Global Automotive Wheel Market Size, Share, Growth Analysis By Material (Aluminum, Steel, Alloy, Carbon Fibre), By Vehicle (Passenger Vehicles, Commercial Vehicles, Off-Road Vehicles), By Manufacturing Process (Casting, Forging, Flow Forming), By Rim Size (13-15 inches, 16-18 inches, 19-21 inches, Above 21 inches), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 175970

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

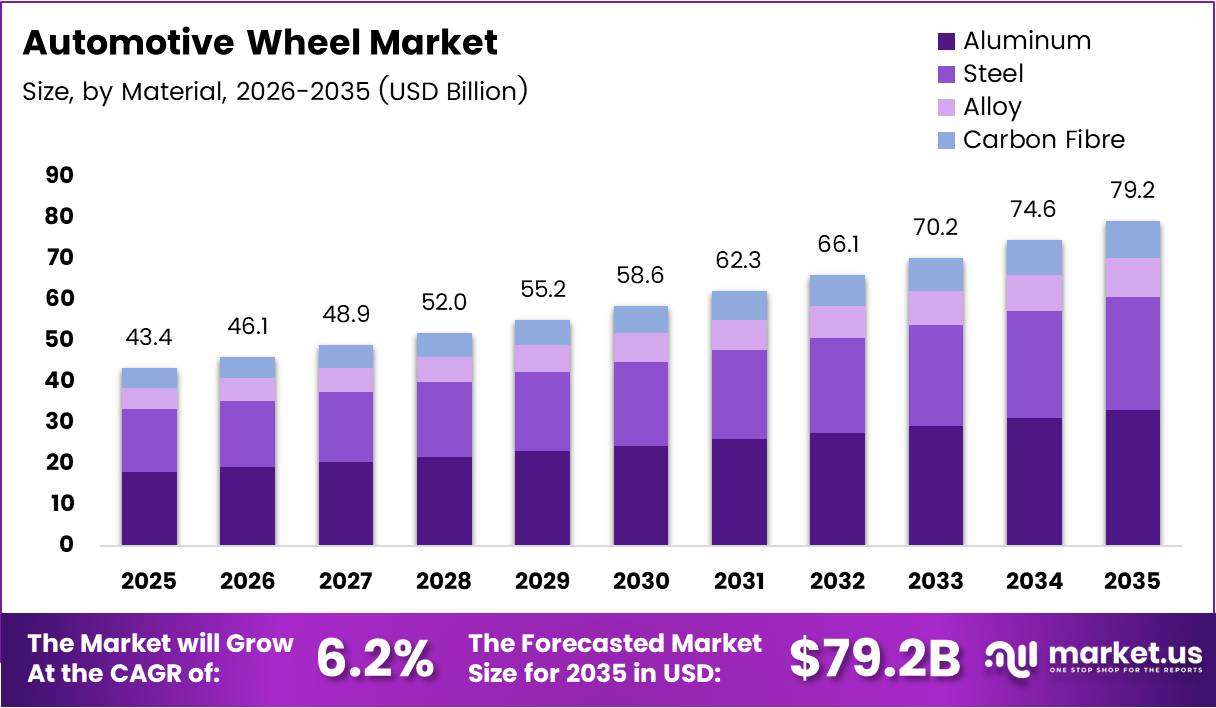

Global Automotive Wheel Market size is expected to be worth around USD 79.2 Billion by 2035 from USD 43.4 Billion in 2025, growing at a CAGR of 6.2% during the forecast period 2026 to 2035.

Automotive wheels form essential structural components connecting vehicles to road surfaces through tire mounting systems. These circular metal frames support vehicle weight and enable motion. Moreover, wheels influence handling characteristics and contribute to vehicle aesthetics.

The market encompasses diverse material options including aluminum, steel, alloy compositions, and carbon fiber variants. Manufacturers serve passenger vehicles, commercial transportation, and off-road applications. Consequently, product innovation focuses on weight reduction and durability enhancement.

Regional production centers concentrate in Asia Pacific, North America, and Europe. Growing vehicle ownership rates stimulate replacement demand across markets. Therefore, wheel manufacturers expand capacity to meet rising consumption patterns globally.

