Global Alpha Olefin Market Size, Share, And Business Benefits By Product (1-Hexene, 1-Butene, 1-Octene, 1-Decene, 1-Dodecene, Others), By Application (Polyethylene, Detergent Alcohol, Synthetic Lubricant, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161309

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

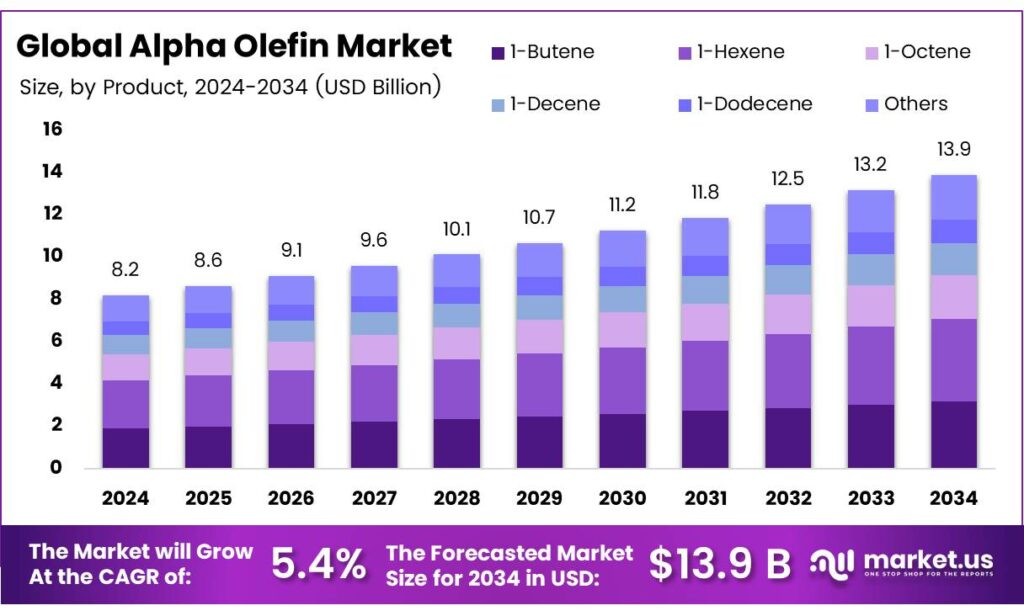

The Global Alpha Olefin Market size is expected to be worth around USD 13.9 billion by 2034, from USD 8.2 billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

Alpha Olefin, a formaldehyde-free, mild surfactant from sodium C14-C16 olefins, preserved with MCI/MI, offers excellent viscosity, hard water stability, detergency, foam, and pH stability (pH 4-10). Gentler than lauryl sulfate, it’s ideal for sulfate-free shampoos, shower gels, hand sanitizers, and pet care products. AOS unloads poor fluids and particles in gas wells and is thermally stable up to 400°F. It is readily biodegradable.

Alpha Olefin is produced from alpha olefins, which serve as versatile intermediates. The process involves sulfonation in a continuous membrane reactor, yielding a mixture of olefin sulfonic acid and sulfolactone. This mixture is neutralized with aqueous sodium hydroxide and hydrolyzed at elevated temperatures to convert sulfolactone into alkene sulfonate and hydroxysulfonate, forming an aqueous Alpha Olefins sulfonate solution. For solid anhydrous products, isopropanol can be used instead of water during neutralization and hydrolysis.

The LINEALENE 4 (1-butene) grade exceeds 99.5% purity with minimal by-products like n-butane (<0.2%) and isobutene (<0.3%). Moving up the chain, LINEALENE 6 to 12 (1-hexene to 1-dodecene) maintain 95–97.5% α-olefin purity and exhibit densities from 0.673 to 0.758 g/cm³. Their low melting points (−140 °C to −35 °C) and controlled boiling ranges (62–216 °C) support polymerization uses such as polyethylene comonomers and lubricant intermediates.

LINEALENE products are high-purity α-olefins produced via an award-winning catalytic process, recognized by the Japan Petroleum Institute and Catalysis Society. This technology ensures exceptional linearity by minimizing internal olefins, delivering uniform molecular structures ideal for high-performance synthetic lubricants, surfactants, and specialty chemicals. Their linear design enhances reactivity, polymer compatibility, and stability for tailored industrial applications.

LINEALENE 14–18 α-olefins (1-tetradecene to 1-octadecene) have >88.5% purity, 0.771–0.788 g/cm³ density, 113–159 °C flash points, and −13 °C to 18 °C melting points. Ideal for detergent alcohols, synthetic base oils, and plasticizers, they offer excellent thermal stability and >99% uniform carbon distribution. Blended LINEALENE 124, 148, and 168 grades provide tailored C12–C18 distributions for fluidity and lubricity, with 91–141 °C flash points and 0.764–0.784 g/cm³ density. LINEALENE 2024 (40–60% C20, 25–50% C22) suits high-viscosity oils, waxes, and lubricants with superior oxidative resistance.

