Global Biomass Heating Plant Market Size, Share Analysis Report By Fuel Type (Solid Biomass, Liquid Biomass, Gaseous Biomass), By Technology (Direct Combustion, Gasification, Anaerobic Digestion, Others), By End-Use (Residential, Commercial, Industrial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170958

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

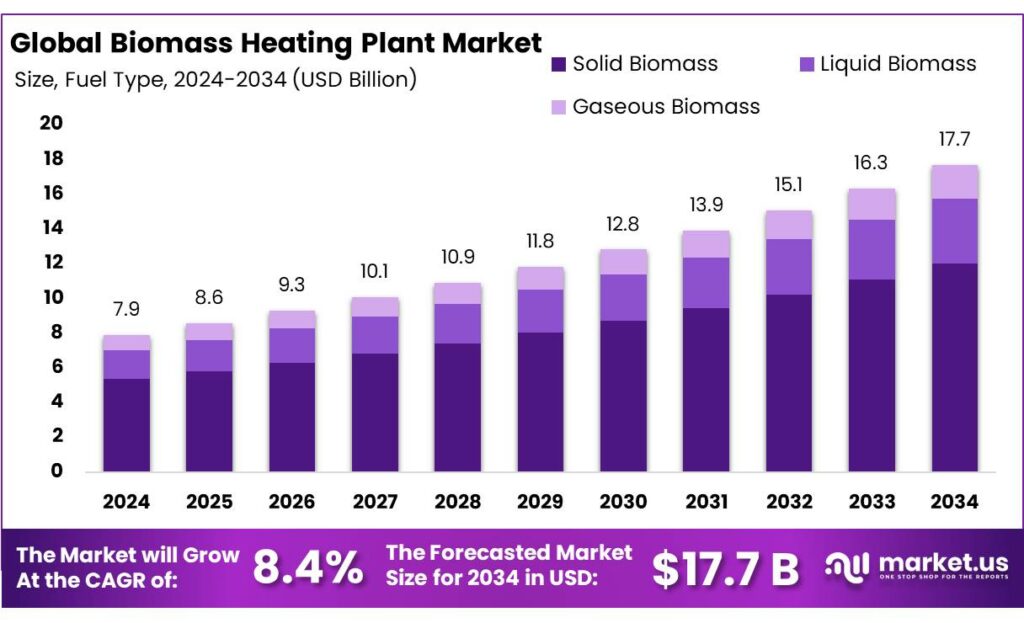

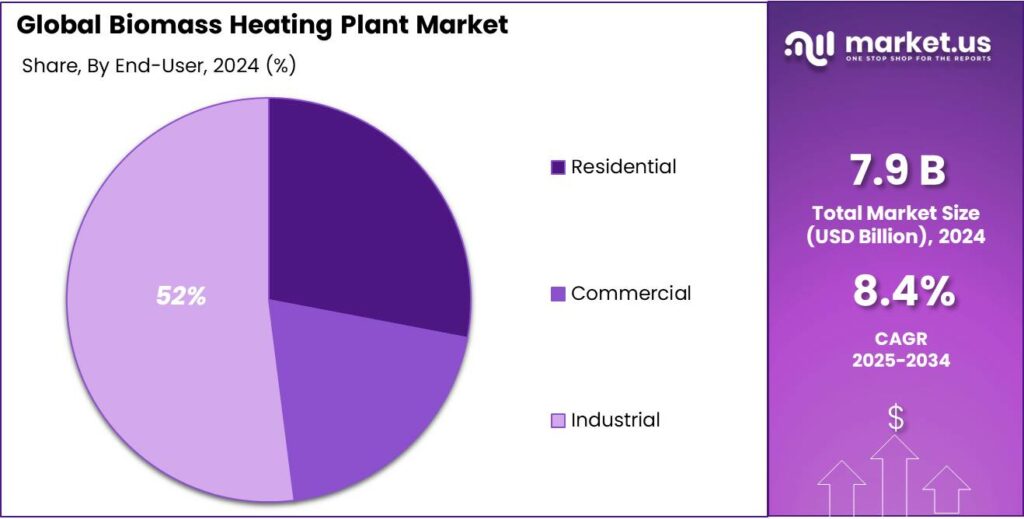

The Global Biomass Heating Plant Market size is expected to be worth around USD 17.7 Billion by 2034, from USD 7.9 Billion in 2024, growing at a CAGR of 8.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 47.9% share, holding USD 15.2 Billion revenue.

