Global Bimodal High Density Polyethylene Market Size, Share, And Business Benefit By Processing Method (Extrusion, Blow Molding, Injection Molding, Compression Molding), By Application (Packaging, Automotive, Electronics and Electrical (E&E), Construction, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 163713

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

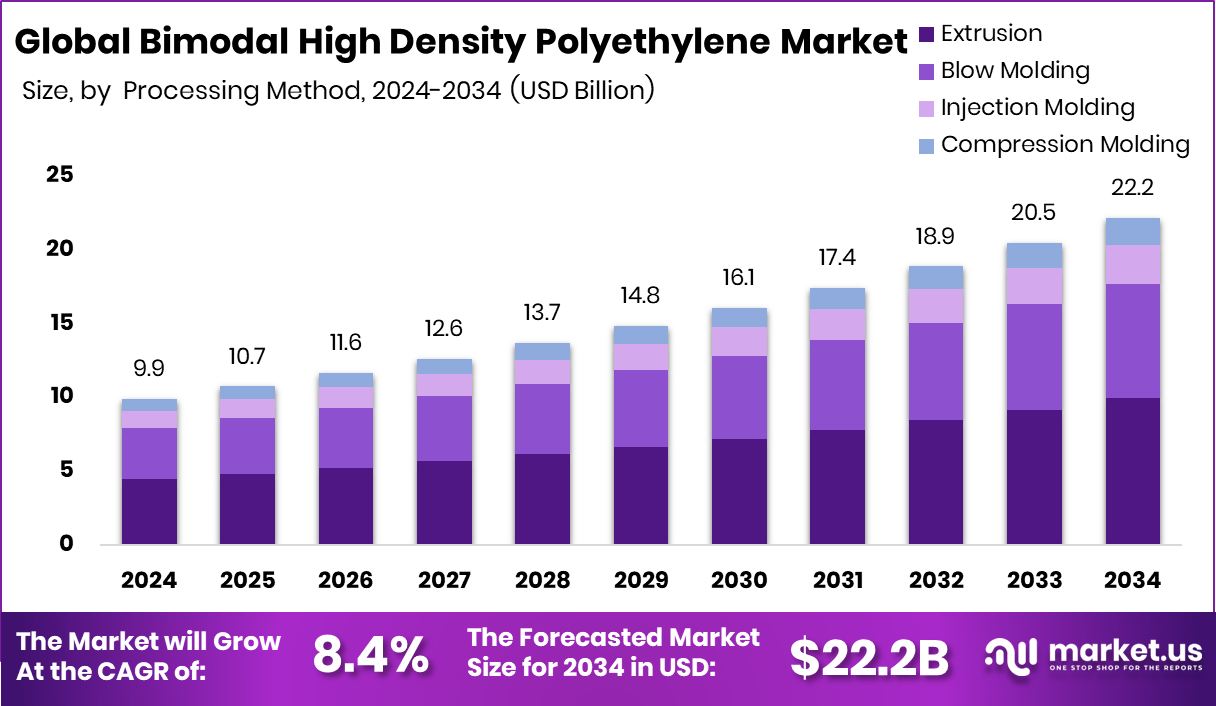

The Global Bimodal High Density Polyethylene Market is expected to be worth around USD 22.2 billion by 2034, up from USD 9.9 billion in 2024, and is projected to grow at a CAGR of 8.4% from 2025 to 2034. Strong industrial growth and infrastructure expansion boosted Asia Pacific’s 43.80% demand for bimodal HDPE.

Bimodal high-density polyethylene (HDPE) is a specially engineered polyethylene type made by combining high molecular-weight and low molecular-weight polymer fractions in the same resin. This dual-molecular-weight, or “bimodal” structure offers a superior mix of stiffness, toughness, and ease of processing. Because of the longer chains, it delivers strength and durability, and the shorter chains improve flow and processability, while the architecture also enhances environmental stress-crack resistance and chemical durability.

