Anti Venom Market By Type (Monovalent, Polyvalent, and Others), By Species (Snake, Scorpion, Spider, and Others), By Mode of Action (Neurotoxic, Cytotoxic, Haemotoxic, Myotoxic, Cardiotoxic, and Others), By End-user (Hospitals & Clinics, Ambulatory Surgical Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 137785

- Number of Pages: 230

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

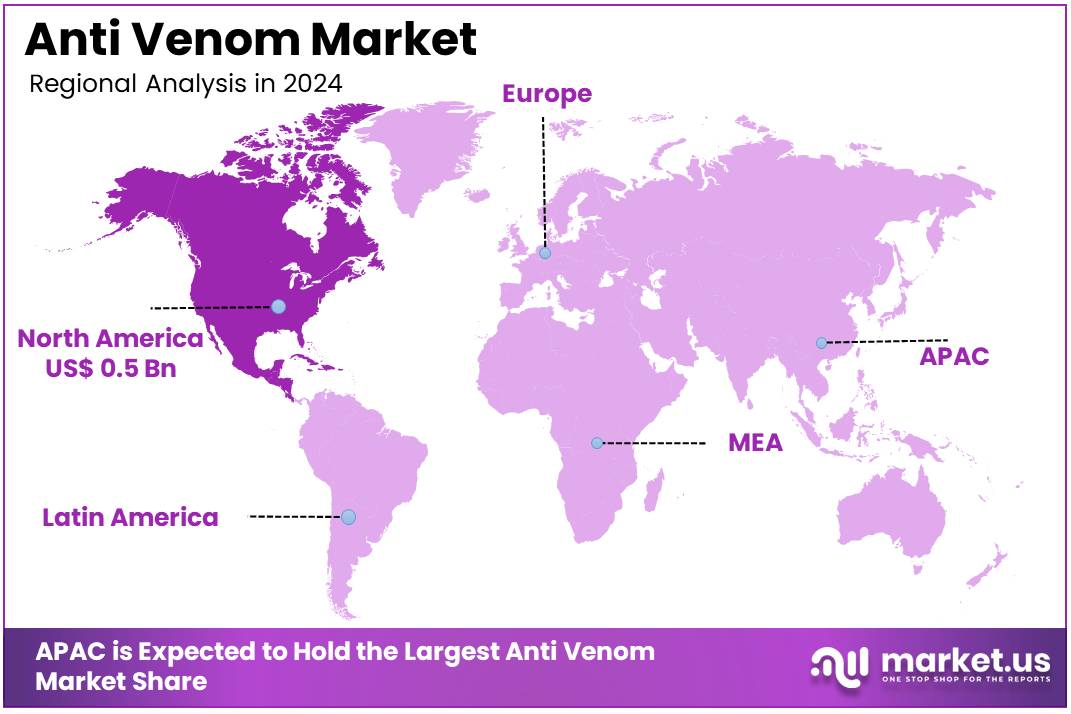

The Global Anti Venom Market Size is expected to be worth around US$ 2.8 Billion by 2034, from US$ 1.3 Billion in 2024, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 39.6% share and holds US$ 0.5 Billion market value for the year.

Increasing cases of snakebites and the rising awareness of the need for effective treatment are driving the growth of the anti-venom market. Anti-venoms are critical for treating venomous snakebites, which, if untreated, can lead to death or permanent disability. These life-saving treatments neutralize the toxins introduced by venomous bites and prevent severe complications such as organ failure and paralysis.

According to the WHO, Africa registers approximately 435,000 to 580,000 snakebites each year, underscoring the growing global need for effective anti-venom solutions. In addition to snakebites, anti-venoms are also used to treat envenomations caused by scorpions, spiders, and marine animals, broadening their application.

In February 2024, scientists at Scripps Research developed an antibody capable of blocking the lethal effects of toxins found in the venoms of various snake species across Africa, Asia, and Australia. This innovation highlights the ongoing research and development efforts to improve anti-venom efficacy and broaden its scope of use.

