Global Biorationals Market Size, Share, Analysis Report By Type (Pesticides, Insecticides, Fungicides, Nematicides, Herbicides, Plant Growth Regulators, Others), By Formulation (Liquid, Dry), By Mode of Application (Foliar Spray, Soil Treatment, Trunk Injection, Others), By Crop Type (Fruits and Vegetables, Cereals, Grains, Corn, Others), By End User (Agriculture, Forestry, Public Health, Aquaculture, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156012

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

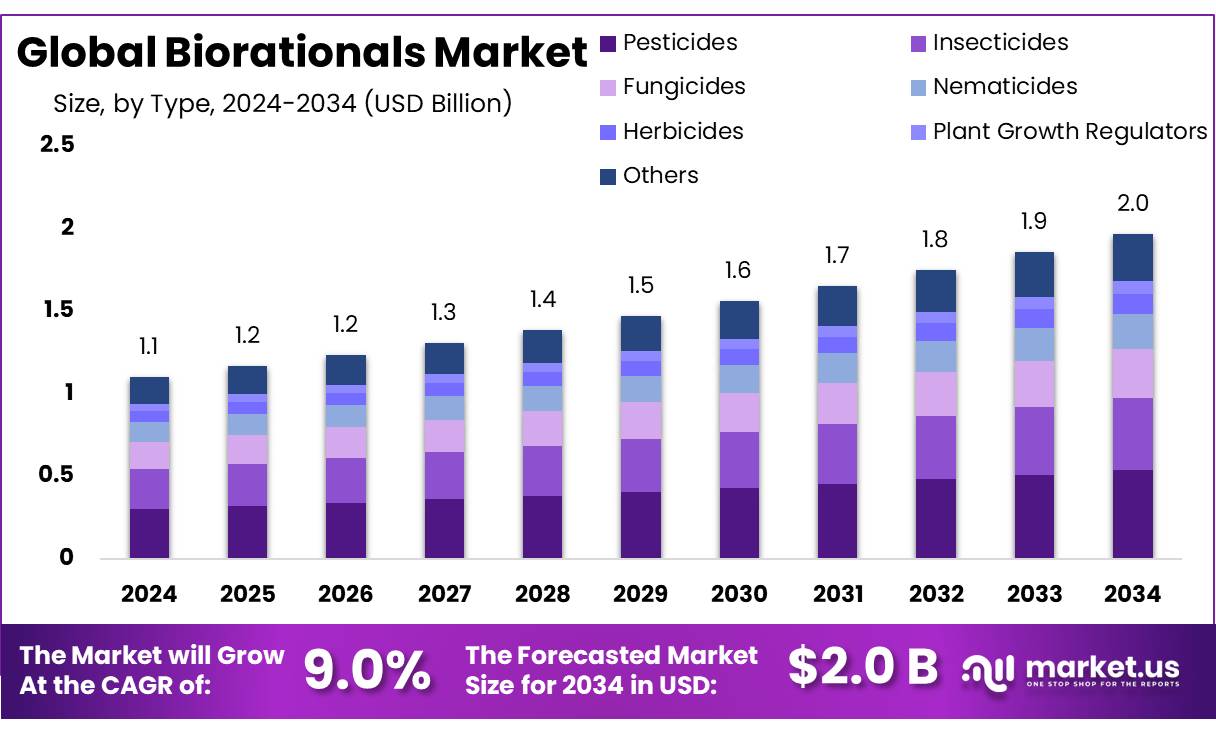

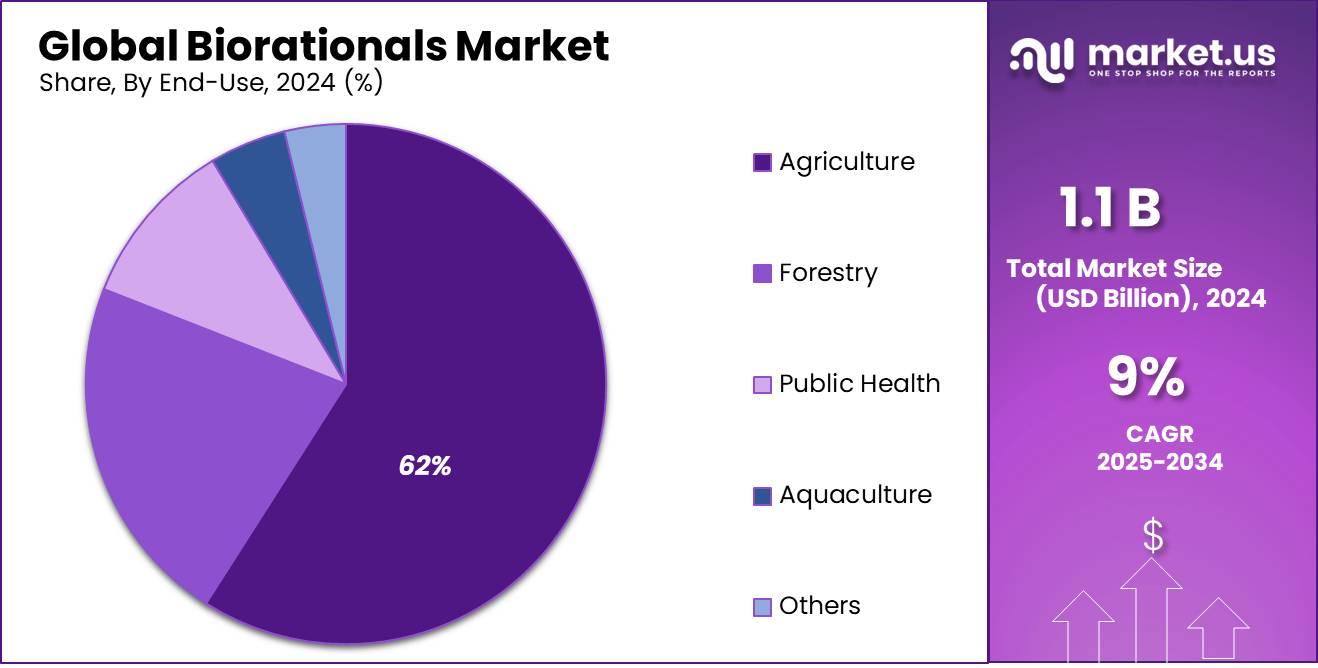

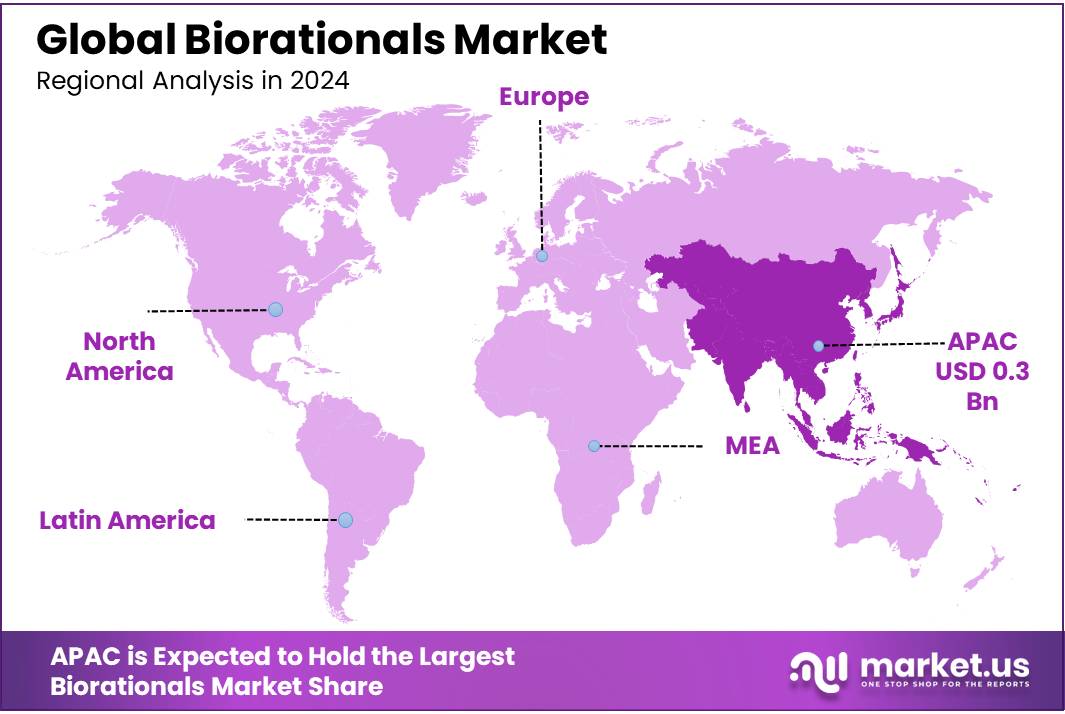

The Global Biorationals Market size is expected to be worth around USD 2.0 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 9.0% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 35.8% share, holding USD 0.3 Billion revenue.

Biorationals, also known as biopesticides or biostimulants, have emerged as a pivotal segment within the global agricultural sector, especially in India, where sustainable farming practices are gaining prominence. These products, derived from natural organisms or substances, serve as alternatives to conventional chemical pesticides and fertilizers, aligning with the increasing demand for eco-friendly agricultural solutions.

From an industrial standpoint, biorationals concentrates are being integrated into existing chemical manufacturing infrastructure—benefiting from the vast chemical industry’s scale. In India, the chemical sector contributes approximately 7% of GDP, stands as the world’s sixth-largest chemical producer, and comprises more than 80,000 different chemical products, with an estimated value of USD 100 billion in 2019. This well‑established ecosystem affords opportunities for companies to pivot part of their R&D and production toward biologically based concentrates.

