Global Automotive Steering System Market Size, Share, Growth Analysis By Mechanism (Electronic Power Steering (EPS), Hydraulic Power Steering (HPS), Electro-hydraulic Power Steering (EHPS), Steer by Wire), By Component (Steering Column/Rack, Hydraulic Pump, Electric Motor, Sensors, Electronic Control Unit (ECU), Others), By Vehicle Type (Passenger Cars; Commercial Vehicles), By Electric Motor Type (Brushless, Brushed), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177287

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

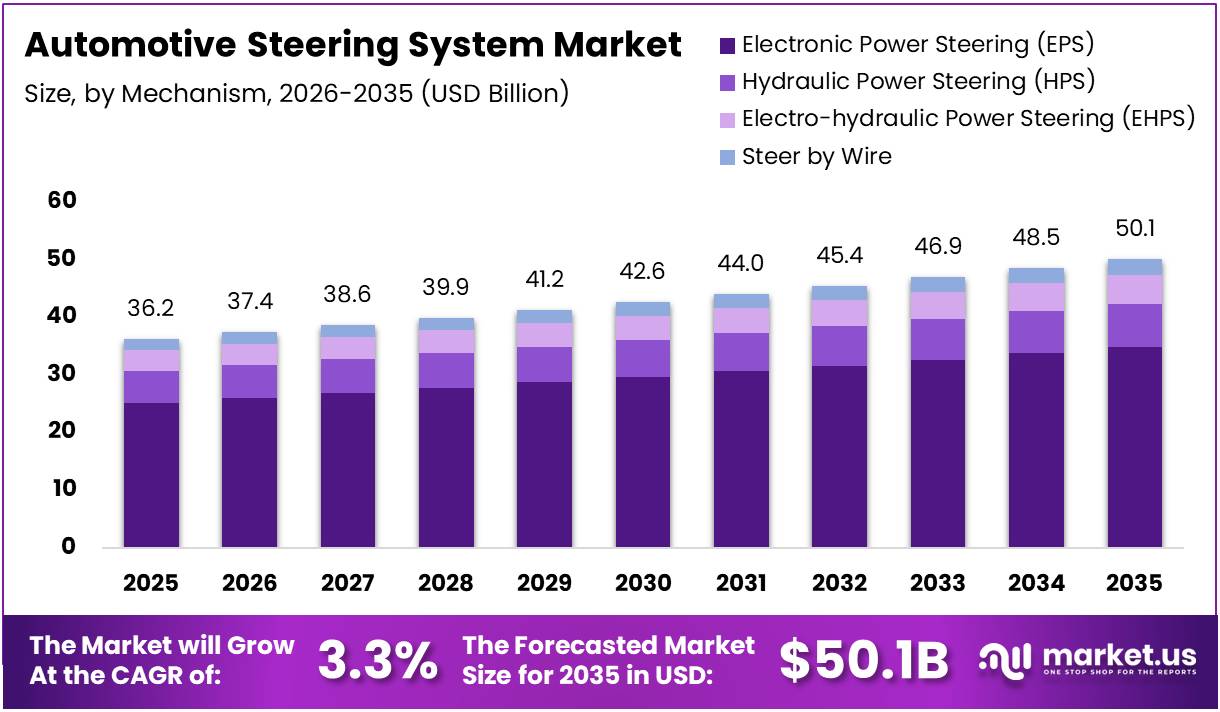

The Global Automotive Steering System Market size is expected to be worth around USD 50.1 Billion by 2035 from USD 36.2 Billion in 2025, growing at a CAGR of 3.3% during the forecast period 2026 to 2035.

The Automotive Steering System Market encompasses mechanical and electronic components that enable directional control of vehicles. These systems translate driver input into wheel movement, ensuring precise handling and safety. Modern steering technologies range from traditional hydraulic systems to advanced electronic and steer-by-wire solutions.

Market growth is driven by increasing vehicle production worldwide and rising demand for fuel-efficient steering technologies. Moreover, stringent safety regulations mandate advanced steering control features in both passenger and commercial vehicles. Consequently, automakers are integrating sophisticated steering systems with driver assistance technologies to enhance vehicle performance.