Key Takeaways

- The Global Alpha Olefin Market is projected to grow from USD 8.2 billion in 2024 to USD 13.9 billion by 2034, at a CAGR of 5.4%.

- 1-Hexene held a 27.9% market share in 2024, vital for high-performance polyethylene (LLDPE, HDPE) production.

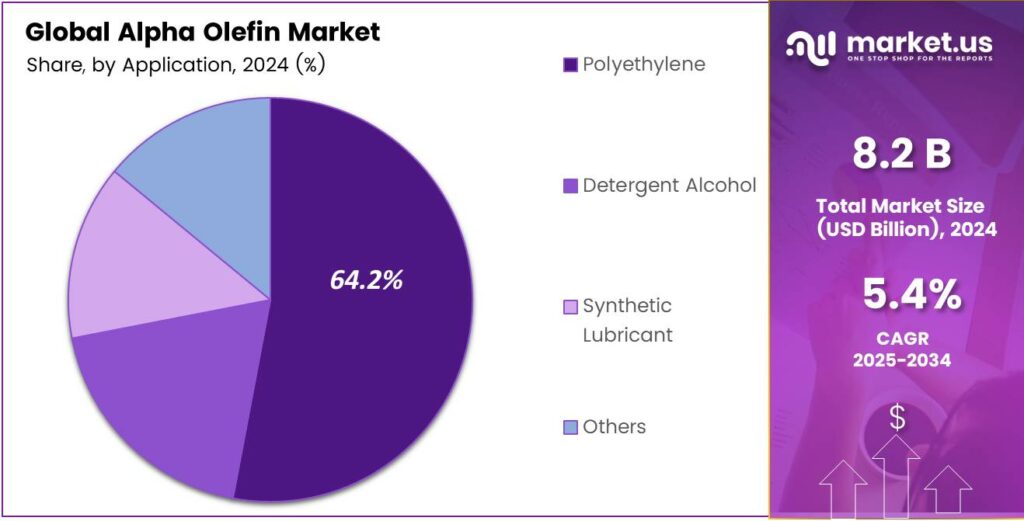

- Polyethylene dominated with a 64.2% market share in 2024, driven by its use in films, packaging, pipes, and containers.

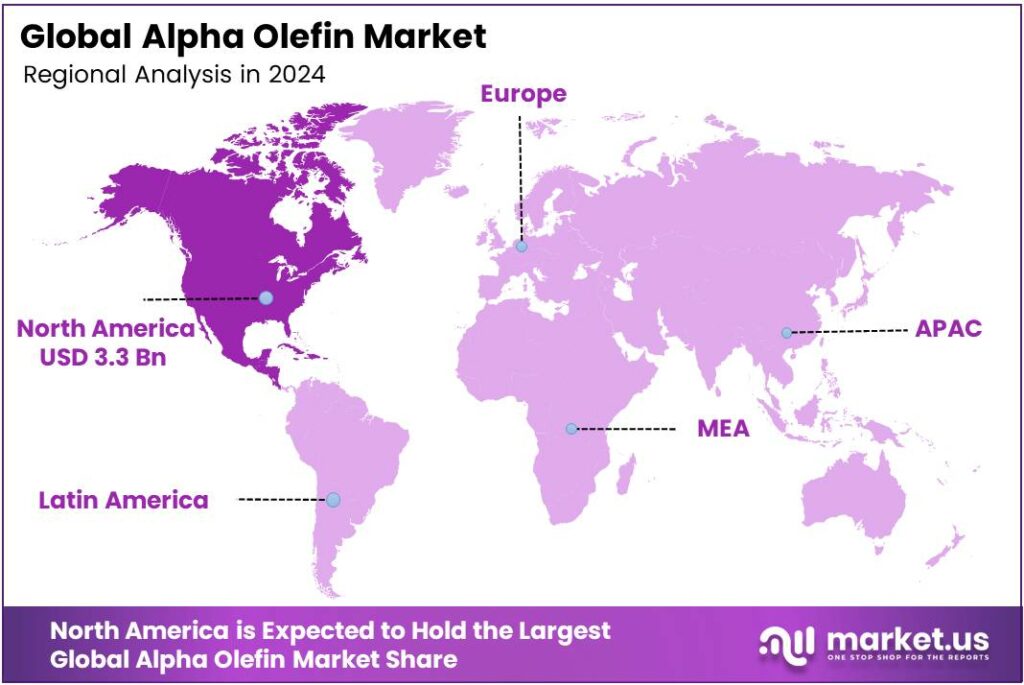

- North America led with a 41.2% market share in 2024, valued at USD 3.3 billion, fueled by strong petrochemical infrastructure.

