Global Biotin Market Size, Share Analysis Report By Product Type (Tablets, Capsules, Gummies, Powders, Others), By End-Use (Nutraceuticals, Food, Cosmetics And Personal Care, Others), By Sales Channel (Direct Sale, Indirect Sale) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162404

- Number of Pages: 365

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

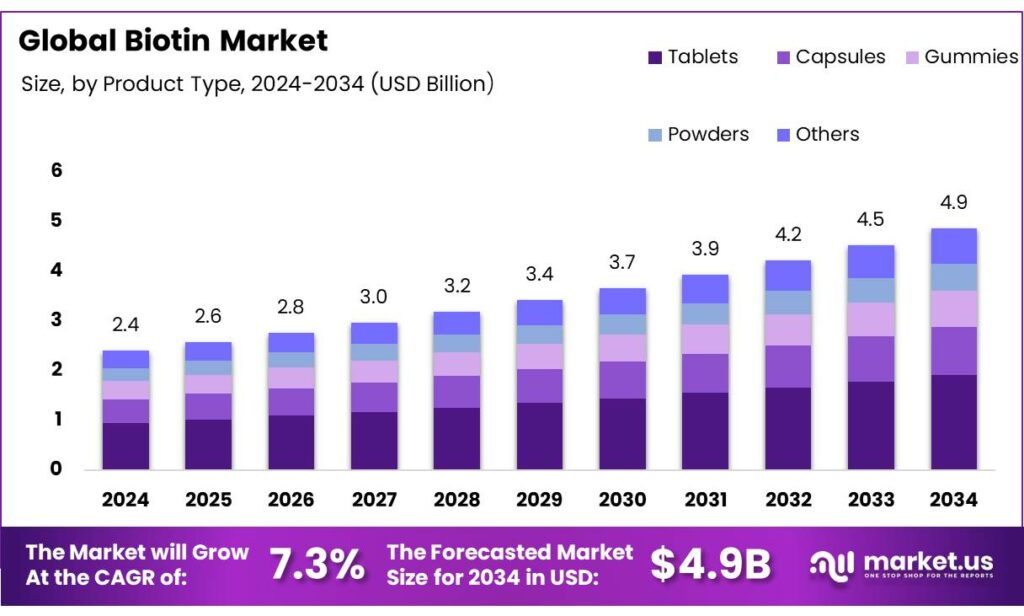

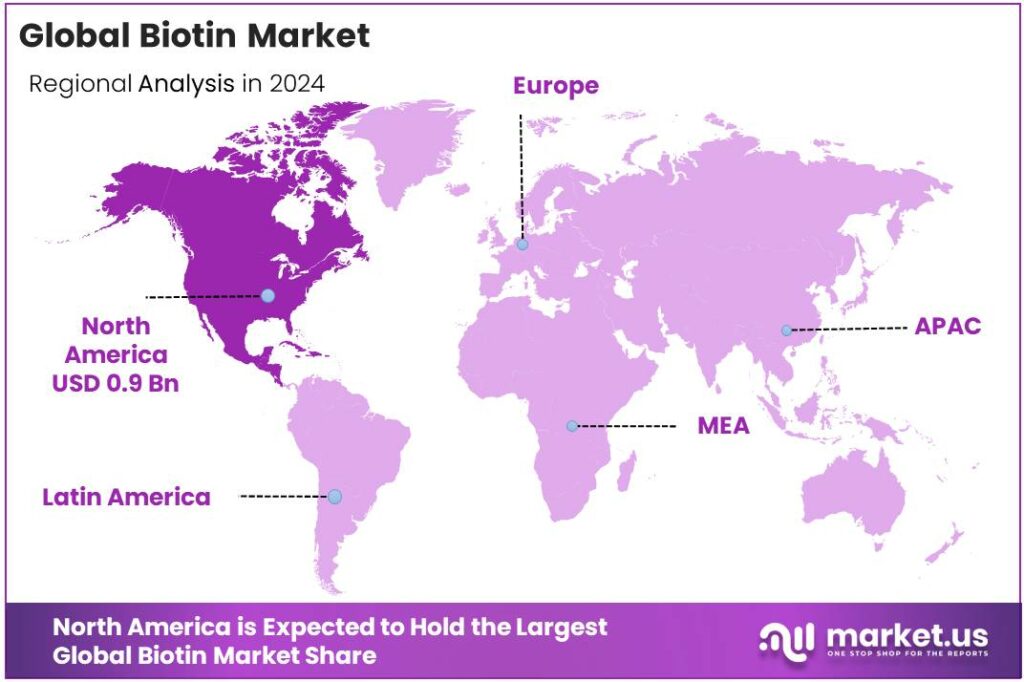

The Global Biotin Market size is expected to be worth around USD 4.9 Billion by 2034, from USD 2.4 Billion in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 39.3% share, holding USD 0.9 Billion in revenue.

