Global Aluminum Beverage Cans Market Size, Share, And Business Benefits By Type (Standard Cans, Slim Cans, Specialty Cans, Sleek Cans), By Volume Capacity (Below 250 ML, 250 ML-330ML, 330ML-500ML, Above 500ML), By Application (Carbonated Soft Drinks (CDS), Alcohol Beverages, Energy Drinks, Others), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154366

- Number of Pages: 338

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

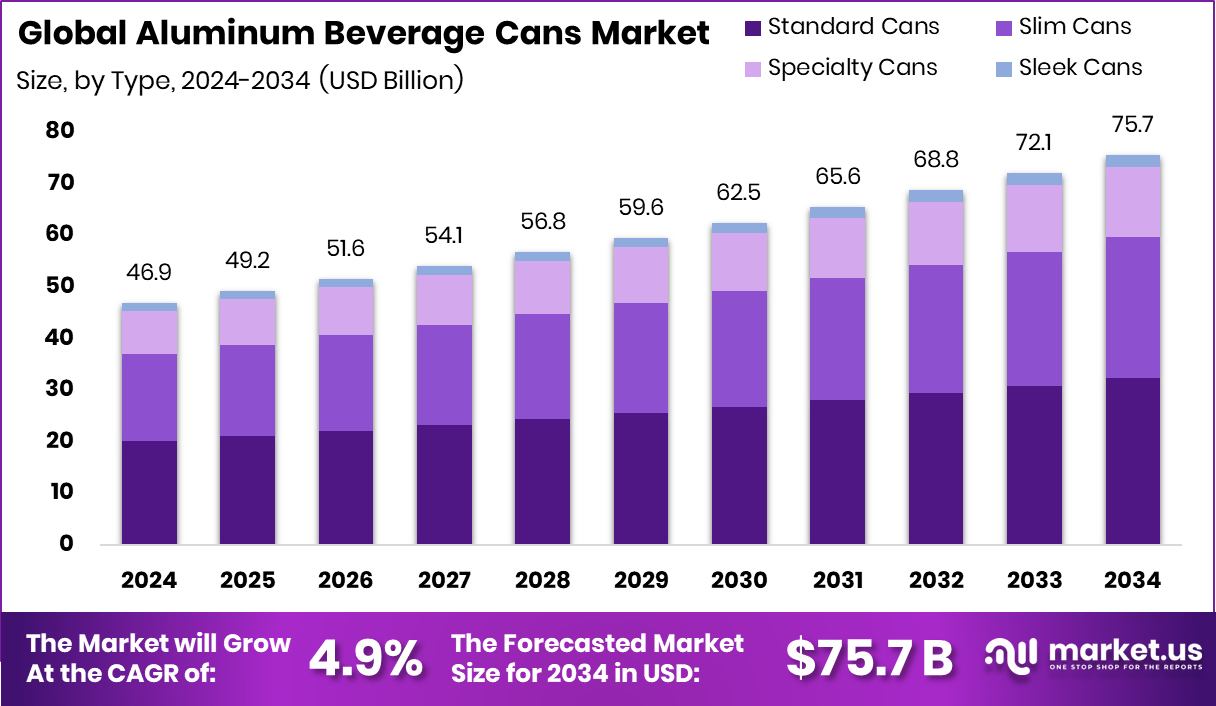

The Global Aluminum Beverage Cans Market is expected to be worth around USD 75.7 billion by 2034, up from USD 46.9 billion in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034. Aluminum can usage in North America rose, capturing 32.80% of the global market.

Aluminum beverage cans are containers manufactured primarily from aluminum alloy, designed to package drinks such as soft drinks, juices, beers, and energy drinks. These cans are lightweight, corrosion‑resistant, and preserve product freshness. Their recyclability is notable, allowing multiple cycles of reuse without quality loss—attributes that align with sustainable packaging objectives.

The aluminum beverage cans market encompasses activities related to can production, distribution, consumption, recycling, and associated infrastructure. Government policies in multiple jurisdictions support circular economy goals via container deposit legislation and recycling funding.

