Global Bioactive Ingredients Market Size, Share, And Business Benefits By Source (Plant based, Animal based, Microbial, Others), By Product (Fiber, Vitamins, Omega 3 PUFA, Plant Extracts, Minerals, Probiotics, Others), By Application (Functional Food and Beverage, Dietary Supplements, Clinical Nutrition, Personal Care, Others), By Distribution Channel (Hypermarket/Supermarket, Specialty Stores, Online Retail Store, Pharmacy Stores Online Retailers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156300

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

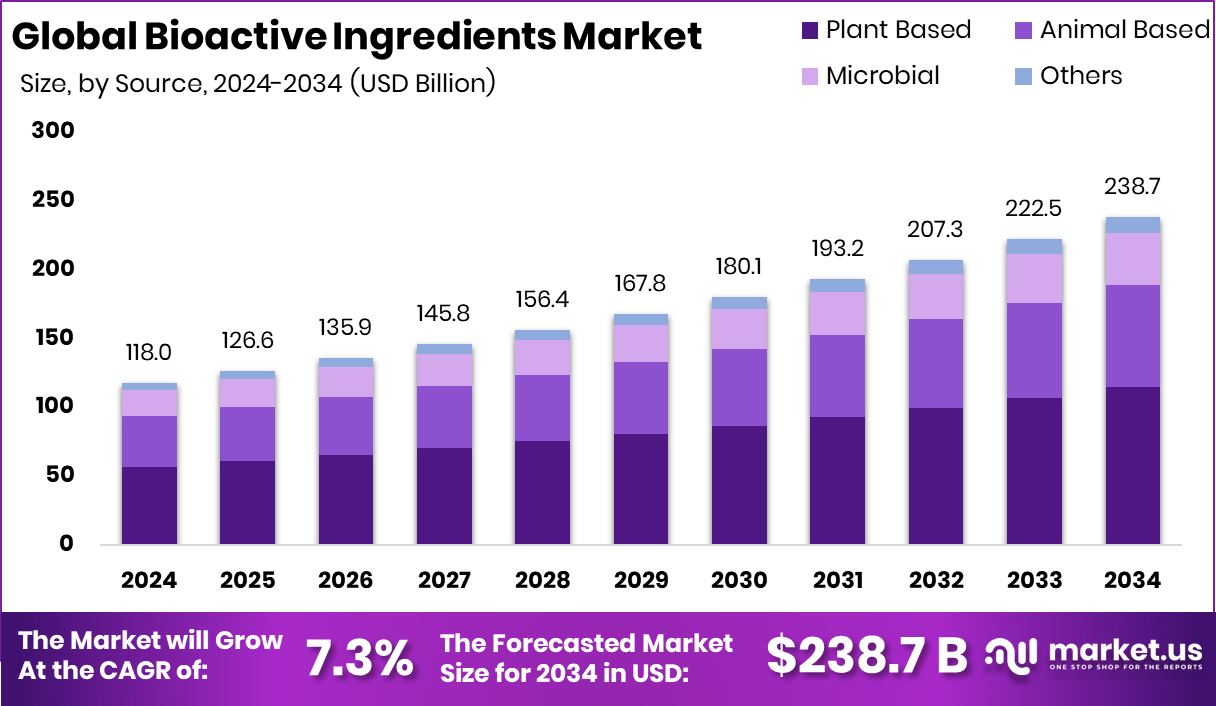

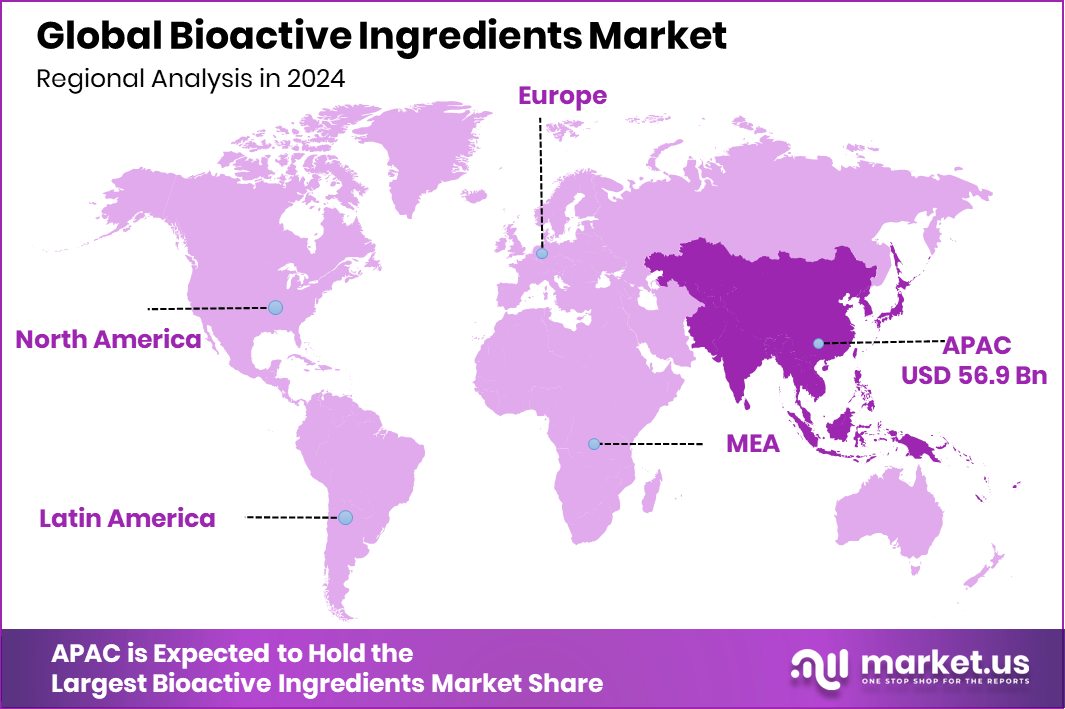

The Global Bioactive Ingredients Market is expected to be worth around USD 238.7 billion by 2034, up from USD 118.0 billion in 2024, and is projected to grow at a CAGR of 7.3% from 2025 to 2034. Market value in the Asia Pacific stood at USD 56.9 Bn, 48.30%.

Bioactive ingredients are natural compounds found in foods, plants, or microorganisms that provide health benefits beyond basic nutrition. These include vitamins, minerals, flavonoids, carotenoids, probiotics, fatty acids, and plant extracts that influence body functions such as immunity, metabolism, and heart health. Unlike regular nutrients, bioactive ingredients actively interact with cells and biological systems, supporting disease prevention and overall wellness.

The bioactive ingredients market refers to the global trade and usage of these compounds across industries like food & beverages, nutraceuticals, cosmetics, and pharmaceuticals. It is driven by consumer demand for functional products that support preventive health, aging management, and lifestyle-related disease reduction. According to an industry report, Unilever Ventures invests $6 million in Series A for Perelel Health vitamin brand.

The bioactive ingredients market refers to the global trade and usage of these compounds across industries like food & beverages, nutraceuticals, cosmetics, and pharmaceuticals. It is driven by consumer demand for functional products that support preventive health, aging management, and lifestyle-related disease reduction. According to an industry report, Unilever Ventures invests $6 million in Series A for Perelel Health vitamin brand.Rising health consciousness and the global shift toward preventive healthcare are strong drivers of market expansion. Consumers are increasingly preferring functional foods and supplements enriched with bioactive compounds to reduce the risks of obesity, diabetes, and cardiovascular issues. According to an industry report, HealthKart raised USD 153 million in a new funding round.

Demand is accelerating due to lifestyle changes, urbanization, and the growing interest in natural and plant-based ingredients. Functional beverages, fortified foods, and personal care products are becoming mainstream choices, widening the use of bioactive ingredients. According to an industry report, ARTAH Nutrition secured £2.85 million in funding to expand its dietary supplement business.

Key Takeaways

- The Global Bioactive Ingredients Market is expected to be worth around USD 238.7 billion by 2034, up from USD 118.0 billion in 2024, and is projected to grow at a CAGR of 7.3% from 2025 to 2034.

