Global Automotive Dyno Market Size, Share, Growth Analysis By Dyno Type (Chassis Dynamometers, Engine Dynamometers, Hub Dynamometers), By Power Capacity (Low-Power (Up to 500 hp), Mid-Power (500 to 1,500 hp), High-Power (Over 1,500 hp)), By End Use (Automotive OEMs, Aftermarket Service Providers, Motorsport Teams, Commercial Vehicles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156464

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

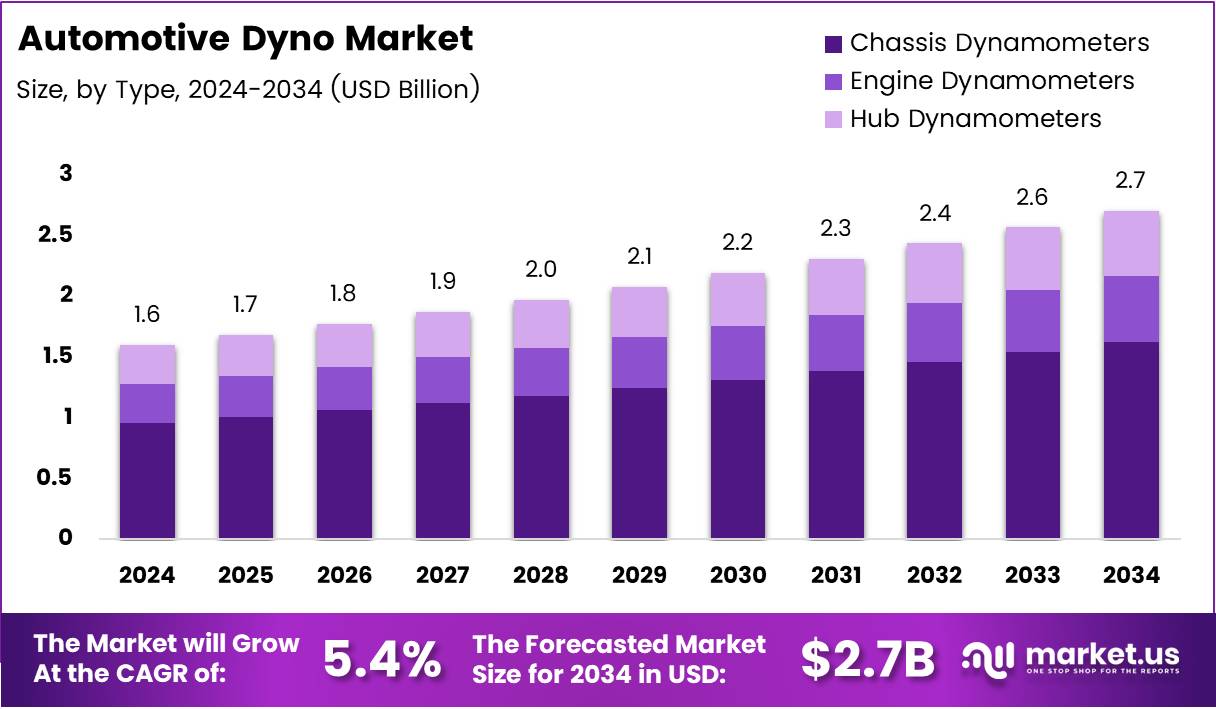

The Global Automotive Dyno Market size is expected to be worth around USD 2.7 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

The Automotive Dyno Market is experiencing significant growth, driven by the increasing need for performance testing in the automotive industry. A dynamometer (dyno) is used to measure engine power output and simulate real-world driving conditions. With the demand for high-performance vehicles, automotive testing becomes crucial to ensure safety, reliability, and optimal engine performance.

Growth in the automotive sector, especially electric vehicles (EVs), is fueling the expansion of the automotive dyno market. As manufacturers increasingly focus on improving vehicle performance, automotive dynos are becoming essential for testing various parameters. The increasing adoption of stringent emissions regulations worldwide is also driving the need for advanced testing equipment.

Opportunities for the automotive dyno market lie in the growing trend of performance enhancement in vehicles, both for internal combustion engines (ICEs) and EVs. With innovations like hybrid technology and more sophisticated engine control systems, dynos are crucial for R\&D and product testing. Moreover, the rise of electric and autonomous vehicles is creating new avenues for testing and innovation in this space.