The U.S. Environmental Protection Agency reported that in 2023, approximately 43% of aluminum beverage cans shipped in the United States were recycled; this represented the lowest rate since tracking began, compared to the previous longer‑term average of around 50%. Meanwhile, European government data shows a record recycling rate of 75% (74.6%) for aluminum beverage cans across the EU, UK, Switzerland, Norway, and Iceland in 2022.

Demand is propelled by governments investing in recycling infrastructure and deposit return systems. In the United States, container deposit return (DRS) programs yield approximately 74% recycling for cans in deposit states, compared with only 26% from non‑deposit systems. This structured policy‑based yield reinforces consumer trust in aluminum packaging and encourages adoption across beverage supply chains.

Opportunities arise from improvements in closed‑loop recycling infrastructure backed by government funding. The European Union’s schemes aim for recycling rates of 90% or more under deposit systems, with many nations approaching or achieving this threshold—for example, Sweden’s deposit system yielded recycling rates between 81% and 90% for aluminum cans in recent years.

Key Takeaways

- The Global Aluminum Beverage Cans Market is expected to be worth around USD 75.7 billion by 2034, up from USD 46.9 billion in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034.

- In 2024, Standard Cans led the Aluminum Beverage Cans Market with a 42.8% volume share.

- The 330ML–500ML segment dominated by volume, accounting for 45.9% in aluminum beverage cans.

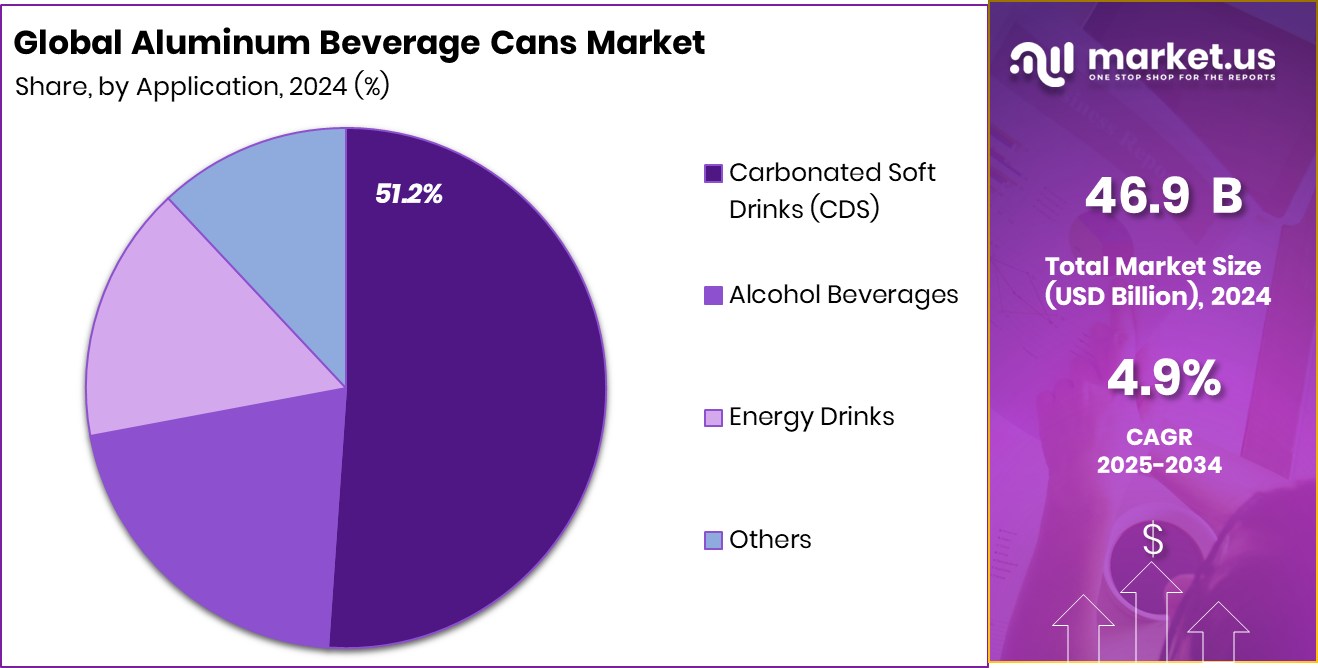

- Carbonated Soft Drinks held the top application spot, capturing 51.2% of the aluminum beverage cans market.

