Global Bakery Emulsions Market Size, Share, And Business Benefits By Source (Plant, Animal), By Nature (Conventional, Organic), By Flavor (Vanilla Emulsion, Lemon Emulsion, Almond Emulsion, Red Velvet Emulsion), By Application (Cakes and Cupcakes, Cookies and Pastries, Breads and Rolls, Confections and Ice Cream, Others), By Distribution Channel (Supermarkets and Hypermarkets, Store-Based Retail, Specialty Stores, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152609

- Number of Pages: 318

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

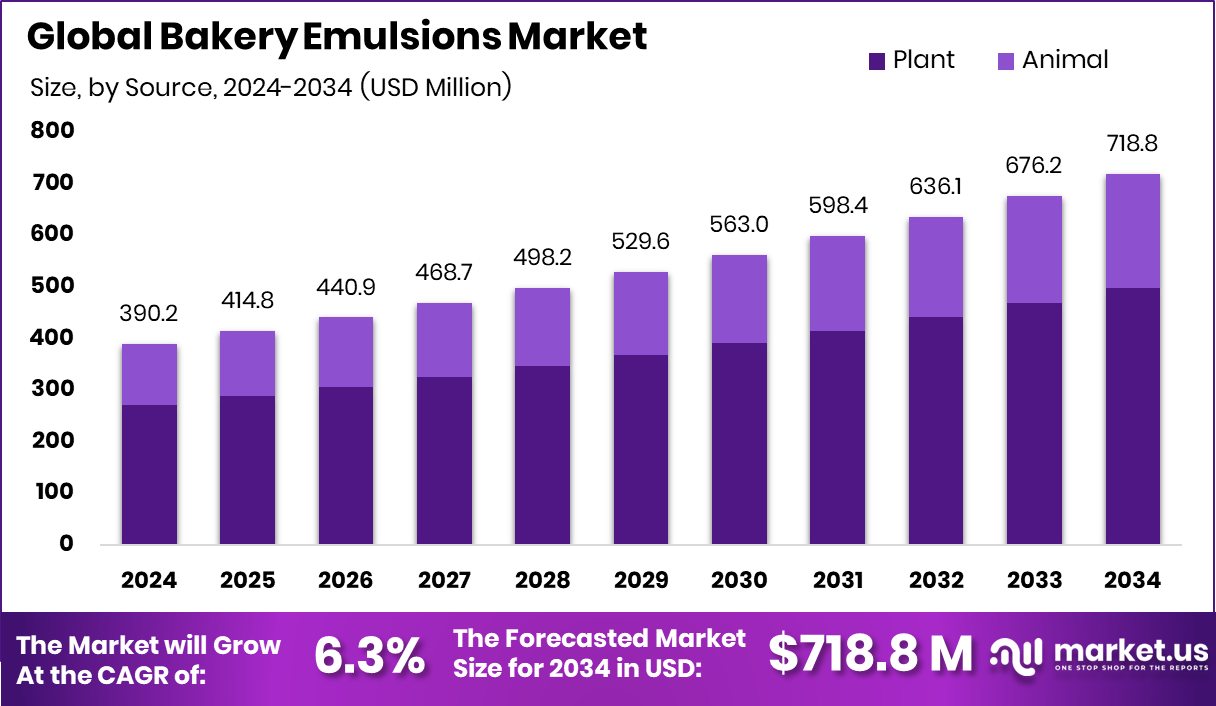

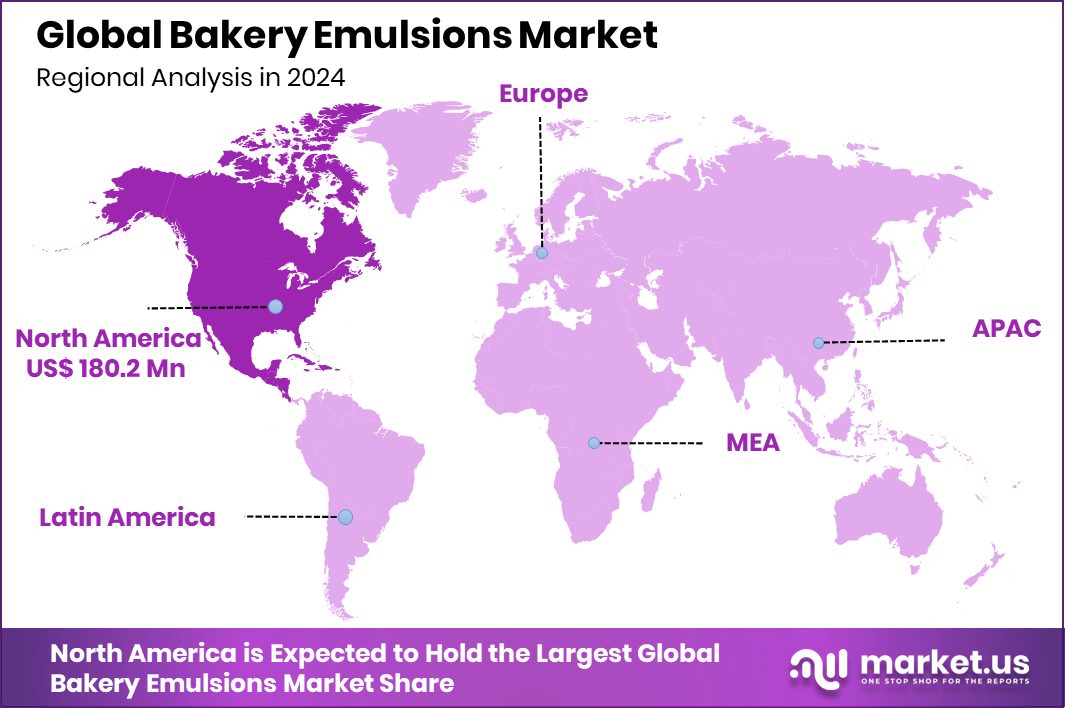

Global Bakery Emulsions Market is expected to be worth around USD 718.8 million by 2034, up from USD 390.2 million in 2024, and grow at a CAGR of 6.3% from 2025 to 2034. Strong demand for bakery products supported North America’s USD 180.2 Mn market dominance.

Bakery emulsions are flavoring agents and functional ingredients used in baking to improve the texture, consistency, and shelf life of bakery products. Unlike alcohol-based extracts, bakery emulsions are water-based, allowing them to retain their flavor better under high baking temperatures. They are commonly used in cakes, cookies, frostings, and breads to evenly distribute flavors and fats throughout the mixture, resulting in improved taste and texture.