Biotin (vitamin B7) is a water-soluble cofactor for carboxylases involved in fatty-acid, amino-acid and glucose metabolism. For healthy adults, the U.S. sets an Adequate Intake (AI) at 30 µg/day (35 µg/day for lactation), reflecting sufficiency without a formal RDA; no Tolerable Upper Intake Level is established due to very low toxicity at typical intakes.

Human nutrition, animal nutrition, and clinical nutrition/diagnostics. In human nutrition, supplement penetration is the core volume driver: 57.6% of U.S. adults reported taking any dietary supplement in the past 30 days in 2017–2018, underscoring a large addressable base for biotin-containing products. In animal nutrition, biotin fortification supports hoof, skin, and egg-production outcomes; demand scales with livestock output. The FAO reports world egg production reached ~97 million tonnes in 2023, a structural pull for layer feed premixes that include biotin.

Regulatory and safety dynamics also shape manufacturing and QA. FDA has warned that high supplemental intakes can interfere with immunoassays. Typical recommended intakes (~30 µg/day) yield serum biotin <1 ng/mL, but reported consumer use up to 300 mg/day can exceed 1,000 ng/mL; FDA recommends IVD biotin-interference testing up to 3,500 ng/mL and explicit labeling where relevant—pushing test makers and brand owners to coordinate on warnings and product information.

Animal nutrition is a meaningful volume outlet—particularly in poultry, swine, and dairy rations where biotin supports integument, hoof/footpad integrity, and performance. Macro livestock trends reinforce this: FAO notes poultry meat represented ~40% of global meat production in 2020 and remains the growth leader; recent FAO/OECD outlooks highlight continued poultry expansion through 2024–2034, supporting steady micronutrient premix consumption (biotin inclusion typically in the 0.1–0.2 mg/kg feed range depending on species and life stage).

Key Takeaways

- Biotin Market size is expected to be worth around USD 4.9 Billion by 2034, from USD 2.4 Billion in 2024, growing at a CAGR of 7.3%.

- Tablets held a dominant market position, capturing more than a 39.4% share.

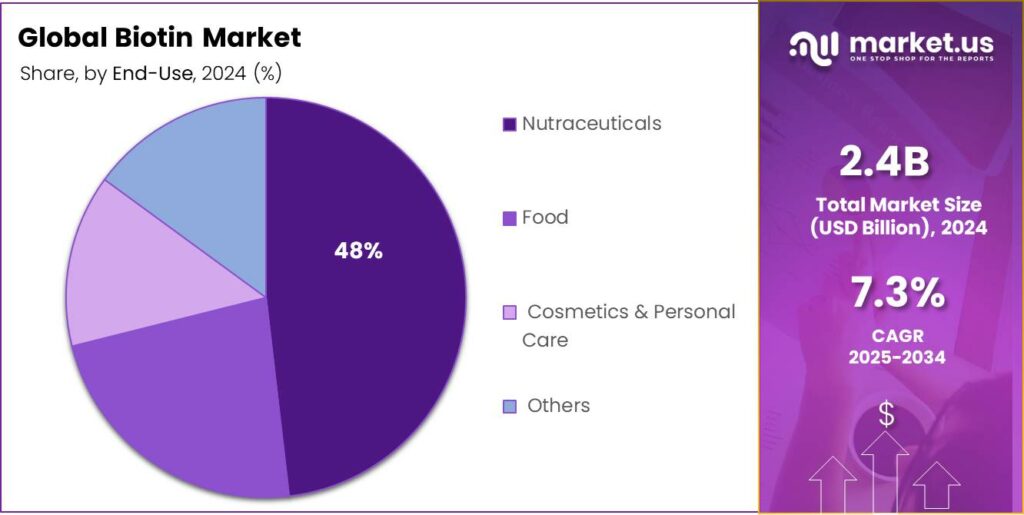

- Nutraceuticals held a dominant market position, capturing more than a 48.3% share of the global biotin market

- Indirect Sale held a dominant market position, capturing more than a 72.2% share of the global biotin market.

- North America emerged as the leading regional market for biotin, capturing a significant 39.3% share, with market valuation reaching approximately USD 0.9 billion.

