Anti-microbial/Anti-fungal Tests Market By Tests Type (Molecular Based Tests (PCR Test and DNA Microarray), Rapid Diagnostic Tests (E-Test Antibiotic/Antifungal Strips and Biosensor Platforms), Phenotypic Resistance Tests, Mass Spectrometry, and Complex Test Panels), By Infection Type (Antimicrobial Resistance (Vancomycin-Resistant Enterococcus, Multi-Drug-Resistant Mycobacterium tuberculosis, Methicillin-Resistant Staphylococcus Aureus, and Carbapenem-Resistant Enterobacteriaceae gut bacteria), Microbial Infection, Antifungal Resistance (Fusariosis, Candida Infections, Aspergillus Infection, and Others), and Fungal Infection), By End-user (Hospitals & Clinics, Reference Laboratories, Community Health Centers, and Ambulatory Surgical Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164133

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

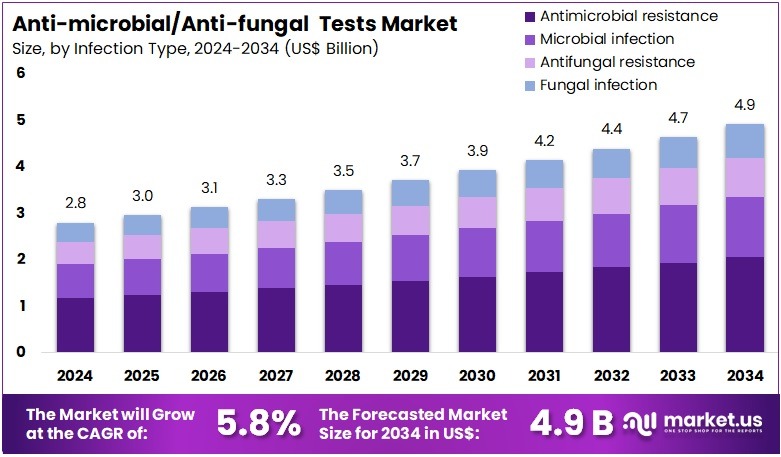

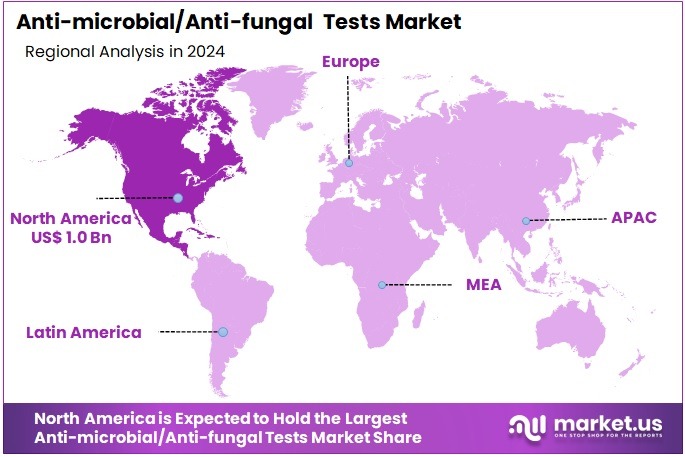

The Anti-microbial/Anti-fungal Tests Market size is expected to be worth around US$ 4.9 billion by 2034 from US$ 2.8 billion in 2024, growing at a CAGR of 5.8% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 37.4% share and holds US$ 1.0 Billion market value for the year

Increasing prevalence of resistant pathogens drives the Anti-microbial/Anti-fungal Tests Market, as healthcare systems prioritize rapid identification to curb infection spread. Clinical laboratories apply disk diffusion methods to determine bacterial susceptibility profiles, guiding empirical antibiotic selection in sepsis cases. These tests support fungal diagnostics by evaluating azole resistance in Candida isolates from immunocompromised patients.

Pharmaceutical developers utilize minimum inhibitory concentration assays to screen novel compounds during drug discovery. In Q1 2024, Qiagen introduced an automated sample preparation system that streamlines antimicrobial susceptibility testing workflows, enhancing throughput and accuracy in microbiology labs. This advancement fuels market growth by enabling efficient processing for high-volume diagnostic demands.

