Global Blackcurrant Powder Market Size, Share, And Enhanced Productivity By Nature (Organic, Conventional), By Function (Colorant, Flavoring, Nutritional Ingredient), By End-Use (Food (Bakery, Dessert and Ice-cream, Sauces and Seasonings, Meat and Egg Replacement, Others), Beverages (Sports Drinks, Functional Beverages, Fruit Juices, Others)), By Distribution Channel (Convenience Stores, Independent Grocery Retailers, Specialty Food Stores, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 172142

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

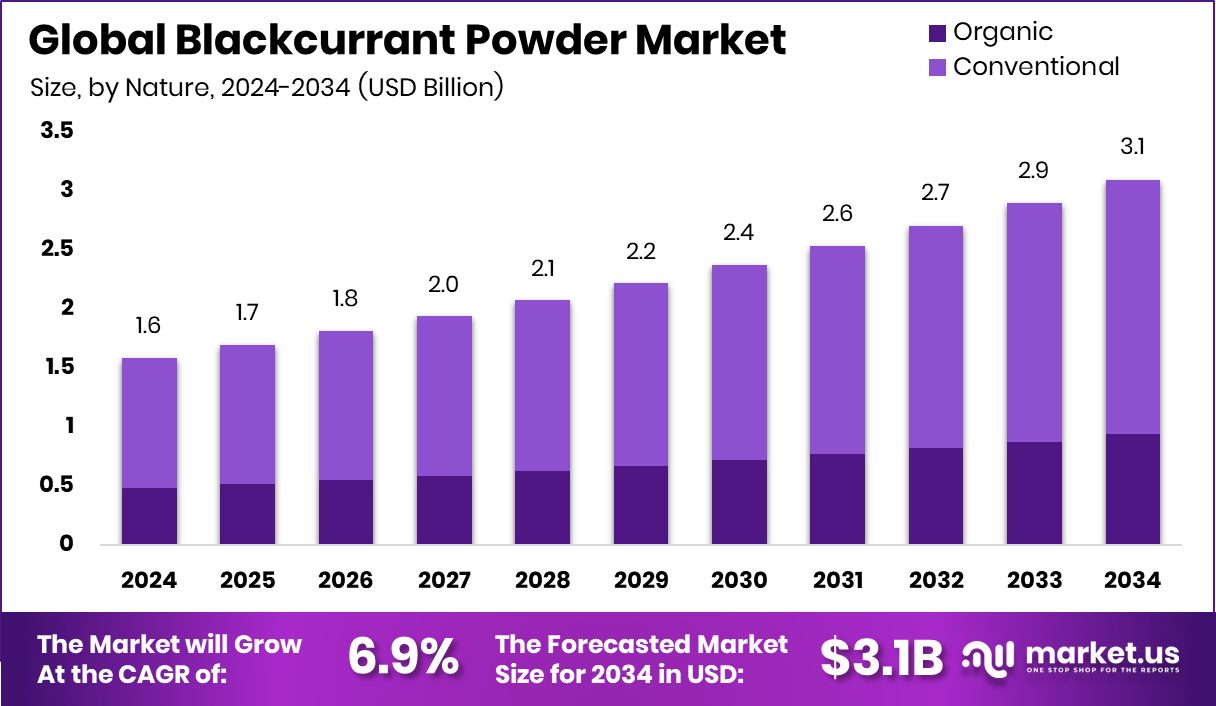

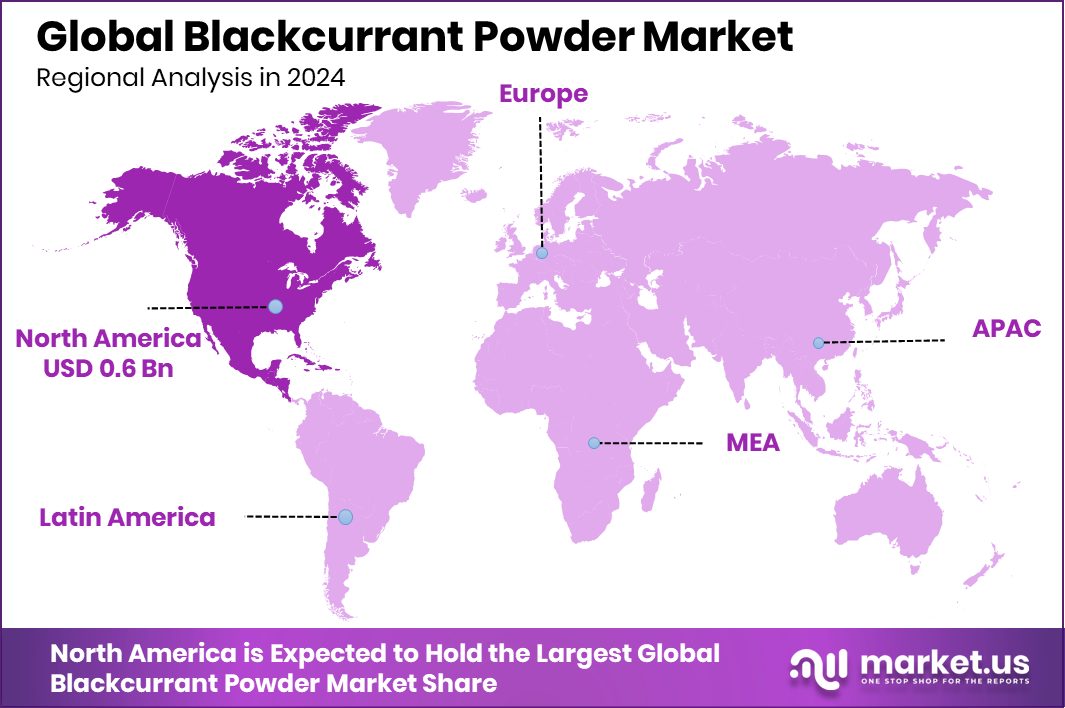

The Global Blackcurrant Powder Market is expected to be worth around USD 3.1 billion by 2034, up from USD 1.6 billion in 2024, and is projected to grow at a CAGR of 6.9% from 2025 to 2034. In 2024, North America led the market with a share of 38.70%, USD 0.6 Bn.

Blackcurrant Powder is made by drying and grinding blackcurrants, preserving their natural flavor, color, and nutrients. It is rich in vitamin C, antioxidants, and anthocyanins, making it highly valued in health foods, beverages, and supplements. The powder offers convenience for food manufacturers and consumers, allowing easy incorporation into smoothies, bakery items, and functional foods without losing nutritional benefits.

The Blackcurrant Powder Market refers to the global trade and consumption of blackcurrant powder across food, beverage, and nutraceutical industries. It includes raw powders, organic variants, and value-added blends. The market growth is driven by increasing health awareness, rising demand for clean-label products, and adoption in functional and natural beverages. Next-gen juice brand Alienkind raises $1.2 million in a seed funding round, reflecting investor interest in health-oriented fruit products.

