Global Acrylonitrile Styrene Acrylate Market Size, Share, And Business Benefit By Manufacturing Process (3D Printing, Thermoforming, Injection Moulding, Others), By Application (Car Exterior Panels, Side View Mirror Housing, Commercial Sliding, Electrical Housing, Furniture, Medical Devices, Garden Equipment, Others), By End-Use (Automotive, Electronics, Consumer Goods, Construction, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 167133

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

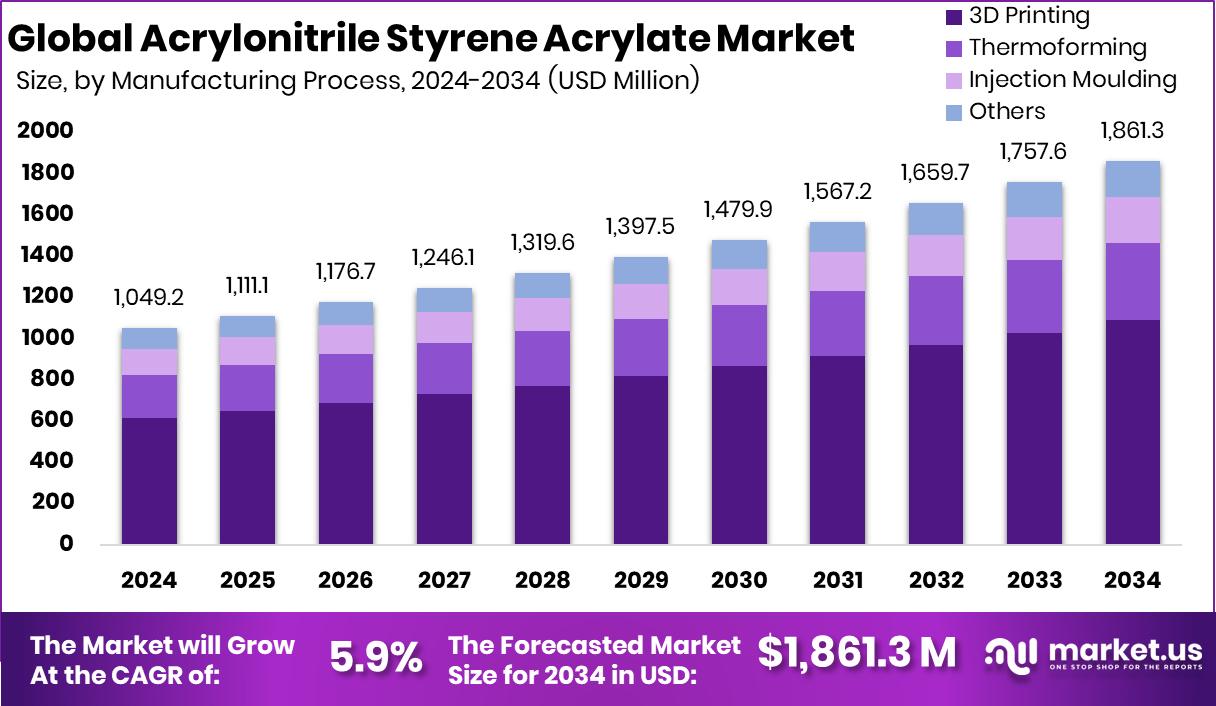

The Global Acrylonitrile Styrene Acrylate Market is expected to be worth around USD 1,861.3 million by 2034, up from USD 1049.2 million in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034. Asia-Pacific’s 45.90% share reflects the expanding use of ASA across automotive and industrial sectors.

Acrylonitrile Styrene Acrylate (ASA) is an advanced thermoplastic known for its strong weather resistance, UV stability, and durability. It is widely used in outdoor products, automotive components, electrical housings, and consumer appliances because it retains colour and structural strength even when exposed to sunlight or rain. Its toughness and ease of processing make it a preferred alternative to traditional materials in demanding industrial environments.

The acrylonitrile styrene acrylate market refers to the global demand, production, and commercial use of ASA across industries such as automotive, construction, consumer goods, and 3D printing. The market continues to expand as manufacturers look for stable, impact-resistant polymers that perform well outdoors. Growth is supported by rising product innovation, improved compounding technologies, and the expanding need for durable plastics in lightweight applications.

