Global Beet Sugar Market Size, Share, And Enhanced Productivity By Nature(Organic, Conventional), By Product (White Beet Sugar, Brown Beet Sugar, Liquid Beet Sugar), By Form (Granulated Sugar, Powdered Sugar, Liquid Sugar), By Application (Dairy Products, Bakery Products, Beverages, Confectionery Products, Dietary Supplements, Snacks, Others), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177308

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

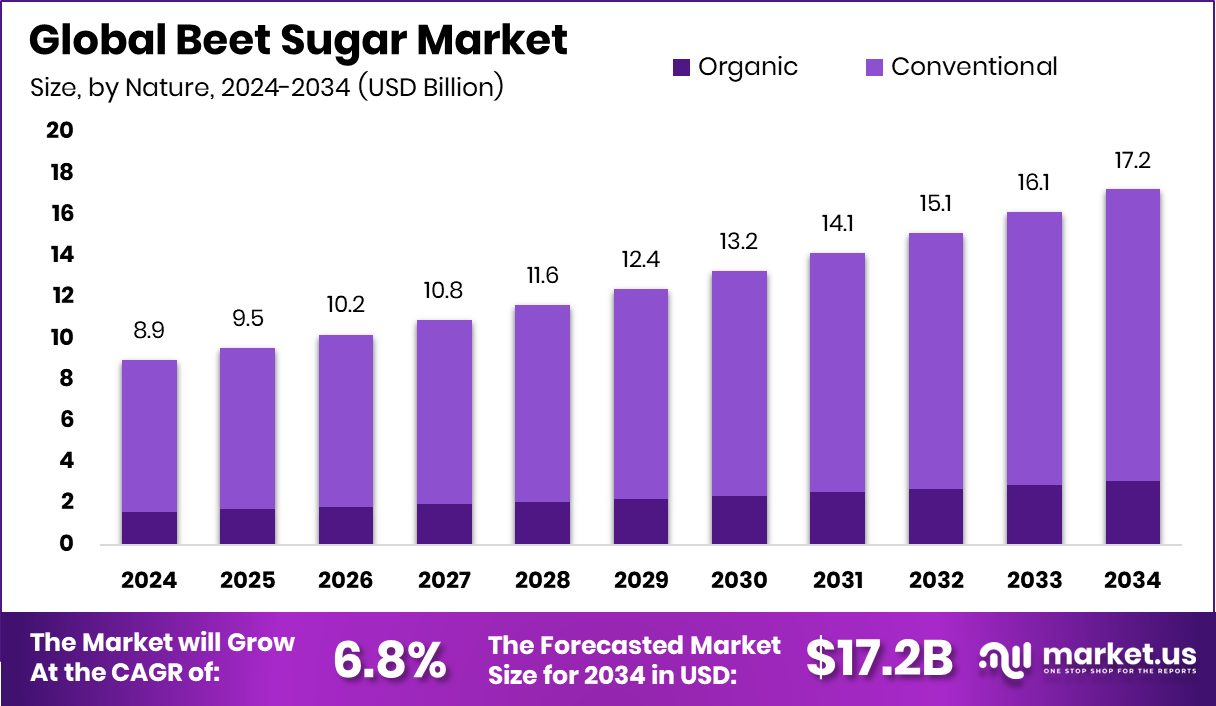

The Global Beet Sugar Market is expected to be worth around USD 17.2 billion by 2034, up from USD 8.9 billion in 2024, and is projected to grow at a CAGR of 6.8% from 2025 to 2034. Europe captured 47.1% market share in Beet Sugar, totaling USD 4.1 Bn.

Beet sugar is a natural sweetener extracted from sugar beet roots, valued for its clean taste, consistent crystallization, and suitability across food applications. It is produced through slicing, diffusion, purification, evaporation, and crystallization, resulting in forms such as granulated, powdered, brown, and liquid sugar. The Beet Sugar Market represents the full ecosystem of cultivation, processing, refining, and distribution of beet-derived sweeteners used in dairy, bakery, beverages, snacks, confectionery, and dietary products.