The biorationals segment plays a pivotal role within the bioeconomy, contributing to sustainable agricultural practices and reducing dependency on chemical pesticides and fertilizers. This shift is supported by various government initiatives, including the National Biopharma Mission, which co-funded with the World Bank, supports over 100 projects and 30 micro, small, and medium enterprises (MSMEs). Additionally, the BioSaarthi mentorship initiative, launched in March 2025, aims to nurture biotech startups, providing structured mentor-mentee engagements to foster innovation and entrepreneurship in the biotech sector.

Second, government initiatives promote sustainable agriculture broadly: for instance, the Government of India’s Prime Minister Dhan‑Dhaanya Krishi Yojana, launched in July 2025 with an annual budgetary outlay of ₹24,000 crore (approximately USD 3 billion), fosters organic farming, diversification, and improved agronomic infrastructure—policy foundations likely to benefit the uptake of biopesticide and biorational solutions. Third, technological advances in microbial and nano‑formulations are enhancing efficacy, specificity, and delivery, strengthening the product appeal.

Key Takeaways

- Biorationals Market size is expected to be worth around USD 2.0 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 9.0%.

- Pesticides held a dominant market position, capturing more than a 27.4% share in the biorationals market.

- Bovine Milk held a dominant market position, capturing more than a 67.2% share in the biorationals market.