Biomass heating plants are purpose-built facilities that convert solid biomass into usable heat for district heating networks, public buildings, campuses, greenhouses, and industrial process heat. They sit in the wider “heat decarbonisation” shift, because heat is the hardest-working part of the energy system: in 2022, heat represented almost half of total final energy consumption and about 38% of energy-related CO₂ emissions, so replacing fossil boilers delivers outsized climate impact per project.

Industrial adoption is moving from small boilers toward larger, utility-style heat plants and CHP configurations that can anchor local energy infrastructure. Globally, district heating still supplies only about 9% of total final heat consumption, but it is a critical scaling channel because it can aggregate demand from buildings and industry and switch fuels at the plant level. Within modern renewables, bioenergy remains the workhorse: the IEA notes modern bioenergy is ~55% of renewable energy, and that heating remains the largest use, with modern bioenergy use rising about 4% per year on average from 2010–2023.

- Demand momentum is strongest where policy, fuel supply chains, and heating networks align. In Europe, renewable energy accounted for 26.2% of heating and cooling energy use in 2023, a rise from 25.0% in 2022, driven largely by biomass and heat pumps—evidence that renewable heat is already scaling in mature markets. The policy signal is also tightening: the EU’s Renewable Energy Directive sets a binding target of at least 42.5% renewables in the overall energy mix by 2030, which keeps investment pressure on renewable heat assets that can be deployed quickly.

Driving factors for the biomass heating plant industry include rising energy costs, stringent greenhouse gas reduction targets, and the need for energy diversification. Biomass offers a renewable and cost-effective alternative to fossil fuels with generally lower lifecycle carbon emissions when sourced sustainably, encouraging adoption in sectors where electrification is challenging. Bioenergy currently delivers the majority of modern renewable heat growth globally, accounting for nearly 80% of renewable heat expansion, especially in industrial and building applications.

- Government initiatives and regulatory frameworks have been pivotal, with many national renewable energy action plans mandating biomass integration into heating and cooling portfolios. For example, the EU27 reported biomass heat representing ~18% (3.1 EJ) of heating fuel in 2022, positioning it as the dominant renewable heat source within the bloc. Additionally, global strategies aligned with the IEA’s Net Zero by 2050 Scenario envision the phase-out of inefficient traditional biomass and the scaling of modern biomass technologies to meet Sustainable Development Goal 7 on affordable, clean energy by 2030.

Key Takeaways

- Biomass Heating Plant Market size is expected to be worth around USD 17.7 Billion by 2034, from USD 7.9 Billion in 2024, growing at a CAGR of 8.4%.

- Fixed Tilt held a dominant market position, capturing more than a 67.3% share in the DG ground-mounted solar PV market.

- Solar Panels held a dominant market position, capturing more than a 58.2% share in the DG ground-mounted solar PV market.

- Utility held a dominant market position, capturing more than a 51.5% share in the DG ground-mounted solar PV market.

- North America held a dominant position in the distributed generation (DG) ground-mounted solar PV market, representing 47.9% of regional share and an estimated US$15.2 billion.

By Fuel Type Analysis

Fixed Tilt systems lead with a 67.3% share due to their simple design and lower installation cost.

In 2024, Fixed Tilt held a dominant market position, capturing more than a 67.3% share in the DG ground-mounted solar PV market. This strong position was mainly supported by its straightforward structure, fewer moving parts, and lower capital and maintenance needs when compared with tracking systems. Fixed tilt systems are widely preferred for small to mid-scale distributed generation projects where land availability is stable and energy output predictability is important.

