Global Aerospace Coatings Market Size, Share, And Industry Analysis Report By Resin Type (Epoxy, Polyurethane, Acrylic, Others), By Technology (Solvent-borne, Water-borne, Others), By Aviation Type (Commercial Aviation, Military Aviation, General Aviation), By End User (Original Equipment Manufacturer (OEM), Maintenance, Repair and Operations (MRO)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177230

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

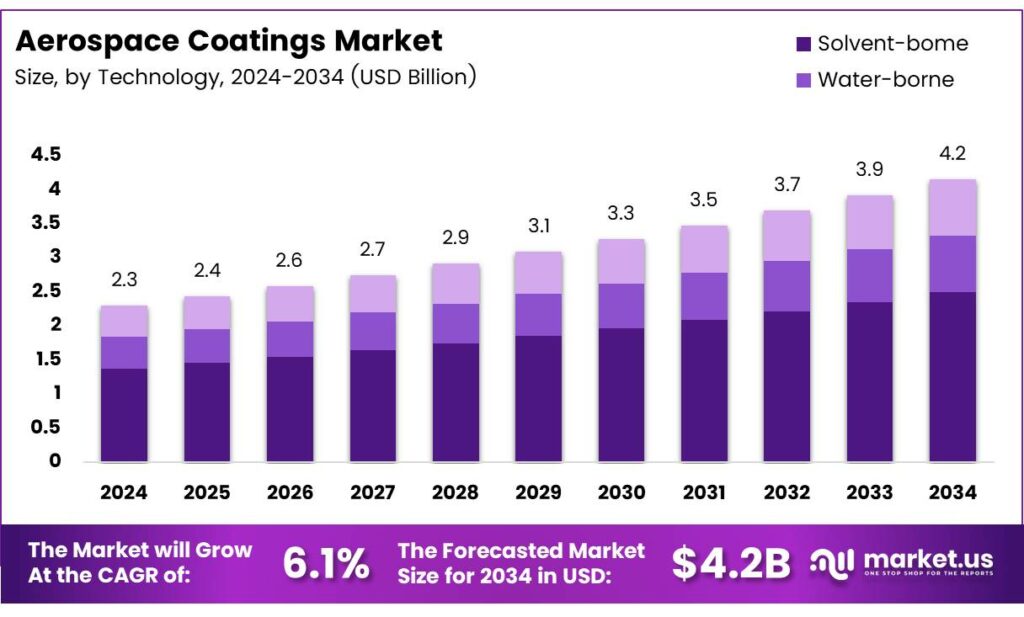

The Global Aerospace Coatings Market size is expected to be worth around USD 4.2 billion by 2034, from USD 2.3 billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034.

The aerospace coatings market includes high-performance paints and surface protection materials used on aircraft exteriors and interiors. These coatings protect against corrosion, UV exposure, temperature shifts, and fluid abrasion. They also support fuel efficiency, brand visibility, and regulatory compliance. The market expands as the aviation sector adopts advanced materials, sustainable technologies, and high-durability coating solutions.

The aerospace coatings market continues to evolve as airlines prioritize operational efficiency and sustainability. Manufacturers increasingly adopt lightweight coating chemistries to reduce fuel burn and maintenance cycles. At the same time, regulatory agencies push for safer, low-VOC formulations, encouraging faster innovation across the coatings ecosystem.

- The airline industry has regained 90% of its pre-pandemic traffic, driving higher demand for aerospace coatings as aircraft operate more frequently and require more repainting. PPG notes that coatings designed to withstand 40,000-foot altitudes and Mach 0.86 speeds need advanced polymer engineering, underscoring the growing reliance on high-performance resins as modern fleets face more demanding conditions.

The industry also benefits from expanding global air travel, which boosts OEM production rates and maintenance repainting cycles. As emerging markets increase passenger capacity, aerospace coatings suppliers gain long-term demand visibility. Meanwhile, sustainability initiatives accelerate transitions toward water-based and chrome-free coatings aligned with environmental policy developments.

Key Takeaways

- The Global Aerospace Coatings Market is projected to reach USD 4.2 billion by 2034, rising from USD 2.3 billion in 2024, at a 6.1% CAGR during 2025–2034.

- Epoxy resin leads the market with a dominant 45.7% share due to its high durability.

- Solvent-borne coatings hold the highest technology share at 59.8% in 2025.

