Global Acrylamide Market Size, Share, And Business Benefit By Product (Polyacrylamide, Acrylamide Copolymers, Acrylamide Crystals), By lonic Type (Cationic, Anionic, Non-ionic), By Form (Solid, Liquid), By Application (Waste Water Treatment, Dispersing Agent, Oil Recovery Agent, Stabilizer and Thickener, Water Repellent, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161352

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

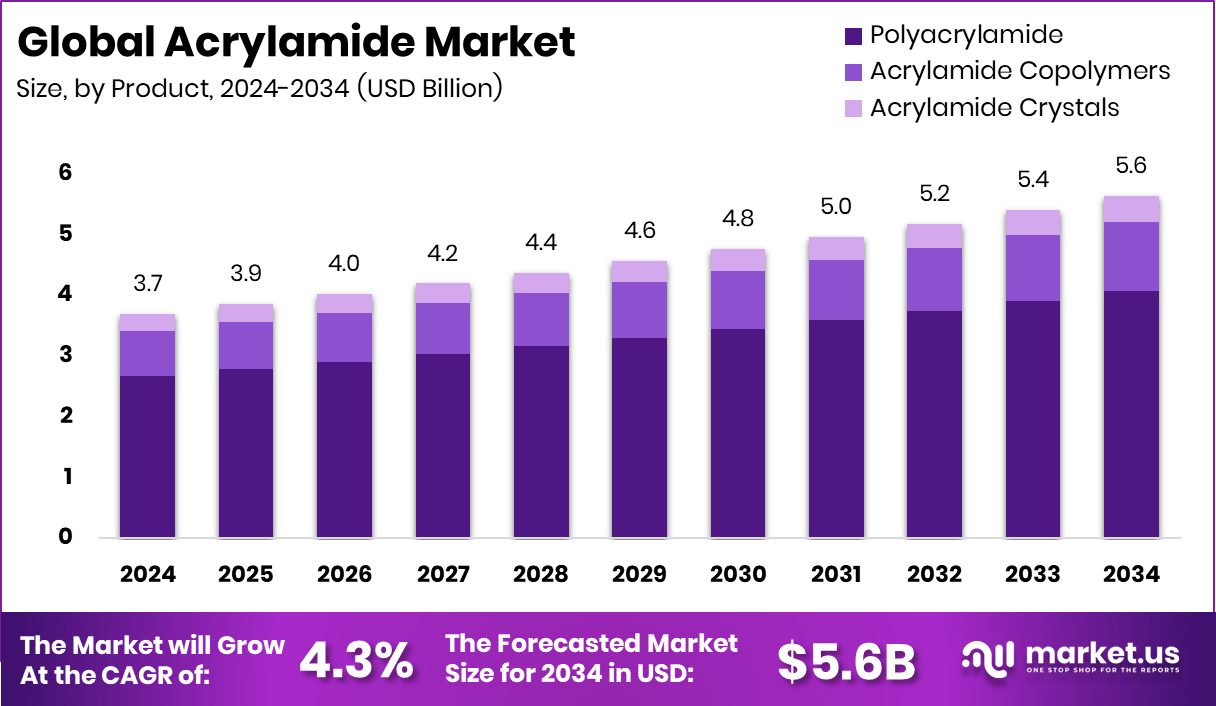

The Global Acrylamide Market is expected to be worth around USD 5.6 billion by 2034, up from USD 3.7 billion in 2024, and is projected to grow at a CAGR of 4.3% from 2025 to 2034.

Acrylamide is a small, colorless crystalline organic compound with the formula CH₂=CH–C(O)NH₂. It is widely used industrially as a monomer to produce polyacrylamide, which acts as a flocculant, thickener, or coagulant in applications such as water treatment, paper production, and mining. In food science, acrylamide can also form during high-temperature cooking of starchy foods through reactions between sugars and amino acids.

The acrylamide market refers to the global trade, production, and consumption of both the monomer and related compounds, driven by demand in downstream industries. The market encompasses manufacturing, supply chains, pricing dynamics, regulatory influences, and evolving technical applications.