In 2024, these systems were commonly used in industrial parks, agricultural solar projects, and commercial campuses, where cost control and reliability remained top priorities. Moving into 2025, the segment continued to benefit from rising demand for decentralized solar solutions, especially in regions with high solar irradiation where fixed tilt angles can be optimized for annual output. The growing focus on fast project deployment and lower balance-of-system costs further supported the preference for fixed tilt configurations.

By Technology Analysis

Solar panels dominate with a 58.2% share driven by their direct role in power generation and falling module costs.

In 2024, Solar Panels held a dominant market position, capturing more than a 58.2% share in the DG ground-mounted solar PV market. This leadership was mainly supported by the continuous decline in module prices and steady improvements in panel efficiency. Solar panels account for the largest portion of total system cost and directly determine energy output, making them the most critical component in project planning. In 2024, high adoption of monocrystalline and high-efficiency modules helped project owners maximize power generation from limited land areas.

Demand for solar panels remained strong as distributed generation projects expanded across industrial, commercial, and agricultural sites. Stable supply chains and large-scale manufacturing supported consistent availability, while long-term performance warranties improved buyer confidence. The focus on faster project returns and higher lifetime energy production continued to favor investment in advanced panel technologies. As a result, solar panels maintained their dominant role within DG ground-mounted systems, reinforcing their position as the core value-driving component of the market.

By End-Use Analysis

Utility applications lead with a 51.5% share due to large project sizes and stable long-term power demand.

In 2024, Utility held a dominant market position, capturing more than a 51.5% share in the DG ground-mounted solar PV market. This strong share was mainly supported by the scale of utility-led solar installations, which are designed to deliver high and steady power output over long operating lifetimes. Utility projects benefit from better access to land, grid connectivity, and financing, allowing larger capacities to be deployed compared to other applications.

Long-term power purchase agreements and predictable cash flows made utility solar projects financially attractive. The ability to integrate energy storage and upgrade existing sites further strengthened this segment. As a result, utility applications continued to lead the DG ground-mounted solar PV market, maintaining their dominant role through scale, reliability, and long-term energy planning advantages.

Key Market Segments

By Fuel Type

- Solid Biomass

- Liquid Biomass

- Gaseous Biomass

By Technology

- Direct Combustion

- Gasification

- Anaerobic Digestion

- Others

By End-Use

- Residential

- Commercial

- Industrial

Emerging Trends

Rising Role of Bioenergy in Modern Renewable Heat

One of the most notable and human-relevant trends in biomass heating plants today is the growing contribution of modern bioenergy to renewable heat, especially in industrial and community applications. This trend reflects a shift in how nations, businesses, and even food-related industries think about heat — not just as an energy necessity, but as a way to cut emissions, support local supply chains, and build resilience in a warming world. Heat isn’t a luxury — it’s essential for baking bread, pasteurizing milk, operating dryers in food processing, and keeping homes and workplaces comfortably warm. Modern biomass heat is stepping up to meet that need in ways fossil fuels simply cannot sustain.

- According to the International Energy Agency (IEA), renewable energy — including modern bioenergy — is now capturing a larger share of heat demand globally. Between 2018 and 2024, annual global heat consumption grew by about 6%, and although renewable energy sources only met about half of that increase, nearly 80% of overall renewable heat growth came from bioenergy and renewable electricity combined. Bioenergy — a category that includes biomass heating plants — remains the dominant source of renewable heat, particularly in industrial applications where electrification can be difficult.

This trend is deeply meaningful for everyday life and industry. For food producers — from flour mills to breweries — heat is the backbone of production. Modern biomass delivers that heat with a near-zero emissions profile, because the carbon it releases when burned was previously absorbed from the atmosphere by the plants themselves. The IEA reports that modern bioenergy accounts for nearly 55% of total renewable energy (excluding traditional biomass use) and contributes more than 6% of global energy supply, emphasizing biomass heat’s central role in the clean energy transition.

