Global Advanced Battery Market Size, Share Analysis Report By Product (Lithium Ion Polymer Battery, Sodium Sulfur Battery, Sodium Metal Halide Battery, Advanced Lead Acid Battery, Smart Nano Battery, Others), By Application (Consumer Electronics, Automotive Batter, Energy Storage Systems, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154878

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

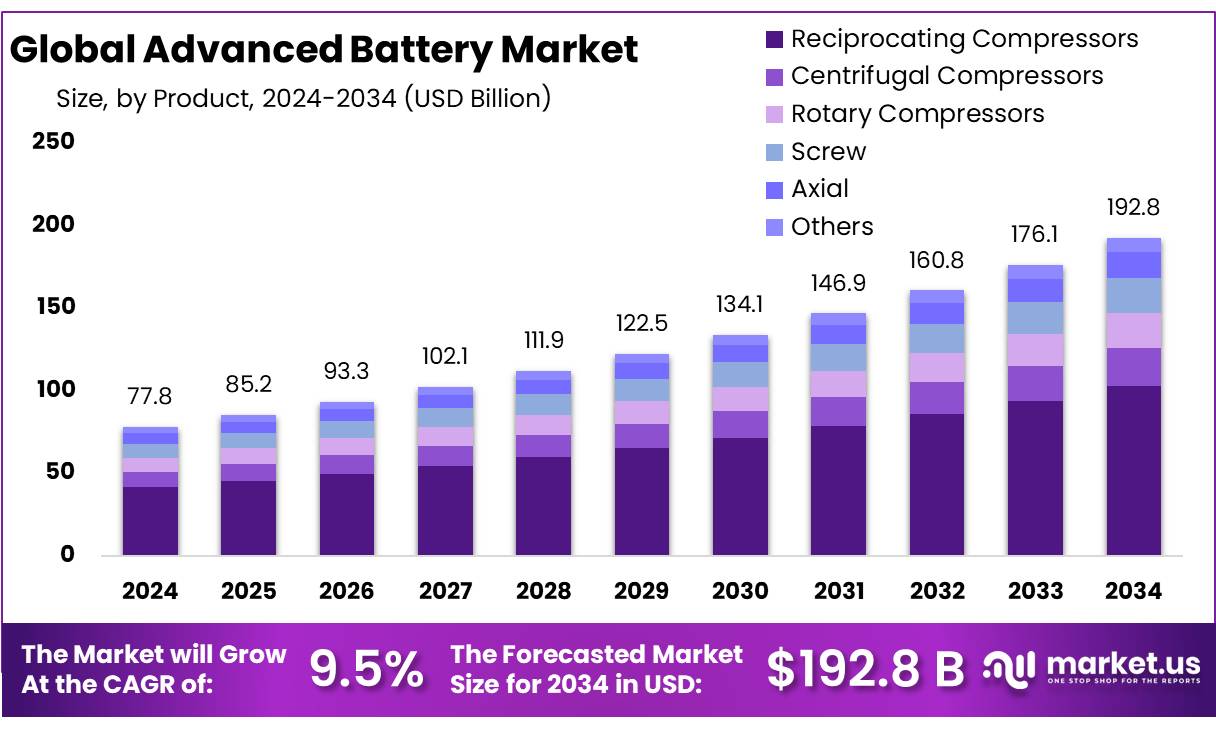

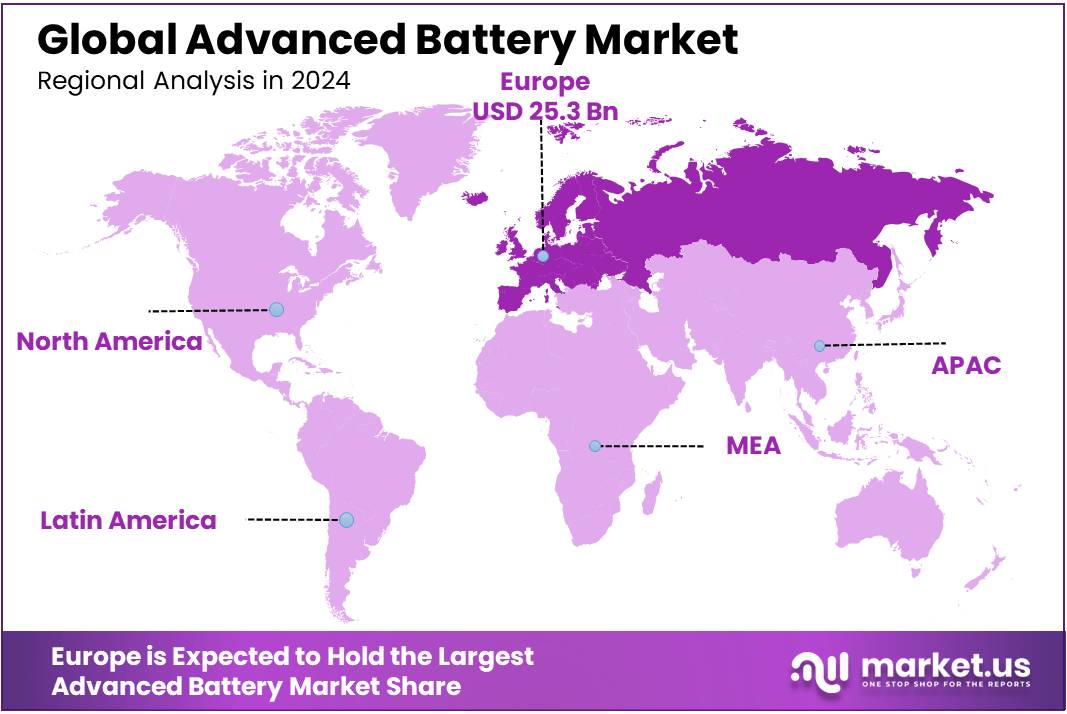

The Global Advanced Battery Market size is expected to be worth around USD 192.8 Billion by 2034, from USD 77.8 Billion in 2024, growing at a CAGR of 9.5% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 32.6% share, holding USD 25.3 Billion revenue.

The advanced battery concentrates industry, integral to the production of high-performance battery cells, is experiencing significant growth, driven by the global shift towards electric vehicles (EVs) and renewable energy storage solutions. These concentrates, composed of active materials such as lithium, cobalt, nickel, and graphite, are essential in manufacturing advanced chemistry cells (ACCs) that power EVs, energy storage systems, and portable electronics. The increasing demand for these applications necessitates a robust supply of high-quality battery concentrates to meet performance and sustainability standards.

Driving factors for the growth of the advanced battery concentrates industry include the escalating demand for EVs, the integration of renewable energy sources, and the need for efficient energy storage solutions. The Indian government’s target to achieve 500 GW of non-fossil fuel-based energy capacity by 2030 necessitates substantial investments in energy storage systems, thereby propelling the demand for advanced battery technologies.

