Global Automotive Coolant Market Size, Share, And Business Benefit By Product Type (Ethylene Glycol, Propylene Glycol, Glycerin, Others), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Technology (Inorganic Additive Technology (IAT), Organic Additive Technology (OAT), Hybrid Organic Acid Technology (HOAT)), By End User (Original Equipment Manufacturer (OEM), Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165553

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

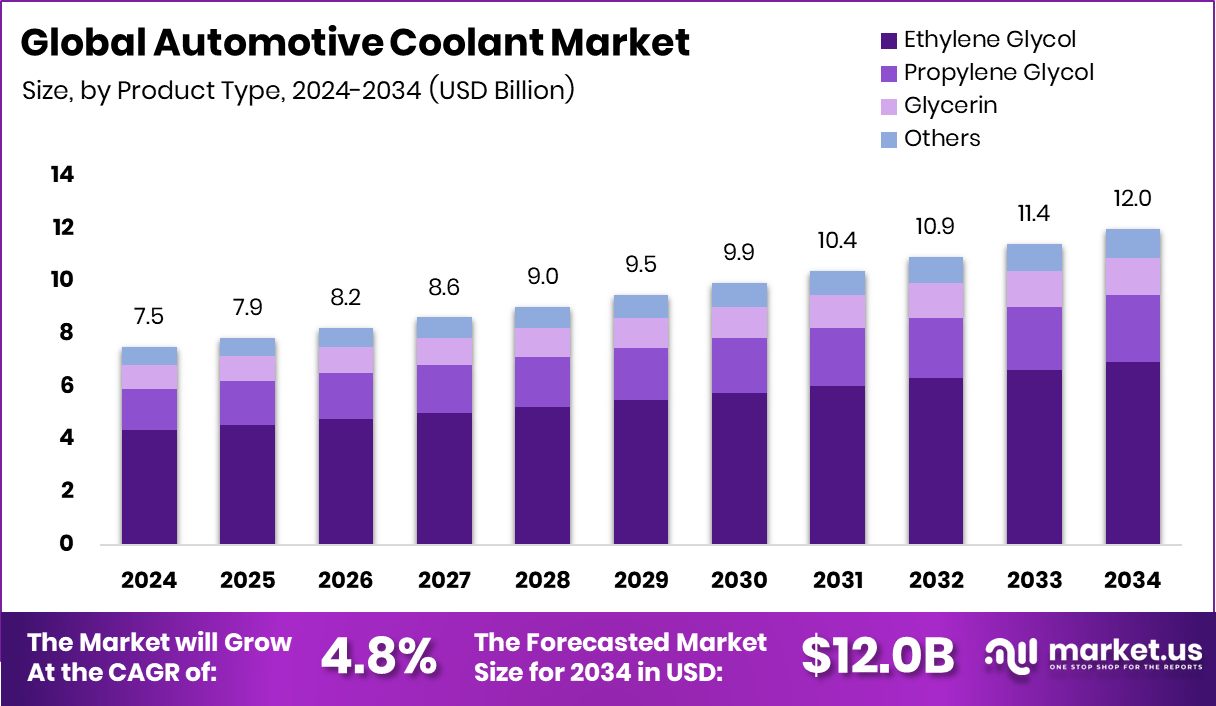

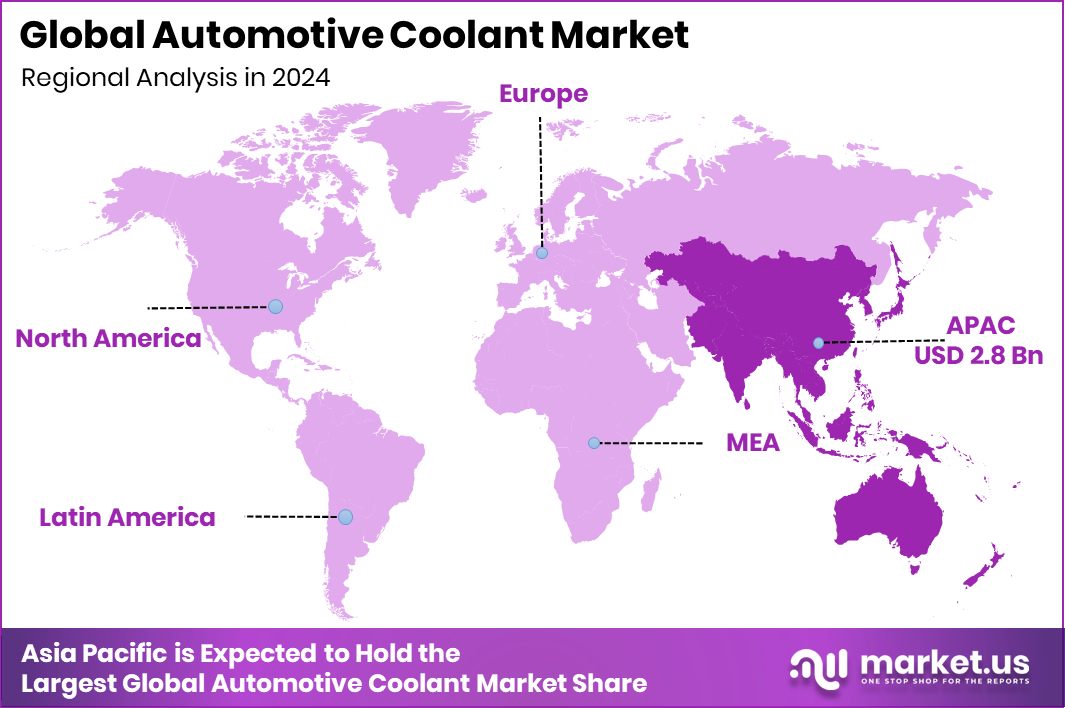

The Global Automotive Coolant Market is expected to be worth around USD 12.0 billion by 2034, up from USD 7.5 billion in 2024, and is projected to grow at a CAGR of 4.8% from 2025 to 2034. Asia Pacific strengthens its lead, reaching 38.40% and a USD 2.8 Bn scale today.

Automotive coolant is a heat-transfer fluid that protects an engine from overheating and freezing. It circulates through the engine block, absorbs excess heat, and releases it through the radiator. Modern coolants also prevent corrosion, reduce scale formation, and keep metal parts stable under high thermal stress. They are essential for gasoline, diesel, hybrid, and even electric vehicles, where temperature control directly affects battery and power electronics’ life.

The automotive coolant market reflects this growing need for thermal stability across expanding vehicle segments. As engines run hotter and electric drivetrains require precise temperature regulation, coolant formulations are becoming more advanced. Growth factors include rising vehicle production, long-life coolant demand, and the push for cleaner mobility. Recent financial actions—such as Lotte Chemical selling its Indonesian stake for $448 million—signal strategic restructuring that can indirectly support new material innovations for coolant technologies.

Demand is also shaped by the shift toward electrification. Battery packs, power inverters, and fast-charging systems depend on efficient liquid cooling to remain safe and dependable. Government attention to cleaner industry, including the U.S. committing $6 billion toward industrial decarbonization, encourages improved manufacturing efficiency and greener coolant chemistries that reduce environmental impact.

Opportunities emerge as automakers look for coolant systems that can support higher thermal loads, longer service intervals, and compatibility with mixed-metal engine designs. New lines of electric buses, two-wheelers, and fleet vehicles in developing regions further widen the adoption landscape. Investments and policy signals are encouraging companies to rethink heat-management materials, opening the door for safer, more durable, and lower-emission coolant solutions across global markets.

Key Takeaways

- The Global Automotive Coolant Market is expected to be worth around USD 12.0 billion by 2034, up from USD 7.5 billion in 2024, and is projected to grow at a CAGR of 4.8% from 2025 to 2034.

- Ethylene glycol holds a 58.9% share, highlighting its dominance in global automotive coolant product formulations today.

- Passenger cars capture 69.1% market share, driving stronger coolant consumption across expanding vehicle populations worldwide.

- Organic additive technology represents a 56.2% share, reflecting industry preference for durable, long-life coolant solutions globally.