- Foliar Spray held a dominant market position, capturing more than a 56.8% share in the biorationals market.

- Fruits & Vegetables held a dominant market position, capturing more than a 37.3% share in the biorationals market.

- Agriculture held a dominant market position, capturing more than a 62.5% share in the biorationals market.

- Asia Pacific emerged as the leading regional market for biorationals, capturing more than 35.8% of the global share, valued at approximately USD 0.3 billion.

By Type Analysis

Pesticides dominate with 27.4% due to their essential role in pest control.

In 2024, Pesticides held a dominant market position, capturing more than a 27.4% share in the biorationals market by type. This strong performance is largely driven by the rising need for eco-friendly pest control alternatives that pose minimal harm to beneficial insects and the environment. Pesticide-based biorationals—often derived from natural sources like botanical extracts, microbial agents, or fermentation products—have become a go-to choice for farmers looking to reduce synthetic chemical usage while still ensuring effective crop protection.

Their popularity also stems from increasing global regulations restricting conventional agrochemicals and encouraging the adoption of safer, sustainable crop protection solutions. In particular, crops like fruits, vegetables, and ornamentals have witnessed higher adoption rates of biorational pesticides, thanks to their lower residue levels and compliance with export standards. These factors have helped drive consistent demand through 2024.

By Formulation Analysis

Bovine Milk dominates with 67.2% due to its liquid flexibility and fast action.

