Global Anti-Corrosion Coatings Market Size, Share, Growth Analysis By Coating Type (Barrier Coatings, Inhibitive Coatings, Sacrificial Coatings), By Technology (Solvent Based, Water Based, Powder, Others), By Material (Epoxy, Acrylic, Alkyd, Polyurethane, Zinc, Others), By End-user Industry (Oil & Gas, Marine, Construction, Industrial & Manufacturing, Aerospace & Defense, Transportation, Automotive, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 175651

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

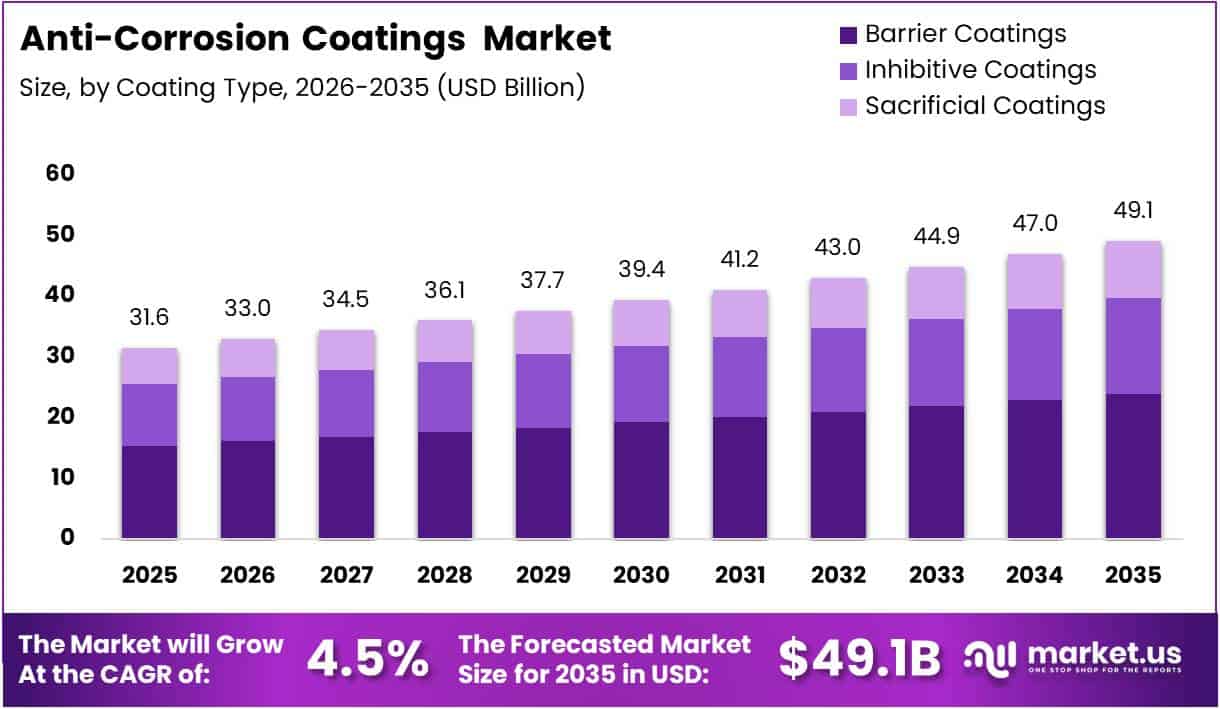

The Global Anti-Corrosion Coatings Market size is expected to be worth around USD 49.1 Billion by 2035 from USD 31.6 Billion in 2025, growing at a CAGR of 4.5% during the forecast period 2026 to 2035.

Anti-corrosion coatings are specialized protective layers applied to metal surfaces to prevent degradation caused by environmental factors, chemicals, and moisture. These coatings form a barrier between the substrate and corrosive elements, extending the lifespan of industrial assets and infrastructure.

