Global Battery Systems for Electric Vehicle Market Size, Share Analysis Report By Battery Type, Lithium-Ion, Nickel-Metal-Hydride, Lead-Acid, Ultracapacitors, Solid-State, Others, By Battery Chemistry, NMC, NCA, LFP, LMO, Sodium-Ion & Emerging, By Vehicle Type, Passenger Cars, Commercial Vehicles, By Propulsion Technology, Battery Electric Vehicle (BEV), Plug-In Hybrid Electric Vehicle (PHEV), Hybrid Electric Vehicle (HEV), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165177

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

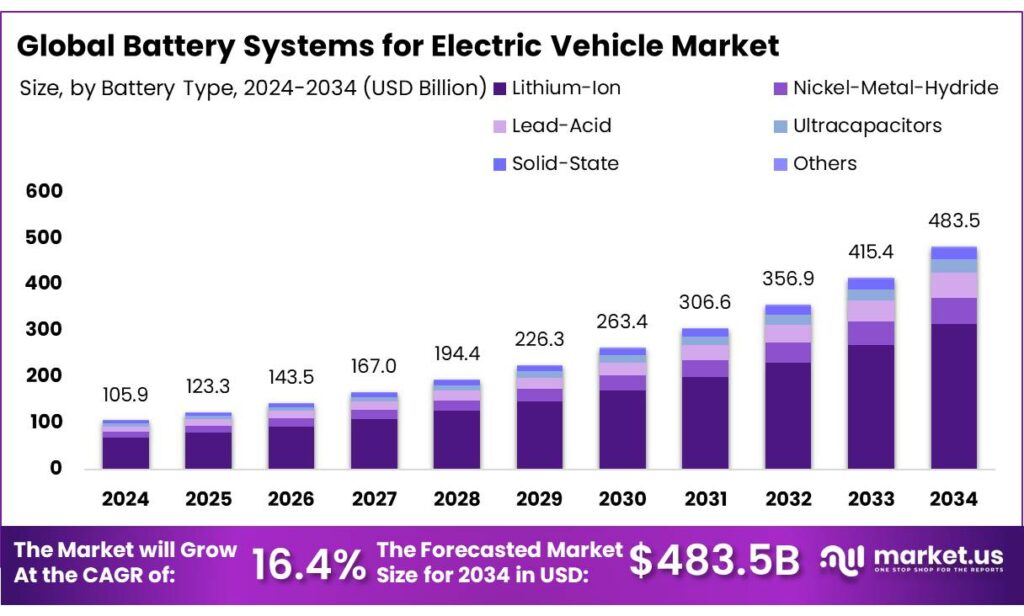

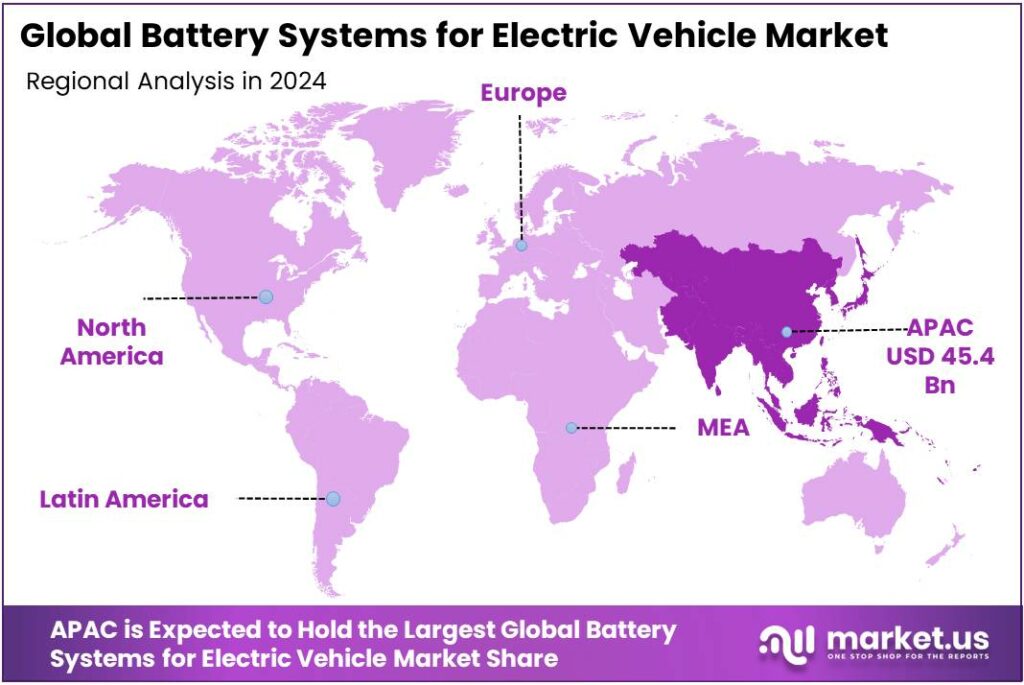

The Global Battery Systems for Electric Vehicle Market size is expected to be worth around USD 483.5 Billion by 2034, from USD 105.9 Billion in 2024, growing at a CAGR of 16.4% during the forecast period from 2025 to 2034. In 2024 Asia–Pacific held a dominant market position, capturing more than a 42.9% share, holding USD 45.4 Billion in revenue.

Battery systems for electric vehicles (EVs) have moved from niche to core industrial infrastructure, underpinned by rapid scale-up across chemistries (notably LFP and NMC), manufacturing capacity, and charging networks. In 2024, global electric-car sales topped 17 million, up more than 25% year-on-year—solid evidence that battery supply chains are meeting demand while costs fall.

The industrial landscape is defined by fast-expanding production and infrastructure. Battery manufacturing capacity additions in 2023 lifted global capacity to ~2.5 TWh, with 780 GWh added in a single year—more than 25% higher additions than in 2022—signaling deepening gigafactory pipelines and tooling maturity.