Advanced Battery Concentrates—comprising high‑purity critical minerals and refined precursor materials such as lithium, nickel, cobalt, and graphite—serve as foundational inputs for advanced battery chemistries, including lithium‑ion and next‑generation technologies.

As of 2023, world‑wide demand for electric vehicle batteries surpassed 750 GWh, while global lithium‑ion production capacity approached 2,000 GWh, with approximately 772 GWh consumed in EVs alone. The predominance of lithium‑ion systems is anticipated to persist, comprising around 70% of the rechargeable battery market by 2025. These figures underline the centrality of advanced battery concentrates in facilitating energy transition.

Additionally, the Bureau of Energy Efficiency (BEE) launched the Assistance in Deploying Energy Efficient Technologies in Industries and Establishments (ADEETIE) scheme, with a budget of ₹1,000 crore. This initiative aims to promote advanced energy-efficient technologies in micro, small, and medium enterprises (MSMEs), including those in the battery manufacturing sector.

Private enterprises are also actively contributing to the industry’s growth. For instance, Exide Industries is investing ₹6,000 crore to establish a 12 GWh lithium-ion cell manufacturing plant in Karnataka, aiming to cater to the burgeoning EV market and stationary applications. Similarly, Reliance New Energy Battery Limited has been awarded a 10 GWh ACC capacity under the PLI scheme, signaling a robust entry into the domestic battery manufacturing landscape.

The demand for advanced battery concentrates is propelled by several factors. The Indian government’s target of achieving 500 GW of non-fossil fuel energy capacity by 2030 underscores the need for scalable energy storage solutions. Additionally, the anticipated 48% increase in lithium-ion battery demand by 2030, driven by the adoption of EVs and renewable energy systems, further accentuates the necessity for a robust supply of high-quality battery materials.