Electronic power steering systems dominate the market due to their superior fuel efficiency and integration capabilities with autonomous driving features. Additionally, the shift toward electric vehicles accelerates demand for electrically assisted steering solutions. Therefore, manufacturers are investing heavily in developing next-generation steering technologies that support electrification and automation trends.

Government initiatives promoting vehicle safety standards further propel market expansion across developed and emerging economies. However, concerns regarding electronic system reliability and maintenance complexity pose challenges to widespread adoption. Nevertheless, technological advancements continue to address these limitations through improved sensor integration and software-based control mechanisms.

According to SAE International, field trials of an Electric Powered Hydraulic Steering system in heavy-duty vehicles demonstrated a 3%–6% improvement in fuel economy compared to conventional engine-driven hydraulic steering systems under loaded conditions. This improvement highlights the efficiency gains achievable through modern steering technologies in commercial applications.

According to ScienceDirect, an optimized pump-controlled electro-hydraulic steering system reduced total steering input energy by 76.19% compared with non-optimized conditions in experimental real-road tests. These findings underscore the significant energy savings potential of advanced steering system optimization. Consequently, such innovations drive manufacturer interest in developing more efficient steering solutions for future vehicle platforms.

Key Takeaways

- Global Automotive Steering System Market projected to reach USD 50.1 Billion by 2035 from USD 36.2 Billion in 2025 at 3.3% CAGR

- Electronic Power Steering (EPS) segment dominates by mechanism with 69.6% market share in 2025

