Anti-Malarial Drugs Market By Drug Class (Antifolate Compounds, Artemisinin Compounds, Aryl Aminoalcohol Compounds, and Others), By Malaria Type (Plasmodium Falciparum, Plasmodium Malariae, Plasmodium Vivax, and Plasmodium Ovale), By Distribution Channel (Hospital Pharmacy, E-Commerce, Retail Pharmacy, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132974

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

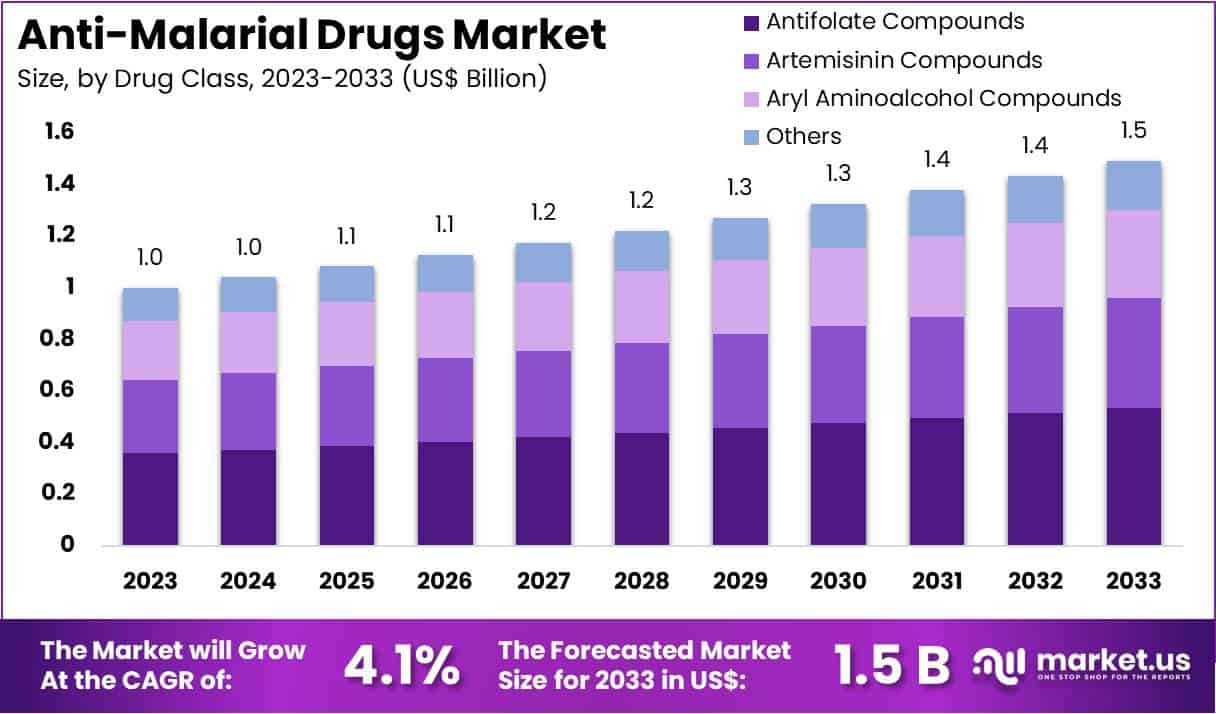

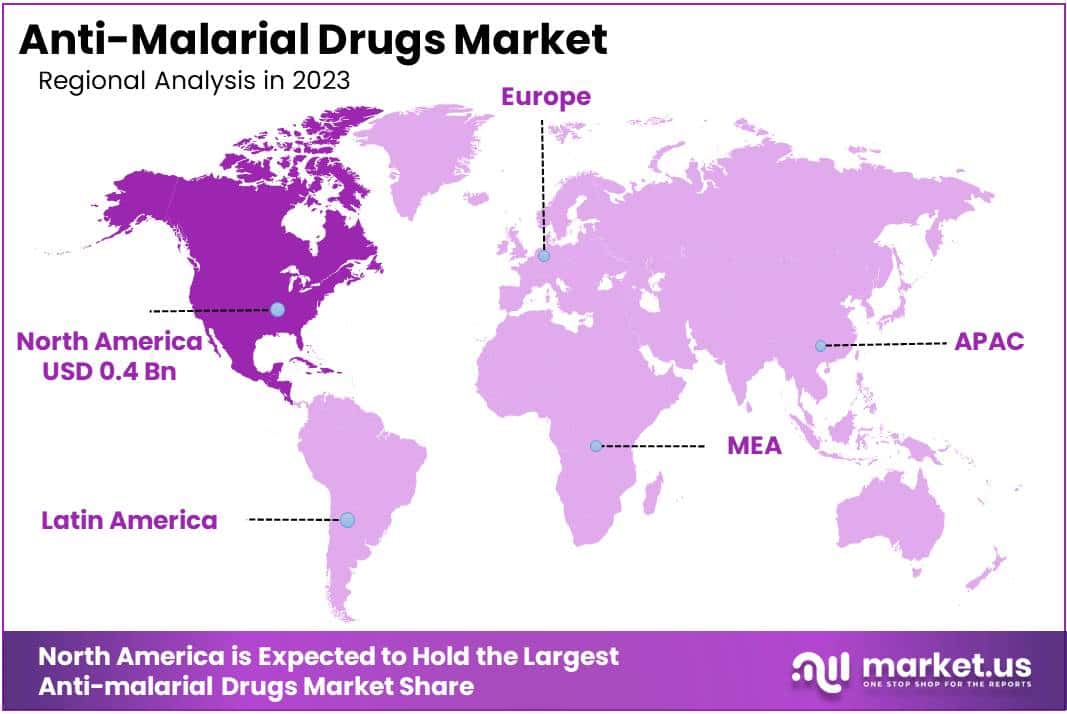

The Global Anti-Malarial Drugs Market size is expected to be worth around US$ 1.5 Billion by 2033, from US$ 1 Billion in 2023, growing at a CAGR of 4.1% during the forecast period from 2024 to 2033. North America led the market with a 39.8% revenue share due to approved artesunate injections for severe malaria.

Rising prevalence of malaria significantly drives the anti-malarial drugs market, as healthcare providers seek effective solutions to combat this life-threatening disease. Anti-malarial drugs play a crucial role in both the prevention and treatment of malaria, addressing various stages of the Plasmodium parasite’s lifecycle. The WHO reported that in 2021, the African Region accounted for 95% of global malaria cases and 96% of malaria-related deaths, underscoring the urgent need for accessible and effective treatments.

The market benefits from the wide application of drugs such as artemisinin-based combination therapies (ACTs), which remain the gold standard for treating uncomplicated malaria. Recent trends highlight increased investment in developing next-generation anti-malarials, including single-dose cures and long-acting formulations, to improve compliance and efficacy.

Opportunities arise from the growing focus on addressing drug resistance, which threatens the effectiveness of existing therapies. Research into novel drug targets and combination therapies aims to overcome resistance and enhance treatment outcomes. The rising demand for pediatric formulations and preventative treatments, such as chemoprophylaxis for travelers, further expands the market’s scope.

Key Takeaways

- In 2023, the market for anti-malarial drugs generated a revenue of US$ 1.0 billion, with a CAGR of 4.1%, and is expected to reach US$ 1.5 billion by the year 2033.

- The drug class segment is divided into antifolate compounds, artemisinin compounds, aryl aminoalcohol compounds, and others, with antifolate compounds taking the lead in 2023 with a market share of 35.8%.

- Considering malaria type, the market is divided into plasmodium falciparum, plasmodium malariae, plasmodium vivax, and plasmodium ovale. Among these, plasmodium falciparum held a significant share of 42.5%.