Growth in this market is supported by stricter environmental and water-quality regulations, pushing industries to adopt better wastewater treatment. Investments in water infrastructure—such as Alma receiving $20 million to upgrade a treatment plant, Washington communities getting $309 million for clean water, Iraq securing €130 million for sanitation, and Canada committing over CAD 369.5 million—fuel demand.

Demand stems from its role in treating industrial and municipal wastewater, in enhanced oil recovery, in mining, and in pulp & paper. Urbanization and industrial expansion increase the volumes of wastewater needing treatment, thereby pushing up acrylamide usage.

Opportunities lie in innovation toward lower-residual monomer acrylamides, biodegradable versions, and integration with sustainable water recycling systems. Projects like sustainable recycling funded with £2 million, or Oxyle raising €15.3 million for pollutant removal, open pathways to newer high-value applications.

Key Takeaways

- The Global Acrylamide Market is expected to be worth around USD 5.6 billion by 2034, up from USD 3.7 billion in 2024, and is projected to grow at a CAGR of 4.3% from 2025 to 2034.

- In 2024, the acrylamide market was dominated by polyacrylamide, capturing around 72.3% share globally.

- Anionic acrylamide held the largest ionic segment, accounting for approximately 47.2% market share in 2024.

- In 2024, solid form dominated the acrylamide market, capturing about 67.9% of total revenue.

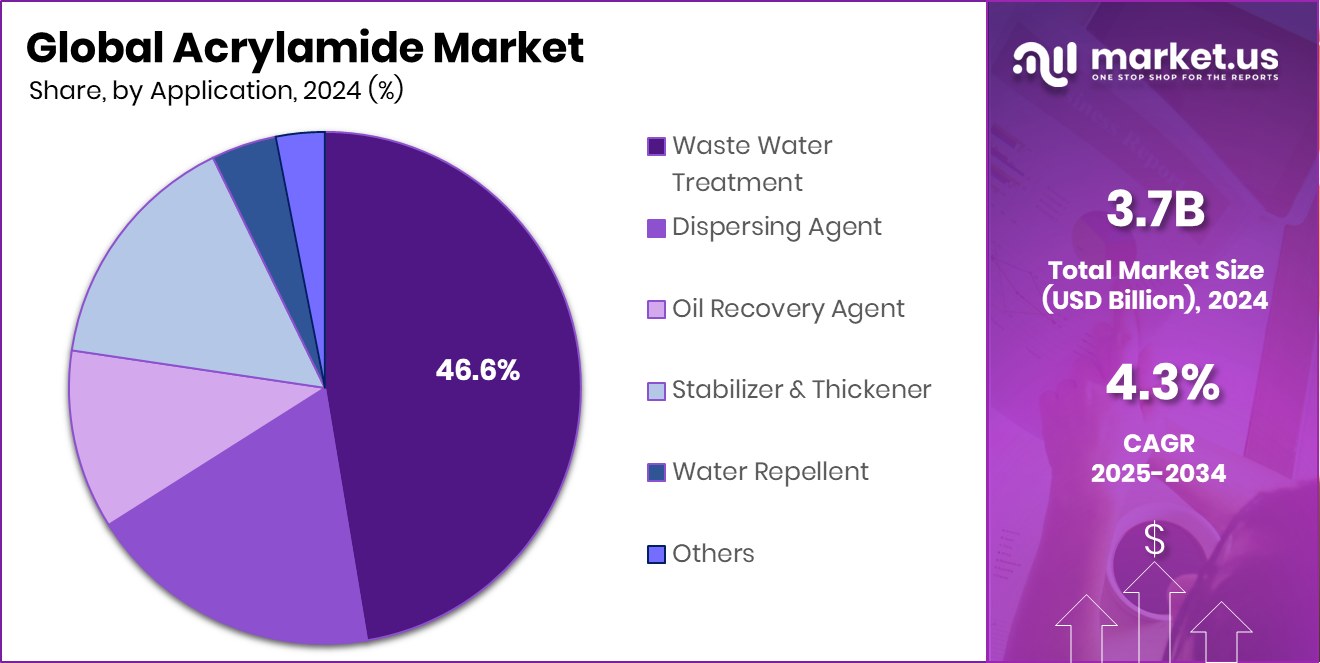

- Wastewater treatment applications led the acrylamide market, accounting for 46.6% of global consumption in 2024.