Government investments and regulations play a key role in shaping the automotive dyno market. Several countries have implemented strict emissions standards, encouraging manufacturers to enhance vehicle testing methods. Additionally, government initiatives to promote the development of electric vehicles and sustainable transport have led to a rise in demand for advanced testing equipment, including automotive dynos.

Furthermore, as the automotive industry moves towards Industry 4.0, digital dynos and automation are becoming increasingly popular. The integration of artificial intelligence (AI) and machine learning in testing solutions presents further growth opportunities for dyno manufacturers. These technological advancements provide manufacturers with accurate insights to optimize vehicle performance and ensure compliance with regulatory standards.

Key Takeaways

- The Global Automotive Dyno Market is expected to reach USD 2.7 Billion by 2034, growing at a CAGR of 5.4% from 2025 to 2034.

- Chassis Dynamometers held the dominant market share in 2024, with a 57.2% share in the Dyno Type Analysis segment.

- Mid-Power (500 to 1,500 hp) led the By Power Capacity Analysis segment with a 47.7% share in 2024.

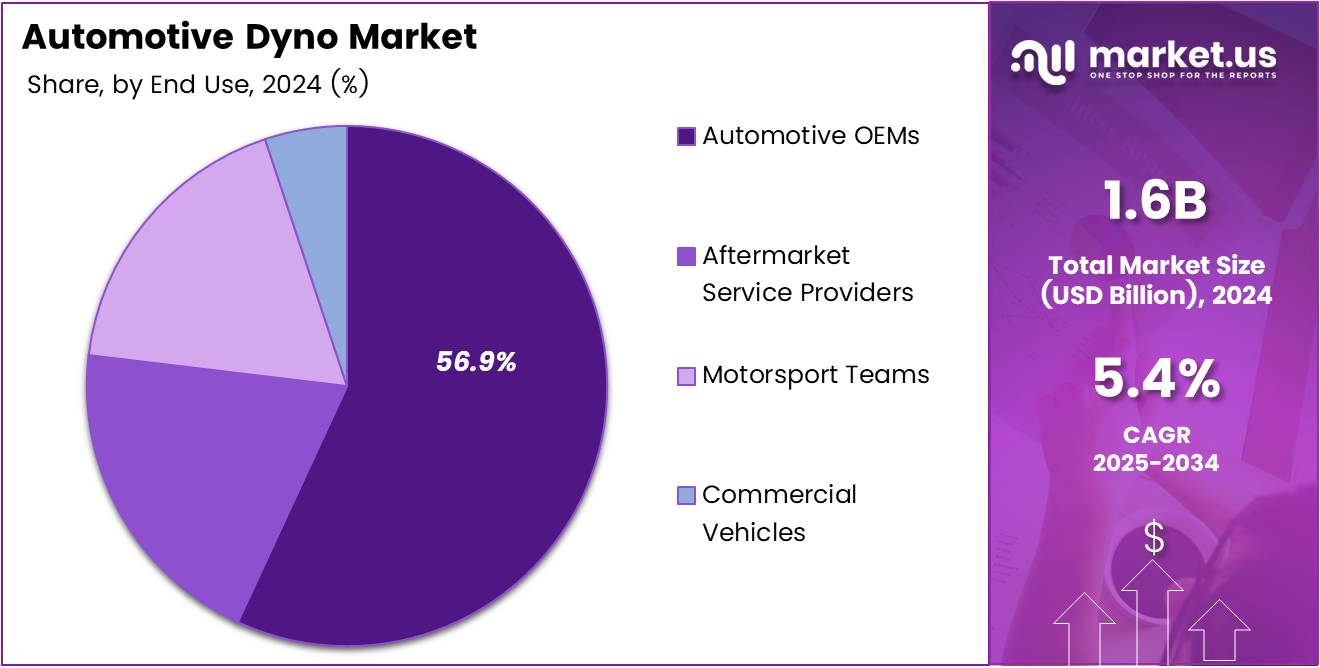

- Automotive OEMs dominated the By End Use Analysis segment, holding a 56.9% share in 2024.

