Global Agricultural Ventilation Fans Market By Product Type (Duct Fans, Circulation Fans, Exhaust Fans, Portable Fans, and Others), By Application (Dairy/Livestock, Equine, Greenhouse, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160241

- Number of Pages: 212

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overviews

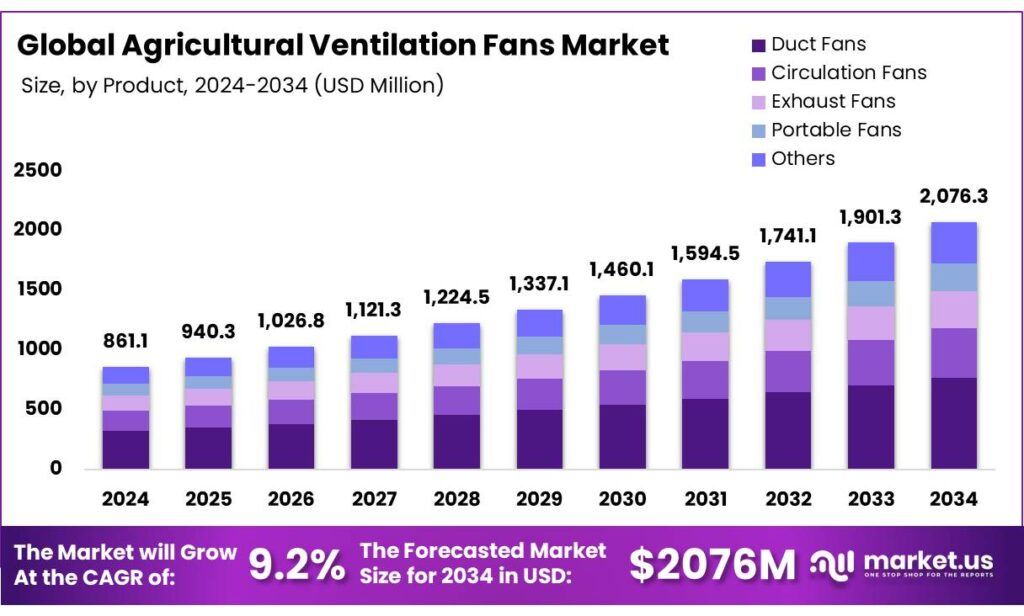

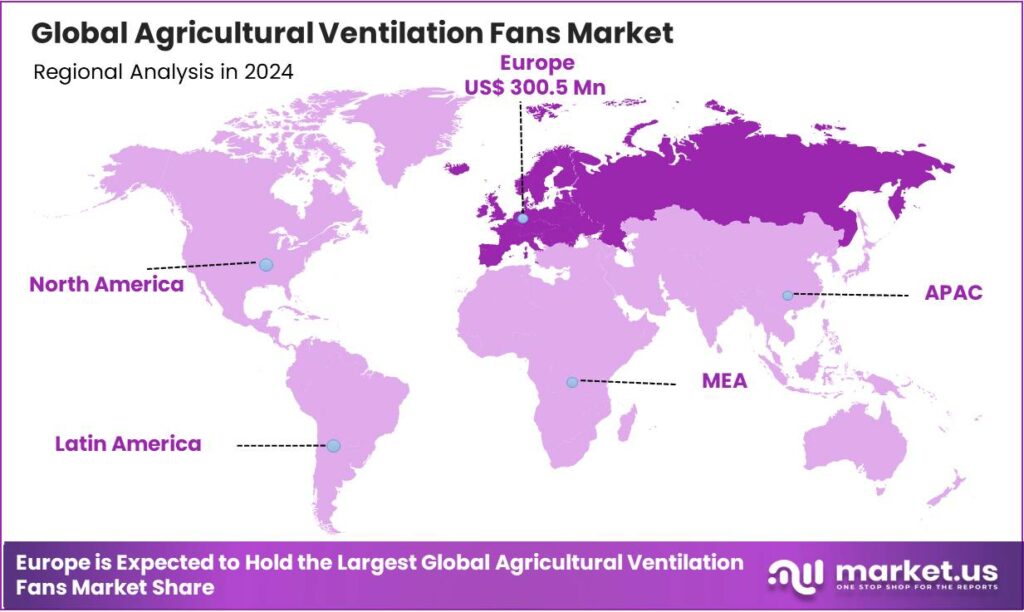

The Global Agricultural Ventilation Fans Market size is expected to be worth around USD 2076.3 Million by 2034, from USD 861.1 Million in 2024, growing at a CAGR of 9.2% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 34.9% share, holding USD 300.5 Million in revenue.

Agricultural ventilation fans are powerful fans designed for farming environments like barns, greenhouse, and storage facilities, used to control temperature, humidity, and air quality by moving air to improve animal and plant health and worker comfort. They generate high-volume, low-speed airflow to remove heat, moisture, and harmful gases such as ammonia, creating a healthier and more productive environment for both livestock and crops.