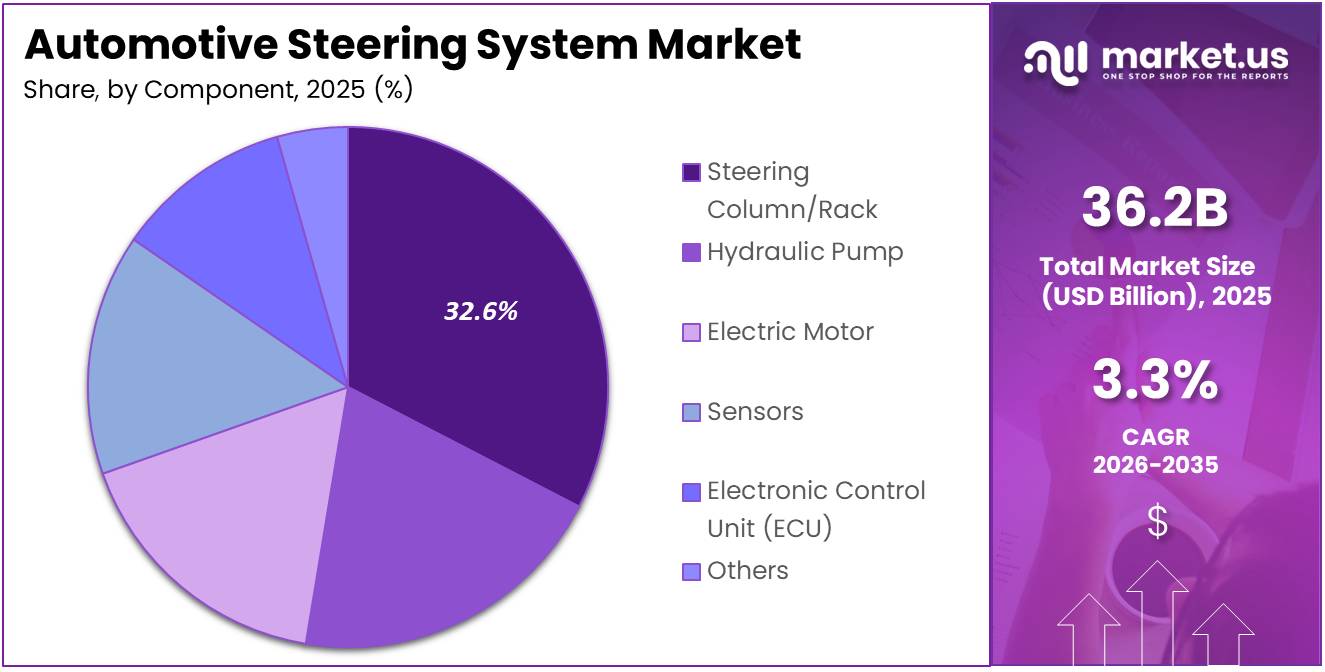

- Steering Column/Rack component segment leads with 32.6% share in 2025

- Passenger Cars segment accounts for 75.2% of market by vehicle type in 2025

- Brushless electric motor type holds 69.5% market share in 2025

- OEM sales channel dominates with 85.4% market share in 2025

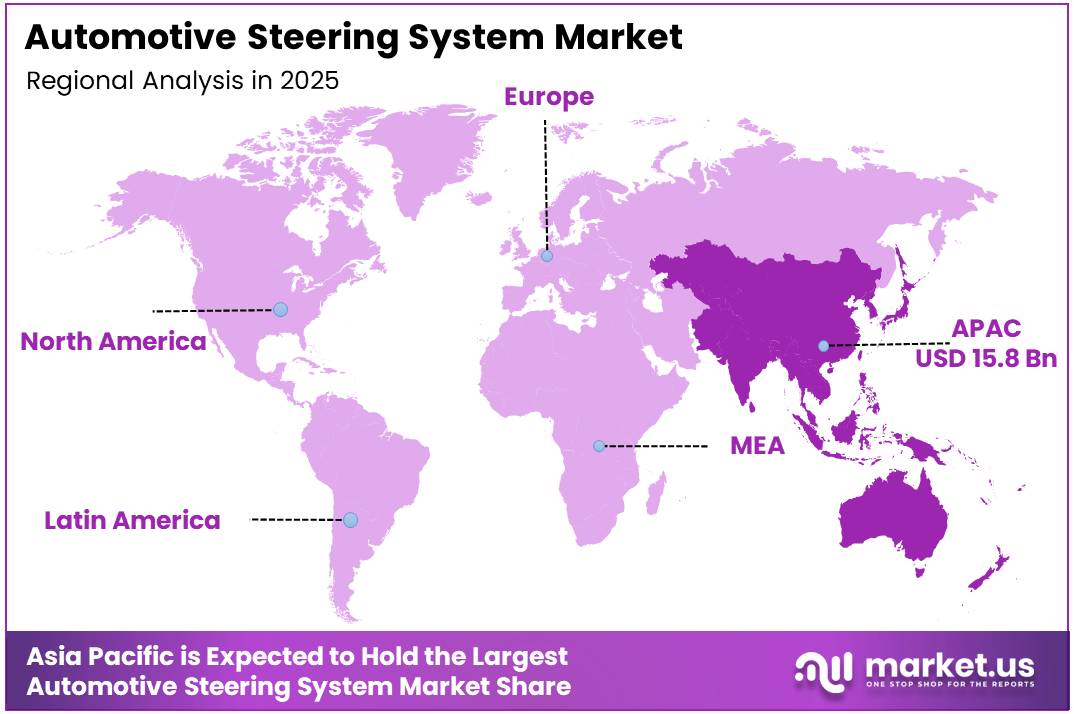

- Asia Pacific region leads with 43.70% share valued at USD 15.8 Billion in 2025

Mechanism Analysis

Electronic Power Steering (EPS) dominates with 69.6% due to superior fuel efficiency and integration with advanced driver assistance systems.

In 2025, Electronic Power Steering (EPS) held a dominant market position in the By Mechanism segment of Automotive Steering System Market, with a 69.6% share. EPS eliminates traditional hydraulic pumps, reducing engine load and improving fuel economy significantly. Moreover, these systems integrate seamlessly with electronic vehicle architectures, enabling advanced safety features and autonomous driving capabilities.

Hydraulic Power Steering (HPS) continues serving legacy vehicle platforms and applications requiring robust mechanical feedback. Traditional hydraulic systems provide reliable performance in heavy-duty commercial vehicles and off-road applications. However, declining adoption in passenger vehicles reflects industry transition toward more efficient electronic alternatives driven by environmental regulations.