Public charging is scaling in parallel: over 1.3 million public charging points were added in 2024 alone, with China now hosting ~65% of public chargers and ~60% of the global electric light-duty vehicle stock—critical for utilization and consumer confidence. Average lithium-ion pack prices fell 20% in 2024 to a record low of US$115/kWh as overcapacity, raw-material deflation, and LFP adoption filtered through procurement, supporting more affordable models and commercial electrification.

Demand fundamentals remain strong and increasingly diversified across modes. EV battery demand was ~1 TWh in 2024 and is expected to exceed 3 TWh by 2030 in the IEA STEPS, aided by rising contributions from electric trucks. Regionally, 2024 battery demand grew by >30% in China and ~20% in the United States, while the European Union was flat—highlighting how policy, model availability, and vehicle size (the U.S. features ~25% larger batteries per EV) shape cell offtake.

Policy remains a decisive driver. In the United States, announced “Investing in America” commitments reached US$898 billion by mid-2024, including US$177 billion earmarked for EVs and batteries—anchoring upstream materials, cell lines, and pack assembly in new regional hubs. In the European Union, the Batteries Regulation (EU) 2023/1542—effective from February 2024—introduces lifecycle rules and sets collection and recovery benchmarks, tightening sustainability and recycling economics for EV batteries.

Key Takeaways

- Battery Systems for Electric Vehicle Market size is expected to be worth around USD 483.5 Billion by 2034, from USD 105.9 Billion in 2024, growing at a CAGR of 16.4%.

- Static Battery Systems for Lithium-Ion held a dominant market position, capturing more than a 65.0% share in the global battery systems for electric vehicles market.

- NMC (Nickel Manganese Cobalt) held a dominant market position, capturing more than a 39.1% share in the global battery systems for electric vehicles market.