In 2024, Bovine Milk held a dominant market position, capturing more than a 67.2% share in the biorationals market by formulation. This large share reflects the increasing preference for liquid formulations, which are easier to mix, apply, and absorb by plants compared to other forms. Liquid biorationals, like Bovine Milk-based solutions, are especially popular in foliar sprays and drip irrigation systems, where quick action and even coverage are critical for effective crop protection and growth stimulation.

The growing shift toward organic and residue-free farming has also supported the rise of such natural liquid inputs. Bovine Milk formulations are appreciated for their dual function—not only do they support plant health through nutrients and enzymes, but they also exhibit mild pest-repellent properties. Their liquid state helps maintain uniformity during field application, reducing the chances of overdosing and crop damage.

By Mode of Application Analysis

Foliar Spray leads with 56.8% due to its quick nutrient absorption and ease of use.

In 2024, Foliar Spray held a dominant market position, capturing more than a 56.8% share in the biorationals market by mode of application. This strong lead is mainly because foliar spray allows for direct application of nutrients and protective agents to plant leaves, ensuring faster absorption and quicker visible results. Farmers widely prefer this method, especially in high-value crops like vegetables, fruits, and horticulture, where quick recovery from stress and targeted pest management are crucial.

Foliar sprays are also cost-effective since they require less product compared to soil applications. Their efficiency in minimizing nutrient loss due to leaching or soil fixation has made them an ideal choice in areas with poor soil health or irregular rainfall. Additionally, the simplicity of spray techniques—using handheld or mechanized tools—makes this method suitable for both small and large farms across regions.

By Crop Type Analysis

Fruits & Vegetables lead with 37.3% due to their high demand for safe produce.

In 2024, Fruits & Vegetables held a dominant market position, capturing more than a 37.3% share in the biorationals market by crop type. This strong share is largely driven by the growing consumer demand for pesticide-free, residue-free, and healthier produce. Fruits and vegetables, being consumed fresh and in large quantities, require safer crop protection solutions, and biorationals perfectly meet this need with their natural origin and low toxicity.

The perishable nature of these crops also makes them more vulnerable to pests, diseases, and environmental stress. Biorational products like microbial pesticides, botanical extracts, and biostimulants are widely used in these segments to protect crop health without harming soil quality or leaving harmful residues. Exporters and retailers further favor biorational treatment, as it aligns with global food safety standards and certification programs.

By End User Analysis

Agriculture leads with 62.5% thanks to rising demand for eco-friendly farming inputs.

In 2024, Agriculture held a dominant market position, capturing more than a 62.5% share in the biorationals market by end use. This leading share comes from the increasing shift toward sustainable farming practices across both developed and developing nations. Farmers are looking for safer alternatives to chemical pesticides and fertilizers, and biorationals offer an effective solution that supports long-term soil health, crop productivity, and environmental protection.

The growing need to reduce chemical residues in food crops, meet international export standards, and protect beneficial organisms like pollinators has made biorationals a preferred choice in agricultural operations. These products are especially valuable in integrated pest management (IPM) strategies, where they work alongside traditional inputs without creating resistance issues or harming biodiversity.

Key Market Segments

By Type

- Pesticides

- Insecticides

- Fungicides

- Nematicides

- Herbicides

- Plant Growth Regulators

- Others

By Formulation

- Liquid

- Dry

By Mode of Application

- Foliar Spray

- Soil Treatment

- Trunk Injection

- Others

By Crop Type

- Fruits & Vegetables

- Cereals

- Grains

- Corn

- Others

By End User

- Agriculture

- Forestry

- Public Health

- Aquaculture

- Others

Emerging Trends

Integration of Biological Solutions with Precision Agriculture

A significant trend shaping the future of biorational pesticides in India is the integration of biological solutions with precision agriculture technologies. This convergence is enabling farmers to adopt more targeted and efficient pest management practices, thereby enhancing the effectiveness of biorational products.

Precision agriculture involves the use of data-driven technologies, such as soil health monitoring, satellite imagery, and AI-based pest detection systems, to optimize farming practices. When combined with biorational pesticides, these technologies allow for precise application, reducing waste and minimizing environmental impact. For instance, AI-powered pest detection systems can identify pest infestations early, enabling timely application of biorational pesticides only where needed, thus conserving resources and enhancing crop protection.

