Global Agricultural In-Cab Display Market Size, Share, And Enhanced Productivity By Size (Small Displays (up to 5 inch), Medium Displays (5.1 to 10 inch), Large Displays (above 10.1 inch)), By Distribution Type (Integrated Display Sales, Standalone Display Sales, Mounted Displays (Equipment/Tractor), Handheld Displays), By Application (Application Control, Equipment Control, Data Management, Equipment Monitoring, Others), By Display (Touch Screen, Non-Touch Screen), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 178022

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

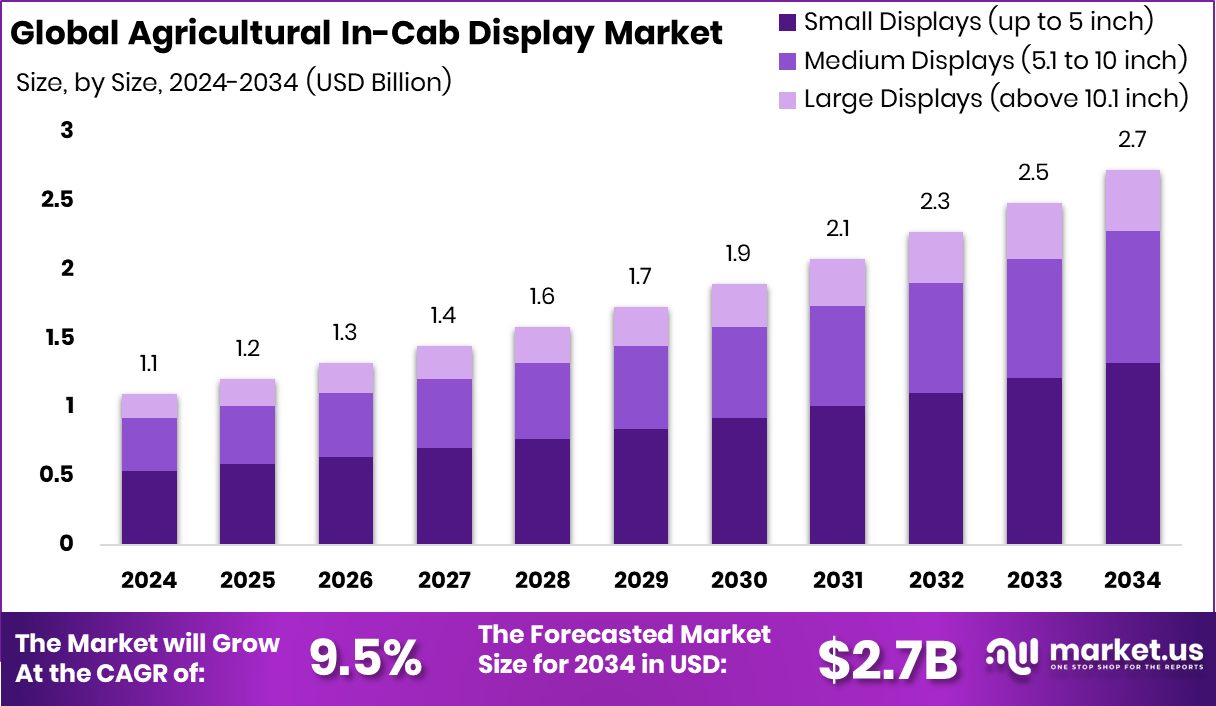

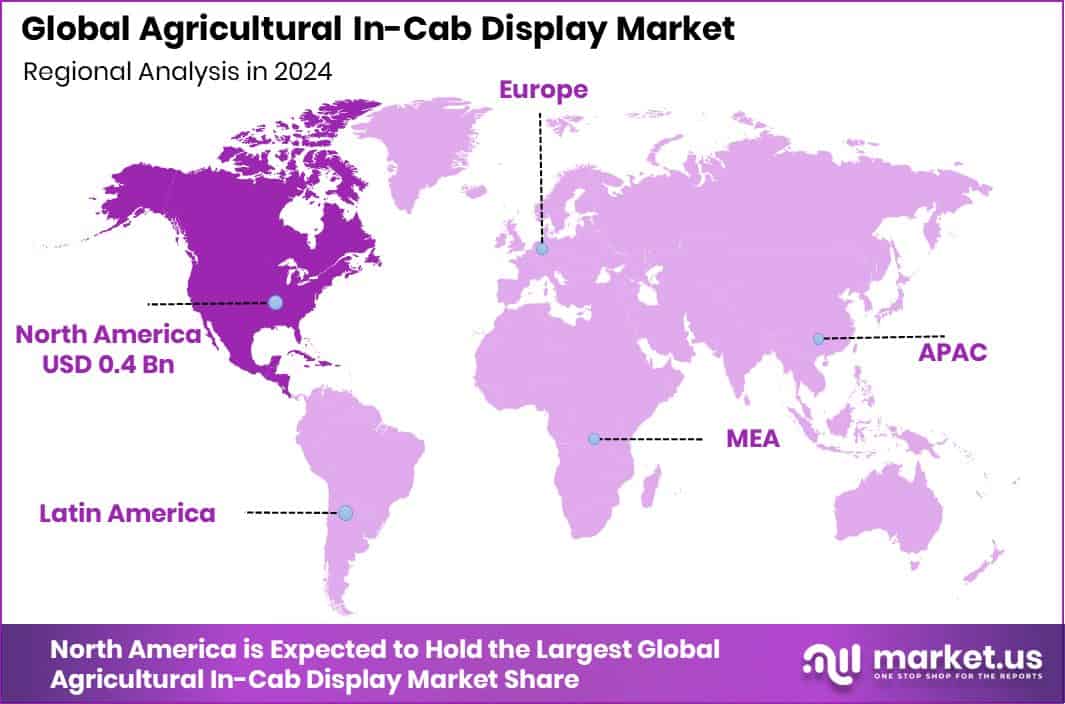

The Global Agricultural In-Cab Display Market is expected to be worth around USD 2.7 billion by 2034, up from USD 1.1 billion in 2024, and is projected to grow at a CAGR of 9.5% from 2025 to 2034. North America accounted for 37.1%, reaching USD 0.4 Bn.

Agricultural In-Cab Display is a digital screen installed inside farm machinery such as tractors, harvesters, and sprayers. It allows operators to monitor machine performance, adjust operational settings, and access real-time field data directly from the cabin. These displays serve as the main interface between the operator and advanced agricultural systems, helping improve accuracy, efficiency, and decision-making during farming activities. Modern systems range from small screens for basic monitoring to large touch-enabled panels that manage complex precision farming functions.

