Global Bariatric Beds Market By Weight Capacity (500-700 lbs, 700-1000 lbs and Above 1000 lbs), By End-User (Hospitals, Nursing Homes and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 178411

- Number of Pages: 248

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

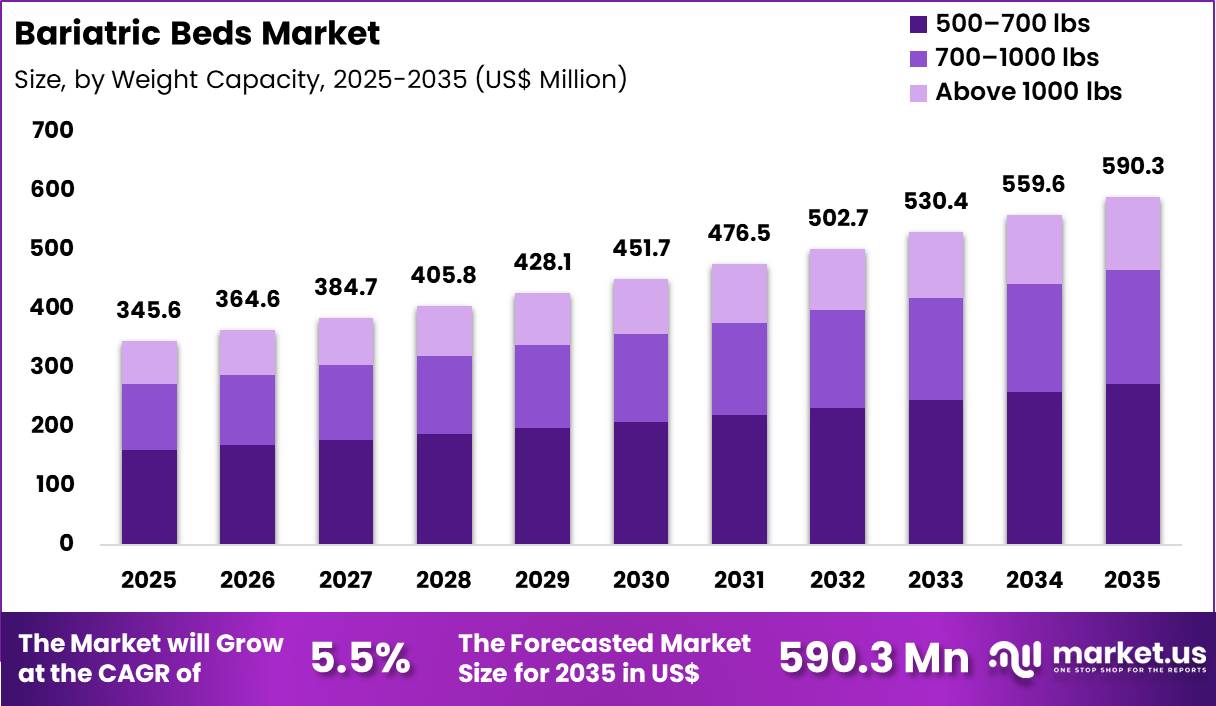

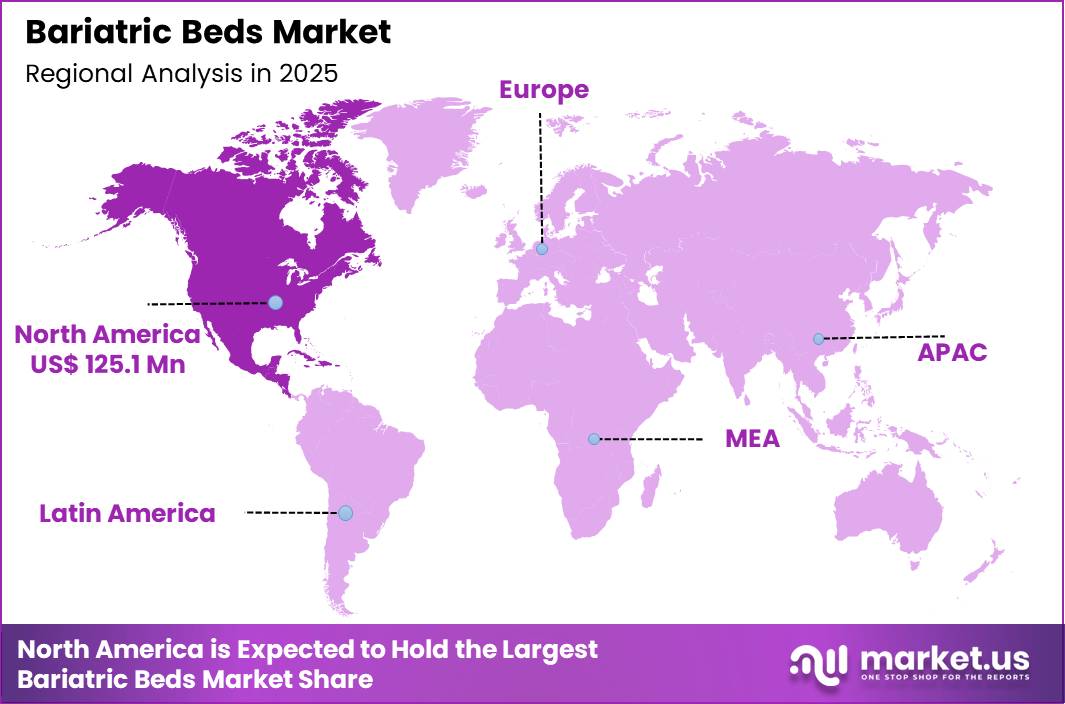

Global Bariatric Beds Market size is expected to be worth around US$ 590.3 Million by 2035 from US$ 345.6 Million in 2025, growing at a CAGR of 5.5% during the forecast period 2026-2035. In 2025, North America led the market, achieving over 36.2% share with a revenue of US$ 125.1 Million.

Rising prevalence of obesity-related comorbidities and the need for specialized patient handling propel the bariatric beds market as healthcare facilities prioritize equipment that ensures safety, dignity, and effective care for individuals with high body mass indices.

Hospital staff increasingly deploy bariatric beds in medical-surgical units to accommodate patients exceeding standard weight limits, providing reinforced frames, wider surfaces, and higher weight capacities that prevent equipment failure during repositioning or transfers.

These beds support critical care applications in intensive care units, where integrated scale systems monitor fluid balance and pressure-relieving mattresses reduce the risk of pressure injuries in immobile bariatric patients. Long-term care facilities utilize bariatric beds with full electric articulation for patients with limited mobility, facilitating safe transfers and reducing caregiver strain during daily hygiene and positioning tasks.