By Product Analysis

In 2024, polyacrylamide dominated the acrylamide market, capturing a 72.3% share.

In 2024, polyacrylamide held a dominant market position in the By Product segment of the Acrylamide Market, with a 72.3% share. The strong share reflects its extensive use as a flocculant and coagulant across municipal and industrial wastewater treatment plants. Its efficiency in solid–liquid separation and sludge dewatering has made it a preferred material in large-scale water management systems.

Moreover, polyacrylamide’s versatility in enhanced oil recovery, paper manufacturing, and mineral processing contributes significantly to its market leadership. Continuous advancements in polymer formulations and the growing adoption of high-molecular-weight variants for better performance further strengthen its market share. This dominance is expected to continue as industries increasingly prioritize cleaner and more efficient water treatment solutions.

By Lonic Type Analysis

The anionic type held a 47.2% share in the acrylamide market.

In 2024, Anionic held a dominant market position in the By Ionic Type segment of the Acrylamide Market, with a 47.2% share. This dominance is attributed to its wide use in wastewater treatment, where anionic acrylamide polymers effectively remove suspended particles and organic matter. Their strong performance in flocculation and clarification processes makes them essential in both municipal and industrial water systems.

Additionally, the anionic form is preferred in applications such as mineral processing, paper manufacturing, and soil conditioning due to its excellent binding and stabilizing properties. Its cost-effectiveness, high efficiency, and adaptability across various pH conditions continue to reinforce its leading market share and sustained preference among end-use industries globally.

By Form Analysis

Solid form accounted for 67.9% of the acrylamide market share.

In 2024, Solid held a dominant market position in the By Form segment of the Acrylamide Market, with a 67.9% share. The solid form is preferred for its stability, ease of storage, and longer shelf life compared to liquid variants. It is widely utilized in water treatment, mining, and paper manufacturing, where dry polymers are hydrated before use, ensuring efficient performance and minimal waste.

Solid acrylamide also allows for convenient handling and transportation, making it suitable for bulk industrial applications. Its consistent demand from large-scale facilities and the growing focus on operational efficiency have reinforced its leading position in the market, maintaining its dominance across multiple industrial end-use sectors in 2024.

By Application Analysis

Wastewater treatment dominated the acrylamide market with a 46.6% contribution.

In 2024, Waste Water Treatment held a dominant market position in the By Application segment of the Acrylamide Market, with a 46.6% share. This strong share is driven by the extensive use of acrylamide-based polymers, especially polyacrylamide, in municipal and industrial wastewater treatment plants. These polymers play a vital role in flocculation and sludge dewatering, improving water clarity and enabling efficient recycling processes.

The rising demand for clean water and stricter environmental regulations has further boosted the adoption of acrylamide products in treatment systems. Their effectiveness in reducing suspended solids and contaminants continues to make wastewater treatment the largest application area, reflecting the segment’s pivotal contribution to the global acrylamide market growth in 2024.

Key Market Segments

By Product

- Polyacrylamide

- Acrylamide Copolymers

- Acrylamide Crystals

By lonic Type

- Cationic

- Anionic

- Non-ionic

By Form

- Solid

- Liquid

By Application

- Waste Water Treatment

- Dispersing Agent

- Oil Recovery Agent

- Stabilizer and Thickener

- Water Repellent

- Others

Driving Factors

Rising Demand for Convenient and Fresh Snack Options

The major driving factor for the Refrigerated Snacks Market in 2024 is the increasing consumer demand for convenient, ready-to-eat, and fresh food options that fit modern, busy lifestyles. Consumers are shifting toward refrigerated snacks such as yogurts, cheese bites, fruit packs, and protein bars because they offer freshness, longer shelf life, and better nutrition compared to traditional packaged snacks.

The growing urban population and rising disposable incomes further support this trend. Additionally, advancements in cold-chain infrastructure and energy sectors are improving refrigerated logistics. India’s massive energy discovery worth nearly 2 lakh crore liters of oil in the Andaman region, as highlighted by Hardeep Puri, could boost industrial efficiency and cold storage capabilities, indirectly supporting the refrigerated food ecosystem.