The Agricultural In-Cab Display Market refers to the global demand and supply of these integrated and standalone display systems across various farm equipment categories. The market includes small, medium, and large displays distributed through integrated OEM sales, mounted systems, and handheld units. Applications span equipment control, application control, data management, and monitoring, with both touch and non-touch interfaces serving diverse farming needs.

Growth in this market is strongly linked to rising investment in agricultural technology and automation. Funding activity, such as Verdant Robotics raising $46.5 million to advance autonomous precision farming, and Growmark and CHS forming a $50 million fund for ag-tech start-ups, reflects increasing capital flow into smart farming solutions. Farmobile’s $18 million Series B funding further highlights the push toward data-driven agriculture.

Demand is expanding as farmers seek better productivity, real-time monitoring, and simplified machine control. Opportunities lie in connected farming ecosystems, data integration platforms, and expanding digital adoption across developing agricultural regions.

Key Takeaways

- The Global Agricultural In-Cab Display Market is expected to be worth around USD 2.7 billion by 2034, up from USD 1.1 billion in 2024, and is projected to grow at a CAGR of 9.5% from 2025 to 2034.

- Small Displays up to five inches dominate the Agricultural In-Cab Display Market with 48.6% share.

- Integrated display sales lead the Agricultural In-Cab Display Market distribution segment, holding 68.3% share.

- Equipment control applications account for 31.9% within the Agricultural In-Cab Display Market globally.