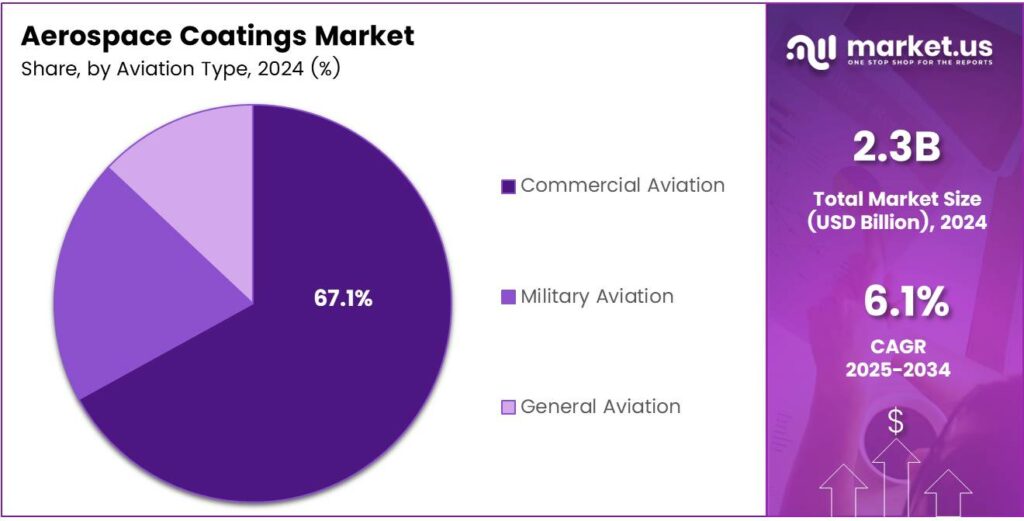

- Commercial Aviation remains the top aviation segment with a 67.1% market share.

- OEM end users dominate with a 59.2% share driven by strong aircraft production.

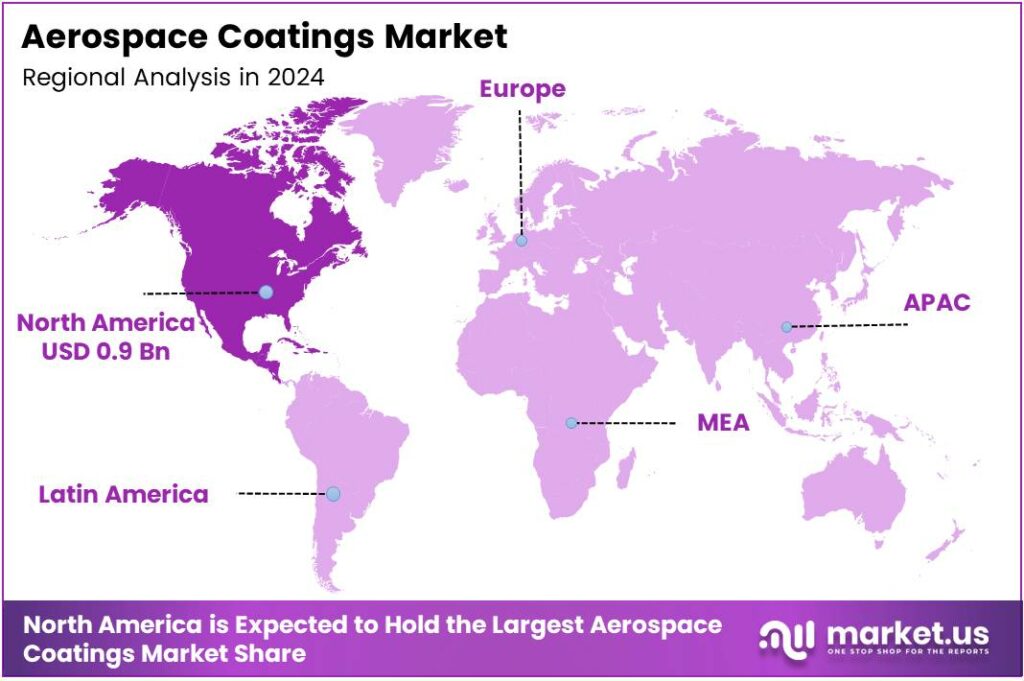

- North America leads globally with a 41.9% regional share, valued at USD 0.9 billion.