Key Takeaways

- Advanced Battery Market size is expected to be worth around USD 192.8 Billion by 2034, from USD 77.8 Billion in 2024, growing at a CAGR of 9.5%.

- Lithium Ion Polymer Battery held a dominant market position, capturing more than a 53.4% share of the global advanced battery market.

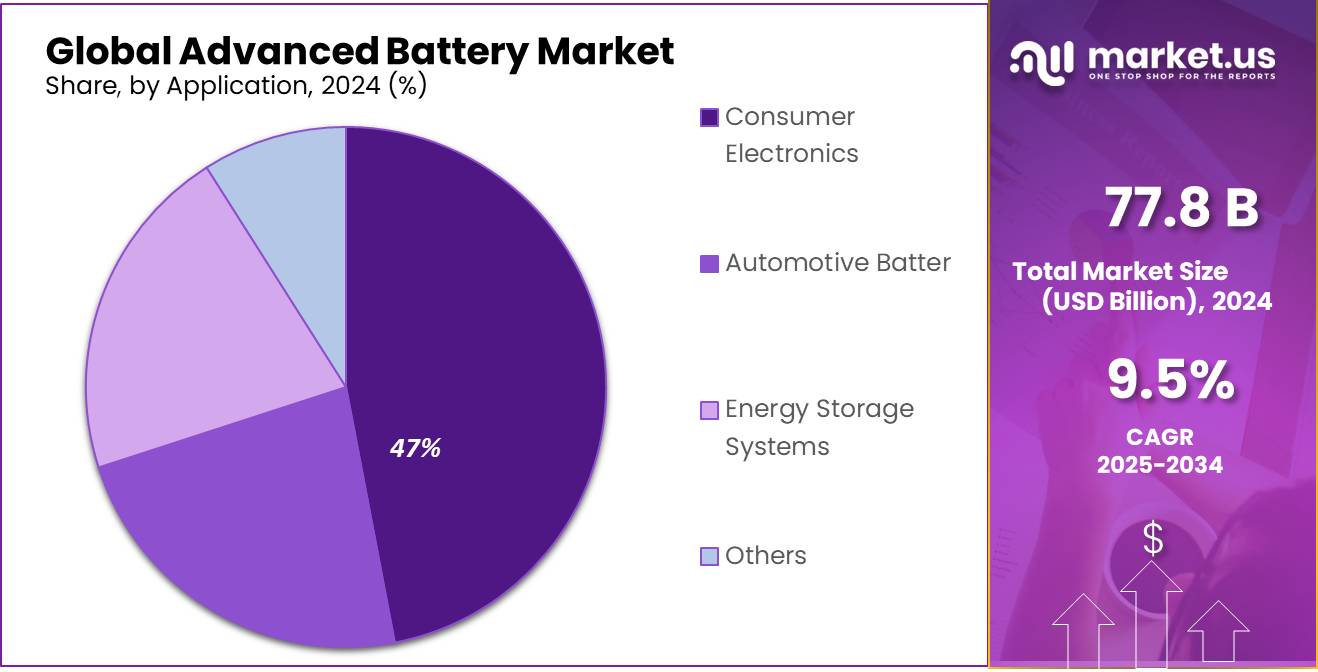

- Consumer Electronics held a dominant market position, capturing more than a 47.8% share of the global advanced battery market.

- Europe emerged as a preeminent region within the advanced battery market, securing a commanding 32.6% share and representing approximately USD 25.3 billion.

By Product Analysis

Lithium Ion Polymer Battery dominates with 53.4% due to its high energy density and compact design.

In 2024, Lithium Ion Polymer Battery held a dominant market position, capturing more than a 53.4% share of the global advanced battery market. This strong lead was largely due to its lightweight structure, high energy density, and ability to be molded into various shapes, which made it ideal for compact electronic devices, electric vehicles, and portable energy storage systems. The year saw growing demand from the electric mobility sector, where manufacturers increasingly chose lithium polymer formats to reduce battery weight without compromising performance.

