Global Bio-Polyamide Market Size, Share, And Business Benefits By Product (Polyamide 6, Polyamide 66, Polyamide 10, Polyamide 11, Polyamide 12), By Application (Fiber, Engineering Plastics), By End-use (Automotive, Textile, Film and Coating, Consumer Goods, Electrical and Electronics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161027

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

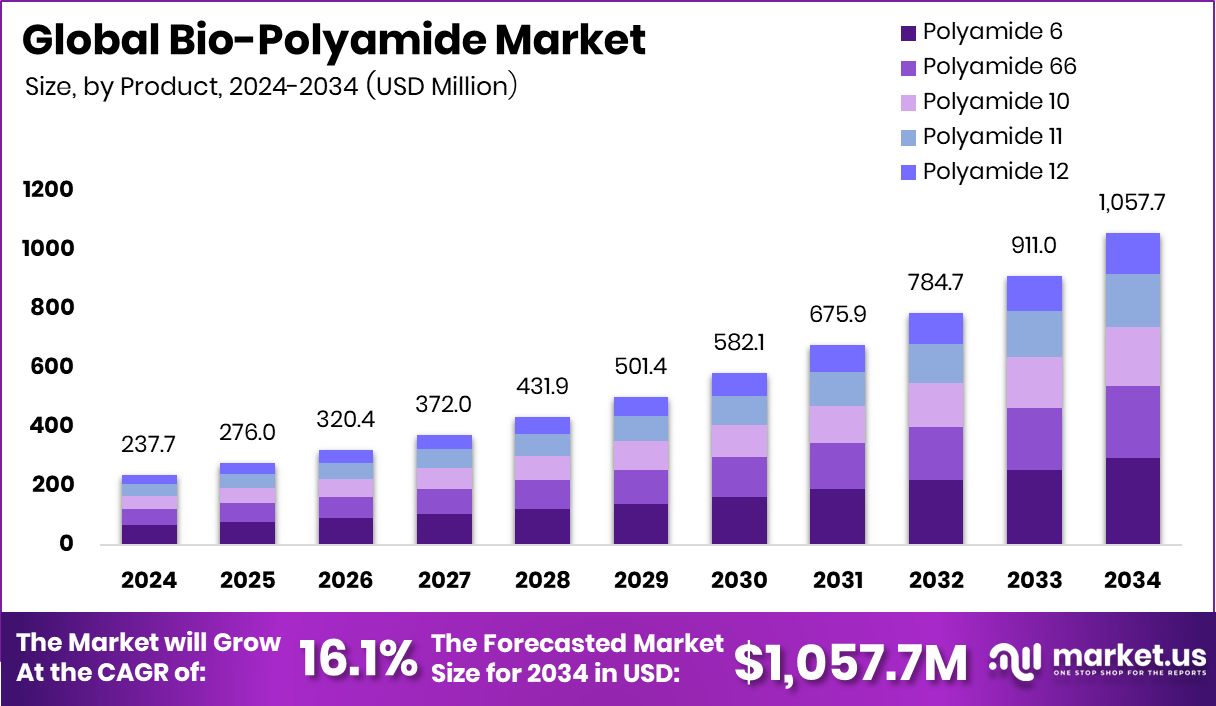

The Global Bio-Polyamide Market is expected to be worth around USD 1,057.7 million by 2034, up from USD 237.7 million in 2024, and is projected to grow at a CAGR of 16.1% from 2025 to 2034. Strong sustainability initiatives in Europe continue driving growth within the USD 92.4 million market.

Bio-polyamide is a kind of nylon (polyamide) where at least some of the monomers are derived from renewable, biological sources rather than just fossil fuels. It behaves like conventional polyamides—with strength, flexibility, and thermal stability—but brings a smaller carbon footprint and better sustainability. In effect, bio-polyamides blend performance with a greener production pathway.

The bio-polyamide market refers to the entire value chain around producing, distributing, and applying these renewable-feedstock polyamides across industries—from chemical makers to end users such as textiles, automotive parts, and consumer goods. Demand, pricing, technology maturity, regulation, and feedstock supply all interact to shape how big that market can grow over time.