- Offline channels accounted for 82.3% of aluminum beverage cans distribution in 2024, reflecting widespread retail preference.

- The strong demand for carbonated drinks supports its North America USD 15.3 billion value.

By Type Analysis

Standard cans dominate the aluminum beverage cans market with a 42.8% share.

In 2024, Standard Cans held a dominant market position in the By Type segment of the Aluminum Beverage Cans Market, with a 42.8% share. This significant market presence can be attributed to the widespread preference for traditional can sizes among both beverage manufacturers and consumers.

Standard cans offer a balanced combination of volume, portability, and cost-efficiency, making them ideal for mass-market soft drinks, energy beverages, and carbonated water. Their well-established compatibility with existing filling and packaging lines further reinforces their continued adoption across global bottling facilities.

The dominance of standard cans also reflects their broad consumer appeal, especially in convenience-driven retail environments such as supermarkets, vending machines, and convenience stores. Their consistent shape and size simplify logistics, storage, and stacking during distribution, reducing operational costs for suppliers.

In addition, the recyclability of aluminum aligns with increasing regulatory and consumer pressure for sustainable packaging formats, thereby strengthening the position of standard cans in the market. As beverage brands prioritize both environmental goals and operational efficiency, the role of standard cans is expected to remain central in the aluminum beverage packaging landscape.

By Volume Capacity Analysis

The 330ML-500ML segment leads volume capacity with 45.9% share.

In 2024, 330ML–500ML held a dominant market position in the By Volume Capacity segment of the Aluminum Beverage Cans Market, with a 45.9% share. This volume range remains the industry standard for a wide variety of beverages, particularly carbonated soft drinks, beer, and energy drinks. Its popularity stems from its ideal balance between serving size and consumer convenience, making it the preferred choice for single-use consumption across retail, foodservice, and on-the-go channels.

The 330ML–500ML cans are widely accepted by consumers due to their portability and ease of handling, supporting high-volume sales in both developed and emerging markets. From a manufacturing perspective, this volume range is well-integrated into automated filling and packaging lines, contributing to operational efficiency and cost-effectiveness for beverage producers.

Their dominance is also driven by strong demand in vending machines and takeaway outlets, where this size fits standard cooling compartments and shelf layouts. As beverage brands continue to target impulse buyers and maintain shelf presence, the 330ML–500ML segment is expected to retain its stronghold due to its broad compatibility and market-tested consumer acceptance.

By Application Analysis

Carbonated soft drinks drive demand, holding 51.2% application share.

In 2024, Carbonated Soft Drinks (CSD) held a dominant market position in the By Application segment of the Aluminum Beverage Cans Market, with a 51.2% share. This leadership is primarily driven by the high global consumption of carbonated beverages, particularly in urban areas where demand for ready-to-drink, portable options remains strong. Aluminum cans are the preferred packaging format for CSDs due to their ability to preserve carbonation and protect the product from light and oxygen, ensuring freshness and shelf stability.

The 51.2% market share reflects not only the consistent demand for soft drinks but also the operational advantages aluminum cans offer in large-scale bottling and distribution. Their lightweight, durable structure reduces transportation costs and supports bulk movement, which is essential for high-volume CSD production. Additionally, aluminum’s recyclability aligns with the sustainability goals of major beverage companies, further reinforcing its selection as a primary container for soft drinks.