- Plant-based bioactive ingredients lead with 48.1%, reflecting rising consumer preference for natural wellness.

- Fibers hold 26.4%, driven by their strong role in digestive health and chronic disease prevention.

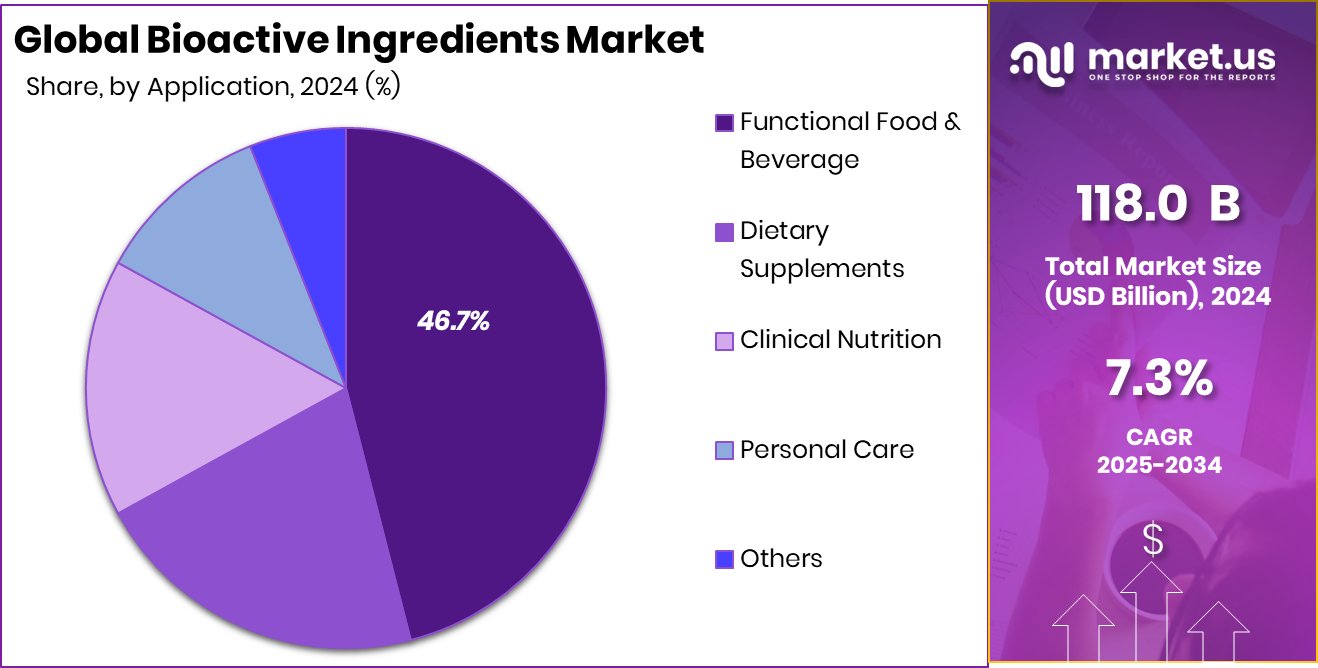

- Functional food and beverages dominate at 46.7%, highlighting demand for nutrition-enhanced everyday consumables worldwide.

- Hypermarkets and supermarkets capture 31.2%, showcasing convenience-driven consumer purchasing behavior for bioactive products.

- Asia Pacific, with a 48.30% share, reached USD 56.9 Bn.

By Source Analysis

Plant-based bioactive ingredients lead with 48.1% market dominance.

In 2024, Plant Based held a dominant market position in the By Source segment of the Bioactive Ingredients Market, with a 48.1% share. This leadership is strongly tied to the rising preference for natural, clean-label, and sustainable health solutions.

Consumers worldwide are shifting toward plant-derived bioactives such as flavonoids, polyphenols, carotenoids, and plant-based omega fatty acids, which are increasingly recognized for their role in improving immunity, supporting cardiovascular health, and enhancing metabolic functions.