Growth in this market is supported by expanding food manufacturing needs and improving beet farming conditions. Programs like the USDA’s $285 million disaster aid for sugar beet farmers highlight efforts to stabilize production after climate-related disruptions. In addition, sustainability investments such as British Sugar’s £7.5 million carbon-reduction support reflect the sector’s shift toward cleaner operations.

Demand continues to rise as brands explore new formulations where beet sugar provides stable performance. Opportunities are reinforced by innovations in sweetening technologies and ingredient efficiency, demonstrated by Incredo’s $30 million funding round to scale next-generation sugar-reduction systems. Parallel developments, like NoMy’s €1.25 million for fungal protein alternatives and Wyoming’s $28 million biogas-from-beets initiative, show wider industrial interest in beet-based value chains. Expansion efforts, including a EUR 13 million Romanian capacity grant, further signal long-term potential in the beet-sugar ecosystem.

Key Takeaways

- The Global Beet Sugar Market is expected to be worth around USD 17.2 billion by 2034, up from USD 8.9 billion in 2024, and is projected to grow at a CAGR of 6.8% from 2025 to 2034.

- The Beet Sugar Market continues expanding as conventional products hold a strong 82.4% preference worldwide.

- White beet sugar dominates the Beet Sugar Market with a substantial 73.8% share in 2025.

- Granulated sugar leads the Beet Sugar Market, securing 56.2% due to its versatile industrial applications.

- Dairy products drive steady growth in the Beet Sugar Market, contributing 38.9% to overall demand.