Recent trends also reflect a shift toward developing polyclonal and monoclonal antibody based treatments that offer more specific, faster, and safer therapeutic options. As the global burden of envenomations continues to grow, opportunities for the anti-venom market include enhancing production processes, improving accessibility in underserved areas, and advancing the development of more universal treatments for diverse venom types.

Key Takeaways

- In 2024, the market for Anti Venom generated a revenue of US$ 1.3 billion, with a CAGR of 8.1%, and is expected to reach US$ 2.8 billion by the year 2034.

- The type segment is divided into monovalent, polyvalent, and others, with polyvalent taking the lead in 2024 with a market share of 58.3%.

- Considering species, the market is divided into snake, scorpion, spider, and others. Among these, snake held a significant share of 64.7%.

- Furthermore, concerning the mode of action segment, the neurotoxic sector stands out as the dominant player, holding the largest revenue share of 50.4% in the Anti Venom market.

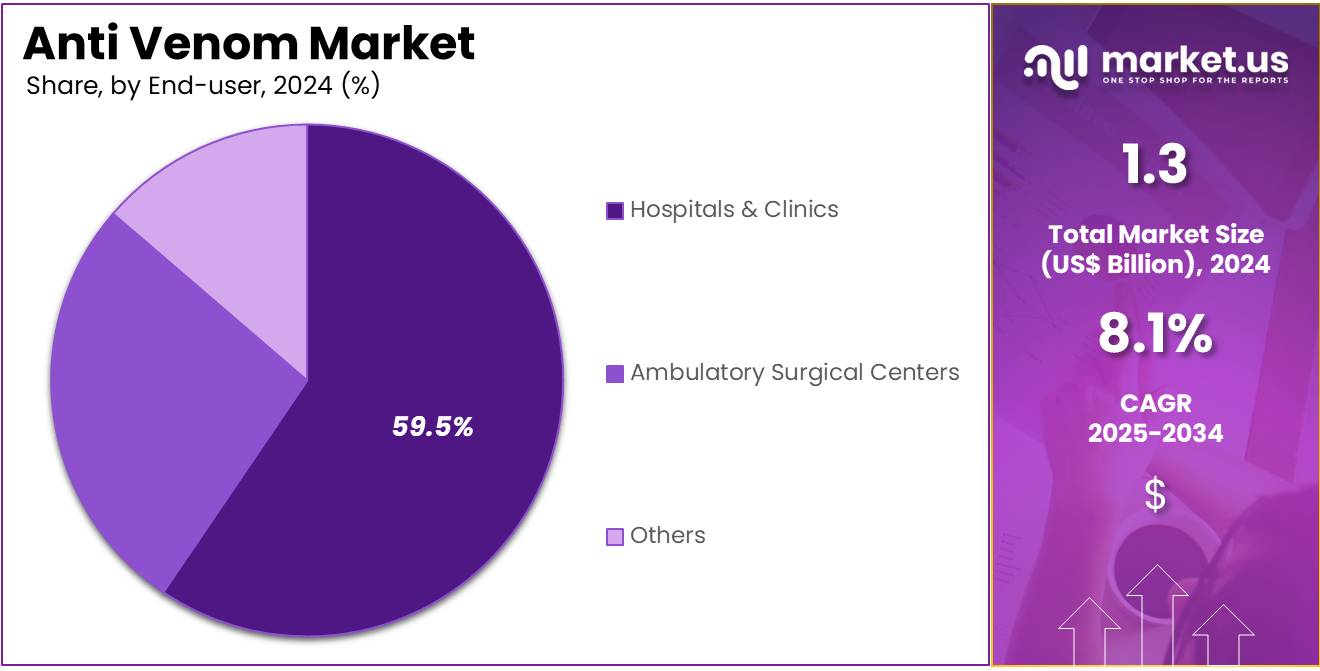

- The end-user segment is segregated into hospitals & clinics, ambulatory surgical centers, and others, with the hospitals & clinics segment leading the market, holding a revenue share of 59.5%.

- North America led the market by securing a market share of 39.6% in 2024.