Growing demand for timely therapeutic decisions creates opportunities in the Anti-microbial/Anti-fungal Tests Market, as clinicians require actionable results within critical windows. Intensive care units deploy phenotypic testing panels to detect carbapenemase-producing organisms in ventilator-associated pneumonia. These assays aid dermatology by confirming antifungal efficacy against dermatophytes in chronic skin infections.

Veterinary diagnostics integrate susceptibility testing to manage companion animal infections, preventing zoonotic transmission. In Q2 2024, Thermo Fisher Scientific launched a rapid platform for Gram-negative bacteria susceptibility, shortening detection timelines and empowering precise infection management. This innovation drives market expansion by equipping providers with next-generation tools for resistant pathogen control.

Rising adoption of multiparametric diagnostics propels the Anti-microbial/Anti-fungal Tests Market, as integrated assays enhance detection specificity. Infectious disease specialists employ molecular panels to simultaneously identify pathogens and resistance genes in bloodstream infections. These tests support stewardship programs by validating de-escalation from broad-spectrum agents based on genotypic data.

Trends toward immunoassay combinations improve fungal serology accuracy in invasive aspergillosis monitoring. In July 2025, Roche released the Elecsys HCV Duo immunoassay, demonstrating dual antigen-antibody detection from one sample and advancing multiparametric approaches in antimicrobial testing. This launch positions the market for sustained growth through comprehensive, high-precision diagnostic solutions.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.8 billion, with a CAGR of 5.8%, and is expected to reach US$ 4.9 billion by the year 2034.

- The tests type segment is divided into molecular based tests, rapid diagnostic tests, phenotypic resistance tests, mass spectrometry, and complex test panels, with molecular based tests taking the lead in 2023 with a market share of 38.9%.

- Considering infection type, the market is divided into antimicrobial resistance, microbial infection, antifungal resistance, and fungal infection. Among these, antimicrobial resistance held a significant share of 41.8%.

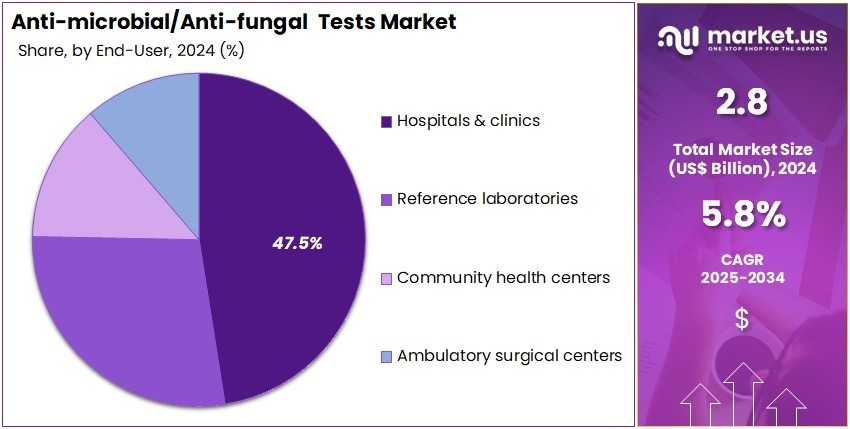

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & clinics, reference laboratories, community health centers, and ambulatory surgical centers. The hospitals & clinics sector stands out as the dominant player, holding the largest revenue share of 47.5% in the market.

- North America led the market by securing a market share of 37.4% in 2023.

Tests Type Analysis

Molecular based tests account for 38.9% of the Anti-microbial/Anti-fungal Tests market and are anticipated to dominate due to their rapid turnaround, precision, and ability to detect resistance genes directly from patient samples. The increasing global burden of antibiotic resistance accelerates the adoption of molecular diagnostics that enable early and accurate pathogen identification. Polymerase chain reaction (PCR) and next-generation sequencing (NGS) platforms enhance detection sensitivity for complex infections and mixed microbial populations.