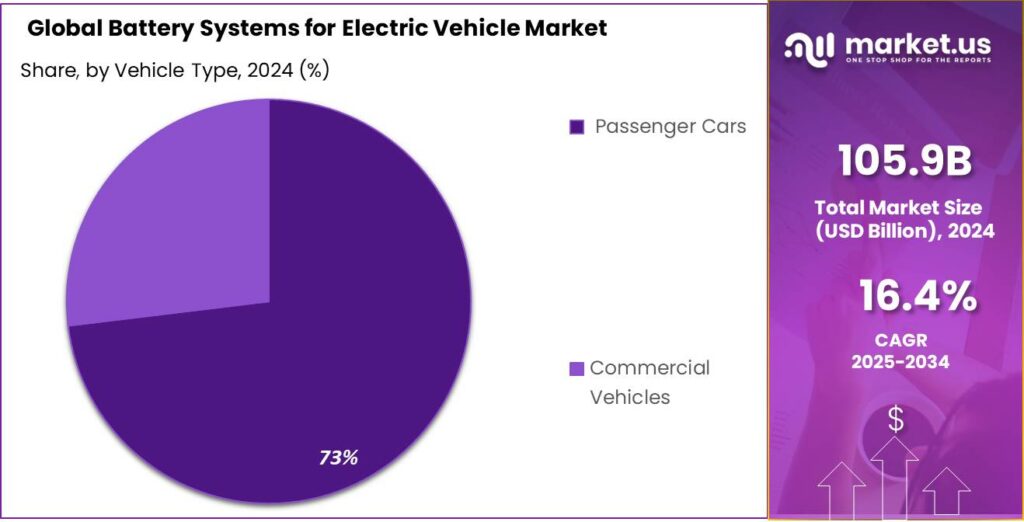

- Passenger Cars held a dominant market position, capturing more than a 73.3% share in the global battery systems for electric vehicles market.

- Battery Electric Vehicle (BEV) held a dominant market position, capturing more than a 66.2% share in the global battery systems for electric vehicles market.

- Asia–Pacific region has firmly established itself as the dominant force in the battery systems market for electric vehicles, with a market share of about 42.9% and a market value of roughly USD 45.4 billion.

By Battery Type Analysis

Lithium-Ion Batteries dominate with 65.0% share due to their high energy efficiency and reliability

In 2024, Static Battery Systems for Lithium-Ion held a dominant market position, capturing more than a 65.0% share in the global battery systems for electric vehicles market. The dominance of lithium-ion technology has been primarily driven by its superior energy density, lightweight design, and long lifecycle compared to alternative chemistries. These attributes make it the preferred choice for electric vehicle manufacturers seeking higher driving ranges and faster charging performance.

By 2025, the demand for lithium-ion battery systems is projected to rise further as electric vehicle adoption accelerates globally under supportive government initiatives promoting zero-emission transport. The improvement in battery recycling infrastructure and advancements in solid-state and lithium iron phosphate (LFP) variants are expected to strengthen the segment’s growth trajectory. Moreover, increased R&D spending by leading OEMs is supporting the development of next-generation lithium-ion batteries with higher thermal stability and extended lifespan.

By Battery Chemistry Analysis

NMC Batteries lead with 39.1% share driven by their high energy density and long cycle life

In 2024, NMC (Nickel Manganese Cobalt) held a dominant market position, capturing more than a 39.1% share in the global battery systems for electric vehicles market. The strong performance of NMC batteries can be attributed to their balanced chemistry that combines high energy density, strong thermal stability, and long cycle life, making them highly suitable for both passenger and premium electric vehicles.

By 2025, the NMC segment is expected to witness sustained demand as major EV manufacturers continue to prefer this chemistry for long-range models and high-performance applications. Continuous innovations aimed at reducing cobalt content, improving recyclability, and lowering production costs are reinforcing NMC’s position in the market. Additionally, partnerships between cell manufacturers and automotive companies are ensuring stable supply chains and technological improvements in cathode composition.

By Vehicle Type Analysis

Passenger Cars dominate with 73.3% share driven by rising consumer adoption and mass electrification initiatives

In 2024, Passenger Cars held a dominant market position, capturing more than a 73.3% share in the global battery systems for electric vehicles market. The growth in this segment has been primarily driven by increasing consumer preference for electric mobility, supported by falling battery costs and expanding charging infrastructure. Major automakers have accelerated production of electric passenger models to meet stricter emission regulations and achieve sustainability targets, resulting in a significant rise in battery demand.

By 2025, the passenger car segment is expected to maintain its lead as governments worldwide continue to introduce purchase incentives, tax rebates, and zero-emission mandates to promote electric vehicle ownership. Advancements in lithium-ion and NMC battery technologies are enhancing vehicle performance, driving range, and safety—factors that continue to attract mainstream buyers.

