Global Bioplastics Market Size, Share, And Business Benefit By Product (Biodegradable (Polylactic Acid, Starch Blends, PBAT, PBS, Others), Non-biodegradable (Polyethylene, Polyethylene Terephthalate, Polyamide, Polytrimethylene Terephthalate, Others)), By Feedstock (Sugarcane / Sugar Beet, Corn, Cassava and Potato, Cellulosic and Wood Waste, Others), By Processing Technology (Extrusion, Injection Molding, 3 Blow Molding, 3D Printing, Others), By Application (Packaging, Agriculture, Automotive and Transportation, Electronics, Textile, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 167153

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

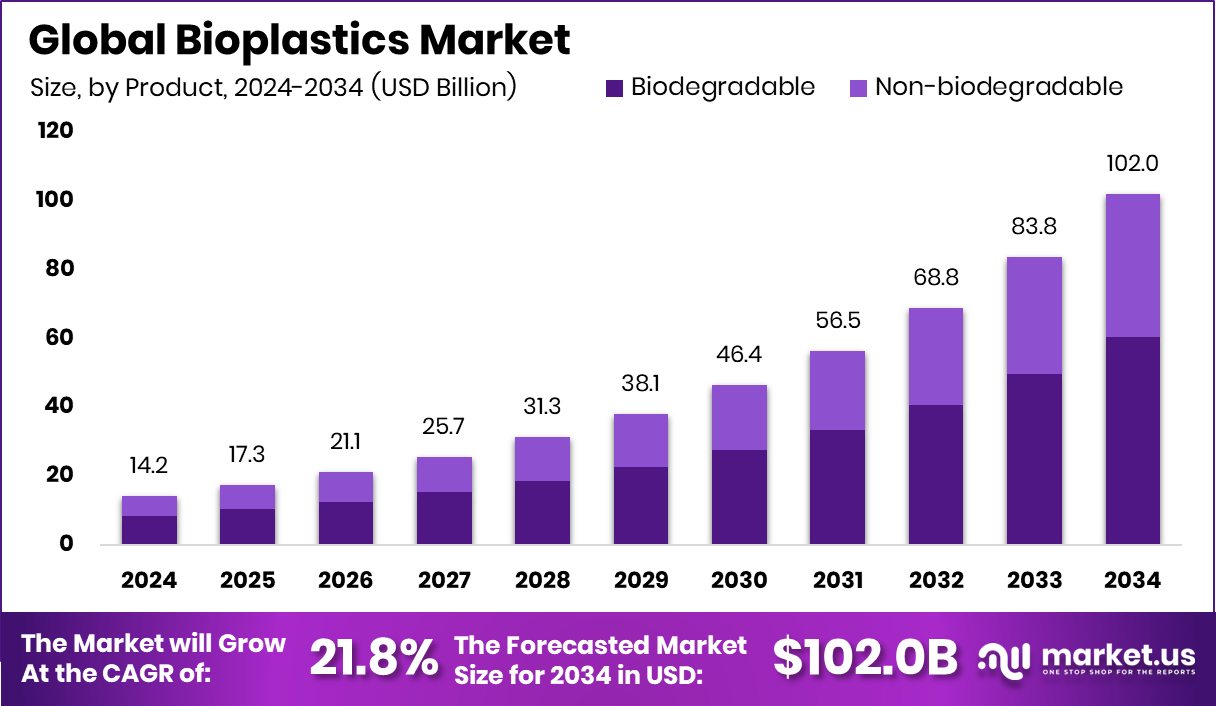

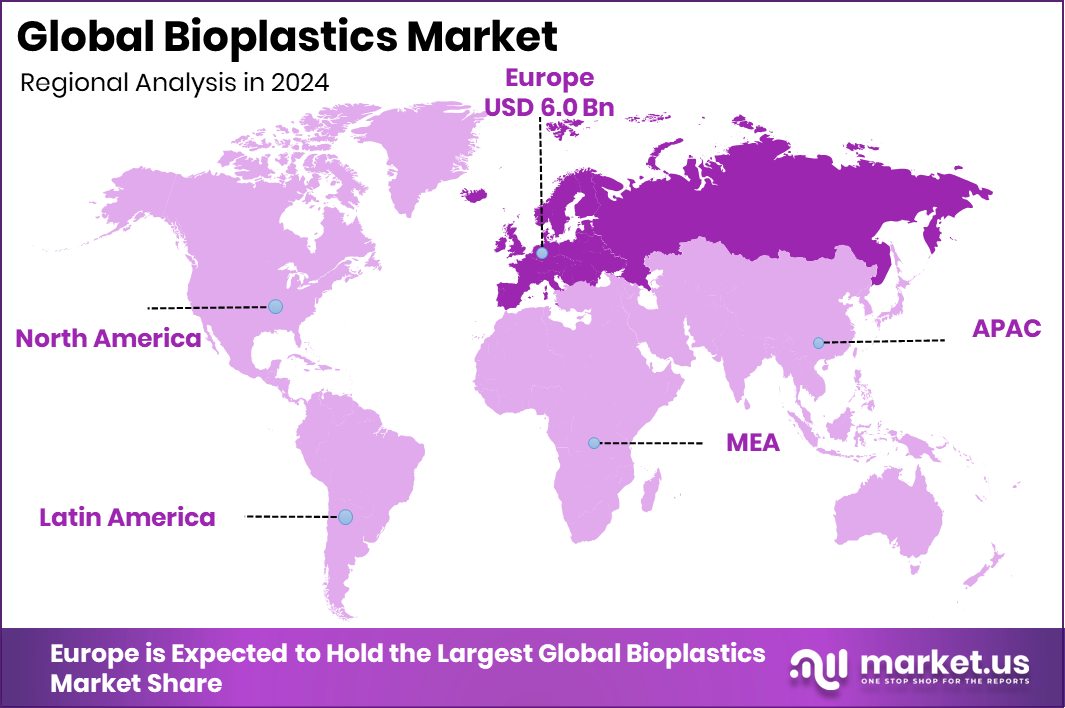

The Global Bioplastics Market is expected to be worth around USD 102.0 billion by 2034, up from USD 14.2 billion in 2024, and is projected to grow at a CAGR of 21.8% from 2025 to 2034. With a USD 6.0 Bn size, Europe leads the bioplastics market at 42.70% share.

Bioplastics are materials made from renewable biological sources such as starch, sugarcane, corn, algae, and food waste. They are designed to reduce dependency on fossil-based plastics and lower environmental impact through better biodegradability and circular production. As industries look for alternatives to traditional polymers, bioplastics have become a key part of sustainable packaging, consumer goods, automotive trims, and textile applications.

The bioplastics market is expanding as governments introduce policies to cut plastic pollution and companies look for lower-carbon materials. New investments are accelerating production capacity, especially in polylactic acid and next-generation biodegradable resins. Funding such as TripleW, raising $16.5 million to turn food waste into lactic acid and bioplastic, and Floreon securing GBP 250 million to scale its bioplastic technology, is reshaping the supply landscape.

