Global Bromobutyl Rubber Market Size, Share Analysis Report By Property (Excellent Air Impermeability, High Damping Properties, Resistant to Oils, Acids, and Chemicals, Low Compression Set, Long Service Life), By Application (Inner Tubes, Tires, Films and Sheets, Butyl Sealing Tapes and Mastics, Diaphragms and Gaskets, Others), By End-Use Industry (Automotive, Construction, Aerospace, Pharmaceuticals, Packaging, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173235

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

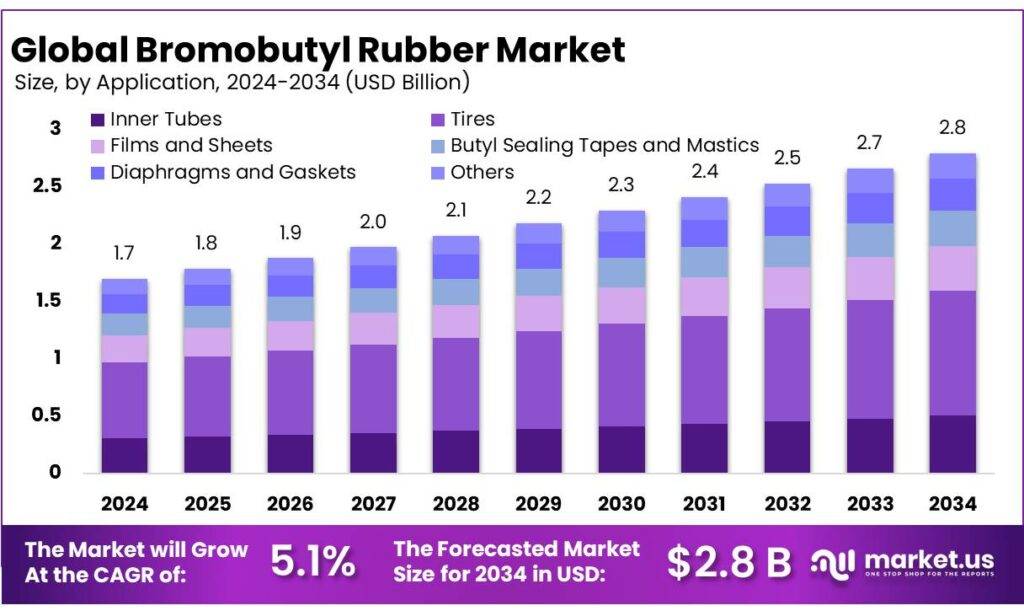

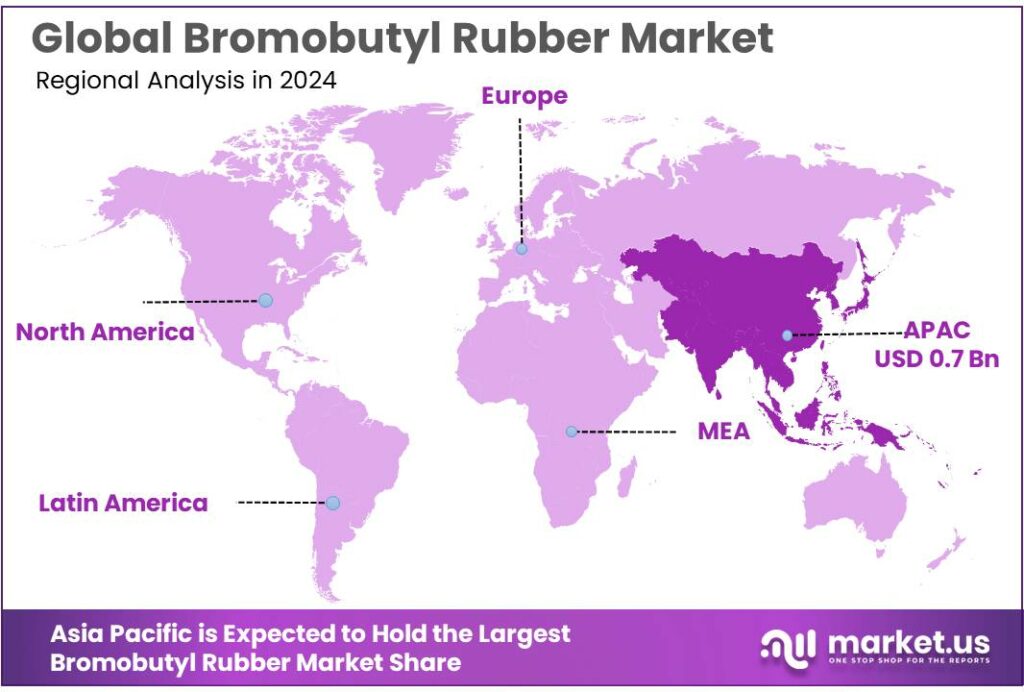

The Global Bromobutyl Rubber Market size is expected to be worth around USD 2.8 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 43.8% share, holding USD 0.7 Billion in revenue.

Bromobutyl rubber (BIIR) is a brominated halobutyl elastomer valued for very low gas permeability, strong damping, and good chemical resistance. In industrial supply chains, it sits downstream of isobutylene–isoprene rubber chemistry and is typically compounded into high-performance innerliners, bladders, and seals where air retention and long service life matter.

From an industrial scenario perspective, the tire and mobility ecosystem remains the anchor demand center. Global vehicle output provides a practical proxy for replacement and OE tire pull-through: OICA’s country/region tables report total world motor vehicle production of 92,504,338 units in 2024.

In North America, the U.S. Tire Manufacturers Association projected total U.S. tire shipments of 337.3 million units in 2024 and 337.4 million units in 2025, signaling a large, stable installed base that continuously consumes innerliner materials and curing bladders where halobutyl rubbers are standard. In Europe, ETRMA highlights the scale of the regional tire and rubber footprint, noting a sector of nearly 4,400 companies with more than 350,000 directly employed in the EU.