Rehabilitation centers apply these specialized beds during post-surgical recovery from bariatric procedures, offering adjustable heights and Trendelenburg positioning to optimize circulation and respiratory function while promoting early ambulation.

Manufacturers pursue opportunities to integrate smart features such as integrated scales, pressure mapping sensors, and automated turning mechanisms, expanding applications in home care settings where caregivers require reliable support for bariatric patients with chronic conditions.

Developers advance low-height designs that minimize fall risks during transfers, broadening utility in geriatric and post-operative environments. These innovations facilitate compatibility with patient lifts and mobility aids, streamlining workflows in multidisciplinary care teams.

Opportunities emerge in sustainable materials and modular components that allow easy upgrades, addressing facility needs for cost-effective fleet management. Companies invest in ergonomic controls and antimicrobial surfaces that enhance infection prevention in high-acuity settings.

Recent trends emphasize patient-centered designs with enhanced comfort features and caregiver safety mechanisms, positioning bariatric beds as essential infrastructure in value-based care models focused on injury prevention, operational efficiency, and improved outcomes for high-risk patients.

Key Takeaways

- In 2025, the market generated a revenue of US$ 345.6 Million, with a CAGR of 5.5%, and is expected to reach US$ 590.3 Million by the year 2035.

- The weight capacity segment is divided into 500-700 lbs, 700-1000 lbs and above 1000 lbs, with 500-700 lbs taking the lead with a market share of 46.3%.