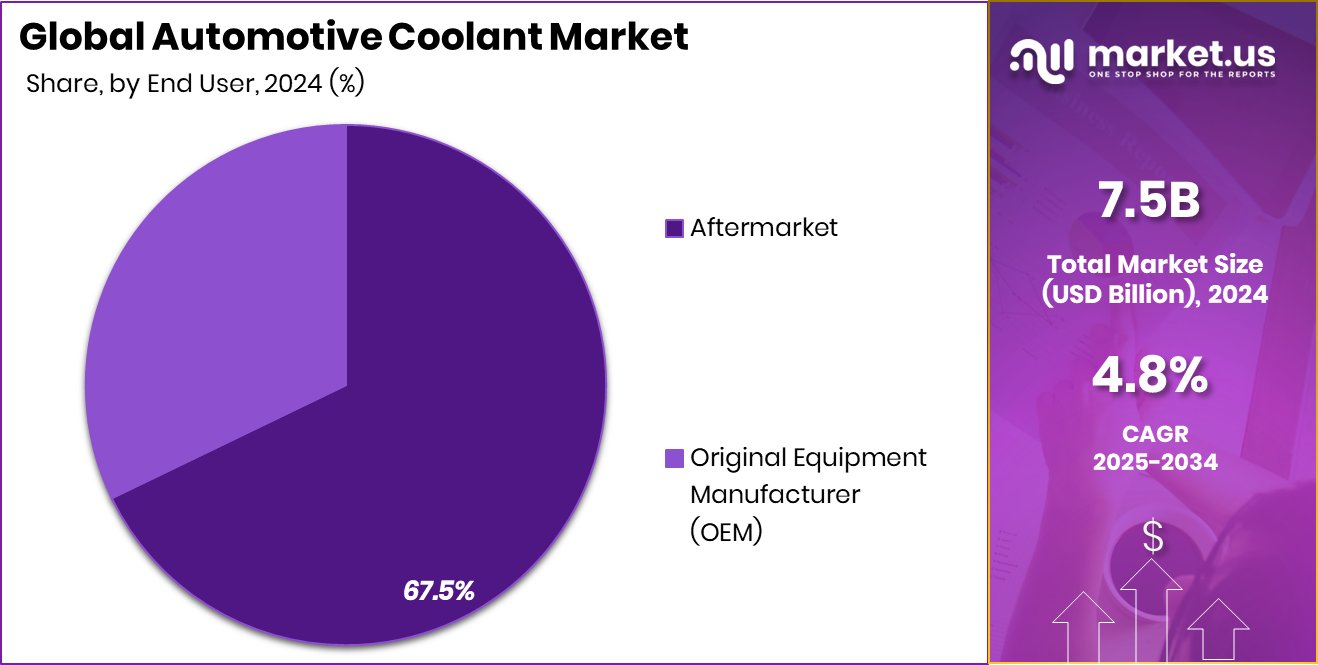

- Aftermarket accounts for a 67.5% share, sustained by frequent coolant replacements and rising vehicle maintenance activity.

- Asia Pacific drives coolant demand with 38.40% share and a USD 2.8 Bn market.

By Product Type Analysis

Ethylene glycol dominates the automotive coolant market with 58.9% segment share.

In 2024, Ethylene Glycol held a dominant market position in the By Product Type segment of the Automotive Coolant Market, with a 58.9% share. This strong position reflects its long-established use as a reliable base fluid for engine cooling and freeze protection. Its thermal stability and compatibility with conventional engine materials continue to support widespread adoption across passenger and commercial vehicles.

The segment’s strength also aligns with steady demand for coolants that balance heat-transfer efficiency and cost-effectiveness. As vehicles operate under higher temperature loads and maintenance intervals stretch longer, Ethylene Glycol remains the primary choice for manufacturers and service networks, helping sustain its leading share within the overall coolant landscape.

By Vehicle Type Analysis

Passenger cars drive coolant consumption, accounting for 69.1% of total demand.

In 2024, Passenger Cars held a dominant market position in the By Vehicle Type segment of the Automotive Coolant Market, with a 69.1% share. This leadership reflects the large global car population and the consistent need for regular coolant replacement to maintain engine efficiency and durability.

Passenger vehicles rely heavily on stable thermal management, especially as engines become more compact and operate at higher temperatures. The strong share also mirrors steady servicing cycles in both urban and highway-driven vehicles, where coolant health directly influences engine life. With rising usage intensity and longer daily travel patterns, passenger cars continue to anchor coolant consumption, reinforcing their prominent role within the overall market structure.