By Product Type Analysis

Tablets dominate Biotin market with 39.4% share in 2024

In 2024, Tablets held a dominant market position, capturing more than a 39.4% share of the global biotin market due to their convenience, precise dosing, and widespread consumer familiarity. This segment has been particularly preferred in the dietary supplement industry, where ease of consumption and portability are key factors driving adoption. Tablets offer stability and a longer shelf life compared to liquid or powder alternatives, which makes them attractive for both manufacturers and end-users.

The steady growth in health-conscious populations, especially among adults seeking hair, skin, and nail benefits, has further reinforced the prominence of tablet formulations. With continued consumer trust and routine usage patterns, tablets are expected to maintain their leadership in the coming years, supported by ongoing product innovations such as combination formulas with other vitamins and minerals. The segment’s dominance underscores its role as the cornerstone of biotin supplementation in 2024.

By End-Use Analysis

Nutraceuticals lead Biotin market with 48.3% share in 2024

In 2024, Nutraceuticals held a dominant market position, capturing more than a 48.3% share of the global biotin market, driven by increasing consumer awareness of health, wellness, and preventive care. The growing popularity of dietary supplements for hair, skin, and nail health has significantly contributed to the segment’s strong performance. Nutraceuticals provide a convenient and regulated way for consumers to meet their daily biotin requirements, supporting overall wellness without the need for prescription products.

Rising demand for plant-based and natural formulations has also reinforced the adoption of biotin in nutraceutical applications. Additionally, widespread distribution through pharmacies, online platforms, and health stores has enhanced accessibility, making nutraceuticals the preferred choice for individuals seeking daily supplementation. The segment’s growth in 2024 highlights its key role in driving overall market expansion, with continued opportunities anticipated in functional foods and combination vitamin products.

By Sales Channel Analysis

Indirect Sale dominates Biotin market with 72.2% share in 2024

In 2024, Indirect Sale held a dominant market position, capturing more than a 72.2% share of the global biotin market, reflecting the strong reliance on distributors, wholesalers, and online retail platforms for product distribution. This sales channel has become the preferred route for manufacturers to reach a wide consumer base efficiently, ensuring availability across pharmacies, health stores, and e-commerce platforms.

The indirect model provides benefits such as broader market penetration, reduced logistical challenges for producers, and the ability to leverage established retail networks. Rising consumer demand for dietary supplements and nutraceutical products, coupled with the convenience of accessing biotin through multiple retail touchpoints, has reinforced the prominence of indirect sales. In 2024, this channel clearly remained the backbone of the biotin market, supporting consistent growth and widespread product adoption.

Key Market Segments

By Product Type

- Tablets

- Capsules

- Gummies

- Powders

- Others

By End-Use

- Nutraceuticals

- Food

- Cosmetics & Personal Care

- Others

By Sales Channel

- Direct Sale

- Indirect Sale

Emerging Trends

Right-sized biotin in public nutrition—fortification, school meals, and prenatal MMS

A clear, recent trend is the move from standalone, very-high-dose biotin pills toward “right-sized” biotin delivered inside multi-micronutrient programs—fortified staples, school meals, and antenatal supplements—so populations get reliable, modest amounts as part of everyday nutrition. The public-health need is undeniable: the World Health Organization estimates more than 2 billion people are deficient in key vitamins and minerals. That ongoing “hidden hunger” keeps fortification and supplementation high on government agendas and opens large, predictable channels for vitamin premixes that include biotin at safe, regulated levels.

Fortification is now truly mainstream policy. According to the Food Fortification Initiative, 94 countries have legislation mandating fortification of at least one industrially milled cereal grain, and 93 countries specifically mandate wheat-flour fortification. This is a dramatic expansion from a few dozen countries two decades ago and shows how national standards are maturing. For biotin suppliers, this means specifications, audits, and tenders—not hype—drive demand. Premix formulators can offer biotin alongside the B-complex and minerals, meeting national rules and filling routine procurement for flour, complementary foods, and condiments.

School meals amplify the trend by turning policy into daily practice. The World Food Programme reports 466 million children benefit from school-meal programmes globally, with most costs carried by national governments and WFP providing technical support. When ministries upgrade menus, they increasingly look at micronutrient quality, not just calories. That invites standardized vitamin blends in milk, snacks, and staple foods—precisely where a small, well-documented biotin dose fits. These programmes run year-round, creating stable, multi-year demand that supports investments in quality, traceability, and local blending capacity.

- Consumer behavior sustains a retail baseline. In the United States, 57.6% of adults reported using a dietary supplement in the prior 30 days in 2017–2018, including 63.8% of women and 50.8% of men. High, steady usage keeps space for biotin-containing multivitamins and hair/skin/nail blends, but the big growth lever is now the institutional side—programs that reach millions with modest, daily doses.

