Global Big Data Security Market Size, Share Analysis By Component (Software, Services), By Deployment (On-premises, Cloud), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By End-use (BFSI, Utilities, IT & ITES, Healthcare & Life Sciences, Retail & Ecommerce, Telecom, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155169

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Highlights and Key Takeaways

- Role of AI

- Analysts’ Viewpoint

- U.S. Market Size

- Top Growth Factors

- Top 5 Trends and Innovations

- Component Analysis

- Deployment Mode Analysis

- Enterprise Size Analysis

- End-use Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Development and News

- Report Scope

Report Overview

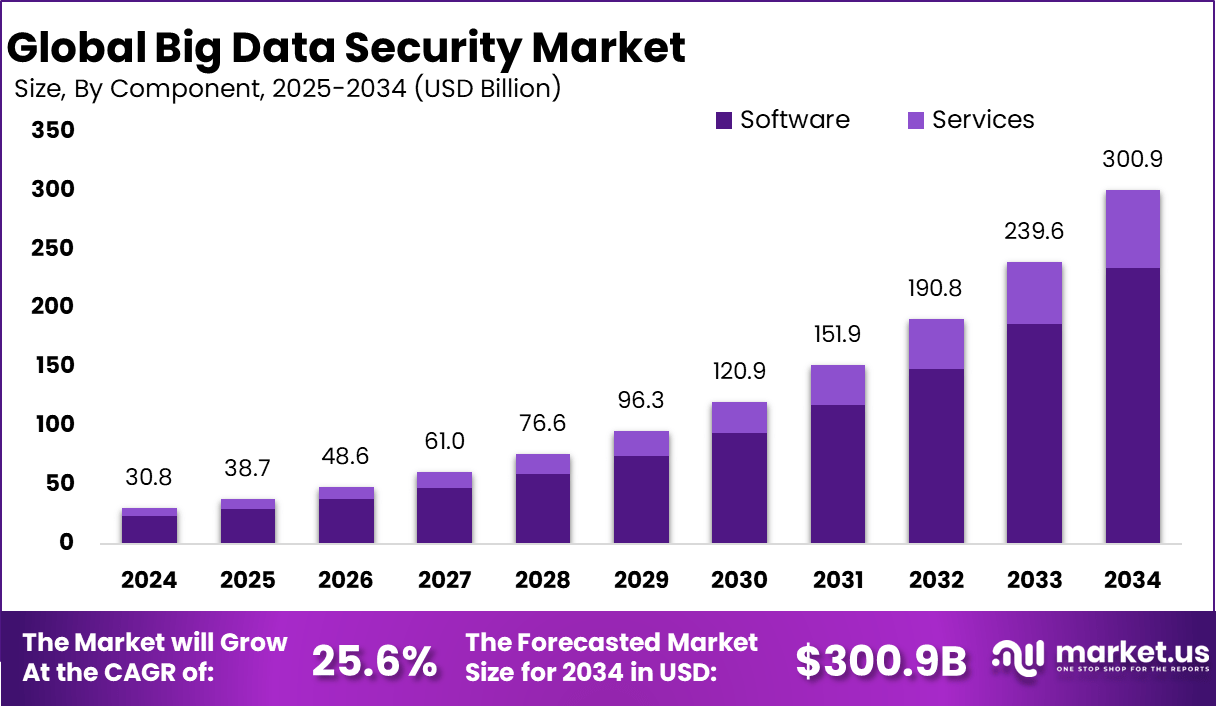

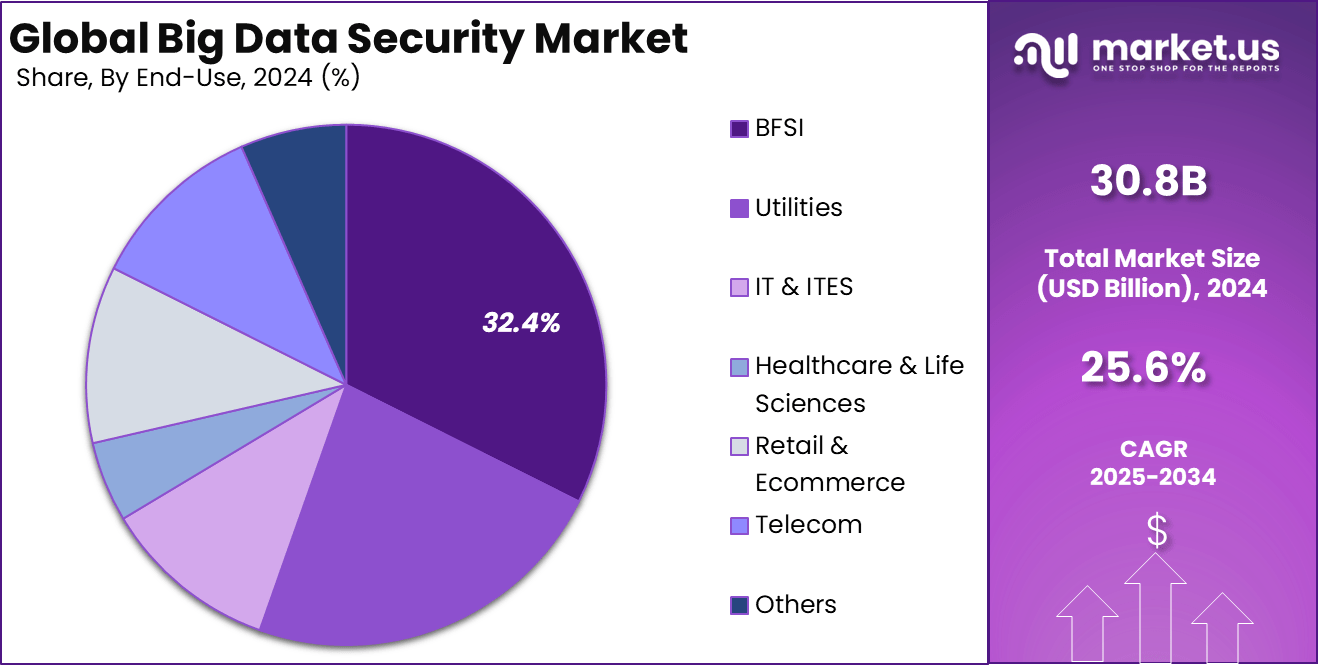

The Global Big Data Security Market size is expected to be worth around USD 300.9 billion by 2034, from USD 30.8 billion in 2024, growing at a CAGR of 25.6% during the forecast period from 2025 to 2034. This robust expansion is being driven by escalating cyber-attacks, heightened regulatory compliance mandates, and increased adoption of cloud-based platforms across industries. Rising volumes of structured and unstructured data have necessitated advanced encryption, access control, and anomaly detection solutions.

The Big Data Security Market is a crucial and rapidly expanding sector focused on protecting the vast volumes of data generated and processed by organizations against increasing cyber threats. This market addresses the complex challenges of securing diverse and dynamic data environments in the face of escalating cyberattacks such as data breaches, ransomware, and identity theft. With data growing rapidly in volume, variety, and speed, advanced security is vital to protect sensitive information and maintain business integrity.

Highlights and Key Takeaways

- By component, Software dominated with a 77.9% share, reflecting the growing reliance on advanced analytics, threat detection, and data encryption tools to safeguard large-scale datasets.

- On-premises deployment held a 70.6% share, driven by organizations prioritizing full control over sensitive data and compliance with stringent regulatory requirements.

- Large enterprises accounted for 65.8% of the market, leveraging big data security solutions to protect vast, complex IT ecosystems and mission-critical operations.

- By end-use, the BFSI sector led with a 32.4% share, driven by the sector’s high data sensitivity, strict compliance mandates, and need for fraud prevention measures.

