Global Air Electrode Battery Market Size, Share Analysis Report By Type (Rechargeable, Fuel Cells, Non-rechargeable), By Application (Transportation, Medical Devices, Military Devices, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164958

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

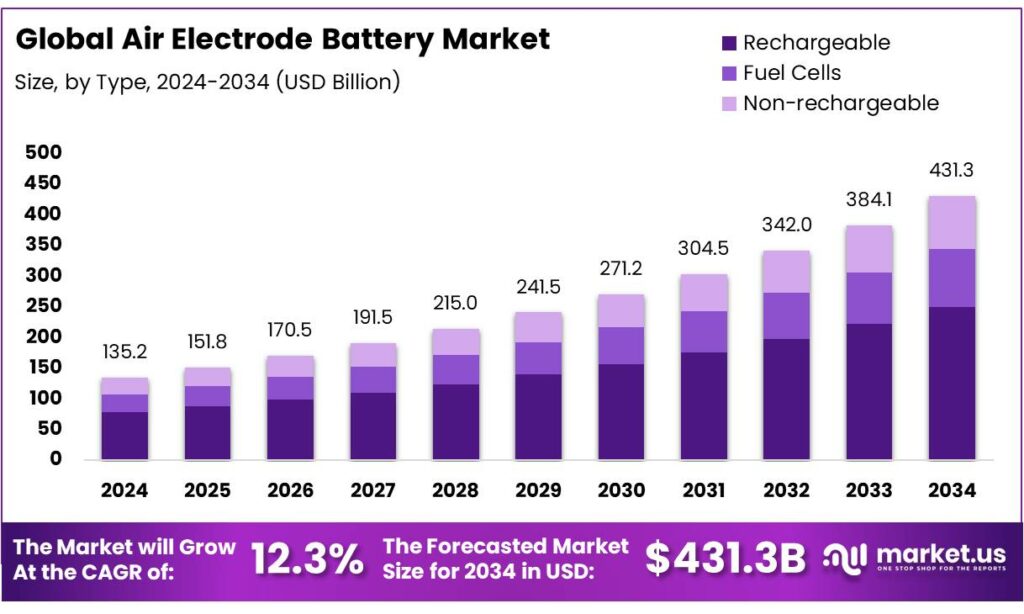

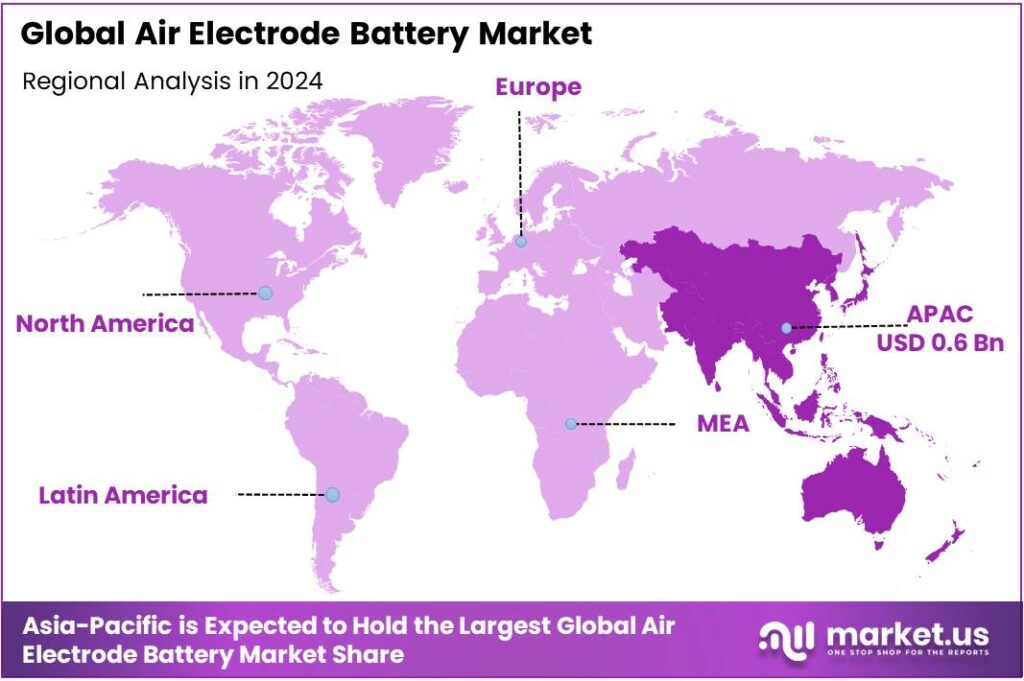

The Global Air Electrode Battery Market size is expected to be worth around USD 431.2 Billion by 2034, from USD 135.2 Billion in 2024, growing at a CAGR of 12.3% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific (APAC) held a dominant market position, capturing more than a 43.9% share, holding USD 0.6 Billion in revenue.