CSD brands continue to invest in visually distinctive can designs to capture consumer attention on retail shelves, capitalizing on the printability and branding flexibility aluminum offers. The established infrastructure for can manufacturing and recycling also supports the segment’s dominance. This combination of consumer preference, logistical efficiency, and environmental compatibility has cemented aluminum cans as the top choice for carbonated soft drinks.

By Distribution Channel Analysis

Offline channels capture 82.3% share in aluminum cans distribution.

In 2024, Offline held a dominant market position in the By Distribution Channel segment of the Aluminum Beverage Cans Market, with an 82.3% share. This overwhelming dominance can be attributed to the extensive presence of aluminum cans across traditional retail outlets such as supermarkets, hypermarkets, convenience stores, and beverage wholesalers. These offline channels remain the primary point of sale for both carbonated and non-carbonated beverages packaged in aluminum cans, largely due to their established consumer reach and high-volume sales capabilities.

The 82.3% market share is also supported by strong supply chain integration between beverage producers and offline retailers, enabling efficient distribution and shelf placement. Brick-and-mortar stores continue to attract consumers seeking immediate purchase and consumption, which aligns with the impulse nature of beverage purchases. Additionally, offline channels play a crucial role in regional markets where digital penetration remains limited and consumer preference leans toward in-person shopping experiences.

Promotions, in-store displays, and bulk purchase options available through offline retail further enhance aluminum can sales volume. As a result, offline distribution remains a critical component for driving consumption and maintaining brand visibility. The format’s reliability, availability, and consumer familiarity have firmly positioned offline as the leading distribution channel for aluminum beverage cans.

Key Market Segments

By Type

- Standard Cans

- Slim Cans

- Specialty Cans

- Sleek Cans

By Volume Capacity

- Below 250 ML

- 250 ML-330ML

- 330ML-500ML

- Above 500ML

By Application

- Carbonated Soft Drinks (CDS)

- Alcohol Beverages

- Energy Drinks

- Others

By Distribution Channel

- Offline

- Online

Driving Factors

Eco-Friendly Packaging Boosts Market Demand for Cans

One of the biggest driving factors for the aluminum beverage cans market is the growing demand for eco-friendly packaging. Aluminum cans are 100% recyclable and can be reused multiple times without losing quality. This makes them a better choice compared to plastic or glass. As governments and consumers push for greener alternatives, many beverage companies are shifting to aluminum cans to meet environmental goals.

In addition, recycling aluminum uses much less energy than making new cans from raw materials. This not only helps the planet but also reduces production costs. Because of this, both companies and consumers are choosing aluminum cans more often, helping the market grow steadily across the world.

Restraining Factors

Rising Aluminum Prices Increase Overall Production Costs

A key restraining factor for the aluminum beverage cans market is the rising cost of aluminum. The price of raw aluminum often fluctuates due to factors like supply shortages, global trade tensions, and high energy costs used in smelting. When aluminum prices go up, it directly impacts the cost of making beverage cans.

This puts pressure on manufacturers, especially small and medium-sized producers, who may struggle to manage higher input costs. As a result, some beverage companies may consider switching to cheaper packaging options like plastic or glass. These cost challenges can limit the growth of the aluminum cans market and make it harder for producers to maintain stable profit margins over time.

Growth Opportunity

Expanding Premium Drinks Sector Drives Can Demand

One of the most promising growth opportunities for the aluminum beverage cans market lies in the expanding premium drinks sector. Consumers are increasingly seeking high‑quality, craft, and upscale beverages such as specialty beers, premium juices, organic sparkling waters, and ready‑to‑drink cocktails. Manufacturers are thus choosing aluminum cans due to their ability to preserve taste, maintain carbonation, and offer high-end printed packaging.

Aluminum cans also enhance brand image with custom designs and luxurious finishes, appealing to discerning customers. The lightweight structure supports on-the-go consumption and convenience. As more brands enter the premium space and innovate with unique formulations and packaging, the demand for aluminum cans is expected to rise.