Growth factors for blackcurrant powder include rising demand for antioxidant-rich ingredients, natural flavorings, and immune-boosting products. Government grants and investments, such as the NSW government granting Grove Juice $2.5 million for a new bottling line, support innovation and expansion in the beverage and powder processing space. Malaysia’s Being Juice securing $1 million seed funding shows continued financial support for juice and fruit powder production.

Market demand is fueled by consumers seeking convenient, nutrient-rich options in beverages, snacks, and supplements. Instant food brand Yu securing Rs 55 Cr from Ashish Kacholia and Asian Paints Promoter Group highlights the financial backing for innovative, ready-to-use health products. Better Juice raising $8 million further reflects increasing market interest in functional juice and powder-based products.

Future opportunities exist in product diversification, functional formulations, and international expansion. Creative Juice launching a $50M fund to invest in creators and MinusSugar raising $2.5M to innovate sugar reduction solutions demonstrates potential for partnerships and innovation in blackcurrant-based products. Nomva’s closing $3M funding in the cold-pressed juice category also indicates growing interest in fruit powders for premium beverage applications, showing strong opportunities for growth globally.

Key Takeaways

- The Global Blackcurrant Powder Market is expected to be worth around USD 3.1 billion by 2034, up from USD 1.6 billion in 2024, and is projected to grow at a CAGR of 6.9% from 2025 to 2034.

- In the Blackcurrant Powder Market, conventional products dominated by nature, accounting for 69.3% share globally.

- By function, flavoring applications led the Blackcurrant Powder Market, capturing 49.6% demand worldwide overall, consistently.