Type Analysis

The polyvalent segment led in 2024, claiming a market share of 58.3% owing to the increasing need for a broader spectrum of protection against multiple venomous species. Polyvalent anti-venoms, which are designed to target the venom from various species of snakes and other venomous creatures, are likely to see greater demand as regions with diverse venomous species experience higher incidences of bites and stings.

The growing prevalence of snakebites and the complexity of treating envenomation from different species are expected to drive the adoption of polyvalent formulations. Additionally, advancements in research and the development of more effective polyvalent anti-venoms are anticipated to improve the efficacy and reduce the side effects associated with these treatments, further supporting their market growth.

Species Analysis

The snake held a significant share of 64.7% due to the rising number of snakebite incidents, particularly in tropical and subtropical regions. Snakes, being responsible for a significant proportion of venomous bites, are likely to continue to dominate the market. The increasing awareness of the dangers posed by venomous snakes, coupled with the growing availability of snakebite treatment in endemic areas, is anticipated to fuel the demand for snake-specific anti-venoms.

Moreover, ongoing advancements in the development of more efficient anti-venoms targeting a wide range of snake species are projected to drive this segment’s growth. As the global incidence of snakebites continues to rise, especially in rural and underserved areas, the demand for snake-specific treatments is likely to expand.

Mode of Action Analysis

The neurotoxic segment had a tremendous growth rate, with a revenue share of 50.4% owing to the increasing number of cases involving venomous species whose bites lead to neurotoxic effects. Neurotoxic venoms, which target the nervous system and can lead to paralysis or even death, are a major concern in the treatment of envenomation. The growing number of neurotoxic snake and insect species, particularly in tropical and subtropical areas, is expected to drive demand for anti-venoms targeting neurotoxic venom.

Additionally, advancements in neurotoxic venom research are anticipated to result in the development of more effective and specific anti-venoms. As the awareness of the dangers of neurotoxic envenomations grows, the demand for treatments that target neurotoxic venom is expected to increase, thereby contributing to the expansion of this segment in the market.

End-User Analysis

The hospitals & clinics segment grew at a substantial rate, generating a revenue portion of 59.5% due to the increasing number of snakebite and venomous insect cases requiring immediate medical intervention. Hospitals and clinics are likely to remain the primary settings for the administration of anti-venoms, as they are equipped to handle severe envenomations and provide the necessary supportive care.

The rising number of emergency medical cases involving venomous species, particularly in areas with limited access to healthcare, is expected to fuel the demand for anti-venom treatments in these settings. Additionally, the increasing awareness of the importance of timely and effective treatment for venomous bites, combined with the expansion of healthcare infrastructure in endemic regions, is projected to drive the growth of this segment. The development of more accessible anti-venom delivery systems in hospitals and clinics is also likely to enhance treatment outcomes and support market growth.

Key Market Segments

By Type

- Monovalent

- Polyvalent

- Others

By Species

- Snake

- Scorpion

- Spider

- Others

By Mode of Action

- Neurotoxic

- Cytotoxic

- Haemotoxic

- Myotoxic

- Cardiotoxic

- Others

By End-user

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Others

Drivers

Rise in Incidence of Snake Bites Driving the Anti-Venom Market

Rising incidence of snake bites is anticipated to drive the anti-venom market significantly. According to the World Health Organization, snake bites impact approximately 5.4 million people globally every year, with fatal outcomes ranging between 81,410 and 137,880 annually. The substantial health burden associated with these incidents necessitates the development of effective anti-venom therapies.

Regions with high snakebite prevalence, particularly in rural and tropical areas, face increased demand for accessible and affordable treatment solutions. Pharmaceutical companies are focusing on improving anti-venom formulations to target a broader spectrum of snake species. Expanding healthcare infrastructure in developing regions enhances the availability of life-saving treatments.

Collaborative initiatives between global health organizations and local governments are accelerating the distribution of anti-venoms in underserved regions. Increased awareness campaigns and training for medical professionals strengthen the market by ensuring prompt and accurate administration of treatments. Advancements in biotechnology and the development of next-generation anti-venoms support better efficacy and reduced adverse reactions.