The Indian government has recognized the potential of this integration and is actively promoting it through various initiatives. Programs like the Paramparagat Krishi Vikas Yojana (PKVY) and the Mission Organic Value Chain Development for North Eastern Region (MOVCDNER) aim to encourage organic farming and the adoption of sustainable agricultural practices. These programs provide financial assistance and training to farmers, facilitating the transition to organic farming and the use of biorational pesticides.

Furthermore, the government’s focus on digital agriculture is fostering the adoption of precision farming technologies. Through initiatives such as the Digital Agriculture Mission, the government is promoting the use of digital tools and platforms to enhance farm productivity and sustainability. These efforts are creating a conducive environment for the growth of biorational pesticides, as they align with the principles of precision agriculture.

Drivers

Government Support for Biorationals in India

One of the primary drivers behind the growth of biorational concentrates in India is the government’s strong commitment to sustainable agriculture. This commitment is evident through various initiatives aimed at promoting eco-friendly farming practices and reducing dependency on chemical inputs.

The National Mission for Sustainable Agriculture (NMSA) is a flagship program launched by the Government of India to promote climate-resilient and sustainable agricultural practices. Under this mission, several schemes have been introduced to encourage the adoption of organic farming and integrated pest management. For instance, the Paramparagat Krishi Vikas Yojana (PKVY) supports farmers in adopting organic farming methods by providing financial assistance and training.

Additionally, the Mission Organic Value Chain Development for North Eastern Region (MOVCDNER) focuses on promoting organic farming in the northeastern states. These initiatives not only aim to reduce the environmental impact of agriculture but also improve the livelihoods of farmers by enhancing soil health and reducing input costs.

Furthermore, the government’s emphasis on natural farming is gaining momentum. In August 2025, Prime Minister Narendra Modi launched the National Mission on Natural Farming (NMNF) with an allocation of ₹2,481 crore. This mission aims to promote sustainable agricultural practices across 750,000 hectares and enhance the income of 10 million farmers. The focus is on encouraging practices that are in harmony with nature, thereby reducing the reliance on chemical fertilizers and pesticides.

Restraints

Limited Shelf Life and Stability Constraints Affecting Market Penetration

One of the significant challenges hindering the widespread adoption of biorational concentrates in India is their limited shelf life and stability. Unlike synthetic chemical pesticides, which often have extended shelf lives, biorationals are susceptible to degradation due to environmental factors such as temperature, humidity, and light exposure. This instability can lead to reduced efficacy over time, making them less reliable for farmers who require consistent and long-lasting pest control solutions.

The limited shelf life of biorationals poses logistical challenges as well. Farmers may hesitate to invest in products that have a short usability period, fearing potential wastage if the products are not used promptly. Additionally, the need for specialized storage conditions to maintain the integrity of these products adds to the complexity and cost of their use. This situation is particularly challenging for smallholder farmers who may lack the resources to adhere to the required storage protocols.

Furthermore, the inconsistency in performance due to stability issues can erode farmer confidence in biorationals. If these products do not deliver the expected results, farmers are less likely to adopt them in the future, preferring the reliability of traditional chemical pesticides. This creates a barrier to the growth of the biorational sector, as sustained adoption is crucial for market expansion.

Opportunity

Government Support and Market Growth: A Promising Future for Biorationals in India

India’s agricultural landscape is undergoing a significant transformation, with a growing emphasis on sustainable practices and eco-friendly solutions. One of the most promising avenues in this evolution is the adoption of biorationals—biologically-based products such as biopesticides, biofertilizers, and biostimulants. These products are gaining traction due to their minimal environmental impact and effectiveness in pest and disease management.

The Indian government has recognized the potential of biorationals in promoting sustainable agriculture. Initiatives like the National Mission on Agricultural Extension and Technology (NMAET) and the National Biofuels Policy aim to integrate biotechnology into farming practices. These policies not only encourage the use of biorationals but also provide financial incentives and support for research and development in this sector.