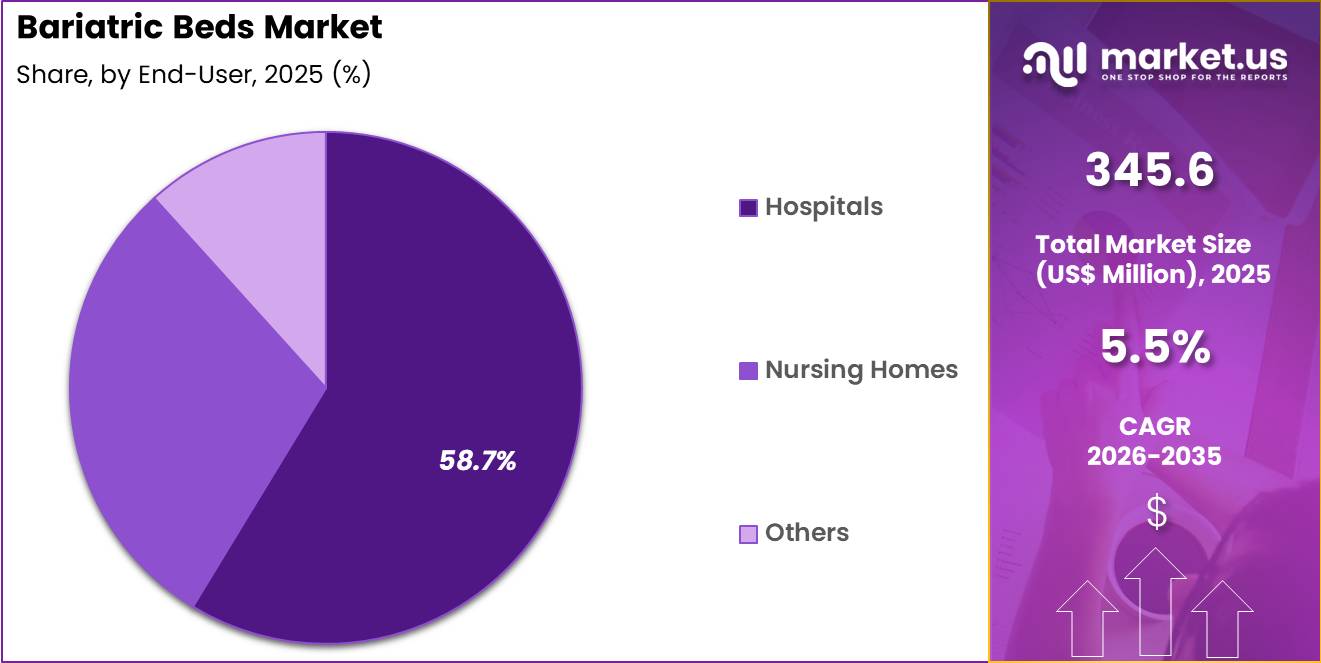

- Considering end-user, the market is divided into hospitals, nursing homes and others. Among these, hospitals held a significant share of 58.7%.

- North America led the market by securing a market share of 36.2%.

Weight Capacity Analysis

The 500–700 lbs segment contributed 46.3% of growth within weight capacity and led the bariatric beds market due to its alignment with the majority of bariatric patient requirements. Hospitals and long-term care facilities frequently encounter patients within this weight range, which increases procurement of mid-capacity bariatric beds.

These beds provide enhanced width, reinforced frames, and motorized positioning to support patient mobility and caregiver safety. Rising obesity prevalence across adult populations strengthens demand for appropriately rated support surfaces.

Growth strengthens as healthcare providers emphasize fall prevention and pressure injury reduction among high-risk patients. The 500–700 lbs range balances structural strength with space efficiency, which suits standard hospital rooms.

Improved ergonomic controls and integrated safety rails enhance usability. Reimbursement policies for bariatric care further support equipment acquisition. The segment is expected to remain dominant as healthcare systems adapt infrastructure to accommodate a growing overweight patient population.

End-User Analysis

Hospitals accounted for 58.7% of growth within end-user and dominated the bariatric beds market due to high admission rates of obese patients requiring acute and surgical care. Emergency departments, medical wards, and intensive care units rely on specialized beds to manage mobility limitations safely. Hospitals prioritize bariatric beds to reduce caregiver strain and prevent handling injuries. Centralized procurement and safety compliance standards reinforce consistent adoption.

Growth continues as hospitals expand bariatric surgery programs and chronic disease management units. Patient safety initiatives highlight the importance of appropriate weight-rated equipment. Teaching hospitals further increase demand through training and quality improvement programs.

Rising hospitalization rates associated with obesity-related comorbidities strengthen equipment utilization. The segment is anticipated to remain the primary growth driver as hospitals continue to lead comprehensive bariatric patient care services.

Key Market Segments

By Weight Capacity

- 500-700 lbs

- 700-1000 lbs

- Above 1000 lbs

By End-User

- Hospitals

- Nursing Homes

- Others

Drivers

Increasing prevalence of obesity is driving the market.