One key growth driver is regulatory pressure and consumer preference pushing for lower-carbon, sustainable materials. Companies want to reduce their environmental impact, so switching to bio-polyamides helps with ESG goals. Also, advances in biotechnology and polymer chemistry are lowering production costs and improving material properties, making bio-polyamides more competitive with traditional nylon.

Demand is especially rising in sectors like automotive, electronics, and high-performance textiles, where lighter weight and durability matter. There’s an opportunity in developing niche grades (for example, medical or barrier applications) and scaling up production in regions with abundant biomass feedstocks. Researchers funded by the Research Council of Finland (over 2 million euros) are working on green plastics and biomaterials for medical uses.

UNSW’s plastics recycling project just won a $4.99 million grant. Engineering professors’ work on plastics recycling and sustainability got a $1 million award. In the corporate sphere, ADIA, Motilal Oswal MF, and others acquired a 2.9% stake in Shaily Engineering Plastics for ₹284 crore; US-based Capital Group bought a 1.67% stake worth ₹148 crore; and a mutual fund’s bulk deal buying a 2.76% stake sent that company’s stock up ~4%.

Key Takeaways

- The Global Bio-Polyamide Market is expected to be worth around USD 1,057.7 million by 2034, up from USD 237.7 million in 2024, and is projected to grow at a CAGR of 16.1% from 2025 to 2034.

- In 2024, Polyamide 6 held a 27.8% share in the global Bio-Polyamide Market.

- Engineering plastics accounted for a 67.2% share in the overall bio-polyamide market during 2024.

- The automotive sector captured a 32.7% share of the global bio-polyamide market in 2024.

- The European market reached a valuation of around USD 92.4 million in 2024.

By Product Analysis

In 2024, Polyamide 6 dominated the Bio-Polyamide Market with a 27.8% share.

In 2024, Polyamide 6 held a dominant market position in the By Product segment of the Bio-Polyamide Market, with a 27.8% share. This strong presence is attributed to its exceptional mechanical strength, high chemical resistance, and wide applicability across industries such as automotive, consumer goods, and electrical components.

Polyamide 6 derived from bio-based feedstocks offers comparable performance to conventional nylon while supporting sustainability goals and reducing dependency on petrochemical sources. Its ability to deliver lightweight, durable, and recyclable materials has increased its adoption in manufacturing and engineering applications. The segment’s growth reflects a rising industry preference for eco-friendly polymers that meet both environmental regulations and performance standards.

By Application Analysis

Engineering plastics held a leading 67.2% share in the bio-polyamide market.

In 2024, Engineering Plastics held a dominant market position in the By Application segment of the Bio-Polyamide Market, with a 67.2% share. This leadership is driven by the growing utilization of bio-based polyamides in high-performance components requiring durability, heat resistance, and dimensional stability.

Engineering plastics made from renewable polyamides are increasingly used in sectors such as automotive, electronics, and industrial machinery to reduce carbon emissions and enhance product sustainability. Their superior mechanical and thermal characteristics make them a preferred alternative to conventional materials. The segment’s dominance highlights the industry’s transition toward eco-efficient engineering materials that combine performance reliability with environmental responsibility.