Electro-hydraulic Power Steering (EHPS) combines hydraulic actuation with electric pump control, offering intermediate efficiency improvements over conventional systems. This technology provides transitional solution for manufacturers upgrading from purely hydraulic architectures. Additionally, EHPS systems maintain hydraulic feel preferred by performance vehicle enthusiasts while achieving partial electrification benefits.

Steer-by-Wire represents emerging technology eliminating mechanical linkages between steering wheel and wheels entirely through electronic control systems. These advanced systems enable flexible vehicle interior design and support fully autonomous driving functionality. Consequently, leading manufacturers invest in steer-by-wire development for next-generation electric and autonomous vehicle platforms.

Component Analysis

Steering Column/Rack dominates with 32.6% due to critical role in translating driver input and supporting multiple steering system architectures.

In 2025, Steering Column/Rack held a dominant market position in the By Component segment of Automotive Steering System Market, with a 32.6% share. These structural components form the mechanical foundation of steering systems across all vehicle types. Moreover, advanced columns integrate torque sensors and electronic interfaces essential for modern power steering functionality.

Hydraulic Pump components remain essential in traditional and electro-hydraulic steering architectures, generating necessary fluid pressure for assisted steering. These pumps continue serving existing vehicle fleets and applications requiring hydraulic actuation. However, market share gradually declines as electronic power steering adoption accelerates across passenger vehicle segments.

Electric Motor components drive the rapid growth of electronic power steering systems, providing precise assist control through software calibration. Advanced motor designs deliver improved efficiency and compact packaging suitable for diverse vehicle platforms. Additionally, brushless motor technology dominates premium applications due to superior reliability and performance characteristics.

Sensors provide real-time monitoring of steering angle, torque, and vehicle dynamics, enabling precise control and integration with safety systems. These monitoring components facilitate advanced driver assistance features and autonomous driving capabilities. Moreover, sensor accuracy directly impacts steering system responsiveness and overall vehicle handling performance.

Electronic Control Unit (ECU) serves as the computational brain managing steering assist levels, integrating inputs from multiple sensors and vehicle systems. These control units execute sophisticated algorithms coordinating steering response with vehicle speed, road conditions, and driver preferences. Additionally, ECU software enables over-the-air updates and continuous performance optimization throughout vehicle lifecycle.

Others category encompasses supporting components including wiring harnesses, mounting brackets, and auxiliary systems that complete steering system assemblies. These miscellaneous elements ensure reliable installation and operation across diverse vehicle platforms. Furthermore, this segment includes specialized components for unique applications and aftermarket accessories enhancing steering functionality.

Vehicle Type Analysis

Passenger Cars dominate with 75.2% due to high production volumes and rapid adoption of advanced steering technologies.

In 2025, Passenger Cars held a dominant market position in the By Vehicle Type segment of Automotive Steering System Market, with a 75.2% share. This segment includes Hatchback, Sedan, Sport Utility Vehicle, and Multi-Purpose Vehicle categories, collectively representing the largest automotive manufacturing volume globally. Moreover, passenger vehicles drive innovation in electronic power steering and driver assistance integration.

Commercial Vehicles including Light Commercial Vehicles and Heavy Commercial Vehicles require robust steering systems handling increased loads and demanding operational conditions. Electric-hydraulic and fully electric steering solutions improve fuel economy in commercial applications. However, reliability and durability requirements maintain demand for proven hydraulic technologies in heavy-duty transport segments.

Electric Motor Type Analysis

Brushless motors dominate with 69.5% due to superior efficiency, reliability, and reduced maintenance requirements.

In 2025, Brushless electric motor type held a dominant market position in the By Electric Motor Type segment of Automotive Steering System Market, with a 69.5% share. Brushless motors eliminate physical commutators, significantly reducing wear and extending operational lifespan in automotive applications. Moreover, these motors deliver higher power density and efficiency critical for electronic power steering performance.

Brushed motors continue serving cost-sensitive vehicle segments and aftermarket replacement applications due to simpler construction and lower initial costs. Traditional brushed designs provide adequate performance for basic power steering assistance in entry-level vehicles. However, maintenance requirements and shorter service life limit brushed motor adoption in modern vehicle platforms prioritizing reliability and total ownership costs.

