Global Alloy Cast Iron Mold Market Size, Share, And Enhanced Productivity By Type (Gray Iron, Ductile Iron, White Iron, Malleable Iron, Others), By Application (Automotive, Construction, Aerospace, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171102

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

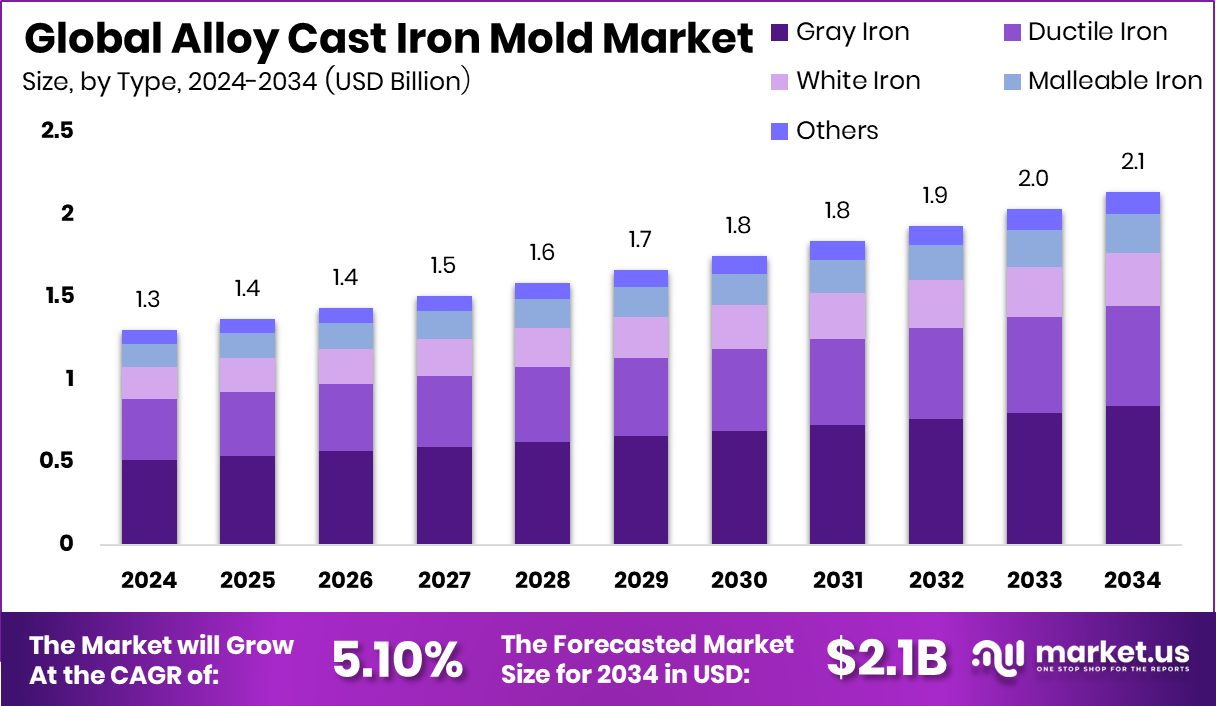

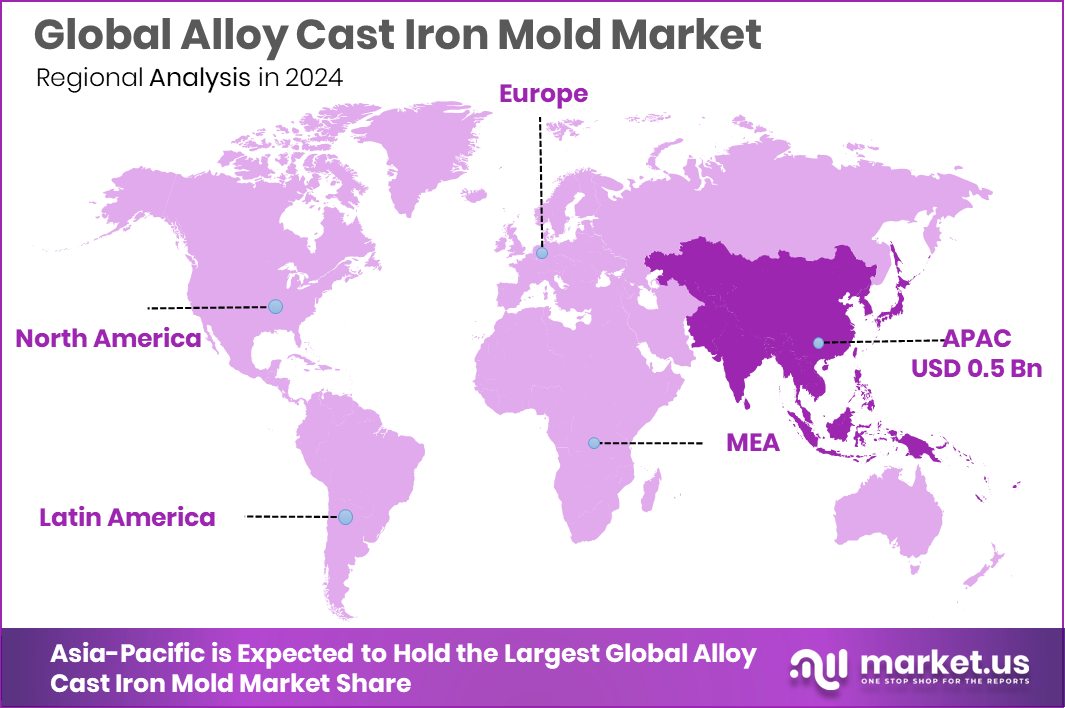

The Global Alloy Cast Iron Mold Market is expected to be worth around USD 2.1 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 5.10% from 2025 to 2034. Within the Asia-Pacific region, the Alloy Cast Iron Mold Market reached 41.70% share of USD 0.5 Bn.

An alloy cast iron mold is a durable shaping tool made from cast iron blended with alloying elements to improve strength, heat resistance, and wear life. These molds are widely used where repeated heating, cooling, and pressure are involved. Their stable structure helps manufacturers achieve consistent shapes and surface quality in metal casting, cookware, and heavy industrial components, while reducing mold failure and downtime.

The alloy cast iron mold market covers the production and use of these molds across industrial manufacturing, infrastructure components, and consumer goods. Demand comes from sectors that rely on precise, repeatable casting and long service life. The market evolves alongside investment in iron processing, cleaner production methods, and modernization of foundry operations, supporting steady long-term relevance.

Growth is supported by rising investment in iron-related infrastructure and cleaner production systems. Government-backed funding for iron and steel ecosystems indirectly supports mold demand by strengthening upstream production capacity.

- Australia announced a A$1 bn green iron fund, reallocating nearly A$600 m to support long-term iron facilities and cleaner processing pathways.

- BHP secured a US$2 bn funding deal with GIP to develop an iron ore power network, improving supply-side stability.

Demand is reinforced by industrial expansion, infrastructure upgrades, and consumer focus on durable metal products. Projects like ACIPCO’s proposed $185 M investment and EGLE’s $65.9 M clean water grants increase the use of cast iron components, which rely on reliable molds for large-scale production.

Opportunities are emerging from private investments and specialty manufacturing. Allana Group’s $10 M investment in Iron Pillar Fund II and rising funding for toxin-free kitchenware, including $1.5 M and Rs 23.1 Crore rounds, signal expanding end-use applications where alloy cast iron molds play a supporting role.

Key Takeaways

- The Global Alloy Cast Iron Mold Market is expected to be worth around USD 2.1 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 5.10% from 2025 to 2034.

- In the Alloy Cast Iron Mold Market, Gray Iron dominates by type, holding 39.4% share.