Government regulations mandate safety standards and performance specifications for automotive wheels worldwide. Testing protocols verify load-bearing capacity and impact resistance. Additionally, environmental policies encourage recyclable materials throughout production cycles.

Electric vehicle adoption creates demand for lightweight wheel solutions that extend battery range. Passenger car buyers increasingly select premium alloy wheels for enhanced visual appeal. Furthermore, aftermarket customization trends drive consumer spending on aesthetic upgrades.

In July 2025, Les Schwab Tire Centers acquired Staley’s Tire & Automotive, adding two Billings locations. This acquisition demonstrates consolidation momentum within distribution networks. The expansion strengthens service offerings including custom wheels across regional markets.

The Asia Pacific region leads global production supported by massive automotive manufacturing infrastructure. Supply chain integration connects raw material suppliers and vehicle assembly plants efficiently. However, material cost fluctuations challenge profitability across market participants.

Key Takeaways

- Global Automotive Wheel Market projected to reach USD 79.2 Billion by 2035, growing at 6.2% CAGR

- Aluminum wheels dominate material segment with 48.1% market share in 2025

- Passenger vehicles lead application segment accounting for 69.7% market share

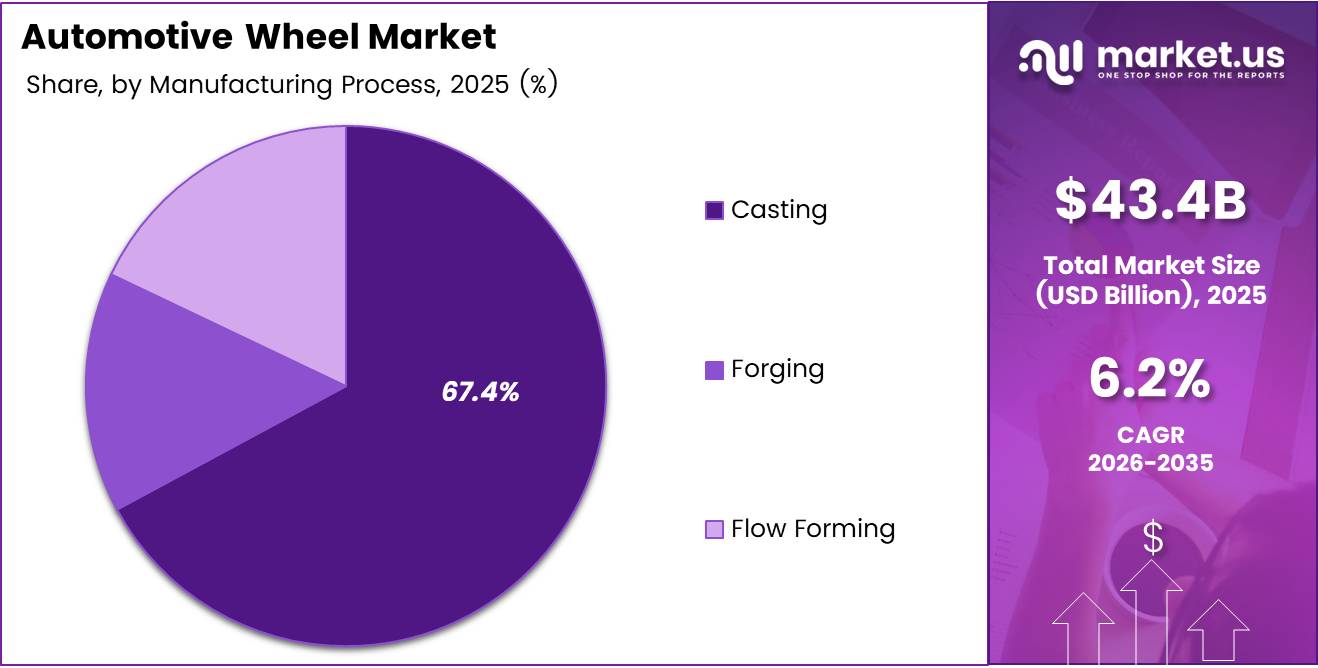

- Casting manufacturing process holds 67.4% share of production methods

- 16-18 inches rim size captures 39.6% of market demand

- OEM sales channel commands 69.9% market share in distribution

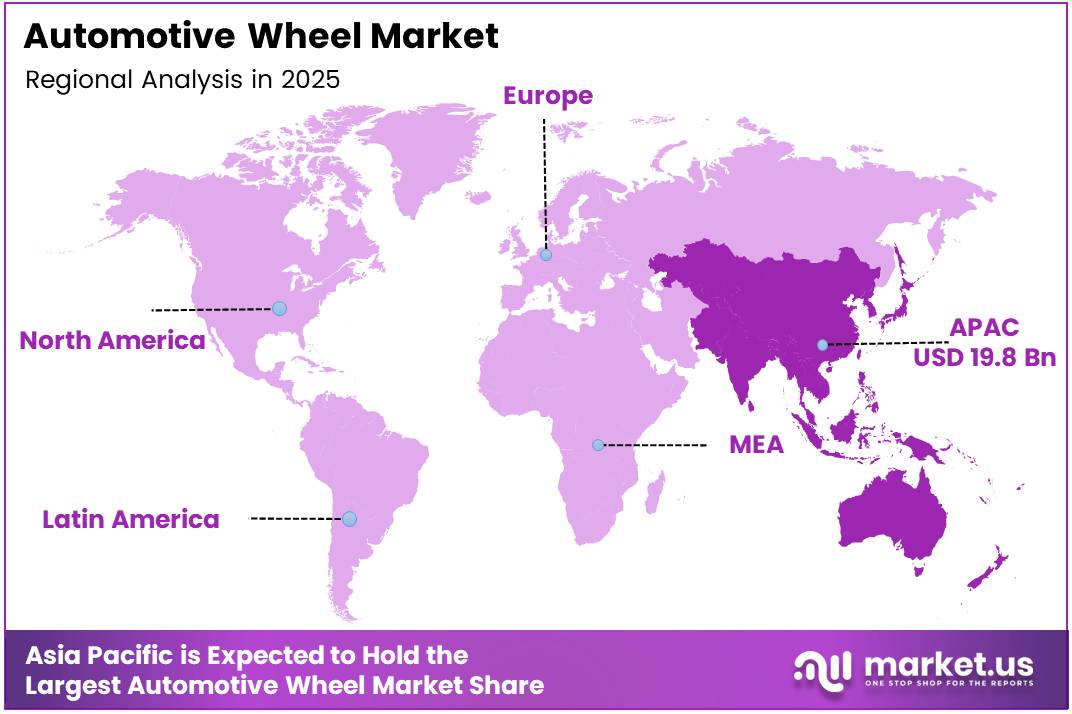