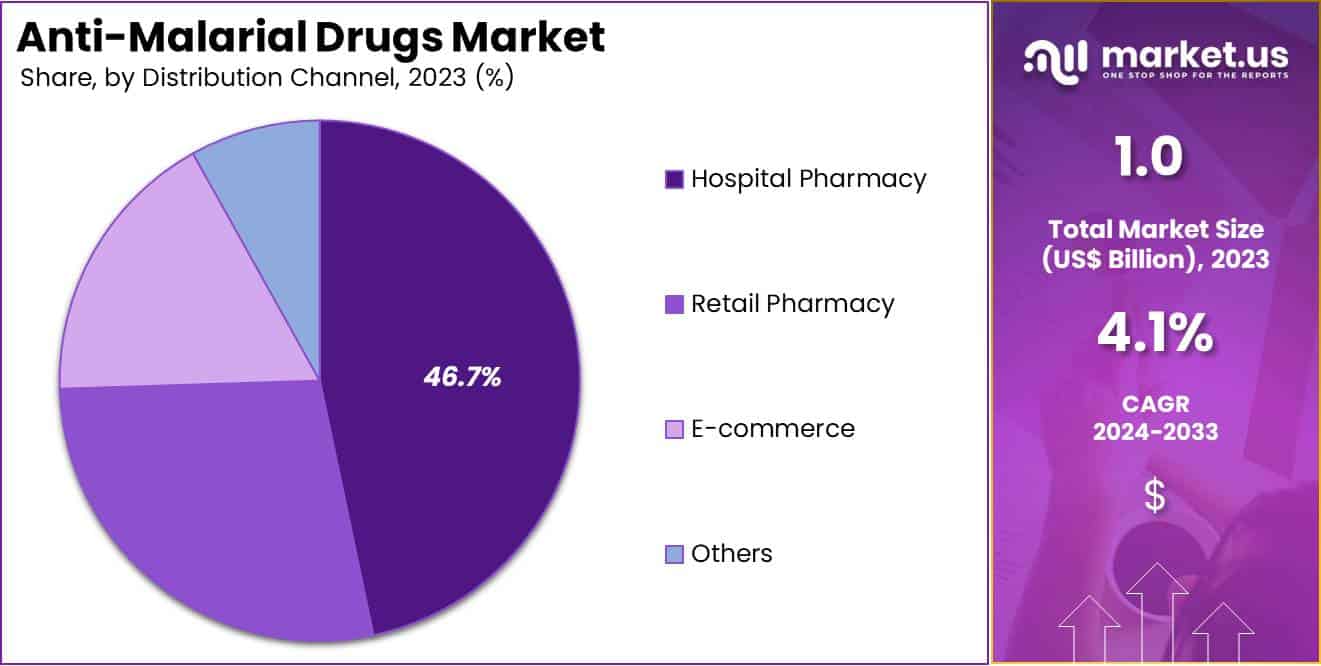

- Furthermore, concerning the distribution channel segment, the market is segregated into hospital pharmacy, e-commerce, retail pharmacy, and others. The hospital pharmacy sector stands out as the dominant player, holding the largest revenue share of 46.7% in the anti-malarial drugs market.

- North America led the market by securing a market share of 39.8% in 2023.

Drug Class Analysis

The antifolate compounds segment led in 2023, claiming a market share of 35.8% owing to the increasing prevalence of drug-resistant malaria strains, which makes antifolate-based therapies essential for effective treatment. Antifolate compounds, such as pyrimethamine and sulfadoxine, are often used in combination therapies to enhance efficacy and reduce the development of resistance.

Their affordability and widespread availability in endemic regions further support their adoption. Additionally, ongoing research into new antifolate formulations aimed at improving patient outcomes is likely to boost demand. Government initiatives and global health programs targeting malaria control and elimination also promote the use of antifolate-based treatments. As these efforts intensify, the antifolate compounds segment is projected to expand steadily within the anti-malarial drugs market.

Malaria Type Analysis

The plasmodium falciparum held a significant share of 42.5% due to the high prevalence and severity of P. falciparum infections, which cause the majority of malaria-related deaths worldwide. Healthcare providers prioritize the treatment of P. falciparum due to its rapid progression and resistance to older therapies, increasing the demand for effective anti-malarial drugs.

The development of artemisinin-based combination therapies (ACTs), which are highly effective against P. falciparum, further supports this segment’s growth. Additionally, global health initiatives, such as those led by the World Health Organization, focus heavily on combating P. falciparum in malaria-endemic regions. As awareness and diagnostic capabilities improve, the P. falciparum segment is projected to see robust expansion.

Distribution Channel Analysis

The hospital pharmacy segment had a tremendous growth rate, with a revenue share of 46.7% owing to the critical role hospital pharmacies play in managing severe and complicated malaria cases, particularly in regions with high disease burden. Patients admitted for acute malaria often require immediate access to potent anti-malarial drugs, which hospital pharmacies reliably provide.

The availability of specialized care and professional oversight enhances patient outcomes, increasing reliance on this distribution channel. Furthermore, hospital pharmacies benefit from direct procurement agreements with manufacturers, ensuring a consistent supply of essential medications. As healthcare infrastructure expands in malaria-endemic regions, the hospital pharmacy segment is likely to experience continued growth, supported by rising hospitalization rates for malaria treatment.

