Global Automotive NFC market Market Size, Share, Growth Analysis By Level of Autonomy (Semi-Autonomous, Autonomous), By Vehicle Type (Low-End, Mid-Range, High-End), By Chip Type (Passive NFC, Active NFC), By Application (Interior, Exterior), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168339

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

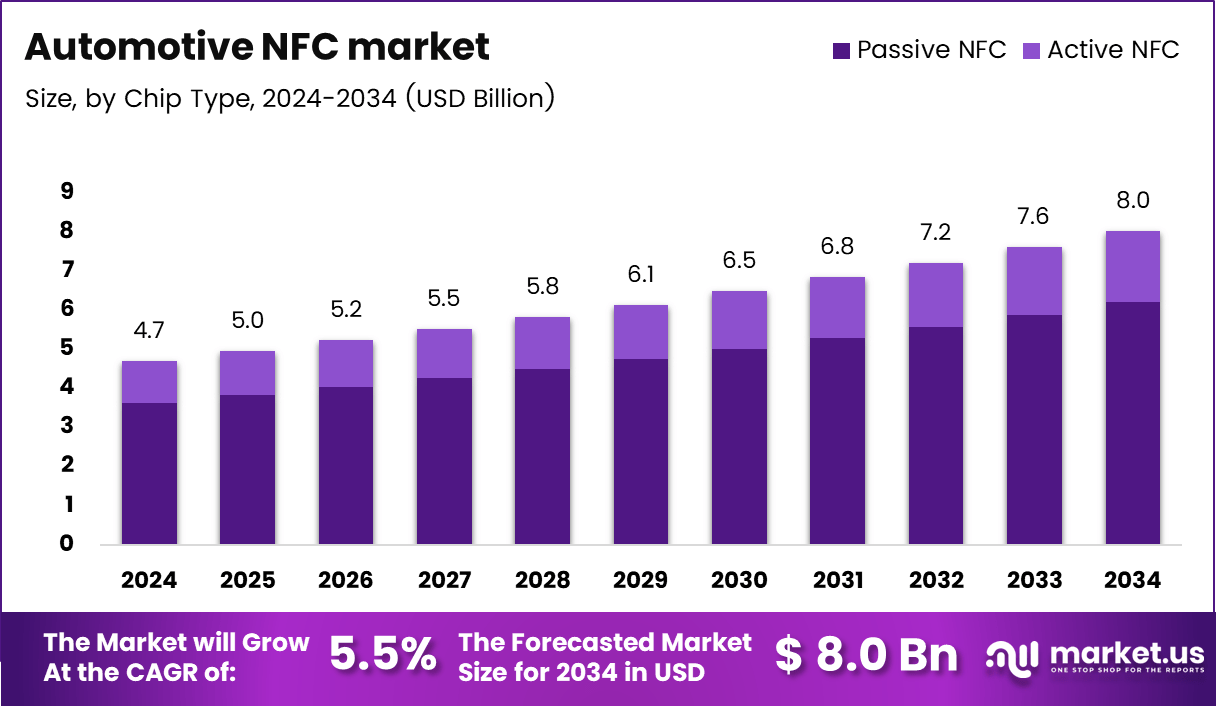

The Global Automotive NFC market size is expected to be worth around USD 8.0 billion by 2034, from USD 4.7 billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

The Automotive NFC market represents a rapidly advancing segment focused on secure connectivity, smart access, and seamless in-vehicle authentication. The market benefits from rising digitalization in vehicles as automakers integrate NFC for keyless entry, user personalization, and payment-enabled infotainment systems. Increasing demand for convenience enhances adoption across premium and mid-range vehicle categories.

The Automotive NFC market represents a rising pillar within smart mobility, enabling digital key access, secure authentication, and seamless smartphone pairing. The market evolves as vehicles adopt contactless technologies that enhance convenience and support next-generation in-vehicle connectivity. This shift accelerates interest in embedded NFC modules, digital access systems, and personalized mobility experiences.

Transitioning toward connected mobility strengthens demand as automakers integrate NFC to streamline user interaction and improve security layers. Consumers increasingly expect fast pairing, driver-profile activation, and frictionless vehicle entry, which pushes the industry to adopt standardized and secure communication protocols. This evolution enhances the value proposition of NFC-enabled vehicle platforms.