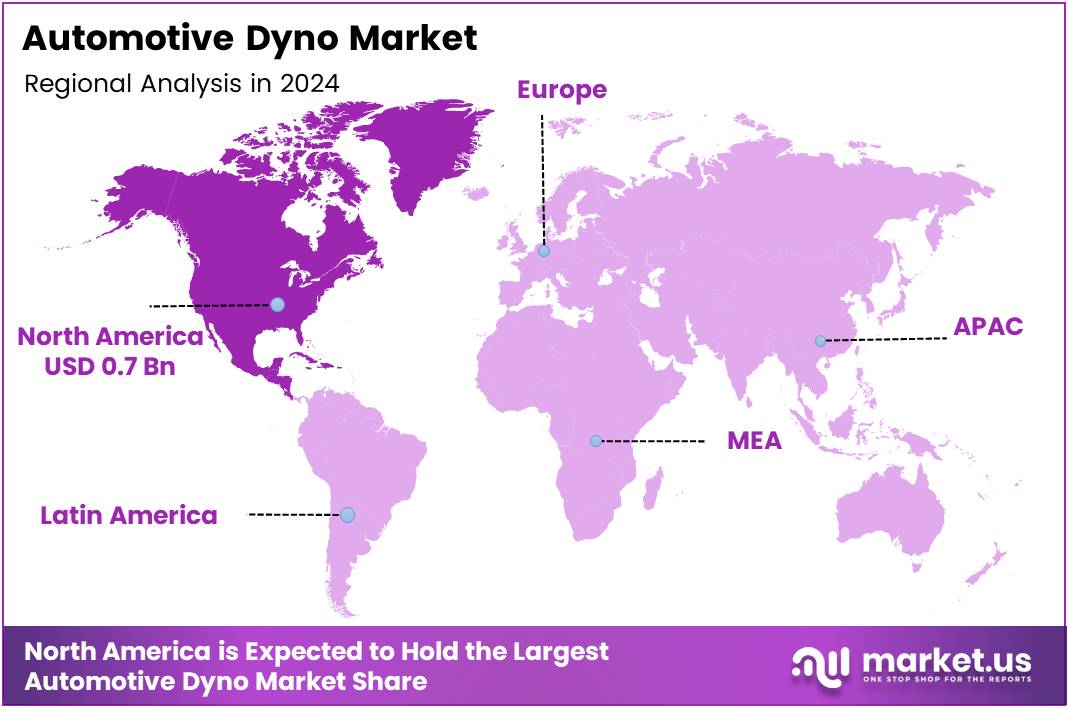

- North America held the largest market share of 43.8%, valued at USD 0.7 billion in 2024.

Dyno Type Analysis

Chassis Dynamometers dominates with 57.2% due to its comprehensive vehicle testing capabilities and widespread industry adoption.

In 2024, Chassis Dynamometers held a dominant market position in By Dyno Type Analysis segment of Automotive Dyno Market, with a 57.2% share. This substantial market leadership reflects the critical role chassis dynamometers play in complete vehicle performance evaluation, offering manufacturers and testing facilities the ability to simulate real-world driving conditions while maintaining controlled laboratory environments.

Engine Dynamometers represent a significant secondary segment, providing specialized testing capabilities for isolated engine performance analysis. These systems are particularly valuable for engine manufacturers and research institutions focusing on powertrain development and optimization.

Hub Dynamometers occupy a niche but important position in the market, offering precise wheel-end testing capabilities. While representing a smaller market share, hub dynamometers serve specialized applications in motorsport and advanced vehicle development programs where individual wheel performance analysis is crucial.

The dominance of chassis dynamometers underscores the industry’s emphasis on holistic vehicle testing approaches, enabling comprehensive analysis of vehicle dynamics, emissions, fuel economy, and overall performance characteristics in a single testing platform.

Power Capacity Analysis

Mid-Power dynamometers dominate with 47.7% due to their optimal balance between capability and cost-effectiveness for mainstream automotive applications.

In 2024, Mid-Power (500 to 1,500 hp) held a dominant market position in By Power Capacity Analysis segment of Automotive Dyno Market, with a 47.7% share. This segment’s leadership position reflects its ideal alignment with the power requirements of most passenger vehicles, light commercial vehicles, and performance cars, making it the preferred choice for automotive manufacturers and testing facilities.

