including plant-based options. This product launch reflects the company’s effort to diversify its portfolio and attract younger consumers interested in nutritious breakfast foods, which often pair well with calcium (for example, with milk).

Report Scope

Report Features Description Market Value (2024) USD 3.5 Billion Forecast Revenue (2034) USD 6.6 Billion CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Conventional), By Product Type (Bakery and Confectionery, (Bread and Baked Products, Cookies and Biscuits, Cakes and Pastries, Confectioneries), Dairy and Dairy Alternatives, Infant Formula, Others), By Source (Calcium Carbonate, Calcium Citrate, Calcium Phosphates, Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Specialty Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Danone, Arla Foods amba, Nestlé S.A., Lucerne Foods, Kellogg’s, Clif Bar & Company, Abbott Laboratories, Hain Celestial Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Calcium Fortified Foods MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Calcium Fortified Foods MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Danone

- Arla Foods amba

- Nestlé S.A.

- Lucerne Foods

- Kellogg’s

- Clif Bar & Company

- Abbott Laboratories

- Hain Celestial Group