Government regulations further support this market by promoting digital identity frameworks, cybersecurity compliance, and encrypted data exchange. These regulatory efforts encourage standardization around digital keys and secure vehicle-access technologies. As transportation ecosystems modernize, NFC-driven authentication becomes a logical step in improving safety, enabling smart-city alignment, and supporting future autonomous ecosystems.

Additionally, growing opportunities emerge from expanding car-sharing services, fleet digitization, and subscription-based mobility models. NFC enables quick, traceable access and supports operational efficiency for fleet operators. The rise of electric vehicles also strengthens adoption since EV platforms increasingly demand unified security, intelligent charging authentication, and seamless user-vehicle communication.

Toward the end of the adoption curve, public data on automotive NFC usage remains limited, yet broader technology patterns offer meaningful indicators. According to global connectivity projections, 90% of vehicles sold by 2030 are expected to be connected, creating a strong foundation for NFC-based authentication and automotive digital key deployment. This trajectory highlights growing alignment between consumer expectations and connected-vehicle capabilities.

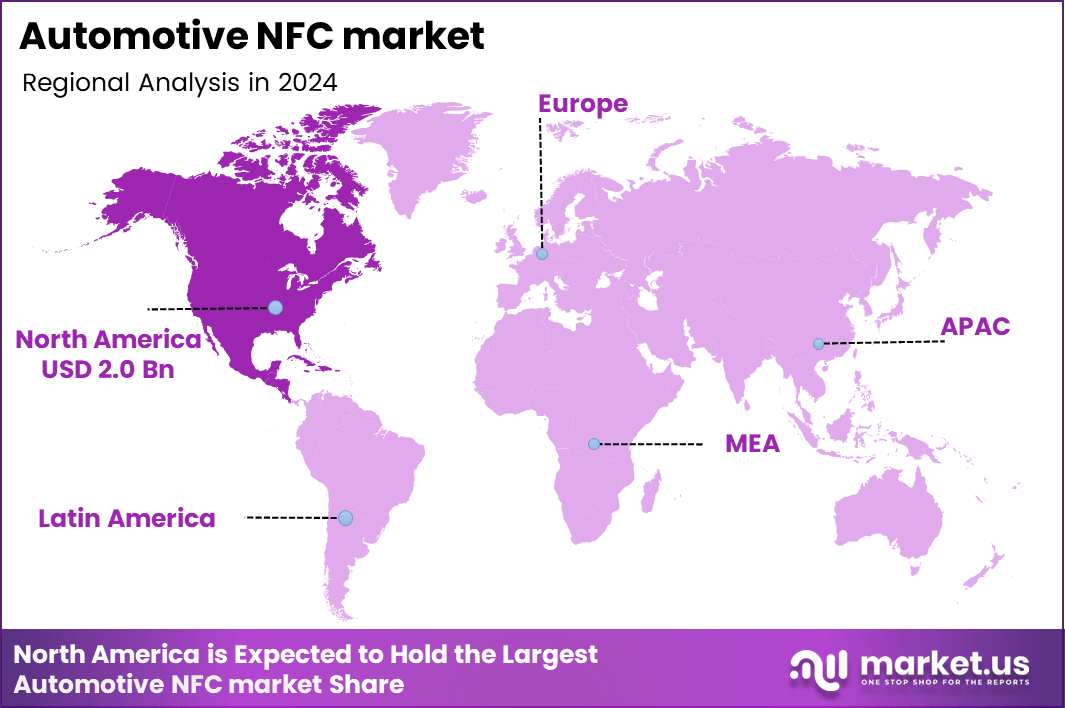

Regional dynamics also reinforce market readiness. According to publicly available digital-key adoption reports, North America accounted for roughly 37% of digital car-key usage in 2024. Additionally, the steady global expansion of NFC technology across devices and IoT ecosystems supports rising familiarity with contactless interactions. Together, these verified signals demonstrate accelerating momentum for Automotive NFC solutions, even though detailed consumer-behavior surveys specific to this category are still emerging.

Key Takeaways

- The global Automotive NFC market reached USD 4.7 billion in 2024 and is projected to hit USD 8.0 billion by 2034.

- The market expands at a 5.5% CAGR from 2025–2034, driven by rising adoption of digital key systems.

- 106 Kbit/S emerged as the leading Type segment with a 44.2% share in 2024.

- Semi-Autonomous vehicles dominated the autonomy segment with a 67.9% contribution.

- Mid-range vehicles led the Vehicle Type category with a 55.7% share.

- Passive NFC remained the leading Chip Type with a significant 77.3% market share.