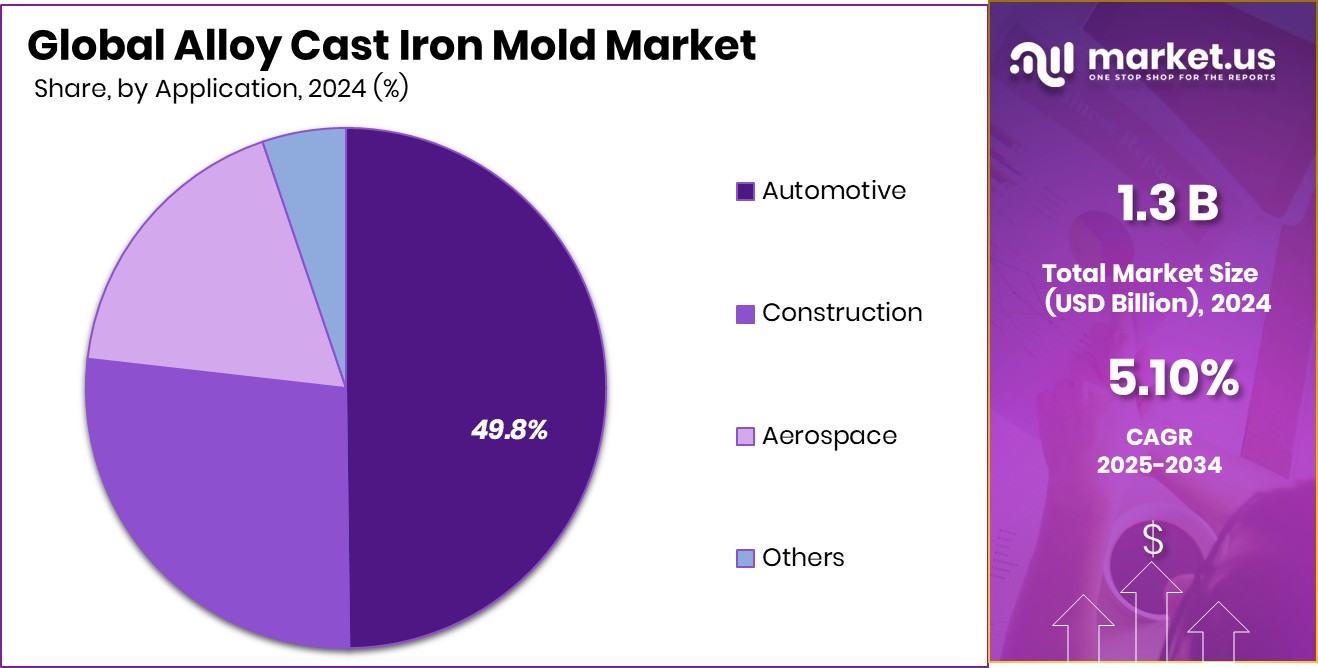

- In the Alloy Cast Iron Mold Market, Automotive applications lead demand, accounting for 49.8% share.

- Asia-Pacific dominance reflects strong demand, capturing 41.70% and generating USD 0.5 Bn revenue.

By Type Analysis

Gray iron dominates the Cast Iron Mold Market by type with 39.4% share.

In 2024, Gray Iron held a dominant market position in the By Type segment of the Alloy Cast Iron Mold Market with a 39.4% share. This leadership reflects its long-standing use in mold manufacturing, where consistent thermal stability and reliable casting behavior are essential. Gray iron molds are widely preferred for their ability to handle repeated heating and cooling cycles without rapid wear, which supports steady production output and predictable mold life in industrial casting operations.

The strong position of gray iron is also linked to its ease of machining and dimensional stability during mold fabrication. These characteristics help manufacturers maintain tight tolerances while controlling production complexity, reinforcing gray iron’s continued relevance in alloy cast iron mold applications.

By Application Analysis

Automotive application leads the Cast Iron Mold Market demand, accounting for 49.8% share.

In 2024, Automotive held a dominant market position in the By Application segment of the Alloy Cast Iron Mold Market with a 49.8% share. This dominance is driven by the automotive industry’s sustained demand for high-volume, repeatable casting processes that rely on durable and dimensionally stable molds. Alloy cast iron molds support the production of complex automotive components where consistency, surface finish, and thermal performance are critical.