- Asia Pacific dominates regional market with 45.8% share, valued at USD 19.8 Billion

Material Analysis

Aluminum dominates with 48.1% due to lightweight properties and corrosion resistance benefits.

In 2025, Aluminum held a dominant market position in the By Material segment of Automotive Wheel Market, with a 48.1% share. Aluminum wheels offer superior weight reduction compared to traditional steel alternatives. Manufacturers favor aluminum for excellent strength-to-weight ratio and enhanced aesthetic appeal. Moreover, aluminum wheels dissipate brake heat effectively.

Steel wheels maintain significant presence in commercial vehicle applications and price-sensitive segments. Steel construction provides exceptional durability and impact resistance for heavy-duty requirements. Consequently, fleet operators prioritize steel wheels for long-term cost effectiveness. However, steel’s heavier weight limits passenger vehicle adoption.

Alloy wheels combine multiple metals to optimize performance characteristics and manufacturing versatility. These composite materials balance strength, weight, and aesthetic customization for premium applications. Therefore, alloy wheels command higher price points while delivering enhanced attributes. Additionally, alloy compositions enable intricate design possibilities.

Carbon Fiber wheels represent emerging technology for ultra-premium and high-performance vehicle applications. Carbon fiber construction achieves extreme weight reduction while maintaining structural integrity. Furthermore, carbon fiber wheels offer superior stiffness and reduced rotational mass. Nevertheless, manufacturing complexity limits adoption to niche segments.