Low-Power (Up to 500 hp) dynamometers serve an essential role in testing smaller displacement engines, hybrid systems, and entry-level vehicles. This segment caters to manufacturers focusing on fuel efficiency, emissions compliance, and cost-effective testing solutions for lower-powered applications.

High-Power (Over 1,500 hp) dynamometers represent a specialized segment serving high-performance applications including heavy-duty commercial vehicles, racing engines, and advanced powertrain development. While smaller in market share, this segment commands premium pricing due to its specialized engineering requirements.

The mid-power segment’s dominance demonstrates the automotive industry’s focus on mainstream vehicle development, where the balance between testing capability and operational costs creates optimal value proposition for manufacturers and testing service providers.

End Use Analysis

Automotive OEMs dominate with 56.9% due to their extensive testing requirements for vehicle development and regulatory compliance.

In 2024, Automotive OEMs held a dominant market position in By End Use Analysis segment of Automotive Dyno Market, with a 56.9% share. This commanding market position reflects the critical role dynamometers play in the vehicle development lifecycle, from initial powertrain design through final production validation and regulatory certification processes.

Aftermarket Service Providers represent a substantial secondary segment, utilizing dynamometer technology for vehicle diagnostics, performance tuning, and maintenance services. This segment benefits from the growing complexity of modern vehicles and increased consumer demand for performance optimization services.

Motorsport Teams constitute a specialized but influential segment, requiring high-precision testing equipment for competitive advantage. These users often drive technological innovations that eventually benefit broader market segments through advanced testing methodologies and equipment capabilities.

Commercial Vehicles segment addresses the unique testing requirements of trucks, buses, and specialized vehicles, focusing on durability, efficiency, and regulatory compliance. The dominance of OEMs underscores the automotive industry’s commitment to comprehensive testing protocols and quality assurance throughout the vehicle development process.

Key Market Segments

By Dyno Type

- Chassis Dynamometers

- Engine Dynamometers

- Hub Dynamometers

By Power Capacity

- Low-Power (Up to 500 hp)

- Mid-Power (500 to 1,500 hp)

- High-Power (Over 1,500 hp)

By End Use

- Automotive OEMs

- Aftermarket Service Providers

- Motorsport Teams

- Commercial Vehicles

Drivers

Rising Demand for High-Performance Vehicles Accelerates Market Expansion

The automotive dyno market is experiencing significant growth driven by consumers’ increasing appetite for high-performance vehicles. Car enthusiasts and buyers are demanding more powerful engines and better acceleration, pushing manufacturers to invest heavily in dyno testing equipment. These systems help engineers measure horsepower, torque, and overall engine performance with precision.

Modern automotive testing technologies are advancing rapidly, making dyno systems more accurate and efficient than ever before. Digital sensors, computer-controlled systems, and real-time data collection have revolutionized how manufacturers test their vehicles. These technological improvements allow for more detailed analysis and faster testing cycles.

Stricter fuel efficiency and emission standards worldwide are forcing automakers to optimize their engines carefully. Dyno testing helps engineers fine-tune engines to meet these regulations while maintaining performance. Government policies in major markets require extensive testing to ensure compliance with environmental standards.

The growing popularity of electric and hybrid vehicles is creating new testing requirements. These vehicles need specialized dyno systems to test electric motors, battery performance, and regenerative braking systems. As EV adoption increases globally, demand for compatible testing equipment continues to rise, presenting substantial opportunities for dyno manufacturers.

Restraints

Limited Market Penetration in Developing Regions Constrains Growth

The automotive dyno market faces several challenges that limit its expansion potential. Developing markets show limited adoption of advanced dyno testing equipment due to high initial investment costs and lack of technical infrastructure. Many smaller automotive companies in these regions rely on basic testing methods, creating a significant market gap.

Regulatory challenges regarding noise and emissions from dyno facilities pose another major constraint. Testing centers must comply with strict environmental regulations, often requiring expensive soundproofing and emission control systems. These additional costs make dyno installations less attractive for many potential buyers, particularly in urban areas where noise restrictions are stringent.