Another tangible sign of this trend is the increased use of biomass in both industrial and residential heat. According to industry data, biomass delivers about 89% of renewable heat and around 23% of total heat globally, with roughly two-thirds of that used in modern bioenergy applications in industry — a clear indicator that biomass is no longer a niche fuel but a core part of decarbonising heat.

Drivers

Decarbonising Heat and Cutting Climate Pollution

One of the biggest and most humane driving forces behind the adoption of biomass heating plants is the urgent need to reduce greenhouse gas emissions from heat generation — a challenge that affects food producers, industries, and everyday communities alike. Heat accounts for roughly half of all energy consumed in the world, mainly because factories, farms, and buildings require warmth for processes like drying, cooking, and space heating. However, most of that heat comes from burning fossil fuels — coal, oil, and gas — which are major sources of carbon dioxide (CO₂) that drive global warming and climate change. Transitioning to biomass heat offers a way to cut those emissions significantly while continuing to meet energy needs reliably and affordably.

To put numbers to this shift, modern biomass already delivers a large share of renewable heat globally: it accounts for about 89% of all renewable heat and roughly 23% of total heat generated worldwide today. This means nearly a quarter of the heat people and industries use comes from biomass rather than fossil fuels. That scale shows how important biomass is in replacing planet-warming fuels with cleaner alternatives.

- Governments around the world recognize the role of biomass in reducing emissions. For example, many nations within the European Union (EU) have set increasingly ambitious renewable energy goals. In 2024, renewable energy sources made up about 25.4% of total final energy use in the EU, and solid, gaseous, and liquid biomass together formed the largest share of renewable energy at 46% of that total. These policies are designed to move countries away from fossil fuels for both electricity and heating, encouraging investment in biomass boilers and heating infrastructure.

The International Energy Agency (IEA) also highlights how bioenergy — which includes biomass used for heat — plays a key role in clean energy transitions. Modern bioenergy already makes up a large portion of renewable energy (about 55% of renewable energy supply excluding traditional biomass use) and contributes over 6% of global energy supply overall. IEA scenario planning suggests that increasing modern bioenergy usage is an important part of meeting global climate goals and replacing fossil-based heat with low-carbon alternatives.

Restraints

Feedstock Supply and Cost Challenges

Governments around the world know this is a real issue. In many places, policy makers are trying to strengthen supply chains with incentives and support for biomass logistics, but the complexity of the problem remains. For instance, the International Energy Agency (IEA) has noted that although bioenergy is the largest renewable energy source globally, modern bioenergy deployment needs to drive feedstock sustainability and supply security to scale up effectively and fairly.

For biomass heating to grow beyond small local projects and into broader industrial use — including food processing and rural community support — these supply and cost challenges must be tackled head-on. Possible solutions include investing in better storage infrastructure, improving logistics networks to reduce transport costs, and creating structured feedstock markets where prices are transparent and predictable. There’s also room for government support through fuel supply contracts and incentives that help stabilize prices for biomass suppliers and plant operators alike.

A biomass heating plant relies on organic material such as wood chips, agricultural residues, pellets, or energy crops. Unlike fossil fuels, these materials are scattered, seasonal, and often hard to gather and transport efficiently. Feedstock availability varies by region and season, and because biomass has low energy density, transporting it long distances becomes inefficient, adding to cost and logistical burdens. For example, wet biomass is heavy and requires significant energy just for transportation — a factor that can make the overall fuel cost higher than expected. This is a genuine concern especially in rural areas where roads may be poor and storage space is limited.

Opportunity

Scaling Renewable Heat in Hard-to-Electrify Industries

One of the most promising growth opportunities for biomass heating plants lies in their capacity to replace fossil fuels in industrial heat use, especially in sectors that struggle to shift to electricity or other clean energy sources. This potential is particularly meaningful for food processing, breweries, large bakeries, and other agri-food businesses where reliable, high-temperature heat is essential every day. Unlike small changes to office electricity, heat demand is a basic human and economic need — flour must dry, boilers must run, and ovens must stay hot. As the world works to reduce climate pollution, modern bioenergy presents a concrete pathway to do this while keeping factories running.