By Technology Analysis

Organic Additive Technology leads advanced formulations, holding a strong 56.2% share globally.

In 2024, Organic Additive Technology (OAT) held a dominant market position in the By Technology segment of the Automotive Coolant Market, with a 56.2% share. This leading position reflects the growing preference for longer-life coolant formulations that offer strong corrosion protection without relying on traditional inorganic inhibitors. OAT coolants support extended service intervals, which align well with modern vehicle maintenance expectations.

Their ability to perform reliably under high-temperature operating conditions further strengthens adoption across a wide range of engines. As vehicles increasingly require stable thermal management and reduced deposit formation, OAT continues to be the favored choice, helping it maintain a firm hold on the technology landscape within the coolant market.

By End User Analysis

Aftermarket channels remain crucial, capturing 67.5% of overall coolant sales.

In 2024, Aftermarket held a dominant market position in the By End User segment of the Automotive Coolant Market, with a 67.5% share. This strong presence reflects the continuous replacement needs driven by routine vehicle maintenance and coolant change intervals. As vehicles age and accumulate higher mileage, aftermarket demand naturally rises due to increased servicing frequency.

The segment’s large share also aligns with the widespread availability of coolant products through workshops, service centers, and retail channels that cater to diverse vehicle types. With drivers prioritizing engine protection and thermal stability, aftermarket purchases remain steady, reinforcing its leading role in overall coolant consumption across global vehicle service ecosystems.

Key Market Segments

By Product Type

- Ethylene Glycol

- Propylene Glycol

- Glycerin

- Others

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Technology

- Inorganic Additive Technology (IAT)

- Organic Additive Technology (OAT)

- Hybrid Organic Acid Technology (HOAT)

By End User

- Original Equipment Manufacturer (OEM)

- Aftermarket

Driving Factors

Rising Need for Better Engine Temperature Control

A major driving factor for the Automotive Coolant Market is the growing need for stronger and more reliable engine temperature control as modern engines run hotter than before. Today’s vehicles use compact engines, turbocharging, and advanced combustion systems that create more heat during operation. To keep these engines safe, coolants must work harder, stay stable for longer periods, and prevent corrosion inside the cooling system.

Drivers also travel longer distances and expect fewer maintenance stops, which increases the demand for long-life coolants that protect engines under heavy daily use. As a result, automakers and service centers rely more on high-quality coolant solutions to ensure smoother performance, lower repair risks, and better overall engine efficiency.

Restraining Factors

Environmental Concerns Around Coolant Chemical Disposal

One key restraining factor for the Automotive Coolant Market is the growing concern over how coolant chemicals are handled and disposed of after use. Many coolants contain substances that can harm soil, water, and animals if they are not treated or recycled properly.

Improper disposal by workshops or individual users increases environmental risks, pushing authorities to tighten rules and raise disposal standards. These regulations can increase handling costs for service centers and create extra steps for consumers.

At the same time, manufacturers face pressure to redesign formulations to be safer and easier to recycle. While these changes are important for environmental protection, they slow market growth by increasing development costs and limiting the use of some widely used coolant ingredients.

Growth Opportunity

Rising Demand for Coolants in Electric Vehicles

A major growth opportunity for the Automotive Coolant Market comes from the fast-growing electric vehicle segment. EVs depend heavily on liquid cooling to manage the temperature of batteries, power electronics, and fast-charging systems, all of which generate significant heat during operation. As more countries push for cleaner mobility, EV sales are increasing steadily, creating a wider need for advanced coolant solutions that can handle higher thermal loads.

These specialized coolants must stay stable under long charging cycles and protect sensitive components from overheating. This shift opens new doors for companies to design EV-focused thermal fluids that improve battery life, safety, and overall vehicle efficiency. With EV adoption rising every year, demand for these advanced coolants is set to grow strongly.

Latest Trends

Growing Shift Toward Long-Life Coolant Formulations

One of the latest trends in the Automotive Coolant Market is the strong move toward long-life coolant formulations that stay effective for many years without frequent replacement. Modern engines operate at higher temperatures and use mixed-metal systems, so coolants must protect these parts for longer periods while reducing corrosion and deposits. Drivers also prefer fewer maintenance visits, which increases the popularity of coolants that last through extended service intervals.