Vehicle Analysis

Passenger Vehicles dominate with 69.7% due to high production volumes and consumer replacement demand.

In 2025, Passenger Vehicles held a dominant market position in the By Vehicle segment of Automotive Wheel Market, with a 69.7% share. Passenger cars represent the largest automotive segment globally, driving substantial wheel demand. Consumers prioritize wheel aesthetics and performance in personal vehicles. Moreover, passenger vehicle owners frequently upgrade wheels for customization.

Hatchback vehicles utilize compact wheel designs optimized for urban driving efficiency. These smaller passenger cars typically feature 13-15 inch and 16-18 inch wheel sizes. Consequently, hatchback manufacturers focus on cost-effective wheel solutions that maintain affordability. Additionally, lightweight wheel options improve fuel economy.

Sedan applications demand balanced wheel designs that prioritize comfort and refined aesthetics. Mid-size and full-size sedans commonly specify 16-18 inch and 19-21 inch wheel diameters. Therefore, sedan wheel designs emphasize visual sophistication and premium finishes. Furthermore, sedan buyers increasingly select alloy wheels for enhanced appearance.

SUV/Crossover vehicles drive demand for larger diameter wheels accommodating increased vehicle weight. These utility vehicles commonly feature 19-21 inch and above 21 inch wheel sizes. Moreover, SUV wheels require enhanced load-bearing capacity for varied driving conditions. Consequently, SUV segment growth accelerates premium wheel demand.

Commercial Vehicles encompass diverse transportation applications requiring specialized wheel designs and materials. Light, medium, and heavy commercial vehicles specify wheels based on payload capacity. Therefore, commercial segment emphasizes durability over aesthetic considerations. Additionally, steel wheels dominate due to strength requirements.

Light Commercial Vehicles (LCV) utilize wheels designed for urban delivery and service applications. LCV wheels balance weight efficiency with durability for frequent stop-and-go driving. Therefore, LCV manufacturers select cost-effective solutions that minimize ownership costs. Additionally, LCV wheels share design platforms with passenger vehicles.

Medium Commercial Vehicles (MCV) require wheels engineered for regional transportation and distribution operations. MCV wheels emphasize durability and load-bearing capabilities for extended service intervals. Consequently, steel wheels dominate MCV applications due to superior strength. Furthermore, MCV operators prioritize wheel longevity and minimal maintenance.

Heavy Commercial Vehicles (HCV) demand robust wheel designs that withstand extreme loads and challenging environments. HCV wheels must meet stringent safety and performance standards for long-haul transportation. Moreover, HCV wheels feature specialized mounting systems and reinforced construction. Therefore, heavy-duty steel wheels remain the preferred solution.

Off-Road Vehicles necessitate specialized wheel designs that deliver durability in challenging terrain conditions. Off-road wheels feature reinforced construction and protective finishes to withstand impacts. Additionally, off-road vehicle owners select larger diameter wheels for enhanced capability. Therefore, off-road wheels prioritize strength over weight reduction.

Manufacturing Process Analysis

Casting dominates with 67.4% due to cost efficiency and production scalability advantages.

In 2025, Casting held a dominant market position in the By Manufacturing Process segment of Automotive Wheel Market, with a 67.4% share. Casting processes enable high-volume wheel production with relatively low tooling costs. Manufacturers utilize gravity casting, low-pressure casting, and counter-pressure casting methods. Moreover, casting technology accommodates complex wheel designs efficiently.

Forging delivers superior material properties and weight reduction compared to cast alternatives. Forged wheels exhibit enhanced grain structure and mechanical strength through compression forming. Therefore, premium vehicle manufacturers increasingly adopt forged wheel technology. Additionally, forging reduces material waste while improving product consistency.

Flow Forming combines casting and forging advantages through advanced rotary forging techniques. This hybrid manufacturing process strengthens wheel barrel sections while maintaining design flexibility. Furthermore, flow forming achieves significant weight reduction without compromising structural integrity. Consequently, flow formed wheels bridge traditional cast and forged segments.