The shortage of skilled operators for dyno testing equipment significantly impacts market growth. These sophisticated systems require trained technicians who understand complex testing procedures and can interpret detailed performance data. Many companies struggle to find qualified personnel, leading to underutilization of expensive equipment.

Additionally, maintenance and calibration requirements for dyno systems demand specialized knowledge and regular professional servicing. The limited availability of technical support in certain regions makes companies hesitant to invest in these systems, knowing that proper maintenance might be challenging and costly to obtain.

Growth Factors

Electric Vehicle Testing Applications Create Substantial Growth Opportunities

The automotive dyno market is positioned for significant expansion through several emerging opportunities. Electric vehicle testing applications represent the largest growth potential, as EV manufacturers require specialized equipment to test electric motors, battery systems, and energy efficiency. This shift toward electrification is creating entirely new market segments for dyno manufacturers.

Development of portable and cost-effective dyno systems is opening doors to smaller automotive businesses and independent testing facilities. These compact solutions make professional-grade testing accessible to companies that previously couldn’t afford traditional large-scale dyno installations. Mobile dyno units are particularly popular among racing teams and performance shops.

Integration of Internet of Things (IoT) technology and advanced data analytics is transforming dyno testing capabilities. Modern systems can collect vast amounts of performance data, analyze patterns, and provide predictive insights about vehicle behavior. This technological advancement helps manufacturers optimize designs more efficiently and reduce development time.

Rising interest in motorsports globally is driving increased demand for dyno testing services. Racing teams, performance tuners, and automotive enthusiasts require precise testing to maximize vehicle performance. This growing motorsports culture, combined with increased disposable income in many markets, creates sustained demand for professional dyno testing services and equipment.

Emerging Trends

Advanced Simulation Technologies Transform Industry Testing Practices

The automotive dyno market is experiencing significant transformation through several trending technological factors. Advanced simulation and virtual testing capabilities are becoming standard features in modern dyno systems. These technologies allow engineers to simulate real-world driving conditions without actual road testing, saving time and reducing costs while improving safety during development phases.

Automated and AI-driven dyno systems are revolutionizing testing procedures by reducing human error and increasing consistency. Artificial intelligence algorithms can automatically adjust testing parameters, detect anomalies, and generate detailed reports without constant human supervision. This automation trend is making dyno testing more efficient and reliable across the industry.

Integration with vehicle-to-cloud communication technologies enables real-time data sharing between testing facilities and manufacturers. This connectivity allows engineers to monitor testing remotely, share results instantly, and collaborate more effectively on vehicle development projects. Cloud-based data storage also provides better long-term analysis capabilities and easier access to historical testing data.

Growing collaboration between automotive manufacturers and specialized testing companies is creating new business models in the dyno market. Many automakers are outsourcing complex testing requirements to dedicated facilities, driving demand for professional testing services. These partnerships allow manufacturers to access advanced testing capabilities without major capital investments in equipment and facilities.

Regional Analysis

North America Dominates the Automotive Dyno Market with a Market Share of 43.8%, Valued at USD 0.7 Billion

In 2024, North America held the largest market share of 43.8%, valued at USD 0.7 billion. This region’s dominance can be attributed to the presence of a robust automotive industry, increasing investments in automotive testing and research, and the growing demand for advanced automotive performance testing solutions. The presence of key manufacturers and technological advancements further solidify North America’s market leadership.

Europe Automotive Dyno Market Trends

Europe holds a significant position in the automotive dyno market, driven by stringent regulations related to vehicle emissions and safety standards. The increasing emphasis on electric vehicle testing and the growing automotive manufacturing industry in countries such as Germany and France further support the market’s expansion in this region. Investments in R&D by key automotive manufacturers also play a crucial role in market growth.

Asia Pacific Automotive Dyno Market Trends

Asia Pacific is experiencing steady growth in the automotive dyno market, driven by the rising demand for high-performance vehicles and rapid technological advancements in automotive testing equipment. Countries like China, Japan, and India are key contributors, with growing automotive production and adoption of advanced testing technologies. The region’s market expansion is also fueled by increased investments in automotive infrastructure and research.