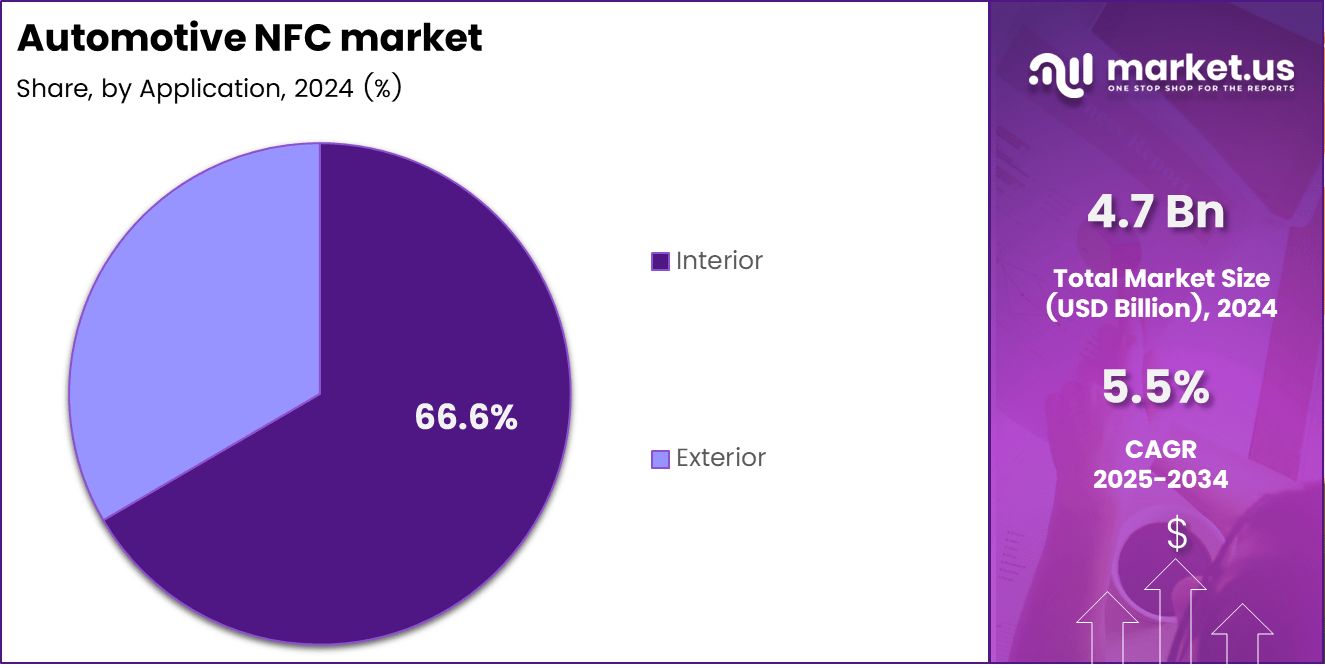

- Interior applications accounted for the largest share at 66.6% in the application segment.

- North America dominated the global landscape with a 43.8% share, valued at USD 2.0 billion in 2024.

By Type Analysis

106 Kbit/S dominates with 44.2% due to its stronger compatibility with standard automotive NFC functions.

In 2024, 106 Kbit/S held a dominant market position in the By Type segment of the Automotive NFC market, with a 44.2% share. This segment advances adoption because its stable speed supports secure authentication, digital key operations, and infotainment pairing, making it suitable for mainstream in-vehicle connectivity ecosystems.

212 Kbit/S recorded increasing traction as automotive OEMs explored higher-speed NFC protocols for enhanced data exchange. This segment grows as vehicle architectures integrate smarter dashboards requiring quicker user validation. Its performance supports smoother communication layers, pushing demand in mid-range and feature-rich mobility applications across evolving digital car environments.

424 Kbit/S expanded steadily due to rising requirements for faster pairing and encrypted high-frequency operations. This segment benefits from emerging digital cockpit functions that require improved responsiveness. Its ability to transmit larger packets efficiently positions it for premium vehicles that emphasize real-time NFC-driven personalization and advanced user interaction inside connected mobility platforms.

By Level of Autonomy Analysis

Semi-Autonomous dominates with 67.9% due to the rising integration of NFC-based driver authentication.

In 2024, Semi-Autonomous held a dominant market position in the By Level of Autonomy segment of the Automotive NFC market, with a 67.9% share. The segment benefits from expanding ADAS platforms that require secure driver identification, remote authorizations, and streamlined vehicle access supported by NFC-enabled communication layers.