The bakery emulsions market is witnessing growing traction due to increasing consumer preference for premium and artisanal baked goods. With a rising awareness about food quality and texture, there is a growing demand for bakery products that offer consistent flavor and longer shelf life. The use of emulsions plays a critical role in achieving these results, especially in commercial-scale bakeries aiming to maintain product consistency across large batches.

One of the major growth factors is the expansion of the bakery industry itself, driven by urbanization, rising disposable incomes, and changing lifestyles. As consumers increasingly seek convenience and variety, ready-to-eat and packaged bakery products have seen a surge, thereby boosting the need for performance-enhancing ingredients like emulsions. According to an industry report, Last Crumb secures $3 million in seed investment.

On the demand side, the clean-label trend is prompting manufacturers to use high-quality emulsions that offer both functionality and natural flavoring. There is also rising interest in plant-based and allergen-free formulations, pushing innovation in bakery emulsions made from natural sources. According to an industry report, Sweetish House Mafia obtains ₹12 crore in funding to grow its presence.

Key Takeaways

- Global Bakery Emulsions Market is expected to be worth around USD 718.8 million by 2034, up from USD 390.2 million in 2024, and grow at a CAGR of 6.3% from 2025 to 2034.

- Plant-based sources dominate the bakery emulsions market, holding a 69.4% share due to clean-label demand.

- Conventional emulsions lead the market with 79.2% share, driven by wide availability and cost-effectiveness.

- Vanilla emulsion accounts for 45.8% share, reflecting strong consumer preference for familiar, classic flavors.

