Global Biofortification Market Size, Share, And Enhanced Productivity By Crop Type (Cereals, Roots and Tubers, Pulses and Legumes, Oilseeds), By Target Nutrient (Provitamin A, Iron, Zinc, Folate, Others), By Technology (Conventional Breeding, Genetic Engineering, Agronomic Biofortification (Soil/Foliar)), By End-Use (Commercial Farming, Animal Feed Raw Material, Government and NGO Seed Procurement), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174769

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

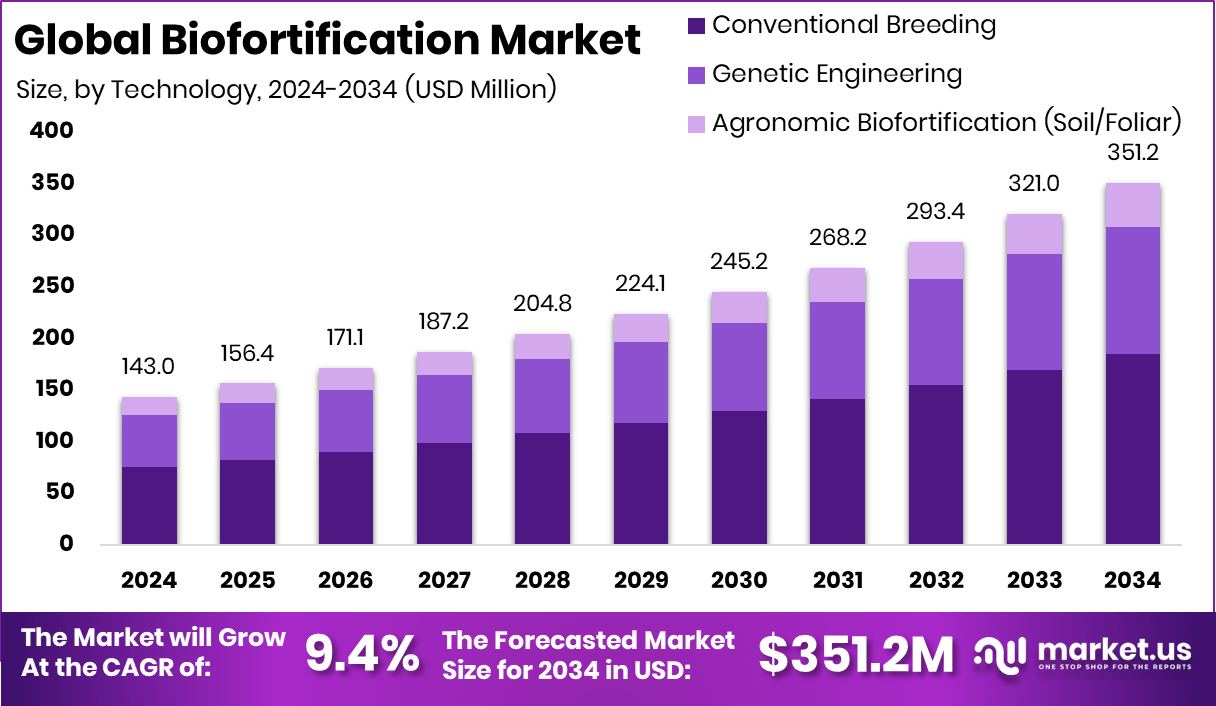

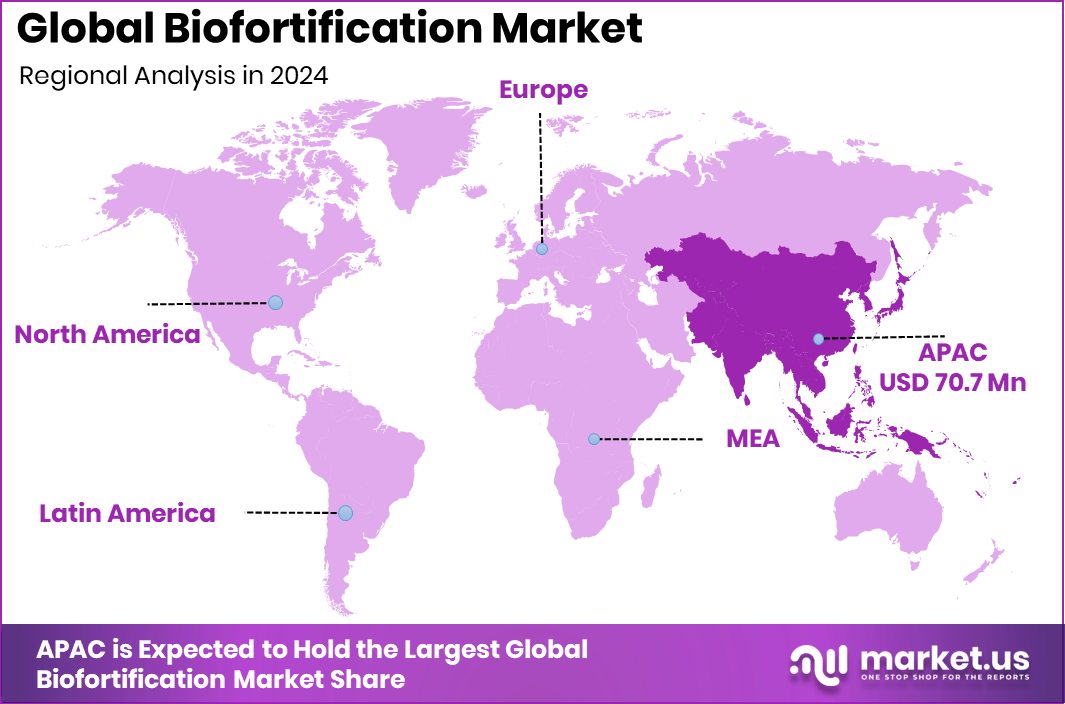

The Global Biofortification Market is expected to be worth around USD 351.2 million by 2034, up from USD 143.0 million in 2024, and is projected to grow at a CAGR of 9.4% from 2025 to 2034. In the Asia Pacific, the biofortification sector achieved 49.5% share totaling USD 70.7 Mn.

Biofortification is the process of naturally increasing the nutritional value of crops during their growth. Instead of adding nutrients after harvest, scientists and breeders develop crop varieties that carry higher levels of vitamins or minerals right from the seed stage. This approach helps communities that rely heavily on staple foods and may not have access to diverse diets. It supports long-term nutrition by improving the inherent quality of the crops people eat every day.

The Biofortification Market revolves around developing, producing, and distributing nutrient-rich crops such as iron-rich beans or vitamin-enhanced cereals. It brings together plant breeders, public institutions, and agriculture programs working toward healthier food systems. As awareness grows, more regions are adopting biofortified seeds to strengthen food security.