Growing interest in advanced 3D printing materials is a major growth factor for ASA. The material’s stability and heat resistance make it ideal for prototyping and end-use parts. Recent investment activity—such as Carbon’s DLS 3D printing technology receiving $60M, Desktop Metal closing a $115M round, and Caracol securing $40M—is accelerating material development and expanding the use of ASA in industrial additive manufacturing.

Demand for ASA is rising as industries shift toward more reliable polymers with strong outdoor performance. Companies in automated additive manufacturing and medical-grade 3D systems are also scaling up. New funding rounds, such as Mosaic raising $28M, Novenda Technologies securing $6.1M, and CustoMED attracting $6M, are driving the adoption of high-performance materials like ASA in specialised applications.

A key opportunity emerges from the growing move toward sustainable lightweight components in mobility, construction, and consumer products. As global manufacturers invest in advanced fabrication technologies and rapid-production platforms, ASA stands to benefit from its balanced mechanical properties and compatibility with large-scale additive manufacturing systems.

Key Takeaways

- The Global Acrylonitrile Styrene Acrylate Market is expected to be worth around USD 1,861.3 million by 2034, up from USD 1049.2 million in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034.

- Injection moulding dominated the Acrylonitrile Styrene Acrylate Market with a 58.5% share.

- Car exterior panels dominated the acrylonitrile styrene acrylate market with a 27.8% share.

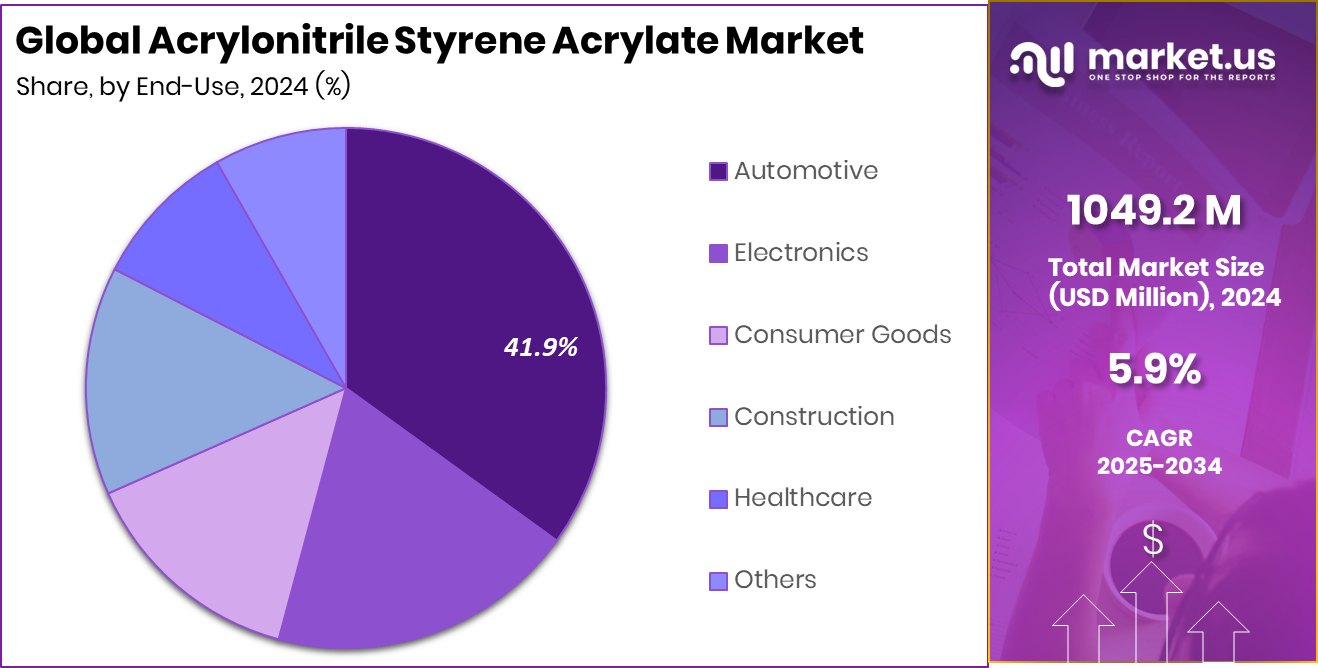

- Automotive dominated the Acrylonitrile Styrene Acrylate Market with a 41.9% share.