Rising investment in snakebite-related research promotes innovation and strengthens the pipeline for advanced solutions. Growing partnerships between research institutions and pharmaceutical companies also contribute to the market’s expansion. These trends underscore the critical role of effective anti-venom therapies in addressing the global snakebite crisis.

Restraints

High Costs Are Restraining the Anti-Venom Market

High costs associated with the production and distribution of anti-venom are restraining the market. The manufacturing process requires advanced technologies, extensive research, and expensive biological materials. Limited economies of scale, due to the region-specific nature of snakebite incidents, further increase production costs. The cold chain requirements for storage and transportation add to logistical expenses, particularly in rural and remote areas.

In many developing countries, where snakebite incidents are more frequent, healthcare systems face challenges in financing anti-venom stocks. Low profit margins discourage pharmaceutical companies from investing in the production of anti-venoms for rarer snake species. Regulatory barriers and lengthy approval processes delay product launches, adding to the financial burden. Addressing these challenges requires government subsidies, global partnerships, and innovations in cost-efficient production methods.

Opportunities

Rising R&D Efforts by Governments as an Opportunity for the Anti-Venom Market

Rising research and development efforts by governments create a significant opportunity for the anti-venom market. In March 2024, the Institute for Primate Research in Kenya announced its plans to introduce the first anti-venom developed in Africa. This milestone highlights the growing commitment of governments to address regional health challenges. The Union Health Ministry of India initiated the NAP-SE program, establishing helplines across five states to improve access to snakebite treatment.

These initiatives reflect the increasing focus on localizing anti-venom production and distribution to meet specific regional needs. Government-backed R&D efforts support advancements in anti-venom formulations, enhancing efficacy and safety profiles. Investments in training programs for healthcare providers improve the accuracy of treatment and reduce fatalities.

Collaboration with global health organizations accelerates the development and deployment of innovative solutions. Expanding public-private partnerships further strengthens the infrastructure for anti-venom production and delivery. These trends are anticipated to drive market growth by ensuring wider accessibility and promoting innovation in life-saving therapies.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors have a significant impact on the anti-venom market. On the positive side, increasing healthcare investments and rising awareness about venomous bites and stings, particularly in tropical and subtropical regions, drive the demand for anti-venoms. Governments’ commitment to improving healthcare infrastructure in developing countries further accelerates market growth.

However, economic challenges, such as recessions, can lead to reduced healthcare budgets, hindering the affordability and availability of life-saving anti-venoms in low-income regions. Geopolitical issues, including trade restrictions and regulatory barriers, can also disrupt the distribution of raw materials needed for manufacturing.

Additionally, logistical challenges in remote or conflict-affected regions can delay the delivery of vital treatments. Despite these challenges, the growing global focus on public health, particularly in underserved regions, ensures continued progress and development in the anti-venom market.

Trends

Surge in Partnerships and Collaborations Driving the Anti-Venom Market

Rising partnerships and collaborations are significantly driving the anti-venom market. High cooperation between academic institutions, research organizations, and pharmaceutical companies is expected to accelerate the development of more effective and accessible treatments. These collaborations facilitate the sharing of resources, knowledge, and technological innovations.

In October 2022, Monash University partnered with Agilent Technologies by signing a Memorandum of Understanding (MoU) to create an integrated biology center in Malaysia. This collaboration aims to advance scientific understanding, particularly in developing better anti-venoms and supporting applied biology research. As more partnerships emerge, they are likely to increase the efficiency of anti-venom production, improve treatment accessibility, and reduce the time required to develop new therapies, further expanding the market.

Regional Analysis

North America is leading the Anti Venom Market

North America dominated the market with the highest revenue share of 39.6% owing to increasing awareness of the dangers posed by venomous snakes, advancements in antivenom formulations, and rising demand for effective treatments in the face of snakebite incidents. According to the Centers for Disease Control and Prevention (CDC), between 7,000 and 8,000 individuals in the U.S. experience bites from venomous snakes annually, with roughly five of those incidents resulting in death.