Drivers

Growing Awareness of Micronutrient Shortfalls and Rising Demand for Biotin

One major driving factor for the growing demand for biotin is the widespread global inadequacy of micronutrient intake, which increasingly prompts consumers, health professionals and governments to seek effective solutions. In simple terms: many people around the world are not getting enough vitamins and minerals, and this “hidden hunger” creates a clear role for nutrients like biotin — especially in nutrition supplements, fortified foods and wellness products.

- According to a pooled analysis published in The Lancet Global Health, more than half of preschool-aged children and two-thirds of women of reproductive age worldwide suffer from at least one micronutrient deficiency. Similarly, research from the Global Alliance for Improved Nutrition (GAIN) and affiliated institutions reported that 68% of the global population has insufficient intake of iodine, 67% for vitamin E and 66% for calcium; and over half globally consume inadequate levels of important nutrients such as riboflavin, folate and vitamins C and B6. Meanwhile, according to the World Health Organization (WHO), more than 2 billion people worldwide are estimated to be deficient in key vitamins and minerals.

From the industry side, data from the Centers for Disease Control and Prevention (CDC) show that during 2017-2018, 57.6 % of U.S. adults reported using at least one dietary supplement in the prior 30 days; among women the figure was 63.8%, and for men 50.8%. This shows not only rising consumer willingness to supplement, but also a clear segment of the population ready for nutrients beyond the basic set. As more wellness-aware buyers look for hair, skin, metabolism or energy-related benefits, the broad micronutrient shortfall becomes a compelling market driver.

Restraints

Risk of Lab Test Interference

One major restraining factor for the growth of biotin-based products is the increasingly evident interference of high-dose biotin with diagnostic laboratory tests, which has triggered regulatory caution, increased consumer skepticism and added complexity for manufacturers. To put it plainly: while many users believe that more is better, in the case of biotin, too much of it can muddle important medical test results, and that makes healthcare professionals, regulators and consumers more hesitant.

- For instance, the U.S. Food and Drug Administration (FDA) pointed out that many dietary supplements contain biotin levels up to 650 times the recommended daily intake. That’s a striking number: if the adequate intake (AI) for adults is about 30 µg/day, as per the National Institutes of Health (NIH) Office of Dietary Supplements, supplements offering hundreds or thousands of micrograms represent a huge multiple.

From an industry perspective, this interference risk complicates marketing, labeling and regulatory compliance. On one hand, brands promoting “hair, skin and nail support” with mega-dose biotin must balance consumer demand with safety messaging: they need to clearly caution users who may undergo lab tests. On the other hand, healthcare professionals may advise patients to stop biotin supplementation for a defined period prior to lab tests—introducing friction in the user-experience of the product.

And for regulatory bodies: the absence of a clear tolerable upper intake level (UL) for biotin means there is a grey zone in which high doses are widely used but long-term safety and interference implications are not fully established. For example, the NIH states that “there are not sufficient data on which to base a tolerable upper intake level (UL) for biotin.”

Opportunity

Fortified staples, school meals, and maternal nutrition programs

A powerful growth opportunity for biotin sits inside the global push to fix micronutrient gaps through large-scale food fortification, school meals, and maternal nutrition. The need is clear and urgent: the World Health Organization estimates over 2 billion people are deficient in key vitamins and minerals. This persistent “hidden hunger” keeps fortification and supplementation high on public-health agendas, creating steady demand for vitamin formulations in which biotin often features alongside other B-vitamins.

Government-led fortification programs are expanding in scope and coverage. Today, 93 countries mandate fortification of wheat flour, a dramatic rise from fewer than 40 at the start of the century. As nations update food laws and standards, they open new channels for compliant vitamin premixes across staples, ready-to-eat products, and condiments—practical vehicles to deliver small, safe amounts of vitamins at population scale. For biotin suppliers, this policy momentum means more tenders, more compliant label claims, and more opportunities to pair biotin with other water-soluble vitamins in premixes.

Consumer behavior supports this policy wave. In the United States—one of the world’s largest supplement markets—57.6% of adults reported using a dietary supplement in the prior 30 days, including 63.8% of women. Such high, stable usage underpins retail channels for biotin-containing multivitamins, hair/skin/nail blends, and functional foods, and it often informs label norms in other regions.

Finally, the animal-nutrition side remains attractive. Global feed production reached 1.396 billion metric tons in 2024. Even modest upticks in inclusion rates for layers, breeders, and sows translate into significant tonnage for vitamin premixes that include biotin, given its well-known role in hoof/claw integrity and energy metabolism. Integrated feed players and premix blenders are therefore essential B2B partners in biotin’s growth story.

