Global Barcode Printers Market Size, Share, Growth Analysis By Product (Desktop Printers, Mobile Printers, Industrial Printers), By Technology (Thermal Transfer, Direct Transfer, Laser, Impact, Inkjet), By End-user (Manufacturing, Healthcare, Retail & E-commerce, Transportation & Logistics, Government, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169222

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

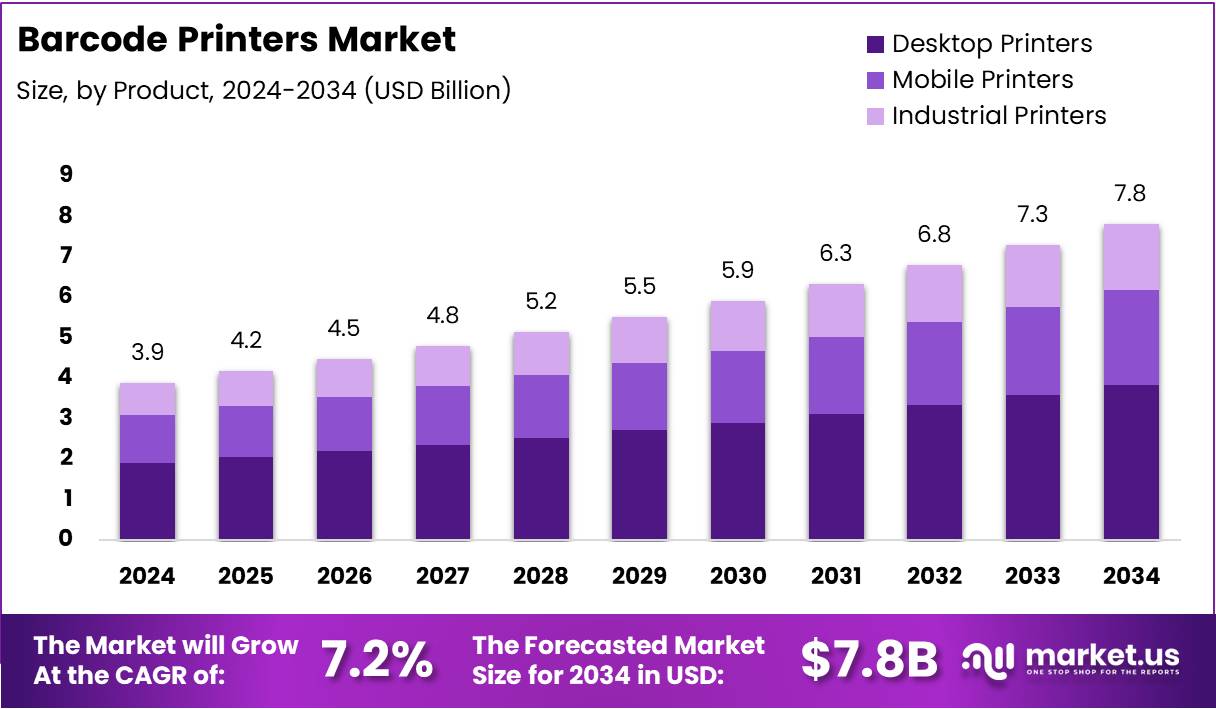

The Global Barcode Printers Market size is expected to be worth around USD 7.8 Billion by 2034, from USD 3.9 Billion in 2024, growing at a CAGR of 7.2% during the forecast period from 2025 to 2034.

The Barcode Printers Market encompasses specialized printing devices designed for generating machine-readable codes across diverse commercial and commercial printing applications. These systems facilitate inventory management, product identification, and supply chain optimization through automated data capture. Subsequently, businesses leverage these solutions to enhance operational efficiency and reduce manual tracking errors across retail, logistics, healthcare, and manufacturing sectors.

Market growth accelerates as digital transformation initiatives drive demand for automated identification systems. Organizations increasingly recognize barcode technology as fundamental infrastructure for real-time inventory visibility and traceability compliance. Consequently, enterprises transition from manual labeling processes to integrated printing solutions that streamline warehouse operations and improve product tracking accuracy throughout distribution networks.