Restraining Factors

High Storage and Transportation Costs Limit Growth

A key restraining factor for the Refrigerated Snacks Market is the high cost associated with storage, transportation, and temperature control. Refrigerated snacks require a continuous cold chain to maintain freshness and prevent spoilage, which significantly increases operational expenses for manufacturers and distributors. Many small and medium food producers struggle to invest in advanced refrigeration systems and insulated logistics, especially in developing regions with limited infrastructure.

Energy costs and maintenance of refrigerated units add further financial pressure. Moreover, temperature fluctuations during transport can cause product losses, affecting profitability. These challenges make it difficult for companies to expand distribution networks, especially in remote or rural markets, slowing overall market growth potential despite rising consumer demand.

Growth Opportunity

Expansion of Healthy and Protein-Rich Snack Options

A major growth opportunity in the Refrigerated Snacks Market lies in the expanding consumer preference for healthy, high-protein, and natural snack options. Growing awareness about nutrition and balanced diets is encouraging consumers to choose snacks made with fresh dairy, fruits, and plant-based ingredients. Companies are focusing on developing low-sugar, probiotic, and gluten-free refrigerated snacks to cater to health-conscious buyers.

The demand for protein-enriched yogurts, smoothies, and cheese snacks is particularly strong among working professionals and fitness enthusiasts. Additionally, rising interest in clean-label and minimally processed foods supports innovation in this category. As consumers increasingly replace traditional snacks with fresh, nutrient-dense alternatives, the market presents significant opportunities for product diversification and premium brand development.

Latest Trends

Growing Popularity of Plant-Based Refrigerated Snacks

One of the latest trends in the Refrigerated Snacks Market is the rising popularity of plant-based snack options. Consumers are increasingly choosing dairy-free and vegan products made from ingredients such as nuts, soy, coconut, and oats. This shift is driven by growing health awareness, lactose intolerance concerns, and environmental consciousness.

Plant-based refrigerated snacks like vegan yogurts, hummus cups, and nut-based cheese alternatives are gaining strong attention across supermarkets and online platforms. Companies are introducing innovative formulations that offer similar taste and texture to traditional dairy snacks while being more sustainable. This trend reflects a broader move toward clean eating and ethical consumption, shaping the future direction of refrigerated snack product development globally.