The bimodal HDPE market refers to the global production, trade, and usage of these high-performance HDPE resins. It covers the supply chain—from resin manufacture through conversion into pipes, blow-molded containers, films, and other end uses—across regions and industry applications. Drivers include infrastructure build-out, packaging, and automotive lightweighting. Additionally, recent funding signals in related advanced polymer and recycling technologies suggest growing investor interest: for instance, one venture secured US $6.5 million to scale up advanced materials processing, and another received €23 million to commercialise innovative plastic-free packaging.

Rapid infrastructure expansion, especially in developing regions, is a key growth factor for bimodal HDPE. As governments invest in water- and gas-distribution networks, as well as renewable energy transmission systems, the demand for robust, long-life piping and conduit materials rises. Bimodal HDPE offers high hydrostatic strength, excellent stress-crack resistance, and good durability in harsh conditions—making it well-suited for such infrastructure applications.

Demand for bimodal HDPE is also driven by modern packaging and automotive needs. In packaging, manufacturers seek materials that allow thinner walls and lower weight yet retain strength and performance—benefits that bimodal HDPE provides. In the automotive sector, where lightweighting is important for fuel efficiency and emissions reduction, the combination of stiffness and impact resistance in these resins makes them attractive for structural and semi-structural components.

From a strategic perspective, there is a strong opportunity in sustainability, circular economy, and advanced processing segments. As the plastics industry moves toward higher-value, longer-life, and more recyclable materials, bimodal HDPE grades can play a role in new product lines. Innovations in polymerization, catalyst systems, and recycling compatibility open possibilities for differentiated grades that command premium value.

Key Takeaways

- The Global Bimodal High Density Polyethylene Market is expected to be worth around USD 22.2 billion by 2034, up from USD 9.9 billion in 2024, and is projected to grow at a CAGR of 8.4% from 2025 to 2034.

- By processing method, extrusion held a 44.8% share in the bimodal high-density polyethylene market in 2024.