Key driving factors extend beyond volumes into regulation and performance standards. The EU’s tire labelling framework (Regulation (EU) 2020/740) reinforces market pull for fuel-efficient, safer tires by making performance information more visible to buyers, which indirectly supports material choices that reduce air loss and help maintain pressure over time. On the healthcare side, immunization scale and safety expectations keep high-barrier elastomer closures strategically important: WHO notes immunization prevents 3.5 million to 5 million deaths every year, and reports Hib vaccine introduction in 193 Member States by end-2024, with global 3-dose Hib coverage estimated at 78%.

Food and beverage manufacturing also supports “steady-use” applications for elastomer seals, gaskets, and closures in hygienic processing and packaging lines. In Europe, FoodDrinkEurope reports the EU food and drink industry employs 4.6 million people, generates about €1.1 trillion in turnover, and €229 billion in value added, underscoring the scale of equipment fleets that rely on reliable sealing materials. In the United States, USDA reports the agriculture and food industry contributes $1.1 trillion to U.S. GDP and represents nearly 11% of total U.S. employment—another indicator of large processing and packaging infrastructure where durable seals and liners are essential.

Europe highlights a similar replacement-led story. ETRMA reported that consumer replacement tire volumes reached 58.727 million units in Q1 2025, up from 57.277 million in Q1 2024 (a 3% rise), and noted that the recovery seen in the second half of 2024 was +8% in consumer tires. In the U.S., USTMA also reports an annual tire-industry economic footprint of $170.6 billion and more than 291,000 U.S. jobs, which helps explain why governments and regulators tend to engage actively on tire performance, safety, and end-of-life management—areas that indirectly shape BIIR specifications and demand.

Key Takeaways

- Bromobutyl Rubber Market size is expected to be worth around USD 2.8 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 5.1%.

- Excellent Air Impermeability held a dominant market position, capturing more than a 37.2% share in the bromobutyl rubber market.

- Tires held a dominant market position, capturing more than a 39.1% share in the bromobutyl rubber market.