Growth factors are becoming stronger as consumer preference shifts toward compostable packaging and industries demand sustainable feedstocks. Major announcements—including NatureWorks receiving a $350M loan for its PLA plant in Thailand and the Energy Department awarding $118 million for biofuel-linked projects—signal broader public-private momentum supporting low-carbon materials.

Demand continues to rise as brands and manufacturers look for alternatives that align with circular-economy goals and compliance deadlines. Government initiatives such as the US pledge of $14 million to combat plastic pollution amplify this shift. At the same time, textile innovators like Rubi securing a $1 million SBIR Phase II grant show how bioplastic-linked fibers and yarns are expanding new end-use demand.

Opportunities are widening as emerging markets invest heavily in PLA and biomass-derived polymers. India is becoming a strategic hotspot, driven by moves such as Balrampur Chini Mills’ Rs 2,850-crore PLA plant MoU and an ethanol-based project with ₹2,580-crore capex planned for FY27. These developments open doors for stronger local supply chains, export potential, and scalable bioplastic manufacturing ecosystems.

Key Takeaways

- The Global Bioplastics Market is expected to be worth around USD 102.0 billion by 2034, up from USD 14.2 billion in 2024, and is projected to grow at a CAGR of 21.8% from 2025 to 2034.

- The bioplastics market sees strong adoption of non-biodegradable products, capturing 59.3% due to broad industrial usage.

- Sugarcane and sugar beet feedstocks hold 34.1%, strengthening bio-based growth across the bioplastics market globally.