The market encompasses various coating technologies including barrier, inhibitive, and sacrificial coatings. Each type offers distinct protection mechanisms tailored to specific industrial applications. Moreover, advancements in formulation chemistry have enabled the development of high-performance solutions for extreme environments.

Growth in this market is driven by increasing infrastructure development across emerging economies. The oil and gas sector particularly demands robust anti-corrosion solutions for offshore platforms and pipelines. Additionally, stringent environmental regulations are accelerating the adoption of eco-friendly waterborne and powder coating technologies.

Government investments in infrastructure modernization and industrial expansion continue to fuel market expansion. The construction industry requires durable coatings for structural steel and reinforced concrete. Furthermore, the marine sector demands specialized coatings to protect vessels from saltwater corrosion and biofouling.

Technological innovation is reshaping the competitive landscape with smart coating solutions gaining traction. Smart coatings, including Self-healing coatings and nanotechnology-based formulations offer superior protection and longer service life. However, high initial costs and technical application complexity remain challenges for widespread adoption.

The automotive and aerospace industries are increasingly adopting advanced anti-corrosion coatings to meet performance standards. These sectors require lightweight yet durable solutions that withstand harsh operating conditions. Consequently, manufacturers are investing in research and development to create next-generation coating systems.

According to research, 25%–30% of annual corrosion costs could be saved if optimum corrosion management practices were employed. This statistic highlights the significant economic impact of effective corrosion prevention strategies. Therefore, industries are prioritizing investment in high-quality protective coating solutions to reduce long-term maintenance expenses.

Key Takeaways

- Global Anti-Corrosion Coatings Market is projected to reach USD 49.1 Billion by 2035 from USD 31.6 Billion in 2025, growing at a CAGR of 4.5%

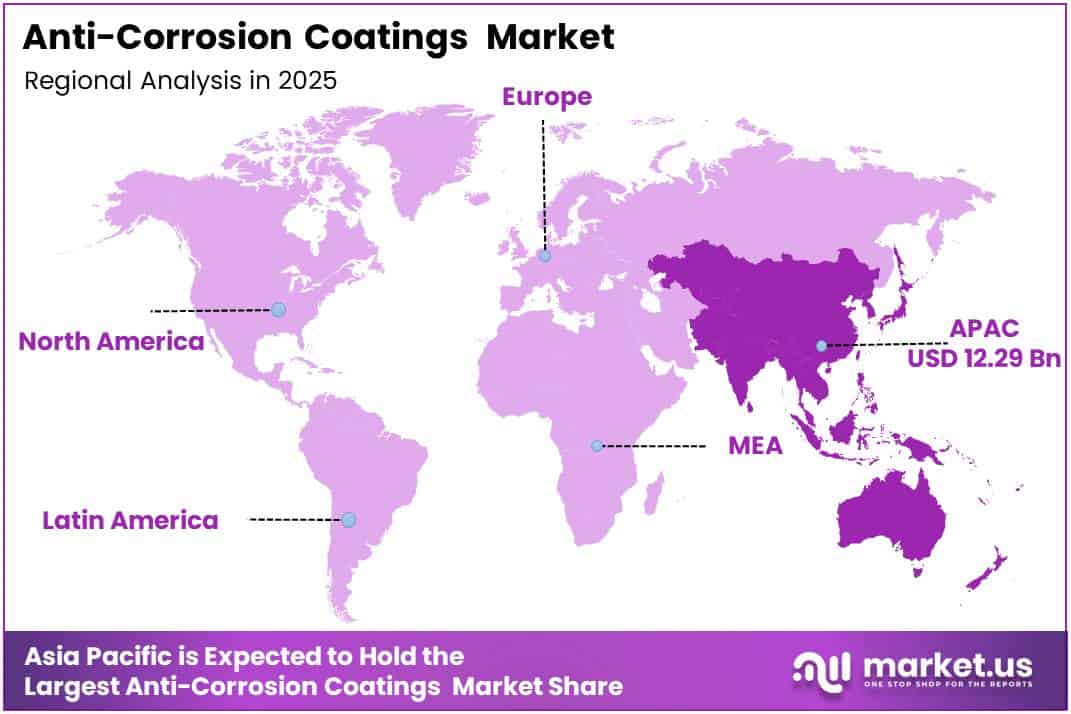

- Asia Pacific dominates the market with 38.9% share, valued at USD 12.29 Billion