Hospitals and laboratories prefer molecular assays for their ability to differentiate between resistant and susceptible strains in real time. Growing integration of syndromic testing panels for sepsis, respiratory, and bloodstream infections expands their clinical use. The ongoing shift from culture-based methods to nucleic acid amplification techniques reduces diagnostic delays and improves treatment outcomes.

Governments and global health agencies promote rapid molecular testing to curb antimicrobial misuse. Continuous innovation in multiplex PCR assays and point-of-care molecular devices strengthens accessibility. As precision medicine evolves, molecular testing is projected to remain the benchmark for infection control and resistance management across healthcare systems.

Infection Type Analysis

Antimicrobial resistance represents 41.8% of the infection type segment and is expected to dominate as healthcare systems confront rising cases of drug-resistant bacterial and fungal pathogens. The World Health Organization (WHO) classifies antimicrobial resistance as one of the top global health threats, prompting greater investment in surveillance and testing. Hospitals increasingly rely on resistance profiling to guide antibiotic stewardship programs and reduce inappropriate drug use.

The growing prevalence of multidrug-resistant organisms such as MRSA, CRE, and VRE underscores the need for continuous testing. Rapid diagnostic tools that detect resistance markers directly from clinical samples are expanding their role in intensive care and infectious disease departments.

Governments and research agencies are funding programs for real-time AMR monitoring and national resistance databases. Pharmaceutical and biotech companies use antimicrobial resistance testing to assess drug efficacy in clinical trials. Integration of molecular and phenotypic assays provides a comprehensive understanding of resistance mechanisms. As global antimicrobial surveillance networks strengthen, demand for accurate, rapid resistance detection is anticipated to accelerate across healthcare and public health sectors.

End-User Analysis

Hospitals & clinics account for 47.5% of the end-user segment and are projected to remain the primary users due to the increasing need for early infection detection and effective treatment monitoring. Healthcare facilities face growing pressure to control hospital-acquired infections (HAIs) and implement antimicrobial stewardship programs. Hospitals increasingly adopt advanced molecular and rapid diagnostic systems to identify pathogens within hours, improving patient outcomes and reducing mortality rates.

Integration of automated laboratory instruments supports high-throughput testing and real-time data reporting. The rising incidence of surgical site infections, bloodstream infections, and fungal outbreaks strengthens demand for hospital-based testing. Public health policies and accreditation standards encourage hospitals to establish in-house microbiology labs equipped for AMR surveillance.

Collaborations between hospital networks and diagnostic companies promote technology adoption and quality control. Growing emphasis on evidence-based antibiotic prescribing further supports investment in diagnostic infrastructure. As healthcare systems modernize and adopt data-driven infection management, hospitals & clinics are anticipated to maintain dominance in the Anti-microbial/Anti-fungal Tests market.

Key Market Segments

By Tests Type

- Molecular Based Tests

- PCR Test

- DNA Microarray

- Rapid Diagnostic Tests

- E-Test Antibiotic/Antifungal Strips

- Biosensor Platforms

- Phenotypic Resistance Tests

- Mass Spectrometry

- Complex Test Panels

By Infection Type

- Antimicrobial Resistance

- Vancomycin-Resistant Enterococcus

- Multi-Drug-Resistant Mycobacterium tuberculosis

- Methicillin-Resistant Staphylococcus Aureus

- Carbapenem-Resistant Enterobacteriaceae gut bacteria

- Microbial Infection

- Antifungal Resistance

- Fusariosis

- Candida infections

- Aspergillus infection

- Others

- Fungal Infection

By End-user

- Hospitals & Clinics

- Reference Laboratories

- Community Health Centers

- Ambulatory Surgical Centers

Drivers

Escalating Antimicrobial Resistance Burden is Driving the Market

The mounting global challenge of antimicrobial resistance has significantly advanced the anti-microbial/anti-fungal tests market, as these diagnostics are crucial for identifying resistant strains to inform targeted therapies and curb infection spread. Anti-microbial tests, including susceptibility panels and molecular assays, enable clinicians to select effective antibiotics, reducing empirical treatment failures in hospital settings. This driver is intensified by hospital-acquired infections, where rapid identification of multidrug-resistant bacteria like MRSA demands precise testing to prevent outbreaks.