Sales Channel Analysis

OEM channel dominates with 85.4% due to integrated steering system installation during vehicle manufacturing.

In 2025, OEM sales channel held a dominant market position in the By Sales Channel segment of Automotive Steering System Market, with a 85.4% share. Original equipment manufacturers integrate steering systems directly into vehicle production lines, ensuring precise calibration and warranty coverage. Moreover, automakers increasingly specify advanced electronic steering technologies as standard equipment across vehicle lineups.

Aftermarket channel serves replacement demand for aging vehicle fleets and performance upgrade applications requiring steering system components. Independent repair facilities and specialty shops distribute aftermarket steering parts for maintenance and customization purposes. Additionally, growing vehicle parc creates sustained demand for replacement steering components, though electronic system complexity favors OEM-sourced parts for reliability.

Key Market Segments

By Mechanism

- Electronic Power Steering (EPS)

- Hydraulic Power Steering (HPS)

- Electro-hydraulic Power Steering (EHPS)

- Steer by Wire

By Component

- Steering Column/Rack

- Hydraulic Pump

- Electric Motor

- Sensors

- Electronic Control Unit (ECU)

- Others

By Vehicle Type

- Passenger Cars

- Hatchback

- Sedan

- Sport Utility Vehicle

- Multi-Purpose Vehicle

- Commercial Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Electric Motor Type

- Brushless

- Brushed

By Sales Channel

- OEM

- Aftermarket

Drivers

Rising Vehicle Production with Integrated Safety and Handling Requirements Drives Market Growth

Global automotive production expansion creates sustained demand for advanced steering systems across passenger and commercial vehicle segments. Manufacturers integrate sophisticated steering technologies to meet consumer expectations for enhanced safety and driving comfort. Moreover, emerging markets experience rapid motorization, increasing steering system requirements for diverse vehicle platforms and price points.

Stringent vehicle safety regulations mandate advanced steering control features including electronic stability programs and emergency steering assistance. Regulatory frameworks across major automotive markets require steering systems supporting collision avoidance and lane-keeping technologies. Consequently, automakers invest heavily in developing compliant steering solutions that integrate seamlessly with mandatory safety architectures.

Electronic power steering adoption accelerates as manufacturers prioritize fuel efficiency improvements to meet increasingly stringent emission standards globally. EPS systems reduce parasitic engine losses compared to traditional hydraulic alternatives, directly improving vehicle fuel economy. Additionally, electric steering enables precise torque control supporting advanced driver assistance systems and contributing to overall vehicle efficiency optimization efforts.

Restraints

Reliability Concerns and Maintenance Complexity in Electronic Steering Systems Limit Market Adoption

Electronic power steering systems introduce increased complexity through integrated sensors, control units, and software dependencies requiring specialized diagnostic equipment. Maintenance challenges arise when troubleshooting electronic failures compared to straightforward mechanical hydraulic system repairs. Moreover, concerns regarding electronic component longevity in harsh automotive environments create hesitation among fleet operators prioritizing long-term reliability.

Performance limitations emerge when electronic steering systems operate under extreme driving conditions including severe temperatures and demanding off-road applications. Traditional hydraulic systems maintain consistent performance across wider environmental ranges without electronic component vulnerabilities. Additionally, power supply dependencies create potential failure modes absent in mechanically driven hydraulic architectures.

Higher initial costs associated with advanced electronic steering technologies create adoption barriers in price-sensitive vehicle segments and developing markets. Component complexity and electronic content increase manufacturing expenses compared to conventional hydraulic alternatives. Furthermore, aftermarket service infrastructure requires significant investment in training and equipment to support electronic steering system maintenance and repair capabilities.

Growth Factors

Expansion of Steer-by-Wire Systems in Next-Generation Electric Vehicles Accelerates Market Growth

Steer-by-wire technology eliminates mechanical linkages, enabling flexible vehicle interior packaging and supporting autonomous driving architectures in electric vehicles. Leading manufacturers develop redundant electronic steering systems meeting safety requirements for fully automated driving functions. Moreover, steer-by-wire facilitates innovative vehicle designs including adjustable driving positions and reconfigurable interior spaces impossible with conventional steering columns.