By Product

1-Hexene Dominates Alpha Olefin Product Segment – 27.9% Share

In 2024, 1-Hexene held a dominant market position, capturing more than a 27.9% share of the global alpha olefin market. This product plays a critical role as a co-monomer in producing high-performance polyethylene (PE), particularly linear low-density polyethylene (LLDPE) and high-density polyethylene (HDPE).

Its consistent molecular structure and superior reactivity make it ideal for applications in packaging films, pipes, and automotive components. The year 2024 saw rising adoption of 1-Hexene in flexible packaging and extrusion processes as industries shifted toward durable yet lightweight materials.

The market momentum for 1-Hexene remains strong, driven by growing global demand for polyethylene products in the construction and consumer goods sectors. Advancements in on-purpose 1-Hexene production technologies and new catalyst developments have improved yield efficiency, further supporting supply stability.

By Application

Polyethylene Leads Alpha Olefin Application Segment – 64.2% Share

In 2024, Polyethylene held a dominant market position, capturing more than a 64.2% share of the global alpha olefin market. This strong position reflects its extensive use in manufacturing high-density (HDPE) and linear low-density polyethylene (LLDPE), which are essential materials for films, packaging, pipes, and containers.

The growing demand for flexible packaging, particularly in food and e-commerce sectors, boosted polyethylene consumption. Industries increasingly preferred alpha-olefin-based polyethylene due to its excellent mechanical strength, durability, and environmental resistance. Additionally, global infrastructure expansion and the construction of new polymerization units contributed to higher product utilization.

Polyethylene applications are expected to remain the leading growth driver within the alpha olefin industry. Rising production of lightweight automotive parts, durable geomembranes, and recyclable packaging materials continues to enhance market prospects. The dominance of polyethylene underscores its irreplaceable role in modern manufacturing.

Key Market Segments

By Product

- 1-Hexene

- 1-Butene

- 1-Octene

- 1-Decene

- 1-Dodecene

- Others

By Application

- Polyethylene

- Detergent Alcohol

- Synthetic Lubricant

- Others

Drivers

Regulatory Push Toward Safer & More Compliant Food-Contact Materials

One of the major drivers for the use of alpha olefins in food and packaging applications is the increasing regulatory pressure from government and food safety authorities on the materials that come into contact with food. As regulators tighten rules, manufacturers are compelled to adopt materials that not only perform well but also satisfy migration limits, purity standards, and overall safety.

In the U.S., the FDA maintains an Inventory of Food Contact Substances under 21 CFR, which lists olefin-derived materials that are authorized for limited food contact under specified conditions. Meanwhile, under 21 CFR § 175.105, alpha-olefin sulfonates (alkyl groups in the range C₁₀–C₁₈, with ≥ 50% C₁₄–C₁₆) are permitted in food-contact adhesives, subject to strict conditions.

These regulatory shifts push companies to reformulate packaging, coatings, adhesives, or barriers using olefin-based chemistries that can meet compliance (low migration, high purity) while retaining mechanical, barrier, or processing advantages. In essence, the rules act as a gatekeeper: only materials proven safe under strict conditions get to stay.

Restraints

Risk of Chemical Migration & Safety Compliance Burden

One of the major restraints to broader adoption of alpha olefins (and related olefin-based polymers) in food contact or packaging applications is the risk of chemical migration — that is, unwanted leaching of residual monomers, additives, or degradation products into food — and the heavy burden of ensuring compliance with safety limits.

In the European Union, regulations impose a strict Overall Migration Limit (OML) for non-volatile substances migrating from plastic into food, of 10 mg per dm² of contact surface. The regulatory framework also caps migration in terms of 60 mg per kg of food, especially when expressed in food mass terms. Because alpha olefins may contain residual low-molecular fragments, impurities, or undergo degradation, some portion could migrate, especially under heat, fat contact, or long storage.

Opportunity

Rising Demand for Sustainable & Recyclable Packaging Materials

One major growth driver for alpha olefins in the food and packaging sector is the increasing global push for sustainable, recyclable, and circular packaging, which creates a demand for advanced olefin-based resins and materials that can meet strict recycling and purity requirements.

Many food companies have pledged to reduce reliance on virgin plastics. Post-consumer recycled (PCR) content in food packaging nearly doubled, from 2.5% to 6.2% more recently, though still modest overall. This shows the industry’s direction toward more recycled material use, and for that, materials like alpha olefins will be needed to match performance and compliance needs.

Governments, brands, and consumers are all pushing for solutions that minimize waste, improve recyclability, and reduce environmental impact. In that environment, alpha olefins, if engineered and applied thoughtfully, have real room to grow as essential building blocks in safer, recyclable food packaging systems.