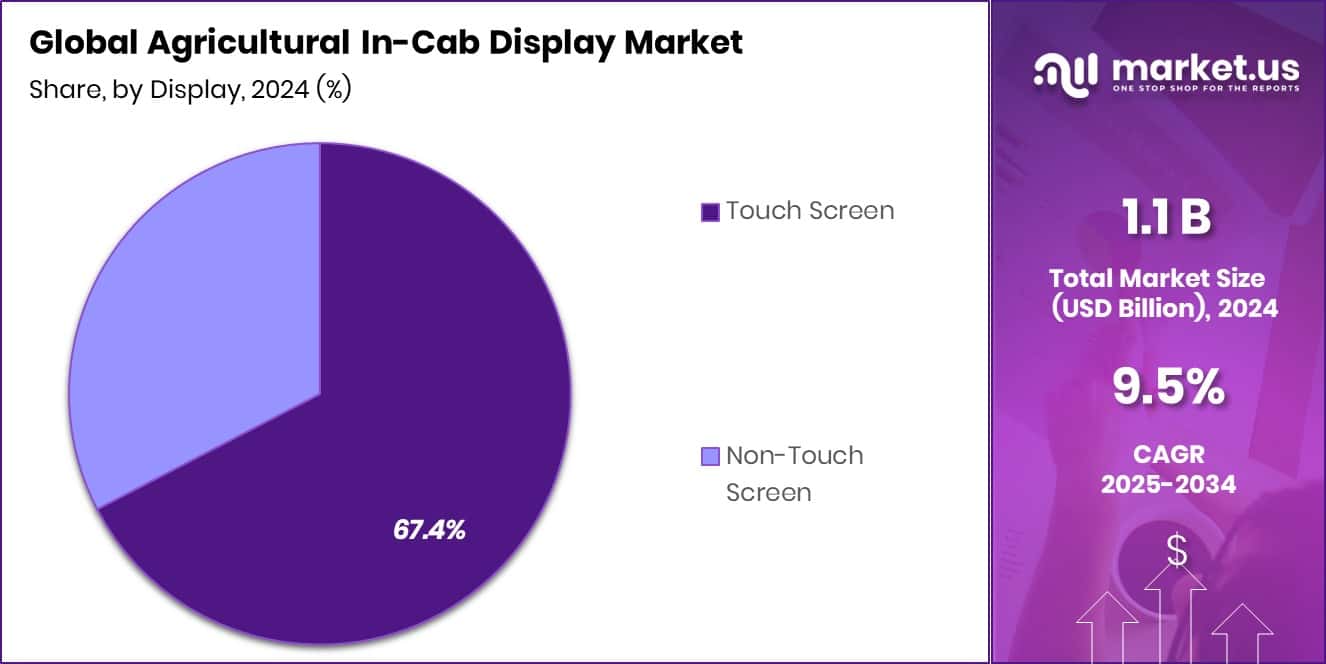

- Touch screen technology captures 67.4% share in the Agricultural In-Cab Display Market segment.

- North America generated USD 0.4 Bn in revenue in 2024.

By Size Analysis

Agricultural In-Cab Display Market sees small displays dominating with 48.6% share.

In 2024, the Small Displays segment, defined as screens up to 5 inches, accounted for 48.6% of the Agricultural In-Cab Display Market, reflecting strong demand for compact and cost-effective interface systems in tractors, harvesters, and sprayers. Farmers increasingly prefer smaller displays for essential machine data such as speed, fuel levels, engine diagnostics, and basic guidance functions. These units are easier to integrate into compact cabins and mid-range equipment, especially in emerging agricultural economies where affordability and simplicity remain key purchasing criteria.

Manufacturers are focusing on improving brightness, durability, and anti-glare performance to ensure visibility under harsh field conditions. The segment also benefits from growing adoption among small and medium-sized farms seeking practical digital upgrades without investing in larger, high-cost display systems.

By Distribution Type Analysis

Agricultural In-Cab Display Market leads through integrated display sales at 68.3%.

In 2024, Integrated Display Sales dominated the Agricultural In-Cab Display Market with a 68.3% share, indicating that most displays are sold as factory-installed components rather than aftermarket additions. Original equipment manufacturers are embedding advanced display systems directly into new agricultural machinery to enhance user experience and machine intelligence. This trend aligns with rising demand for connected farming solutions, telematics integration, and precision agriculture tools.

Integrated systems provide seamless compatibility with onboard sensors, GPS modules, and machine control units, reducing installation complexity and performance issues. Farmers prefer integrated displays due to warranty coverage, software optimization, and long-term reliability. As machinery modernization accelerates globally, OEM-driven integrated display solutions are expected to maintain strong momentum across developed and developing agricultural markets.

By Application Analysis

Agricultural In-Cab Display Market is driven by equipment control applications at 31.9%.