Autonomous vehicle development demands advanced steering solutions capable of precise control without driver input across diverse driving scenarios. Steering systems integrate with artificial intelligence and sensor fusion technologies to execute complex maneuvering decisions autonomously. Consequently, automotive technology companies invest substantially in developing steering architectures supporting Level 4 and Level 5 automation capabilities.

Rapid automotive electrification drives widespread adoption of electronic power steering systems optimized for battery electric vehicle platforms and energy efficiency. Electric vehicles eliminate traditional engine-driven hydraulic pumps, necessitating fully electric steering solutions aligned with vehicle electrification strategies. Additionally, smart steering systems leverage vehicle connectivity and data analytics to provide adaptive steering characteristics enhancing driving experience and efficiency.

Emerging Trends

Digital Transformation Reshapes Automotive Steering System Landscape Through Software and Connectivity

Industry transition from hydraulic to fully electric power steering architectures reflects broader automotive electrification and digitalization trends. Manufacturers phase out traditional hydraulic systems in new vehicle platforms, prioritizing electronic solutions offering superior efficiency and integration capabilities. Moreover, this architectural shift enables over-the-air software updates and continuous steering system performance optimization throughout vehicle lifecycle.

Integration of steering systems with advanced driver assistance systems and vehicle control software creates unified chassis management architectures. Coordinated control between steering, braking, and suspension systems enhances vehicle stability and safety beyond individual component capabilities. Additionally, artificial intelligence algorithms optimize steering response based on driving conditions, road surfaces, and driver preferences in real-time.

Sensor proliferation and software-based steering control systems enable intelligent features including lane-keeping assistance, automated parking, and adaptive steering ratios. Advanced torque sensors and position monitors provide precise feedback for electronic control units managing steering assistance levels. Furthermore, redundant sensor architectures ensure fail-safe operation supporting autonomous driving safety requirements and regulatory compliance across global markets.

Regional Analysis

Asia Pacific Dominates the Automotive Steering System Market with a Market Share of 43.70%, Valued at USD 15.8 Billion

Asia Pacific leads the automotive steering system market with 43.70% share valued at USD 15.8 Billion, driven by massive vehicle production volumes in China, Japan, South Korea, and India. The region’s automotive manufacturing dominance, combined with rapid electrification initiatives and growing middle-class vehicle ownership, sustains robust steering system demand. Moreover, regional suppliers invest heavily in advanced electronic steering technologies supporting local and export market requirements.

North America Automotive Steering System Market Trends

North America demonstrates strong demand for advanced steering systems driven by premium vehicle preferences and early autonomous driving technology adoption. Stringent safety regulations and consumer expectations for driver assistance features accelerate electronic power steering integration across vehicle segments. Additionally, established automotive manufacturers and technology companies collaborate on next-generation steer-by-wire systems supporting automated driving development in the region.

Europe Automotive Steering System Market Trends

Europe maintains significant steering system market presence through leading automotive manufacturers prioritizing advanced safety and environmental performance standards. Aggressive emission reduction targets drive rapid electronic power steering adoption and innovation in efficient steering technologies. Furthermore, European regulatory frameworks establishing autonomous driving standards influence global steering system development priorities and technological advancement trajectories.

Latin America Automotive Steering System Market Trends

Latin America experiences growing steering system demand supported by increasing vehicle production and economic development in Brazil and Mexico. Regional automotive manufacturing expansion attracts investment in steering system production facilities and supply chain development. However, market growth faces challenges from economic volatility and price sensitivity favoring conventional steering technologies over advanced electronic alternatives.