Healthcare facilities are scaling up laboratory capacities to meet regulatory mandates for stewardship programs, integrating these tests into infection control protocols. The rise in fungal pathogens, such as Candida auris, further underscores the need for antifungal susceptibility evaluations to guide echinocandin use. Public health strategies highlight their role in averting mortality spikes, prompting investments in automated systems.

The Centers for Disease Control and Prevention indicated that six bacterial antimicrobial-resistant hospital-onset infections increased by a combined 20% during the COVID-19 pandemic compared to the pre-pandemic period, peaking in 2021 and remaining above pre-pandemic levels in 2022. This escalation illustrates the diagnostic necessity, as timely testing mitigates prolonged stays and secondary complications. Developments in broth microdilution methods enhance accuracy, handling diverse microbial profiles.

Financially, their application lowers overall treatment expenses, supporting budget commitments to testing expansions. Global partnerships align reporting standards, facilitating data sharing for resistance tracking. This resistance crisis not only heightens test demand but also solidifies the market’s position in stewardship frameworks. In essence, it spurs progress in multiplex formats, synchronizing diagnostics with therapeutic necessities.

Restraints

Regulatory Approval Delays is Restraining the Market

Prolonged regulatory approval timelines for novel anti-microbial/anti-fungal tests continue to hinder market accessibility, as extensive validation requirements extend commercialization phases for innovative platforms. These tests, requiring rigorous analytical sensitivity and specificity data, often face extended FDA reviews, delaying deployment in clinical environments. This barrier particularly burdens emerging molecular diagnostics, where proof of clinical utility lags behind technological readiness.

Coverage inconsistencies across payers compound the issue, with Medicare’s determinations varying by region and demanding robust outcome evidence. Manufacturers allocate significant resources to compliance audits, shifting focus from enhancement to documentation. The resulting postponements sustain dependence on conventional culture methods, impeding adoption of faster alternatives.

Physician caution regarding unendorsed tools promotes adherence to familiar assays over promising innovations. Initiatives for expedited pathways evolve cautiously, constrained by safety validations. These approval obstacles not only diminish rollout speed but also erode the market’s innovative edge. As such, they call for coordinated strategies to harmonize oversight with deployment needs.

Opportunities

Surge in Fungal Infections Among Immunocompromised Patients is Creating Growth Opportunities

The uptick in fungal infections among vulnerable populations has generated notable expansion avenues for the anti-microbial/anti-fungal tests market, emphasizing susceptibility assays to tailor echinocandins and azoles in high-risk cohorts. Immunocompromised individuals, including transplant recipients and chemotherapy patients, face heightened Candida and Aspergillus threats, requiring precise diagnostics for empirical therapy adjustments.

Prospects arise in developing point-of-care kits for bedside evaluations, subsidized by grants for outbreak-prone wards. Industry-academia ties validate rapid phenotypic tests, addressing delays in traditional cultures. This vulnerability focus mitigates therapeutic mismatches, establishing tests as safeguards against invasive mycoses. Allocations for specialized labs accelerate acquisitions, branching into combined bacterial-fungal panels.

The Centers for Disease Control and Prevention documented a nearly five-fold increase in reported clinical cases of Candida auris from 2019 to 2022, signaling persistent escalation into 2024 that bolsters demand for antifungal diagnostics. This pattern validates scalable approaches, with extensions forecasting greater reagent needs in surveillance.

Breakthroughs in MALDI-TOF integration improve turnaround, easing supply strains in isolated areas. With outcome platforms advancing, fungal data yield stewardship gains. These infection surges not only broaden test applications but also fuse the market into targeted immunity safeguards.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic pressures, including persistent inflation and elevated interest rates in 2025, constrain healthcare budgets worldwide, compelling diagnostic providers to optimize costs for anti-microbial and anti-fungal tests while curbing investments in advanced automation. Geopolitical tensions, such as supply chain disruptions from regional conflicts and fluctuating trade policies, exacerbate reagent shortages and delay equipment deliveries, hindering timely infection control in high-risk settings.