The steady rise in adult obesity rates has directly increased the need for specialized bariatric beds capable of safely supporting higher patient weights. Healthcare facilities are expanding their equipment inventories to accommodate the growing number of obese patients requiring hospitalization or long-term care.

Improved public health surveillance has highlighted the scale of the issue, prompting hospitals to invest in wider and stronger beds. The correlation between obesity and comorbidities such as diabetes and cardiovascular disease further drives demand for appropriate patient handling solutions.

Government agencies track these trends to guide resource allocation in acute and long-term care settings. Bariatric beds reduce injury risks to both patients and staff during transfers and repositioning. National health programs emphasize safe care standards for heavier patients.

Manufacturers are responding by developing models with higher weight capacities and enhanced mobility features. This driver supports broader adoption across hospitals, nursing homes, and home care environments. According to the Centers for Disease Control and Prevention, the prevalence of obesity among U.S. adults was 40.3% during August 2021–August 2023.

Restraints

High acquisition and maintenance costs are restraining the market.

The premium pricing of bariatric beds, which include reinforced frames, wider decks, and advanced drive systems, restricts purchases in facilities operating under tight budgets. Specialized components for weight capacities exceeding 1,000 pounds add significantly to manufacturing expenses. Smaller hospitals and long-term care facilities often delay upgrades due to limited capital availability.

Regulatory requirements for safety testing and certification further increase overall costs. In public health systems, procurement decisions frequently favor standard beds to control expenditures. Providers may rely on rental options or modified standard equipment as temporary solutions. This restraint is especially pronounced in rural and low-resource settings.

Industry efforts to introduce modular or lighter designs aim to reduce costs over time. Despite clear safety benefits, economic pressures limit widespread replacement of older equipment. Addressing affordability through leasing programs or bulk purchasing remains essential for broader market penetration.

Opportunities

Expansion of home healthcare services for obese patients is creating growth opportunities.

The shift toward home-based care for chronically ill and obese patients has opened new channels for bariatric bed deployment outside traditional hospital settings. Government initiatives promoting aging-in-place and post-acute care support the procurement of specialized beds for residential use.

Rising demand for safe patient handling in home environments encourages manufacturers to develop lighter, more portable models. Partnerships with home medical equipment suppliers facilitate distribution and training for caregivers. The large population of obese individuals requiring long-term support amplifies potential in the home care segment.

Educational programs for families and home health aides promote proper use of bariatric equipment. This opportunity allows companies to diversify beyond acute care and tap into growing community-based services. Key players are expanding product lines with features tailored for home use, such as lower height ranges and easier assembly.

Overall, home healthcare growth aligns with efforts to reduce hospital readmissions and improve patient dignity. Strategic focus on this segment can generate sustained revenue in an evolving care landscape.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the bariatric beds market through hospital capital allocation, long term care spending, and procurement discipline across health systems. Inflation and elevated interest rates increase the cost of steel, electronics, freight, and financing, which slows replacement and expansion plans for specialized beds.

Geopolitical tensions disrupt supplies of motors, control units, actuators, and medical grade materials, creating sourcing uncertainty and delivery delays. Current US tariffs on imported components and finished equipment raise landed costs for manufacturers and distributors, which compresses margins and tighten budget approvals. These constraints affect smaller facilities and nursing homes more directly due to limited capital flexibility.

On the positive side, trade pressure encourages regional manufacturing, supplier diversification, and stronger quality oversight. Rising obesity prevalence and focus on patient safety continue to drive clinical demand for bariatric support solutions. With disciplined sourcing, durable design, and service oriented models, the market remains positioned for steady and confident growth.

Latest Trends

Introduction of ultra-low-height bariatric beds is a recent trend in the market.

In 2024, manufacturers introduced bariatric beds capable of descending to significantly lower heights to enhance patient safety and caregiver ergonomics. These designs minimize fall risks for heavier patients while allowing easier transfers from wheelchairs or stretchers. New models incorporate advanced drive systems and reinforced frames without compromising weight capacity.

Clinical feedback from hospitals has driven refinements in low-position functionality. Rotec launched the VersaTech 1100 ULB bariatric bed in 2024, which lowers to an 8-inch deck height while supporting up to 1,100 pounds. This innovation addresses longstanding challenges in safe patient handling for obese individuals.

The trend emphasizes compatibility with existing hospital workflows and reduced caregiver strain. Regulatory evaluations in 2024 confirmed compliance for these low-profile systems. Industry collaborations continue to optimize materials for durability and ease of cleaning. These developments position ultra-low-height bariatric beds as a key advancement in modern patient care equipment.