The surge in vegan and flexitarian lifestyles has also pushed demand for plant-based alternatives in functional foods, dietary supplements, and beverages, where bioactive ingredients are positioned as essential for preventive healthcare.

Another factor behind this growth is the strong alignment of plant-based sources with sustainability goals, as consumers and industries are focusing on eco-friendly production and ethical sourcing. This has given plant-based bioactive ingredients a strong advantage over synthetic or animal-derived counterparts, further cementing their market lead.

Moreover, technological advancements in extraction and formulation have expanded the application of plant-based bioactives in fortified snacks, sports nutrition, and beauty-from-within products. With their high acceptance across multiple industries and consistent consumer demand, plant-based sources are set to sustain their dominance in the bioactive ingredients market in the coming years.

By Product Analysis

Fiber accounts for 26.4%, highlighting rising dietary health preferences.

In 2024, Fiber held a dominant market position in the By Product segment of the Bioactive Ingredients Market, with a 26.4% share. This strong presence reflects the growing awareness of dietary fiber’s role in supporting digestive health, weight management, and overall wellness.

Consumers are increasingly incorporating fiber-enriched foods and supplements into their daily routines as part of a preventive approach to lifestyle-related health concerns such as obesity, diabetes, and cardiovascular disease. The inclusion of fibers in functional foods, bakery products, cereals, and beverages has positioned them as one of the most versatile and widely adopted bioactive ingredients across global markets.

The rise in demand is also supported by regulatory and health authority recommendations advocating higher fiber intake to meet nutritional balance. This has led food manufacturers to innovate with soluble and insoluble fiber formulations that not only meet health requirements but also improve product texture, taste, and stability.

Additionally, the clean-label movement and consumer interest in natural ingredients are encouraging the use of plant-derived fibers, further boosting their acceptance. With their proven health benefits, broad application range, and alignment with global wellness trends, fiber continues to lead the bioactive ingredients market, reinforcing its pivotal role in shaping consumer dietary habits.

By Application Analysis

Functional food and beverages dominate with 46.7% global consumer adoption.

In 2024, Functional Food and Beverage held a dominant market position in the By Application segment of the Bioactive Ingredients Market, with a 46.7% share. This leadership is driven by the rising demand for fortified and health-oriented consumables that address preventive healthcare needs and lifestyle-related concerns.

Consumers are increasingly seeking foods and drinks enriched with bioactive compounds such as antioxidants, fibers, polyphenols, and plant-derived extracts to support immunity, digestive wellness, energy balance, and healthy aging. This shift is further encouraged by a growing preference for everyday nutrition solutions that are both convenient and effective, positioning functional foods and beverages as a mainstream choice.

The sector’s dominance is reinforced by the global movement toward natural and clean-label products, where functional beverages like probiotic drinks, fortified juices, and plant-based milks are gaining significant traction. Similarly, snacks, cereals, and dairy alternatives enriched with bioactive ingredients are seeing widespread adoption among health-conscious consumers.

Rapid urbanization and busy lifestyles are also accelerating demand for on-the-go functional food products that combine taste with nutrition. With strong consumer trust, versatile applications, and consistent product innovation, functional food and beverages continue to anchor the bioactive ingredients market, setting the pace for growth in this evolving health-focused industry.

By Distribution Channel Analysis

Hypermarkets and supermarkets hold a 31.2% share, ensuring accessibility.

In 2024, Hypermarket/Supermarket held a dominant market position in the By Distribution Channel segment of the Bioactive Ingredients Market, with a 31.2% share. This dominance is largely due to the wide product availability, convenient shopping formats, and trust consumers place in organized retail outlets.

Hypermarkets and supermarkets provide an extensive range of bioactive ingredient-based products, including functional foods, fortified beverages, dietary supplements, and wellness-focused personal care items, all under one roof. This variety allows consumers to make informed choices while comparing product labels, health claims, and price points directly in-store, which significantly strengthens purchasing confidence.

The channel’s strength also lies in its ability to offer promotional deals, attractive packaging displays, and private-label options that cater to a broad spectrum of health-conscious buyers. With increasing urbanization and a growing middle-class population, more consumers are frequenting these large retail stores as primary access points for health-oriented products.