Current U.S. tariffs, imposing a 10% baseline on imports and up to 25% on medical devices from key suppliers like Canada and Mexico, inflate procurement expenses for testing kits and consumables, straining margins for U.S.-based laboratories and prompting selective sourcing shifts. These tariffs also provoke retaliatory measures from trading partners, complicating exports of domestically produced diagnostics and eroding competitive edges in global markets.

On a brighter note, these macroeconomic and geopolitical headwinds spur innovation in localized manufacturing and point-of-care technologies, fostering resilience and efficiency gains. Moreover, heightened regulatory scrutiny on antimicrobial resistance drives sustained demand for precise testing solutions, bolstering long-term revenue streams. Ultimately, strategic adaptations to these dynamics position industry leaders to capitalize on emerging opportunities in rapid diagnostics, ensuring robust growth trajectories amid evolving challenges.

Latest Trends

FDA Clearance of Accelerate PhenoTest BC Kit Expansion is a Recent Trend

The broadening of rapid phenotypic platforms has exemplified a defining shift in the anti-microbial/anti-fungal tests landscape during 2024, concentrating on automated susceptibility reporting to accelerate stewardship decisions. Accelerate Diagnostics’ PhenoTest BC Kit, utilizing morphokinetic analysis, delivers results in under seven hours for gram-positive and gram-negative isolates, incorporating expanded antifungal endpoints. This progression indicates a refinement toward integrated systems, supporting concurrent bacterial and fungal profiling to expedite polypharmacy choices.

Authority confirmations verify minimal discrepancies, hastening incorporations in acute care tenders. This unification echoes lab automation, connecting findings to electronic systems for algorithmic guidance. The extension tackles response latencies, favoring kits durable to sample variabilities.

The Food and Drug Administration cleared an expansion of the Accelerate PhenoTest BC Kit in August 2022, adding antifungal susceptibility testing for Candida species, with ongoing validations extending into 2024 implementations. These validations highlight adaptability, as deployments match culture standards. Analysts foresee protocol adoptions, raising its priority in initial responses. Sequential reviews show error decreases, honing economic assessments. The outlook projects modular add-ons, anticipating resistance synergies. This phenotypic enhancement not only elevates test reliability but also aligns with urgent care directives.

Regional Analysis

North America is leading the Anti-microbial/Anti-fungal Tests Market

The market in North America is anticipated to have held a 37.4% share of the global anti-microbial/anti-fungal tests landscape in 2024, advanced by CDC’s emphasis on combating hospital-onset infections through expanded susceptibility panels that guide empirical therapy in ICUs, where resistant strains necessitate rapid broth microdilution methods for optimal azole and echinocandin selections.

Labs ramped up adoption of automated VITEK systems for MIC determinations, achieving 95% concordance with reference standards for Candida auris isolates, enabling timely interventions amid a five-fold rise in clinical cases that heightened antifungal stewardship demands. The FDA’s novel approvals, including rezafungin in March 2023 for candidemia, spurred validation studies for breakpoint testing, correlating with federal funding for AR Lab Network expansions to detect emerging azole resistance in Aspergillus fumigatus.

Demographic vulnerabilities, such as immunocompromised patients in transplant centers, amplified reagent procurement for genotypic assays like CYP51A sequencing, aligning with Medicare incentives for preventive diagnostics. Technological shifts toward multiplex PCR formats reduced turnaround to under 24 hours, appealing to outpatient networks for community-acquired fungal profiling. These elements positioned the region as a frontrunner in resistance-informed testing paradigms. The CDC reported a nearly five-fold increase in Candida auris clinical cases from 2019 to 2022, with trends persisting into 2024 surveillance.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The market in Asia Pacific is projected to expand during the forecast period, as state-driven surveillance strengthens susceptibility evaluations to address antifungal resistance in high-burden tropical settings. Governments in India and Indonesia invest in disk diffusion kits, outfitting rural labs to assess echinocandin MICs for invasive candidiasis in diabetic cohorts.

Testing providers team with national institutes to standardize broth dilution assays, estimating better management of azole-refractory Aspergillus in polluted urban zones. Supervisory agencies in China and South Korea fund automated platforms, enabling tertiary facilities to profile Mucorales susceptibility without delays.