By Resin Type Analysis

Epoxy dominates with 45.7% due to its superior durability and corrosion resistance.

In 2025, Epoxy held a dominant market position in the By Resin Type segment of the Aerospace Coatings Market, with a 45.7% share. It continued gaining preference as aircraft manufacturers increasingly valued high-strength coatings. Additionally, its robust adhesion and chemical resistance supported longer maintenance cycles and improved operational efficiency across aviation platforms.

Polyurethane coatings expanded steadily as aircraft surfaces required flexible finishes. This type offered strong UV stability and gloss retention, helping airlines maintain visual appeal. Its ability to resist weathering contributed to rising usage, especially in commercial fleets. The segment benefited from technological improvements that enhanced coating durability while supporting environmental compliance.

Acrylic coatings gained traction through cost advantages and easier application. Their ability to deliver quick-drying finishes supported fast turnaround in repainting and maintenance projects. The segment advanced as emerging aerospace suppliers adopted lightweight coating materials, aligning with fuel-efficiency improvements. Acrylic became a favorable option for non-critical surfaces needing aesthetic enhancement.

By Technology Analysis

Solvent-borne dominates with 59.8% due to its proven performance and long-standing industry trust.

In 2025, Solvent-borne technology held a dominant market position in the By Technology segment of the Aerospace Coatings Market, with a 59.8% share. Its reliability in harsh operating environments sustained strong adoption. Aircraft manufacturers valued its consistent application quality, making it a preferred choice for mission-critical coating layers across fleets.

Water-borne coatings gained momentum as airlines and OEMs prioritized sustainability. Reduced VOC emissions and compliance with global regulations strengthened demand. These coatings advanced through innovations improving drying time and adhesion, allowing broader usage. Their adoption grew within newer aircraft programs focused on balancing environmental responsibility with operational performance.

Other technology options included powder coatings and emerging advanced chemistries. These alternatives catered to specific aerospace needs where traditional coatings faced limitations. Their adoption increased in specialized components requiring maximum durability. While modest in share, they expanded gradually as manufacturers experimented with novel materials supporting next-generation aerospace structures.

By Aviation Type Analysis

Commercial Aviation dominates with 67.1%, driven by fleet expansion and heavy maintenance activity.

In 2025, Commercial Aviation held a dominant market position in the By Aviation Type segment of the Aerospace Coatings Market, with a 67.1% share. Strong global passenger traffic and rising aircraft deliveries supported coating demand. Airlines invested in protective finishes to enhance fuel efficiency, exterior durability, and brand visibility across expanding fleets.

Military Aviation coatings progressed due to increasing defense modernization programs. These coatings provided stealth properties, corrosion resistance, and thermal protection. Governments worldwide invested in advanced aircraft, supporting consistent usage. As performance requirements grew more complex, specialized military-grade coatings gained strategic importance in mission-critical operations.

General Aviation continued evolving as private aircraft usage increased. Coatings demand rose among business jets, helicopters, and small aircraft requiring lightweight and aesthetic finishes. Manufacturers integrated modern materials to improve longevity and reduce maintenance frequency. Enhanced surface protection supported wider adoption across recreational and corporate aviation.

By End User Analysis

Original Equipment Manufacturer (OEM) dominates with 59.2% driven by rising aircraft production cycles.

In 2025, Original Equipment Manufacturer (OEM) held a dominant market position in the By End User segment of the Aerospace Coatings Market, with a 59.2% share. The increasing production of commercial and defense aircraft boosted demand. OEMs adopted advanced coatings to improve component reliability, reduce weight, and enhance long-term asset performance.

Maintenance, Repair, and Operations (MRO) expanded as airlines focused on fleet upkeep. Higher aircraft utilization increased repainting and refurbishment activities. MRO providers adopted faster-curing coatings to reduce downtime and improve operational efficiency. The segment benefited from long-term service agreements and the global expansion of maintenance networks supporting aging aircraft fleets.