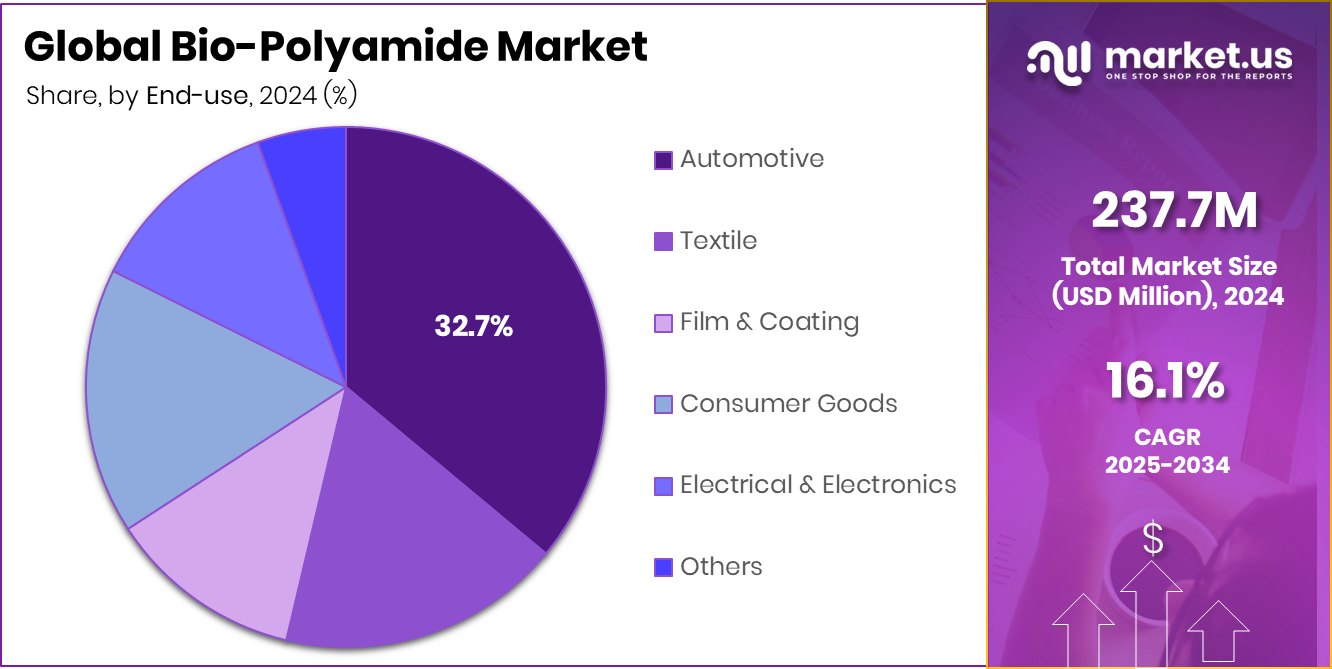

By End-use Analysis

The automotive segment captured 32.7% of the bio-polyamide market.

In 2024, Automotive held a dominant market position in the by-end-use segment of the Bio-Polyamide Market, with a 32.7% share. This dominance is attributed to the growing adoption of bio-based polyamides in vehicle components such as fuel lines, air intake manifolds, and under-the-hood parts. The automotive industry’s push toward lightweight materials for improved fuel efficiency and reduced emissions has driven demand for bio-polyamides due to their high mechanical strength and thermal stability.

Additionally, their recyclability and lower carbon footprint align with global sustainability goals and stricter emission regulations. The segment’s prominence reflects the ongoing shift toward greener materials in next-generation automotive manufacturing.

Key Market Segments

By Product

- Polyamide 6

- Polyamide 66

- Polyamide 10

- Polyamide 11

- Polyamide 12

By Application

- Fiber

- Engineering Plastics

By End-use

- Automotive

- Textile

- Film and Coating

- Consumer Goods

- Electrical and Electronics

- Others

Driving Factors

Sustainability and Innovation Drive Bio-Polyamide Growth

The major driving factor for the Bio-Polyamide Market is the strong global shift toward sustainable materials and innovative polymer solutions. Industries are steadily replacing fossil-based plastics with renewable, bio-derived alternatives to reduce carbon emissions and environmental impact. Bio-polyamides, known for their high strength, flexibility, and temperature resistance, meet these sustainability goals without compromising performance. Governments and organizations worldwide are also funding green innovations to accelerate material circularity.

Recently, Plastic Degradation Company emerged from stealth with $10.5 million in seed funding, developing a naturally-derived solution to degrade multiple plastics, reflecting growing investor confidence in sustainable polymer technologies. Such advancements are encouraging wider industrial adoption of bio-polyamides in automotive, electronics, and consumer product manufacturing.

Restraining Factors

High Production Cost Limits Market Expansion Potential

A key restraining factor for the Bio-Polyamide Market is its high production cost compared to conventional petroleum-based polyamides. The manufacturing of bio-polyamides involves complex processes such as biomass conversion, fermentation, and polymerization, which require advanced technology and significant investment. Additionally, the limited availability of bio-based raw materials further increases costs and affects scalability. These higher expenses make it difficult for manufacturers to offer bio-polyamides at competitive prices, especially in price-sensitive markets.