This statistic underscores the need for effective and readily available anti-venoms, which has contributed to the market’s expansion. Additionally, as the awareness of the effectiveness of early administration of anti-venoms grows, there has been a rise in the availability and accessibility of these life-saving treatments.

The growing prevalence of snakebites in both rural and urban settings, coupled with improvements in healthcare infrastructure, has driven the demand for better, more affordable, and rapid-response anti-venoms. Moreover, the ongoing research in developing broad-spectrum antivenoms targeting a variety of venomous species has further fueled market growth in the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to a high incidence of snakebites and increasing government and private sector investment in antivenom development. Countries in the region, particularly India, China, and Southeast Asian nations, experience a higher frequency of venomous snakebites, driving the demand for effective anti-venom treatments.

In August 2022, Bharat Serums and Vaccines Ltd. partnered with the Indian Institute of Science (IISc) to advance snakebite antivenom development, aiming to improve antivenom therapy and provide more effective treatments for snakebite victims. This initiative is expected to play a key role in reducing fatalities and improving survival rates, further contributing to the market’s growth.

As healthcare systems in the region continue to develop and the awareness of effective snakebite treatments rises, the anti-venom market is anticipated to expand, with governments and healthcare organizations focusing on ensuring the availability of these critical treatments. Enhanced research, improved healthcare infrastructure, and increased public awareness are likely to support the sustained growth of the anti-venom market in Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the anti-venom market focus on strategies such as advancing production methods to improve efficacy and reduce adverse reactions in patients. Companies invest in R&D to develop polyvalent products that target multiple venom types, enhancing their utility in diverse regions. Collaborations with governments and healthcare organizations help ensure availability in underserved areas and emergency situations. Geographic expansion into regions with high incidences of snakebites and scorpion stings strengthens their market presence.

Many players also emphasize regulatory compliance and affordability to increase access and adoption. Bharat Serums and Vaccines Limited is a leading company in this market, offering high-quality anti-venom products for snake and scorpion envenomations. The company focuses on innovation and partnerships to address public health needs in regions with high venomous animal encounters. Bharat Serums’ commitment to quality and affordability has established it as a trusted name in the industry.

Top Key Players in the Anti Venom Market

- Rare Disease Therapeutics Inc

- Pfizer, Inc

- Ophirex

- MicroPharm Limited

- Merck & Co., Inc

- Incepta Pharmaceuticals Limited

- CSL Limited

- Boston Scientific Corporation

- Boehringer Ingelheim International GmbH

Recent Developments

- In April 2021, Rare Disease Therapeutics revealed that the US FDA had granted approval for an expanded use of ANAVIP, an equine-derived antivenin, for treating North American Pit Viper envenomation in both pediatric and adult patients.

- In March 2022, Ophirex announced that its drug, varespladib-methyl (also known as “oral varespladib”), received Fast Track designation from the US FDA for snakebite treatment. The company is conducting clinical trials in both the US and India to develop a broad-spectrum antidote for snakebites.

Report Scope

Report Features Description Market Value (2024) US$ 1.3 billion Forecast Revenue (2034) US$ 2.8 billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Monovalent, Polyvalent, and Others), By Species (Snake, Scorpion, Spider, and Others), By Mode of Action (Neurotoxic, Cytotoxic, Haemotoxic, Myotoxic, Cardiotoxic, and Others), By End-user (Hospitals & Clinics, Ambulatory Surgical Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Rare Disease Therapeutics Inc, Pfizer, Inc, Ophirex, MicroPharm Limited, Merck & Co., Inc, Incepta Pharmaceuticals Limited, CSL Limited, Boston Scientific Corporation, and Boehringer Ingelheim International GmbH. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Rare Disease Therapeutics Inc

- Pfizer, Inc

- Ophirex

- MicroPharm Limited

- Merck & Co., Inc

- Incepta Pharmaceuticals Limited

- CSL Limited

- Boston Scientific Corporation

- Boehringer Ingelheim International GmbH