Middle East & Africa Automotive Steering System Market Trends

Middle East and Africa regions show emerging potential for steering system market growth driven by infrastructure development and increasing vehicle ownership rates. Import-dependent markets gradually develop local automotive assembly and component manufacturing capabilities including steering systems. Additionally, harsh operating environments in certain markets maintain demand for robust hydraulic steering solutions alongside growing interest in modern electronic technologies.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

JTEKT Corporation maintains a leading position in the automotive steering system market through comprehensive product portfolios spanning hydraulic, electric, and steer-by-wire technologies. The company leverages decades of steering system expertise and strong relationships with major global automakers to drive innovation in electronic power steering solutions. Moreover, JTEKT invests significantly in autonomous driving-ready steering architectures, positioning itself strategically for future mobility transformation across passenger and commercial vehicle segments.

Robert Bosch GmbH delivers advanced steering system solutions integrating seamlessly with broader vehicle safety and automation technologies within its extensive automotive portfolio. The company’s electronic power steering systems feature sophisticated sensor integration and software capabilities supporting advanced driver assistance functions. Additionally, Bosch’s global manufacturing footprint and research capabilities enable rapid deployment of next-generation steering technologies meeting diverse regional market requirements and regulatory standards.

ZF Friedrichshafen AG provides comprehensive steering system offerings through its chassis technology division, emphasizing integration with vehicle dynamics control and autonomous driving systems. The company develops innovative steer-by-wire technologies and redundant steering architectures addressing safety-critical requirements for automated vehicles. Furthermore, ZF’s recent partnerships with autonomous trucking companies demonstrate commitment to expanding steering system applications beyond traditional passenger vehicle markets.

Nexteer Automotive Corporation specializes exclusively in advanced steering and driveline systems, enabling focused innovation in electric power steering and steer-by-wire technologies. The company actively participates in industry standardization efforts, particularly advancing chassis-by-wire standards in key automotive markets including China. Moreover, Nexteer’s dedicated steering system expertise positions it as preferred partner for automakers developing sophisticated steering solutions for electric and autonomous vehicle platforms.

Key players

- JTEKT Corporation

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Nexteer Automotive Corporation

- NSK Ltd

- Mando Corporation

- Showa Corporation

- Astemo

- Hyundai Mobis

- Schaeffler Group

Recent Developments

- January 2026 – Nexteer Automotive sponsored the Automotive Chassis-by-Wire Standards Research Group Meeting, actively advancing steer-by-wire technology standardization efforts in China. This initiative demonstrates industry collaboration toward establishing unified technical specifications and safety frameworks for next-generation steering systems supporting autonomous vehicle deployment across Asian markets.

- November 2025 – Kodiak AI expanded its partnership with ZF Friedrichshafen AG through purchase of 100 redundant steering systems designed to enhance autonomous trucking safety capabilities. This significant order reflects growing commercial vehicle automation demand and importance of fail-safe steering architectures in autonomous freight transportation applications.

- February 2025 – Global investment firm Carlyle completed acquisition of controlling stake in Highway Industries Limited and Roop Automotives Limited through proprietary exclusive transaction. This strategic investment strengthens automotive component manufacturing capabilities and expands steering system production capacity serving growing Asian automotive markets.

Report Scope

Report Features Description Market Value (2025) USD 36.2 Billion Forecast Revenue (2035) USD 50.1 Billion CAGR (2026-2035) 3.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Mechanism (Electronic Power Steering (EPS), Hydraulic Power Steering (HPS), Electro-hydraulic Power Steering (EHPS), Steer by Wire), By Component (Steering Column/Rack, Hydraulic Pump, Electric Motor, Sensors, Electronic Control Unit (ECU), Others), By Vehicle Type (Passenger Cars – Hatchback, Sedan, Sport Utility Vehicle, Multi-Purpose Vehicle; Commercial Vehicles – Light Commercial Vehicles, Heavy Commercial Vehicles), By Electric Motor Type (Brushless, Brushed), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape JTEKT Corporation, Robert Bosch GmbH, ZF Friedrichshafen AG, Nexteer Automotive Corporation, NSK Ltd, Mando Corporation, Showa Corporation, Astemo, Hyundai Mobis, Schaeffler Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Steering System MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Automotive Steering System MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- JTEKT Corporation

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Nexteer Automotive Corporation

- NSK Ltd

- Mando Corporation

- Showa Corporation

- Astemo

- Hyundai Mobis

- Schaeffler Group