The large share highlights how automotive manufacturers prioritize mold reliability to maintain production efficiency and reduce downtime. As vehicle platforms continue to require precision-engineered cast parts, the automotive sector remains a key driver shaping demand patterns within the alloy cast iron mold market.

Key Market Segments

By Type

- Gray Iron

- Ductile Iron

- White Iron

- Malleable Iron

- Others

By Application

- Automotive

- Construction

- Aerospace

- Others

Driving Factors

Large-Scale Industrial Investment Driving Mold Demand

A key driving factor for the Alloy Cast Iron Mold Market is the rise in large-scale industrial and infrastructure investments, which directly increase demand for durable and high-precision casting molds. When heavy industrial projects expand, they require reliable molds that can withstand repeated casting cycles and high thermal stress.

For example, Gina Rinehart-backed Vulcan Energy secured full funding to build a $3.9 billion lithium project in Germany, supported by the European Union’s lending arm. Such mega-projects accelerate demand for cast components and supporting mold systems used in energy, mining, and processing equipment.

At the same time, financial pressure on public systems, highlighted by $320 million in liability payouts in Los Angeles, is pushing authorities and industries to favor long-lasting materials that reduce replacement and maintenance costs. Alloy cast iron molds fit this need by offering durability, dimensional stability, and cost efficiency over long operating periods.

Restraining Factors

High Energy Costs Limit Mold Production Efficiency

A major restraining factor for the Alloy Cast Iron Mold Market is the high energy requirement involved in producing and maintaining these molds. Alloy cast iron mold manufacturing depends on continuous melting, controlled alloying, and repeated heat treatment, all of which consume large amounts of electricity and fuel. Rising energy prices increase operating costs for foundries, making mold production more expensive and sometimes less competitive for small and mid-sized manufacturers.

In addition, strict temperature control is essential to avoid defects, which further raises energy use during production cycles. When energy costs rise, manufacturers may delay capacity expansion or limit output to protect margins. This restraint slows overall market growth, as end users become more cautious about investing in new molds and focus instead on extending the life of existing tooling wherever possible.

Growth Opportunity

Toxin-Free Cookware Expansion Boosts Mold Usage

A strong growth opportunity for the Alloy Cast Iron Mold Market is the rapid expansion of toxin-free and safe cookware manufacturing. As consumers become more health-conscious, cookware brands are increasing production of cast iron products that avoid chemical coatings and synthetic materials. This shift directly increases the need for high-quality alloy cast iron molds that can deliver smooth finishes, uniform thickness, and long service life.

The opportunity is clearly reflected in recent funding activity, where The Indus Valley raised Rs 23.1 Crore in a Pre-Series A round led by DSG Ventures to expand its toxin-free kitchenware portfolio. Scaling cookware production requires reliable molds capable of supporting high volumes without quality loss. Alloy cast iron molds meet this requirement by offering durability and consistent heat performance, making them essential for brands moving toward safer, premium cookware lines.

Latest Trends

Public Funding Strengthens Regional Casting Infrastructure Capacity

A notable latest trend in the Alloy Cast Iron Mold Market is the growing role of public funding in strengthening regional manufacturing and casting infrastructure. Governments are increasingly supporting projects that improve industrial capability, workforce stability, and local production resilience. This trend is visible in the $3 million in federal funding directed toward Erie’s EMI project, which aims to support manufacturing-related development and industrial renewal.

Such initiatives indirectly raise demand for durable alloy cast iron molds by encouraging localized production and equipment upgrades. At the same time, policy commitments also influence material-intensive sectors linked to casting.

For example, £46 million has been guaranteed to be returned to farmers, supporting agricultural stability and equipment demand, where cast iron components and molds play a supporting role. Together, these funding actions signal a shift toward regionally anchored, policy-backed industrial growth that sustains long-term mold usage.