As a result, many industries still prefer traditional polymers despite environmental concerns. To overcome this restraint, continued research, technological innovation, and expanded feedstock sourcing are needed to reduce costs and enhance the commercial feasibility of bio-polyamides globally.

Growth Opportunity

Rising Demand for Sustainable Automotive Components Globally

A major growth opportunity for the Bio-Polyamide Market lies in the increasing demand for sustainable materials in the automotive industry. As vehicle manufacturers aim to reduce overall weight and carbon emissions, bio-polyamides offer an ideal alternative due to their high strength, durability, and lower environmental impact. These materials are being adopted in parts such as fuel systems, air ducts, and electrical connectors to replace metal and conventional plastics.

The growing focus on electric and hybrid vehicles further supports this trend, as manufacturers seek eco-friendly solutions for lightweight design and improved efficiency. This rising preference for bio-based engineering materials presents a significant opportunity for market expansion in the coming years.

Latest Trends

Advancing Research Boosts Sustainable Polymer Development Worldwide

One of the latest trends in the Bio-Polyamide Market is the growing focus on advanced research and innovation in sustainable polymer science. Governments, research councils, and universities are increasingly funding projects that aim to improve the performance, recyclability, and scalability of bio-based materials. A notable example is the grant of £6 million for five sustainable plastics research projects, which support breakthroughs in renewable feedstocks, green processing, and end-of-life degradation technologies.

These initiatives are accelerating the development of next-generation bio-polyamides with enhanced heat resistance and durability, suitable for high-performance applications. This global trend of research-driven innovation is helping industries transition toward more eco-efficient materials and strengthening the long-term sustainability of the polymer value chain.

Regional Analysis

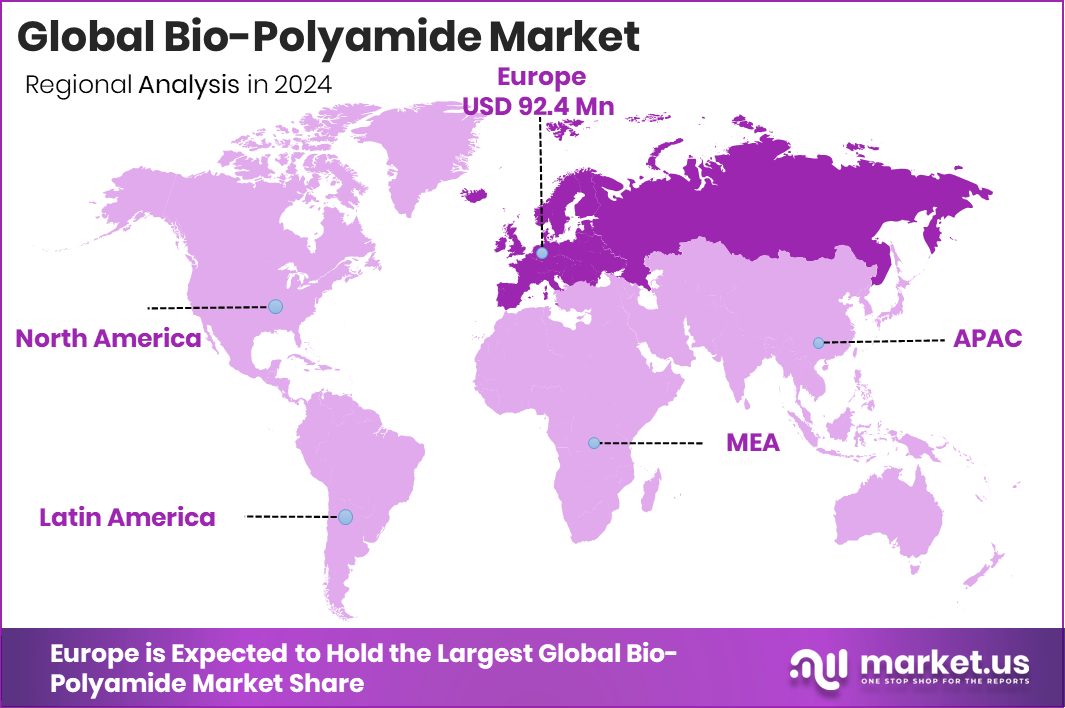

In 2024, Europe dominated the Bio-Polyamide Market with 38.90% regional share.