Additionally, the battery’s improved safety features, such as reduced risk of electrolyte leakage, contributed to its widespread adoption in consumer electronics and industrial tools. Governments across regions continued to support advanced battery development through funding and incentives in 2024 and into 2025, further strengthening the segment’s position. As energy storage and EV industries expand globally, lithium ion polymer batteries are expected to maintain their lead, especially in applications where space, weight, and safety are critical.

By Application Analysis

Consumer Electronics dominates with 47.8% due to growing demand for smartphones, laptops, and wearable devices.

In 2024, Consumer Electronics held a dominant market position, capturing more than a 47.8% share of the global advanced battery market. This dominance was driven by the increasing use of advanced batteries in everyday portable devices like smartphones, tablets, laptops, smartwatches, and wireless earbuds. As consumer preferences continued to shift toward thinner, lighter, and longer-lasting devices, manufacturers favored lithium-based battery technologies that offer high energy density and reliable performance.

The year also saw a surge in global smartphone shipments and growing demand for high-performance electronics, especially in emerging economies, which further boosted battery consumption in this segment. Additionally, the rise of remote work and digital learning created strong year-round demand for laptops and tablets in 2024. These factors together reinforced the leading position of consumer electronics as the primary application for advanced batteries. Looking ahead into 2025, this segment is expected to maintain its momentum, supported by continuous innovations in battery efficiency and the rollout of next-generation connected devices.

Key Market Segments

By Product

- Lithium Ion Polymer Battery

- Sodium Sulfur Battery

- Sodium Metal Halide Battery

- Advanced Lead Acid Battery

- Smart Nano Battery

- Others

By Application

- Consumer Electronics

- Automotive Batter

- Energy Storage Systems

- Others

Emerging Trends

Growth of Solid-State Batteries

One of the most exciting developments in advanced battery technology is the rise of solid-state batteries. These batteries promise to revolutionize energy storage by offering higher energy densities, faster charging times, and enhanced safety compared to traditional lithium-ion batteries.

- Solid-state batteries replace the liquid electrolyte found in conventional batteries with a solid electrolyte, which can lead to significant improvements in performance. For instance, Toyota has been at the forefront of this innovation, securing 8,274 solid-state battery patents between 2020 and 2023. The company plans to begin using these batteries in hybrid vehicles by 2025, with a goal of achieving a 1,000 km driving range and 10-minute fast charging capabilities by 2027–2028.

In the United States, the Department of Energy has been actively supporting the development of solid-state batteries through various initiatives. The Inflation Reduction Act, passed in 2022, includes provisions for advanced manufacturing tax credits that can cover up to $35 per kilowatt-hour for domestic battery production, including solid-state technologies. This policy aims to reduce reliance on foreign battery suppliers and stimulate domestic innovation.

The potential advantages of solid-state batteries are driving significant investment and research. For example, Factorial Energy, a U.S.-based startup, has developed a solid-state battery with an energy density of 391 Wh/kg and is working with Mercedes-Benz to integrate this technology into electric vehicles. Similarly, Maxell Corporation has begun mass production of large-capacity solid-state batteries, which are expected to offer longer lifespans and better heat resistance, making them suitable for industrial applications.

Drivers

Rising Demand for Electric Vehicles

One of the major driving factors for the advancement of battery technology is the soaring demand for electric vehicles (EVs). As the automotive industry shifts toward sustainability and greener solutions, EVs are rapidly becoming a core part of the future of transportation. This growing trend is pushing for improved, more efficient, and cost-effective battery technologies to power these vehicles.

Electric vehicles are no longer seen as a niche market; they have started to capture significant market share in the global automotive industry. For example, according to the International Energy Agency (IEA), there were over 10 million electric cars on the road globally in 2022, a number that continues to rise as more countries set ambitious goals for reducing carbon emissions. In fact, global sales of electric vehicles increased by more than 60% in 2021 compared to the previous year, with China leading the way as the largest EV market, followed by Europe and North America.

- Governments worldwide have also played a crucial role in this shift by introducing policies and incentives to make electric vehicles more accessible. In the U.S., the Biden administration has laid out a plan to build 500,000 EV charging stations by 2030 and offers tax incentives for EV buyers. Meanwhile, in Europe, the European Commission has set a target for 30 million EVs to be on the road by 2030, further pushing demand for advanced battery technologies.