Rim Size Analysis

16-18 inches dominates with 39.6% due to widespread adoption across passenger vehicle segments.

In 2025, 16-18 inches held a dominant market position in the By Rim Size segment of Automotive Wheel Market, with a 39.6% share. This size range balances ride comfort, handling performance, and tire availability. Manufacturers optimize 16-18 inch wheels for mainstream sedans, hatchbacks, and compact SUVs. Moreover, this diameter range offers consumers broad tire selection.

13-15 inches wheels serve entry-level passenger vehicles and smaller urban transportation applications. These compact wheel sizes prioritize affordability, fuel efficiency, and comfortable ride characteristics. Therefore, budget-conscious consumers maintain demand for 13-15 inch wheel options. Additionally, smaller diameter wheels reduce vehicle weight.

19-21 inches wheels cater to premium passenger vehicles, luxury sedans, and larger SUV applications. These larger diameter wheels enhance vehicle aesthetics and accommodate high-performance brake systems. Furthermore, 19-21 inch wheels improve handling precision and visual presence. Consequently, premium vehicle segments drive increasing adoption globally.

Above 21 inches wheels represent ultra-premium and performance vehicle applications with specialized requirements. These oversized wheels deliver maximum visual impact and accommodate advanced braking systems. Moreover, above 21 inch wheels appeal to luxury SUV buyers. However, larger wheels increase tire costs and may compromise ride comfort.

Sales Channel Analysis

OEM dominates with 69.9% due to new vehicle production volumes and manufacturer specifications.

In 2025, OEM held a dominant market position in the By Sales Channel segment of Automotive Wheel Market, with a 69.9% share. Original equipment manufacturers maintain direct relationships with automotive companies for wheel supply. OEM channels ensure consistent quality standards and design integration with vehicle assembly. Moreover, OEM wheel specifications influence vehicle performance and aesthetic appeal.

Aftermarket channels serve replacement demand and consumer customization preferences across vehicle ownership lifecycles. Aftermarket wheel sales encompass replacement due to damage and elective upgrades. Therefore, aftermarket distribution includes retailers, online platforms, and specialty wheel shops. Additionally, aftermarket channels offer broader design variety than original equipment specifications.

Key Market Segments

By Material

- Aluminum

- Steel

- Alloy

- Carbon Fibre

By Vehicle

- Passenger Vehicles

- Hatchback

- Sedan

- SUV/Crossover

- Commercial Vehicles

- Light Commercial Vehicles (LCV)

- Medium Commercial Vehicles (MCV)

- Heavy Commercial Vehicles (HCV)

- Off-Road Vehicles

By Manufacturing Process

- Casting

- Forging

- Flow Forming

By Rim Size

- 13-15 inches

- 16-18 inches

- 19-21 inches

- Above 21 inches

By Sales Channel

- OEM

- Aftermarket

Drivers

Rising Global Passenger Vehicle Production and Sales Volume Drives Market Growth

Global automotive production expansion creates sustained demand for original equipment wheel supply. Vehicle manufacturers increase production capacity to meet growing consumer demand in markets. Moreover, rising middle-class populations stimulate first-time vehicle purchases and fleet expansion. Consequently, passenger vehicle production growth translates to increased wheel consumption.

In August 2024, Lacks Enterprises acquired Forgeline Motorsports, a leading producer of premium custom wheels. This strategic acquisition demonstrates industry consolidation as manufacturers expand premium capabilities. Furthermore, increasing vehicle ownership rates globally create replacement cycles sustaining market growth. Therefore, manufacturers invest in production capacity expansion.

Consumer preferences shift toward larger vehicles including SUVs and crossovers requiring premium wheels. These vehicle segments specify larger diameter wheels and advanced materials for performance. Therefore, automakers invest in wheel development programs that differentiate vehicle offerings. Additionally, safety regulations mandate wheel performance standards driving technology advancement.

