Global Barrier Films Market Size, Share, And Business Benefit By Material (Polyethylene (PE), Polyethylene Terephthalate (PET), Polypropylene (PP), Polyamides (PA), Ethylene Vinyl Alcohol (EVOH), Linear Low-Density Polyethylene (LLDPE), Others), By Type (Metalized Barrier Films, Transparent Barrier Films, White Barrier Film), By Application (Food and Beverage, Pharmaceutical, Electronics, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161761

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

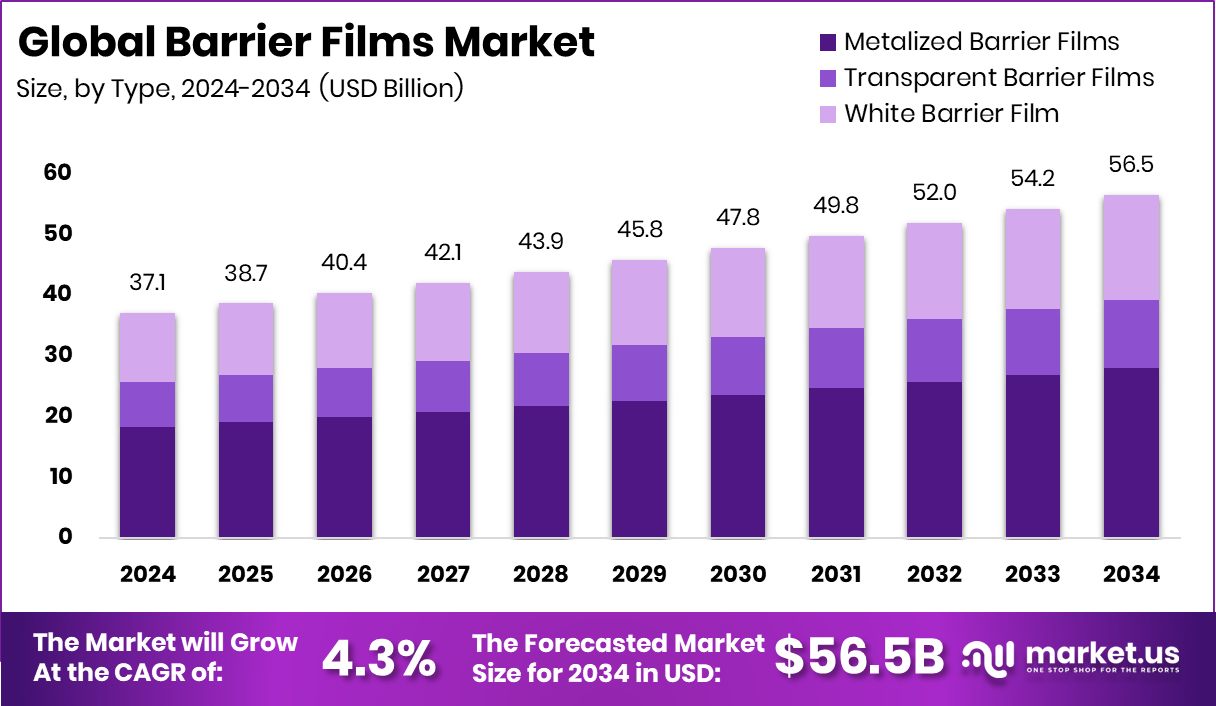

The Global Barrier Films Market is expected to be worth around USD 56.5 billion by 2034, up from USD 37.1 billion in 2024, and is projected to grow at a CAGR of 4.3% from 2025 to 2034. Rapid industrialization and food safety awareness boosted the Asia Pacific’s 43.90% market position.

A barrier film is a thin, engineered coating or laminate applied to packaging or surfaces to block or slow the passage of gases, moisture, oxygen, light, or contaminants. These films help preserve product quality by creating a protective barrier against environmental influences. They are widely used in food, pharmaceutical, electronics, and specialty packaging applications.

