Global Bentonite Market Size, Share Analysis Report By Product (Sodium Bentonite, Calcium Bentonite, Others), By Application (Foundry Sands, Cat Litter, Iron Ore Pelletizing, Refining, Drilling Muds, Absorbent/Adsorbent, Binder, Sealant, Civil Engineering, Others), By End-Use Industry (Construction, Pharmaceuticals, Cosmetics, Oil and Gas, Food and Beverage, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155700

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

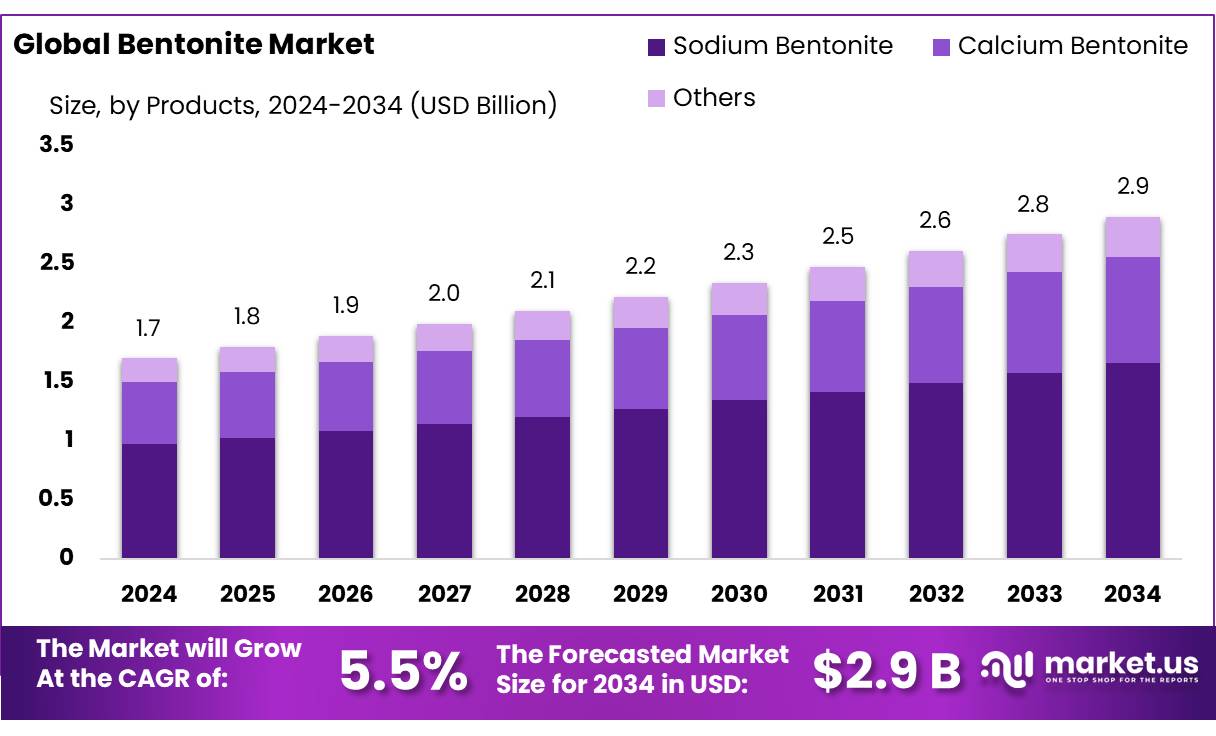

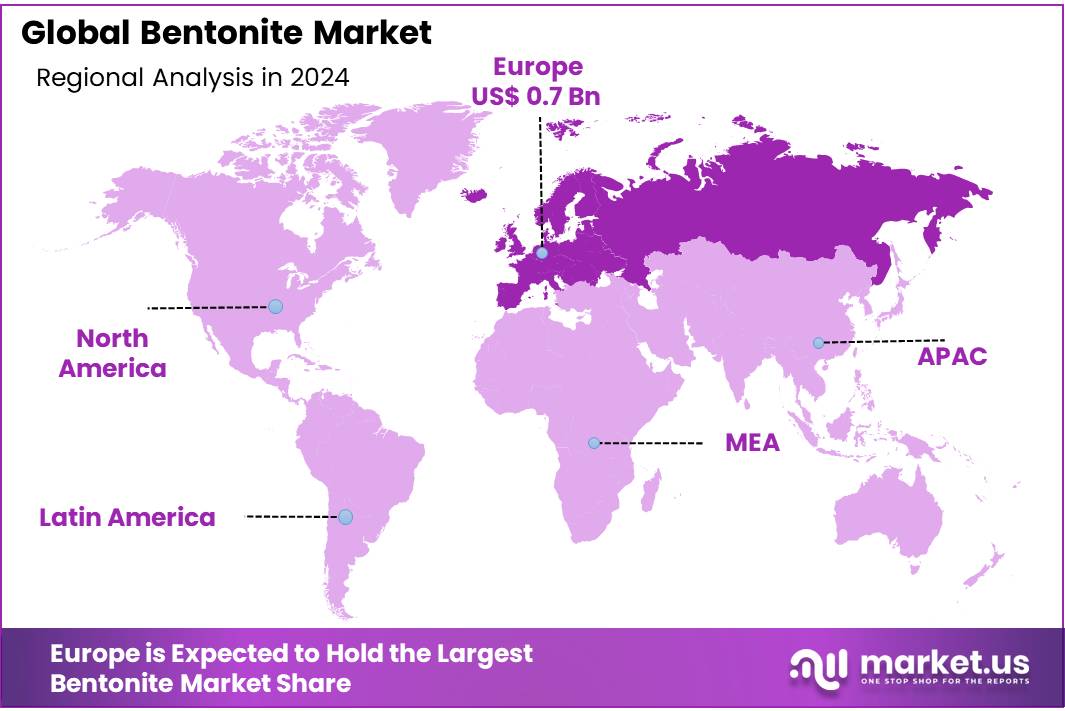

The Global Bentonite Market size is expected to be worth around USD 2.9 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 46.2% share, holding USD 0.7 Billion revenue.

Bentonite, a versatile clay primarily composed of montmorillonite, holds significant industrial value due to its unique properties such as high swelling capacity, water absorption, and thixotropic behavior. In India, bentonite is predominantly utilized in applications like drilling fluids, foundry sands, iron ore pelletizing, and civil engineering projects. The country is a major global producer, ranking third with an estimated production of 3 million tonnes annually, following the United States and China.

In the United States, total clays output was about 26 million tons valued at $1.7 billion in 2024; within this, bentonite’s principal domestic uses were ~48% absorbents and ~23% drilling mud. The U.S. exported an estimated 700,000 tons of bentonite in 2024, while the average unit value for bentonite was $99/metric ton ex-works. These data underscore a large, diversified base for bentonite concentrates across industrial value chains.

Macro demand signals are supportive. Iron-ore pelletizing remains a structural driver because bentonite is the standard inorganic binder in pellet plants. Global crude steel output in calendar 2024 reached ~1,884.6 Mt, a level that sustains pellet demand and, by extension, binder consumption in major steelmaking regions. In India—one of the fastest-growing pellet and steel hubs—the National Steel Policy (NSP-2017) targets 300 Mt crude steel capacity and 255 Mt production by 2030-31, implying multi-year tailwinds for pellet-grade bentonite supply chains serving domestic mines and integrated mills.

Energy activity cycles also shape drilling-grade bentonite needs. As of the week ending 15 Aug 2025, the U.S. rig count stood at 539; after declining ~20% in 2023 and 5% in 2024, activity stabilized in 2025, with EIA still forecasting higher U.S. oil and gas output. The Baker Hughes rig count is a leading indicator for drilling-fluid materials, so any sustained pickup—especially in North America and MENA—would lift demand for API-grade concentrates.

Key Takeaways

- Bentonite Market size is expected to be worth around USD 2.9 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 5.5%.

- Sodium Bentonite held a dominant market position, capturing more than a 57.3% share.

- Foundry Sands held a dominant market position, capturing more than a 29.2% share of the bentonite market.