Regional Analysis

North America is leading the Bariatric Beds Market

North America accounted for a 36.2% share of the Bariatric Beds market in 2024, reflecting sustained demand from hospitals, long term care facilities, and home healthcare providers. Rising prevalence of severe obesity increased the need for reinforced beds designed to support higher weight capacities and enhance patient safety. Healthcare facilities prioritized specialized equipment to reduce caregiver injury during patient handling and repositioning.

Growth in bariatric surgeries and obesity related hospital admissions further strengthened procurement across acute care settings. Nursing homes and rehabilitation centers also upgraded infrastructure to accommodate heavier patients with mobility limitations. Reimbursement support for durable medical equipment improved accessibility in home care environments.

A strong supporting indicator comes from the Centers for Disease Control and Prevention, which reported in 2023 that 41.9% of US adults have obesity, underscoring the structural healthcare demand that drives adoption of high capacity medical beds.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Bariatric Beds market in Asia Pacific is expected to grow steadily during the forecast period as obesity rates and chronic disease burdens increase across urban populations. Governments expand hospital capacity and modernize patient care infrastructure to manage rising admissions linked to metabolic disorders.

Private hospitals invest in heavy duty patient handling equipment to improve safety standards and reduce staff injuries. Growing awareness of obesity related complications encourages earlier medical intervention and longer inpatient stays. Medical tourism in countries such as Thailand and India also supports procurement of specialized hospital furnishings.

Home healthcare services expand across aging societies, strengthening demand for reinforced care beds. A verifiable signal of underlying need appears in 2023 data from the World Health Organization, which reported that obesity has nearly tripled worldwide since 1975, highlighting the expanding patient population that supports continued regional growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the bariatric beds market grow by advancing structural strength, comfort features, and ease-of-use adjustments that support safer handling and improved patient experience across acute care and long-term care settings. They also broaden product portfolios with integrated pressure relief surfaces, high-capacity lifts, and accessory compatibility that align with evolving clinical safety standards and caregiver efficiency goals.

Firms deepen customer engagement through on-site training, maintenance support programs, and flexible financing options that help healthcare providers manage total cost of ownership. Strategic partnerships with hospital groups, rehabilitation centers, and group purchasing organizations strengthen procurement pathways and secure recurring volume contracts.

Drive DeVilbiss Healthcare exemplifies a diversified patient care solutions provider with a strong lineup of high-capacity beds and support systems, robust distribution networks, and coordinated commercial strategies that address clinical performance and operational needs.

The company advances its competitive agenda through disciplined R&D investment, targeted product enhancements based on caregiver feedback, and a customer-centric approach that translates practical innovation into measurable care improvements.

Top Key Players

- Hillrom

- Invacare

- Stryker

- Medline Industries

- GF Health Products

- Drive DeVilbiss Healthcare

- Arjo

- Span America

- Joerns Healthcare

- Savaria

Recent Developments

- In 2025, Baxter International Inc. reported third-quarter revenue of US$ 773 million from its Healthcare Systems & Technologies segment, which includes the Hillrom portfolio of medical-surgical beds and bariatric care systems. The company attributed performance to sustained global demand for connected care platforms and high-capacity patient support solutions designed to improve safety standards and operational efficiency across acute care settings in the US and international markets.

- In 2024, Stryker disclosed full-year net sales of US$ 13.5 billion for its MedSurg and Neurotechnology division. The segment, which features advanced hospital beds and bariatric-ready patient handling systems, posted an 11.1% year-over-year revenue increase. Growth was driven by continued hospital investment in capital equipment upgrades and infrastructure modernization aimed at supporting higher-acuity and bariatric patient populations.

Report Scope

Report Features Description Market Value (2025) US$ 345.6 Million Forecast Revenue (2035) US$ 590.3 Million CAGR (2026-2035) 5.5% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Weight Capacity (500-700 lbs, 700-1000 lbs and Above 1000 lbs), By End-User (Hospitals, Nursing Homes and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Hillrom, Invacare, Stryker, Medline Industries, GF Health Products, Drive DeVilbiss Healthcare, Arjo, Span America, Joerns Healthcare, Savaria Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Hillrom

- Invacare

- Stryker

- Medline Industries

- GF Health Products

- Drive DeVilbiss Healthcare

- Arjo

- Span America

- Joerns Healthcare

- Savaria