Restraints

Volatility in Raw Material Prices for Aluminum and Steel Limits Market Profitability

Aluminum and steel price fluctuations create significant cost pressures for wheel manufacturers. Raw material expenses represent substantial portions of total manufacturing costs, reducing margins. Moreover, manufacturers struggle to pass cost increases to automakers due to contracts. Consequently, material cost volatility creates financial uncertainty and impacts investment decisions.

Global commodity markets influence aluminum and steel availability based on mining output and policies. Supply chain disruptions and geopolitical tensions periodically constrain material access and inflate costs. Therefore, wheel producers implement hedging strategies and diversify supplier networks for mitigation. Additionally, recycled aluminum adoption increases to reduce dependency on primary sources.

High replacement and custom wheel costs in price-sensitive markets limit aftermarket penetration rates. Premium alloy and forged wheels command price points exceeding budget constraints. Furthermore, developing market consumers prioritize essential vehicle maintenance over discretionary upgrades. Consequently, aftermarket wheel sales concentrate in affluent markets where consumers allocate customization spending.

Growth Factors

Expanding Electric Vehicle Production Requiring Lightweight Wheel Solutions Accelerates Market Expansion

Electric vehicle manufacturers prioritize weight reduction strategies to maximize battery range and efficiency. Lightweight aluminum and carbon fiber wheels deliver measurable improvements in EV performance. Moreover, EV platforms accommodate larger wheel diameters that enhance vehicle aesthetics. Consequently, electric vehicle growth creates demand for advanced wheel technologies.

In December 2025, Fastco Canada, a subsidiary of Groupe Touchette, acquired the ENVY wheel brand. This acquisition reflects growing aftermarket opportunities as vehicle personalization trends intensify globally. Furthermore, EV adoption rates accelerate in major automotive markets driven by incentives. Therefore, wheel manufacturers develop specialized products for electric vehicle applications.

Growing aftermarket demand for custom and aesthetic wheel designs stimulates consumer spending. Vehicle owners increasingly view wheels as expression of personal style and differentiation. Therefore, aftermarket retailers expand inventory offerings with diverse designs and finishes. Additionally, online sales channels improve consumer access to specialty wheel products.

Emerging Trends

Increasing Use of Large-Diameter Wheels in SUVs and Premium Cars Reshapes Market Landscape

Consumer preferences shift toward larger diameter wheels that enhance vehicle commanding presence. Premium sedan and SUV buyers select 19-21 inch and above 21 inch wheels. Moreover, larger wheels accommodate advanced brake systems required for performance vehicles. Consequently, wheel manufacturers develop product portfolios emphasizing larger diameter options across segments.

Sustainable and recyclable wheel materials gain importance as automotive industry addresses environmental concerns. Manufacturers implement closed-loop recycling programs that reclaim aluminum from end-of-life wheels. Therefore, recycled aluminum content increases in wheel manufacturing while maintaining standards. Additionally, sustainable material sourcing improves brand reputation and meets corporate commitments.

Smart sensor integration in wheels enables tire pressure monitoring and performance data collection. Advanced wheel designs incorporate sensor mounting provisions for real-time monitoring systems. Furthermore, smart wheel technology connects with vehicle telematics systems providing predictive maintenance. Consequently, technology integration adds value beyond traditional wheel structural functions.

Regional Analysis

Asia Pacific Dominates the Automotive Wheel Market with a Market Share of 45.8%, Valued at USD 19.8 Billion

Asia Pacific leads global automotive wheel production and consumption supported by massive infrastructure. The region hosts major wheel suppliers serving domestic automakers and export markets. Moreover, Asia Pacific dominates aluminum wheel production through integrated supply chains. Consequently, APAC’s 45.8% market share valued at USD 19.8 Billion reflects its automotive manufacturing leadership.

North America Automotive Wheel Market Trends

North America maintains significant wheel demand driven by high vehicle ownership and customization culture. The region emphasizes premium alloy wheels and larger diameter sizes for SUVs. Moreover, North American manufacturers focus on advanced materials and manufacturing processes. Therefore, the region represents a mature market with stable replacement demand.

Europe Automotive Wheel Market Trends

Europe demonstrates strong demand for lightweight aluminum and alloy wheels supporting efficiency objectives. European automakers lead premium vehicle production requiring advanced wheel designs and materials. Moreover, strict safety and quality standards drive technology innovation across manufacturing operations. Consequently, Europe maintains significant market position with emphasis on sustainability.