One key growth factor is the rising global investment in cereal improvement programs. For example, Manitoba boosts its stake in a cereals centre to $23.5 million, and the UF’s participation in a $22M cereal crops project funded by USAID shows how governments value nutrient-focused crop development.

Demand is also expanding with new product efforts in cereals and grains. The $3.1bn Ferrero–Kellogg’s deal and OffLimits securing $2.3M for plant-based cereal products signal renewed attention toward healthier grain-based foods.

Finally, strong opportunities are emerging as investors support nutrition-focused innovation. Better Nutrition raising Rs10 Cr and the $13-million Manitoba agriculture exchange investment reflect growing interest in food quality. Even unconventional stories, like Airbnb’s CEO crediting a $40 cereal box with shaping their future, show how cereals remain culturally relevant, opening space for creative biofortified products.

Key Takeaways

- The Global Biofortification Market is expected to be worth around USD 351.2 million by 2034, up from USD 143.0 million in 2024, and is projected to grow at a CAGR of 9.4% from 2025 to 2034.

- The Biofortification Market sees strong momentum as cereals dominate crop type with 48.3% share.

- Growing demand for nutrient-rich foods boosts the Biofortification Market, led by iron, targeting 38.7% share.

- The Biofortification Market expands steadily as conventional breeding technology holds a leading 52.8% share.