The barrier films market refers to the commercial industry for producing, supplying, and applying such films across multiple sectors. Demand comes from producers of packaged goods who need to extend shelf life, improve safety, and reduce waste. Growth is sustained by shifts toward lighter, flexible packaging and stricter regulatory and safety demands.

One key growth factor is the rising consumer expectation for fresher, longer-lasting food and pharmaceutical products. As diets diversify and supply chains lengthen, manufacturers increasingly adopt barrier films to prevent spoilage and contamination. In parallel, regulatory pressure for safe packaging pushes adoption in sensitive markets.

As for opportunity, innovation in sustainable, recyclable barrier films is a promising frontier. Many firms and funds are investing in recycling and cleantech: Closed Loop Partners invested $5 million in Myplas to expand polyethylene recycling; Plastic Energy completed a €145 million raise; DePoly secured a $23 million seed round; and major plastic resin makers launched a $25 million recycling fund targeting PP and PE waste. These financing efforts create synergies for barrier film producers to tap recycled feedstocks and market “green” barrier film solutions.

Key Takeaways

- The Global Barrier Films Market is expected to be worth around USD 56.5 billion by 2034, up from USD 37.1 billion in 2024, and is projected to grow at a CAGR of 4.3% from 2025 to 2034.

- In 2024, the Barrier Films Market saw Polyethylene (PE) hold a 29.3% share due to durability.

- Metalized Barrier Films dominated the Barrier Films Market with a 49.6% share, driven by superior oxygen protection.

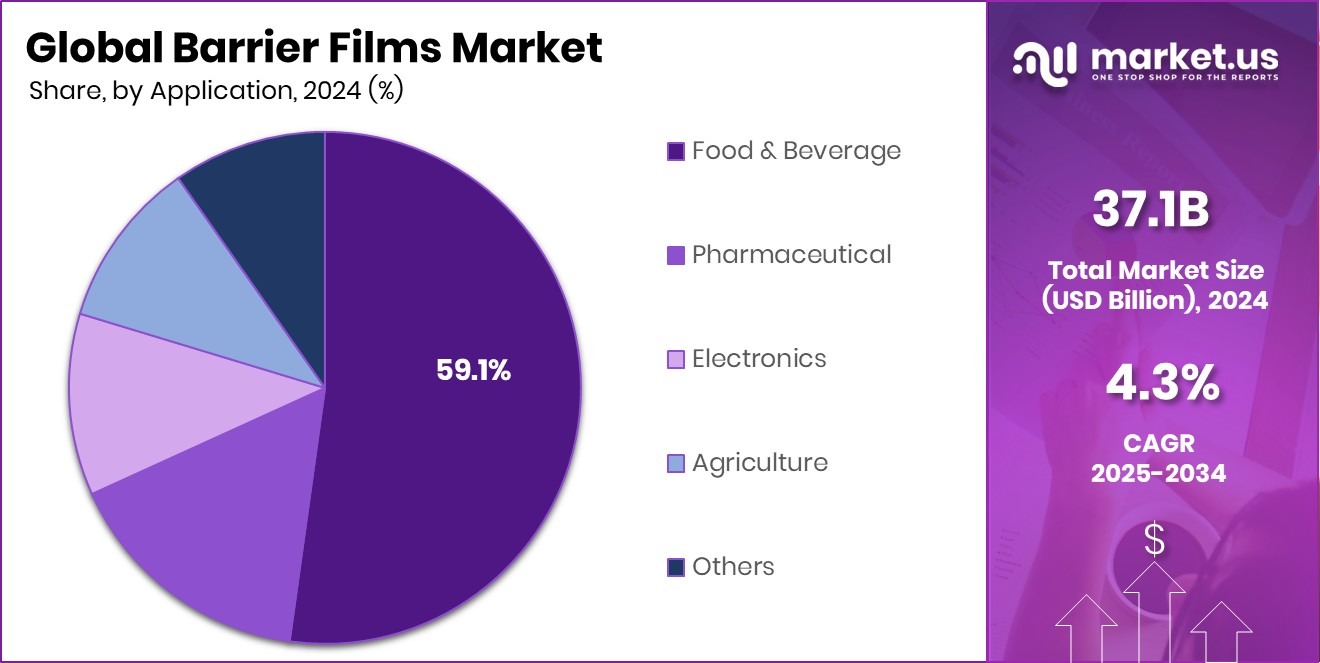

- The Food and Beverage segment captured 59.1% share of the barrier films market in 2024.