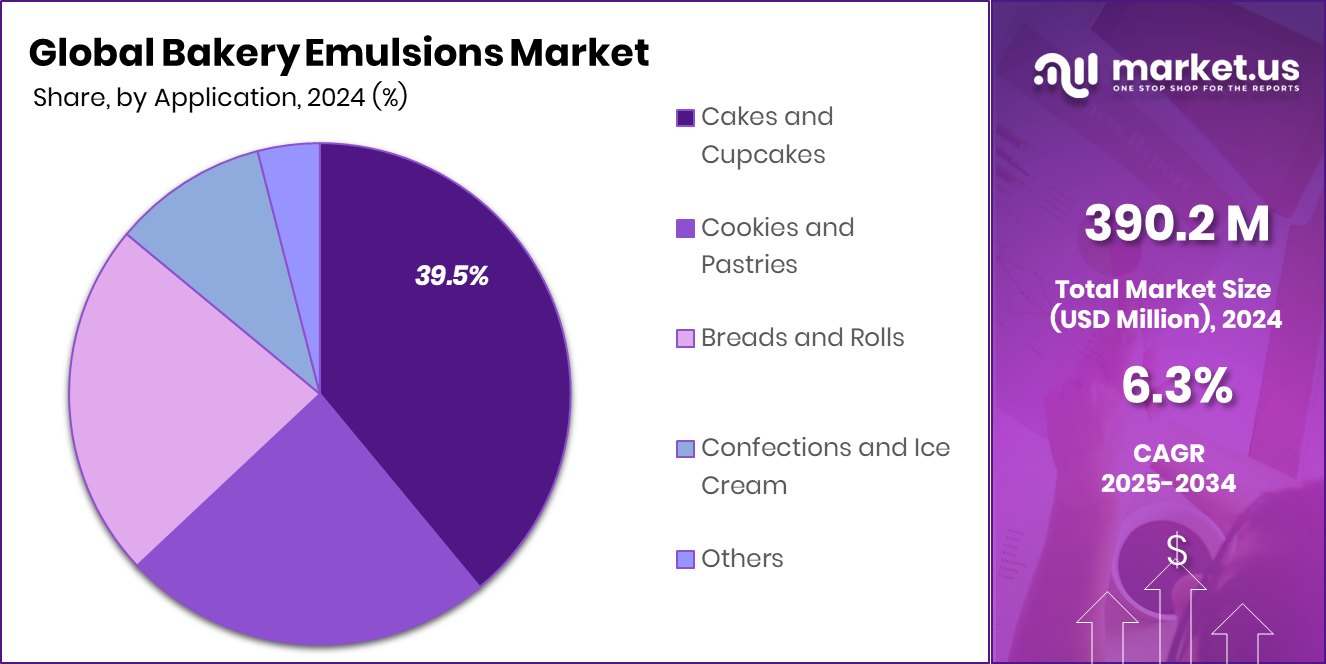

- Cakes and cupcakes hold 39.5% application share, supported by rising demand for premium bakery products.

- Supermarkets and hypermarkets lead with a 38.3% distribution share, offering accessibility and product variety to consumers.

- North America recorded a market value of approximately USD 180.2 million in 2024.

By Source Analysis

Plant-based emulsions dominate the Bakery Emulsions Market with 69.4% share.

In 2024, Plant held a dominant market position in the By Source segment of the Bakery Emulsions Market, with a 69.4% share. This substantial lead reflects the growing consumer demand for clean-label and plant-based ingredients in bakery formulations. As awareness regarding artificial additives and synthetic compounds increases, both consumers and manufacturers are shifting toward naturally sourced emulsifiers derived from plants.

The dominance of plant-sourced bakery emulsions is further supported by their wide compatibility with various dietary requirements, including vegan, allergen-free, and organic product lines. Their functional versatility in maintaining moisture, enhancing flavor distribution, and extending shelf life in baked goods has made them a preferred choice among bakery professionals.

The strong presence of plant-based emulsions in the market indicates a clear shift in industry formulation standards, where clean and recognizable ingredients are increasingly prioritized. As consumers continue to prioritize health and ingredient transparency, plant-based emulsions are expected to maintain their leadership in the source category.

By Nature Analysis

Conventional emulsions lead the Bakery Emulsions Market at 79.2%.