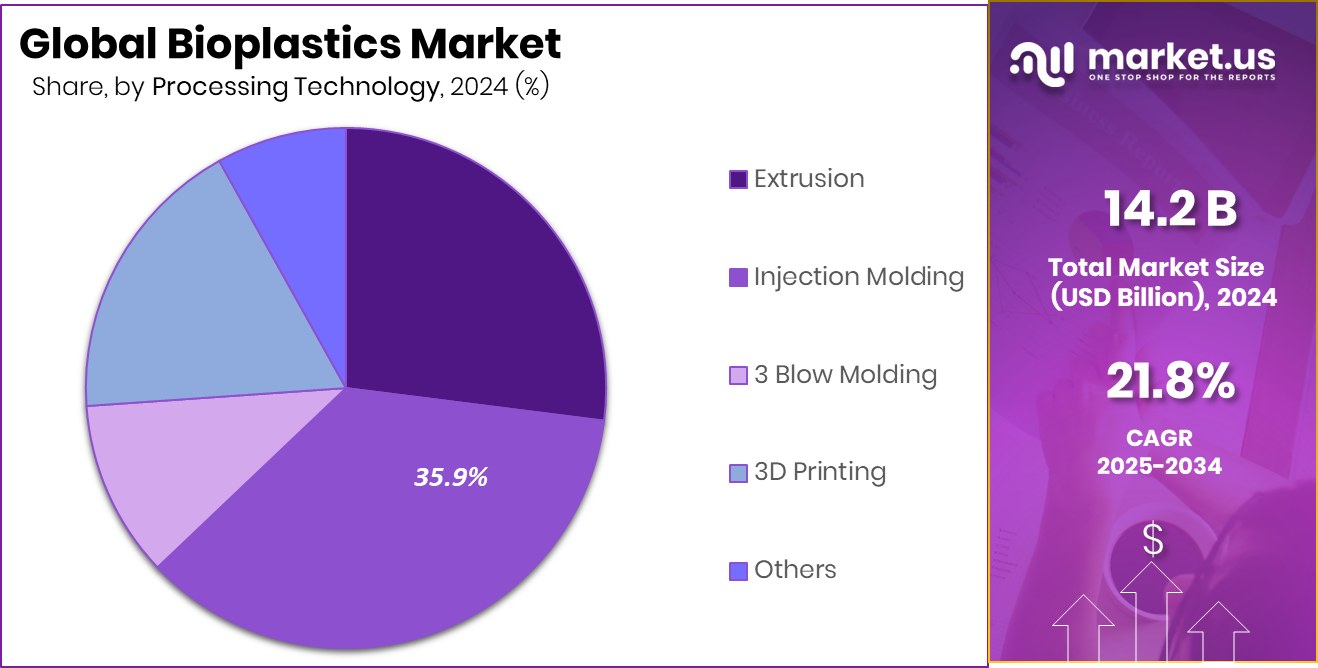

- Injection molding leads with 35.9%, improving processing efficiency and expanding applications within the bioplastics market.

- Packaging dominates at 44.4%, making it the largest and fastest-growing segment in the bioplastics market.

- The Europe region drives bioplastics adoption with its 42.70% share and USD 6.0 Bn value.

By Product Analysis

The Bioplastics Market sees strong momentum as non-biodegradable products capture 59.3%.

In 2024, Non-biodegradable held a dominant market position in the by-product segment of the Bioplastics Market, with a 59.3% share. This segment maintained its lead as industries preferred durable, high-performance bio-based plastics that can withstand heat, mechanical stress, and long-term usage.

Non-biodegradable bioplastics are widely used in packaging, consumer goods, and industrial applications where strength and stability are essential. Their compatibility with existing manufacturing lines and ability to replace conventional plastics without major redesigns further supported this high adoption rate.

Growing investments in bio-based polymers and strong demand for low-carbon materials also reinforced the prominence of this segment. As companies scale production and improve material efficiency, the segment continues to attract interest across global markets.

By Feedstock Analysis

In the Bioplastics Market, sugarcane and sugar beet feedstock hold 34.1%.

In 2024, Sugarcane / Sugar Beet held a dominant market position in the By Feedstock segment of the Bioplastics Market, with a 34.1% share. This leadership came from the strong availability of these crops and their high efficiency in producing bio-based intermediates such as ethanol and lactic acid.

Industries preferred sugarcane and sugar beet because they offer consistent yield, lower carbon intensity, and well-established processing routes that support large-scale bioplastic production. Their use also aligns with global sustainability goals, encouraging manufacturers to shift toward renewable feedstocks with predictable supply chains.

As demand for bio-based materials continued to rise, sugarcane and sugar beet remained the most reliable and economically attractive choices for bioplastic producers worldwide.

By Processing Technology Analysis

Injection molding leads the Bioplastics Market with a commanding 35.9% share.

In 2024, Injection Molding held a dominant market position in the By Processing Technology segment of the Bioplastics Market, with a 35.9% share. This strong lead came from its ability to produce complex shapes with precision, making it ideal for packaging, consumer goods, and various industrial components. The process supports high-volume manufacturing and delivers consistent quality, which encourages producers to adopt bioplastics without altering existing equipment.