Autonomous vehicles gained emerging attention as manufacturers explored fully digital access frameworks. NFC supports in-cabin personalization, secure fleet assignment, and mobility-as-a-service models. Although adoption remains slower, rising investments in self-driving technologies encourage research into advanced NFC chips that enhance passenger safety and operational traceability.

By Vehicle Type Analysis

Mid-Range dominates with 55.7% as automakers expand connected features in affordable segments.

In 2024, Mid-Range vehicles held a dominant market position in the By Vehicle Type segment of the Automotive NFC market, with a 55.7% share. This category benefits from increasing integration of digital keys, smartphone pairing, and secure identity verification across models targeted at mass-market buyers seeking upgraded connectivity.

Low-end vehicles demonstrated gradual growth as NFC adoption entered cost-sensitive segments. Manufacturers added NFC-driven locking, diagnostics access, and service authentication features. Although penetration remains limited, rising smartphone access and simplified chip architectures strengthen the potential for wider deployment in basic vehicle platforms.

High-end vehicles continued to adopt advanced NFC modules as premium customers expect seamless digital access. These vehicles integrate multi-layer authentication, personalized cabin settings, and infotainment synchronization. Strong interest in luxury connectivity experiences supports broader utilization of high-frequency NFC chips across high-value vehicle architectures.

By Chip Type Analysis

Passive NFC dominates with 77.3% supported by low power needs and wider automotive integration.

In 2024, Passive NFC held a dominant market position in the By Chip Type segment of the Automotive NFC market, with a 77.3% share. Its advantage lies in zero external power needs, enabling secure driver verification, keyless operations, and component-level tagging across various vehicle systems.

Active NFC showed incremental adoption as vehicles required faster communication and higher processing capabilities. These chips support enhanced signal range and real-time data exchange, making them suitable for premium digital cockpits. Their expanding functionality drives interest in advanced connected mobility solutions.

By Application Analysis

Interior dominates with 66.6% due to the strong use of NFC for personalization and access control.

In 2024, Interior held a dominant market position in the By Application segment of the Automotive NFC market, with a 66.6% share. This dominance stems from NFC’s role in seat settings, profile loading, digital key entry, and secure infotainment pairing—functions that modern drivers expect inside connected vehicles.

Exterior applications expanded moderately as NFC supported door access, trunk authentication, and charging-port verification in EVs. Growth continues as contactless vehicle interactions increase, especially in shared cars and mobility services requiring quick, secure, and trackable access management.

Key Market Segments

By Type

- 106 Kbit/S

- 212 Kbit/S

- 424 Kbit/S

By Level of Autonomy

- Semi-Autonomous

- Autonomous

By Vehicle Type

- Low-End

- Mid-Range

- High-End

By Chip Type

- Passive NFC

- Active NFC

By Application

- Interior

- Exterior

Drivers

Rising Integration of NFC-Based Digital Key Systems Drives Market Growth

The rising integration of NFC-based digital key systems encourages rapid adoption across connected and electric vehicles. Automakers focus on convenience, allowing users to lock, unlock, and start vehicles through smartphones. This shift improves user experience and reduces dependency on physical keys. The trend strengthens as EV adoption expands globally.

The increasing adoption of NFC for in-car personalization also accelerates market growth. Drivers use NFC-based authentication to load personal settings such as seat position, infotainment layout, and climate preferences. This convenience supports shared vehicles and enhances comfort for multi-user households. It also aligns with OEM strategies to improve interior digitalization.

The expansion of NFC-enabled infotainment ecosystems contributes significantly to market progress. Seamless smartphone-to-vehicle connectivity helps drivers access navigation, media, and communication with minimal effort. Automakers adopt NFC to simplify pairing and deliver faster interaction between devices. This approach supports the growing demand for connected in-car experiences.

Growing OEM investment in secure contactless payment systems strengthens market momentum. NFC enables drivers to pay for EV charging, tolling, and parking without physical cards. As secure in-vehicle payments become essential for modern mobility, NFC emerges as a trusted solution. This investment supports wider digital transformation across automotive ecosystems.

Restraints

High Implementation Cost of Secure NFC Modules Restrains Market Growth

The high implementation cost of secure NFC modules remains a major restraint for automakers. Automotive-grade chipsets and embedded security frameworks require advanced development, making integration expensive for mid-range and entry-level vehicles. These costs slow adoption among price-sensitive manufacturers and limit widespread NFC integration across developing markets.