In 2024, Conventional held a dominant market position in the By Nature segment of the Bakery Emulsions Market, with a 79.2% share. This dominance is largely attributed to its widespread use in large-scale commercial baking operations, where consistency, cost-effectiveness, and reliable performance are critical. Conventional bakery emulsions are preferred due to their stable formulation, which offers dependable flavor retention and textural improvements under varying baking conditions.

Manufacturers continue to rely on conventional emulsions to meet the high-volume production demands of breads, cakes, pastries, and other baked goods. These emulsions provide essential functions such as improved batter stability, uniform fat distribution, and enhanced moisture retention—key attributes that help maintain product quality over extended shelf periods. The established infrastructure supporting the production and distribution of conventional emulsions further reinforces their market position, enabling manufacturers to source these ingredients at scale and with predictable quality.

Despite evolving trends in natural and clean-label ingredients, conventional emulsions maintain a strong preference among bakery producers due to their proven efficiency, longer shelf life, and versatility across diverse bakery applications. This continued reliance underscores their central role in supporting both product development and production efficiency across the global bakery sector.

By Flavor Analysis

Vanilla flavor holds 45.8% in the Bakery Emulsions Market segment.

In 2024, Vanilla Emulsion held a dominant market position in the By Flavor segment of the Bakery Emulsions Market, with a 45.8% share. This leading position is primarily driven by vanilla’s universal appeal and its integral role in enhancing the taste profile of a wide range of bakery products. Its familiarity, versatility, and ability to blend seamlessly with other ingredients make vanilla emulsion a preferred choice among both commercial and artisanal bakers.

Vanilla emulsion is widely used in cakes, cookies, muffins, frostings, and pastries due to its strong flavor retention, especially under high-temperature baking conditions. Compared to alcohol-based extracts, the emulsion format allows for more stable and consistent flavor distribution, which is critical in large-batch and repeat formulations. This reliability contributes to its widespread adoption in the bakery industry, especially where flavor uniformity is a key quality attribute.

The high demand for classic and comforting flavors in the bakery segment continues to support vanilla emulsion’s dominance. Its ability to complement both sweet and neutral bases has reinforced its position as an essential flavoring agent. The substantial market share held by vanilla emulsion in 2024 reflects its enduring consumer preference and continued importance in bakery flavor innovations.

By Application Analysis

Cakes and cupcakes application captures 39.5 of % Bakery Emulsions Market.

In 2024, Cakes and Cupcakes held a dominant market position in the By Application segment of the Bakery Emulsions Market, with a 39.5% share. This strong performance is primarily driven by the widespread consumption and commercial production of these baked goods across both household and industrial settings. Cakes and cupcakes require emulsions to achieve a moist, soft, and uniform texture, which directly influences consumer satisfaction and repeat purchases.

Bakery emulsions used in cakes and cupcakes play a vital role in improving batter stability, ensuring even mixing of fats and liquids, and enhancing the final product’s flavor and shelf life. These functional benefits are especially crucial in high-volume production environments, where consistency and quality control are essential. The dominance of this segment reflects the ongoing popularity of celebration-based and on-the-go bakery items, where cakes and cupcakes remain key categories.

Furthermore, the adaptability of cakes and cupcakes to various flavor profiles—including classic, seasonal, and innovative variants—makes them a central application for emulsions. Their strong demand across retail bakeries, cafes, supermarkets, and online platforms contributes to their continued relevance in the market. The 39.5% share in 2024 underscores the critical role emulsions play in maintaining the appeal and commercial success of these bakery staples.

By Distribution Channel Analysis

Supermarkets and hypermarkets distribute 38.3% of the Bakery Emulsions Market.

In 2024, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of the Bakery Emulsions Market, with a 38.3% share. This leadership is primarily attributed to their extensive reach, strong supply chain networks, and the convenience they offer to both commercial buyers and individual consumers. These retail formats provide a one-stop destination for a wide variety of baking ingredients, including emulsions, making them a preferred choice for sourcing quality bakery supplies.

The dominant share of supermarkets and hypermarkets reflects their ability to stock multiple brands and flavor varieties of bakery emulsions in different packaging sizes, catering to the needs of both household bakers and small-scale commercial users. The availability of in-store expert advice and promotional displays further enhances product visibility and purchasing confidence among buyers.