- Barrier Coatings segment leads the Coating Type category with 48.9% market share

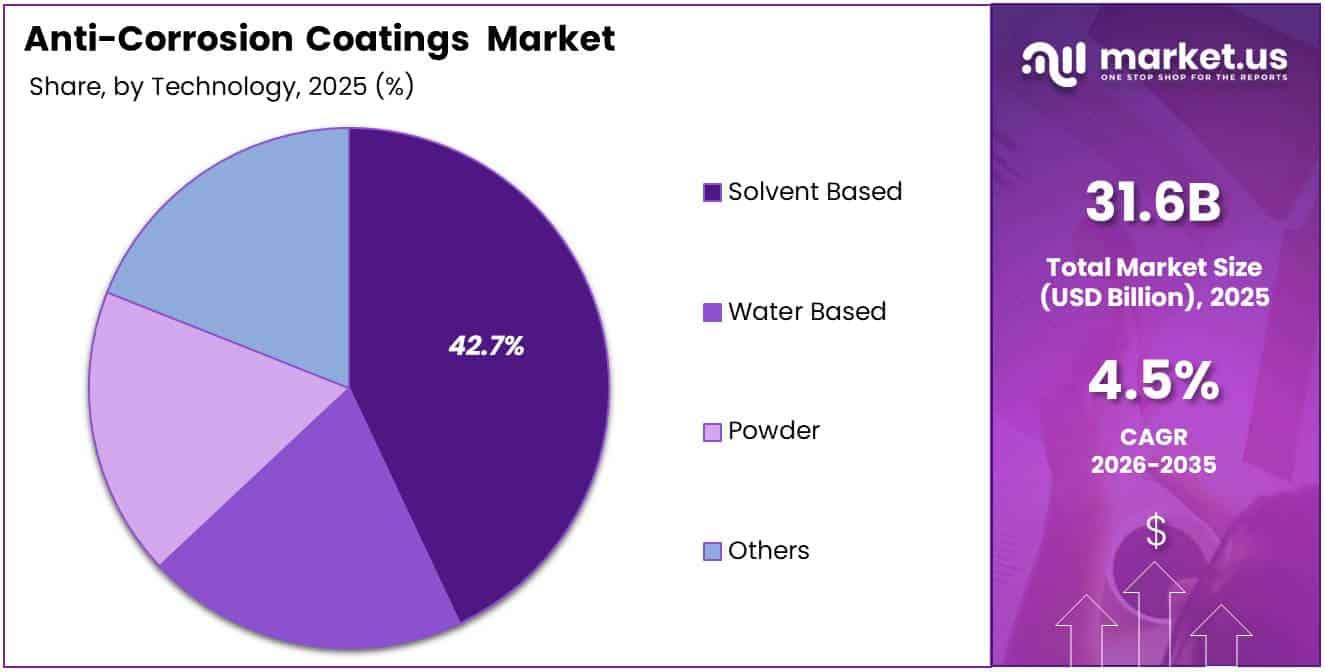

- Solvent Based technology holds the largest share at 42.7% in the Technology segment

- Epoxy material dominates with 34.5% share in the Material segment

- Oil & Gas industry represents the largest end-user segment with 24.3% market share

Coating Type Analysis

Barrier Coatings dominates with 48.9% due to superior protective properties and widespread industrial adoption.