Latest Trends

Customized Can Designs Attract Modern Young Consumers

A major trend in the aluminum beverage cans market is the growing use of customized and artistic can designs. Beverage companies are increasingly using eye-catching graphics, vibrant colors, and limited-edition prints to connect with younger audiences. These designs are not only used to reflect brand identity but also to make the product stand out on store shelves and on social media platforms.

Today’s consumers, especially millennials and Gen Z, often share interesting or stylish packaging online, helping brands gain free exposure. Personalized designs also help brands promote seasonal themes, local events, or sustainability messages. This trend is turning aluminum cans into powerful marketing tools, creating stronger brand engagement and boosting product appeal in competitive beverage markets.

Regional Analysis

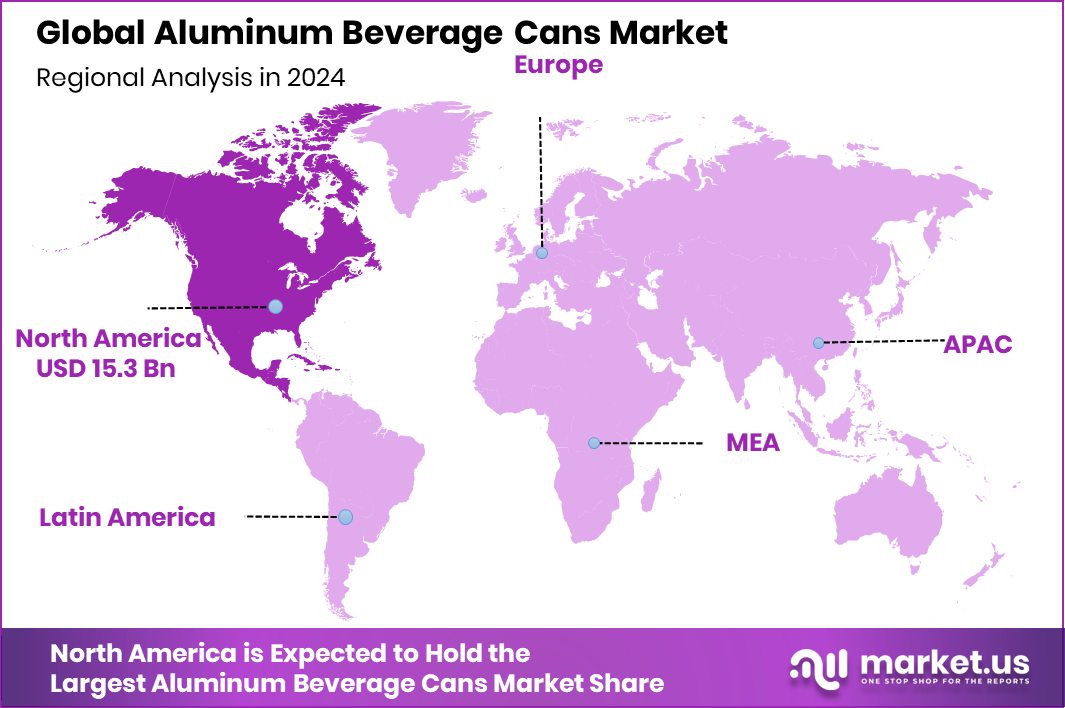

In 2024, North America held 32.80% market share, reaching USD 15.3 billion.

In 2024, North America emerged as the leading region in the global aluminum beverage cans market, accounting for 32.80% of the total market share, with a recorded value of USD 15.3 billion. The dominance of this region is largely supported by the high consumption of carbonated soft drinks, energy beverages, and ready-to-drink products across the United States and Canada.

North America’s well-established beverage industry and advanced recycling infrastructure contribute significantly to the steady demand for aluminum cans. Europe followed closely, driven by increasing environmental awareness and strong adoption of sustainable packaging alternatives across countries like Germany, the United Kingdom, and France.