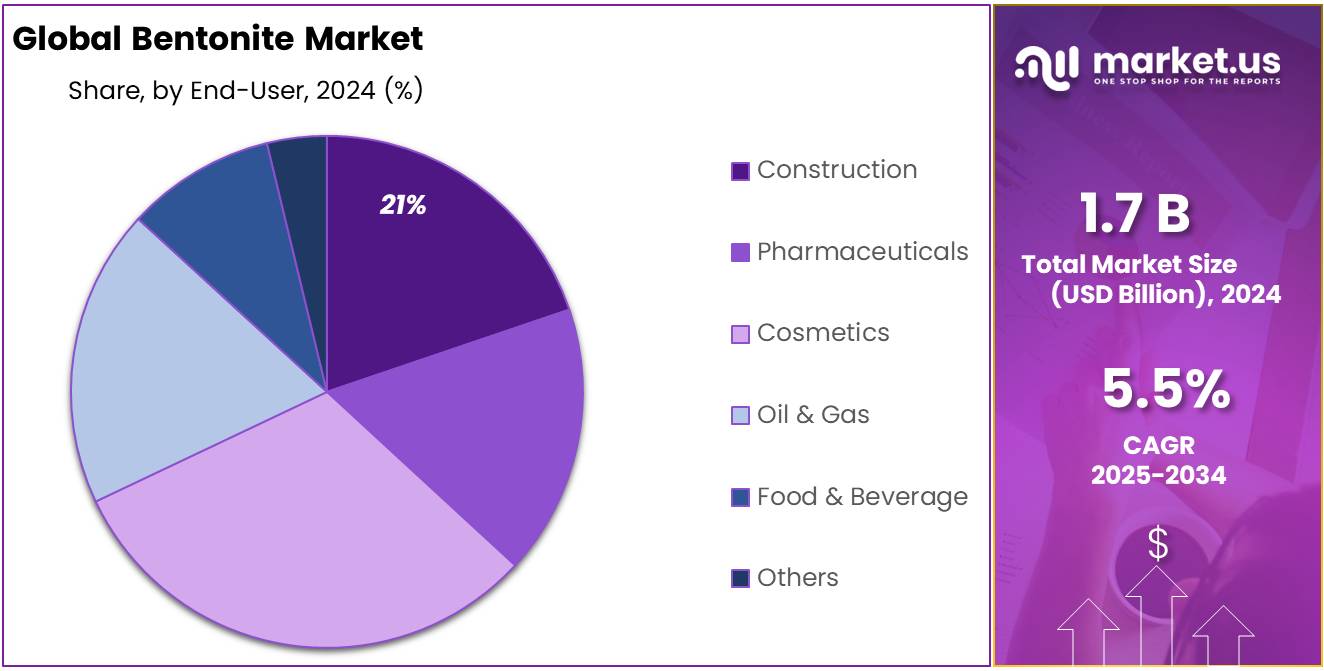

- Construction held a dominant market position, capturing more than a 21.6% share of the bentonite market.

- Europe emerged as the leading region in the global bentonite market, holding a dominant 46.2% share, valued at approximately USD 0.7 billion.

By Product Analysis

Sodium Bentonite leads with 57.3% share due to its versatile applications

In 2024, Sodium Bentonite held a dominant market position, capturing more than a 57.3% share. Its wide use in iron ore pelletizing, drilling fluids, absorbents, and environmental sealing has made it the most preferred product in the bentonite market. The year 2024 saw strong demand from steel production, where sodium bentonite is an essential binder for iron ore pellets, supporting global crude steel output of nearly 1,882 million metric tons. Additionally, drilling activity in oil and gas maintained steady consumption, as sodium bentonite remains a key component for mud systems due to its swelling and viscosity control properties.

Moving into 2025, demand for sodium bentonite continues to rise in emerging economies such as India and China, where infrastructure and steel expansion projects are increasing the requirement for pelletizing binders. In India, the National Steel Policy projects 255 million tons of crude steel production capacity by 2030, with significant progress already underway, ensuring higher usage of sodium bentonite in pellet plants. Environmental regulations in waste management and groundwater protection have further boosted its role in geosynthetic clay liners, where high-swelling sodium bentonite is mandated to ensure impermeability.