Its efficiency, lower material wastage, and compatibility with a wide range of bio-based polymers further strengthened its market role. As demand grew for sustainable products with reliable performance, injection molding remained the preferred technology for industries transitioning toward environmentally responsible materials.

By Application Analysis

Packaging dominates the Bioplastics Market as applications reach a notable 44.4%.

In 2024, Packaging held a dominant market position in the By Application segment of the Bioplastics Market, with a 44.4% share. This leadership was driven by strong demand for sustainable packaging solutions across the food, beverage, and consumer goods industries. Brands adopted bioplastic packaging to meet rising eco-friendly expectations and comply with waste-reduction policies. The segment benefited from the material’s lightweight nature, clarity, and ability to replace conventional plastics in films, trays, bottles, and molded containers.

Its broad suitability for everyday products supported rapid adoption, especially as companies focused on reducing carbon footprints and improving recyclability. As regulatory pressure and consumer awareness continued to rise, packaging remained the core application driving bioplastic consumption worldwide.

Key Market Segments

By Product

- Biodegradable

- Polylactic Acid

- Starch Blends

- PBAT

- PBS

- Others

- Non-biodegradable

- Polyethylene

- Polyethylene Terephthalate

- Polyamide

- Polytrimethylene Terephthalate

- Others

By Feedstock

- Sugarcane / Sugar Beet

- Corn

- Cassava and Potato

- Cellulosic and Wood Waste

- Others

By Processing Technology

- Extrusion

- Injection Molding

- 3 Blow Molding

- 3D Printing

- Others

By Application

- Packaging

- Agriculture

- Automotive and Transportation

- Electronics

- Textile

- Others

Driving Factors

Government Push Accelerates Global Bioplastics Adoption

A major driving factor for the Bioplastics Market in 2024 is the strong global push for cleaner materials supported by government programs, private investments, and expanding industrial innovation. Countries are encouraging alternatives to fossil-based plastics, and this momentum is drawing substantial financial commitments into the sector.

Funding activity is strengthening the ecosystem, including Desktop Metal closing a $115 million round to advance accessible metal 3D printing, which indirectly supports bioplastics by enabling next-gen tooling for bio-material manufacturing.

Governments continue to boost sustainability programs, helping brands shift toward renewable feedstocks and compostable packaging. These combined investments are improving production technology, lowering costs, and accelerating commercial adoption of bioplastics across packaging, consumer goods, and industrial applications.

Restraining Factors

High Production Costs Slow Bioplastics Expansion

One major restraining factor for the Bioplastics Market is the high cost of producing bio-based polymers compared to traditional plastics. Even as demand rises, manufacturers struggle with expensive feedstocks, limited large-scale infrastructure, and higher processing costs. These challenges make it harder for companies to match the pricing of fossil-based plastics, especially in mass-market packaging. Although innovation is improving, the industry still faces scale limitations.

Recent funding—such as Carbon closing a $60 million round to advance 3D-printing technology—shows strong interest in material innovation, but the benefits take time to reach commercial bioplastics production. Until costs fall further, many industries remain cautious about fully replacing conventional plastics with more expensive bio-alternatives.

Growth Opportunity

Rising Bio-Based Innovations Create New Opportunities

A major growth opportunity for the Bioplastics Market comes from rapid innovation in bio-based materials, especially in textiles, packaging, and advanced manufacturing. New technologies are opening the door for bioplastics to enter sectors that once relied heavily on synthetic polymers.

Recent funding momentum reflects this shift. Simplifyber securing $3.5 million in seed funding to commercialize 3D-printed cellulose garments and Rubi receiving a government grant of nearly $1 million to scale its carbon-to-cellulose platform show how quickly bio-derived materials are expanding.

These breakthroughs create new demand pathways for bioplastic feedstocks and processing technologies. As more companies adopt cellulose-based and carbon-capturing innovations, the bioplastics industry gains stronger diversification, better cost efficiency, and broader global market potential.

Latest Trends

Advanced 3D Printing Accelerates Bioplastics Innovation

One of the latest trends in the Bioplastics Market is the rapid integration of advanced 3D-printing technologies to improve product design, reduce waste, and enhance material efficiency. Manufacturers are increasingly experimenting with bioplastic-compatible printing systems to create lightweight components, customized packaging formats, and fast-prototyped consumer products. This trend is gaining stronger momentum as major funding flows into the 3D-printing ecosystem.