Air-electrode batteries—most notably metal-air chemistries such as lithium-air and zinc-air—use oxygen from ambient air as the cathode reactant, allowing a lightweight cell design with very high theoretical energy density. As a reference point, today’s commercial lithium-ion packs deliver roughly 200–300 Wh/kg at the cell level, underscoring why new chemistries that move beyond heavy intercalation cathodes are drawing investment.

Cutting-edge work funded by the U.S. Department of Energy shows a solid-state lithium-air cell that enables a four-electron reaction at room temperature, with rechargeability to 1,000 cycles and a projected path toward ~1,200 Wh/kg—several times lithium-ion.

The International Energy Agency (IEA) estimates global battery manufacturing capacity reached ~3 TWh in 2024, and could triple within five years if announced projects proceed—expanding supplier bases, tooling, and know-how that next-gen chemistries can tap. On the grid, global battery storage grew 120% in 2023 to 55.7 GW; China rose to 27.1 GW and the United States to 16.2 GW, with California alone exceeding 5 GW—evidence that system integrators and grid operators are rapidly adopting batteries for flexibility.

- Demand-side drivers are strengthening. The IEA expects stationary storage to require ~400 GWh (STEPS) to ~500 GWh (APS) of batteries by 2030—about 12% of EV battery demand—pulling innovation toward higher energy density and lower cost per delivered kWh.

The U.S. DOE’s Long-Duration Energy Storage (LDES) strategy targets up to a 90% cost reduction by 2030 for technologies capable of 10+ hours, opening a runway for metal-air systems that prioritize cost per kWh-cycle. California has earmarked over US$270 million to demonstrate non-lithium-ion LDES, catalyzing utility-scale pilots and bankability data. In Europe, the Innovation Fund 2024 launched with €3.4 billion for net-zero manufacturing, including energy storage components and pilots, signaling multi-year procurement for advanced chemistries.

Key Takeaways

- Air Electrode Battery Market size is expected to be worth around USD 431.2 Billion by 2034, from USD 135.2 Billion in 2024, growing at a CAGR of 12.3%.

- Rechargeable held a dominant market position, capturing more than a 58.9% share of the overall air electrode battery market.

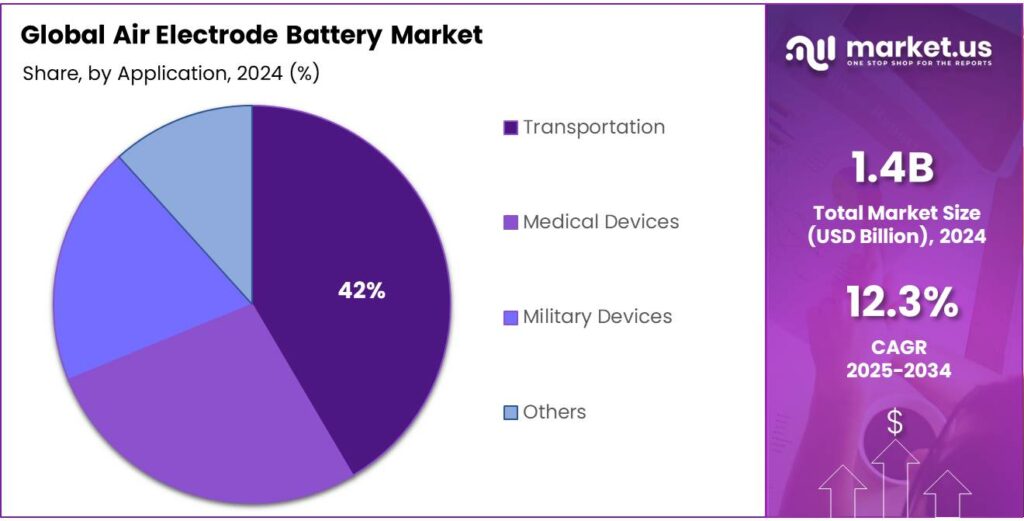

- Transportation held a dominant market position, capturing more than a 42.6% share of the global air electrode battery market.