Key Market Segments

By Drug Class

- Antifolate Compounds

- Artemisinin Compounds

- Aryl Aminoalcohol Compounds

- Others

By Malaria Type

- Plasmodium Falciparum

- Plasmodium Malariae

- Plasmodium Vivax

- Plasmodium Ovale

By Distribution Channel

- Hospital Pharmacy

- E-Commerce

- Retail Pharmacy

- Others

Drivers

Increasing Prevalence of Malaria

The rising prevalence of malaria significantly drives the demand for anti-malarial drugs as millions of individuals worldwide remain at risk of contracting this life-threatening disease. According to the World Malaria Report 2022, there were around 247 million cases of malaria globally in 2021, with a potential range of 224 to 276 million. The report also highlighted approximately 619,000 malaria-related deaths during the same period, emphasizing the critical need for effective treatment solutions.

As malaria continues to pose a significant public health challenge, especially in tropical and subtropical regions, the demand for anti-malarial drugs is anticipated to grow. Increased travel to endemic areas and changing climatic conditions further contribute to the disease’s spread. Governments and international organizations are intensifying efforts to combat malaria, including improved access to life-saving medications. This persistent global health burden underlines the importance of expanding the availability of anti-malarial treatments, driving market growth in the coming years.

Restraints

Lack of Proper Treatment in Developing Nations

The lack of proper treatment infrastructure in developing and underdeveloped nations hampers the growth of the anti-malarial drugs market. In many malaria-endemic regions, healthcare systems struggle with limited resources, inadequate funding, and a lack of trained medical personnel. These challenges hinder the timely diagnosis and effective treatment of malaria, reducing the reach of anti-malarial therapies. Poor distribution networks further impede access to essential medications, particularly in rural and remote areas.

Additionally, counterfeit drugs and substandard treatment practices compromise patient outcomes and undermine public trust in available therapies. Rising healthcare inequalities exacerbate these challenges, leaving vulnerable populations without adequate protection against malaria. Addressing these systemic issues is anticipated to be critical for improving the adoption and effectiveness of anti-malarial interventions in resource-limited settings.

Opportunities

Growing Awareness for Malaria Prevention and Treatment

Growing awareness about malaria prevention and treatment presents a significant opportunity for the anti-malarial drugs market. Global health campaigns and educational initiatives have successfully highlighted the importance of early diagnosis and effective treatment in reducing malaria-related morbidity and mortality. In July 2022, the Gates Foundation, through the Gavi vaccination project, introduced the world’s first malaria vaccine, Mosquirix, developed by GlaxoSmithKline (GSK), in Kenya, Ghana, and Malawi. This landmark initiative aims to combat Plasmodium falciparum transmission in regions with moderate to high malaria prevalence.

Public health organizations increasingly collaborate with governments to promote access to both preventive and therapeutic solutions. These efforts are anticipated to drive demand for anti-malarial drugs by ensuring that at-risk populations recognize the importance of early treatment. Rising awareness also fosters increased investment in healthcare infrastructure, paving the way for better management of the disease and strengthening the market’s growth prospects.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the anti-malarial drugs market. Economic growth in developed regions enhances healthcare funding, facilitating the procurement and distribution of malaria treatments. Conversely, economic instability and limited healthcare budgets in developing countries hinder access to essential medications, exacerbating disease prevalence. Geopolitical tensions and conflicts disrupt supply chains, causing shortages and increasing costs of raw materials necessary for drug production.

Additionally, stringent regulatory environments in various regions pose challenges for market entry and compliance, affecting the availability of anti-malarial drugs. However, global initiatives and collaborations, such as the World Health Organization’s efforts to combat malaria, promote research and development, leading to innovative treatments and improved distribution networks. These concerted efforts aim to reduce malaria incidence and mortality rates worldwide, fostering a positive outlook for the market.

Trends

Impact of Rising Research Activities on the Anti-Malarial Drugs Market

Rising research activities focused on malaria are anticipated to drive the anti-malarial drugs market. In August 2022, the British Heart Foundation funded a study at the University of Surrey to investigate the effects of anti-malarial medications on cardiac rhythm, aiming to understand their impact on heart health. Such initiatives reflect a growing commitment to enhancing the safety and efficacy of malaria treatments.