Several agricultural fans are built with rugged materials such as galvanized steel or fiberglass to withstand harsh farm conditions and corrosive elements. The major driver of these fans is the demand for ventilation in the places where livestock reside. In addition, technological advancements such as precision agriculture and energy-efficient fans further boost the market. Despite the advantages, the market faces challenges of high initial upfront cost, particularly in developing countries.

- Global livestock numbers are extensive, with the Food and Agriculture Organization (FAO) estimating the global ruminant population to be around 3.6 billion, while the population of chickens alone reached approximately 26.6 billion by 2022. Asia holds the largest livestock population by Livestock Standard Units (LSU). Similarly, the global production of primary crops reached 9.9 billion tons in 2023.

Key Takeaways

- The global agricultural ventilation fans market was valued at USD 861.1 million in 2024.

- The global agricultural ventilation fans market is projected to grow at a CAGR of 9.2% and is estimated to reach USD 2076.3 Million by 2034.

- On the basis of types of products in the agricultural ventilation fans market, duct fans dominated the market in 2024, comprising about 37.1% share of the total global market.

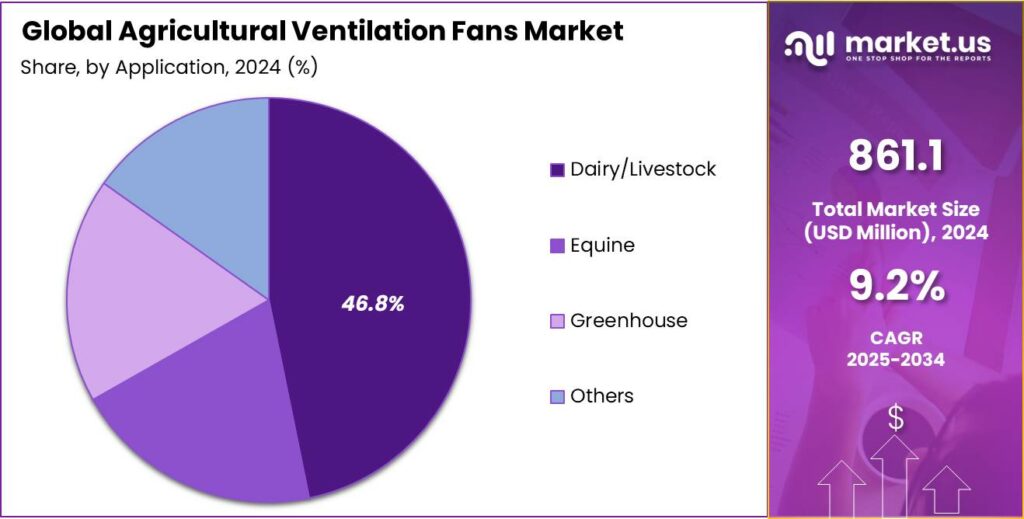

- Based on the applications of the agricultural ventilation fans, dairy/livestock dominated the market with approximately 46.8% of the total market share.

- Europe was the largest market for the agricultural ventilation fans in 2024, accounting for around 34.9% of the total global consumption.

Product Type Analysis

Duct Fans Emerged as a Leading Segment in the Market.

Based on the types of product, the market is divided into duct fans, circulation fans, exhaust fans, portable fans, and others. Duct fans dominated the market in 2024 with a market share of 37.1%. Duct fans are more widely utilized in agricultural settings compared to circulation, exhaust, or portable fans due to their efficiency in controlling airflow across large, enclosed spaces such as poultry houses, greenhouses, and livestock barns.

Unlike circulation or exhaust fans, which primarily move air within or out of a space, duct fans are designed to direct air precisely through duct systems, ensuring even distribution of fresh air and removal of stale or contaminated air from specific zones. This targeted airflow is particularly beneficial in maintaining consistent temperature, humidity, and air quality across different sections of a facility. Additionally, duct fans integrate well with automated climate control systems, making them ideal for precision agriculture environments where environmental uniformity is critical to animal health and productivity.

Application Analysis

In 2024, the Agricultural Ventilation Fans Market was Primarily Driven by Dairy/Livestock.

Among the applications of the agricultural ventilation fans, in 2024, dairy/livestock was at the forefront of the market, with the total global market share of 46.8%. Agricultural ventilation fans are used more extensively in dairy and livestock operations than in equine or greenhouse settings due to the higher density of animals and the greater need for consistent air quality control.