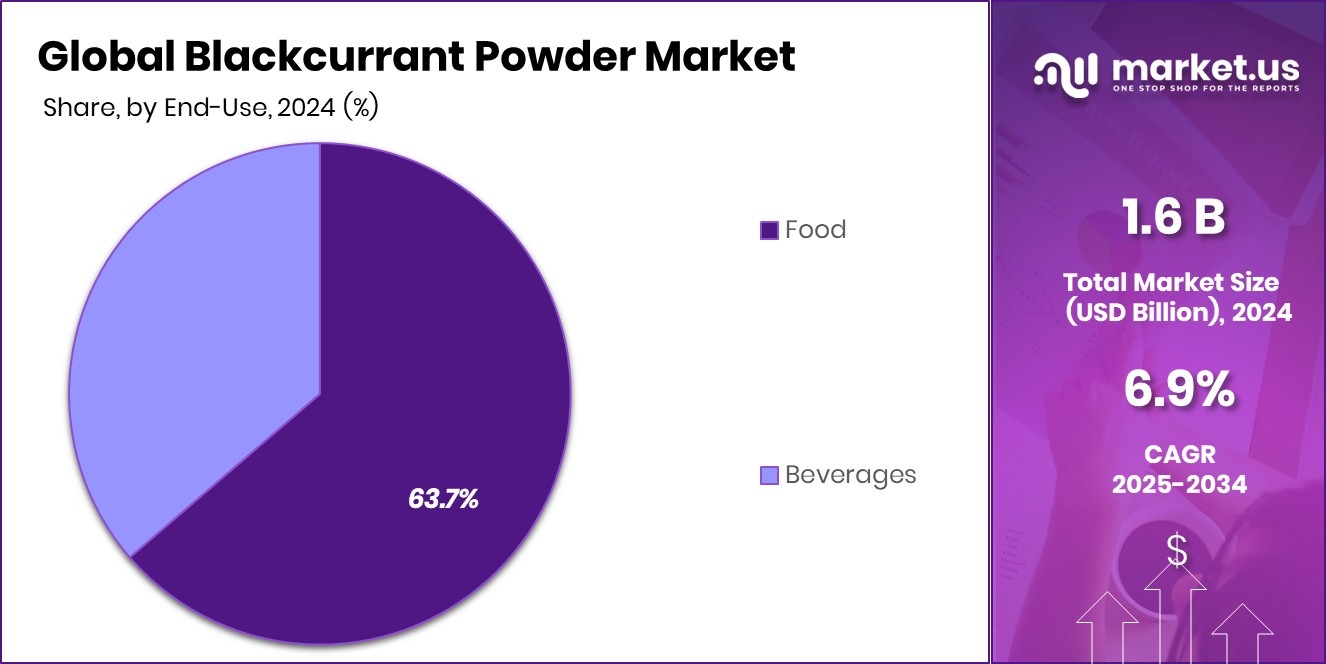

- The food end-use segment dominated the Blackcurrant Powder Market, holding 63.7% consumption share globally in 2024.

- Independent grocery retailers led distribution channels in the Blackcurrant Powder Market with 32.5% share dominance.

- In 2024, North America remained the leading region, capturing 38.70%, USD 0.6 Bn.

By Nature Analysis

Conventional nature dominates the Blackcurrant Powder Market, holding a 69.3% share globally in 2024.

In 2024, the conventional segment dominated the Blackcurrant Powder Market, accounting for 69.3% of the overall market share. Consumer preference for naturally sourced and minimally processed ingredients continues to drive the adoption of conventional blackcurrant powder across various applications. Manufacturers are leveraging traditional extraction methods while ensuring high nutritional content to meet consumer demand.

Additionally, rising awareness about health benefits, such as antioxidants and vitamin C, strengthens market preference for conventional products over organic alternatives. Industry players are also investing in large-scale production to maintain cost efficiency while catering to increasing demand from domestic and international markets, thereby consolidating the market’s reliance on conventional products.

By Function Analysis

Flavoring function leads the Blackcurrant Powder Market with 49.6% utilization worldwide across industries.

In 2024, the flavoring function segment accounted for 49.6% of the Blackcurrant Powder Market. This indicates that flavor enhancement remains the primary application of blackcurrant powder in beverages, confectionery, and bakery products. Manufacturers are increasingly integrating blackcurrant powder into new product innovations due to its natural fruity taste and appealing color.

The demand is further propelled by consumer inclination toward natural flavorings rather than synthetic additives. Moreover, the versatility of blackcurrant powder in both sweet and savory preparations ensures sustained growth in the flavoring segment, attracting investment from leading ingredient suppliers to expand product portfolios and distribution networks.

By End-Use Analysis

The food end-use segment dominates the blackcurrant powder market, accounting for 63.7% of demand globally.

In 2024, the food end-use segment captured a dominant share of 63.7% in the Blackcurrant Powder Market. Blackcurrant powder is widely incorporated in jams, sauces, beverages, and dietary supplements due to its rich nutritional profile. Rising health consciousness among consumers is driving manufacturers to emphasize the functional benefits of blackcurrant powder, including antioxidant activity and immune support.