This surge in EV adoption is directly fueling advancements in battery technology. One key area of focus is the development of batteries that offer greater energy density, faster charging times, and longer lifespan. The lithium-ion batteries commonly used in electric vehicles today have limitations, such as long charging times and concerns about sustainability. As a result, there is a strong push toward next-generation battery technologies, such as solid-state batteries, that promise to overcome these challenges.

- For instance, battery costs have fallen significantly in recent years, from more than $1,100 per kilowatt-hour in 2010 to about $132 per kilowatt-hour in 2021, according to BloombergNEF. This price reduction has helped make electric vehicles more affordable and accessible to consumers.

Restraints

High Cost of Raw Materials

One of the major restraining factors for the advancement of battery technology is the high cost and supply chain limitations of key raw materials, particularly lithium, cobalt, and nickel. These materials are essential in the production of lithium-ion batteries, which are widely used in electric vehicles (EVs), smartphones, and renewable energy storage systems. However, the rising costs and limited availability of these raw materials pose significant challenges to the large-scale adoption of advanced battery technologies.

- Lithium, for instance, is one of the primary components of the most common types of rechargeable batteries. According to the U.S. Geological Survey (USGS), global lithium production has increased significantly in recent years, but it still faces challenges in meeting the rapidly growing demand. In 2021, the average price of lithium increased by nearly 500%, from $13,000 per ton to over $60,000 per ton, as reported by the Financial Times. This dramatic price spike has made it more expensive to produce batteries, especially for electric vehicles, which rely on large battery packs.

Similarly, cobalt and nickel, which are also vital for battery production, have seen price increases and supply shortages due to geopolitical factors and mining challenges. For example, cobalt is primarily mined in the Democratic Republic of Congo, where political instability and ethical concerns regarding child labor have raised significant challenges in ensuring a stable supply. The price of cobalt surged in 2021 by more than 60%, adding to the financial pressure on manufacturers. Nickel, which is used to improve battery energy density, also faces price volatility, with global production being largely concentrated in countries like Indonesia and the Philippines.

Governments have recognized this issue and are exploring various strategies to address it. The U.S. government, for example, has committed to strengthening domestic supply chains for critical minerals, including lithium, cobalt, and nickel. In 2021, the U.S. Department of Energy announced a $15 million investment into research and development aimed at improving the efficiency of battery recycling and reducing dependence on mined materials. The European Union is also supporting research into alternative materials, such as sodium-ion and solid-state batteries, to mitigate the risks associated with reliance on scarce and expensive raw materials.

Opportunity

Government Initiatives Driving Battery Manufacturing in India

India’s journey towards self-reliance in battery manufacturing is gaining momentum, thanks to robust government initiatives and strategic policy frameworks. Recognizing the critical role of advanced battery technologies in sectors like electric vehicles (EVs), renewable energy storage, and consumer electronics, the Indian government has introduced several programs to bolster domestic production and reduce dependence on imports.

One of the flagship initiatives is the Production Linked Incentive (PLI) Scheme for Advanced Chemistry Cell (ACC) Battery Storage, launched in 2021 with an allocation of ₹18,100 crore (approximately $2.48 billion USD). This scheme aims to establish giga-scale ACC manufacturing facilities across India, promoting domestic value addition and reducing reliance on imported batteries .

Under this scheme, the government offers incentives to companies that set up large-scale battery manufacturing plants. For instance, Reliance Industries secured a bid under this program to produce up to 10 gigawatts of ACCs, supporting the country’s goal of increasing electric car usage. The PLI scheme encourages companies to integrate vertically and promote indigenization of key components in the battery value chain, with a base subsidy capped at ₹2,000 per kWh of ACC sold .

In addition to the PLI scheme, the government has introduced the Battery Waste Management Rules (BWMR) in 2022. These regulations aim to promote battery circularity by encouraging the recycling and reuse of battery materials. The BWMR mandates the use of recycled materials in new batteries, sets collection targets, and establishes extended producer responsibility (EPR) mechanisms to ensure responsible disposal and recycling of batteries.

These government initiatives are complemented by research and development efforts from institutions like the Central Salt and Marine Chemicals Research Institute (CSMCRI) in Bhavnagar, Gujarat. CSMCRI has developed an innovative, eco-friendly technique to extract lithium from used batteries, achieving 97% purity in just one hour. This breakthrough aligns with India’s goal of reducing dependence on imported lithium and establishing a sustainable lithium supply chain.