Furthermore, the expansion of modern retail infrastructure in emerging economies is enhancing product visibility and accessibility for bioactive ingredient-based goods. As a result, hypermarkets and supermarkets continue to be the most influential distribution platforms, enabling both awareness and sales growth, while reinforcing their central role in shaping consumer buying behavior in this sector.

Key Market Segments

By Source

- Plant based

- Animal based

- Microbial

- Others

By Product

- Fiber

- Vitamins

- Omega 3 PUFA

- Plant Extracts

- Minerals

- Probiotics

- Others

By Application

- Functional Food and Beverage

- Dietary Supplements

- Clinical Nutrition

- Personal Care

- Others

By Distribution Channel

- Hypermarket/Supermarket

- Specialty Stores

- Online Retail Store

- Pharmacy Stores Online Retailers

- Others

Driving Factors

Rising Health Awareness Driving Preventive Nutrition Demand

One of the strongest driving factors for the Bioactive Ingredients Market is the rising global awareness about health and preventive nutrition. Consumers today are more informed about the connection between diet, lifestyle, and long-term wellness, leading to a shift toward functional foods, fortified beverages, and dietary supplements enriched with bioactive compounds.

Growing concerns over obesity, diabetes, heart problems, and weakened immunity are encouraging people to choose products with added fibers, antioxidants, probiotics, and plant-based extracts.

Governments and health organizations are also promoting balanced diets and recommending higher intake of natural nutrients, which further supports this trend. With preventive healthcare gaining preference over curative treatment, demand for bioactive ingredients is set to expand steadily across industries worldwide.

Restraining Factors

High Production Costs Limiting Market Growth Potential

A major restraining factor for the Bioactive Ingredients Market is the high cost of production and processing. Extracting and formulating bioactive compounds such as polyphenols, carotenoids, and probiotics often requires advanced technology, strict quality control, and sustainable sourcing, which increases overall expenses.

These costs make the final products, such as fortified foods and supplements, relatively expensive compared to conventional alternatives, limiting accessibility for price-sensitive consumers, especially in developing regions.

Additionally, maintaining a consistent supply and ensuring stability of bioactive compounds during processing and storage adds further challenges. While demand for natural and functional products is growing, the premium pricing caused by costly production methods remains a barrier to mass adoption and market expansion.

Growth Opportunity

Personalized Nutrition Creating New Market Opportunities

One of the biggest growth opportunities for the Bioactive Ingredients Market lies in the rise of personalized nutrition. With growing interest in tailored health solutions, consumers are increasingly looking for products designed to meet their specific needs—whether for immunity, digestion, energy, or healthy aging.

Advances in technology, including DNA testing and digital health tracking, are making it possible to match individuals with functional foods, supplements, and beverages that contain targeted bioactive compounds.

This trend is especially popular among younger consumers and health-conscious professionals who prefer customized wellness approaches over generic options. As personalized nutrition becomes more accessible and affordable, it offers a powerful opportunity for expanding the use of bioactive ingredients across global markets.

Latest Trends

Clean-Label Products Driving Strong Consumer Preference

A key latest trend in the Bioactive Ingredients Market is the rapid rise of clean-label products. Consumers are increasingly demanding foods, beverages, and supplements made with simple, natural, and transparent ingredients, avoiding artificial additives or synthetic chemicals. This has led to a strong shift toward bioactive compounds sourced from plants, fruits, and natural fermentation processes.

Clean-label positioning not only builds trust but also aligns with the growing focus on sustainability and ethical sourcing. Companies are highlighting natural fibers, plant-based antioxidants, and probiotics on packaging to attract health-conscious buyers. As awareness of ingredient transparency grows, clean-label products are becoming the standard in the wellness industry, making this trend a major force shaping the market’s future direction.

Regional Analysis

In 2024, the Asia Pacific held 48.30%, USD 56.9 Bn.