Latin America Automotive Wheel Market Trends

Latin America exhibits growing wheel demand supported by expanding automotive production in Brazil. The region balances cost-effective steel wheels with increasing aluminum wheel adoption. Moreover, aftermarket channels expand as vehicle ownership increases across countries. Therefore, Latin America represents an emerging growth opportunity with improving conditions.

Middle East & Africa Automotive Wheel Market Trends

Middle East and Africa show increasing wheel demand driven by vehicle imports. The region emphasizes durable wheel solutions for challenging climate conditions. Moreover, luxury vehicle sales in Gulf Cooperation Council countries drive premium demand. Consequently, Middle East and Africa markets offer growth potential through development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

CITIC Dicastal operates as a leading global aluminum wheel manufacturer serving major brands. The company maintains advanced production facilities across China with significant capacity. Moreover, CITIC Dicastal invests heavily in research and development for technologies. Consequently, the company strengthens its market position through vertical integration.

Ronal specializes in premium aluminum wheels for passenger vehicles with strong presence. The company delivers innovative designs combining aesthetic appeal with engineering excellence. Moreover, Ronal emphasizes quality manufacturing processes ensuring consistent product performance. Therefore, Ronal maintains its reputation as a preferred supplier for applications.

Iochpe-Maxion represents one of the world’s largest wheel manufacturers serving markets globally. The company operates production facilities across Americas, Europe, and Asia providing solutions. Moreover, Iochpe-Maxion invests in manufacturing technology advancement to improve efficiency. Consequently, the company leverages its global footprint and diversified product portfolio.

Enkei focuses on lightweight aluminum wheel manufacturing utilizing advanced casting and forming technologies. The company serves automotive manufacturers and aftermarket channels with products emphasizing reduction. Moreover, Enkei maintains strong presence in motorsports demonstrating product durability. Therefore, Enkei builds brand reputation through racing heritage and technology leadership.

Key players

- CITIC Dicastal

- Ronal

- Iochpe-Maxion

- Enkei

- Borbet

- Superior Industries International

- Prime Wheel

- BBS Autotechnik

- Topy Industries

- Zhejiang Wanfeng Auto Wheel

- Accuride

Recent Developments

- April 2025 – ASR Motorsport acquired Corsart Wheels, broadening its custom automotive wheels lineup and enhancing market presence in specialty segments with expanded design capabilities and manufacturing capacity for performance applications.

- September 2024 – Dent Wizard International acquired Armani Wheels to expand service capabilities in New York and New Jersey, strengthening its wheel repair and refinishing network across metropolitan markets with high demand.

- May 2025 – The G.M.P. Group completed the acquisition of Diewe Wheels, strengthening its presence in the German automotive wheel market and expanding product portfolio with established European brand recognition and channels.

- January 2026 – Sun Auto Tire & Service completed the acquisition of Mac’s Tire & Service in Tupelo, Mississippi as part of its national expansion strategy, extending aftermarket wheel and tire service across regions.

Report Scope

Report Features Description Market Value (2025) USD 43.4 Billion Forecast Revenue (2035) USD 79.2 Billion CAGR (2026-2035) 6.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Aluminum, Steel, Alloy, Carbon Fibre), By Vehicle (Passenger Vehicles, Commercial Vehicles, Off-Road Vehicles), By Manufacturing Process (Casting, Forging, Flow Forming), By Rim Size (13-15 inches, 16-18 inches, 19-21 inches, Above 21 inches), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape CITIC Dicastal, Ronal, Iochpe-Maxion, Enkei, Borbet, Superior Industries International, Prime Wheel, BBS Autotechnik, Topy Industries, Zhejiang Wanfeng Auto Wheel, Accuride Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- CITIC Dicastal

- Ronal

- Iochpe-Maxion

- Enkei

- Borbet

- Superior Industries International

- Prime Wheel

- BBS Autotechnik

- Topy Industries

- Zhejiang Wanfeng Auto Wheel

- Accuride