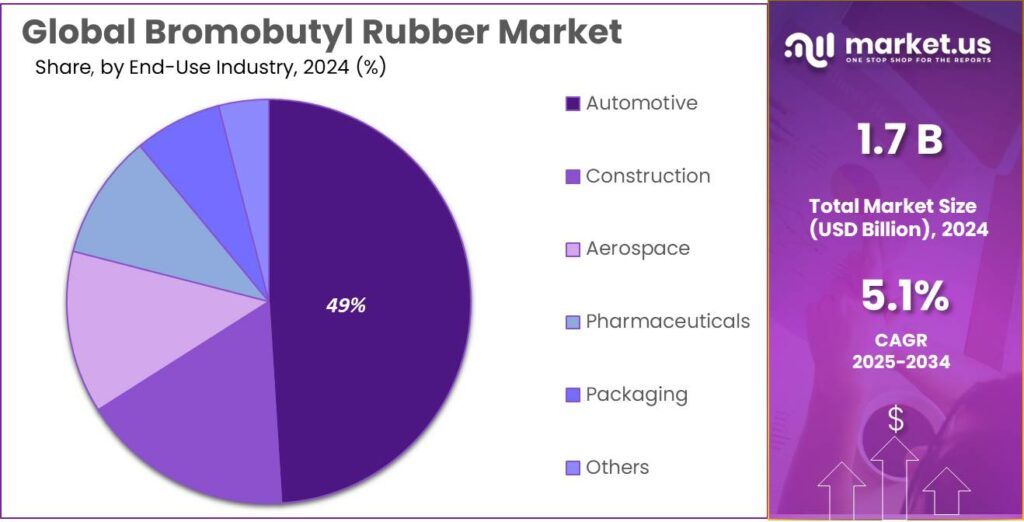

- Automotive held a dominant market position, capturing more than a 49.8% share in the bromobutyl rubber market.

- Asia Pacific emerged as the dominant regional market in the Bromobutyl Rubber sector, capturing a 43.80% share with an estimated USD 0.7 billion.

By Property Analysis

Excellent Air Impermeability leads with 37.2% as tire makers prioritize long-lasting pressure retention

In 2024, Excellent Air Impermeability held a dominant market position, capturing more than a 37.2% share in the bromobutyl rubber market. This leadership was mainly driven by its critical role in tire inner liners, where low air leakage is essential for safety, fuel efficiency, and longer tire life. Bromobutyl rubber with excellent air impermeability was widely preferred by automotive manufacturers, as it helps maintain stable tire pressure over extended periods and reduces maintenance needs. The growing focus on vehicle efficiency and durability supported higher adoption across passenger and commercial vehicles during 2024.

In addition, this property supported compliance with stricter performance and quality standards in global tire manufacturing. Moving into 2025, demand remained steady as tire producers continued to prioritize materials that improve reliability and reduce air loss under varying temperature and road conditions. The consistent performance of bromobutyl rubber in sealing applications beyond tires, such as pharmaceutical stoppers and industrial closures, further reinforced its market position. Overall, excellent air impermeability remained a key functional property shaping material selection decisions, supporting its leading share within the bromobutyl rubber market.

By Application Analysis

Tires dominate with 39.1% as air retention and durability drive material choice

In 2024, Tires held a dominant market position, capturing more than a 39.1% share in the bromobutyl rubber market. This strong share was mainly supported by the material’s excellent air retention, heat resistance, and long service life, which are critical for modern tire manufacturing. Bromobutyl rubber continued to be widely used in inner liners for passenger cars, trucks, and two-wheelers, helping reduce air loss and improve overall tire safety.

During 2024, steady vehicle production and replacement tire demand supported consistent consumption of bromobutyl rubber across major automotive markets. The application also benefited from growing awareness around fuel efficiency, as better air retention supports lower rolling resistance. Moving into 2025, tire manufacturers maintained their focus on high-performance elastomers that deliver durability under varied road and climate conditions. This sustained preference reinforced the leading role of the tires segment, ensuring its continued dominance within the bromobutyl rubber market based on application.