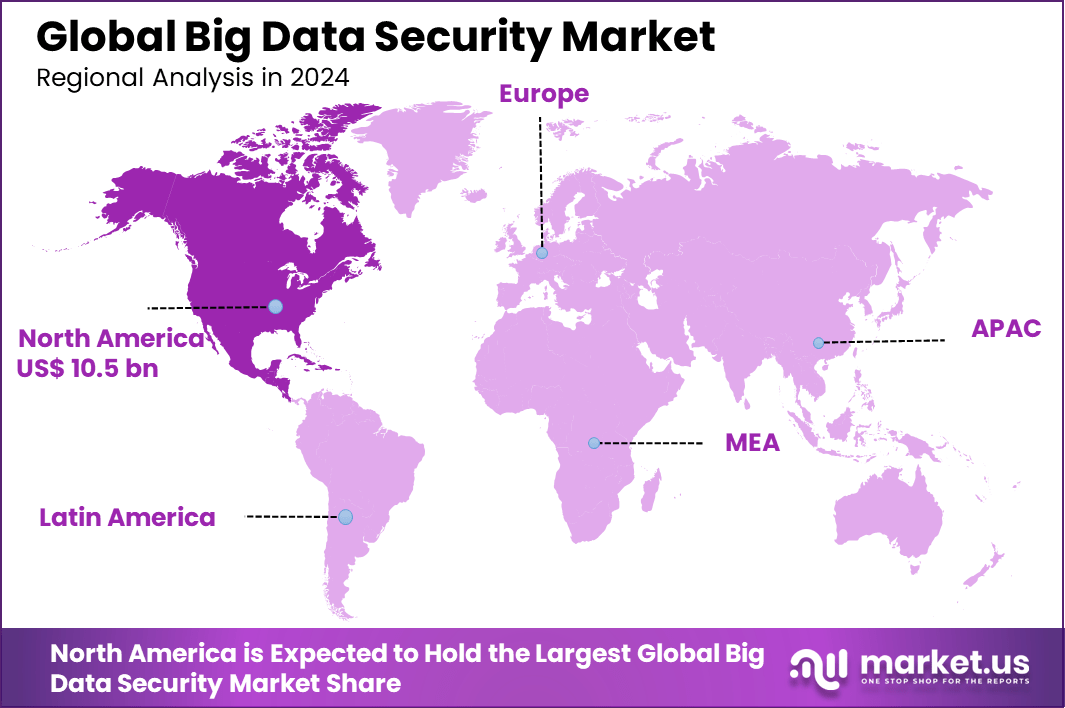

- North America captured 34.2% of the global market, supported by early adoption of big data analytics and strong cybersecurity infrastructure.

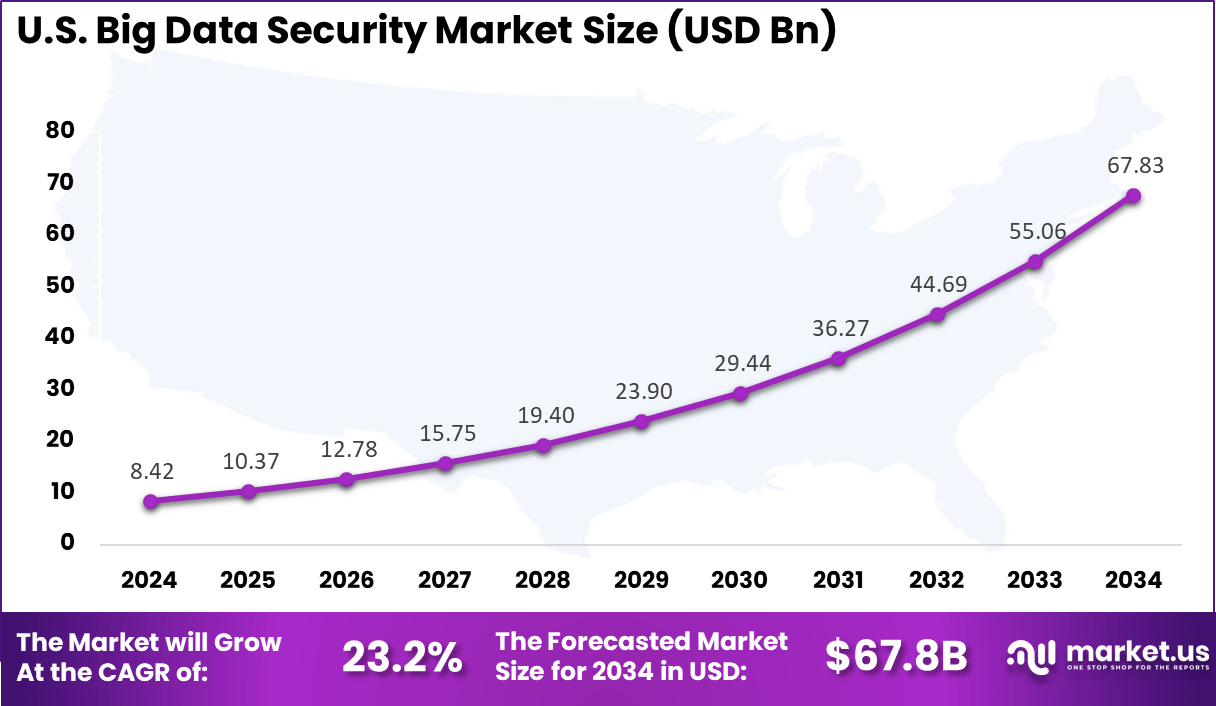

- The U.S. market was valued at USD 8.42 billion and is expected to grow at a robust CAGR of 23.2%, fueled by rapid digital transformation and increasing cybersecurity investments.