Investment opportunities emerge across thermal printing technology segments addressing varied resolution requirements. Desktop models serve small-to-medium enterprises requiring cost-effective labeling solutions, while industrial-grade systems attract logistics providers needing high-volume output capabilities. Furthermore, mobile printing devices gain traction among field service operations and retail environments demanding portable labeling functionality for dynamic inventory management scenarios.

Government regulations regarding product traceability and supply chain transparency substantially influence market expansion. Regulatory frameworks in pharmaceuticals, food safety, and automotive sectors mandate standardized barcode labeling for compliance verification. Additionally, public sector investments in healthcare digitization and smart logistics infrastructure create sustained demand for enterprise-grade printing systems supporting regulatory adherence and operational modernization initiatives.

Technology specifications directly impact application suitability across operational contexts. Label resolution requirements vary considerably, wherein 203 DPI suits shipping labels and large barcodes, 300 DPI addresses product and retail labels, 406 DPI accommodates small text and barcodes, while 600 DPI enables micro-labels and tiny 2D codes. Performance differentiation becomes evident through printing speeds, where typical desktop models achieve maximum rates of 102mm/4 inches per second, whereas industrial printers deliver 356mm/14 inches per second capabilities. These technical parameters enable organizations to align equipment specifications with throughput demands and labeling precision requirements across operational workflows.

Key Takeaways

- Global barcode printers market expected to reach USD 7.8 Billion by 2034, doubling from USD 3.9 Billion in 2024.

- Market grows at a steady 7.2% CAGR driven by automation and digital labeling adoption across industries.

- Desktop printers lead the product segment with a dominant 49.2% market share in 2024.

- Thermal transfer technology holds the largest technology share at 39.1% across global applications.