By End-Use Analysis

Automotive leads with 49.8% as vehicle production sustains strong rubber demand

In 2024, Automotive held a dominant market position, capturing more than a 49.8% share in the bromobutyl rubber market. This dominance was largely supported by its extensive use in automotive components, especially tire inner liners, where air impermeability and heat resistance are essential. During 2024, steady vehicle manufacturing and replacement demand across both developed and emerging markets helped maintain strong consumption levels. Bromobutyl rubber continued to be preferred for its ability to enhance safety, extend tire life, and support fuel efficiency through improved pressure retention.

The segment also benefited from stricter performance standards in the automotive industry, which increased reliance on high-quality elastomers. Moving into 2025, automotive demand remained stable as manufacturers focused on durability and long-term performance in both conventional and electric vehicles. As a result, the automotive end-use industry retained its leading role, reinforcing its position as the primary demand driver for bromobutyl rubber globally.

Key Market Segments

By Property

- Excellent Air Impermeability

- High Damping Properties

- Resistant to Oils, Acids, and Chemicals

- Low Compression Set

- Long Service Life

By Application

- Inner Tubes

- Tires

- Films and Sheets

- Butyl Sealing Tapes and Mastics

- Diaphragms and Gaskets

- Others

By End-Use Industry

- Automotive

- Construction

- Aerospace

- Pharmaceuticals

- Packaging

- Others

Emerging Trends

Sustainability and Circular Food Systems Drive Elastomer Choices

A major latest trend in the world of bromobutyl rubber (BIIR) is the growing focus on sustainability and circular food systems, which is reshaping how sealing and barrier materials are chosen in food processing and packaging. BIIR has long been valued for its excellent gas barrier, stable sealing, and chemical resistance, but buyers today are not only looking for performance—they also want materials that support lower waste, better recycling, and reduced environmental impact throughout the product lifecycle.

At its core, this trend is tied to the reality that food loss and waste remain stubbornly high. According to the Food and Agriculture Organization (FAO), roughly 14% of the world’s food is lost between harvest and retail, with inadequate storage and transport conditions as major causes. Meanwhile, the United Nations Environment Programme (UNEP) reports that about 19% of food produced for human consumption—around 1.05 billion tonnes—is wasted annually.

Another part of this trend is collaboration across the food chain. Brands that participate in Zero Hunger and Responsible Consumption and Production goals under the United Nations SDGs are more open to suppliers who can show how their materials contribute to waste reduction. SDG Target 12.3 specifically calls for halving food waste and reducing losses by 2030.

These regulatory shifts are shaping a trend where BIIR makers are improving formulations for recyclability and end-of-life handling. That means working with converters and brands to design seals that are easier to separate from plastic closures, or that can be remanufactured. BIIR is inherently durable, and increased interest in life extension of parts—through better cleaning resistance and longer service life—is aligned with both sustainability goals and cost reduction.

Drivers

Food safety rules and waste reduction push barrier-grade sealing demand

A major driver for bromobutyl rubber (BIIR) is the rising need for safer, longer-lasting, better-sealed food products as modern supply chains stretch across countries and climates. BIIR is not a “food ingredient,” but it quietly supports food systems through high-barrier seals in caps, liners, gaskets, hoses, and closure components used in processing and packaging equipment.

The scale of food throughput itself keeps growing, which increases the need for dependable sealing and hygienic handling. In 2024, global meat production was estimated to rise 1.3% to 365 Mt, showing how large volumes must be processed, packed, moved, and stored with tight controls to avoid spoilage. When volumes are this high, even small improvements in sealing performance can translate into meaningful reductions in product loss during filling, transport, and cold storage.

Food safety pressure is another direct accelerator. The World Health Organization states that unsafe food causes 600 million cases of foodborne disease and 420,000 deaths each year worldwide. WHO also notes an estimated US$ 110 billion is lost each year in productivity and medical expenses linked to unsafe food in low- and middle-income countries. Waste reduction targets further strengthen the case for higher-performance packaging and closures.