In 2024, Equipment Control emerged as a leading application segment with a 31.9% share in the Agricultural In-Cab Display Market, highlighting the growing role of digital interfaces in managing critical farming operations. In-cab displays are increasingly used to monitor and control seeding rates, fertilizer application, irrigation settings, and harvesting parameters in real time. These systems enable operators to make quick adjustments directly from the cabin, improving efficiency and reducing input waste.

The integration of GPS-guided automation and variable rate technology further strengthens the importance of display-driven equipment control. As farms continue to adopt precision agriculture practices to enhance productivity and sustainability, demand for advanced control-oriented display systems is expected to expand steadily across large-scale and technologically progressive farming operations.

By Display Analysis

Agricultural In-Cab Display Market prefers touch screen displays, holding 67.4%.

In 2024, Touch Screen displays held a dominant 67.4% share of the Agricultural In-Cab Display Market, reflecting the industry’s shift toward more intuitive and user-friendly interfaces. Touch-enabled systems allow operators to navigate menus, adjust settings, and access data quickly without relying on multiple physical buttons. This design improves operational efficiency, especially during long working hours in the field.

Manufacturers are enhancing touch sensitivity, glove compatibility, and ruggedness to withstand dust, vibration, and temperature fluctuations. The growing familiarity of farmers with smartphone and tablet technology also supports the rapid adoption of touchscreen displays in agricultural machinery. As digital farming ecosystems expand, touch-based interfaces are becoming central to seamless machine connectivity, diagnostics, and real-time decision-making within modern farm cabins.

Key Market Segments

By Size

- Small Displays (up to 5 inch)

- Medium Displays (5.1 to 10 inch)

- Large Displays (above 10.1 inch)

By Distribution Type

- Integrated Display Sales

- Standalone Display Sales

- Mounted Displays (Equipment/Tractor)

- Handheld Displays

By Application

- Application Control

- Equipment Control

- Data Management

- Equipment Monitoring

- Others

By Display

- Touch Screen

- Non-Touch Screen

Driving Factors

Rising demand for precision farming technology

Rising demand for precision farming technology continues to support the expansion of the Agricultural In-Cab Display Market. Farmers are increasingly adopting digital systems to manage seeding, spraying, and harvesting activities with greater accuracy and efficiency. In-cab displays play a central role in delivering real-time field data, machine diagnostics, and operational control from inside the tractor cabin.

The broader environment of public funding and technology support also reflects the importance of digital systems across sectors, such as NYC Health + Hospitals/Metropolitan, receiving $4 million in funding from NYC Council Deputy Speaker Diana Ayala to strengthen infrastructure and technology capabilities. Similar funding momentum across industries reinforces confidence in digital transformation, indirectly supporting agricultural equipment modernization and smart interface adoption in farming operations worldwide.

Restraining Factors

High costs of advanced display systems

High costs of advanced display systems remain a significant challenge for widespread adoption, particularly among small and mid-sized farms. Modern in-cab displays equipped with touchscreen interfaces, GPS integration, and real-time analytics can substantially increase overall machinery costs. Budget limitations often delay upgrades, especially in regions where agricultural profitability fluctuates due to commodity price volatility.

At the same time, public spending priorities in other infrastructure areas, such as Colorado potentially receiving $43 million more for air-quality monitoring and electric lawn equipment rebates, highlight how funding allocation can shift toward environmental initiatives rather than farm equipment digitization. These financial dynamics may limit immediate investment in premium in-cab display technologies, slowing adoption rates in cost-sensitive agricultural markets.

Growth Opportunity

Expansion into emerging agricultural markets

Expansion into emerging agricultural markets presents strong growth opportunities for the Agricultural In-Cab Display Market. Developing economies are gradually modernizing their farming equipment fleets, creating demand for affordable and scalable digital display systems. As farms grow larger and more mechanized, operators require better monitoring and control tools inside cabins.

Broader industrial technology funding trends also signal opportunities for crossover innovation, such as Tractian raising $15 million to monitor industrial equipment through advanced analytics. Similar monitoring principles can be adapted to agricultural machinery, strengthening predictive maintenance and operational efficiency. As digital awareness increases in emerging markets, manufacturers can introduce adaptable display platforms tailored to regional farming practices and cost structures.