Carbon’s DLS 3D printing technology, receiving $60 million in its latest funding round, underscores how innovation in additive manufacturing is expanding the possibilities for bioplastics. As these systems become more precise and scalable, companies can test new bio-based formulations faster and enter the market with improved performance materials. This convergence of bioplastics and advanced printing is reshaping product development across multiple industries.

Regional Analysis

Europe holds a strong 42.70% share, reaching USD 6.0 Bn in 2024.

In 2024, Europe dominated the Bioplastics Market with a 42.70% share, valued at USD 6.0 Bn, supported by strong environmental regulations, waste-reduction mandates, and consistent investment in circular-material technologies. The region’s aggressive push toward renewable feedstocks and compostable packaging strengthened industrial adoption across food, consumer goods, and retail sectors.

North America followed with steady growth driven by sustainability policies and the rising shift toward low-carbon materials in packaging and automotive components. Asia Pacific showed accelerating interest due to expanding manufacturing bases and large-scale bioplastic consumption across emerging economies, particularly in packaging and textile applications.

The Middle East & Africa witnessed a gradual uptake as countries explored diversification beyond petrochemical reliance, while Latin America advanced moderately with rising bio-based feedstock availability.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, TEIJIN LIMITED strengthened its position in the global bioplastics landscape by expanding its focus on advanced bio-based materials aligned with lightweighting, mobility, and sustainable packaging needs. The company continued leveraging its expertise in polymers and fibers to develop bio-derived resins that support lower emissions and improved recyclability. TEIJIN’s emphasis on integrating bioplastics into high-performance applications positioned it well among customers seeking durable alternatives to conventional plastics.

Toray Industries, Inc. remained a key innovator by advancing bio-based polymers designed for strong mechanical properties and stability. Its long-standing capabilities in synthetic chemistry supported ongoing work toward renewable materials suitable for electronics, automotive interiors, and packaging. Toray’s consistent commitment to R&D helped it address performance gaps that often limit the shift from fossil-based plastics to renewable options, giving it a strategic edge in high-specification segments.

Toyota Tsusho Corporation contributed to market momentum by strengthening the supply chain for bio-based feedstocks and expanding its presence in renewable chemicals. Its role as a trading and industrial solutions provider enabled it to support partnerships across biomass processing, biopolymer production, and end-use applications. Toyota Tsusho’s involvement in scaling sustainable materials made it an important enabler in the broader bioplastics ecosystem.

Top Key Players in the Market

- TEIJIN LIMITED

- Toray Industries, Inc.

- Toyota Tsusho Corporation

- Avantium

- PTT MCC Biochem Co., Ltd.

- An Phat Holdings

- NatureWorks LLC

- SABIC

- BASF

- Futerro

Recent Developments

- In December 2024, Toray announced the installation of a pilot facility for mass-production technology of biomass/biomaterial processes, planned for the fiscal year starting April 2025. The facility aims to scale technology for biomass-based raw materials, including bio-resins and films.

- In October 2024, Teijin Frontier (a subsidiary) launched its BIOFRONT® PLA resin globally. This polylactic acid (PLA) resin includes a “biodegradation accelerator” to speed up breakdown in oceans, rivers, and soil while maintaining strength and moldability. It can now be processed like conventional PLA resins and is marketed under the group’s THINK ECO® strategy.

Report Scope

Report Features Description Market Value (2024) USD 14.2 Billion Forecast Revenue (2034) USD 102.0 Billion CAGR (2025-2034) 21.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Biodegradable (Polylactic Acid, Starch Blends, PBAT, PBS, Others), Non-biodegradable (Polyethylene, Polyethylene Terephthalate, Polyamide, Polytrimethylene Terephthalate, Others)), By Feedstock (Sugarcane / Sugar Beet, Corn, Cassava and Potato, Cellulosic and Wood Waste, Others), By Processing Technology (Extrusion, Injection Molding, 3 Blow Molding, 3D Printing, Others), By Application (Packaging, Agriculture, Automotive and Transportation, Electronics, Textile, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape TEIJIN LIMITED, Toray Industries, Inc., Toyota Tsusho Corporation, Avantium, PTT MCC Biochem Co., Ltd., An Phat Holdings, NatureWorks LLC, SABIC, BASF, Futerro Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- TEIJIN LIMITED

- Toray Industries, Inc.

- Toyota Tsusho Corporation

- Avantium

- PTT MCC Biochem Co., Ltd.

- An Phat Holdings

- NatureWorks LLC

- SABIC

- BASF

- Futerro