In the Asia Pacific region, growth is being propelled by rising urbanization and expanding beverage production in countries such as China and India. Meanwhile, the Middle East & Africa and Latin America represent emerging markets where demand is gradually increasing due to changing consumer lifestyles and growing preference for portable, eco-friendly packaging formats.

Although these regions hold smaller shares compared to North America, their future potential remains promising as beverage consumption continues to rise. Overall, North America’s established recycling culture, combined with its mature beverage industry, has positioned it as the top contributor to the aluminum beverage cans market in 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Ball Corporation maintained a strong foothold in the global aluminum beverage cans market, leveraging its extensive manufacturing network and emphasis on sustainable packaging solutions. The company continued to invest in expanding its capacity across North America and Europe, addressing the rising demand for recyclable and lightweight beverage containers. Ball’s commitment to innovation in design and production efficiency further strengthened its competitive position.

Crown Holdings Inc. also played a significant role in shaping the market, driven by its wide global presence and focus on metal packaging technologies. The company’s operational excellence, especially in North America and Europe, supported its leadership in supplying high-volume beverage brands. Its strategic emphasis on reducing carbon emissions across facilities aligned well with sustainability goals.

Ardagh Group remained a key contributor to market growth by delivering high-quality aluminum cans tailored for premium and specialty beverages. The company’s strong customer relationships and flexible manufacturing capabilities helped it meet diverse regional demands. Ardagh’s focus on innovation and design gave it an edge in branding-oriented packaging segments.

Can-Pack S.A. showed notable performance in emerging markets, particularly in Eastern Europe and parts of Asia. Known for its adaptable production capabilities and focus on customized can designs, Can-Pack capitalized on demand from regional beverage manufacturers. Its competitive pricing and strong service support allowed it to secure key supply agreements in growth markets.

Top Key Players in the Market

- Ball Corporation

- Crown Holdings Inc.

- Ardagh Group

- Can-Pack S.A.

- Toyo Seikan Group Holdings, Ltd.

- Kian Joo Can Factory Berhad

- Silgan Holdings Inc

- Nampak Ltd

- Bangkok Can Manufacturing

- Orora Limited

- Envases Group

- Swan Industries (Thailand) Co., Ltd

Recent Developments

- In April 2025, Crown reported a 64% jump in adjusted diluted earnings per share versus Q1 2024, driven by expanded beverage can shipments across the Americas and Europe. Global beverage can volumes rose by approximately 1%, with regional gains of 2% in North America, 5% in Europe, and 11% in Brazil.

- In October 2024, Ball Corporation acquired Alucan, a European leader in extruded aluminum cans and bottles. This move added impact‑extruded cylinder and bottle capabilities, leveraging Ball’s existing sustainable aluminum packaging portfolio in Europe. The acquisition broadened Ball’s footprint in sustainable extruded aluminum solutions.

Report Scope

Report Features Description Market Value (2024) USD 46.9 Billion Forecast Revenue (2034) USD 75.7 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Standard Cans, Slim Cans, Specialty Cans, Sleek Cans), By Volume Capacity (Below 250 ML, 250 ML-330ML, 330ML-500ML, Above 500ML), By Application (Carbonated Soft Drinks (CDS), Alcohol Beverages, Energy Drinks, Others), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ball Corporation, Crown Holdings Inc., Ardagh Group, Can-Pack S.A., Toyo Seikan Group Holdings, Ltd., Kian Joo Can Factory Berhad, Silgan Holdings Inc, Nampak Ltd, Bangkok Can Manufacturing, Orora Limited, Envases Group, Swan Industries (Thailand) Co., Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Aluminum Beverage Cans MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Aluminum Beverage Cans MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ball Corporation

- Crown Holdings Inc.

- Ardagh Group

- Can-Pack S.A.

- Toyo Seikan Group Holdings, Ltd.

- Kian Joo Can Factory Berhad

- Silgan Holdings Inc

- Nampak Ltd

- Bangkok Can Manufacturing

- Orora Limited

- Envases Group

- Swan Industries (Thailand) Co., Ltd