At the same time, workshops benefit from using stable, long-lasting fluids that maintain engine performance even under heavy daily driving. This trend encourages manufacturers to create improved formulas that stay clean, resist breakdown, and support both traditional engines and modern powertrain systems.

Regional Analysis

Asia Pacific holds a 38.40% share valued at USD 2.8 Bn overall in 2024.

Asia Pacific holds the dominant position in the global Automotive Coolant Market with 38.40% share valued at USD 2.8 Bn, reflecting its strong manufacturing base, large vehicle population, and continuous expansion of passenger and commercial fleets. The region’s leadership is supported by rising service requirements across densely populated markets and steady maintenance cycles that keep coolant consumption high.

North America contributes through consistent aftermarket activity and a well-established servicing network that supports regular coolant replacement across diverse vehicle types. Europe remains stable, driven by structured maintenance practices and a wide presence of vehicles that rely on dependable thermal-management fluids.

Latin America and the Middle East & Africa show steady participation as vehicle usage grows and servicing awareness gradually increases. Together, all regions contribute to the overall demand pattern, yet Asia Pacific clearly anchors the market due to its scale, growing mobility needs, and sustained servicing frequency, reinforcing its dominant 38.40% and USD 2.8 Bn position.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE remains influential because of its deep background in additive chemistry and its ability to supply stable coolant ingredients that support long-life formulations. Its long experience in developing corrosion-inhibitor technologies positions it well as engines become more demanding and require cleaner, more durable thermal-management fluids.

Dow Inc. contributes through its strong materials science capabilities, especially in developing glycol-based solutions that form the backbone of many coolant blends. Its focus on consistent quality, thermal stability, and metal compatibility aligns with the market’s shift toward extended drain intervals and modern engine designs.

Chevron Corporation adds strength from the finished-fluids side, offering coolants that are widely used in passenger and commercial vehicles. Its background in engine oils and lubricants supports a broad servicing presence, which naturally extends to coolant products distributed through workshops and fleet networks.

Top Key Players in the Market

- BASF SE

- Dow Inc.

- Chevron Corporation

- ExxonMobil Corp.

- Shell plc

- TotalEnergies SE

- China Petroleum and Chemical Corp. (Sinopec)

- BP plc (Castrol)

- Cummins Inc

- Fuchs Petrolub SE

Recent Developments

- In October 2025, Dow and MEGlobal expanded their strategic ethylene supply agreement, with Dow supplying an additional equivalent of 100 kilo-tonnes per annum of ethylene to MEGlobal’s ethylene-glycol (EG) manufacturing at their Oyster Creek site. Ethylene glycol is a key base fluid in antifreeze and coolant formulations, so this deal strengthens Dow’s feedstock position and indirectly supports higher coolant-fluid volume.

- In September 2025, BASF launched its GLYSANTIN® ELECTRIFIED® low-electrical-conductivity coolants (LECCs) for electric vehicles. These new coolants are engineered to work with high-voltage battery systems, reduce fluid decomposition and hydrogen generation, and comply with China’s GB 29743.2-2025 standard (effective 1 Oct 2025). Production began at BASF’s Pudong site in Shanghai.

Report Scope

Report Features Description Market Value (2024) USD 7.5 Billion Forecast Revenue (2034) USD 12.0 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ethylene Glycol, Propylene Glycol, Glycerin, Others), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Technology (Inorganic Additive Technology (IAT), Organic Additive Technology (OAT), Hybrid Organic Acid Technology (HOAT)), By End User (Original Equipment Manufacturer (OEM), Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Dow Inc., Chevron Corporation, ExxonMobil Corp., Shell plc, TotalEnergies SE, China Petroleum and Chemical Corp. (Sinopec), BP plc (Castrol), Cummins Inc, Fuchs Petrolub SE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Coolant MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Coolant MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Dow Inc.

- Chevron Corporation

- ExxonMobil Corp.

- Shell plc

- TotalEnergies SE

- China Petroleum and Chemical Corp. (Sinopec)

- BP plc (Castrol)

- Cummins Inc

- Fuchs Petrolub SE