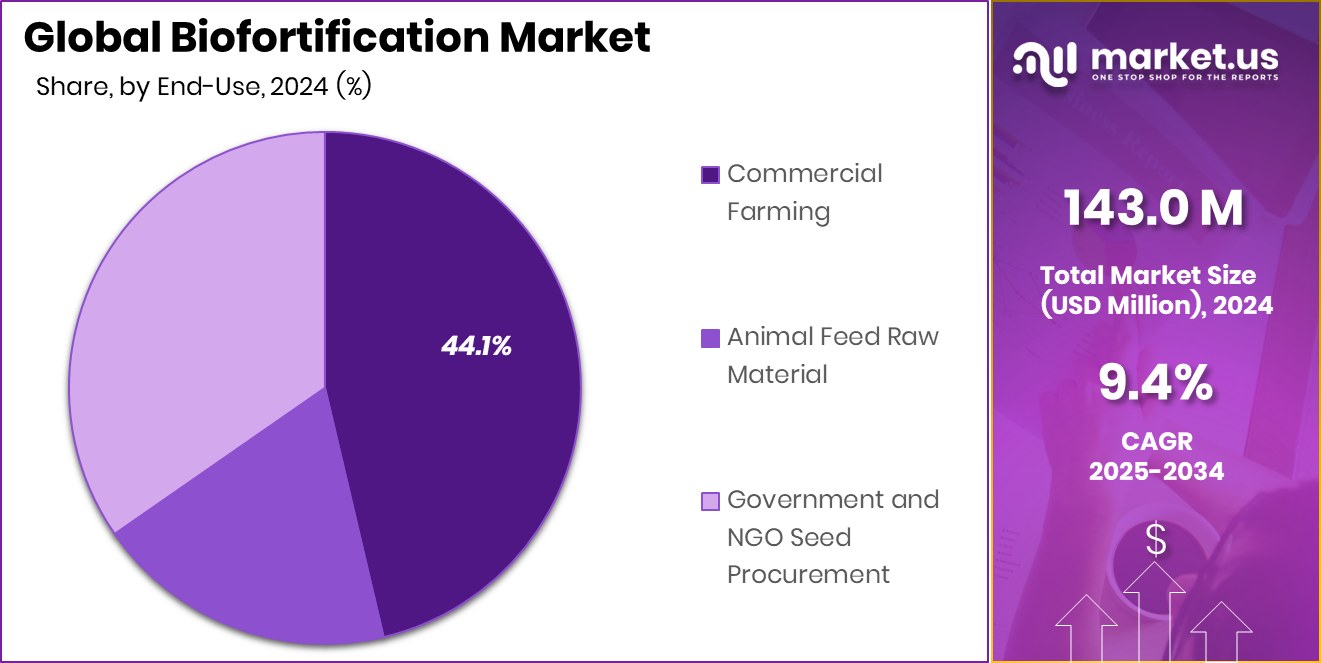

- Rising adoption in large-scale agriculture supports Biofortification Market growth, with commercial farming at 44.1%.

- The Asia Pacific region dominates biofortification demand, holding 49.5% and reaching USD 70.7 Mn.

By Crop Type Analysis

The biofortification market sees cereals dominate with 48.3% share due to staple consumption.

In 2024, the Biofortification Market was strongly led by cereals, which held a dominant 48.3% share due to their widespread consumption and role as staple foods in low- and middle-income regions. Cereals such as rice, maize, and wheat remain the primary focus of biofortification programs because they offer the fastest and broadest nutritional reach.

Governments and global nutrition bodies intensified investments to enhance micronutrient density, especially in regions facing chronic deficiencies. Improved varieties rich in vitamin A, zinc, and iron gained rapid adoption in rural farming systems, enabling scalable distribution. The rising need to combat hidden hunger pushed breeders, public organisations, and seed developers to prioritise cereal-based biofortification as a cost-effective nutrition strategy.

By Target Nutrient Analysis

Biofortification market highlights iron leading at 38.7% as deficiency concerns rise globally worldwide.

In 2024, iron emerged as the leading nutrient segment in the Biofortification Market, contributing 38.7% of the share as iron-deficiency anaemia remained a global public health challenge. Countries with high anaemia prevalence, particularly in Africa and South Asia, prioritised iron-rich crop varieties to strengthen food security.

Biofortified beans, pearl millet, and rice saw growing acceptance due to their ability to naturally enhance iron intake without altering consumer habits. Global agencies also supported large field trials to improve soil-plant nutrient uptake, ensuring stable iron expression in biofortified crops. The rise of nutrition-sensitive agriculture encouraged farmers and policymakers to integrate iron-focused biofortified seeds into national health programs, improving long-term nutritional resilience.

By Technology Analysis

The biofortification market relies on conventional breeding, holding 52.8% for cost efficiency benefits.

In 2024, conventional breeding remained the dominant technology in the Biofortification Market, accounting for 52.8% of the total share. Its leadership was driven by affordability, regulatory acceptance, and ease of adoption among smallholder farmers. Unlike genetic modification, conventional breeding faces minimal consumer resistance and aligns with long-standing agricultural practices in developing countries.