- FAO reports that 13% of food—about 1.25 billion tonnes—was lost globally after harvest and before reaching retail in 2021. On top of that, UNEP estimates 19% of food—about 1.05 billion tonnes—was wasted at retail, food service, and households in 2022.

Government and regulatory initiatives amplify this direction. The UN’s SDG Target 12.3 calls for halving per-capita food waste and reducing losses across supply chains by 2030. In Europe, the European Commission states the EU is committed to meeting SDG 12.3, including halving per-capita food waste at retail and consumer level by 2030.

Restraints

Recyclability rules and packaging cuts squeeze rubber liners

A major restraining factor for bromobutyl rubber (BIIR) is the fast shift in packaging policy toward less packaging, easier recycling, and simpler material structures. BIIR is a strong sealing material, but it is often used as a small liner or gasket inside caps, closures, and equipment seals. In today’s circular-economy push, “small” parts still matter because they can complicate recycling when they are bonded to plastics, mixed with other elastomers, or hard to separate during sorting and reprocessing.

The numbers behind packaging pressure are large and keep attention high. Eurostat reported that the EU generated 79.7 million tonnes of packaging waste in 2023, equal to 177.8 kg per inhabitant. Eurostat also highlighted plastic packaging waste specifically at 35.3 kg per person in 2023, and only 14.8 kg per person was recycled. When regulators see figures like these, they push for designs that are easier to recycle at scale.

Policy changes are becoming very direct. The European Commission explains that under the new packaging framework, all packaging must be recyclable by 2030. In parallel, the European Parliament’s communication on the agreed rules includes packaging reduction targets of 5% by 2030, 10% by 2035, and 15% by 2040. These targets encourage “light-weighting” and removal of non-essential parts. That can translate into thinner liners, alternative sealing designs, or closure formats that rely less on separate elastomer elements.

This pressure is linked to food industry reality, not just politics. Food producers operate at huge scale, and packaging is a cost line that repeats every day. The OECD-FAO outlook estimated global meat production at 365 Mt in 2024, showing how much food is processed and packed through industrial systems where closures and seals are used at very high volumes.

Opportunity

Cold-chain upgrades create new demand for high-seal rubber parts

One major growth opportunity for bromobutyl rubber (BIIR) is the global push to improve food cold chains—the refrigerated storage, transport, and packaging systems that keep perishable food safe from plant to plate. BIIR is not a “food product,” but it plays a practical role in cold-chain reliability through tight-sealing gaskets, liners, and flexible barrier parts used in processing equipment, refrigerated logistics, and packaging closures.

- The size of the food-loss problem shows why cold-chain investments are becoming a priority. FAO estimates that 14% of food produced for human consumption is lost before reaching the consumer, and it highlights the lack of effective refrigeration as a key issue in many regions.

- Separately, UNEP reports that in 2022 the world wasted 1.05 billion tonnes of food, equal to 19% of food available to consumers, or 132 kg per capita—with 60% of that waste happening in households, 28% in food service, and 12% in retail.

Cold-chain gaps are also quantified more directly. The International Institute of Refrigeration (IIR) states that 12% of global food production is lost due to insufficient cold chains, and it adds that expanding cold-chain infrastructure could save 475 million tonnes of food annually—enough to feed 950 million people.

The opportunity is not only about building more refrigeration; it is also about making cold chains more sustainable. UNEP notes that the food cold chain is responsible for around 4% of total global greenhouse gas emissions when both cold-chain technology and food loss from lack of refrigeration are included.

Regional Insights

Asia Pacific Bromobutyl Rubber Market – Leading Region with 43.80 % Share and $0.7 Bn in 2024

In 2024, Asia Pacific emerged as the dominant regional market in the Bromobutyl Rubber sector, capturing a 43.80% share with an estimated USD 0.7 billion in revenue. This substantial share was supported by the region’s strong automotive and manufacturing landscape, particularly in countries such as China, India, Japan, and South Korea, where vehicle production rates and tire manufacturing volumes continue to rise, fostering steady demand for bromobutyl rubber in tire inner liners and sealing applications.