Additionally, the structured retail environment of supermarkets and hypermarkets supports consumer trust in product authenticity and shelf life, which is particularly important for functional ingredients like emulsions. These stores often feature dedicated bakery ingredient sections, making emulsions easily accessible and helping to drive consistent sales. The 38.3% market share captured by this segment in 2024 highlights its pivotal role in the distribution and accessibility of bakery emulsions across diverse consumer bases.

Key Market Segments

By Source

- Plant

- Animal

By Nature

- Conventional

- Organic

By Flavor

- Vanilla Emulsion

- Lemon Emulsion

- Almond Emulsion

- Red Velvet Emulsion

By Application

- Cakes and Cupcakes

- Cookies and Pastries

- Breads and Rolls

- Confections and Ice Cream

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Store-Based Retail

- Specialty Stores

- Online Retail

- Others

Driving Factors

Rising Demand for Baked Goods Worldwide

One of the key driving factors behind the growth of the bakery emulsions market is the increasing global demand for baked products such as cakes, cookies, pastries, and breads. As urban lifestyles evolve and people seek quick, convenient food options, baked goods have become a popular choice across age groups.

This growing consumption is directly boosting the use of bakery emulsions, which help improve product quality, taste, and shelf life. The emulsions provide better flavor stability and texture, making baked items more appealing to consumers. With the rising number of bakeries, cafes, and packaged food brands worldwide, the demand for efficient and high-performing emulsions continues to grow steadily, making it a strong market driver in 2024 and beyond.

Restraining Factors

Health Concerns Over Synthetic Ingredients Limit Growth

A major restraining factor in the bakery emulsions market is growing consumer concern over synthetic and artificial ingredients. Many conventional bakery emulsions are made using artificial flavorings, preservatives, and stabilizers, which are increasingly being avoided by health-conscious buyers. With rising awareness around clean-label and natural food products, consumers are scrutinizing ingredient lists more closely than ever.

This shift in preference has put pressure on manufacturers to reformulate emulsions using natural sources, which can be more expensive and technically challenging. As a result, brands that rely heavily on synthetic emulsions may face reduced demand. This health-driven shift in consumer behavior poses a challenge for the growth of conventional bakery emulsions, especially in markets with strong organic and wellness trends.

Growth Opportunity

Natural and Clean‑Label Emulsions Drive Expansion

The greatest growth opportunity in the bakery emulsions market lies in the development and adoption of natural and clean‑label emulsions. As an increasing number of consumers prioritize health, sustainability, and ingredient transparency, bakery manufacturers are seeking emulsions made from plant-based, non-synthetic sources. This shift opens a clear path for suppliers to innovate: by leveraging emulsifiers derived from fruits, seeds, or other natural extracts, companies can meet evolving market demand.

Additionally, clean‑label emulsions help brands differentiate their products and build consumer trust. As regulatory bodies in various regions also encourage clearer labeling and natural ingredient usage, manufacturers that invest in education, quality, and sourcing of clean‑label emulsions are well-positioned to capture this fast-growing niche and expand their presence in health-conscious markets.

Latest Trends

Rise of Plant-Based Emulsions in Baking

One of the latest trends in the bakery emulsions market is the growing use of plant-based emulsions. As consumers become more health-aware and environmentally conscious, there is a clear shift toward using ingredients derived from plants instead of synthetic or animal-based sources. Plant-based emulsions are gaining popularity because they align with vegan, vegetarian, and clean-label preferences.

These emulsions offer excellent performance in terms of texture, flavor stability, and shelf life while meeting the demand for more natural and sustainable ingredients. Bakers and food manufacturers are increasingly adopting these alternatives to cater to a wider consumer base.

Regional Analysis

In 2024, North America led the bakery emulsions market with a 46.2% share.

In 2024, North America emerged as the dominant region in the global Bakery Emulsions Market, holding a leading market share of 46.2%, which translates to a market value of approximately USD 180.2 million. This dominance is largely supported by the region’s strong demand for processed and packaged baked goods, driven by changing consumer lifestyles, increasing urbanization, and a preference for convenient, ready-to-eat food options. The well-established bakery industry across the United States and Canada continues to adopt emulsions to ensure consistent quality, improved shelf life, and enhanced product texture.