Globally, heat accounts for nearly half of all final energy consumption and generates more than a third of energy-related CO₂ emissions. Renewable energy uptake in heat is growing, but continues to lag behind electricity decarbonization. Biomass — a form of modern bioenergy — already supplies the largest share of renewable heat worldwide, and offers an immediate opportunity to drastically cut emissions from industrial heat where electrification is difficult.

- According to the International Energy Agency (IEA), modern bioenergy contributes about 55% of total renewable energy and more than 6% of global energy supply, with industrial heat being a major portion of that use.

In simple human terms, this means biomass heating plants can step in where other renewables fall short — especially for businesses that need consistent, high-temperature heat every hour of operation. For example, many food processing facilities require steady heat to cook, sterilize, dry, or pasteurize products. Electrification technologies like heat pumps work well for lower-temperature applications but struggle with higher heat demands above ~400 °C. Biomass can fill that gap today, enabling companies to cut fossil fuel use without disrupting production.

Regional Insights

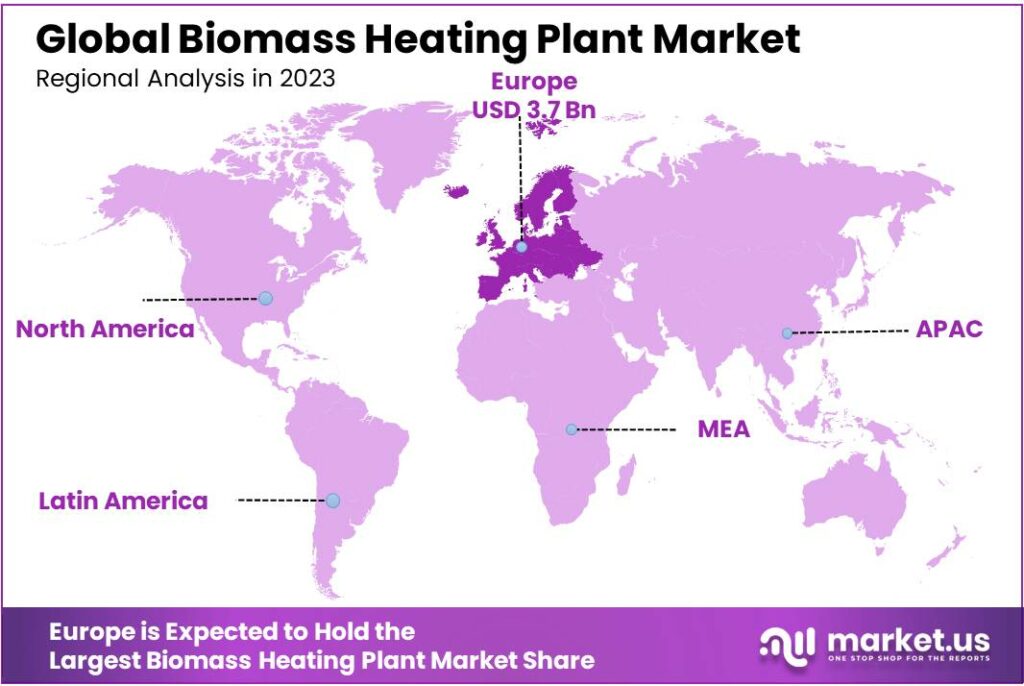

Europe Dominates the Biomass Heating Plant Market with a Market Share of 47.70%, Valued at USD 3.7 Bn

In 2024, Europe emerged as the dominant region in the Biomass Heating Plant Market, accounting for 47.70% of total market share with an estimated value of USD 3.7 billion, reflecting the region’s long-standing commitment to renewable heat and decarbonisation of space and industrial heating. The strong regional position was mainly supported by strict carbon reduction targets, high fossil fuel prices, and well-established policy frameworks promoting biomass-based heating across residential, commercial, and industrial applications.