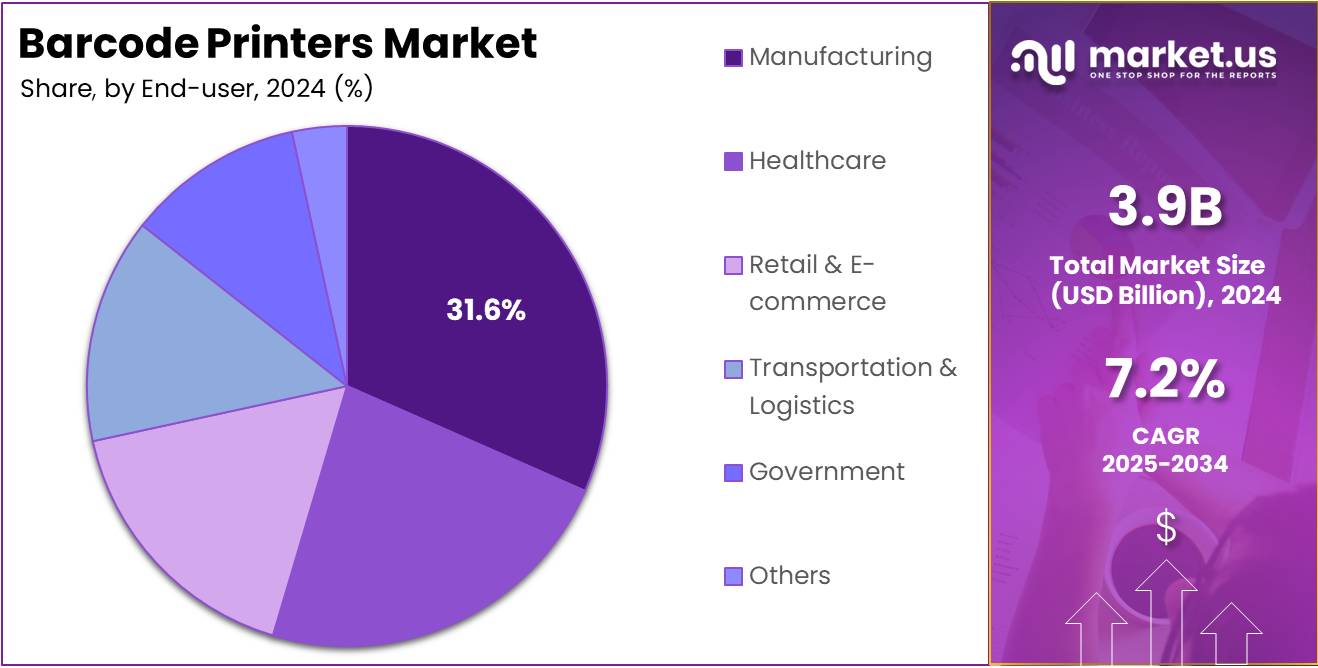

- Manufacturing remains the top end-user segment with 31.6% contribution to overall market demand.

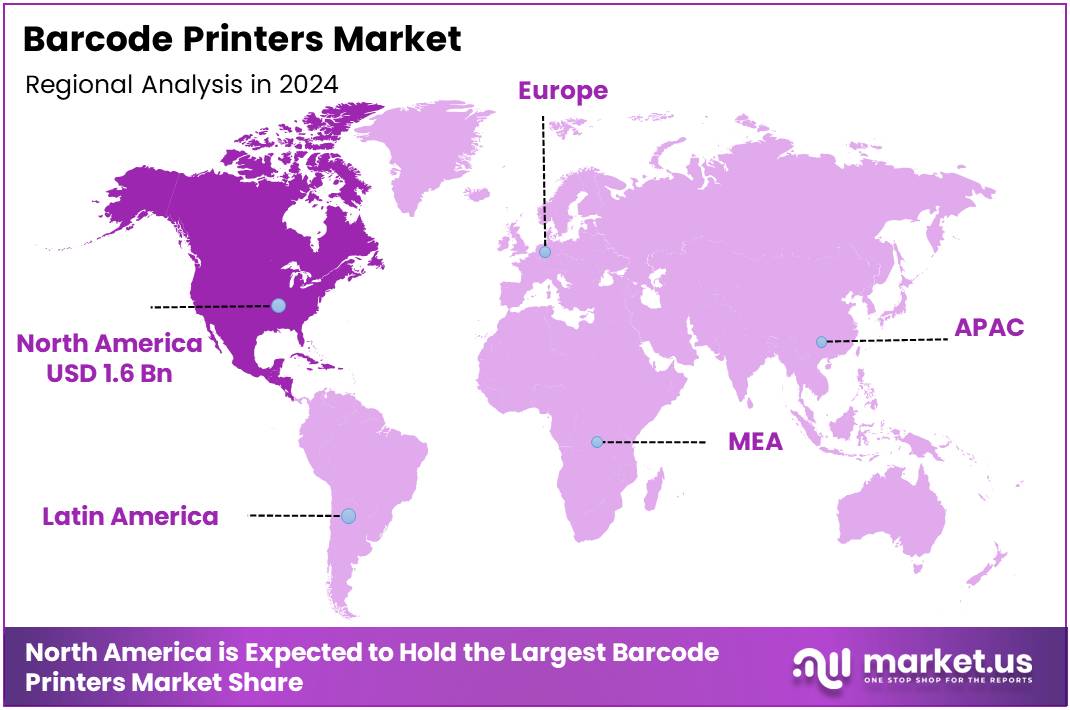

- North America leads regionally with 43.2% market share valued at USD 1.6 Billion in 2024.

By Product Analysis

Desktop Printers dominate with 49.2% due to their optimal balance of functionality and affordability for medium-volume printing needs.

In 2024, Desktop Printers held a dominant market position in the By Product Analysis segment of Barcode Printers Market, with a 49.2% share. These printers excel in office environments and retail settings where space efficiency matters. Their compact design enables seamless integration into workstations while delivering reliable label printing. Furthermore, desktop models offer user-friendly interfaces that require minimal training, making them accessible for businesses of all sizes seeking cost-effective barcode solutions.

Mobile Printers represent a growing segment driven by field service operations and logistics applications. These portable devices enable on-demand label printing at warehouses, delivery points, and retail floors. Their wireless connectivity and rechargeable batteries provide flexibility for workers who require printing capabilities while moving. Additionally, mobile printers support real-time inventory management and shipping documentation, enhancing operational efficiency across supply chain touchpoints.