Key Market Segments

By Resin Type

- Epoxy

- Polyurethane

- Acrylic

- Others

By Technology

- Solvent-borne

- Water-borne

- Others

By Aviation Type

- Commercial Aviation

- Military Aviation

- General Aviation

By End User

- Original Equipment Manufacturer (OEM)

- Maintenance, Repair, and Operations (MRO)

Emerging Trends

Shift Toward Nanotechnology-Enhanced and Smart Aerospace Coatings

One of the strongest trends shaping the aerospace coatings market is the adoption of nanotechnology. Nano-coatings offer superior scratch resistance, UV protection, and improved adhesion, making them ideal for both exterior and interior aircraft surfaces. Their lightweight nature also aligns with aviation’s push for better fuel efficiency.

- Smart coatings are another fast-emerging trend. These coatings can change color, detect corrosion early, or heal minor surface damage. In the U.S., the aerospace manufacturing and rework NESHAP standards set a VOC content cap for many aircraft topcoats at 420 g/L (3.5 lb/gal) as applied (with a higher allowance for certain general aviation rework cases).

Digitalization is also influencing the market. Aircraft manufacturers increasingly use robotic and automated coating systems to achieve precise application, reduce material waste, and maintain consistent quality. Combined with sustainability trends and the industry’s growing interest in high-durability formulas, these innovations are setting a new standard for modern aerospace coatings.

Drivers

Growing Need for Lightweight and Fuel-Efficient Aircraft Coatings

Lightweight and fuel-efficient aircraft are becoming essential for airlines as they try to cut operating costs and meet strict emission rules. Aerospace coatings play a major role by reducing drag, improving aerodynamics, and protecting aircraft surfaces from corrosion. This push for energy-efficient fleets encourages manufacturers to invest in advanced coating technologies that help aircraft fly longer while consuming less fuel.

- The need for protective and performance-enhancing coatings rises sharply. Coatings that improve durability and reduce maintenance downtime are now prioritized because they help operators keep aircraft in service for longer periods. PPG’s Desothane HS CA 8000 series states the coating is VOC compliant at 420 grams/liter of VOC, which aligns with the regulatory ceiling and supports ready-to-spray workflows that help reduce rework time.

Modern aircraft use more carbon-fiber structures, which require specialized coatings for protection and long-term stability. This shift creates new demand for coatings with stronger adhesion, UV resistance, and thermal stability. Together, these factors make advanced aerospace coatings essential for next-generation aircraft performance.

Restraints

High Regulatory and Safety Compliance Costs Slow Market Expansion

A major restraint in the aerospace coatings market is the strict regulatory environment. Aviation coatings must meet rigorous safety, durability, and environmental standards, which increases development time and certification costs. Manufacturers often spend years testing formulas to ensure they can withstand extreme temperatures, pressure changes, and chemical exposure encountered during flights.

- Environmental regulations limit the use of volatile organic compounds (VOCs) and hazardous chemicals in coating formulations. While necessary for sustainability, these rules require companies to reformulate products, invest in cleaner technologies, and upgrade manufacturing systems—raising production costs. In the U.S., OSHA sets the permissible exposure limit (PEL) for chromium(VI) at 5 µg/m³ as an 8-hour time-weighted average, with an action level at 2.5 µg/m³.

Specialized resins, pigments, and additives used in aerospace coatings are expensive and sensitive to global supply disruptions. When supply chains tighten, production delays occur, slowing the rate at which manufacturers can deliver coatings to aircraft builders and maintenance companies. These combined regulatory and cost pressures limit faster market growth.

Growth Factors

Rising Demand for Eco-Friendly and High-Performance Coating Solutions

One of the biggest growth opportunities in the aerospace coatings market is the global shift toward eco-friendly materials. Airlines and aircraft makers are actively seeking low-VOC and water-based coatings to meet sustainability goals. This demand opens doors for producers to innovate and develop greener solutions without compromising performance or durability.

Another promising opportunity comes from the expansion of the Maintenance, Repair, and Overhaul (MRO) sector. As the number of commercial aircraft increases worldwide, maintenance cycles become more frequent. Each repainting and refurbishment session requires advanced coatings that resist corrosion and improve aesthetics.

The rise of space exploration and satellite launches also broadens the market. Spacecraft require thermal-resistant and radiation-protective coatings that can withstand harsh outer-space conditions. Manufacturers that specialize in high-temperature and anti-erosion technologies are well-positioned to benefit from this new demand.