For instance, the Department of Biotechnology (DBT) has been instrumental in fostering innovation through grants and collaborations with research institutions. Such support has led to the development of several biorational products tailored to Indian agricultural needs, enhancing their accessibility and adoption among farmers.

Regional Insights

Asia Pacific dominates with 35.8% owing to expanding organic farming and government support.

In 2024, Asia Pacific emerged as the leading regional market for biorationals, capturing more than 35.8% of the global share, valued at approximately USD 0.3 billion. This dominance is primarily driven by the rapid adoption of sustainable agriculture practices across major economies such as India, China, Japan, and Southeast Asian countries.

The increasing awareness among farmers regarding the harmful effects of synthetic pesticides, coupled with the demand for residue-free crops, has fueled the uptake of biorational inputs. Government programs like India’s Paramparagat Krishi Vikas Yojana (PKVY), which supports organic farming, and China’s ongoing policies to reduce chemical pesticide usage, have further accelerated market penetration.

North America follows closely, supported by strong regulatory backing for environmentally friendly inputs and well-established organic farming systems, particularly in the U.S. and Canada. In 2024, the North American market showed steady growth, supported by rising demand for organic fruits, vegetables, and grains, along with increasing adoption of integrated pest management (IPM) techniques. The region is also home to many research institutions and start-ups focusing on biopesticide innovation and commercialization.

In Europe, countries like Germany, France, and Italy are actively transitioning toward greener agricultural practices, with the European Union enforcing strict residue limits and supporting sustainable input use under its Common Agricultural Policy (CAP). Latin America and the Middle East & Africa are witnessing growing interest in biorationals, especially in export-oriented fruit and vegetable cultivation, but adoption rates remain lower compared to Asia Pacific and North America.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Isagro S.p.A, based in Italy, is a prominent player in the biorationals sector, focusing on crop protection solutions derived from natural sources. The company emphasizes innovation in copper-based fungicides, biofungicides, and biostimulants. Its investments in sustainable R&D and eco-friendly formulations have strengthened its position in European and Latin American markets. With a strong export network and regulatory approvals across regions, Isagro continues to contribute to the global shift toward environmentally safe agriculture.

UK-based Russell IPM is a global leader in pest monitoring and control solutions, with a strong focus on pheromone-based biorationals. The company serves over 80 countries, offering products for agriculture, public health, and food safety. Russell IPM’s strength lies in its R&D capabilities and precision pest management tools, particularly for horticultural crops. By emphasizing non-toxic, environmentally safe solutions, it continues to innovate in the development of smart traps and bio-based repellents for targeted crop protection.

Syngenta, a Switzerland-based agrochemical and seed company, is a major contributor to the biorationals market through its biological portfolio. The company develops biostimulants, biofungicides, and microbial-based pest control products. With a focus on regenerative agriculture, Syngenta aims to improve soil health, reduce chemical dependence, and enhance farm productivity. Its acquisitions and R&D centers worldwide support rapid innovation. Through training programs and farmer outreach, Syngenta promotes the effective use of biorationals in both traditional and organic farming.

Top Key Players Outlook

- Isagro S.P.A

- Gowan Company LLC

- Russell IPM

- BASF SE

- Syngenta

- Nufarm

Recent Industry Developments

In 2024, Syngenta recorded group-wide sales of US $28.8 billion, down 10% from the prior year, with EBITDA hitting US $3.9 billion.

In September 2024, Nufarm reported revenue of USD 3,345.9 million, reflecting a modest −3.9% decline from the previous year.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Bn Forecast Revenue (2034) USD 2.0 Bn CAGR (2025-2034) 9.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Pesticides, Insecticides, Fungicides, Nematicides, Herbicides, Plant Growth Regulators, Others), By Formulation (Liquid, Dry), By Mode of Application (Foliar Spray, Soil Treatment, Trunk Injection, Others), By Crop Type (Fruits and Vegetables, Cereals, Grains, Corn, Others), By End User (Agriculture, Forestry, Public Health, Aquaculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Isagro S.P.A, Gowan Company LLC, Russell IPM, BASF SE, Syngenta, Nufarm Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Isagro S.P.A

- Gowan Company LLC

- Russell IPM

- BASF SE

- Syngenta

- Nufarm