- Asia-Pacific (APAC) held a dominant position in the global Air Electrode Battery Market, accounting for more than 43.9% of total revenue, valued at approximately USD 0.6 billion.

By Type Analysis

Rechargeable Air Electrode Batteries dominate with 58.9% share driven by rising energy storage demand

In 2024, Rechargeable held a dominant market position, capturing more than a 58.9% share of the overall air electrode battery market. The segment’s strong growth has been primarily supported by increasing investments in advanced energy storage technologies for renewable integration, electric mobility, and stationary backup systems. Rechargeable air electrode batteries, including lithium-air and zinc-air variants, are gaining traction as sustainable alternatives to conventional lithium-ion systems due to their higher theoretical energy density and use of abundant raw materials.

During 2024, several demonstration projects across the United States, Europe, and Asia-Pacific showcased the commercial potential of rechargeable air systems for long-duration energy storage applications. The technology is increasingly being adopted by energy utilities and industrial users seeking lower-cost, longer-cycle storage solutions to complement solar and wind generation. Additionally, advancements in bifunctional air electrode catalysts and solid-state electrolytes in 2025 are expected to enhance battery cycle life and energy efficiency, further supporting market penetration in both grid-scale and electric vehicle applications.

By Application Analysis

Transportation leads the market with 42.6% share driven by rising adoption of electric mobility solutions

In 2024, Transportation held a dominant market position, capturing more than a 42.6% share of the global air electrode battery market. The segment’s growth has been primarily driven by the increasing use of high-energy-density battery systems in electric vehicles (EVs), hybrid electric vehicles (HEVs), and emerging long-range mobility platforms. Air electrode batteries, particularly lithium-air and zinc-air types, are being recognized for their potential to extend driving range while reducing vehicle weight and dependence on critical minerals such as cobalt and nickel.

Several automotive manufacturers and research institutions intensified pilot programs to integrate rechargeable air electrode batteries into prototype electric vehicles, aiming to achieve up to five times the energy density of traditional lithium-ion batteries. These efforts align with global initiatives to decarbonize transportation and meet net-zero emission targets by 2050. By 2025, advancements in air cathode design and electrolyte stability are expected to improve rechargeability and enhance safety, supporting wider commercial testing in the automotive sector.

Key Market Segments

By Type

- Rechargeable

- Fuel Cells

- Non-rechargeable

By Application

- Transportation

- Medical Devices

- Military Devices

- Others

Emerging Trends

Metal–air (air-electrode) batteries are moving into food cold-chains

A clear trend is the use of zinc-air and aluminum-air batteries to keep food cold-chains running when the grid is weak or diesel is costly. Why this matters is simple: too much food is lost before it reaches people. FAO’s latest SDG 12.3.1a update estimates 13.3% of food is lost after harvest, in transport, storage, processing and wholesale (2023). Cutting those losses needs reliable cold storage close to farms.

Waste at the consumer end is also huge. The UNEP Food Waste Index 2024 reports 1.05 billion tonnes of food wasted in 2022, equal to 132 kg per person, with households causing 60% of that waste. Cooling, better last-mile logistics and steadier power supply help here too, especially for perishables.

Air-electrode batteries fit this gap. They have high specific energy and simple architecture: oxygen from the air reacts at the cathode, so the pack carries less inactive mass. In farm cool-rooms and reefer micro-hubs, zinc-air modules can act as long-duration backup for solar-plus-storage systems, keeping compressors running overnight without diesel. They can also be “refueled” or swapped in modular cassettes, a practical advantage for small operators.

The direction of travel is supported by the broader storage build-out: in the IEA Net-Zero Scenario, grid-scale battery capacity must expand ~35-fold to nearly 970 GW by 2030—a signal to suppliers to scale safer, low-cost chemistries, including metal-air variants tailored for stationary use.

Drivers

Decarbonizing and securing food cold-chains with high-energy air-electrode batteries

A powerful, near-term demand driver for air-electrode batteries is the need to decarbonize and stabilize refrigeration across food cold-chains and agro-processing. Food agencies flag the scale of the problem: the UN Food and Agriculture Organization (FAO) reports that about 14% of global food is lost between harvest and retail, worth roughly US$400 billion each year—much of it tied to weak storage and logistics. UNEP and FAO add that ineffective refrigeration alone accounted for the loss of ~12% of total food production (2017), while the food cold-chain contributes ~4% of global greenhouse-gas emissions when both equipment and loss-related emissions are counted.