Trends

The Push from Plastics: How Food Industry Packaging Demands are Reshaping Alpha Olefin Production

One of the most significant emerging factors for the Alpha Olefin market isn’t coming from the chemical industry’s labs, but from the public’s dinner table and the grocery store aisle. It’s the intense, growing pressure on the food industry to fix the plastic waste crisis.

For decades, our reliance on single-use plastics for everything from bread bags to beverage bottles has created an environmental problem we can no longer ignore. People are genuinely worried about the images of plastic choking our oceans and filling our landfills.

This isn’t just a vague concern anymore; it’s a powerful consumer force that is directly influencing the materials companies choose to use. This is where Alpha Olefins, the critical building blocks for many of the plastics and detergents we use every day, are getting a new lease on life, driven by the demand for better, more responsible packaging.

Regional Analysis

North America Dominates the Alpha Olefin Market with 41.2% Share, Valued at USD 3.3 Billion

In 2024, North America held a dominant position in the global alpha olefin market, capturing more than a 41.2% share, equivalent to approximately USD 3.3 billion. The regional growth is largely driven by the presence of strong petrochemical manufacturing infrastructure, advanced refining technologies, and the region’s high consumption of polyethylene, synthetic lubricants, and surfactants.

The United States remains the central hub, supported by abundant shale gas reserves that provide cost-effective ethylene feedstock for alpha olefin production. States like Texas and Louisiana host major integrated complexes, ensuring stable supply and competitive pricing for key derivatives such as linear low-density polyethylene (LLDPE) and polyalphaolefins (PAO).

North American producers continue to invest in sustainable olefin technologies aligned with EPA and Department of Energy (DOE) initiatives to promote low-emission manufacturing and circular chemical recycling. For instance, U.S. federal incentives for carbon-efficient chemical plants and renewable feedstock integration are fostering modernization across major production clusters.

The regional alpha olefin market is expected to maintain steady expansion as downstream sectors—especially plastics, lubricants, and bio-based surfactants continue to recover post-pandemic. With established infrastructure, regulatory alignment, and ongoing innovation in recyclable olefin-based materials, North America will likely sustain its leadership position in the global alpha olefin landscape through the forecast period.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ExxonMobil leverages its massive upstream integration and proprietary technology to produce a wide range of high-purity alpha olefins. Its strength lies in its extensive, reliable supply chain and global distribution network, serving diverse sectors from polyethylene comonomers to synthetic lubricants. This vertical integration and scale provide a significant competitive edge.

Mitsubishi Chemical is a key player, particularly strong in the Asian market. It focuses on producing high-value, specialty alpha olefins like 1-Hexene and 1-Octene, which are critical as comonomers in producing specific grades of polyethylene. The company’s strategy emphasizes technological innovation and product quality to serve the advanced plastics and performance chemicals sectors.

SABIC holds a formidable position in the alpha olefin market. Its strength is derived from vast hydrocarbon resources and strategic integration with its downstream polymer production. This ensures a captive market for its alpha olefin output, primarily used as comonomers for its polyethylene plants. SABIC’s global presence and focus on innovation and sustainability allow it to serve a broad international customer base, making it a dominant and influential force in the industry.

Top Key Players in the Market

- Chevron Phillips Chemical Company LLC

- Exxon Mobil Corporation

- Idemitsu Kosan Co., Ltd.

- INEOS Oligomers

- Mitsubishi Chemical Corporation

- SABIC

Sasol - Shell plc

- Jam Petrochemical

- Dow

Recent Developments

- In 2024, SABIC partnered with Sinopec to establish a joint venture for a new alpha olefins production facility in Fujian, China, with a capacity of approximately 1.8 million tons per year. This targets growing demand in Asia for polyethylene and specialty chemicals, securing local ethylene feedstock integration.

- In 2025, Sasol reported stable alpha olefins output within its chemicals division. Key highlights include renewed atmospheric emissions licenses (AELs) for its Secunda Operations (SO), incorporating sulfur emission variations for steam plant boilers. This supports ongoing LAO production amid coal-to-chemicals transitions.

Report Scope

Report Features Description Market Value (2024) USD 8.2 Billion Forecast Revenue (2034) USD 13.9 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (1-Hexene, 1-Butene, 1-Octene, 1-Decene, 1-Dodecene, Others), By Application (Polyethylene, Detergent Alcohol, Synthetic Lubricant, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Chevron Phillips Chemical Company LLC, Exxon Mobil Corporation, Idemitsu Kosan Co., Ltd., INEOS Oligomers, Mitsubishi Chemical Corporation, SABIC, Sasol, Shell plc, Jam Petrochemical, and Dow. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Chevron Phillips Chemical Company LLC

- Exxon Mobil Corporation

- Idemitsu Kosan Co., Ltd.

- INEOS Oligomers

- Mitsubishi Chemical Corporation

- SABIC Sasol

- Shell plc

- Jam Petrochemical

- Dow