Regional Insights

North America leads Biotin market with 39.3% share valued at USD 0.9 billion in 2024

In 2024, North America emerged as the leading regional market for biotin, capturing a significant 39.3% share, with market valuation reaching approximately USD 0.9 billion. The dominance of this region can be attributed to high consumer awareness regarding health, wellness, and preventive care, coupled with well-established nutraceutical and dietary supplement industries.

The United States, as the largest contributor within North America, has demonstrated robust growth due to the widespread adoption of hair, skin, and nail health products, as well as increasing fortification of functional foods and beverages with biotin. Regulatory frameworks supporting supplement safety, such as the FDA’s guidelines on daily biotin intake (30 µg for adults), have further bolstered market confidence and consumer trust, enabling higher penetration of biotin-containing products.

The growth is also driven by expanding retail networks, including e-commerce platforms, pharmacies, and health stores, which facilitate convenient access to biotin supplements for diverse consumer segments. Additionally, rising interest in preventive healthcare and beauty-from-within concepts has encouraged manufacturers to innovate with combination products and value-added formulations, further strengthening market adoption.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE is a major chemical and nutrition player with a robust presence in the biotin market. The company supplies high-quality biotin for dietary supplements, pharmaceuticals, and feed industries. In 2024, BASF leveraged its chemical expertise to provide stable, pure, and traceable biotin products globally. Continuous investment in production facilities and R&D enables the development of customized formulations for human and animal nutrition. BASF’s established global supply chain and strong regulatory compliance make it a trusted partner in the biotin market, supporting consistent growth and adoption.

Zhejiang Medicine Co., Ltd. is a leading biopharmaceutical and nutraceutical manufacturer in China, producing biotin for both human and animal use. In 2024, the company emphasized quality, safety, and regulatory compliance, supplying biotin to supplement manufacturers and feed producers domestically and internationally. Investments in modern production facilities and R&D capabilities support innovative formulations and high-volume supply. Zhejiang Medicine’s strategic focus on expanding export markets and enhancing product accessibility has strengthened its position as a significant player in the regional and global biotin industry.

Shandong Luwei Pharmaceutical Co., Ltd. specializes in vitamins and nutritional supplements, including biotin. In 2024, the company produced high-purity biotin catering to nutraceutical, pharmaceutical, and feed markets. Its integrated production facilities and stringent quality controls ensure compliance with national and international standards. Shandong Luwei leverages domestic and international distribution networks to enhance market reach. Ongoing R&D efforts focus on product consistency, stability, and formulation flexibility, reinforcing the company’s reputation as a reliable supplier in the global biotin market.

Top Key Players Outlook

- DSM

- BASF SE

- Zhejiang Medicine Co., Ltd.

- Shandong Luwei Pharmaceutical Co., Ltd.

- Xiamen Kingdomway Group Company

- Lonza Group

- Glanbia plc

- Kerry Group plc

- Zhejiang NHU Co., Ltd.

- CSPC Pharmaceutical Group Limited

Recent Industry Developments

In 2024, DSM, now operating as DSM-Firmenich, continued to be a significant player in the global biotin market. The company reported revenues of €12.8 billion for the full year, marking a 20% increase from 2023.

Xiamen Kingdomway Group Company, a publicly listed Chinese firm, has been actively engaged in the biotin sector, focusing on the production and sale of nutritional supplements. In 2024, the company achieved an annual revenue of ¥3.24 billion, marking a 4.43% increase from the previous year.

Report Scope

Report Features Description Market Value (2024) USD 2.4 Bn Forecast Revenue (2034) USD 4.9 Bn CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Tablets, Capsules, Gummies, Powders, Others), By End-Use (Nutraceuticals, Food, Cosmetics And Personal Care, Others), By Sales Channel (Direct Sale, Indirect Sale) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape DSM, BASF SE, Zhejiang Medicine Co., Ltd., Shandong Luwei Pharmaceutical Co., Ltd., Xiamen Kingdomway Group Company, Lonza Group, Glanbia plc, Kerry Group plc, Zhejiang NHU Co., Ltd., CSPC Pharmaceutical Group Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- DSM

- BASF SE

- Zhejiang Medicine Co., Ltd.

- Shandong Luwei Pharmaceutical Co., Ltd.

- Xiamen Kingdomway Group Company

- Lonza Group

- Glanbia plc

- Kerry Group plc

- Zhejiang NHU Co., Ltd.

- CSPC Pharmaceutical Group Limited