Industrial Printers cater to high-volume production environments requiring robust performance and durability. These heavy-duty machines handle continuous printing operations in manufacturing facilities and distribution centers. Their advanced features include high-resolution printing, multiple connectivity options, and compatibility with various label materials. Moreover, industrial printers deliver superior throughput rates, making them indispensable for enterprises managing large-scale labeling requirements across diverse industrial applications.

By Technology Analysis

Thermal Transfer dominates with 39.1% due to its exceptional print durability and versatility across various label materials.

In 2024, Thermal Transfer held a dominant market position in the By Technology Analysis segment of Barcode Printers Market, with a 39.1% share. This technology utilizes heated ribbons to transfer ink onto labels, creating long-lasting, smudge-resistant prints. Its superiority shines in applications requiring permanent labels that withstand harsh environments, chemicals, and UV exposure. Consequently, thermal transfer remains the preferred choice for industries demanding high-quality, durable barcode labels with extended lifespan.

Direct Transfer technology offers simplified printing mechanisms by applying heat directly to specialized thermal paper. This ribbon-free approach reduces operational costs and maintenance requirements, appealing to budget-conscious businesses. However, the printed labels exhibit shorter longevity compared to thermal transfer. Nevertheless, direct transfer suits applications like shipping labels and receipts where temporary marking suffices, making it popular in retail and logistics sectors.

Laser printers deliver high-speed, high-resolution barcode printing using toner-based systems. They excel in producing detailed graphics and text alongside barcodes. Their precision makes them valuable for pharmaceutical labeling and product packaging. Additionally, laser technology supports various media types, offering versatility for specialized printing requirements across different industries.

Impact printers utilize mechanical printing heads striking inked ribbons against paper. Though considered legacy technology, they remain relevant for multi-part forms and carbon copy applications. Their durability in rugged environments ensures continued usage in specific industrial settings requiring simultaneous multi-copy printing capabilities.

Inkjet printers provide color printing capabilities and high-resolution output for product labels requiring graphics and branding elements. Their versatility accommodates various substrate materials including plastics and films. Moreover, inkjet technology enables on-demand customization, supporting businesses needing variable data printing for promotional campaigns and personalized labeling applications.

By End-user Analysis

Manufacturing dominates with 31.6% due to extensive labeling requirements across production lines and inventory management systems.

In 2024, Manufacturing held a dominant market position in the By End-user Analysis segment of Barcode Printers Market, with a 31.6% share. Manufacturing facilities require continuous barcode labeling for work-in-progress tracking, finished goods identification, and quality control processes. These labels facilitate automated inventory management and traceability throughout production cycles. Consequently, manufacturers invest heavily in barcode printing infrastructure to maintain operational efficiency, compliance standards, and seamless supply chain integration across their facilities.

Healthcare sector relies extensively on barcode printers for patient safety and regulatory compliance. Medical facilities use barcodes for patient identification wristbands, medication administration, specimen tracking, and medical device management. This technology minimizes medication errors and enhances patient care coordination. Furthermore, healthcare providers implement barcode systems to meet stringent documentation requirements and improve operational workflows across hospitals, clinics, and pharmacies.

Retail & E-commerce businesses depend on barcode printers for price labeling, inventory management, and order fulfillment operations. These labels streamline checkout processes and enable accurate stock tracking across multiple sales channels. Additionally, e-commerce platforms utilize shipping labels extensively, driving demand for reliable printing solutions that support high-volume order processing and customer delivery expectations.

Transportation & Logistics companies require barcode printers for package tracking, shipping documentation, and warehouse management systems. These labels ensure accurate sorting, routing, and delivery confirmation throughout the supply chain. Moreover, logistics providers use mobile printers for proof-of-delivery documentation, enhancing transparency and accountability in freight operations.

Government agencies utilize barcode printers for asset management, document tracking, and identification systems across various departments. These applications support administrative efficiency and security protocols.