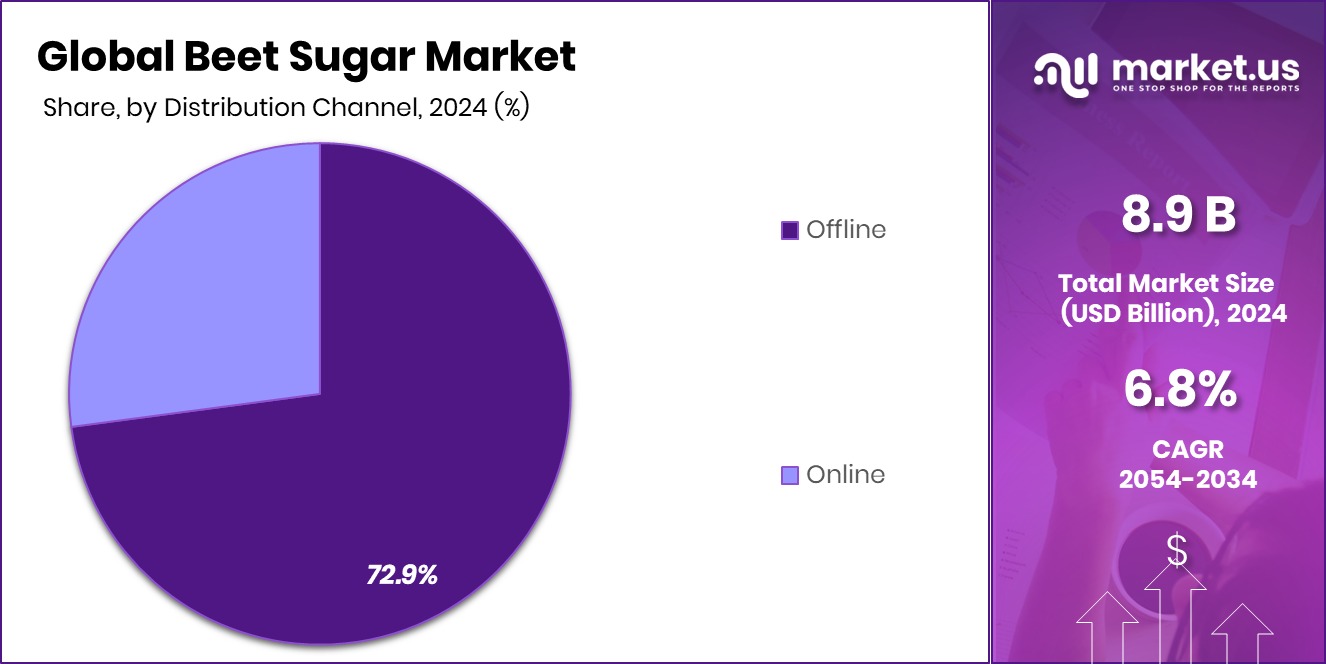

- Offline channels remain crucial in the Beet Sugar Market, maintaining 72.9% distribution dominance globally.

- The Beet Sugar Market in Europe achieved 47.1%, generating USD 4.1 Bn revenue.

By Nature Analysis

The Beet Sugar Market shows strong conventional dominance with 82.4% consumer preference globally.

In 2024, the Beet Sugar Market continued to strengthen its position as manufacturers leaned heavily toward conventional production, which dominated the segment with 82.4% share. This dominance reflected the wide availability of conventionally cultivated sugar beets, cost-effective farming processes, and long-established supply chains supporting bulk procurement for food processors.

Brands prioritized consistency, high extraction yields, and reliable quality, making conventional beet sugar the preferred choice for large-scale producers across bakery, confectionery, and dairy sectors. With rising global consumption, conventional variants remained central to price-sensitive markets where affordability and steady supply outweigh the premium shift toward organic alternatives. As consumer demand stabilizes, conventional beet sugar is expected to maintain its market influence through dependable performance.

By Product Analysis

White beet sugar leads the Beet Sugar Market, capturing a significant 73.8% product share.

In 2024, the Beet Sugar Market saw White Beet Sugar sustain its leadership, capturing a strong 73.8% share owing to its high purity, neutral flavor, and extensive suitability across processed food categories. Its refined taste profile made it essential for confectionery, bakery, and beverage manufacturers seeking consistent sweetness without altering product characteristics.

Foodservice operators also favored white beet sugar for its dissolvability, shelf stability, and compatibility with hot and cold formulations. Supported by efficient refining technologies and continuous expansion of beet-processing facilities, white beet sugar remained the most traded product type globally. Its dominance further reflects the market’s preference for standardized, premium-grade sugar that offers both versatility and scalable production advantages.

By Form Analysis

Granulated sugar remains essential in the Beet Sugar Market with 56.2% demand strength.

In 2024, the Beet Sugar Market recorded strong demand for granulated sugar, which remained the top-performing form with a 56.2% share due to its ease of handling and broad application across household and industrial users. Granulated beet sugar’s free-flowing texture and high solubility made it suitable for packaged foods, beverages, baked goods, and everyday consumer use.

Manufacturers benefited from its stability during storage and transport, reducing production losses. Retail channels also saw consistent adoption as granulated sugar is widely preferred for home cooking. This form’s adaptability across large-scale and small-scale consumption patterns ensured its continued market relevance, positioning it as a dependable ingredient that supports both value-driven and specialty product segments.

By Application Analysis

Dairy products drive steady growth within the Beet Sugar Market, holding 38.9% usage share.

In 2024, the Beet Sugar Market witnessed growing utilization within the dairy segment, which held a notable 38.9% share due to expanding demand for sweetened dairy categories. Beet sugar played a crucial role in flavored milk, ice cream, yogurt, milk-based beverages, and condensed dairy formulations, providing balanced sweetness and texture enhancement. Dairy brands increasingly preferred beet sugar for its natural origin and consistent performance in heat-processed products.

As consumer interest in indulgent and value-added dairy continued to rise, manufacturers incorporated beet sugar to improve mouthfeel and flavor stability. This application segment also benefited from product innovation, especially in children’s dairy snacks, premium desserts, and ready-to-drink dairy beverages.

By Distribution Channel Analysis

Offline channels continue leading Beet Sugar Market purchases, maintaining a solid 72.9% share.