Countries such as Germany, Sweden, Finland, Austria, and Denmark continued to lead installations, supported by feed-in tariffs, renewable heat incentives, and district heating programs. In 2024, biomass heating plants were widely adopted in industrial facilities, agro-processing units, and municipal heating networks, where stable baseload heat demand favored solid biomass systems. Europe’s large forestry resources and mature pellet and wood-chip supply chains further strengthened fuel availability and price stability.

Additionally, the replacement of aging coal- and oil-based heating infrastructure with biomass systems accelerated market penetration, particularly in Central and Northern Europe. Technological maturity also played a key role, with higher-efficiency boilers, automated fuel handling, and advanced emission control systems improving operational reliability and regulatory compliance.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Hurst Boiler & Welding Co., Inc. supplied industrial biomass boilers ranging from 10 MBH to 50 MMBtu/hr, serving commercial and manufacturing clients. These robust systems are designed for solid biomass fuels like wood chips and agricultural residues. Hurst’s focus on durability and service ensured reliable heat delivery for diverse industrial needs.

In 2024, Thermax Limited strengthened its presence in biomass heating through boilers and energy solutions across Asia. The company recorded revenues of approximately ₹97 billion and delivered biomass systems from 2 TPH to 100 TPH, catering to industrial clients. Its solutions emphasised efficiency, emissions control, and sustainable fuel use in large thermal applications.

In 2024, Hurst Boiler & Welding Co., Inc. supplied industrial biomass boilers ranging from 10 MBH to 50 MMBtu/hr, serving commercial and manufacturing clients. These robust systems are designed for solid biomass fuels like wood chips and agricultural residues. Hurst’s focus on durability and service ensured reliable heat delivery for diverse industrial needs.

Top Key Players Outlook

- Siemens AG

- Valmet

- Energy Saving Trust

- Hurst Boiler & Welding Co, Inc

- Babcock & Wilcox Enterprises, Inc

- Thermax Limited

- Aalborg Energie Technik a/s

- Treco Ltd

- Doosan Enerbility

- HoSt Energy Systems

Recent Industry Developments

In fiscal 2024, which ended on September 30, 2024, Siemens Group reported revenue of €75.9 billion and net income of €9.0 billion, underscoring its extensive industrial scale and capacity to support energy transition technologies.

In 2024, Thermax Limited strengthened its position in the biomass heating plant sector by delivering engineered biomass boiler systems and turnkey energy solutions for large industrial heat and power needs. One notable project involved a 33 TPH hybrid biomass boiler, designed to operate on briquettes and loose biomass fuels to produce both steam and 4 MW of power while cutting nearly 48,000 tonnes of CO₂ per year compared to oil‑fired systems, reflecting tangible environmental impact.

Report Scope

Report Features Description Market Value (2024) USD 7.9 Bn Forecast Revenue (2034) USD 17.7 Bn CAGR (2025-2034) 8.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fuel Type (Solid Biomass, Liquid Biomass, Gaseous Biomass), By Technology (Direct Combustion, Gasification, Anaerobic Digestion, Others), By End-Use (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Siemens AG, Valmet, Energy Saving Trust, Hurst Boiler & Welding Co, Inc, Babcock & Wilcox Enterprises, Inc, Thermax Limited, Aalborg Energie Technik a/s, Treco Ltd, Doosan Enerbility, HoSt Energy Systems Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Biomass Heating Plant MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Biomass Heating Plant MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens AG

- Valmet

- Energy Saving Trust

- Hurst Boiler & Welding Co, Inc

- Babcock & Wilcox Enterprises, Inc

- Thermax Limited

- Aalborg Energie Technik a/s

- Treco Ltd

- Doosan Enerbility

- HoSt Energy Systems