Interoperability challenges between multi-brand smartphones and vehicle operating systems further restrict market expansion. Variations in NFC standards, device compatibility, and OS-level security protocols create inconsistent user experiences. These issues reduce consumer confidence in digital key reliability and delay OEM adoption timelines.

Complex certification requirements also add delays to technology rollout. Automakers must meet strict cybersecurity and safety standards before bringing NFC-enabled systems to market. This process increases engineering time and raises development burdens, affecting overall cost efficiency.

Additionally, limited awareness among consumers about NFC-based automotive functionalities slows adoption. Many users still rely on traditional key fobs and remain unfamiliar with digital access solutions. This gap reduces market penetration, especially in regions where connected vehicle features are still emerging. As OEMs work to educate buyers and streamline compatibility, restraining factors continue shaping development efforts.

Growth Factors

Expansion of Smart City Infrastructure Supporting NFC-Based Mobility Systems

The development of multi-modal NFC and UWB hybrid keyless access solutions strengthens future adoption as automakers aim to offer faster, safer, and more convenient entry systems. This transition supports a more connected vehicle ecosystem, making daily driving smoother and allowing users to unlock, start, and personalize cars through secure digital credentials.

The rising demand for NFC-enabled fleet management tools creates strong growth opportunities as commercial fleets prioritize accurate driver authentication. More logistics, rental, and ride-hailing companies adopt NFC identification to monitor driver behavior, prevent unauthorized vehicle access, and streamline operations. This shift improves safety and helps companies run their fleets more efficiently.

Smart city expansion accelerates NFC usage as urban planners add contactless mobility features such as NFC-enabled parking, EV charging, and public transport access. These integrations allow vehicles to communicate seamlessly with city infrastructure, improving user convenience and supporting cleaner, technology-driven transportation networks.

The aftermarket potential for NFC-enabled accessories continues to grow as car owners and service centers look for affordable retrofitting options. NFC modules, digital key add-ons, and contactless payment upgrades gain popularity, enabling older vehicles to benefit from modern connectivity. Additionally, increasing integration of automated tire-handling and storage solutions in service centers and rising demand from EV service and fleet stations further encourage wider NFC adoption across automotive workflows.

Emerging Trends

Growing Shift Toward Virtual Car Keys Integrated Into OEM Apps Influences Market Trends

The growing shift toward virtual car keys integrated into OEM mobile applications increasingly shapes market trends. These digital keys allow drivers to access vehicles using smartphones, offering improved convenience and stronger security. OEMs highlight app-based access as a premium feature in connected vehicle lineups.

The adoption of NFC-based driver wellness monitoring also sets a new trend in vehicle safety. Systems use NFC to authenticate drivers before monitoring fatigue levels, stress indicators, and emergency alerts. This approach supports safer driving and aligns with rising interest in smart cockpit technologies across modern vehicles.

Integration of NFC in shared mobility platforms becomes a dominant trend as cities adopt car-sharing and subscription-based models. NFC enables fast onboarding, secure access, and simplified authentication for short-term vehicle users. This makes NFC essential for efficient mobility-as-a-service ecosystems.

A rising trend toward NFC-supported in-cabin IoT device pairing also influences vehicle digitalization. Drivers use NFC to connect wearables, audio devices, and personalized settings instantly. These features support differentiated user experiences and complement the growing shift toward intelligent, software-defined vehicle interiors.

Regional Analysis

North America Dominates the Automotive NFC Market with a Market Share of 43.8%, Valued at USD 2.0 Billion

North America leads the Automotive NFC market due to strong adoption of digital key systems, secure authentication technologies, and connected mobility features. The region’s robust automotive digital ecosystem accelerates integration of NFC across mid-range and premium vehicles. With a market share of 43.8% and a valuation of USD 2.0 billion, growth remains supported by rising EV penetration and increasing demand for seamless smartphone-to-vehicle connectivity.

Europe Automotive NFC Market Trends

Europe shows steady advancement driven by strong regulatory focus on digital safety, secure access technologies, and automotive cybersecurity compliance. Growing adoption of smart mobility solutions further enhances NFC deployment across vehicle platforms. Expanding EV infrastructure and consumer preference for digital access features support continued regional uptake.