In 2024, the Beet Sugar Market continued to rely heavily on offline distribution, which dominated with 72.9% share, thanks to the strong presence of supermarkets, hypermarkets, wholesalers, and local retail networks. Bulk purchasing by food manufacturers and bakery chains further strengthened offline sales channels. Traditional retail formats remained vital in emerging markets where physical stores drive most household sugar purchases.

Offline trade also benefits from consumer trust, easy accessibility, and the ability to compare product quality in person. With stable supply chains supporting large shipments of beet sugar for industrial buyers, offline channels continued to capture major market activity despite the rising influence of e-commerce.

Key Market Segments

By Nature

- Organic

- Conventional

By Product

- White Beet Sugar

- Brown Beet Sugar

- Liquid Beet Sugar

By Form

- Granulated Sugar

- Powdered Sugar

- Liquid Sugar

By Application

- Dairy Products

- Bakery Products

- Beverages

- Confectionery Products

- Dietary Supplements

- Snacks

- Others

By Distribution Channel

- Offline

- Online

Driving Factors

Rising demand for natural sweetener alternatives

The Beet Sugar Market continues to grow as consumers and manufacturers steadily shift toward natural sweetener alternatives that provide clean taste and dependable performance. Beet sugar fits well into this movement because it offers a recognizable ingredient profile and works across dairy, bakery, snacks, and beverage categories. The sector’s momentum is also supported by broader activity in better-for-you foods.

For example, David closes $75M funding round, reflecting rising investor confidence in health-aligned food brands. Additionally, the company’s flagship bar, containing 28 g of protein, launched in September 2024, mirroring the rising preference for ingredient transparency. These developments indirectly reinforce the pull toward natural sugars like beet sugar as brands revisit formulation strategies.

Restraining Factors

Production costs increase operational market pressure

Despite healthy demand, the Beet Sugar Market faces pressure from rising production costs that influence farming, processing, and distribution cycles. Energy use, labor availability, and agricultural inputs all continue to affect cost structures, making it challenging for producers to maintain steady pricing. Broader activity across the confectionery and plant-based sweets sector also highlights financial stress points.

For instance, Vegan Sweets TREASURE IN STOMACH accelerates global expansion with ¥50 million funding, showing increasing capital needs in sweets manufacturing. Similarly, Canada’s Awake Chocolate celebrates securing $8 million in funding, underscoring how companies must strengthen financial resilience to manage operational pressures. These examples mirror the overall environment where cost control becomes a key limitation for beet sugar producers.

Growth Opportunity

Growing potential in sustainable sugar processing

Sustainable processing is emerging as a meaningful opportunity for the Beet Sugar Market as customers and retailers prioritize lower-impact ingredients. Beet sugar already benefits from efficient agricultural cycles, and companies are exploring cleaner refining and energy-saving technologies. Broader food-sector investments also highlight rising interest in responsible production. Doughlicious gains $5 million funding boost to enhance its range, signaling market alignment with sustainability-driven innovation.

Likewise, Awake Chocolate secures $5.8 million investment, indicating strengthening financial interest in upgraded manufacturing and ingredient handling. These developments support a wider shift toward responsible sourcing, creating space for beet sugar processors to modernize facilities, reduce emissions, and market their products as part of a cleaner value chain.

Latest Trends

Rapid shift toward low-carbon production

A prominent trend shaping the Beet Sugar Market is the move toward lower-carbon and cleaner production pathways. Manufacturers are evaluating opportunities to reduce emissions during beet cultivation, processing, and refining while aligning with global sustainability expectations. Broader industry activity also shows how food categories are embracing low-carbon transitions.

For example, Planet A Foods raises $30M to scale a cocoa-free chocolate alternative, achieving an 80% lower carbon footprint, demonstrating how ingredient producers are being pushed toward greener operations. These kinds of innovations encourage beet sugar processors to integrate renewable energy, optimize heat recovery, and adopt low-impact logistics. As sustainability becomes essential rather than optional, low-carbon output is emerging as a central trend in beet sugar supply chains.