In dairy and livestock barns, large numbers of animals produce significant amounts of heat, moisture, and waste gases such as ammonia and methane, which can negatively impact animal health and productivity if not properly ventilated. Ventilation fans help regulate temperature, reduce humidity, and remove harmful gases, which is critical in preventing respiratory illnesses and heat stress, particularly in high-producing dairy cows and confined livestock. In contrast, equine facilities typically house fewer animals with more space per animal, and greenhouses often use alternative climate control systems tailored for plant needs. The scale and biological demands of dairy and livestock operations drive a much higher demand for robust and continuous ventilation solutions.

Key Market Segments

By Product Type

- Duct Fans

- Circulation Fans

- Exhaust Fans

- Portable Fans

- Others

By Application

- Dairy/Livestock

- Equine

- Greenhouse

- Others

Drivers

Demand for Animal Health and Welfare Drives the Agricultural Ventilation Fans Market.

The rising focus on animal health and welfare is a key factor driving the demand for agricultural ventilation fans. Proper ventilation is essential in livestock farming, as it directly affects the animals’ respiratory health, productivity, and overall well-being. Poor air circulation in barns and poultry houses can lead to the accumulation of harmful gases such as ammonia and carbon dioxide, which are detrimental to animal health. The optimal environmental conditions can improve feed conversion ratios in poultry by up to 10% and reduce mortality rates in pigs by as much as 5%.

Ventilation systems help maintain ideal temperature and humidity levels, especially in extreme weather conditions, thus minimizing heat stress-related issues. For instance, in dairy farming, heat-stressed cows can produce up to 25% less milk, making ventilation a crucial investment. As awareness of animal welfare standards grows globally, farmers are increasingly adopting ventilation solutions to ensure a healthy and productive livestock environment.

Restraints

High Upfront Costs and Maintenance Might Hamper the Growth of the Agricultural Ventilation Fans Market.

High upfront costs and ongoing maintenance requirements may pose significant challenges to the widespread adoption of agricultural ventilation fans, particularly among small and medium-scale farmers. Installing advanced ventilation systems, especially those integrated with automation or precision controls, often involves substantial initial investment in equipment, electrical infrastructure, and installation labor. For instance, energy-efficient fans with variable speed drives or smart controls can cost significantly more than conventional units.

Additionally, maintenance costs, including regular cleaning, motor servicing, and replacement of worn-out components, can add to the long-term financial burden. According to agricultural engineering studies, poor maintenance of ventilation systems can lead to up to 40% reduction in airflow efficiency, negatively impacting animal health and productivity. In regions with limited access to technical support or funding, these costs can discourage farmers from upgrading or adopting such systems altogether. Despite the benefits of improved ventilation, economic constraints can hinder market penetration, especially in developing agricultural economies.

Opportunity

Innovations in Precision Agriculture Create Opportunities in the Agricultural Ventilation Fans Market.

Innovations in precision agriculture are creating significant opportunities in the agricultural ventilation fans market by enabling more efficient and data-driven farm management. Precision agriculture leverages technologies such as IoT sensors, automated climate control systems, and AI-based analytics to monitor and regulate environmental conditions within livestock and poultry facilities. For instance, smart ventilation systems can automatically adjust airflow, temperature, and humidity based on real-time data, ensuring optimal conditions for animal health and productivity.

According to studies, implementing precision climate control can reduce energy consumption by up to 30% while maintaining ideal conditions for livestock. For instance, in poultry farming, automated ventilation systems can help maintain consistent temperatures, reducing the risk of heat stress and disease outbreaks. Additionally, integrated systems allow farmers to receive alerts and remotely control fan operations via smartphones or computers, enhancing convenience and responsiveness. As precision agriculture continues to evolve, it opens up new avenues for technologically advanced, efficient, and sustainable ventilation solutions in animal farming.

Trends

Focus on Energy-Efficient Fans.

The growing emphasis on sustainability and cost reduction is driving a strong trend toward energy-efficient fans in the agricultural ventilation market. Farmers are increasingly adopting high-efficiency fan systems that consume less power while maintaining optimal airflow, helping to reduce energy bills and lower carbon footprints.

- According to the U.S. Department of Agriculture (USDA), ventilation systems can account for up to 20-25% of a livestock facility’s total energy usage, making energy efficiency a key consideration.

Modern fans equipped with variable frequency drives (VFDs), brushless DC motors, and aerodynamic blades are capable of reducing energy consumption by 30–50% compared to traditional models. For instance, tunnel ventilation systems using high-efficiency fans can provide consistent airflow with significantly reduced power input, which is particularly beneficial in large-scale poultry and swine operations. In addition to cost savings, energy-efficient systems support compliance with environmental regulations, making them a practical and responsible choice for modern agricultural operations.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the Agricultural Ventilation Fans Market.

Geopolitical tensions have had a notable impact on the agricultural ventilation fans market, disrupting global supply chains and increasing the cost of raw materials and components. Conflicts and trade disputes between major economies have led to tariffs, export restrictions, and logistical challenges, affecting the availability of essential materials such as steel, aluminum, and electronic components used in fan manufacturing. For instance, the United States is a large market for ventilation fans, and several Asian countries export their raw materials or the finished product to the country.