Market Size and Growth

Metric Statistic / Value Market Value (2024) USD 30.8 Bn Forecast Revenue (2034) USD 300.9 Bn CAGR(2025-2034) 25.6% Leading Segment By Component – Software: 77.9% Top driving factors shaping this market include the relentless growth of data produced across industries, the increasing intricacy of data ecosystems, and the rising sophistication of cyberattacks targeting big data infrastructures. Compliance with stringent regulatory frameworks like GDPR, HIPAA, and regional data privacy laws further compels organizations to strengthen their security protocols. The rise of cloud computing, IoT, and hybrid data environments creates new vulnerabilities, driving demand for specialized big data security solutions.

Based on data from vpnalert, In 2023, 86.6% of companies reported a shortage of skilled data security personnel, highlighting a critical talent gap in the industry. As of April 2023, women represented 39% of American data security analysts, reflecting gradual progress toward gender diversity in the field. The global data security market was valued at $26,852.5 million in 2022, with spending reaching $3,193 million in 2021.

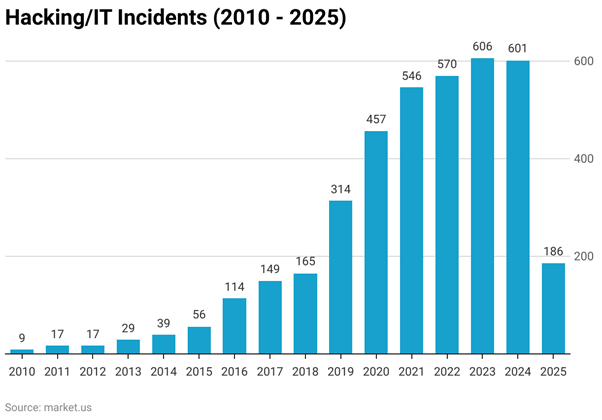

For instance, in May 2025, Healthcare data breaches in the United States are still primarily caused by hacking and IT incidents, as evidenced by recent statistics from The HIPAA Journal. Hundreds of healthcare organizations reported significant breaches in 2024 due to unauthorized access to electronic protected health information (ePHI), which often resulted from ransomware attacks, phishing campaigns, or exploiting system vulnerabilities.

Role of AI

Role/Function Description AI-Powered Threat Detection Machine learning and AI analyze vast datasets in real time to identify anomalies, detect threats, and enable faster incident response. Behavioral Analytics AI monitors user behavior to detect insider threats, credential misuse, and abnormal patterns often missed by traditional methods. Automated Security Operations AI enables automation in threat hunting, correlation, and triage, reducing manual workload and enhancing security efficiency. Predictive Analytics AI forecasts potential vulnerabilities and attack vectors by learning from historical data and emerging threat intelligence. Data Encryption and Masking AI assists in dynamic data anonymization, tokenization, and encryption to meet evolving regulatory requirements. Compliance Monitoring AI-powered auditing tools ensure real-time policy enforcement and adherence to standards like GDPR, CCPA, and HIPAA. Analysts’ Viewpoint

The Big Data Security Market offers strong investment opportunities, driven by rising demand for advanced security capabilities and expanding digital ecosystems. Key focus areas include AI-powered threat detection, cloud security solutions, and industry-specific protection tools. North America leads in infrastructure and investment, while Asia Pacific experiences the fastest growth due to rapid digital transformation and increasing cybersecurity awareness.

Investments in big data security deliver substantial business benefits, including better risk management, compliance alignment, stronger operational resilience, and safeguarding of intellectual property. Robust security frameworks allow organizations to utilize data analytics with confidence, fostering innovation and maintaining competitive advantage. Insurers and regulators also gain from reduced systemic risks associated with breaches.