Air-electrode batteries—such as metal-air variants—prioritize energy per kilogram by leveraging oxygen from air as the cathodic reactant. Their high specific energy makes them attractive for long outages and remote nodes where diesel backup is costly and polluting. The IEA underscores the systemic pull: grid-scale storage is “essential” to keep variable renewables stable as electricity demand rises, and EV-driven learning is rapidly scaling battery manufacturing (EV battery deployment +40% in 2023).

Public policy is now targeting the long-duration segment where air-electrode chemistries could shine. California has allocated over US$270 million specifically for non-lithium long-duration energy storage (LDES), and has issued large project grants—including US$30 million for a 100-hour system—to diversify beyond conventional chemistries. At the federal level, the U.S. Department of Energy has opened calls of up to US$100 million for non-lithium LDES pilots capable of ≥10-hour discharge—programs that can help de-risk metal-air designs in real cold-chain and agro-processing use cases.

In the U.S., battery build-out shows what scale can deliver. California has installed ~8.6 GW of battery capacity, at times supplying up to 20% of peak power; this grid experience lowers integration barriers for advanced chemistries aimed at industrial loads like refrigeration.

Restraints

Air-Management And Durability Penalties in Real Cold-Chain Environments

A major constraint on air-electrode batteries (e.g., metal-air) is the cost and complexity of managing real-world air in food cold-chains—where carbon dioxide, moisture, and organics are routinely elevated. Lithium-air cells are highly sensitive to ambient CO₂/H₂O; CO₂ reacts to form lithium carbonate at the air electrode, a by-product widely recognized to hinder reversibility and cycle life. Preventing this requires scrubbers, filters, or membranes, adding balance-of-plant cost and maintenance that offset energy-density benefits. Peer-reviewed studies explicitly link CO₂ ingress to parasitic carbonate formation and degraded cycling in Li-air systems.

Food facilities regularly run with CO₂ levels far above ambient. Controlled-atmosphere (CA) cold stores for produce operate with ~1–5% CO₂ and ~1–5% O₂, versus normal air at ~0.03% CO₂—conditions intentionally maintained for quality but hostile to an unprotected air cathode. Banana ripening rooms must keep CO₂ below ~1%, yet CO₂ spikes are common during climacteric respiration, forcing active venting and monitoring; guidance from Indian horticulture agencies specifies CO₂ sensing and ventilation controls for proper ripening.

Grid reliability compounds the restraint. Food processors in many emerging markets face frequent outages, driving a preference for proven diesel backup and creating a high bar for any new battery. World Bank Enterprise Survey data show the share of firms experiencing electrical outages is persistently high; in Nigeria, historical values reached 95.6% (2007) and 77.6% (2014) of firms reporting outages.

Paradoxically, the climate case for cleaner backup is strong: about 4% of global GHG emissions are tied to the food cold-chain when both refrigeration and spoilage are counted, so the sector needs scalable, low-emission storage. Yet these same facilities’ elevated CO₂/RH environments raise integration costs for air-electrode batteries today. Industry and policy are trying to close the gap—California’s Long-Duration Energy Storage program has allocated >US$270 million for non-lithium demonstrations, including a US$30 million grant for a 100-hour project to validate long-autonomy storage and derisk new designs.

Opportunity

Powering Resilient, Low-Carbon Food Cold-Chains with Air-Electrode Storage

Air-electrode batteries have a clear commercial opening wherever food systems need long-autonomy, low-cost backup and renewable shifting. The scale of the prize is large and well quantified by food bodies. The UN Food and Agriculture Organization estimates around 14% of the world’s food is lost between harvest and retail, equal to about US$400 billion per year—a loss profile concentrated in storage, handling and transport where dependable power matters most.

UNEP and FAO further report that the food cold-chain accounts for ~4% of global greenhouse-gas emissions when equipment and loss-related emissions are combined, so cutting cold-chain diesel use and spoilage delivers immediate climate dividends.

Independent coverage of IEA’s analysis adds a system-level marker: meeting the COP28 goal to triple renewables requires about 1,500 GW of energy storage by 2030—a ~15× increase from current levels—creating headroom for diverse chemistries, including air-electrode batteries optimized for long duration.