Middle East and Africa Automotive Dyno Market Trends

The Middle East and Africa are gradually emerging as important regions for the automotive dyno market, driven by the expanding automotive industry and increasing investments in infrastructure development. The demand for high-quality automotive testing solutions is growing in this region, especially in countries with established automotive manufacturing and research facilities. The region’s market is expected to experience steady growth due to improved automotive testing capabilities.

Latin America Automotive Dyno Market Trends

Latin America’s automotive dyno market is expanding steadily, supported by the growing automotive manufacturing industry and increasing demand for high-quality testing solutions. Key markets in Brazil and Mexico are leading the charge, with investments in automotive testing facilities and research initiatives. However, the region’s growth is expected to be slower compared to North America and Asia Pacific due to economic factors and infrastructure challenges.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Dyno Company Insights

The global automotive dynamometer market continues to evolve with several established players maintaining strong competitive positions through technological innovation and market penetration strategies.

Rototest has solidified its position as a premium provider of chassis dynamometers, particularly excelling in emissions testing solutions for regulatory compliance. The company’s focus on precision measurement systems and environmental testing capabilities has strengthened its presence in European and North American markets. Their advanced roller dynamometer technology continues to attract automotive manufacturers seeking reliable testing infrastructure.

Dynotronics maintains its reputation as a specialized manufacturer of engine and chassis dynamometers, with particular strength in custom testing solutions for performance applications. The company’s ability to deliver tailored dyno systems for specific customer requirements has established strong relationships within the motorsports and automotive tuning segments. Their focus on high-performance testing equipment continues to drive market share growth.

Fih Dyno Technologies has emerged as a significant player in the Asian markets, leveraging cost-effective manufacturing capabilities while maintaining quality standards. The company’s strategic positioning in emerging automotive markets has enabled substantial growth opportunities, particularly in regions experiencing rapid automotive industry expansion. Their comprehensive product portfolio spans both engine and chassis dynamometer solutions.

Dynojet remains a dominant force in the performance testing segment, with strong brand recognition among automotive enthusiasts and professional tuning facilities. The company’s innovative approach to portable dynamometer solutions and data acquisition systems has created a loyal customer base. Their continuous investment in software integration and user-friendly interfaces maintains competitive advantages in the performance testing market segment.

Top Key Players in the Market

Key Players

- Rototest

- Dynotronics

- Fih Dyno Technologies

- Dynojet

- AVL List GmbH

- SuperFlow Technologies

- Mustang Dynamometer

- Dynametric Dyne Systems

- Mainline Dyno

Recent Developments

- In July 2025, ServiceUp secured $55 million in Series B funding to accelerate its growth and expansion in the service management sector.

- In February 2025, Dynolt Technologies raised $1.7 million in seed funding, with the round being led by Transition VC to support its early-stage product development.

- In April 2024, Venshure Test Services was acquired by AB Dynamics, marking a significant move to enhance AB Dynamics’ portfolio in the testing and simulation sector.

- In July 2024, DYNO secured over €2.5 million in pre-seed financing, which will be used to develop its innovative solutions in the automotive sector.

- In March 2024, Detect Auto raised $748K in seed funding to develop and scale its vehicle detection technology for the automotive industry.

- In March 2024, Axion Ray closed a $17.5 million Series A funding round, which will be utilized to expand its technology and strengthen its position in the optical sensing market.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion Forecast Revenue (2034) USD 2.7 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Dyno Type (Chassis Dynamometers, Engine Dynamometers, Hub Dynamometers), By Power Capacity (Low-Power (Up to 500 hp), Mid-Power (500 to 1,500 hp), High-Power (Over 1,500 hp)), By End Use (Automotive OEMs, Aftermarket Service Providers, Motorsport Teams, Commercial Vehicles) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Rototest, Dynotronics, Fih Dyno Technologies, Dynojet, AVL List GmbH, SuperFlow Technologies, Mustang Dynamometer, Dynametric Dyne Systems, Mainline Dyno, Maha Maschinenbau Automationstechnik GmbH Co.KG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Rototest

- Dynotronics

- Fih Dyno Technologies

- Dynojet

- AVL List GmbH

- SuperFlow Technologies

- Mustang Dynamometer

- Dynametric Dyne Systems

- Mainline Dyno