By Propulsion Technology Analysis

Battery Electric Vehicles (BEVs) dominate with 66.2% share due to strong policy support and advancing battery efficiency

In 2024, Battery Electric Vehicle (BEV) held a dominant market position, capturing more than a 66.2% share in the global battery systems for electric vehicles market. This leadership is largely driven by the accelerating shift toward zero-emission mobility and the rapid scaling of battery manufacturing capabilities worldwide. BEVs, powered solely by battery systems without internal combustion engines, have gained substantial traction as automakers focus on full electrification strategies to comply with tightening emission norms.

By 2025, the BEV segment is projected to sustain its dominance as governments intensify efforts to phase out fossil-fuel vehicles through subsidies, stricter emission regulations, and expanded charging infrastructure. Continuous advancements in lithium-ion and solid-state battery technologies are expected to further improve performance and reduce total cost of ownership. Moreover, rising investment in renewable power generation and grid integration is strengthening the ecosystem that supports BEV adoption.

Key Market Segments

By Battery Type

- Lithium-Ion

- Nickel-Metal-Hydride

- Lead-Acid

- Ultracapacitors

- Solid-State

- Others

By Battery Chemistry

- NMC

- NCA

- LFP

- LMO

- Sodium-Ion & Emerging

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Propulsion Technology

- Battery Electric Vehicle (BEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

Emerging Trends

LFP dominance and 800-V fast-charging are reshaping EV battery systems

A clear, near-term trend in EV battery systems is the rapid shift to lithium-iron-phosphate (LFP) chemistries coupled with 800-volt fast-charging architectures. LFP has moved from niche to mainstream because it is cheaper, cobalt-free, and more tolerant of frequent fast charging. The International Energy Agency reports LFP supplied >40% of global EV battery demand in 2023, more than double its 2020 share. In China, about two-thirds of EV sales used LFP in 2023, while LFP’s share in the United States and Europe was below 10%, suggesting significant room to grow as cost pressure intensifies.

Cost signals reinforce this pivot. The U.S. Department of Energy estimates the average light-duty lithium-ion pack cost fell 90% between 2008 and 2023, reaching US$139/kWh in 2023. Lower pack costs make 800-V platforms more viable for mass-market segments because OEMs can reallocate savings to power electronics, thermal systems, and robust pack designs that withstand repeated high-C-rate charging without excessive degradation.

Fast-charging infrastructure is scaling at the same time, creating a positive feedback loop. The IEA notes that >1.3 million public charging points were added in 2024, a >30% increase year-on-year; since 2020, roughly two-thirds of all new public chargers have been installed in China, which now hosts ~65% of public chargers and ~60% of the global electric light-duty vehicle stock.

Looking back to 2023, the public charging stock grew >40% and fast chargers grew 55%, lifting fast chargers to >35% of the public network. A denser, faster network shortens charging stops, lets carmakers right-size battery packs, and improves total cost of ownership—especially for LFP vehicles whose chemistries pair well with frequent DC fast charging.

Drivers

Government policy is the flywheel for EV battery systems

The single biggest driver of battery systems for electric vehicles is government policy—in plain terms, clear rules and real money that reduce risk for investors and unlock scale. You can see this in sales momentum: nearly one in five cars sold worldwide in 2023 was electric, with about 14 million units delivered, a surge concentrated in China, Europe, and the United States. Those volumes give cell makers confidence to add capacity, while policymakers use targets, tax credits, and local-content rules to keep the flywheel spinning.

Policy lowers costs directly and indirectly. In the United States, the Department of Energy estimates the average light-duty lithium-ion pack cost fell by 90% since 2008, reaching about $139/kWh in 2023. That decline sits on years of public R&D and manufacturing grants, and it pushes EVs closer to purchase-price parity with combustion cars. DOE-supported work also anchors forward cost goals that industry can plan around. Lower pack costs make every policy dollar go further—each charging station or fleet incentive moves more metal.

- Policy also de-risks supply chains. Europe’s Critical Raw Materials Act sets explicit 2030 benchmarks: at least 10% extraction, 40% processing, and 25% recycling of the EU’s annual needs inside the bloc, with no more than 65% sourced from any single third country at any stage. These numbers matter for batteries because cathodes, anodes, and electrolytes rely on lithium, nickel, cobalt, graphite, and manganese. By forcing diversification and recycling scale, the EU reduces volatility for gigafactories and helps ensure that new chemistries—like high-manganese or LFP variants—have secure feedstocks.