Regional Analysis

Europe leads the beet sugar market with 47.1%, reaching a USD 4.1 Bn valuation.

In 2024, the beet sugar market showed strong regional variations, with Europe emerging as the leading region, holding a dominant 47.1% share valued at USD 4.1 Bn, supported by established processing facilities and consistently high beet cultivation volumes. In North America, market growth remained steady as food and beverage manufacturers continued relying on beet-derived sweeteners to meet large-scale production needs across packaged foods.

The Asia-Pacific region experienced rising demand fueled by expanding consumption in bakery, confectionery, and dairy categories, although limited beet crop availability kept its growth moderate compared to Europe. Meanwhile, the Middle East and Africa showed gradual adoption, primarily driven by imports to meet demand in urban markets where sugar consumption continues to rise.

In Latin America, the market benefited from stable demand across household and industrial users, supported by ongoing utilization of beet sugar in processed food categories. Overall, Europe maintained a clear lead due to its strong production base and well-established supply chains.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Südzucker AG continued leveraging its strong beet-processing network, enabling the company to maintain dependable output across European markets. The company’s structured approach toward refining efficiency and product consistency helped safeguard its position as a major supplier to food and beverage manufacturers that prioritize predictable quality.

Nordzucker AG sustained its competitiveness through disciplined production management, emphasizing stable sourcing and efficient utilization of raw beet volumes. Its integrated operations supported steady supply commitments across regional buyers, particularly those requiring uniform granulated and industrial-grade sugar. The company’s focus on operational balance allowed it to respond effectively to shifting customer requirements.

Meanwhile, Associated British Foods plc strengthened its role in the beet sugar landscape through its established refining capabilities and broad customer access. The company’s diversified product offerings and consistent supply chain performance supported its engagement with both retail channels and industrial users. Together, these companies shaped the market’s operational stability in 2024 through disciplined production, reliable distribution, and strong alignment with core demand segments.

Top Key Players in the Market

- Südzucker AG

- Nordzucker AG

- Associated British Foods plc

- Tereos Group

- Cosun Beet Company

- American Crystal Sugar Company

- Amalgamated Sugar Company

- Western Sugar Cooperative

- Southern Minnesota Beet Sugar Cooperative

- COFCO International

Recent Developments

- In September 2025, Nordzucker started its 2025/26 sugar beet processing campaign at European factories, preparing to process beet through mid-January 2026. This step is key for annual beet-to-sugar production cycles.

- In December 2024, Südzucker began producing BeetKraft®, an innovative high-quality fibre made from sugar beet co-products at its Offstein plant in southern Germany. This material is designed as a substitute for wood pulp in paper and packaging, allowing paper producers to replace up to 40% of traditional fibres while improving stability and reducing packaging weight. Production at demonstration scale and trials in industrial paper applications confirmed its suitability for kraft paper and cardboard packaging. This marks an important diversification beyond conventional beet sugar production.

Report Scope

Report Features Description Market Value (2024) USD 8.9 Billion Forecast Revenue (2034) USD 17.2 Billion CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature(Organic, Conventional), By Product (White Beet Sugar, Brown Beet Sugar, Liquid Beet Sugar), By Form (Granulated Sugar, Powdered Sugar, Liquid Sugar), By Application (Dairy Products, Bakery Products, Beverages, Confectionery Products, Dietary Supplements, Snacks, Others), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Südzucker AG, Nordzucker AG, Associated British Foods plc, Tereos Group, Cosun Beet Company, American Crystal Sugar Company, Amalgamated Sugar Company, Western Sugar Cooperative, Southern Minnesota Beet Sugar Cooperative, COFCO International Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Südzucker AG

- Nordzucker AG

- Associated British Foods plc

- Tereos Group

- Cosun Beet Company

- American Crystal Sugar Company

- Amalgamated Sugar Company

- Western Sugar Cooperative

- Southern Minnesota Beet Sugar Cooperative

- COFCO International