In 2025, Barrier Coatings held a dominant market position in the By Coating Type segment of Anti-Corrosion Coatings Market, with a 48.9% share. These coatings provide impermeable layers that physically separate metal substrates from corrosive environments. Their effectiveness in harsh chemical and marine applications makes them the preferred choice across multiple industries.

Inhibitive Coatings utilize chemical compounds that actively prevent corrosion reactions at the molecular level. These formulations contain corrosion inhibitors that passivate metal surfaces and neutralize corrosive agents. Moreover, they offer excellent adhesion properties and compatibility with various topcoat systems, making them valuable in multilayer coating applications.

Sacrificial Coatings employ metals like zinc that corrode preferentially to protect the underlying substrate. This cathodic protection mechanism is particularly effective for steel structures in marine and industrial environments. Additionally, these coatings provide long-term protection with minimal maintenance requirements, though they gradually deplete over time.

Technology Analysis

Solvent Based dominates with 42.7% due to proven performance and established application infrastructure.

In 2025, Solvent Based held a dominant market position in the By Technology segment of Anti-Corrosion Coatings Market, with a 42.7% share. These coatings offer excellent adhesion, rapid drying, and superior film formation characteristics. Their proven track record in demanding industrial applications maintains their market leadership despite environmental concerns.

Water Based coatings are gaining significant traction due to stringent environmental regulations and sustainability initiatives. These formulations emit minimal volatile organic compounds and offer safer handling characteristics. Furthermore, technological advancements have improved their performance to match solvent-based alternatives in many applications.

Powder coatings represent an eco-friendly alternative with zero VOC emissions and high transfer efficiency. They provide excellent durability and uniform coverage through electrostatic application processes. However, their limitation to heat-resistant substrates restricts broader adoption in temperature-sensitive applications.

Others category includes emerging technologies such as high-solids coatings and radiation-cured systems. These innovative formulations combine performance benefits with reduced environmental impact. Additionally, they offer specialized solutions for niche applications requiring unique protection mechanisms.

Material Analysis

Epoxy dominates with 34.5% due to exceptional chemical resistance and mechanical properties.

In 2025, Epoxy held a dominant market position in the By Material segment of Anti-Corrosion Coatings Market, with a 34.5% share. Epoxy-based formulations deliver outstanding adhesion to metal substrates and superior resistance to chemicals and moisture. Their versatility enables use in diverse applications from marine vessels to industrial equipment.

Acrylic materials provide excellent weatherability and UV resistance for outdoor applications. These coatings maintain color stability and gloss retention over extended periods. Moreover, acrylic formulations offer good flexibility and impact resistance, making them suitable for structures subject to thermal expansion.

Alkyd resins combine affordability with satisfactory protective properties for general industrial use. They offer good penetration into porous surfaces and compatibility with various pigments. However, their moderate chemical resistance limits application in highly corrosive environments.

Polyurethane coatings deliver exceptional abrasion resistance and mechanical strength for demanding applications. They provide superior gloss retention and chemical resistance compared to conventional options. Additionally, polyurethane systems offer excellent flexibility, preventing cracking under thermal stress.

Zinc-rich coatings provide galvanic protection through sacrificial corrosion mechanisms. These primers contain high zinc content that corrodes preferentially to steel substrates. Furthermore, they serve as excellent base coats for multilayer protection systems in severe corrosive environments.

Others include specialized materials such as phenolic, vinyl, and ceramic-based coatings. These niche formulations address specific performance requirements in extreme temperature or chemical exposure conditions. Consequently, they command premium pricing in specialized industrial applications.

End-user Industry Analysis

Oil & Gas dominates with 24.3% due to extensive infrastructure requiring continuous corrosion protection.

In 2025, Oil & Gas held a dominant market position in the By End-user Industry segment of Anti-Corrosion Coatings Market, with a 24.3% share. Offshore platforms, pipelines, and storage facilities operate in highly corrosive environments requiring robust protective coatings. The sector’s massive infrastructure investment drives sustained demand for high-performance anti-corrosion solutions.