Regional Analysis

North America Dominates the Aerospace Coatings Market with a Market Share of 41.9%, Valued at USD 0.9 Billion

North America leads the global aerospace coatings market, supported by strong aircraft production, steady defense spending, and an active MRO ecosystem. The region’s dominant 41.9% share reflects stable demand from commercial fleet modernization and military upgrade programs. With a market valuation of USD 0.9 billion, the U.S. remains the core contributor as coating technologies evolve to improve durability, fuel efficiency, and environmental compliance.

Europe remains a high-value market driven by stringent environmental regulations and strong OEM presence across France, Germany, and the U.K. The region benefits from an increasing focus on lightweight, low-VOC coatings and advanced corrosion-resistant systems. Recovery in cross-border air travel and ongoing aircraft modernization programs also reinforce long-term coating demand.

Asia Pacific continues to expand rapidly, fueled by growing aviation passenger traffic, airport development, and rising domestic aircraft production. Countries like China, India, and Japan are investing heavily in fleet expansion and MRO capacity. The region’s upward trajectory is further supported by increasing adoption of high-performance coatings to withstand diverse climatic conditions.

Latin America experiences moderate growth driven by fleet refresh cycles and increasing international route connectivity. Economic recovery and government aviation infrastructure upgrades are gradually improving market stability. Brazil and Mexico remain key contributors as airlines enhance maintenance practices and adopt coatings that support longevity and fuel-saving performance.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2025, Advanced Deposition & Coating Technologies, Inc. stands out for its specialist coating know-how that fits aerospace needs where surface performance and consistency matter. Its value is in process-focused solutions that help customers improve coating quality, reduce rework, and support demanding aerospace component protection.

Akzo Nobel N.V., the analyst’s view is that its strength comes from scale, long-standing aerospace coating expertise, and strong airline/OEM relationships. The company is well placed to benefit as fleets fly more hours, pushing steady demand for durable topcoats, primers, and maintenance repaint cycles across commercial aviation.

Axalta Coating Systems, LLC, the focus is on its practical product portfolio and customer support model that aligns with MRO turnaround pressure. In a market where downtime is costly, suppliers that deliver reliable application performance, repeatable finishes, and fast technical troubleshooting gain an edge with operators and repair facilities.

BASF SE is viewed as a materials-driven player, leveraging deep chemistry and resin capabilities that support advanced coating performance requirements. As aerospace customers look for better corrosion resistance, longer service life, and improved efficiency in coating systems, BASF’s broader materials platform can help it stay relevant across both OEM and aftermarket channels.

Top Key Players in the Market

- Advanced Deposition & Coating Technologies, Inc.

- Akzo Nobel N.V.

- Axalta Coating Systems, LLC

- BASF SE

- BryCoat Inc.

- Henkel AG & Co. KGaA

- Hentzen Coatings, Inc.

- Ionbond

- Jotun

- Mankiewicz Gebr. & Co.

Recent Developments

- In 2025, Advanced Coating was acquired by Novaria Group, a component manufacturing company, enhancing its capabilities in high-risk substrate protection for aerospace and defense. This company specializes in advanced coating solutions, including Parylene conformal coatings and PVD/DLC technologies for aerospace applications.

- In 2025, Akzo Nobel is a major player in aerospace coatings, offering systems like Aerodur and Aviox for aircraft exteriors, interiors, and protective applications. Applied 44 colors using Aerodur 3001 system on a China Southern Airlines C919 livery, setting a record and supporting regional aviation growth via local production in Dongguan.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Billion Forecast Revenue (2034) USD 4.2 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Resin Type (Epoxy, Polyurethane, Acrylic, Others), By Technology (Solvent-borne, Water-borne, Others), By Aviation Type (Commercial Aviation, Military Aviation, General Aviation), By End User (Original Equipment Manufacturer (OEM), Maintenance, Repair and Operations (MRO)) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Advanced Deposition & Coating Technologies, Inc., Akzo Nobel N.V., Axalta Coating Systems, LLC, BASF SE, BryCoat Inc., Henkel AG & Co. KGaA, Hentzen Coatings, Inc., Ionbond, Jotun, Mankiewicz Gebr. & Co. Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Aerospace Coatings MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Aerospace Coatings MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Advanced Deposition & Coating Technologies, Inc.

- Akzo Nobel N.V.

- Axalta Coating Systems, LLC

- BASF SE

- BryCoat Inc.

- Henkel AG & Co. KGaA

- Hentzen Coatings, Inc.

- Ionbond

- Jotun

- Mankiewicz Gebr. & Co.