Others category encompasses educational institutions, hospitality sectors, and entertainment venues implementing barcode solutions for access control, ticketing, and resource management purposes.

Key Market Segments

By Product

- Desktop Printers

- Mobile Printers

- Industrial Printers

By Technology

- Thermal Transfer

- Direct Transfer

- Laser

- Impact

- Inkjet

By End-user

- Manufacturing

- Healthcare

- Retail & E-commerce

- Transportation & Logistics

- Government

- Others

Drivers

Surge in E-Commerce and Retail Automation Driving Demand for Barcode Printer Solutions

The barcode printers market is experiencing strong growth due to the rapid expansion of e-commerce and retail automation. Online shopping has changed how businesses operate, creating massive demand for efficient labeling and tracking systems. Retailers and logistics companies now rely heavily on barcode printers to manage inventory, process orders quickly, and ensure accurate deliveries. As more consumers shop online, businesses need faster and more reliable printing solutions to keep pace with growing order volumes.

Another key driver is the need for accurate product tracking and complete supply chain visibility. Companies want to monitor their products from manufacturing to final delivery. Barcode printers help businesses reduce errors, prevent losses, and improve overall operational efficiency. This transparency has become essential for maintaining customer trust and meeting regulatory requirements.

The manufacturing, logistics, and warehouse sectors are also experiencing rapid automation growth. Modern warehouses use automated systems that depend on barcode technology for sorting, tracking, and inventory management. This shift toward automation creates continuous demand for barcode printing equipment.

Finally, technological advancements in high-speed and high-precision printing are making barcode printers more attractive. Newer models offer faster printing speeds, better print quality, and enhanced durability. These improvements help businesses increase productivity while reducing operational costs, further driving market adoption across various industries.

Restraints

Compatibility and Standardization Issues Restrain Barcode Printer Market Expansion

The barcode printer market faces significant challenges due to compatibility problems with older systems. Many businesses still operate legacy inventory management and point-of-sale systems that were designed decades ago. These older platforms often struggle to communicate effectively with modern barcode printing equipment. When companies attempt to upgrade their printing technology, they frequently encounter integration difficulties that require expensive custom solutions or middleware applications.

Small and medium-sized enterprises are particularly affected by these compatibility barriers. They may need to invest heavily in system overhauls or maintain outdated printing equipment longer than desired. This creates hesitation among potential buyers and slows market adoption rates.

Another major constraint involves the lack of uniform standards across barcode printing and industrial labeling protocols. Different industries and regions follow varying barcode formats, label specifications, and printing requirements. Manufacturers must produce multiple printer models to accommodate these diverse needs, increasing production costs and complexity.

The absence of universal standards also complicates vendor selection for businesses operating across multiple markets. Organizations face challenges ensuring consistent labeling quality and compliance when managing diverse printing infrastructure. This fragmentation limits seamless interoperability and creates additional training requirements for staff handling different printer models and software platforms across various operational environments.

Growth Factors

Integration of IoT-Enabled Barcode Printer Solutions Drives Market Growth

The barcode printer market is experiencing strong growth potential through several key opportunities. IoT-enabled barcode printing systems are transforming inventory management by providing real-time tracking capabilities. These smart printers connect directly to warehouse management systems, allowing businesses to monitor stock levels instantly and reduce operational errors. Companies are investing in these connected solutions to improve supply chain efficiency and gain better visibility across their operations.

Integration of 3D printing technologies with barcode printing presents opportunities for customized product labeling solutions and industrial prototyping. Businesses can develop specialized components, packaging holders, or fixtures to improve workflow efficiency.

The healthcare and pharmaceutical industries present significant expansion opportunities for barcode printer manufacturers. These sectors require strict compliance with safety regulations and need accurate labeling for medications, patient identification, and medical equipment. The growing focus on patient safety and traceability standards is pushing hospitals and pharmaceutical companies to adopt advanced barcode printing solutions.

Mobile and wireless barcode printing technologies are gaining popularity in retail and logistics sectors. These portable devices allow workers to print labels directly at product locations, speeding up operations and reducing manual work. The convenience of wireless connectivity enables faster order fulfillment and improves warehouse productivity.