By Application Analysis

Foundry Sands dominates with 29.2% share driven by casting industry demand

In 2024, Foundry Sands held a dominant market position, capturing more than a 29.2% share of the bentonite market. The demand was primarily fueled by the global casting industry, where bentonite is widely used as a binding material in molding sands for producing iron, steel, and non-ferrous castings. With global crude steel production reaching around 1,882 million metric tons in 2024, the role of foundry sands became even more significant, as automotive, machinery, and construction sectors required precise and durable cast components.

In 2025, consumption is expected to remain steady, supported by strong growth in emerging economies where automotive manufacturing and heavy machinery production are expanding. Countries such as India and China continue to invest in infrastructure and vehicle production, ensuring higher casting output and, consequently, greater bentonite usage in foundry sands. Additionally, the increasing shift toward energy-efficient and lightweight automotive components requires advanced foundry processes, further driving the reliance on high-quality bentonite as a binder.

By End-Use Industry Analysis

Construction dominates with 21.6% share backed by infrastructure expansion

In 2024, Construction held a dominant market position, capturing more than a 21.6% share of the bentonite market. The segment’s strength comes from bentonite’s extensive use in civil engineering applications such as slurry walls, diaphragm walls, tunneling, and groundwater sealing. Rapid urbanization and large-scale infrastructure projects in Asia and the Middle East fueled this demand, as governments invested heavily in highways, metro rail systems, and smart city developments. Bentonite’s ability to provide strong sealing and stability in excavation work made it indispensable in foundation engineering.

By 2025, construction-led consumption of bentonite continues to grow, driven by ongoing infrastructure programs like India’s Smart Cities Mission and China’s Belt and Road Initiative, both of which rely on advanced tunneling and excavation technologies. Developed regions, including North America and Europe, are also witnessing steady demand through refurbishment of aging infrastructure and expansion of underground transit systems. In environmental construction, bentonite’s role in landfill liners and groundwater protection projects remains critical, aligning with stricter regulatory frameworks on waste management.

Key Market Segments

By Product

- Sodium Bentonite

- Calcium Bentonite

- Others

By Application

- Foundry Sands

- Cat Litter

- Iron Ore Pelletizing

- Refining

- Drilling Muds

- Absorbent/Adsorbent

- Binder

- Sealant

- Civil Engineering

- Others

By End-Use Industry

- Construction

- Pharmaceuticals

- Cosmetics

- Oil & Gas

- Food & Beverage

- Others

Emerging Trends

Technological Advancements in Food-Grade Bentonite Processing

A notable trend in the food-grade bentonite industry is the integration of advanced processing technologies to enhance product quality and functionality. These innovations are pivotal in meeting the growing consumer demand for natural and effective food additives.

Technological advancements play a crucial role in this growth trajectory. Modern processing techniques have significantly improved the efficiency and effectiveness of bentonite as a clarifying and binding agent. These innovations have led to its widespread adoption across various applications within the food and beverage sector.

The Asia-Pacific region, in particular, is witnessing substantial growth in the food-grade bentonite market, attributed to the burgeoning food and beverage industry in countries such as China and India. The increasing population, rising disposable incomes, and changing dietary preferences are propelling the demand for processed and convenience foods, thereby boosting the need for food-grade bentonite.

In India, the government’s initiatives to promote food processing under the Pradhan Mantri Kisan Sampada Yojana (PMKSY) are further accelerating this demand. The scheme aims to create modern infrastructure with efficient supply chain management from farm gate to retail outlet. Such developments are expected to increase the need for food-grade additives like bentonite, which are essential in ensuring the quality and safety of processed food products.

Moreover, the increasing consumer preference for natural and organic products is influencing the food industry’s approach to ingredient selection. As consumers become more health-conscious and environmentally aware, there is a growing demand for food products that are free from synthetic additives and preservatives. Bentonite, being a natural substance, aligns with this consumer preference, making it a favorable choice for food processors aiming to meet market demands.

Drivers

Growing Demand for Natural and Effective Clarifying Agents in the Food Industry

One of the primary drivers behind the increasing use of food-grade bentonite is the rising demand for natural and effective clarifying agents in the food industry. Bentonite, a naturally occurring clay mineral, has been utilized for centuries in various food processing applications due to its unique properties. Its ability to adsorb proteins and other impurities makes it an invaluable agent in the clarification process, particularly in winemaking and juice production.