Marine industry requires specialized coatings to protect vessels from saltwater corrosion and biological fouling. Ships, offshore structures, and port facilities face constant exposure to aggressive marine environments. Moreover, international regulations mandate environmentally compliant coating systems that maintain performance standards.

Construction sector utilizes anti-corrosion coatings for structural steel, reinforcement bars, and architectural elements. Infrastructure projects including bridges, buildings, and transportation facilities require long-lasting protection. Additionally, urbanization and smart city initiatives are driving increased coating consumption globally.

Industrial & Manufacturing facilities demand protective coatings for machinery, equipment, and processing infrastructure. Chemical plants, refineries, and manufacturing units operate in corrosive atmospheres requiring durable solutions. Furthermore, maintenance programs for aging facilities create recurring demand for coating applications.

Aerospace & Defense industries require lightweight yet highly protective coating systems for aircraft and military equipment. These applications demand coatings that withstand extreme temperatures and environmental conditions. Consequently, advanced formulations with specialized performance characteristics dominate this premium segment.

Transportation infrastructure including railways, metros, and transit systems requires corrosion protection for extended service life. Rolling stock and supporting infrastructure face diverse environmental exposures. Moreover, safety regulations mandate regular maintenance using approved coating systems.

Automotive manufacturers apply anti-corrosion coatings to vehicle bodies and components for longevity and aesthetic appeal. Electrocoating and advanced primer systems protect against road salt and environmental degradation. Additionally, consumer expectations for durability drive continuous coating technology improvements.

Others encompass diverse applications in power generation, water treatment, and telecommunications infrastructure. These sectors require customized coating solutions addressing specific operational challenges. Therefore, specialty formulations continue expanding market opportunities beyond traditional industries.

Key Market Segments

By Coating Type

- Barrier Coatings

- Inhibitive Coatings

- Sacrificial Coatings

By Technology

- Solvent Based

- Water Based

- Powder

- Others

By Material

- Epoxy

- Acrylic

- Alkyd

- Polyurethane

- Zinc

- Others

By End-user Industry

- Oil & Gas

- Marine

- Construction

- Industrial & Manufacturing

- Aerospace & Defense

- Transportation

- Automotive

- Others

Drivers

Increasing Demand for Protective Coatings in Offshore Oil & Gas Infrastructure Drives Market Growth

Offshore oil and gas facilities operate in extremely corrosive marine environments requiring advanced protective coating systems. Salt spray, humidity, and chemical exposure accelerate metal degradation without proper protection. Consequently, operators invest heavily in high-performance coatings to extend asset lifespan and ensure operational safety.

The automotive and aerospace industries increasingly adopt advanced anti-corrosion solutions to meet stringent performance standards. Modern vehicles and aircraft require lightweight yet durable coatings that withstand harsh operating conditions. Moreover, consumer expectations for longevity drive manufacturers to implement superior coating technologies across production lines.

Stringent environmental regulations are pushing industries toward eco-friendly anti-corrosion solutions with reduced volatile organic compounds. Governments worldwide mandate compliance with emissions standards, accelerating adoption of waterborne and powder coating technologies. Therefore, manufacturers develop innovative formulations balancing environmental responsibility with protective performance requirements.

Restraints

High Technical Complexity and Application Challenges of Advanced Coatings Limit Market Adoption

Advanced anti-corrosion coating systems require specialized application equipment and skilled technicians for proper installation. Surface preparation, environmental conditions, and curing processes critically impact coating performance. Moreover, complex multi-layer systems increase application time and labor costs, deterring adoption among cost-sensitive industries.

Volatility in raw material supply affects production stability and pricing predictability across the coatings industry. Key ingredients including resins, pigments, and additives face supply chain disruptions from geopolitical tensions and natural disasters. Additionally, fluctuating prices of petroleum-based components create uncertainty for manufacturers and end-users.