Emerging Trends

Increasing Use of Cloud-Connected Barcode Printers for Remote Supply Chain Automation

The barcode printer market is experiencing significant growth driven by several emerging trends. Cloud-connected barcode printers and cloud-based printing solutions are gaining popularity as businesses seek better control over their supply chains from remote locations. These smart printers allow companies to monitor inventory, track shipments, and manage printing tasks from anywhere using internet connectivity. This trend is particularly valuable for businesses with multiple warehouses or distribution centers.

Multi-functional printers are becoming the preferred choice for modern businesses. These devices combine printing, scanning, and inventory management capabilities in one unit, reducing equipment costs and workspace requirements. Companies appreciate the convenience of handling multiple tasks with a single device, making operations more efficient and cost-effective.

Portable and compact barcode printers are seeing increased demand, especially in retail, healthcare, and logistics sectors. These on-demand printing solutions allow workers to print labels directly at the point of use, eliminating delays and improving accuracy. The mobility factor helps businesses serve customers faster and manage inventory more effectively.

Industrial label printing services are evolving with customizable options and high-resolution output. Businesses now demand clear, durable labels that can withstand harsh environments while displaying detailed product information, QR codes, and graphics with precision.

Regional Analysis

North America Dominates the Barcode Printers Market with a Market Share of 43.2%, Valued at USD 1.6 Billion

North America establishes its dominance in the global barcode printers market, commanding a substantial market share of 43.2% with a valuation of USD 1.6 billion. The region’s leadership position is primarily attributed to the widespread adoption of advanced automated identification and data capture technologies across retail, healthcare, logistics, and manufacturing sectors. The presence of extensive e-commerce infrastructure, coupled with stringent regulatory requirements for product tracking and inventory management, has significantly driven the demand for high-performance barcode printing solutions.

Additionally, the early adoption of Industry 4.0 practices and the integration of Internet of Things (IoT) technologies in supply chain operations have further reinforced the region’s market supremacy, with businesses increasingly investing in thermal transfer and direct thermal printing technologies to enhance operational efficiency.

Europe Barcode Printers Market Trends

Europe represents a significant market for barcode printers, driven by robust manufacturing activities and stringent compliance standards across various industries. The region’s emphasis on pharmaceutical serialization, food traceability regulations, and automotive component tracking has propelled substantial investments in barcode printing infrastructure.

Germany, the United Kingdom, and France emerge as key contributors, with growing adoption of mobile and portable barcode printers in warehouse management and field service applications. The region’s focus on sustainability has also influenced market dynamics, with increasing preference for eco-friendly printing materials and energy-efficient devices that align with the European Union’s environmental directives.

Asia Pacific Barcode Printers Market Trends

Asia Pacific exhibits the fastest growth trajectory in the barcode printers market, fueled by rapid industrialization, expanding e-commerce platforms, and increasing manufacturing activities across China, India, Japan, and Southeast Asian nations. The region’s burgeoning retail sector, combined with government initiatives promoting digital transformation and smart manufacturing, has created substantial demand for cost-effective and high-volume barcode printing solutions.

The growth of third-party logistics providers and the expansion of cold chain infrastructure for pharmaceutical and food industries are further accelerating market penetration. Additionally, the rise of small and medium-sized enterprises adopting automated inventory management systems presents significant opportunities for market expansion in emerging economies.

Middle East and Africa Barcode Printers Market Trends

The Middle East and Africa region demonstrates steady growth in the barcode printers market, driven by expanding retail infrastructure, healthcare modernization initiatives, and growing logistics operations. Countries in the Gulf Cooperation Council are investing heavily in smart warehousing and automated supply chain solutions as part of their economic diversification strategies.

The healthcare sector’s increasing focus on patient safety and medication tracking, alongside the growth of organized retail formats in urban centers, has created consistent demand for reliable barcode printing technologies. However, the market faces challenges related to economic volatility in certain countries and varying levels of technological adoption across different sub-regions.