Regional Analysis

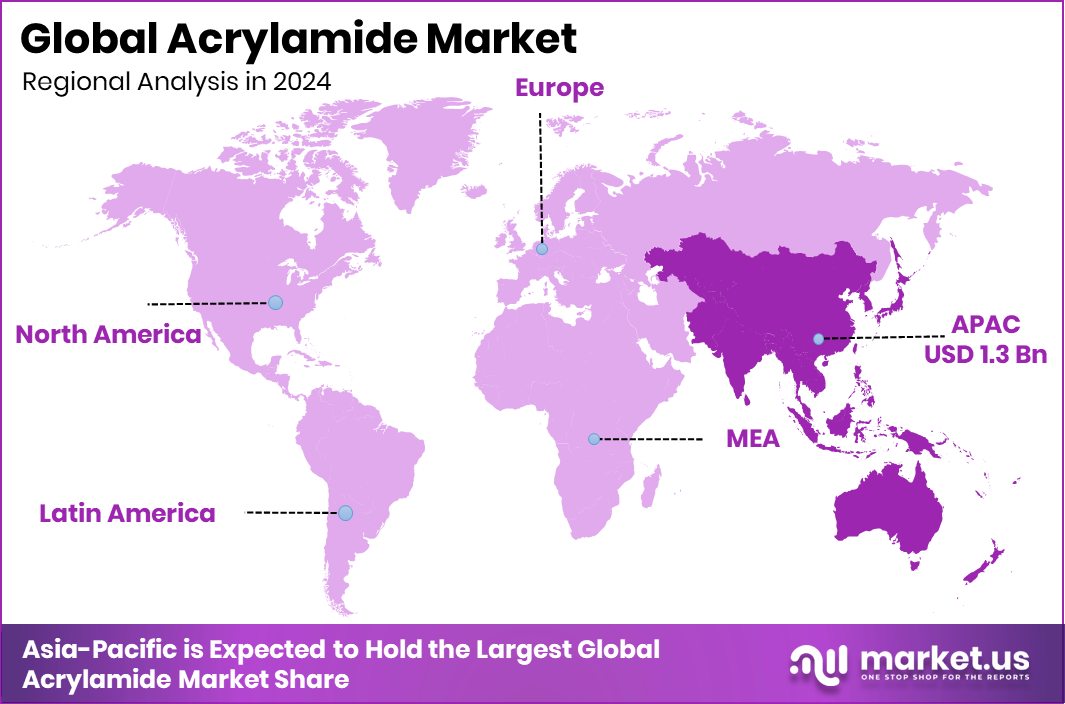

In 2024, the Asia-Pacific dominated the Acrylamide Market with a 37.2% share.

In 2024, Asia-Pacific emerged as the dominant region in the global Acrylamide Market, holding a 37.2% share, valued at approximately USD 1.3 billion. The region’s leadership is driven by strong industrial activity in wastewater treatment, mining, and paper manufacturing across countries like China, India, and Japan. Growing urbanization and increasing demand for clean water solutions continue to expand the consumption of acrylamide-based polymers.

North America follows with steady growth supported by technological advancements in water management and environmental applications. Europe shows moderate expansion due to strict wastewater discharge regulations and growing emphasis on eco-friendly chemical processing.

Meanwhile, the Middle East & Africa and Latin America are gradually emerging markets, supported by infrastructure development and rising investments in industrial wastewater treatment facilities, enhancing overall regional market balance.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

DOW Chemical Company continued to focus on improving polymer chemistry and advancing its range of water-soluble polymers for industrial and municipal wastewater treatment. The company emphasized energy-efficient production processes and tailored solutions to meet the increasing global demand for clean water and sustainable materials.

Ashland strengthened its presence by optimizing product formulations for enhanced performance in paper processing, coatings, and water purification. The company’s technical expertise in specialty chemicals and continuous research into biodegradable and low-toxicity compounds supported its alignment with tightening environmental regulations.

Mitsui Chemical Inc. focused on integrating advanced manufacturing technologies and expanding its product portfolio to meet industrial and environmental standards in Asia-Pacific markets. The company’s long-standing experience in polymer synthesis and chemical innovation enabled it to support sectors like water treatment and enhanced oil recovery efficiently.

Top Key Players in the Market

- DOW Chemical Company

- Ashland

- Mitsui Chemical Inc

- Yongsan Chemicals Inc.

- Zhejiang Xinyong Biochemical Co. Ltd

- Beijing Hengju Chemical Group Corporation

- SNF Floerger

- Others

Recent Developments

- In July 2025, Ashland advanced its $60 million manufacturing network optimization plan, closing factories in Parlin and Chatham, New Jersey, and relocating production (e.g., HEC production to Hopewell, VA). This reorganization aims to boost efficiency, consolidate operations, and cut costs.

- In June 2025, DOW launched a restructuring and cost-rationalization program, including workforce reductions (about 1,500 roles) and rationalizing global assets, including non-core businesses, to strengthen competitiveness.

Report Scope

Report Features Description Market Value (2024) USD 3.7 Billion Forecast Revenue (2034) USD 5.6 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Polyacrylamide, Acrylamide Copolymers, Acrylamide Crystals), By Ionic Type (Cationic, Anionic, Non-ionic), By Form (Solid, Liquid), By Application (Waste Water Treatment, Dispersing Agent, Oil Recovery Agent, Stabilizer and Thickener, Water Repellent, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape DOW Chemical Company, Ashland, Mitsui Chemical Inc., Yongsan Chemicals Inc., Zhejiang Xinyong Biochemical Co., Ltd, Beijing Hengju Chemical Group Corporation, SNF Floerger, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- DOW Chemical Company

- Ashland

- Mitsui Chemical Inc

- Yongsan Chemicals Inc.

- Zhejiang Xinyong Biochemical Co. Ltd

- Beijing Hengju Chemical Group Corporation

- SNF Floerger

- Others