Breeders focused on natural genetic variation to enhance micronutrients, ensuring crops retained their original taste and yield potential. This approach enabled faster scaling through national seed systems and partnerships with agricultural research centres. The continued preference for non-GMO solutions strengthened conventional breeding’s role as the backbone of biofortified crop development across various regions.

By End-Use Analysis

Biofortification market adoption is strongest in commercial farming, with a 44.1% market share segment.

In 2024, commercial farming dominated the end-use segment of the biofortification market with a 44.1% share, reflecting the rising commercialisation of nutrient-enriched crop varieties. Larger farming enterprises adopted biofortified seeds to meet demand from food processors, nutrition-focused brands, and institutional buyers. With increasing awareness of health-enhancing foods, commercial farms scaled production of biofortified wheat, sweet potatoes, and legumes to support bulk supply chains.

Governments and development programs encouraged large-scale cultivation by offering training, subsidies, and linkages to fortified food industries. Stronger market incentives and contract farming opportunities further pushed commercial growers to integrate biofortified crops into their portfolios, strengthening the overall market landscape.

Key Market Segments

By Crop Type

- Cereals

- Roots and Tubers

- Pulses and Legumes

- Oilseeds

By Target Nutrient

- Provitamin A

- Iron

- Zinc

- Folate

- Others

By Technology

- Conventional Breeding

- Genetic Engineering

- Agronomic Biofortification (Soil/Foliar)

By End-Use

- Commercial Farming

- Animal Feed Raw Material

- Government and NGO Seed Procurement

Driving Factors

Rising Research Support Boosts Nutrient Innovation

Growing research investments are becoming a major driving force in the Biofortification Market. Organisations are putting more focus on improving seeds that naturally carry higher vitamins and minerals. A strong example is the $781,432 commitment announced by SaskOilseeds for eight new research projects, which strengthens scientific work on crop nutrition. At the same time, circular-economy efforts support cleaner and more efficient food systems.

The $3 million raised by clean-tech startup Wastelink, led by Avaana Capital, shows how sustainability-focused funding indirectly supports better agricultural practices, which helps the wider biofortification ecosystem. With more resources flowing into seed science, crop nutrition, and waste-reduction technologies, the market gains steady momentum toward healthier and nutrient-rich food crops.

Restraining Factors

Competing Investments Divert Core Crop Focus

The Biofortification Market faces restraints when major agricultural funding shifts toward industrial or energy-driven sectors rather than nutrition-focused crop development. For instance, GrainCorp placing a $500m-plus price tag on an oilseed plant signals capital moving into processing over nutritional improvement. Similarly, the Australian Government’s AU$500 million Green Iron Investment Fund directs significant resources to industrial transformation instead of crop nutrition.

Even sustainability ventures like Wastelink, raising ₹27 crore in Series A funding, draw attention toward waste-to-value systems rather than nutrient-enriched seeds. These competing priorities can delay investments that biofortification programs need, slowing expansion and reducing the speed at which nutrient-rich crop varieties reach farmers globally.

Growth Opportunity

Rising Capital Supports Nutrition Technologies

Large-scale funding going into technology and delivery platforms is creating new opportunities for growth in the Biofortification Market. With global demand rising for healthier food options, innovations in logistics and technology can accelerate the reach of nutrient-rich crops. A strong example is Gopuff securing $1 billion and Bolt raising $711 million, reflecting how fast-delivery and digital commerce can expand access to fortified and biofortified foods.

Additionally, deep-tech advancement is moving quickly, as shown by Chakr Innovation raising $23 million from Iron Pillar and others, supporting cleaner and more efficient agricultural solutions. These investments give biofortified products a stronger route to consumers, opening opportunities for scale, visibility, and market expansion.

Latest Trends

Green Iron Shift Influences Crop Strategy

One of the latest trends shaping the broader agricultural environment is the growing push toward green and clean industrial processes. Although not directly tied to nutrition, these shifts influence how countries prioritise sustainable systems. A notable trend is the $500 million grant aimed at growing green iron production capability, which reflects a move toward eco-friendly industries.

Alongside this, Electra’s $186 million Series B funding to scale clean iron production shows expanding interest in low-carbon technologies. These developments encourage agriculture to adopt similar sustainability values, pushing biofortification programs to align with cleaner, resource-efficient methods. As green innovation rises, biofortification becomes part of a wider trend toward responsible food and industrial systems.