In winemaking, bentonite is employed to remove excessive proteins that can cause haziness or cloudiness in the final product. This ensures that the wine maintains its clarity and aesthetic appeal, which is crucial for consumer acceptance. Similarly, in juice production, bentonite aids in clarifying the juice by removing suspended particles, thereby improving its visual quality and taste.

Government regulations and initiatives also play a crucial role in this trend. Regulatory bodies across various regions have established guidelines to ensure the safety and efficacy of food additives, including bentonite. For example, the European Food Safety Authority (EFSA) has evaluated the safety of bentonite as a feed additive, confirming its safety when used at recommended levels. Such regulatory support provides assurance to manufacturers and consumers alike, further promoting the use of bentonite in food applications.

Moreover, the increasing consumer preference for natural and organic products is influencing the food industry’s approach to ingredient selection. As consumers become more health-conscious and environmentally aware, there is a growing demand for food products that are free from synthetic additives and preservatives. Bentonite, being a natural substance, aligns with this consumer preference, making it a favorable choice for food processors aiming to meet market demands.

Restraints

Regulatory Compliance and Safety Standards

A significant challenge facing the food-grade bentonite industry is navigating the complex and stringent regulatory landscape across various regions. While bentonite is generally recognized as safe (GRAS) by regulatory bodies such as the U.S. Food and Drug Administration (FDA) when used as a processing aid in food applications, it must adhere to specific purity standards and usage limitations.

For instance, the FDA’s Code of Federal Regulations (CFR) Title 21, Section 184.1155, stipulates that bentonite should be used in food at levels not to exceed current good manufacturing practice, ensuring no significant residue remains in the final food product.

Similarly, the European Food Safety Authority (EFSA) has authorized the use of bentonite as an anti-caking agent in food without restriction, assuming it demonstrates similar properties when applied to feed or feed materials prone to caking. However, these regulations necessitate rigorous testing and certification processes, which can be resource-intensive for manufacturers.

Additionally, the global nature of the food industry means that manufacturers must comply with varying standards across different markets. For example, while bentonite may be permitted in certain food applications in the United States and Europe, other regions may have more restrictive regulations or may not permit its use at all. This disparity can create barriers to market entry and complicate international trade for producers of food-grade bentonite.

Furthermore, the increasing consumer demand for clean-label products has led to heightened scrutiny of all ingredients used in food processing, including bentonite. Consumers are increasingly seeking transparency regarding the ingredients in their food, prompting manufacturers to ensure that all additives, including bentonite, are not only safe but also perceived as natural and minimally processed. This trend necessitates that bentonite producers not only meet regulatory standards but also effectively communicate the safety and natural origins of their products to consumers.

Opportunity

Expansion in Emerging Markets and Clean-Label Trends

A significant growth opportunity for food-grade bentonite lies in its expanding applications within emerging markets and the increasing consumer demand for clean-label products. As global awareness of food safety and natural ingredients rises, bentonite’s role as a natural clarifying agent in beverages, edible oils, and as a food desiccant is gaining prominence. This trend is particularly evident in regions like Asia-Pacific, where rapid urbanization and evolving dietary preferences are driving the demand for processed and convenience foods.

For instance, the Asia-Pacific region is anticipated to witness substantial growth in the food-grade bentonite market, attributed to the burgeoning food and beverage industry in countries such as China and India. The increasing population, rising disposable incomes, and changing dietary preferences are propelling the demand for processed and convenience foods, thereby boosting the need for food-grade bentonite.

In India, the government’s initiatives to promote food processing under the Pradhan Mantri Kisan Sampada Yojana (PMKSY) are further accelerating this demand. The scheme aims to create modern infrastructure with efficient supply chain management from farm gate to retail outlet. Such developments are expected to increase the need for food-grade additives like bentonite, which are essential in ensuring the quality and safety of processed food products.

Regional Insights

Europe leads the bentonite market with 46.2% share valued at USD 0.7 billion

In 2024, Europe emerged as the leading region in the global bentonite market, holding a dominant 46.2% share, valued at approximately USD 0.7 billion. The region’s strong position is anchored by well-established industries such as foundry, construction, iron-ore pelletizing, and environmental engineering. Bentonite is a key raw material in the European casting sector, where Germany, Italy, and France serve as major production hubs for automotive and machinery castings.