In 2024, Europe held a dominant position in the Bio-Polyamide Market, accounting for 38.90% of the global share, valued at USD 92.4 million. This leadership is supported by the region’s strong focus on sustainability, stringent environmental regulations, and growing demand for renewable polymers in the automotive and industrial sectors. The European Union’s initiatives promoting bio-based materials and circular economy models have further accelerated adoption across manufacturing industries.

North America follows closely, driven by technological advancements and rising demand for eco-friendly engineering plastics in automotive and electronics. Asia Pacific is emerging as a fast-growing market, with increasing investments in green materials and expanding industrial production.

Meanwhile, the Middle East & Africa and Latin America are witnessing gradual growth due to improving manufacturing infrastructure and supportive government programs promoting sustainable materials. Europe’s dominant share highlights its early adoption of bio-based technologies and robust research ecosystem, positioning it as the leading hub for bio-polyamide innovation and commercialization.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Evonik Industries AG appears as a pioneering force in bio-polyamide development. Its VESTAMID Terra line—particularly PA 610 and PA 1010 grades—demonstrates its commitment to renewable feedstocks and high performance. It also pushed innovation in circularity by introducing INFINAM® eCO PA12, a fully bio-circular powder for 3D printing that replaces fossil feedstock and reduces CO₂ emissions significantly. Evonik’s strategic alignment of its existing polyamide portfolio toward sustainable and renewable production provides it with a competitive edge in emerging bio-polyamide demand, especially in engineering and additive manufacturing segments.

Huntsman International LLC, while more broadly known in specialty chemicals and resins, serves as an important participant in the transition toward more sustainable polymer offerings. In the context of bio-polyamides, Huntsman’s capabilities in tailoring resin systems, compatibilizers, and additives allow it to support and integrate bio-based polyamide formulations into advanced applications. Its global reach and experience across multiple polymer markets will help in scaling bio-polyamide adoption in various end-use sectors.

LANXESS, historically strong in performance polymers and engineering plastics, is positioned to leverage its material science expertise in adapting its portfolio toward bio-derived polyamides. Though its core focus has been specialty and high-performance polymers, LANXESS’s infrastructure, research capabilities, and customer networks enable it to participate selectively in bio-polyamide deployment, especially in application niches where performance and sustainability align.

Top Key Players in the Market

- Evonik Industries AG

- Huntsman International LLC

- LANXESS

- BASF SE

- UBE Corporation

- DOMO Chemicals GmbH

- Arkema

- Asahi Kasei Corporation

- Honeywell International Inc.

- DSM

Recent Developments

- In April 2025, the Launch of bio-based I-BOND® resins: Huntsman introduced two resins called I-BOND® PB BIO 1025 and I-BOND® OSB BIO 1025, which include up to 25% bio-based content. These are designed for composite wood panels and help reduce carbon footprint without sacrificing performance.

- In March 2025, U.S. distribution expansion for INFINAM® PA12: Evonik appointed 3DChimera as an official distributor of its SLS PA12 powders, improving market access for advanced polyamide materials. What they do: Scale availability of performance polyamides for industrial users.

Report Scope

Report Features Description Market Value (2024) USD 237.7 Million Forecast Revenue (2034) USD 1,057.7 Million CAGR (2025-2034) 16.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Polyamide 6, Polyamide 66, Polyamide 10, Polyamide 11, Polyamide 12), By Application (Fiber, Engineering Plastics), By End-use (Automotive, Textile, Film and Coating, Consumer Goods, Electrical and Electronics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Evonik Industries AG, Huntsman International LLC, LANXESS, BASF SE, UBE Corporation, DOMO Chemicals GmbH, Arkema, Asahi Kasei Corporation, Honeywell International Inc., DSM Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Evonik Industries AG

- Huntsman International LLC

- LANXESS

- BASF SE

- UBE Corporation

- DOMO Chemicals GmbH

- Arkema

- Asahi Kasei Corporation

- Honeywell International Inc.

- DSM