The increasing use of blackcurrant powder in functional foods also aligns with global clean-label trends. Furthermore, collaborations between ingredient suppliers and food manufacturers are helping launch innovative products, expanding market penetration, and strengthening blackcurrant powder’s prominence in the food industry.

By Distribution Channel Analysis

Independent grocery retailers lead the Blackcurrant Powder Market distribution, capturing 32.5% sales globally.

In 2024, independent grocery retailers led the distribution channel segment with 32.5% share in the Blackcurrant Powder Market. These retailers play a critical role in reaching end consumers directly, especially in regions where organized retail penetration remains moderate. Their wide network enables consumers to access various blackcurrant powder brands conveniently, supporting impulse purchases and repeat buying patterns.

Additionally, independent retailers often focus on providing smaller packaging options and local promotions, increasing product visibility and affordability. Market participants are leveraging partnerships with these retailers to enhance regional coverage, boost sales, and tap into the growing demand for convenient, health-focused ingredient options among everyday shoppers.

Key Market Segments

By Nature

- Organic

- Conventional

By Function

- Colorant

- Flavoring

- Nutritional Ingredient

By End-Use

- Food

- Bakery

- Dessert and Ice-cream

- Sauces and Seasonings

- Meat and Egg Replacement

- Others

- Beverages

- Sports Drinks

- Functional Beverages

- Fruit Juices

- Others

By Distribution Channel

- Convenience Stores

- Independent Grocery Retailers

- Specialty Food Stores

- Online Retail

- Others

Driving Factors

Rising Health Awareness Boosts Functional Food Demand

In recent years, consumers have become increasingly aware of the benefits of nutrient-rich and antioxidant-packed foods. Blackcurrant powder, being high in vitamin C, anthocyanins, and other antioxidants, is widely recognized for supporting immunity, heart health, and overall wellness. This growing awareness encourages people to include blackcurrant powder in smoothies, juices, supplements, and baked goods, driving its adoption across households and the food and beverage industry.

The demand for healthy and functional beverages also supports market growth. Sports-focused and health-conscious brands are contributing to this trend. For example, C4 Energy launched a $400,000 initiative to support local sports teams, while Cure Hydration raised $2.6M for its healthy sports drink alternative. These investments show increasing consumer interest in functional, nutrient-rich products, indirectly supporting the Blackcurrant Powder Market.

Restraining Factors

High Production Costs Limit Blackcurrant Powder Adoption

The production of blackcurrant powder involves freeze-drying, processing, and quality control, which require advanced technology and skilled labor. These processes increase the overall cost, making blackcurrant powder relatively expensive compared to other fruit powders or synthetic additives. Small-scale manufacturers and startups may find it challenging to enter the market due to these high operational costs, which can slow market growth despite rising demand.

Additionally, the financial focus of companies on new health products can impact blackcurrant powder adoption. For instance, Ketones will fuel the next generation of energy drinks, as AgFunder leads a $4M seed round, and Cure Hydration raises $5.6M to expand its retail footprint. These examples show that investment often prioritizes alternative functional beverages, which can temporarily restrain funding and resources for blackcurrant powder innovation and scaling.

Growth Opportunity

Expansion Potential in Functional Beverage And Food Applications

The Blackcurrant Powder Market has significant growth opportunities in functional beverages, dairy products, and health-focused snacks. Consumers increasingly prefer products that provide natural antioxidants, vitamins, and immune-boosting benefits, which makes blackcurrant powder ideal for smoothies, juices, yogurts, and energy bars. Manufacturers can innovate by integrating blackcurrant powder into new product lines, targeting health-conscious and premium consumers.

Financial investments in related ingredient sectors also highlight potential. For example, Australia’s Eclipse Ingredients nabbed $4.6M for recombinant breast milk protein, Ace International raised $35M from global investors, and Cano-ela secured €1.6 million to accelerate development of seed-based ingredients. These fundings show that investors are eager to support innovation in health-focused and functional food ingredients, creating a favorable environment for blackcurrant powder expansion into new applications and markets globally.

Latest Trends

Rise Of Plant-Based And Vegan Product Demand

One of the latest trends in the Blackcurrant Powder Market is the growing consumer shift toward plant-based and vegan products. Blackcurrant powder fits perfectly in this trend as a natural, fruit-based ingredient that can be added to smoothies, juices, bakery items, and plant-based dairy alternatives. Its rich antioxidant content and vibrant color also make it attractive for clean-label and health-focused product innovation, appealing to consumers seeking natural and sustainable food options.