Increased investment in research facilitates the development of novel therapies and drug combinations, addressing challenges like drug resistance and adverse side effects. Collaborations between academic institutions, healthcare organizations, and pharmaceutical companies accelerate the translation of research findings into clinical applications. This trend aligns with global health objectives to eradicate malaria, thereby stimulating market growth and innovation in anti-malarial drug development.

Regional Analysis

North America is leading the Anti-malarial Drugs Market

North America dominated the market with the highest revenue share of 39.8% owing to the approval and availability of artesunate injection for severe malaria cases. The U.S. Food and Drug Administration’s May 2020 approval of artesunate injection provided healthcare professionals vital tools for the treatment of severe malaria in adults and pediatric patients. This approval enhanced treatment protocols and improved patient outcomes, contributing to the market’s expansion.

Additionally, increased international travel and immigration from malaria-endemic regions led to a rise in imported malaria cases, necessitating effective treatment options. Public health initiatives focusing on malaria awareness and prevention further supported the demand for anti-malarial medications. However, the relatively low incidence of malaria in North America limited the market’s overall growth potential.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the high prevalence of malaria and ongoing efforts to combat the disease. The introduction of novel treatments, such as tafenoquine, is anticipated to enhance therapeutic options. In March 2022, Medicines for Malaria Venture (MMV), in collaboration with GlaxoSmithKline (GSK), received approval in Australia for tafenoquine combined with chloroquine, targeting specific malaria strains in children and adolescents.

This development underscores the region’s commitment to addressing malaria through innovative solutions. Government initiatives aimed at malaria elimination, increased funding for research and development, and collaborations between public and private sectors are likely to further propel market growth. The expansion of healthcare infrastructure and improved access to medical services in rural and endemic areas are also expected to contribute to the increased adoption of anti-malarial drugs across the Asia Pacific region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the anti-malarial drugs market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the anti-malarial drugs market focus on developing new formulations and combination therapies to combat drug-resistant strains of malaria. Many invest heavily in research collaborations with global health organizations to accelerate the discovery of innovative treatments.

Companies expand their distribution networks to improve access in malaria-endemic regions, particularly in low-income countries. They also engage in public awareness campaigns to promote early diagnosis and effective treatment. Additionally, partnerships with governments and non-profits help secure funding and ensure wider reach for their products.

Top Key Players in the Anti-malarial Drugs Market

- Zydus Healthcare Ltd.

- Viatris Inc.

- Sun Pharmaceutical Industries Ltd.

- Sanofi SA

- Novartis AG

- Lupin

- GSK Plc.

- Cipla Ltd.

Recent Developments

- In November 2022: Novartis and Medicines for Malaria Venture (MMV) advanced to a Phase 3 clinical trial for the lumefantrine/ganaplacide-SDF combination. This innovative therapy targets both adults and children affected by malaria, including drug-resistant strains. The progression of this trial underscores the focus on developing next-generation anti-malarial treatments, which is crucial for addressing the global burden of malaria and driving market growth.

- In January 2021: MMV and GSK announced the submission of a Category 1 application to the Australian Therapeutic Goods Administration (TGA) to expand the indication of Kozenis single-dose (tafenoquine) to include pediatric populations. This expansion aims to provide a radical cure for Plasmodium vivax malaria, preventing relapse in children. The approval and subsequent market introduction of such therapies support the growth of the anti-malarial drugs market by addressing unmet needs in pediatric malaria treatment.

Report Scope

Report Features Description Market Value (2023) US$ 1.0 billion Forecast Revenue (2033) US$ 1.5 billion CAGR (2024-2033) 4.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Class (Antifolate Compounds, Artemisinin Compounds, Aryl Aminoalcohol Compounds, and Others), By Malaria Type (Plasmodium Falciparum, Plasmodium Malariae, Plasmodium Vivax, and Plasmodium Ovale), By Distribution Channel (Hospital Pharmacy, E-Commerce, Retail Pharmacy, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zydus Healthcare Ltd., Viatris Inc., Sun Pharmaceutical Industries Ltd., Sanofi SA, Novartis AG, Lupin, GSK Plc., and Cipla Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Zydus Healthcare Ltd.

- Viatris Inc.

- Sun Pharmaceutical Industries Ltd.

- Sanofi SA

- Novartis AG

- Lupin

- GSK Plc.

- Cipla Ltd.