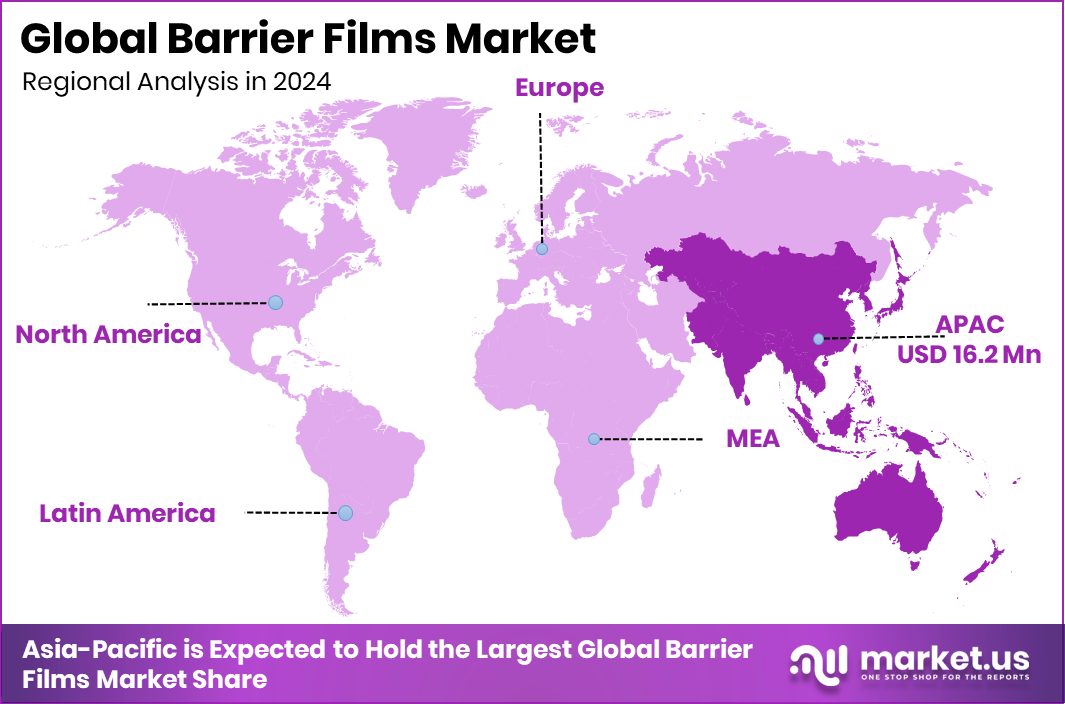

- The Asia Pacific market value reached USD 16.2 Bn, showing strong packaging demand.

By Material Analysis

In 2024, Polyethylene dominated the Barrier Films Market with 29.3%.

In 2024, Polyethylene (PE) held a dominant market position in the By Material segment of the Barrier Films Market, with a 29.3% share. The material’s versatility, cost efficiency, and strong moisture-resistant properties have made it the preferred choice for packaging applications across food, pharmaceuticals, and consumer goods. Its adaptability to both flexible and rigid packaging formats supports wide industrial use.

The growing shift toward lightweight and durable materials has further strengthened polyethylene’s position in the market. Additionally, its compatibility with multilayer film technologies enables enhanced product protection and longer shelf life. These attributes collectively established polyethylene as the leading material category in 2024, sustaining its dominance in global barrier film production and consumption trends.

By Type Analysis

Metalized Barrier Films held the largest share at 49.6% in 2024.

In 2024, Metalized Barrier Films held a dominant market position in the By Type segment of the Barrier Films Market, with a 49.6% share. This dominance is attributed to their superior ability to block moisture, oxygen, and light, ensuring extended shelf life and product freshness in packaged goods. The reflective surface of metalized films enhances durability while maintaining lightweight properties, making them highly suitable for food, pharmaceutical, and industrial packaging.