Investment activity in plant-based alternatives highlights this trend. For example, Dutch scale-up Revyve secured €24 million in funding to boost egg-replacing yeast proteins, and The Every Company raised $55M as animal-free egg protein hits Walmart. These fundings indicate strong investor confidence in plant-based and functional ingredients, creating opportunities for blackcurrant powder to expand into vegan, allergen-free, and health-oriented food and beverage products worldwide.

Regional Analysis

In 2024, North America dominated the Blackcurrant Powder Market with 38.70%, USD 0.6 Bn.

In 2024, North America dominated the Blackcurrant Powder Market, holding a 38.70% share and valued at USD 0.6 billion. The region’s leadership is driven by strong consumer preference for natural and nutrient-rich ingredients in food and beverages, along with widespread awareness of blackcurrants’ health benefits. High demand from the functional food and beverage sector has further reinforced North America’s position as the most lucrative market globally.

Europe represents the second-largest market, with significant adoption in bakery, confectionery, and beverage applications. The region’s growth is supported by increasing interest in clean-label and natural products, along with rising consumption of antioxidant-rich ingredients.

Asia Pacific is witnessing steady growth due to expanding urban populations and rising health-conscious consumers seeking dietary supplements and functional foods.

Middle East & Africa and Latin America show emerging opportunities as manufacturers introduce blackcurrant powder in local retail and foodservice channels. These regions are gradually gaining traction due to increasing awareness about the nutritional value of blackcurrants and growing incorporation into regional cuisines and beverages, offering potential for future market expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Arctic Power Berries continues to strengthen its position in the global Blackcurrant Powder Market by focusing on high-quality sourcing and sustainable processing methods. The company emphasizes cold-pressed and freeze-dried techniques to preserve the natural nutrients and flavor of blackcurrants. This approach has helped Arctic Power Berries cater to both the food and beverage sectors as well as dietary supplement manufacturers. Additionally, their commitment to clean-label and natural products has resonated with health-conscious consumers, giving the brand a competitive edge in premium segments.

LOOV Food has carved a niche in the market by offering versatile blackcurrant powder formulations tailored for culinary and functional applications. The company focuses on innovation and product differentiation, providing powders with varying particle sizes and flavor profiles suitable for beverages, bakery, and confectionery products. LOOV Food’s emphasis on quality control and consistent supply has strengthened its partnerships with retail and foodservice clients, helping the company maintain stable market growth.

LYO FOOD Sp. has positioned itself as a key player by leveraging advanced freeze-drying technology, ensuring maximum retention of nutrients, antioxidants, and natural color. Their blackcurrant powders are designed for use in functional foods, health supplements, and beverages. LYO FOOD Sp.’s dedication to research, quality, and sustainability has reinforced its reputation, attracting both industrial buyers and health-focused consumers.

Top Key Players in the Market

- Arctic Power Berries

- LOOV Food

- LYO FOOD Sp.

- FutureCeuticals

- CurrantC LLC

- Z Natural Foods LLC

- Active Micro Technologies, LLC (AMT)

- Waitaki Bio

- ConnOils LLC

- Northwest Wild Foods

Recent Developments

- In November 2024, LYO FOOD LLC (associated with the LYOFOOD brand) exhibited at the China International Import Expo (CIIE) 2024 in Shanghai. This event showcased their freeze‑dried foods to global buyers, helping increase the brand’s international visibility

- In November 2024, Z Natural Foods released a new Organic Pumpkin Spice Latte Mix. This product combines organic pumpkin and spices with whole milk powder to create a seasonal drink mix. It reflects the company’s focus on natural, organic powder blends for beverages and seasonal tastes.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion Forecast Revenue (2034) USD 3.1 Billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Conventional), By Function (Colorant, Flavoring, Nutritional Ingredient), By End-Use (Food (Bakery, Dessert and Ice-cream, Sauces and Seasonings, Meat and Egg Replacement, Others), Beverages (Sports Drinks, Functional Beverages, Fruit Juices, Others)), By Distribution Channel (Convenience Stores, Independent Grocery Retailers, Specialty Food Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arctic Power Berries, LOOV Food, LYO FOOD Sp., FutureCeuticals, CurrantC LLC, Z Natural Foods LLC, Active Micro Technologies, LLC (AMT), Waitaki Bio, ConnOils LLC, Northwest Wild Foods Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Blackcurrant Powder MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Blackcurrant Powder MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Arctic Power Berries

- LOOV Food

- LYO FOOD Sp.

- FutureCeuticals

- CurrantC LLC

- Z Natural Foods LLC

- Active Micro Technologies, LLC (AMT)

- Waitaki Bio

- ConnOils LLC

- Northwest Wild Foods