Technical limitations of eco-friendly alternatives compared to traditional solvent-based coatings present performance trade-offs. Waterborne formulations may exhibit longer drying times and reduced chemical resistance in certain applications. Furthermore, the transition to sustainable technologies requires significant capital investment in new production facilities and application infrastructure.

Growth Factors

Expansion in Renewable Energy Sector Requiring Durable Coating Solutions Accelerates Market Growth

Wind turbine towers, solar panel frames, and hydroelectric infrastructure require robust anti-corrosion protection for decades-long service life. Renewable energy installations often operate in harsh coastal or offshore environments with extreme corrosion challenges. Therefore, the sector’s rapid expansion creates substantial demand for specialized high-performance coating systems.

Development of nanocoating and nanotechnology-based anti-corrosion coatings offers breakthrough performance through enhanced barrier properties and self-healing mechanisms. Nanoparticle additives improve mechanical strength, chemical resistance, and durability compared to conventional formulations. Moreover, these advanced materials enable thinner coating applications while maintaining superior protection levels.

Increasing retrofitting and maintenance of aging industrial infrastructure generates sustained demand for protective coating applications. Existing facilities require regular recoating to extend operational lifespan and maintain safety standards. Additionally, infrastructure modernization initiatives across developed economies prioritize corrosion management to prevent costly failures and ensure regulatory compliance.

Emerging Trends

Adoption of Smart Coatings with Self-Healing and Anti-Fouling Properties Reshapes Market Landscape

Smart coating technologies incorporate responsive materials that autonomously repair minor damage and prevent biological growth on surfaces. Self-healing polymers release corrosion inhibitors when breached, maintaining protective integrity without manual intervention. Furthermore, antifouling coating reduce maintenance requirements for marine applications, lowering operational costs significantly.

Growing use of waterborne and low-VOC anti-corrosion coatings reflects industry commitment to environmental sustainability and regulatory compliance. Manufacturers develop advanced formulations matching solvent-based performance while minimizing environmental impact. Additionally, consumer preference for green building materials drives adoption across construction and architectural applications.

Shift toward hybrid coatings combining multiple protection mechanisms delivers superior performance across diverse operating conditions. These systems integrate barrier, inhibitive, and sacrificial properties within single formulations. Moreover, hybrid technologies optimize cost-effectiveness while addressing complex corrosion challenges in demanding industrial environments.

Regional Analysis

Asia Pacific Dominates the Anti-Corrosion Coatings Market with a Market Share of 38.9%, Valued at USD 12.29 Billion

Asia Pacific leads the global market driven by rapid industrialization and massive infrastructure development across China, India, and Southeast Asia. The region’s expanding manufacturing base and construction activities create substantial coating demand. Moreover, 38.9% market share reflects strong growth in oil and gas, marine, and automotive sectors with a valuation of USD 12.29 Billion.

North America Anti-Corrosion Coatings Market Trends

North America exhibits steady growth supported by infrastructure maintenance programs and stringent environmental regulations promoting eco-friendly coatings. The United States dominates regional consumption with significant demand from aerospace, defense, and energy sectors. Additionally, technological innovation and premium product adoption characterize this mature market.

Europe Anti-Corrosion Coatings Market Trends

Europe emphasizes sustainable coating solutions complying with strict VOC regulations and environmental directives. Germany, France, and the UK lead regional demand through advanced manufacturing and marine industries. Furthermore, ongoing infrastructure modernization and renewable energy investments sustain market growth across the continent.

Middle East & Africa Anti-Corrosion Coatings Market Trends

Middle East and Africa witness robust growth driven by extensive oil and gas infrastructure and construction megaprojects. GCC countries invest heavily in offshore facilities and petrochemical complexes requiring high-performance coatings. Moreover, harsh desert and marine climates necessitate specialized corrosion protection solutions.