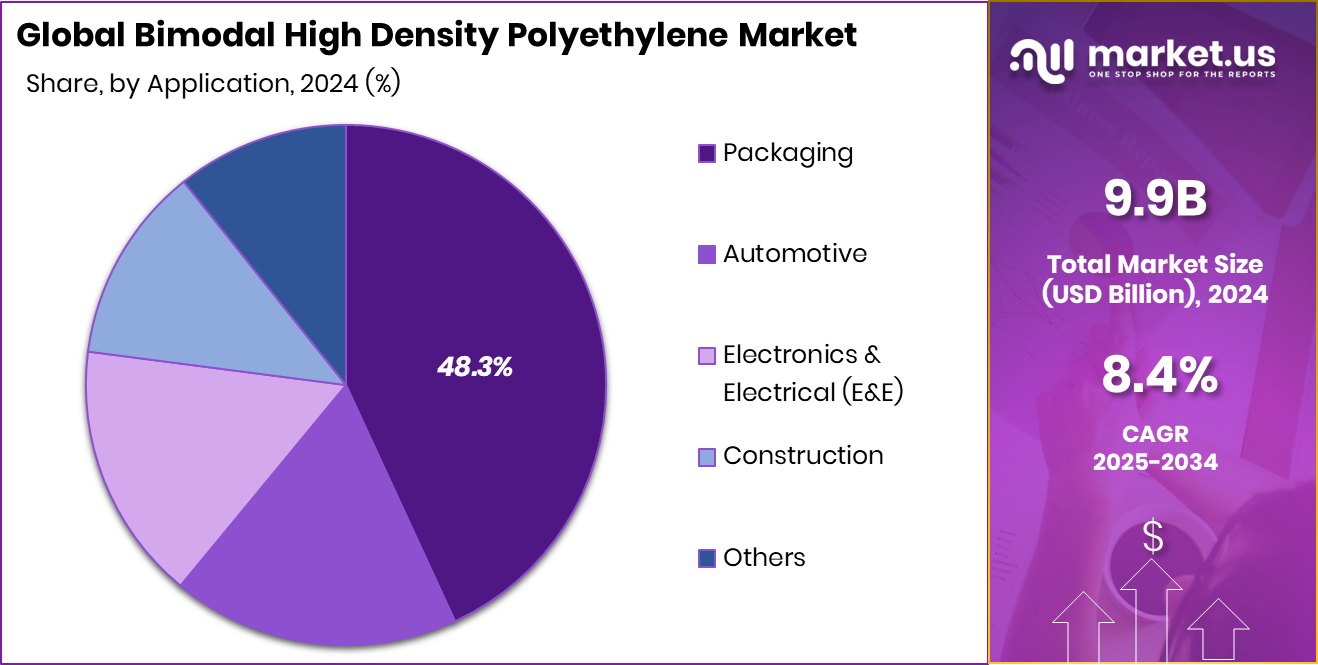

- By application, packaging accounted for a 48.3% share, leading the overall bimodal high-density polyethylene market growth worldwide.

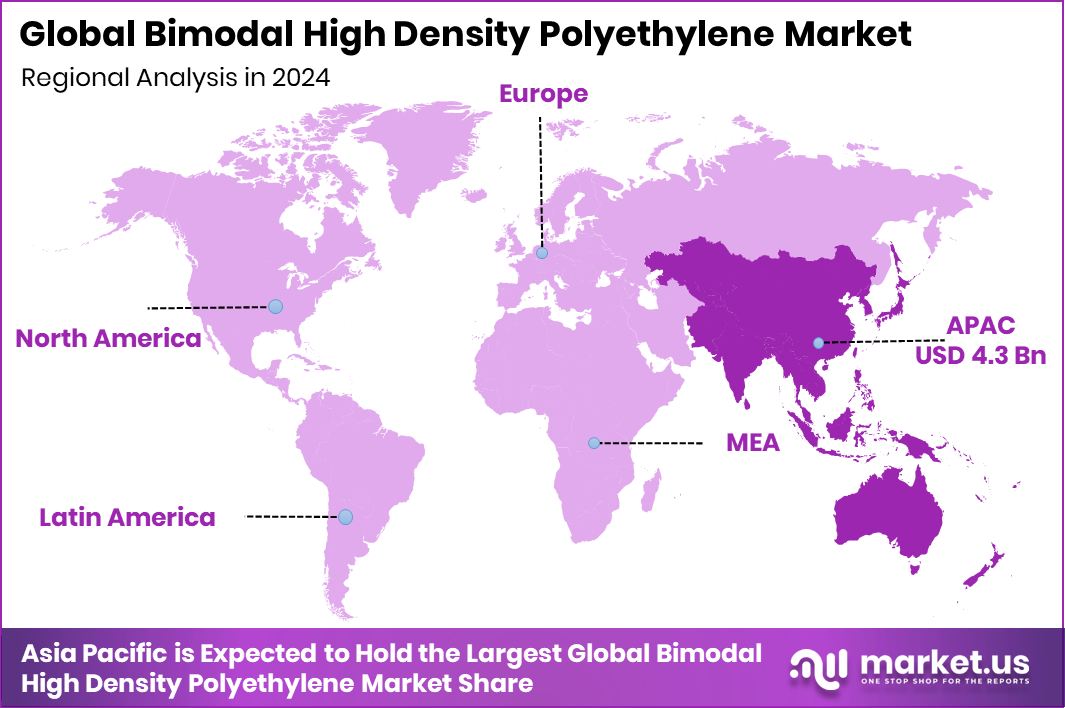

- The Asia Pacific market was valued at approximately USD 4.3 billion during the same year.

By Processing Method Analysis

By processing method, extrusion held a 44.8% share in the Bimodal High-Density Polyethylene Market.

In 2024, Extrusion held a dominant market position in the By Processing Method segment of the Bimodal High Density Polyethylene Market, with a 44.8% share. This dominance reflects the widespread adoption of extrusion in manufacturing pipes, films, and sheets that demand superior mechanical performance and stress-crack resistance. The process allows for uniform material distribution and cost-efficient large-scale production, making it a preferred choice across industrial and infrastructure applications.