Regional Analysis

Asia-Pacific led the Alloy Cast Iron Mold Market with 41.70% share of USD 0.5 Bn.

Asia-Pacific dominated the Alloy Cast Iron Mold Market, holding a leading share of 41.70%, valued at USD 0.5 Bn. This dominance reflects the region’s strong manufacturing base and widespread use of alloy cast iron molds across large-scale industrial production environments. High concentration of casting activities and steady demand from downstream industries continue to anchor Asia-Pacific as the central revenue contributor within the global market structure.

North America represents a mature regional market, supported by established foundry infrastructure and consistent replacement demand for alloy cast iron molds. The region emphasizes operational reliability and standardized mold performance, which sustains stable market participation without rapid structural shifts.

Europe follows with a well-developed industrial landscape where alloy cast iron molds are used in precision-oriented manufacturing settings. Long-standing metallurgical expertise and structured production processes contribute to steady utilization levels across the region.

The Middle East & Africa region shows a gradual market presence, largely aligned with industrial development and localized casting activities. Demand remains selective and project-driven rather than volume-intensive.

Latin America maintains a modest position, supported by regional manufacturing needs and gradual industrial expansion, contributing steadily to overall market continuity.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Hitachi Metals Ltd. continued to play a significant role in the global Alloy Cast Iron Mold Market through its strong metallurgical expertise and long-established manufacturing capabilities. The company’s focus on material consistency and controlled casting processes supports stable mold performance across demanding industrial applications. Its emphasis on quality-driven production helps downstream manufacturers maintain repeatability and operational efficiency.

Thyssenkrupp AG remains an influential participant, leveraging its broad industrial background and deep experience in advanced materials. Within alloy cast iron molds, the company benefits from integrated production knowledge and process optimization practices. This positioning allows Thyssenkrupp to address complex mold requirements where durability and dimensional accuracy are critical to production reliability.

Dandong Foundry holds a relevant position by serving cost-sensitive and volume-driven segments of the alloy cast iron mold space. The company’s strength lies in practical manufacturing execution and the ability to supply molds that meet functional performance expectations at scale. Its regional manufacturing footprint supports timely delivery and consistent output.

Top Key Players in the Market

- Hitachi Metals Ltd.

- Thyssenkrupp AG

- Dandong Foundry

- Waupaca Foundry, Inc.

- Metal Technologies, Inc.

- Eisenwerk Brühl GmbH

- OSCO Industries, Inc.

- Aarrowcast, Inc.

- Denison Industries

- Benton Foundry, Inc

Recent Developments

- In 2024, Eisenwerk Brühl began converting its plant vehicle fleet to run on Neste MY Renewable Diesel (HVO100). This change supports lower carbon emissions in its logistics and foundry support operations, aligning with broader sustainability upgrades at the facility.

- In March 2024, Metal Technologies, Inc. announced it acquired Key 3 Casting LLC, which included aluminum die/squeeze casting operations and a ductile iron foundry (Northern Foundry). The company’s position was that this deal strengthens its long-term casting footprint and adds “value-added services” plus small ductile iron casting capability, which is closely relevant to alloy iron casting supply needs.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 2.1 Billion CAGR (2025-2034) 5.10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Gray Iron, Ductile Iron, White Iron, Malleable Iron, Others), By Application (Automotive, Construction, Aerospace, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Hitachi Metals Ltd., Thyssenkrupp AG, Dandong Foundry, Waupaca Foundry, Inc., Metal Technologies, Inc., Eisenwerk Brühl GmbH, OSCO Industries, Inc., Aarrowcast, Inc., Denison Industries, Benton Foundry, Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Alloy Cast Iron Mold MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Alloy Cast Iron Mold MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Hitachi Metals Ltd.

- Thyssenkrupp AG

- Dandong Foundry

- Waupaca Foundry, Inc.

- Metal Technologies, Inc.

- Eisenwerk Brühl GmbH

- OSCO Industries, Inc.

- Aarrowcast, Inc.

- Denison Industries

- Benton Foundry, Inc