Asia Pacific Automotive NFC Market Trends

Asia Pacific experiences fast growth with rising smartphone penetration, expanding connected car manufacturing, and increasing interest in digital access systems. Countries such as China, Japan, and South Korea are rapidly integrating NFC technology into modern vehicle architectures. Urban mobility expansion and digital-first consumer behavior strengthen regional momentum.

Middle East & Africa Automotive NFC Market Trends

The Middle East & Africa region sees emerging adoption supported by rising demand for modern vehicle technologies and the expansion of premium car segments. Growing digital transformation initiatives encourage NFC-based access and authentication features. Infrastructure improvements and increasing vehicle imports contribute to gradual market expansion.

Latin America Automotive NFC Market Trends

Latin America displays moderate growth as automakers introduce NFC-driven connectivity features in mid-range vehicles across Brazil and Mexico. Rising adoption of digital mobility services improves demand for secure, frictionless vehicle access. Economic recovery trends and broader smartphone usage support the region’s long-term potential.

United States Automotive NFC Market Trends

The United States maintains a strong integration of NFC within connected and electric vehicles due to rising focus on convenience features and digital identity verification. Growing interest in smartphone-enabled vehicle access boosts system adoption across multiple vehicle classes. Advancements in smart mobility ecosystems continue shaping regional demand.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive NFC Market Company Insights

The global Automotive NFC market in 2024 reflects strong momentum as vehicle manufacturers integrate short-range connectivity to enhance access control, personalization, and secure transactions. Leading semiconductor suppliers continue advancing NFC chipsets, secure elements, and in-vehicle communication modules that strengthen interoperability across automotive ecosystems.

Qualcomm Technologies, Inc. drives market influence through its expanding automotive connectivity portfolio, emphasizing secure communication frameworks that support advanced car-access systems and digital-key functions. Its NFC-enabled platforms help automakers streamline integration while delivering low-power, high-performance communication essential for next-generation mobility solutions. The company continues scaling embedded connectivity features across mid- and premium-segment vehicles.

Renesas Electronics Corporation strengthens the landscape with automotive-grade NFC controllers optimized for secure authentication and intuitive user experiences. Its solutions focus on reducing system complexity for OEMs while enhancing compatibility with digital key standards. Renesas benefits from the rising adoption of electrified and connected vehicles that demand stable, low-latency communication components.

Infineon Technologies AG contributes significantly through secure element technologies and robust NFC chipsets designed for automotive security and access management. The company supports highly reliable communication layers tailored for keyless entry, device pairing, and in-cabin personalization. Infineon’s focus on functional safety and cybersecurity aligns closely with increasing regulatory and OEM requirements.

MediaTek Inc. expands its presence by offering cost-efficient NFC solutions that enhance smart in-vehicle interactions and device connectivity. Its automotive-focused chipsets cater to manufacturers prioritizing seamless smartphone pairing and enhanced occupant convenience. MediaTek’s integration capabilities position it well within the growing mass-market NFC adoption curve.

Top Key Players in the Market

- Qualcomm Technologies, Inc

- Renesas Electronics Corporation

- Infineon Technologies AG

- MediaTek Inc.

- Samsung Semiconductors Inc.

- PREMO S.A.

- NXP Semiconductors N.V.

- Sony Corporation

Recent Developments

- In November 2024, PREMO S.A. introduced advanced NFC coil antennas optimized for harsh automotive environments. The product line focused on boosting signal reliability for exterior car-access applications.

- In April 2025, Sony Corporation expanded its NFC sensor capabilities for connected-car interfaces. The upgrade aimed to support seamless multi-device pairing inside vehicle cabins, improving the user experience.

Report Scope

Report Features Description Market Value (2024) USD 4.7 Billion Forecast Revenue (2034) USD 8.0 billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (106 Kbit/S, 212 Kbit/S, 424 Kbit/S), By Level of Autonomy (Semi-Autonomous, Autonomous), By Vehicle Type (Low-End, Mid-Range, High-End), By Chip Type (Passive NFC, Active NFC), By Application (Interior, Exterior) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Qualcomm Technologies, Inc., Renesas Electronics Corporation, Infineon Technologies AG, MediaTek Inc., Samsung Semiconductors Inc., PREMO S.A., NXP Semiconductors N.V., Sony Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Qualcomm Technologies, Inc

- Renesas Electronics Corporation

- Infineon Technologies AG

- MediaTek Inc.

- Samsung Semiconductors Inc.

- PREMO S.A.

- NXP Semiconductors N.V.

- Sony Corporation