Policy is lining up capital for demonstrations that food operators can leverage. California’s Long-Duration Energy Storage (LDES) program approved a US$30 million grant for a 5 MW/500 MWh (100-hour) project—evidence that regulators are paying for multi-day storage to ride through extreme weather and outages.

In India, where farm-to-fork electrification is expanding quickly, the Ministry of Food Processing Industries reports ₹8,853 crore in approved grants under PMKSY across 1,601 projects, with new cold-chain interventions explicitly prioritized—an investment pipeline that can specify clean, long-duration backup in tender documents.

Regional Insights

APAC dominates the Air Electrode Battery Market with 43.9% share valued at USD 0.6 billion

In 2024, Asia-Pacific (APAC) held a dominant position in the global Air Electrode Battery Market, accounting for more than 43.9% of total revenue, valued at approximately USD 0.6 billion. The region’s leadership is attributed to rapid industrialization, strong growth in electric mobility, and large-scale investments in renewable energy integration. Countries such as China, Japan, South Korea, and India are at the forefront of advancing metal–air and rechargeable air electrode battery technologies to support their clean energy and transportation transition goals.

China continues to lead with substantial research and pilot-scale production of lithium–air and zinc–air batteries, driven by the government’s emphasis on achieving carbon neutrality by 2060. The Chinese government has invested heavily in next-generation battery chemistries through national programs under the “Made in China 2025” initiative, targeting higher energy densities for electric vehicles and grid storage. Japan and South Korea are also key contributors, with strong participation from companies and research institutions developing high-performance air cathodes and solid-state electrolytes.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

PolyPlus Battery Company: PolyPlus is a U.S.-based battery-technology firm pioneering lithium-metal and lithium-air chemistries through its Protected Lithium Electrode (PLE™) platform. The company holds over 200 patents, has demonstrated Li-air cells with >800 Wh/kg energy density in test environments, and is focused on bridging the gap to commercial high-energy air-electrode batteries.

BASF SE, a leading German chemical company, drives innovation in air-electrode battery materials, focusing on catalysts, binders, and solid electrolytes. In 2024, BASF’s battery materials division expanded R&D partnerships with European energy institutes under the Horizon Europe framework. The company invests heavily in sustainable cathode components that enable efficient oxygen reactions and longer cycle life. BASF’s initiatives support the EU’s Green Deal objectives, aiming to localize advanced battery manufacturing and accelerate low-carbon industrial electrification worldwide.

Sanyo Electric, a Panasonic Group subsidiary, continues to innovate in advanced battery chemistries, including zinc-air and lithium-air prototypes. The company leverages its experience in rechargeable cells and energy devices to improve air-cathode stability and recharge cycles. In 2024, Sanyo collaborated with Japanese universities on catalytic materials for oxygen reduction and evolution reactions, crucial for air electrodes. These efforts align with Japan’s roadmap for carbon-neutral technologies and the transition toward sustainable power systems by 2050.

Top Key Players Outlook

- Phinergy

- Poly Plus Battery Company

- Hitachi Maxell Ltd.

- Volkswagen Ag

- Sanyo Electric Co., Ltd.

- BASF Global

- Panasonic Corporation

- LG Chem Ltd.

Recent Industry Developments

In 2024, Sanyo’s parent chemical group reported an extraordinary loss of ¥8.5 billion for the fiscal year ended March 31, 2024, following restructuring activities.

In 2024 PolyPlus Battery Company reported a technical milestone: deploying their patented Protected Lithium Electrode system enabling the company to claim >200 issued patents and holding a pilot line at their 13,000 ft² Berkeley, California facility as of that year.

Report Scope

Report Features Description Market Value (2024) USD 135.2 Bn Forecast Revenue (2034) USD 431.3 Bn CAGR (2025-2034) 12.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Rechargeable, Fuel Cells, Non-rechargeable), By Application (Transportation, Medical Devices, Military Devices, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Phinergy, Poly Plus Battery Company, Hitachi Maxell Ltd., Volkswagen Ag, Sanyo Electric Co., Ltd., BASF Global, Panasonic Corporation, LG Chem Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Air Electrode Battery MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Air Electrode Battery MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Phinergy

- Poly Plus Battery Company

- Hitachi Maxell Ltd.

- Volkswagen Ag

- Sanyo Electric Co., Ltd.

- BASF Global

- Panasonic Corporation

- LG Chem Ltd.