However, escalated tariffs imposed by the United States have resulted in delays and higher costs for motors and control systems that are imported, which are critical for assembling advanced ventilation units. Similarly, due to tensions in shipping routes such as the South China Sea, shipping costs for machinery and equipment rose by at least 25%. The disruptions slow down production and increase the final cost for end users, farmers, and agricultural enterprises, who may postpone investments due to economic uncertainty.

Regional Analysis

Europe was the Largest Market for Agricultural Ventilation Fans in 2024.

Europe held the major share of the global agricultural ventilation fans market, valued at around US$ 300.5 million, commanding an estimated 34.9% of the total revenue share. Europe has emerged as the largest market for agricultural ventilation fans, driven by its advanced livestock farming practices, stringent animal welfare regulations, and strong focus on sustainable agriculture.

European countries such as Germany, the Netherlands, Denmark, and France have highly developed animal husbandry sectors, where maintaining optimal indoor air quality is critical for productivity and compliance. The European Union enforces strict welfare standards through regulations such as Council Directive 98/58/EC, which mandates proper ventilation and environmental control in animal housing. For instance, in Dutch pig farms, automated ventilation systems are commonly used to control temperature and humidity, reducing stress and improving feed efficiency.

Additionally, the region’s focus on reducing greenhouse gas emissions has led to a growing preference for energy-efficient ventilation solutions. Similarly, farmers are adopting smart ventilation systems integrated with IoT sensors to monitor barn conditions in real-time, ensuring compliance and enhancing animal health. These factors collectively support Europe’s leadership in adopting modern agricultural ventilation technologies.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major global participants in the agricultural ventilation fans market are AirMax Fans, American Coolair, Bigass Fans, Multi-Wing America, Osborne Industries, QC Supply, Schaefer, Vostermans Ventilation, New York Blower Company, and ebm-papst.

AirMax Fans is a direct manufacturer of high-velocity industrial fans, exhaust systems, and pedestals, as well as a reseller of other ventilation products. They are committed to excellent service, quick delivery, and assisting customers through the entire process of solving airflow problems.

American Coolair Corporation is a privately held, family-founded American manufacturer of premium ventilation and evaporative cooling systems. The company emphasizes the use of quality materials and precise engineering to create durable, energy-efficient ventilation systems that provide years of reliable service.

Schaefer, now a division of Pinnacle Climate Technologies, is a long-established manufacturer of agricultural ventilation fans, specializing in reliable, high-performance air circulation and climate control solutions for livestock, horticultural, and industrial applications. The company is known for its innovation in thermal comfort products, including various types of fans, evaporative cooling systems, and radiant heaters.

The major players in the industry

- AirMax Fans

- American Coolair Corp.

- Bigass Fans

- Multi-Wing America, Inc.

- OSBORNE INDUSTRIES INC.

- QC Supply

- Schaefer

- Vostermans Ventilation

- New York Blower Company

- ebm-papst

- Other Players

Key Strategies

- Smart Technology Integration, the manufacturers incorporate Internet of Things (IoT) and automation into agricultural ventilation systems to optimize performance by deploying sensors to collect real-time data on temperature, humidity, and other environmental factors. This data is sent to a central system for analysis, allowing for automated, real-time adjustments to ventilation, fans, and misting systems to maintain optimal growing conditions, which increases crop yield, reduces resource waste, and improves operational efficiency.

- Customization, the manufacturers offer customized ventilation solutions for farms involving a comprehensive assessment of the specific farm’s needs, such as livestock type, building dimensions, and regional climate, to design a system that provides controlled airflow, temperature regulation, and air quality management. Solutions can range from natural ventilation to complex mechanical systems, often incorporating elements such as ductwork, fans, and air distribution systems to ensure fresh air is consistently delivered at the animal level while controlling moisture, gases, and pathogens.

Report Scope

Report Features Description Market Value (2024) USD 861.1 Mn Forecast Revenue (2034) USD 2076.3 Mn CAGR (2025-2034) 9.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Duct Fans, Circulation Fans, Exhaust Fans, Portable Fans, Others), By Application (Dairy/Livestock, Equine, Greenhouse, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape AirMax Fans, American Coolair Corp., Bigass Fans, Multi-Wing America, Inc., OSBORNE INDUSTRIES INC., QC Supply, Schaefer, Vostermans Ventilation, New York Blower Company, ebm-papst, Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Agricultural Ventilation Fans MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Agricultural Ventilation Fans MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AirMax Fans

- American Coolair Corp.

- Bigass Fans

- Multi-Wing America, Inc.

- OSBORNE INDUSTRIES INC.

- QC Supply

- Schaefer

- Vostermans Ventilation

- New York Blower Company

- ebm-papst

- Other Players