Finally, policy sets credible long-run demand signals that justify multibillion-dollar cathode, anode, and recycling projects. The IEA projects EV battery demand to more than triple to >3 TWh by 2030 under stated policies, up from roughly 1 TWh in 2024—exactly the kind of trajectory investors need to finance precursor plants, materials refineries, and closed-loop recycling. With EV charging additions running at >1.3 million points in 2024, the enabling infrastructure is keeping pace, which further strengthens the investment case for high-volume, lower-cost battery systems.

Restraints

Raw material supply-chain risks act as a major brake on EV battery systems

To start, the component materials for lithium-ion battery packs aren’t spread out evenly around the world. According to a recent study, over 60% of the world’s cobalt comes from Democratic Republic of the Congo (DRC). That means any disruption—whether from labour unrest, regulatory change, export restrictions or shifting global alliances—can ripple through to battery cell makers and automakers. When one small region holds a large share of a critical metal, the risk of interruption or cost jump becomes real.

Cost volatility is another piece of the puzzle. For example, the contained value of nickel in a typical EV battery rose to about US$207 and lithium to around US$209 in early 2024, while cobalt also spiked with a month-on-month 58% jump in one case. Even if costs later fall, the fact that such swings happen means that battery pack makers and OEMs must build bigger buffers, carry more risk, or accept lower margins. That uncertainty can slow investment, delay new factory builds, or discourage automakers from committing to larger volumes.

In parallel, an analysis by the International Energy Agency (IEA) noted that in 2023 supply of cobalt exceeded demand by 6.5% and nickel by 8%, while lithium supply was more than 10% ahead of demand. While that might sound reassuring, the point is the margin is thin when you consider projected growth and the need for processing/refining capacity, not just mined tonnage. A slight hiccup in one link of the chain—a mine, a refinery, a logistic route—could swing things the other way.

Another less-discussed angle is sustainability and circular-economy risk. Battery systems rely on mining, refining, and then (eventually) recycling of materials like cobalt, nickel, lithium and graphite. The fact that many mines are in jurisdictions with weaker labour or environmental safeguards creates reputational and regulatory risks. A disruption based on a labour strike, a policy clamp-down, or export surprise can be as disruptive as a supply shortage.

- For instance, one piece of research estimates that if key material supply chains are constrained, up to 59.54 million tons of avoided CO₂-equivalent emissions could be “lost” because EV adoption gets delayed.

Opportunity

Circularity—second-life and recycling—unlocks the next battery growth wave

A powerful growth opportunity for EV battery systems is circularity: repurposing traction batteries for second-life stationary storage and scaling industrial recycling to recover critical materials. The prize is large and near-term. The IEA expects EV battery demand to top 3 TWh in 2030 (≈3× over 2024), guaranteeing a rising flow of end-of-first-life packs suitable for reuse or materials recovery—an input stream that will feed new business models in logistics, testing, refurbishment, and software.

Second-life batteries can provide cost-effective flexibility for buildings and grids, supporting peak-shaving, solar self-consumption, and backup. Independent assessments show this is no niche: industry analysis compiled by the Energy Institute cites ~185.5 GWh/year of used EV batteries by 2025, creating a meaningful reservoir for reuse before recycling. Academic studies also find second-life use can extend battery service by 3–5 years while delivering consumer savings—evidence that practical deployments can scale.

Policy tailwinds are strong and explicit. Europe’s Critical Raw Materials Act hardwires demand for recycled content and diversified supply by 2030: at least 10% extraction, 40% processing, and 25% recycling within the EU, with no more than 65% of any strategic raw material coming from a single third country. These quantified targets translate into long-term contracts for recyclers, predictable feedstock for cathode and anode makers, and confidence for financiers underwriting circular-economy plants.

The United States is funding the midstream, which directly benefits circular supply. Under its battery manufacturing and recycling programs, the Department of Energy has awarded $1.82 billion across 14 projects to expand materials processing, component manufacturing, and recycling at commercial scale; an additional $3 billion grant program targets battery-materials processing capacity. These dollars catalyze local feedstock hubs where end-of-life EV packs can be dismantled and looped back into cathode precursors, graphite anodes, and electrolytes.