Its ability to produce consistent, durable outputs aligns with the rising demand for high-performance materials used in gas and water pipelines, cable coatings, and protective films. Extrusion’s versatility and compatibility with advanced bimodal HDPE grades further reinforced its leadership during the year.

By Application Analysis

By application, packaging dominated with a 48.3% share in the Bimodal High-Density Polyethylene Market.

In 2024, Packaging held a dominant market position in the By Application segment of the Bimodal High-Density Polyethylene Market, with a 48.3% share. The strong performance of this segment is driven by the rising need for durable, lightweight, and cost-effective packaging materials across consumer goods, food, and industrial applications. Bimodal HDPE offers high stiffness, improved impact strength, and excellent environmental stress-crack resistance, making it ideal for bottles, containers, and industrial drums.

Its ability to provide thinner walls without compromising performance supports sustainability goals by reducing material use and transportation costs. The material’s balance of strength and processability continues to make packaging the most preferred application area in the bimodal HDPE industry.

Key Market Segments

By Processing Method

- Extrusion

- Blow Molding

- Injection Molding

- Compression Molding

By Application

- Packaging

- Automotive

- Electronics and Electrical (E&E)

- Construction

- Others

Driving Factors

Infrastructure Expansion Accelerates Resin Demand

Increased global infrastructure investment is driving demand for high-performance materials such as bimodal high-density polyethylene (HDPE). Large-scale water, gas, and energy pipeline projects in developing and developed regions require durable, long-lasting pipe materials, and bimodal HDPE fits this role thanks to its high stress-crack resistance and superior mechanical properties.

At the same time, recent public-sector backing underscores confidence in polymer innovation: for instance, the Polymer Industry Cluster in Ohio was awarded US $51 million in federal funding to support next-generation polymer manufacturing and sustainable materials. Such investments help expand manufacturing capacity and drive adoption of advanced resin types, further reinforcing infrastructure growth as a critical driver for the bimodal HDPE market.

Restraining Factors

High Production Cost Limits Adoption

One of the major restraining factors for the Bimodal High-Density Polyethylene (HDPE) market is its high production cost. The manufacturing process involves advanced polymerization techniques, specialized catalysts, and strict process controls, which make production more expensive compared to conventional HDPE. These higher costs often discourage small and mid-sized manufacturers from adopting bimodal grades, especially in price-sensitive markets.

Additionally, fluctuations in raw material prices, such as ethylene and energy input,s further add to the cost burden. As a result, industries focused on cost efficiency sometimes prefer traditional HDPE or alternative materials. This cost challenge slows market penetration, particularly in developing regions where affordability remains a key purchasing criterion.

Growth Opportunity

Rising Demand for Sustainable Packaging Solutions

A major growth opportunity for the Bimodal High-Density Polyethylene (HDPE) market lies in the increasing global shift toward sustainable packaging. As industries and governments push for eco-friendly materials with high strength and recyclability, bimodal HDPE stands out for its durability, lightweight nature, and ability to reduce material usage.

Its excellent mechanical performance allows manufacturers to create thinner packaging films and containers without losing strength, helping to cut waste and improve energy efficiency during transport.

The demand for recyclable and long-lasting plastic materials across food, beverage, and industrial sectors continues to grow, positioning bimodal HDPE as a preferred material in next-generation packaging solutions that balance performance with environmental responsibility.

Latest Trends

Tailored Resin Grades Drive Market Innovation

A prominent trend in the bimodal high-density polyethylene (HDPE) market is the move towards customised resin grades designed precisely for targeted applications. Resin makers are increasingly adopting advanced polymerisation and catalyst technologies to fine-tune molecular-weight distributions, enabling performance improvements such as enhanced stiffness, stress-crack resistance, and processability.

This trend allows manufacturers to optimise materials for specific demands—such as pipe systems requiring long-term durability, blow-moulded containers needing thin-wall strength, or automotive components emphasising lightweight and impact resistance. The result is a shift from “one-size” generic HDPE to bespoke bimodal solutions that deliver higher value and meet tighter performance standards.

Regional Analysis

In 2024, the Asia Pacific dominated the Bimodal HDPE Market with a 43.80% share.