The regulatory environment plays a pivotal role, with evolving data protection laws and cybersecurity standards shaping market strategies. While compliance requirements differ by region, most emphasize data privacy, breach notification, and strong security controls. These regulations encourage organizations to adopt advanced protective technologies, further accelerating market expansion.

U.S. Market Size

The market for Big Data Security within the U.S. is growing tremendously and is currently valued at USD 8.42 billion, the market has a projected CAGR of 23.2%. The rapid growth of data across industries has increased the need for strong security to protect sensitive information.

Rising cyberattacks highlight the demand for advanced security solutions. Compliance with data protection regulations further pushes organizations to enhance their security frameworks. Additionally, widespread adoption of cloud computing, IoT, AI, and remote work has created new vulnerabilities, driving the urgent need for effective big data security measures to safeguard complex and expanding data environments

For instance, In April 2024, a massive data breach at National Public Data exposed the personal information of 2.9 billion Americans, including names, Social Security numbers, address histories, and family details, highlighting the critical need for robust security measures like encryption and data segmentation to protect sensitive datasets.

In 2024, North America held a dominant market position in the Global Big Data Security Market, capturing more than a 34.2% share. North America holds a dominant position due to its advanced technological infrastructure, widespread adoption of cloud computing, and strong regulatory frameworks focused on data protection.

The presence of leading cybersecurity companies and significant investments in research and development also contribute to the region’s leadership. Additionally, the rising frequency of cyber threats in North American organizations prioritizes robust big data security solutions, further strengthening the market dominance.

For instance, In May 2025, Kyndryl partnered with Microsoft to enhance distributed cloud services by integrating Microsoft Azure tools like Azure Arc and Azure Fabric, strengthening capabilities in hybrid, multicloud, and edge environments to improve security, data management, and application scalability.

Top Growth Factors

Key Factor Description Rapid Rise in Cyberattacks and Ransomware Increasing sophistication of cyber threats, including AI-enabled attacks, drives demand for advanced security Expansion of Big Data and Cloud Adoption Massive growth in data volume and shift to cloud platforms require enhanced protection of distributed data Stringent Regulatory Compliance Adoption of regulations such as GDPR, CCPA, and others compel organizations to implement robust data security Increasing Digitalization and IoT Proliferation of connected devices and digital infrastructure broadens attack surfaces needing security Growing Awareness of Data Privacy Organizations and consumers demand greater protection of sensitive information, fueling investment in security Top 5 Trends and Innovations

Trend/Innovation Description Integration of AI and Machine Learning AI increasingly embedded in big data security solutions for real-time analytics, anomaly detection, and automated response Zero-Trust Security Models Adoption of zero-trust architecture replacing legacy perimeter defenses to secure every data access transaction Cloud and Hybrid Security Solutions Specialized security tools tailored for cloud-native and hybrid environments to protect data at scale Collaboration Between Security and DevOps Closer integration of security teams with development/operations for continuous monitoring and faster mitigation Edge Computing Security Challenges Increasing focus on securing data at the edge due to real-time processing and distributed data generation Component Analysis

In 2024, the software segment dominates the Big Data Security market, accounting for 77.9%. This reflects the vital role that software solutions play in protecting big data environments, including platforms for data encryption, access control, threat detection, and compliance management. With the increasing volume, variety, and velocity of data, organizations heavily rely on advanced software tools to safeguard sensitive information against breaches, unauthorized access, and evolving cyber threats.

Software solutions in big data security are designed to integrate across diverse data sources and infrastructures, offering real-time monitoring and automated response capabilities. Their flexibility and scalability enable enterprises to maintain robust data protection measures as their data ecosystems grow more complex and distributed.

For Instance, in February 2025, Elon Musk’s Department of Government Efficiency (DOGE) was granted U.S. approval. Labor Department employees are highly concerned about the security of sensitive government data, as they have started using file-transfer and remote access software. Despite the lack of thorough testing, DOGE personnel may be able to bypass established privacy and security protocols by extracting vast amounts of data from labor systems.

Deployment Mode Analysis

In 2024, On-premises deployment holds a significant 70.6% share of the Big Data Security market. Organizations often prefer on-premises solutions to retain direct control over their security infrastructure, data privacy, and regulatory compliance. This deployment model is especially favored by sectors handling highly sensitive information or operating under strict governance frameworks.

On-premises security solutions allow enterprises to customize configurations and implement localized policies tailored to their unique operational needs. Despite the growth of cloud-based offerings, many organizations prioritize on-premises systems for their reliability, data sovereignty, and seamless integration with existing IT environments.