Regional Insights

Asia Pacific leads with a 42.9% share and approximately USD 45.4 billion market value in electric vehicle battery systems

The Asia–Pacific region has firmly established itself as the dominant force in the battery systems market for electric vehicles, with a market share of about 42.9% and a market value of roughly USD 45.4 billion in the most recent year. This leadership reflects the region’s strong manufacturing base, high domestic EV adoption, and coordinated government policy support across key markets such as China, Japan, South Korea and India. In particular, China’s considerable scale in battery-cell production and its growing export presence continue to underpin Asia-Pacific’s dominance.

Growth in this region is being driven by several interlinked factors: expansive gigafactory builds, plentiful incentives for EV purchases and battery manufacturing, and a mature supply chain for critical materials. Furthermore, nations within the region are increasingly emphasizing localisation of cell production and battery recycling to reduce dependence on imports and strengthen supply-chain resilience. The resulting economies of scale have enabled cost reductions in battery pack pricing, which in turn support higher volume EV launches in the region.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Tesla, Inc.: Tesla designs and integrates its own battery packs and cells (including 4680 and LFP formats) alongside its vehicle manufacturing. According to a Wikipedia summary, in 2024 Tesla delivered 1,773,443 vehicles and deployed 31.4 GWh of battery energy storage systems. The company is vertically integrated—batteries, vehicles, energy products—and aims to reduce cost per kWh and boost range. It relies on strategic suppliers and internal development to scale globally.

Panasonic Corporation: Panasonic Energy, a unit of Panasonic, supplies cylindrical lithium-ion battery cells for automotive use and has scaled to serve major EV makers. Its global network spans Japan, North America and China, and it reported delivering about 19 billion cells (powering ~3.7 million EVs) by March 2025. The company focuses on high volume, safety, and partnering with automakers in a cost-competitive supply chain.

BYD Company Limited: BYD began as a battery maker and now builds both EVs and its own cells (via its subsidiary FinDreams Battery). It captured ~15.8 % global EV battery production in 2023, ranking second behind CATL. BYD’s “Blade” LFP battery is noted for safety and cost competitiveness. The vertical model—cells, modules, vehicles—gives BYD control of margins and supply.

Top Key Players Outlook

- Tesla, Inc.

- Panasonic Corporation

- LG Chem Ltd.

- BYD Company Limited

- Contemporary Amperex Technology Co., Limited (CATL)

- Samsung SDI Co., Ltd.

- SK Innovation Co., Ltd.

- A123 Systems LLC

- Johnson Controls International plc

- GS Yuasa Corporation

Recent Industry Developments

In 2024, BYD Company Limited made significant strides in the electric vehicle battery systems arena, with its “Blade Battery” installations nearing 200 GWh for the year, underlining the scale of its manufacturing reach.

In 2024, Samsung SDI reported full-year sales of approximately 16.59 trillion won, down 22.6% year-on-year, while net income fell to 575.5 billion won, a drop of 72.1% compared with the prior year.

Report Scope

Report Features Description Market Value (2024) USD 105.9 Bn Forecast Revenue (2034) USD 483.5 Bn CAGR (2025-2034) 16.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Battery Type, Lithium-Ion, Nickel-Metal-Hydride, Lead-Acid, Ultracapacitors, Solid-State, Others, By Battery Chemistry, NMC, NCA, LFP, LMO, Sodium-Ion & Emerging, By Vehicle Type, Passenger Cars, Commercial Vehicles, By Propulsion Technology, Battery Electric Vehicle (BEV), Plug-In Hybrid Electric Vehicle (PHEV), Hybrid Electric Vehicle (HEV) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Tesla, Inc., Panasonic Corporation, LG Chem Ltd., BYD Company Limited, Contemporary Amperex Technology Co., Limited (CATL), Samsung SDI Co., Ltd., SK Innovation Co., Ltd., A123 Systems LLC, Johnson Controls International plc, GS Yuasa Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Battery Systems for Electric Vehicle MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Battery Systems for Electric Vehicle MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tesla, Inc.

- Panasonic Corporation

- LG Chem Ltd.

- BYD Company Limited

- Contemporary Amperex Technology Co., Limited (CATL)

- Samsung SDI Co., Ltd.

- SK Innovation Co., Ltd.

- A123 Systems LLC

- Johnson Controls International plc

- GS Yuasa Corporation