The Bioactive Ingredients Market shows strong regional variations, with Asia Pacific emerging as the dominant region in 2024, accounting for 48.30% of the global share and valued at USD 56.9 billion. This leadership is largely fueled by rising consumer health awareness, growing middle-class populations, and increasing adoption of functional foods and dietary supplements across major economies such as China, India, and Japan.

Rapid urbanization and changing dietary habits have boosted demand for fortified products enriched with fibers, probiotics, and plant-derived bioactives, aligning with preventive healthcare trends. Additionally, government initiatives promoting nutrition and wellness, alongside expanding retail and e-commerce networks, have improved accessibility to bioactive-enriched products, reinforcing the region’s growth.

In contrast, regions such as North America and Europe continue to show steady demand due to well-established consumer awareness and strong product innovation in functional foods and beverages. The Middle East & Africa and Latin America are witnessing gradual adoption, driven by increasing investments in the food, nutraceutical, and personal care industries.

However, it is Asia Pacific’s sheer population size, rising disposable incomes, and preference for natural health solutions that give it a leading edge. With these factors, the Asia Pacific is expected to retain its dominance in the global bioactive ingredients market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Sabinsa continued to strengthen its position in the bioactive ingredients landscape through its strong focus on natural plant-derived compounds and nutraceutical formulations. With expertise in standardized botanical extracts, probiotics, and specialty fine chemicals, the company has built credibility around innovation and quality. Its emphasis on research-backed bioactives supports the rising demand for preventive health and functional food solutions, aligning well with consumer preferences for natural and sustainable products.

Archer Daniels Midland Company (ADM) maintained its dominance in the global market with its diverse portfolio of bioactive ingredients spanning fibers, plant proteins, and functional compounds for food and beverage applications. ADM’s integrated supply chain and global presence enabled it to meet the increasing demand for fortified foods and beverages. In 2024, the company benefited from its focus on plant-based solutions and advancements in ingredient innovation, allowing it to capture opportunities across nutrition, wellness, and clean-label categories.

BASF SE played a vital role with its expertise in science-driven bioactive formulations. The company’s offerings in vitamins, carotenoids, omega fatty acids, and plant-based extracts cater to the food, nutraceutical, and personal care industries. BASF’s commitment to research and sustainable sourcing positioned it strongly in addressing health concerns such as immunity, aging, and metabolic wellness. By leveraging advanced technologies and global partnerships, BASF expanded its reach across multiple consumer segments.

Top Key Players in the Market

- Sabinsa

- Archer Daniels Midland Company (ADM)

- BASF SE

- Cargill

- Ingredion

- Ajinomoto Co, Inc.

- Owen Biosciences, Inc.

- Nuritas

- DuPont

Recent Developments

- In April 2025, ADM expanded its probiotic portfolio by unveiling a new postbiotic strain—Lactobacillus gasseri CP2305—supporting stress relief, mood balance, and sleep quality through gut-brain axis benefits.

- In April 2024, Sabinsa introduced Babchiol, a natural extract from Psoralea corylifolia, positioned as a milder, plant-based alternative to retinol for skincare use. This new ingredient underscores Sabinsa’s commitment to clean, effective cosmeceutical actives that address aging concerns gently.

Report Scope

Report Features Description Market Value (2024) USD 118.0 Billion Forecast Revenue (2034) USD 238.7 Billion CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Plant based, Animal based, Microbial, Others), By Product (Fiber, Vitamins, Omega 3 PUFA, Plant Extracts, Minerals, Probiotics, Others), By Application (Functional Food and Beverage, Dietary Supplements, Clinical Nutrition, Personal Care, Others), By Distribution Channel (Hypermarket/Supermarket, Specialty Stores, Online Retail Store, Pharmacy Stores Online Retailers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Sabinsa, Archer Daniels Midland Company (ADM), BASF SE, Cargill, Ingredion, Ajinomoto Co, Inc., Owen Biosciences, Inc., Nuritas, DuPont Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bioactive Ingredients MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Bioactive Ingredients MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sabinsa

- Archer Daniels Midland Company (ADM)

- BASF SE

- Cargill

- Ingredion

- Ajinomoto Co, Inc.

- Owen Biosciences, Inc.

- Nuritas

- DuPont