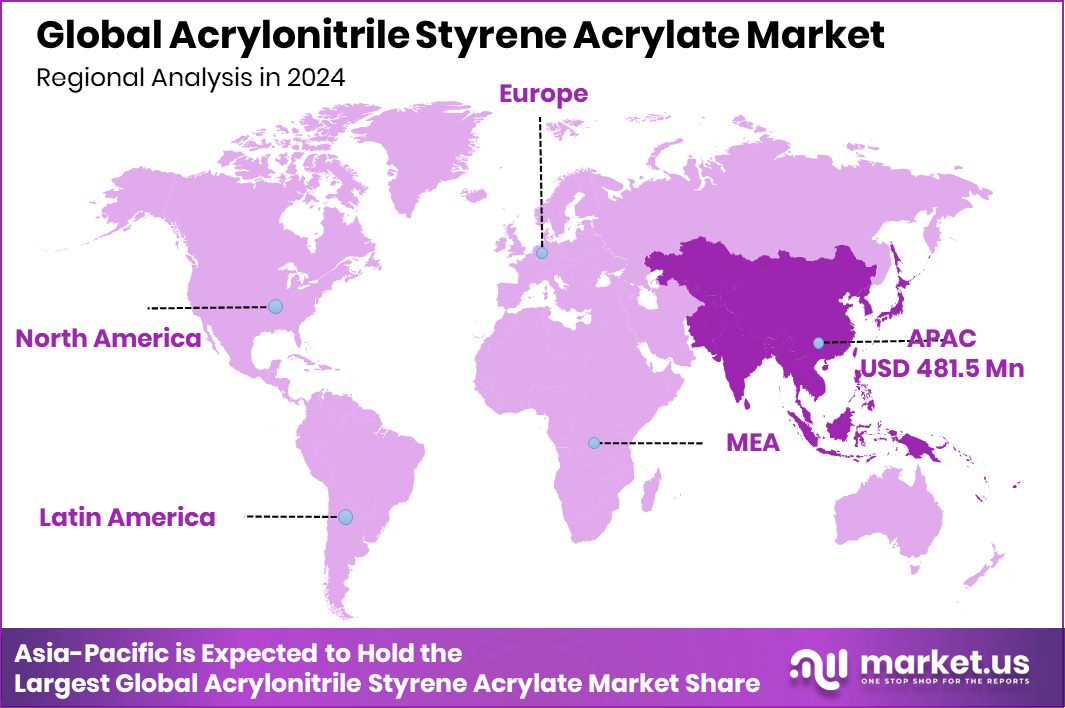

- The Asia-Pacific’sreached a market value of USD 481.5 Mn, driven by manufacturing growth.

By Manufacturing Process Analysis

Injection moulding dominated the Acrylonitrile Styrene Acrylate Market with a 58.5% share in 2024.

In 2024, Injection Moulding held a dominant market position in the By Manufacturing Process segment of the Acrylonitrile Styrene Acrylate Market, with a 58.5% share. This process remained the preferred method because it delivers consistent quality, smooth surface finishing, and strong structural performance, which are essential for outdoor equipment, automotive trims, and durable consumer products.

Manufacturers continued relying on injection moulding to achieve high-volume production with reliable dimensional accuracy. The 58.5% share also reflects the material’s ease of processing under controlled moulding conditions, allowing producers to design complex shapes without compromising strength.

As industries demanded weather-resistant and UV-stable parts, injection moulding remained the most efficient and cost-effective route for shaping Acrylonitrile Styrene Acrylate into end-use components.

By Application Analysis

Car exterior panels dominated the Acrylonitrile Styrene Acrylate Market with a 27.8% share due to strong weather resistance.

In 2024, Car Exterior Panels held a dominant market position in the By Application segment of the Acrylonitrile Styrene Acrylate Market, with a 27.8% share. This strong share reflects the material’s ability to withstand sunlight, temperature changes, and long-term outdoor exposure without losing colour or strength.

Automotive manufacturers continued choosing ASA for exterior panels because it offers a balance of impact resistance and lightweight performance, helping improve fuel efficiency and durability.

The 27.8% share also indicates a growing preference for materials that maintain gloss and surface stability even in harsh weather conditions. As the automotive sector increased its use of advanced plastics for design flexibility and cost efficiency, ASA remained a key choice for high-quality exterior panel applications.