According to the World Steel Association, the EU produced nearly 126 million metric tons of crude steel in 2024, reflecting the continuous role of bentonite in pelletizing and foundry applications. Beyond metallurgy, the region’s robust construction industry has further supported demand, with Eurostat reporting that construction output in the EU grew by 2.1% in 2024, driven by infrastructure upgrades and urban development projects.

Environmental regulations across Europe also play a crucial role in shaping bentonite usage. The EU Landfill Directive (1999/31/EC) mandates strict requirements for waste containment systems, and high-swelling sodium bentonite is widely used in geosynthetic clay liners for landfill sealing and groundwater protection. Countries like Germany, the Netherlands, and the Nordic states have implemented rigorous environmental standards, which directly stimulate steady bentonite demand in environmental construction.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Ashapura Group remained one of the largest global producers of bentonite, leveraging its vast reserves in Gujarat, India. The company supplies sodium and calcium bentonite to iron ore pelletizing, foundry, oil drilling, and construction industries. With exports to over 70 countries, Ashapura plays a key role in meeting Asia and Europe’s growing demand. Its integrated operations, from mining to processing, and focus on high-quality concentrates strengthen its leadership in supplying reliable bentonite solutions worldwide.

Bentonite Performance Minerals LLC, a subsidiary of Halliburton, is a major U.S.-based bentonite supplier, with strong expertise in drilling fluid applications. In 2024, the company expanded its role in energy exploration by delivering consistent, high-performance bentonite grades to oilfield operators. Beyond energy, it also serves foundry, civil engineering, and absorbent markets. With robust production facilities and a global distribution network, Benton Performance Minerals continues to position itself as a dependable source for specialized bentonite concentrates.

Clariant AG, headquartered in Switzerland, is a global specialty chemicals leader and a strong player in the bentonite market through its Functional Minerals division. In 2024, the company enhanced its bentonite-based solutions for foundry, purification, and construction applications. Its bentonite products, particularly for wastewater treatment and environmental sealing, are widely adopted in Europe and beyond. With a focus on sustainability and innovation, Clariant invests in R&D to deliver advanced bentonite solutions that meet stringent regulatory and industrial standards.

Top Key Players Outlook

- Ashapura Group

- Bentonite Performance Minerals LLC.

- Black Hills Bentonite, LLC

- Clariant AG

- Imerys

- Kunimine Industries Co. Ltd

- Minerals Technologies Inc.

- Pacific Bentonite Ltd.

- Wyo-Ben Inc.

- LKAB Minerals

Recent Industry Developments

In 2024, Bentonite Performance Minerals LLC (BPM) continued to stand out as a trusted U.S. producer of Wyoming sodium bentonite, operating two major mining and processing facilities—Lovell and Colony, Wyoming—with a combined output exceeding 1,000,000 tons annually.

In 2024, Clariant AG, amid a mixed macro landscape, Adsorbents & Additives sales dipped organically by 11% in local currency compared to the prior year.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Bn Forecast Revenue (2034) USD 2.9 Bn CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Sodium Bentonite, Calcium Bentonite, Others), By Application (Foundry Sands, Cat Litter, Iron Ore Pelletizing, Refining, Drilling Muds, Absorbent/Adsorbent, Binder, Sealant, Civil Engineering, Others), By End-Use Industry (Construction, Pharmaceuticals, Cosmetics, Oil and Gas, Food and Beverage, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ashapura Group, Bentonite Performance Minerals LLC., Black Hills Bentonite, LLC, Clariant AG, Imerys, Kunimine Industries Co. Ltd, Minerals Technologies Inc., Pacific Bentonite Ltd., Wyo-Ben Inc., LKAB Minerals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ashapura Group

- Bentonite Performance Minerals LLC.

- Black Hills Bentonite, LLC

- Clariant AG

- Imerys

- Kunimine Industries Co. Ltd

- Minerals Technologies Inc.

- Pacific Bentonite Ltd.

- Wyo-Ben Inc.

- LKAB Minerals