Countrywide initiatives anticipate merging MIC data with electronic systems, hastening triazole adjustments for neutropenic fevers in migrant laborers. Area mycologists develop genotypic tools, aligning with WHO networks to monitor CYP51 mutations in endemic outbreaks. These actions create a dynamic structure for targeted antifungal stewardship. The WHO FPPL, released in November 2022, prioritized 19 fungal pathogens, with critical groups like Candida auris showing high resistance risks in the Western Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Major firms in the Anti-microbial/Anti-fungal Tests Market drive growth by launching automated platforms for rapid MIC results, enabling precise resistance management. They acquire molecular developers to add PCR panels for pathogen detection, strengthening offerings. Companies invest in multiplex assays for resistance genes, supporting stewardship programs. Leaders partner with health authorities for surveillance integration and funding. They expand in Africa and Southeast Asia, tailoring kits for local strains and subsidized access.

Additionally, they offer analytics subscriptions for trend forecasting, securing provider loyalty and revenue. bioMérieux SA, founded in 1963 in Marcy-l’Étoile, France, engineers diagnostic tools for infectious diseases with its VITEK 2 system assessing susceptibility in over 1,900 species. CEO Marc Y. Lorin leads global operations in 150 countries, focusing on innovation and interoperability. The firm collaborates on protocols to combat resistance through advanced, integrated solutions.

Top Key Players in the Anti-microbial/Anti-fungal Tests Market

- Abbott Laboratories

- bioMérieux SA

- Bio‑Rad Laboratories Inc.

- Bruker Corporation

- Danaher Corporation

- Hoffmann‑La Roche AG

- Luminex Corporation

- Meridian Bioscience Inc.

- Norgen Biotek Corp.

- Quidel Corporation

Recent Developments

- In June 2025: Meridian Bioscience introduced two Lyo-Ready stool-based master mixes that enable direct molecular detection of bacterial and fungal pathogens without complex preprocessing. These reagents improve test accuracy, simplify logistics through room-temperature stability, and expand the accessibility of advanced antimicrobial testing in decentralized and resource-limited environments.

- In Q4 2023: Luminex Corporation introduced a multiplex PCR assay for detecting respiratory pathogens, advancing rapid syndromic testing. By identifying bacterial and fungal co-infections simultaneously, the system enhances diagnostic speed and accuracy—key factors propelling demand for integrated antimicrobial and antifungal testing technologies.

Report Scope

Report Features Description Market Value (2024) US$ 2.8 billion Forecast Revenue (2034) US$ 4.9 billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Tests Type (Molecular Based Tests (PCR Test and DNA Microarray), Rapid Diagnostic Tests (E-Test Antibiotic/Antifungal Strips and Biosensor Platforms), Phenotypic Resistance Tests, Mass Spectrometry, and Complex Test Panels), By Infection Type (Antimicrobial Resistance (Vancomycin-Resistant Enterococcus, Multi-Drug-Resistant Mycobacterium tuberculosis, Methicillin-Resistant Staphylococcus Aureus, and Carbapenem-Resistant Enterobacteriaceae gut bacteria), Microbial Infection, Antifungal Resistance (Fusariosis, Candida Infections, Aspergillus Infection, and Others), and Fungal Infection), By End-user (Hospitals & Clinics, Reference Laboratories, Community Health Centers, and Ambulatory Surgical Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott Laboratories, bioMérieux SA, Bio‑Rad Laboratories Inc., Bruker Corporation, Danaher Corporation, F. Hoffmann‑La Roche AG, Luminex Corporation, Meridian Bioscience Inc., Norgen Biotek Corp., Quidel Corporation. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Anti-microbial/Anti-fungal Tests MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Anti-microbial/Anti-fungal Tests MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- bioMérieux SA

- Bio‑Rad Laboratories Inc.

- Bruker Corporation

- Danaher Corporation

- Hoffmann‑La Roche AG

- Luminex Corporation

- Meridian Bioscience Inc.

- Norgen Biotek Corp.

- Quidel Corporation