By End-Use Analysis

Automotive dominated the Acrylonitrile Styrene Acrylate Market with 41.9% share, driven by lightweight trends.

In 2024, Automotive held a dominant market position in the By End-Use segment of the Acrylonitrile Styrene Acrylate Market, with a 41.9% share. This leading share highlights the sector’s strong reliance on ASA for components that require durability, UV stability, and long-term outdoor performance. Automotive manufacturers favoured ASA for exterior trims, panels, and functional parts due to its resistance to fading and impact.

The 41.9% share also reflects the continued shift toward lightweight materials that support improved vehicle efficiency and design flexibility. As demand grew for polymers capable of maintaining structural integrity under varying weather conditions, ASA secured its role as a dependable material across multiple automotive applications.

Key Market Segments

By Manufacturing Process

- 3D Printing

- Thermoforming

- Injection Moulding

- Others

By Application

- Car Exterior Panels

- Side View Mirror Housing

- Commercial Sliding

- Electrical Housing

- Furniture

- Medical Devices

- Garden Equipment

- Others

By End-Use

- Automotive

- Electronics

- Consumer Goods

- Construction

- Healthcare

- Others

Driving Factors

Rising Use of ASA in Advanced 3D Manufacturing

A key driving factor for the Acrylonitrile Styrene Acrylate market is the fast-growing use of ASA in advanced 3D manufacturing, especially for outdoor and automotive parts that need strong weather resistance. ASA’s ability to keep its colour, strength, and shape under sunlight and heat makes it one of the preferred materials for industrial-grade additive production. This growth is further supported by rising investment in next-generation 3D printing platforms.

Recently, Carbon raised $60M in new funding, which strengthens the development of high-performance materials like ASA for large-scale manufacturing. As more companies adopt 3D printing for real production rather than just prototypes, ASA demand continues to increase due to its durability, smooth surface finish, and high processing reliability.

Restraining Factors

High Material Cost Limits Wider ASA Adoption

A major restraining factor for the Acrylonitrile Styrene Acrylate market is its higher material cost compared with standard polymers. ASA offers strong UV resistance, colour stability, and outdoor durability, but these advantages also make it more expensive to produce. Many manufacturers in cost-sensitive sectors hesitate to shift from cheaper alternatives, slowing overall adoption. Even though new technologies in large-format 3D printing are improving efficiency, price sensitivity remains a barrier.

Recent investments—such as the $40M round boosting Caracol’s large-format 3D printing ambitions—help expand ASA-compatible production systems, but the higher material cost still challenges smaller firms. This price gap often limits ASA’s use in mass-volume applications where affordability matters more than long-term performance.

Growth Opportunity

Expanding 3D Printing Boosts ASA Market Opportunity

A major growth opportunity for the Acrylonitrile Styrene Acrylate market comes from the rapid expansion of industrial and automated 3D printing systems. ASA is becoming a preferred material for outdoor-grade prototypes, functional parts, and automotive components because it offers UV stability, impact resistance, and long-lasting colour retention. As more companies move toward digital manufacturing, demand for reliable engineering plastics rises.

Recent investment activity is strengthening this shift—Euler closed €2M to scale its AI-powered software for 3D printing, supporting faster adoption and smarter material optimisation. With improved software, better workflow automation, and more industrial users entering additive manufacturing, ASA stands to benefit from wider use in high-performance, weather-resistant 3D printed parts.

Latest Trends

Growing Shift Toward UV-Stable 3D Printed Materials

A key latest trend in the Acrylonitrile Styrene Acrylate market is the rising shift toward UV-stable materials specifically designed for long-term outdoor 3D printing. Industries such as automotive, construction, and consumer products increasingly prefer ASA because it maintains colour, gloss, and strength even after extended sun exposure. This trend is growing as more companies adopt additive manufacturing for real production rather than simple prototyping.

Supporting this momentum, Koobz recently closed a seed round, bringing its total funding to $7.2M, helping accelerate advancements in materials and printing workflows. As innovators focus on durable polymers suitable for large, functional outdoor parts, ASA becomes an attractive choice for manufacturers seeking reliable and weather-resistant 3D-printed components.

Regional Analysis

Asia-Pacific leads the Acrylonitrile Styrene Acrylate Market with 45.90%, showing strong regional demand.