For instance, in August 2024, Broadcom announced the launch of Rally® Anywhere at VMware, introducing an on-premises version of its enterprise agility platform. Rally Anywhere caters to international firms seeking strict data control, strong data protection, and complete management of their IT infrastructure. It empowers their teams to manage, track, and measure organizational performance.

Enterprise Size Analysis

In 2024, Large enterprises represent 65.8% of the market, reflecting their substantive investment in big data security as they handle vast and diverse datasets. These organizations require comprehensive security frameworks to protect critical business information, maintain customer trust, and comply with complex regulatory landscapes across multiple regions.

Their scale and complexity necessitate advanced security solutions that can manage high data volumes and sophisticated threat scenarios. Large enterprises also benefit from dedicated teams and resources for continuous monitoring, threat intelligence, and rapid incident response, reinforcing their leadership in adopting big data security technologies.

For instance, in February 2025, hackers are increasingly targeting and exploiting cloud-based services like Amazon Web Services (AWS) and Microsoft Azure, which are used by large corporations for big data storage and analytics. Misconfigured services, weak authentication, and exposed APIs are among the vulnerabilities that attackers can use to spoof sensitive enterprise data, deploy cryptojacking malware, or launch large-scale attacks.

End-use Analysis

In 2024, the Banking, Financial Services, and Insurance (BFSI) sector holds 32.4% of the big data security market, making it the leading end-use industry. BFSI organizations manage highly sensitive financial data and face rigorous regulatory scrutiny, driving their demand for robust security measures. Protecting customer information, preventing fraud, and ensuring compliance with data protection laws are critical priorities in this sector.

The BFSI industry leverages big data security solutions to monitor transactions, detect anomalies, and safeguard digital assets against continually evolving cyber threats. These capabilities help maintain financial stability, build customer confidence, and protect the integrity of financial systems.

For Instance, In Feb 2025, The Jalgaon Peoples Co-Operative Bank Ltd. partnered with Yotta Suraksha to enhance its cybersecurity infrastructure. This collaboration aimed to fortify the bank’s IT systems against evolving cyber threats, ensuring the protection of sensitive financial data and maintaining customer trust by implementing advanced security solutions.

Key Market Segments

By Component

- Software

- Data Authorization & Access

- Data Discovery & Classification

- Data Encryption, Tokenization, and Masking

- Data Governance & Compliance

- Data Auditing & Monitoring

- Data Backup & Recovery

- Data Security Analytics

- Services

- Managed Services

- Professional Services

By Deployment

- On-premises

- Cloud

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By End-use

- BFSI

- Utilities

- IT & ITES

- Healthcare & Life Sciences

- Retail & Ecommerce

- Telecom

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Demand for Big Data Security Solutions

A principal driver is the exponential increase in data generation fueled by IoT devices, digital transformation, and cloud adoption, which expands the attack surface and elevates security complexity. Rising frequency and sophistication of cyber threats, including data breaches, ransomware, and AI-powered attacks, necessitate advanced big data security measures.

Furthermore, stringent regulatory frameworks like GDPR, CCPA, and HIPAA compel organizations to implement comprehensive data governance and protection strategies, driving demand for specialized security tools. The need for real-time detection, data anonymization, and secure access control also fuels market expansion. Additionally, the growing integration of big data with AI and analytics underscores the demand for robust protective technologies that ensure data integrity and confidentiality.

For instance, in May 2025, Saalai and Intertec Systems announced a strategic collaboration to deliver advanced big data and AI solutions across the GCC region. This partnership seeks to address the growing demand for robust data security measures by integrating cutting-edge technologies to enhance data protection and compliance. This collaboration aims to provide organizations with secure, scalable solutions to manage and analyze vast datasets, thereby strengthening cybersecurity frameworks in the region.

Restraint

Complexity in Implementing Big Data Security

Despite growth prospects, challenges include high implementation costs and the complexity of integrating big data security solutions with existing legacy systems, especially for mid-sized and smaller enterprises. The diversity of data types – including structured, unstructured, and semi-structured data and distributed storage across on-premises and cloud environments complicate the application of uniform security controls.

For instance, In April 2024, organizations using Amazon DocumentDB and Apache Spark on Amazon EMR struggled to secure complex, large-scale data environments. Integrating diverse technologies with different security needs demanded specialized skills and investments, leading to delays and higher operational effort, particularly for those lacking dedicated cybersecurity teams.