Latin America Anti-Corrosion Coatings Market Trends

Latin America shows moderate growth supported by oil and gas activities in Brazil and Mexico. The region’s developing infrastructure and industrial sectors create opportunities for coating manufacturers. However, economic volatility and regulatory challenges impact market expansion in certain countries.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Akzo Nobel N.V. maintains a leading position through comprehensive product portfolios spanning marine, protective, and industrial coatings. The company leverages global manufacturing capabilities and strong distribution networks to serve diverse end-user industries. Moreover, continuous investment in sustainable coating technologies strengthens its competitive advantage in environmentally conscious markets.

Ashland specializes in high-performance specialty chemicals and advanced coating solutions for demanding industrial applications. Their expertise in resin technology enables development of innovative formulations with superior protective properties. Additionally, strategic partnerships with key industries enhance market penetration and customer loyalty.

Axalta Coating Systems, LLC delivers industry-leading coatings for transportation, industrial, and architectural applications worldwide. The company’s focus on technological innovation drives product differentiation in competitive segments. Furthermore, recent strategic acquisitions expand capabilities and geographic reach in high-growth markets.

BASF SE offers extensive anti-corrosion coating solutions leveraging integrated chemical production and formulation expertise. Their commitment to sustainability and circular economy principles aligns with evolving regulatory requirements. Consequently, BASF maintains strong relationships with major industrial customers seeking reliable, eco-friendly protection systems.

Key Players

- Akzo Nobel N.V.

- Ashland

- Axalta Coating Systems, LLC

- BASF SE

- Hempel A/S

- Jotun

- Kansai Paint Co., Ltd.

- PPG Industries, Inc.

- RPM INTERNATIONAL INC.

- The Sherwin-Williams Company

- Beckers Group

- Berger Paints India

- Carboline

- Chugoku Marine Paints, Ltd.

- H.B. Fuller Company

- Other Key Players

Recent Developments

- November 2025 – AkzoNobel and Axalta merged to create a $25 Billion paint company, forming one of the industry’s largest global coatings manufacturers with enhanced market presence and expanded product capabilities across multiple segments.

- November 2025 – BirlaNu, part of the C K Birla Group, acquired Clean Coats Private Limited for ₹120 crore, strengthening its position in specialty coatings and expanding capabilities in sustainable anti-corrosion solutions for industrial applications.

- May 2025 – WEG announced signing a contract to acquire assets of Heresite Protective Coatings, a U.S.-based industrial coatings company, with the acquisition valued at USD 9.5 million, subject to standard price adjustments and regulatory approvals.

Report Scope

Report Features Description Market Value (2025) USD 31.6 Billion Forecast Revenue (2035) USD 49.1 Billion CAGR (2026-2035) 4.5% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Coating Type (Barrier Coatings, Inhibitive Coatings, Sacrificial Coatings), By Technology (Solvent Based, Water Based, Powder, Others), By Material (Epoxy, Acrylic, Alkyd, Polyurethane, Zinc, Others), By End-user Industry (Oil & Gas, Marine, Construction, Industrial & Manufacturing, Aerospace & Defense, Transportation, Automotive, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Akzo Nobel N.V., Ashland, Axalta Coating Systems, LLC, BASF SE, Hempel A/S, Jotun, Kansai Paint Co., Ltd., PPG Industries, Inc., RPM INTERNATIONAL INC., The Sherwin-Williams Company, Beckers Group, Berger Paints India, Carboline, Chugoku Marine Paints, Ltd., H.B. Fuller Company, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Anti Corrosion Coatings MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Anti Corrosion Coatings MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Akzo Nobel N.V.

- Ashland

- Axalta Coating Systems, LLC

- BASF SE

- Hempel A/S

- Jotun

- Kansai Paint Co., Ltd.

- PPG Industries, Inc.

- RPM INTERNATIONAL INC.

- The Sherwin-Williams Company

- Beckers Group

- Berger Paints India

- Carboline

- Chugoku Marine Paints, Ltd.

- H.B. Fuller Company

- Other Key Players