In 2024, Asia-Pacific dominated the Acrylonitrile Styrene Acrylate Market with a 45.90% share, valued at USD 481.5 Mn, reflecting the region’s strong position in automotive manufacturing, outdoor consumer products, and fast-expanding 3D printing activity. Countries across East and Southeast Asia continued increasing their use of weather-resistant polymers, supporting broader ASA adoption in exterior panels, durable parts, and high-performance moulded components.

North America followed with steady growth driven by advanced manufacturing capabilities and rising interest in materials suitable for outdoor equipment and UV-stable printed parts. Europe maintained a consistent demand base, supported by design-driven industries and a strong preference for long-lasting engineering plastics in automotive and consumer goods.

The Middle East & Africa market expanded gradually, supported by industrial diversification and increased use of durable polymers for outdoor infrastructure needs. Latin America saw moderate progress as manufacturers adopted ASA for applications requiring impact strength and good colour stability. Together, these regions contributed to a balanced global outlook, with Asia-Pacific’s 45.90% leadership highlighting its strong production scale, active industrial capacity, and growing integration of ASA into high-volume end-use sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, LG Chem continued to strengthen its position in the Acrylonitrile Styrene Acrylate market by expanding polymer innovation and enhancing material performance for outdoor and automotive applications. The company focused on improving ASA grades with better UV resistance and colour stability, aligning with growing demand for durable plastics in mobility, construction, and 3D printing. Its broad production capabilities and consistent product quality supported strong customer adoption across major end-use sectors.

INEOS Styrolution maintained a solid presence in the ASA market through its expertise in styrenic technologies and its ability to supply high-performance materials to global manufacturers. The company’s strategic emphasis on advanced polymer engineering helped improve thermal stability and processing efficiency of ASA compounds. Its wide application coverage, especially in electronics, automotive trims, and outdoor consumer goods, allowed it to remain a preferred supplier in several regions.

Chi Mei Corporation played a key role in shaping market competitiveness by offering a diverse portfolio of ASA resins suited for exterior panels, appliance housings, and weather-resistant moulded parts. The company’s continuous investment in material refinement supported manufacturers seeking consistent colour retention and long-term durability. Chi Mei’s strong integration in the Asian supply chain also contributed to steady demand within the region’s fast-growing automotive and consumer goods markets.

Top Key Players in the Market

- LG Chem

- INEOS Styrolution

- Chi Mei Corporation

- Formosa Plastics Corporation

- SABIC

- Kumho Petrochemical

- Techno-UMG Co., Ltd.

- Shenzhen Wote Advanced Materials Co., Ltd.

- Suzhou Sunway Polymer Co., Ltd.

Recent Developments

- In April 2025, LG Chem, in partnership with Hanssem and Jinyeong, introduced BCB ASA (Bio-Circular Balanced ASA) — an eco-friendly moulded material derived from plant-based feedstock for use mainly in furniture and construction materials. This material is positioned to reduce carbon emissions while offering the outdoor durability of conventional ASA.

- In April 2024, INEOS Styrolution announced that its Luran® S XA SPF60 grade — an ASA polymer — was selected by a major European truck manufacturer for use in exterior blackening panels. The material offers enhanced UV stability, deep-black surface quality and superior weather resistance for outdoor automotive use.

Report Scope

Report Features Description Market Value (2024) USD 1049.2 Million Forecast Revenue (2034) USD 1,861.3 Million CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Manufacturing Process (3D Printing, Thermoforming, Injection Moulding, Others), By Application (Car Exterior Panels, Side View Mirror Housing, Commercial Sliding, Electrical Housing, Furniture, Medical Devices, Garden Equipment, Others), By End-Use (Automotive, Electronics, Consumer Goods, Construction, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape LG Chem, INEOS Styrolution, Chi Mei Corporation, Formosa Plastics Corporation, SABIC, Kumho Petrochemical, Techno-UMG Co., Ltd., Shenzhen Wote Advanced Materials Co., Ltd., Suzhou Sunway Polymer Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Acrylonitrile Styrene Acrylate MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Acrylonitrile Styrene Acrylate MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- LG Chem

- INEOS Styrolution

- Chi Mei Corporation

- Formosa Plastics Corporation

- SABIC

- Kumho Petrochemical

- Techno-UMG Co., Ltd.

- Shenzhen Wote Advanced Materials Co., Ltd.

- Suzhou Sunway Polymer Co., Ltd.