Their cost-effectiveness compared to traditional foil laminates further drives preference among manufacturers. In addition, the visual appeal and high barrier protection provided by these films contribute to their widespread use, consolidating metalized barrier films as the leading choice in the global market during 2024.

By Application Analysis

The Food and Beverage segment captured 59.1% share of the market.

In 2024, Food and Beverage held a dominant market position in the By Application segment of the Barrier Films Market, with a 59.1% share. The high share is mainly driven by the rising demand for packaged and ready-to-eat food products requiring longer shelf life and superior protection from oxygen and moisture. Barrier films play a vital role in maintaining product freshness, aroma, and quality during storage and transport.

The growing preference for flexible and lightweight packaging further supports their adoption in snacks, dairy, beverages, and frozen foods. Their efficiency in preventing contamination and reducing food waste has reinforced the use of barrier films, making the food and beverage sector the leading application area in 2024.

Key Market Segments

By Material

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Polyamides (PA)

- Ethylene Vinyl Alcohol (EVOH)

- Linear Low-Density Polyethylene (LLDPE)

- Others

By Type

- Metalized Barrier Films

- Transparent Barrier Films

- White Barrier Film

By Application

- Food and Beverage

- Pharmaceutical

- Electronics

- Agriculture

- Others

Driving Factors

Rising Demand for Flexible and Protective Packaging

One of the key driving factors for the Barrier Films Market is the growing need for flexible and protective packaging solutions across the food, beverage, and pharmaceutical sectors. Consumers increasingly prefer lightweight, durable, and easy-to-store packaging that keeps products fresh for longer periods.

Barrier films provide excellent resistance to oxygen, moisture, and contaminants, helping manufacturers maintain product quality and extend shelf life. This demand is further strengthened by rapid industrial investments in packaging materials.

For instance, BPCL announced an investment of ₹5,044 crore in a new polypropylene plant at its Kochi refinery, aimed at boosting domestic production of raw materials used in high-performance films. Such large-scale expansions support continuous innovation and ensure a stable material supply for the growing barrier films industry.

Restraining Factors

High Recycling Challenges and Environmental Concerns

A major restraining factor for the Barrier Films Market is the difficulty in recycling multilayer film structures. These films often combine different materials such as plastics, metals, and coatings to achieve strong barrier properties, making separation and recycling complex and costly.

Many recycling systems are not equipped to handle such mixed-material waste, leading to increased landfill disposal and environmental concerns. Additionally, rising global pressure to reduce plastic waste has resulted in stricter packaging regulations, especially in regions focusing on sustainability goals.

Manufacturers face growing challenges in balancing high-performance requirements with eco-friendly solutions. These recycling limitations and compliance pressures are slowing down the market’s growth, pushing industries to search for new, more recyclable barrier film technologies.

Growth Opportunity

Expanding Scope of Recyclable and Sustainable Films

A major growth opportunity for the Barrier Films Market lies in the rapid shift toward recyclable and sustainable packaging materials. As consumers and governments push for greener products, manufacturers are investing in eco-friendly barrier films that reduce waste without compromising performance.

These innovations aim to replace complex, non-recyclable multilayer structures with mono-material films that are easier to process and reuse. Supporting this transition, The Recycling Partnership has launched a polypropylene recycling group with a $35 million funding target, focused on improving collection, sorting, and recycling infrastructure.

Such initiatives are encouraging companies to develop recyclable barrier film solutions and strengthen circular economy practices, creating strong future opportunities for growth in sustainable packaging applications worldwide.

Latest Trends

Growing Focus on Decarbonization and Green Manufacturing

A key latest trend in the Barrier Films Market is the growing shift toward decarbonized and energy-efficient production processes. Manufacturers are adopting cleaner technologies to reduce emissions and energy use during film manufacturing. This trend aligns with global sustainability goals and rising corporate commitments to carbon neutrality.