Europe also maintains a significant presence in the market, supported by its rich tradition of artisanal and commercial baking. Regulatory emphasis on food quality and growing interest in clean-label ingredients are influencing the use of more stable and functional emulsions.

The Asia Pacific region is showing steady growth as urban populations expand and Western-style bakery products gain popularity. Local bakeries and food service chains are increasingly incorporating emulsions to meet quality and volume demands.

Meanwhile, the Middle East & Africa and Latin America are gradually emerging with rising bakery consumption, supported by changing food habits and increasing demand for diversified baked products. However, North America continues to lead in both market share and value across the global landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players in the global bakery emulsions market—including ADM, Bakels Group, BASF, and Cargill Inc.—held influential positions through strategic innovation, broad product portfolios, and global distribution capabilities.

ADM leveraged its extensive agro-processing expertise to enhance its bakery emulsions lineup, focusing on functional performance and ingredient traceability. Investment in R&D resulted in formulations that improved texture, flavor retention, and shelf life, meeting both commercial and artisanal bakery needs. The company’s global sourcing network supported its distribution strength, especially in regions with strong demand for clean-label ingredients.

Bakels Group capitalized on its heritage in bakery ingredients to offer emulsions that complement its mixes, fillings, and dough conditioners. Its integrated approach provided value-added solutions that appealed to industrial bakers and smaller bakery operations alike. By emphasizing localized production and technical service, Bakels maintained strong relationships across Europe and the Asia Pacific markets.

BASF contributed to the market through its specialty chemicals expertise, delivering emulsions with precise functional properties and stable performance under varied processing conditions. Its portfolio enhancements focused on enabling bakers to achieve consistent dough rheology and moisture control, which are critical in high-volume industrial baking.

Cargill Inc. utilized its global food ingredients infrastructure to expand its bakery emulsions offerings, emphasizing plant-based emulsifier systems aligned with prevailing clean-label trends. With its strength in large-scale production and sustainability initiatives, Cargill supported bakery manufacturers seeking natural and performance-driven emulsions.

Top Key Players in the Market

- ADM (Archer Daniels Midland Company)

- Bakels Group

- BASF

- Cargill Inc.

- Corbion N.V.

- DSM-Firmenich

- DuPont de Nemours, Inc.

- Kerry Group plc

- Lasenor Emul S.L.

- Palsgaard A/S

- Puratos Group

Recent Developments

- In May 2025, Cargill was recognized as the world’s leading edible oil supplier for eliminating industrial trans fats (iTFAs) from its entire portfolio, aligning with WHO guidelines. This milestone demonstrates Cargill’s commitment to healthier fats used in bakery shortenings and emulsions, supporting texture and functionality without compromising nutrition.

- In December 2024, BASF signed a binding agreement to sell its Food and Health Performance Ingredients business—including plant-based food emulsifiers and bakery-related ingredients—to Louis Dreyfus Company. This unit, based in Illertissen, Germany, included aeration agents and fat powders used in baked goods.

Report Scope

Report Features Description Market Value (2024) USD 390.2 Million Forecast Revenue (2034) USD 718.8 Million CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Plant, Animal), By Nature (Conventional, Organic), By Flavor (Vanilla Emulsion, Lemon Emulsion, Almond Emulsion, Red Velvet Emulsion), By Application (Cakes and Cupcakes, Cookies and Pastries, Breads and Rolls, Confections and Ice Cream, Others), By Distribution Channel (Supermarkets and Hypermarkets, Store-Based Retail, Specialty Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ADM (Archer Daniels Midland Company), Bakels Group, BASF, Cargill Inc., Corbion N.V., DSM-Firmenich, DuPont de Nemours, Inc., Kerry Group plc, Lasenor Emul S.L., Palsgaard A/S , Puratos Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ADM (Archer Daniels Midland Company)

- Bakels Group

- BASF

- Cargill Inc.

- Corbion N.V.

- DSM-Firmenich

- DuPont de Nemours, Inc.

- Kerry Group plc

- Lasenor Emul S.L.

- Palsgaard A/S

- Puratos Group