Regional Insights

Europe dominates with 32.6% share commanding a market value of US $25.3 billion.

In 2024, Europe emerged as a preeminent region within the advanced battery market, securing a commanding 32.6% share and representing approximately USD 25.3 billion in revenue. This robust performance was underpinned by several structural and policy-driven factors. The European Union’s rigorous regulatory framework—most notably, the Battery Regulation (EU 2023/1542), which became effective in February 2024—mandates elevated standards for battery safety, sustainability, and embedded carbon content, thereby intensifying demand for advanced battery materials and technologies.

Further reinforcing this industrial growth, the European Battery Alliance (EBA) continues to galvanize investment across the value chain. The initiative envisions Europe capturing a battery market valued at €250 billion by 2025, supported by the development of multiple large-scale cell production facilities designed to meet up to 15% of regional demand.

Battery energy storage deployment within Europe also saw meaningful expansion. In 2024, 21 GWh of new battery energy storage systems (BESS) were commissioned, bringing the continent’s total installed capacity to 61 GWh. Germany and Italy were key contributors, each accounting for approximately 6 GWh, with the top five markets delivering 78% of annual installations.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Alpha HPA—formerly Alpha Battery Technologies—is an Australian firm that has introduced a breakthrough technology to reduce lithium-ion battery fire risks. Employing a coating of high-purity alumina on battery anodes, the technology has demonstrated a complete prevention of thermal runaway incidents. It is currently in discussions with 13 anode manufacturers for commercialization, and the company is preparing to significantly scale production with major investments and workforce expansion.

Founded in 2008 and based in Fremont, California, Amprius Technologies specializes in high‑energy lithium‑ion batteries with silicon anode technology. Its SiMaxx cells deliver exceptionally high energy density—validated at up to 500 Wh/kg—suitable for demanding applications in aviation, drones, EVs, and defense. The company maintains a pilot manufacturing facility and has scaled to MWh‑level production and GWh‑level contract manufacturing agreements.

BYD, originally known for batteries and now a leading Chinese automaker, has become a major advanced battery player—accounting for approximately 16% of global EV battery production in 2023 (111 GWh). The company is recognized for its proprietary ‘blade’ battery design, which offers safety and efficiency benefits; this technology continues to support its strong position in electric vehicles and energy storage.

CATL is the world’s largest manufacturer of lithium‑ion batteries for electric vehicles and energy storage systems. In 2023, it achieved revenues of roughly USD 56.6 billion and held around 37% share of the global EV battery market. Headquartered in Ningde, China, CATL operates multiple production facilities worldwide and continues to lead through innovation and scale.

Top Key Players Outlook

- Alpha Battery Technologies

- Amprius Technologies

- BYD

- CATL

- Duracell

- EnerSys

- Enovix Corporation

- Exide Technologies

- GS Yuasa Corporation

- Hitachi Chemical

Recent Industry Developments

CATL maintained its global lead in the advanced battery industry in 2024, delivering approximately 339.3 GWh of EV batteries—a 31.7% increase over 257.7 GWh in 2023—resulting in a commanding 37.9% share of the global EV battery market.

In 2024, BYD strengthened its hold over the advanced battery landscape, with its battery unit—FinDreams Battery—delivering 153.7 GWh of power batteries, up 37.5% from 111.8 GWh in 2023, and securing a 17.2% share of the global EV battery market.

Report Scope

Report Features Description Market Value (2024) USD 77.8 Bn Forecast Revenue (2034) USD 192.8 Bn CAGR (2025-2034) 9.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Lithium Ion Polymer Battery, Sodium Sulfur Battery, Sodium Metal Halide Battery, Advanced Lead Acid Battery, Smart Nano Battery, Others), By Application (Consumer Electronics, Automotive Batter, Energy Storage Systems, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alpha Battery Technologies, Amprius Technologies, BYD, CATL, Duracell, EnerSys, Enovix Corporation, Exide Technologies, GS Yuasa Corporation, Hitachi Chemical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alpha Battery Technologies

- Amprius Technologies

- BYD

- CATL

- Duracell

- EnerSys

- Enovix Corporation

- Exide Technologies

- GS Yuasa Corporation

- Hitachi Chemical