Regional Analysis

Asia Pacific leads the Biofortification Market with 49.5% share worth USD 70.7 Mn.

In the Biofortification Market, Asia Pacific emerged as the dominating region, holding a 49.5% share valued at USD 70.7 Mn, supported by large-scale adoption of nutrient-enriched crops across densely populated agricultural economies. Countries in this region continue expanding biofortified cereal and staple crop cultivation to address nutritional gaps in rural communities, strengthening their leadership position.

North America follows with strong institutional backing for nutrition-improving crop programs and steady uptake among commercial growers aiming to integrate healthier varieties into mainstream supply chains.

Europe maintains consistent growth driven by regulatory focus on sustainable farming and food-quality enhancement, encouraging the use of biofortified seeds in specialised crop systems. Latin America shows rising participation as regional farmers adopt fortified staples aligned with public nutrition initiatives, contributing to a broader diversification of biofortified crop options.

The Middle East & Africa region continues progressing steadily, with growing interest in resilient, nutrient-dense crops suitable for local climatic conditions. Together, these regions reflect expanding awareness of biofortification as an effective long-term strategy to strengthen food and nutrition security.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Bayer AG plays a strategic role in the biofortification landscape through its long-standing expertise in seed science and crop nutrition. In 2024, the company’s focus remains on improving nutrient efficiency in staple crops while maintaining yield stability and farmer acceptance. Bayer’s integrated approach to breeding and agronomic solutions allows it to support biofortified crop development that aligns with public health goals and sustainable agriculture practices, particularly in regions facing micronutrient deficiencies.

Syngenta Group continues to strengthen its position by advancing crop improvement technologies that naturally enhance nutritional value. The company’s emphasis on resilient seed varieties supports biofortification efforts by ensuring micronutrient-rich crops perform reliably under diverse climatic conditions. In 2024, Syngenta’s alignment with farmer-centric innovation enables scalable adoption of biofortified crops, especially in staple food systems where productivity and nutrition must progress together.

Meanwhile, Corteva Agriscience brings a strong breeding-led approach to the biofortification market. The company prioritises trait development that improves nutrient density without compromising crop performance. In 2024, Corteva’s commitment to accessible seed technologies supports broader deployment of biofortified crops, reinforcing its role in addressing long-term nutrition challenges through agricultural innovation.

Top Key Players in the Market

- Bayer AG

- Syngenta Group

- Corteva Agriscience

- KWS Group

- Rijk Zwaan Zaadteelt en Zaadhandel BV

- CITIC Agri Fund

- HarvestPlus

- Groupe Limagrain

- UPL Ltd.

- Maharashtra Hybrid Seeds Co.

- East-West Seed Group

Recent Developments

- In December 2024, Syngenta acquired Intrinsyx Bio, a California-based start-up focused on nutrient-use efficiency products that help plants take up nutrients more effectively. This supports healthier crops and aligns with bio-enhancement goals in agriculture.

- In June 2024, Bayer announced a major plan to launch ten new blockbuster agricultural products over the next decade that aim to support farmers with higher crop yields and sustainable practices. These innovations include improved seeds and crop technologies that could indirectly support nutrient-rich crops by enhancing overall crop performance. This signals the company’s focus on advanced crop solutions, which aligns with broader agricultural quality goals.

Report Scope

Report Features Description Market Value (2024) USD 143.0 Million Forecast Revenue (2034) USD 351.2 Million CAGR (2025-2034) 9.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Crop Type (Cereals, Roots and Tubers, Pulses and Legumes, Oilseeds), By Target Nutrient (Provitamin A, Iron, Zinc, Folate, Others), By Technology (Conventional Breeding, Genetic Engineering, Agronomic Biofortification (Soil/Foliar)), By End-Use (Commercial Farming, Animal Feed Raw Material, Government and NGO Seed Procurement) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bayer AG, Syngenta Group, Corteva Agriscience, KWS Group, Rijk Zwaan Zaadteelt en Zaadhandel BV, CITIC Agri Fund, HarvestPlus, Groupe Limagrain, UPL Ltd., Maharashtra Hybrid Seeds Co., East-West Seed Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Biofortification MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Biofortification MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Bayer AG

- Syngenta Group

- Corteva Agriscience

- KWS Group

- Rijk Zwaan Zaadteelt en Zaadhandel BV

- CITIC Agri Fund

- HarvestPlus

- Groupe Limagrain

- UPL Ltd.

- Maharashtra Hybrid Seeds Co.

- East-West Seed Group