Opportunities

Adoption of AI and Machine Learning for Threat Detection

Utilizing AI and machine learning to monitor big data security events in real time improves threat detection, predictive analysis, and automated responses. These tools help organizations spot and respond to threats faster and more accurately, minimizing the gap between attacks and detection. As AI/ML technologies mature, they open new growth opportunities for businesses seeking proactive and adaptive security strategies.

For instance, In June 2024, Opaque Systems introduced its Confidential AI Platform, enabling AI and analytics workloads to run directly on encrypted data. It allows machine learning pipelines and frameworks like Python and Spark to function without exposing sensitive information, addressing key security and privacy concerns, particularly in finance, manufacturing, and human resources.

Challenges

Security Vulnerabilities in Emerging Big Data Technologies

Tools designed for analyzing unstructured data and nonrelational databases like NoSQL are still evolving. Security systems often struggle to keep pace, leaving gaps in protection. This issue is further complicated by the need for real-time regulatory compliance and managing false positives, requiring constant adaptation of security strategies to keep up with rapid technological changes.

For instance, In May 2025, security researchers identified 14 vulnerabilities in thousands of DrayTek routers worldwide, including command injection and buffer overflow flaws. These issues could enable remote access, arbitrary code execution, and network disruption, underscoring ongoing risks in evolving network technologies as organizations increasingly depend on connected devices and edge computing for big data processing.

Key Players Analysis

In the Big Data Security Market, leading cloud service providers have strengthened their positions by offering scalable, integrated security solutions tailored for large-scale data environments. Companies such as Amazon Web Services, Microsoft, and Oracle have expanded their capabilities with AI-driven threat detection and advanced encryption.

Cybersecurity specialists like Palo Alto Networks, Broadcom, and McAfee have advanced their offerings with threat intelligence, automated incident response, and real-time monitoring tools. These vendors are targeting the increasing risks associated with data breaches, ransomware, and insider threats.

Analytics and software-driven security providers, including IBM, SAS Institute Inc., Splunk Inc., and Trend Micro, are focusing on data-driven security intelligence. Their platforms use machine learning and behavioral analysis to detect anomalies in high-volume data flows. These companies are enhancing security orchestration, integrating log management, and enabling predictive threat prevention.

Top Key Players in the Market

- Amazon Web Services, Inc.

- Broadcom

- IBM

- McAfee, LLC

- Microsoft

- Oracle

- Palo Alto Networks

- SAS Institute Inc.

- Splunk Inc.

- Trend Micro Incorporated

- Others

Recent Development and News

- In January 2025, the full enforcement of the EU’s General Data Protection Regulation imposed stricter security requirements on organizations handling EU citizens’ data. Businesses responded by investing in advanced security solutions to ensure compliance.

- In January 2024, IBM launched its Big Data Security Intelligence Solution, leveraging AI and machine learning to detect and respond to cybersecurity threats in real time. This development addressed the growing need to protect big data from sophisticated attacks.

- In March 2024, Microsoft and Amazon Web Services formed a strategic partnership to integrate Azure Sentinel with AWS security services. The collaboration enabled seamless threat detection and response across multi-cloud environments, enhancing cloud security capabilities.

- In May 2024, Palo Alto Networks acquired Evident.io for about USD 300 million to strengthen its cloud security offerings. The move expanded its capabilities in continuous security monitoring and compliance, meeting rising business demands for robust cloud protection.

- In December 2023, IBM Consulting and Palo Alto Networks expanded their strategic cybersecurity partnership to strengthen end-to-end enterprise security. The collaboration combined IBM’s consulting expertise with Palo Alto Networks’ advanced security technologies, aiming to modernize security operations and protect cloud transformations.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component, (Software, Services), By Deployment, (On-premises, Cloud), By Enterprise Size, (Large Enterprises, Small & Medium Enterprises), By End-use, (BFSI, Utilities, IT & ITES, Healthcare & Life Sciences, Retail & Ecommerce, Telecom, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon Web Services, Inc., Broadcom, IBM, McAfee, LLC, Microsoft, Oracle, Palo Alto Networks, SAS Institute Inc., Splunk Inc., Trend Micro Incorporated, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Big Data Security MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Big Data Security MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-