Many companies are exploring renewable energy integration and low-carbon raw materials to make production more sustainable. In this direction, a Houston-based company secured $12 million in Series A funding for a decarbonization plant, highlighting strong investor interest in green industrial transformation.

Such initiatives are encouraging the barrier film industry to innovate in cleaner manufacturing, lower carbon footprints, and develop eco-friendly materials that meet both performance and environmental standards.

Regional Analysis

In 2024, the Asia Pacific dominated the Barrier Films Market with a 43.90% share.

In 2024, the Asia Pacific emerged as the dominant region in the Barrier Films Market, accounting for a 43.90% share, valued at USD 16.2 billion. The region’s leadership is driven by strong demand from the food packaging, pharmaceutical, and industrial sectors in countries such as China, India, Japan, and South Korea.

Rapid urbanization, a growing middle-class population, and expanding retail and e-commerce industries have further increased the use of flexible and durable packaging materials. North America shows steady growth, supported by rising consumer awareness of sustainable packaging and advanced recycling systems in the United States and Canada.

Europe continues to focus on eco-friendly packaging solutions driven by strict environmental regulations and the EU’s circular economy goals. Meanwhile, Latin America and the Middle East & Africa are witnessing gradual adoption, fueled by improving manufacturing capacities and growing investments in food and beverage processing.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Amcor Plc is a global packaging leader that benefits from its diversified portfolio across flexible and rigid packaging. In the barrier films space, Amcor is well positioned to leverage scale, R&D capabilities, and broad market reach. Its strong distribution networks and investments in sustainable and high-performance films give it a competitive edge in serving major food, beverage, and consumer goods customers.

Cosmo Films Ltd. is a prominent Indian player with expertise in films and specialty substrates. It is enhancing its barrier film offerings by integrating multilayer and coating technologies, targeting both domestic and export markets. Its agility in adopting newer film grades and regional focus can help it capture growth in Asia and other emerging markets. Cosmo’s established presence in films, labels, and lamination also offers synergy in product development and cross-selling.

DuPont Teijin Films combines DuPont’s heritage in advanced materials with Teijin’s polymer expertise, positioning it strongly in high-barrier, specialty film segments such as for pharmaceuticals, electronics, and high-value packaging. Its technical know-how in barrier coatings, surface treatments, and durability innovations allows it to compete in premium segments. The firm’s strength lies in advancing next-generation barrier technologies and working closely with OEM and brand customers for customized solutions.

Top Key Players in the Market

- Amcor Plc

- Cosmo Films Ltd.

- Dupont Teijin Films

- Flair Flexible Packaging Corporation

- Jindal Poly Films Ltd.

- Mondi plc

- Sealed Air Corporation

- Toppan Inc

Recent Developments

- In November 2024, Amcor agreed to acquire Berry Global in an all-stock transaction. This deal is meant to broaden Amcor’s material and packaging capabilities, including flexible and barrier film technologies.

- In August 2024, Cosmo Films announced the launch of six new films for the U.S. market at LabelExpo Americas 2024. The new films include high-shrink label films, CPP extrusion lamination films, heat-resistant Teplo R films, and primer coatings for label printing.

Report Scope

Report Features Description Market Value (2024) USD 37.1 Billion Forecast Revenue (2034) USD 56.5 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Polyethylene (PE), Polyethylene Terephthalate (PET), Polypropylene (PP), Polyamides (PA), Ethylene Vinyl Alcohol (EVOH), Linear Low-Density Polyethylene (LLDPE), Others), By Type (Metalized Barrier Films, Transparent Barrier Films, White Barrier Film), By Application (Food and Beverage, Pharmaceutical, Electronics, Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Amcor Plc, Cosmo Films Ltd., Dupont Teijin Films, Flair Flexible Packaging Corporation, Jindal Poly Films Ltd., Mondi plc, Sealed Air Corporation, Toppan Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amcor Plc

- Cosmo Films Ltd.

- Dupont Teijin Films

- Flair Flexible Packaging Corporation

- Jindal Poly Films Ltd.

- Mondi plc

- Sealed Air Corporation

- Toppan Inc