Rapid industrialisation and growing consumer vehicle ownership have underpinned the need for advanced elastomers that deliver reliable impermeability and heat resistance, especially in high-performance and commercial vehicle segments. Moving into 2025, the region sustained its dominant position as automotive production forecasts remained robust and as the healthcare sector in the region expanded, increasing use of bromobutyl rubber in pharmaceutical closures and sealing applications. Year-on-year performance also showed that capacity expansions, improved supply chain networks, and local manufacturing efficiencies helped maintain competitive pricing and supply reliability.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Lanxess International SA: Lanxess International SA, a German speciality chemicals firm, supplies high‑performance elastomers including bromobutyl rubber variants tailored for automotive and industrial use. The company’s focus on product innovation and sustainability includes investment in environmentally friendlier rubber production methods. Lanxess reported approximately US$2.10 billion in synthetic rubber revenue in 2024, underlining its strong regional and global presence.

Reliance Sibur Elastomers Private Limited: Reliance Sibur Elastomers, a joint venture between Reliance Industries Ltd (74.9 % stake) and Sibur (25.1 % stake), operates South Asia’s first world‑scale butyl and halogenated butyl rubber plant in Jamnagar with a production capacity of 120,000 metric tonnes per annum. The facility supplies bromobutyl and related rubber products for automotive and industrial applications, supported by integration with Reliance’s refinery feedstocks.

Hebei Xiangyi International Trading Co., Ltd.: Hebei Xiangyi International Trading is a China‑based supplier focused on pharmaceutical packaging materials and bromobutyl rubber stoppers used in sterile medicine packaging. Its product range includes Injection and infusion vial stoppers made from bromobutyl rubber, with production scaling to support export to markets such as the USA, Europe and Southeast Asia, reflecting the company’s role in supporting medical and industrial rubber applications.

Top Key Players Outlook

- Exxon Mobil Corporation

- Lanxess International SA

- Reliance Sibur Elastomers Private Limited

- Hebei Xiangyi International Trading Co., Ltd.

- POLYPLAST

- YUSHENG ENTERPRISE LIMITED

- ENEOS Materials Corporation

- ARLANXEO

- ELGI Rubber

Recent Industry Developments

In 2024, Exxon’s Chemical Products segment generated approximately US$2,577 million in earnings and achieved around 19,392 kt in chemical sales volume, reflecting its broad chemical manufacturing scale, of which synthetic rubbers like bromobutyl are a strategic component of high‑value product lines.

In 2025, Lanxess navigated a challenging market environment, with second‑quarter sales of EUR 1.466 billion and an adjusted EBITDA guidance of EUR 520 million to EUR 580 million for the full year as weaker demand and portfolio changes shaped results.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Bn Forecast Revenue (2034) USD 2.8 Bn CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Property (Excellent Air Impermeability, High Damping Properties, Resistant to Oils, Acids, and Chemicals, Low Compression Set, Long Service Life), By Application (Inner Tubes, Tires, Films and Sheets, Butyl Sealing Tapes and Mastics, Diaphragms and Gaskets, Others), By End-Use Industry (Automotive, Construction, Aerospace, Pharmaceuticals, Packaging, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Exxon Mobil Corporation, Lanxess International SA, Reliance Sibur Elastomers Private Limited, Hebei Xiangyi International Trading Co., Ltd., POLYPLAST, YUSHENG ENTERPRISE LIMITED, ENEOS Materials Corporation, ARLANXEO, ELGI Rubber Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Exxon Mobil Corporation

- Lanxess International SA

- Reliance Sibur Elastomers Private Limited

- Hebei Xiangyi International Trading Co., Ltd.

- POLYPLAST

- YUSHENG ENTERPRISE LIMITED

- ENEOS Materials Corporation

- ARLANXEO

- ELGI Rubber