Latest Trends

Touchscreen displays replacing physical controls

Touchscreen displays are steadily replacing traditional physical control panels in modern agricultural machinery. Farmers prefer intuitive interfaces that resemble smartphones and tablets, enabling faster navigation and simplified operation during fieldwork. Larger screens with improved brightness and durability are becoming common in newly manufactured tractors and harvesters.

Parallel advancements in industrial monitoring technologies further influence display evolution, as seen when Tractian secured $45 million to expand AI-based machinery monitoring solutions. Although focused on industrial equipment, such investments demonstrate strong market confidence in real-time monitoring and digital control systems. These trends continue to shape next-generation in-cab displays, emphasizing connectivity, ease of use, and integrated machine intelligence across agricultural operations.

Regional Analysis

North America dominated the Agricultural In-Cab Display Market with a 37.1% share.

In 2024, North America emerged as the dominating region in the Agricultural In-Cab Display Market, accounting for 37.1% of the global share and generating USD 0.4 Bn in revenue. The region’s leadership is supported by strong adoption of precision agriculture technologies and advanced farm machinery integration.

Europe represents another significant regional market, driven by steady mechanization trends and increasing focus on digital farming solutions across key agricultural economies. Asia Pacific is witnessing a gradual expansion, supported by rising awareness of smart farming practices and the modernization of agricultural equipment in developing countries.

The Middle East & Africa region shows developing potential, with adoption primarily concentrated in large-scale commercial farming operations. Latin America is also progressing steadily, backed by expanding agribusiness activities and improving access to modern agricultural machinery.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Deere & Company continues to position its integrated display systems as part of a broader precision agriculture ecosystem, aligning displays with machine automation, connectivity, and data-driven farm management tools. The company’s strong brand presence and vertically integrated approach allow it to embed advanced display solutions directly into its equipment portfolio.

AGCO Corporation maintains a focused strategy centered on smart farming technologies across its machinery brands. Its in-cab displays are designed to enhance operator efficiency, simplify machine controls, and support precision applications. By emphasizing user-friendly interfaces and compatibility with advanced farming systems, AGCO strengthens its value proposition among professional farmers seeking productivity gains.

CNH Industrial N.V. advances its in-cab display offerings through technology integration and operator-centric design. The company prioritizes intuitive controls, real-time monitoring, and seamless system connectivity within its agricultural equipment range. Collectively, these players drive innovation, integration, and competitive differentiation within the agricultural in-cab display market.

Top Key Players in the Market

- Deere & Company

- AGCO Corporation

- CNH Industrial N.V.

- Trimble Inc.

- Topcon Positioning Systems

- CLAAS KGaA mbH

- Kubota Corporation

- Hexagon AB

- AG Leader Technology

- Hemisphere GNS

Recent Developments

- In December 2025, Deere & Company entered an agreement to acquire Tenna, a technology firm that provides fleet tracking and asset visibility solutions. While not directly an in-cab display product, this acquisition supports broader operational visibility and data sharing that benefits machine interfaces and monitoring in agricultural settings.

- In August 2024, AGCO launched new agricultural products and showcased farmer-focused solutions at the 2024 Farm Progress Show in Boone, Iowa. AGCO’s exhibit featured new tractors from its Fendt® and Massey Ferguson® brands along with precision ag displays like PTx Trimble™ and Precision Planting® technology, giving farmers hands-on access to advanced equipment and digital solutions.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Billion Forecast Revenue (2034) USD 2.7 Billion CAGR (2025-2034) 9.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Size (Small Displays (up to 5 inch), Medium Displays (5.1 to 10 inch), Large Displays (above 10.1 inch)), By Distribution Type (Integrated Display Sales, Standalone Display Sales, Mounted Displays (Equipment/Tractor), Handheld Displays), By Application (Application Control, Equipment Control, Data Management, Equipment Monitoring, Others), By Display (Touch Screen, Non-Touch Screen) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Deere & Company, AGCO Corporation, CNH Industrial N.V., Trimble Inc., Topcon Positioning Systems, CLAAS KGaA mbH, Kubota Corporation, Hexagon AB, AG Leader Technology, Hemisphere GNS Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Agricultural In-Cab Display MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Agricultural In-Cab Display MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Deere & Company

- AGCO Corporation

- CNH Industrial N.V.

- Trimble Inc.

- Topcon Positioning Systems

- CLAAS KGaA mbH

- Kubota Corporation

- Hexagon AB

- AG Leader Technology

- Hemisphere GNS