In 2024, Asia Pacific held a dominant position in the global Bimodal High Density Polyethylene (HDPE) Market, accounting for 43.80% share, valued at around USD 4.3 billion. The region’s strong performance was supported by rapid industrialisation, expanding construction projects, and rising demand for high-performance materials in packaging and infrastructure.

Countries such as China, India, and South Korea witnessed increased adoption of bimodal HDPE in pipelines, containers, and automotive components due to its superior strength and durability. In North America, steady growth was observed, driven by demand for lightweight materials in transportation and sustainable packaging solutions. Europe maintained a mature but stable market supported by stringent environmental regulations and the shift toward recyclable plastics.

Meanwhile, the Middle East & Africa region benefited from rising investments in petrochemical capacity expansion, enhancing its local production potential. Latin America experienced gradual growth with the improvement of industrial infrastructure and packaging modernization.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Bimodal High-Density Polyethylene (HDPE) Market reflected steady technological progress and strategic product innovations from major chemical producers such as Dow Inc., Chevron Phillips Chemical Company, and SABIC.

Dow Inc. continued to strengthen its position through advancements in polymer science and sustainable resin technologies, emphasizing high-performance HDPE grades that improve stress-crack resistance and mechanical strength for industrial and infrastructure applications. The company’s focus on material efficiency and recyclability positioned it well in regions emphasizing circular economy goals.

Chevron Phillips Chemical Company maintained a strong foothold with its expertise in high-performance polyethylene production, leveraging its established infrastructure and feedstock integration to enhance cost efficiency and global supply reliability. The company’s ongoing product developments reflected growing demand for lightweight, durable, and high-strength materials across packaging and pipe applications.

Meanwhile, SABIC focused on diversifying its portfolio through innovations in bimodal and multimodal resin technologies tailored to the energy, construction, and packaging industries. The firm’s emphasis on sustainable manufacturing practices and global partnerships enabled it to capture emerging opportunities in the Asia Pacific and the Middle East.

Top Key Players in the Market

- Dow Inc.

- Chevron Phillips Chemical Company

- SABIC

- Exxon Mobil Corporation

- LyondellBasell Industries N.V.

- INEOS AG

- SINOPEC Beijing Yanshan Company

- PetroChina Company Ltd.

- Braskem S.A.

- Formosa Plastics Corporation

- Daelim Industrial Co., Ltd.

- Mitsui Chemicals Inc.

Recent Developments

- In June 2024, Dow’s subsidiary Univation Technologies, LLC (which is owned by Dow) announced the launch of its UNIGILITY™ Tubular High Pressure PE Process Technology Platform, capable of producing bimodal HDPE among other resin types using a tubular high‐pressure process.

- In May 2024, CPChem was recognised as the leading high-density polyethylene (HDPE) supplier by a national customer survey, highlighting its strength in providing reliable products and services across its HDPE portfolio.

Report Scope

Report Features Description Market Value (2024) USD 9.9 Billion Forecast Revenue (2034) USD 22.2 Billion CAGR (2025-2034) 8.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Processing Method (Extrusion, Blow Molding, Injection Molding, Compression Molding), By Application (Packaging, Automotive, Electronics and Electrical (E&E), Construction, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Dow Inc., Chevron Phillips Chemical Company, SABIC, Exxon Mobil Corporation, LyondellBasell Industries N.V., INEOS AG, SINOPEC Beijing Yanshan Company, PetroChina Company Ltd., Braskem S.A., Formosa Plastics Corporation, Daelim Industrial Co., Ltd., Mitsui Chemicals Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bimodal High Density Polyethylene MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Bimodal High Density Polyethylene MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Dow Inc.

- Chevron Phillips Chemical Company

- SABIC

- Exxon Mobil Corporation

- LyondellBasell Industries N.V.

- INEOS AG

- SINOPEC Beijing Yanshan Company

- PetroChina Company Ltd.

- Braskem S.A.

- Formosa Plastics Corporation

- Daelim Industrial Co., Ltd.

- Mitsui Chemicals Inc.