Latin America Barcode Printers Market Trends

Latin America presents a developing market for barcode printers, characterized by gradual adoption across retail, healthcare, and manufacturing sectors. Brazil and Mexico lead regional demand, supported by growing e-commerce penetration and modernization of supply chain infrastructure. The region’s pharmaceutical industry is increasingly implementing track-and-trace systems to combat counterfeit medications, driving demand for compliant barcode printing solutions.

While the market shows promising potential, economic fluctuations, currency volatility, and infrastructure constraints in certain countries continue to moderate the pace of technology adoption. Nevertheless, the rising awareness of inventory accuracy and operational efficiency benefits is encouraging businesses to invest in barcode printing systems progressively.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Barcode Printers Company Insights

Zebra Technologies Corp maintains its position as a market frontrunner, leveraging its extensive portfolio of enterprise-grade printing solutions and robust ecosystem of software and services that cater to diverse sectors including retail, healthcare, and logistics. The company’s continued investment in intelligent automation and cloud-connected devices has strengthened its competitive advantage in an increasingly digitalized supply chain environment.

Honeywell International Inc. demonstrates significant market presence through its integrated approach, combining barcode printing technology with broader automation and data capture solutions that appeal to industrial and warehouse operations seeking comprehensive workflow optimization. SATO Holdings Corporation has carved out a strong position particularly in the Asia-Pacific region, offering specialized printing solutions that address unique labeling requirements across pharmaceutical, food, and retail applications, while expanding its global footprint through strategic partnerships.

AVERY DENNISON CORPORATION brings a differentiated value proposition by integrating its material science expertise with printing technology, enabling innovative labeling solutions that meet stringent compliance and sustainability standards across multiple industries.

The competitive landscape also includes notable players like Canon Inc., Toshiba Tec Corporation, and Oki Electric Industry Co., Ltd., each contributing specialized technologies that serve niche segments. Meanwhile, companies such as Dascom and Printronix focus on rugged, industrial-grade solutions for demanding environments. This diverse competitive structure ensures continuous innovation while providing customers with varied options tailored to specific operational requirements, ultimately driving market growth and technological advancement throughout 2024.

Top Key Players in the Market

- AVERY DENNISON CORPORATION

- Canon Inc.

- Dascom

- Honeywell International Inc.

- Oki Electric Industry Co., Ltd.

- Printronix

- SATO Holdings Corporation

- Zebra Technologies Corp

- Toshiba Tec Corporation

Recent Developments

- In July 2024, TSC Auto ID introduced the TSC RE310, a compact and rugged 3-inch mobile barcode printer.It supports field, retail, warehouse, and delivery operations with improved mobility and durable printing performance.

- In November 2024, TSC Auto ID acquired Bluebird Inc. to integrate enterprise mobility with advanced Auto-ID printing.This move strengthens its ecosystem by combining mobile computing capabilities with smart barcode printing technologies.

- In July 2024, AWT Labels & Packaging acquired American Label Technologies (ALT), a specialist in RFID and NFC printing.The acquisition expands AWT’s smart-label production capacity and boosts its advanced identification portfolio.

- In July 2024, AWT Labels & Packaging completed the acquisition of American Label Technologies, enhancing its intelligent label offerings.This strategic move supports broader adoption of RFID-enabled printing solutions across logistics and retail sectors.

Report Scope

Report Features Description Market Value (2024) USD 3.9 Billion Forecast Revenue (2034) USD 7.8 Billion CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Desktop Printers, Mobile Printers, Industrial Printers), By Technology (Thermal Transfer, Direct Transfer, Laser, Impact, Inkjet), By End-user (Manufacturing, Healthcare, Retail & E-commerce, Transportation & Logistics, Government, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape AVERY DENNISON CORPORATION, Canon Inc., Dascom, Honeywell International Inc., Oki Electric Industry Co., Ltd., Printronix, SATO Holdings Corporation, Zebra Technologies Corp, Toshiba Tec Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AVERY DENNISON CORPORATION

- Canon Inc.

- Dascom

- Honeywell International Inc.

- Oki Electric Industry Co., Ltd.

- Printronix

- SATO Holdings Corporation

- Zebra Technologies Corp

- Toshiba Tec Corporation