Global Acetaldehyde Market Size, Share, And Business Benefits By Process (Oxidation of Ethylene, Oxidation of Ethanol, Dehydrogenation of Ethanol, Others), By Application (Chemicals, Food and Beverage, Pharmaceuticals , Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152222

- Number of Pages: 323

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

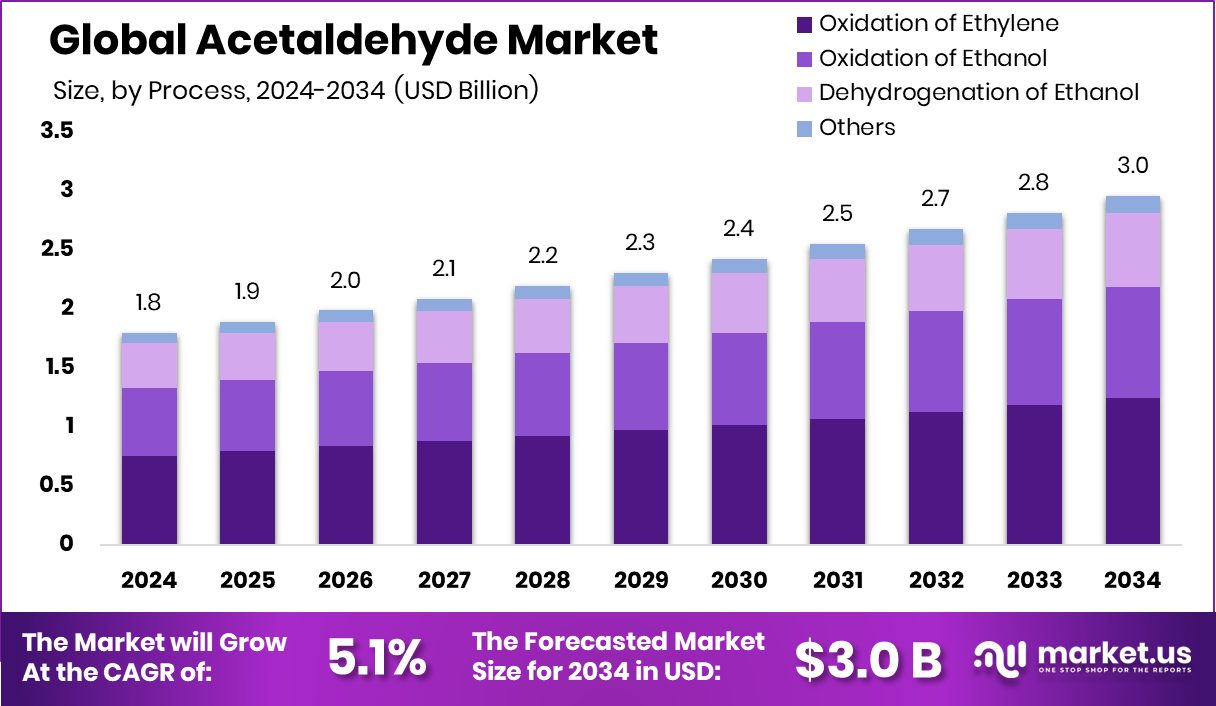

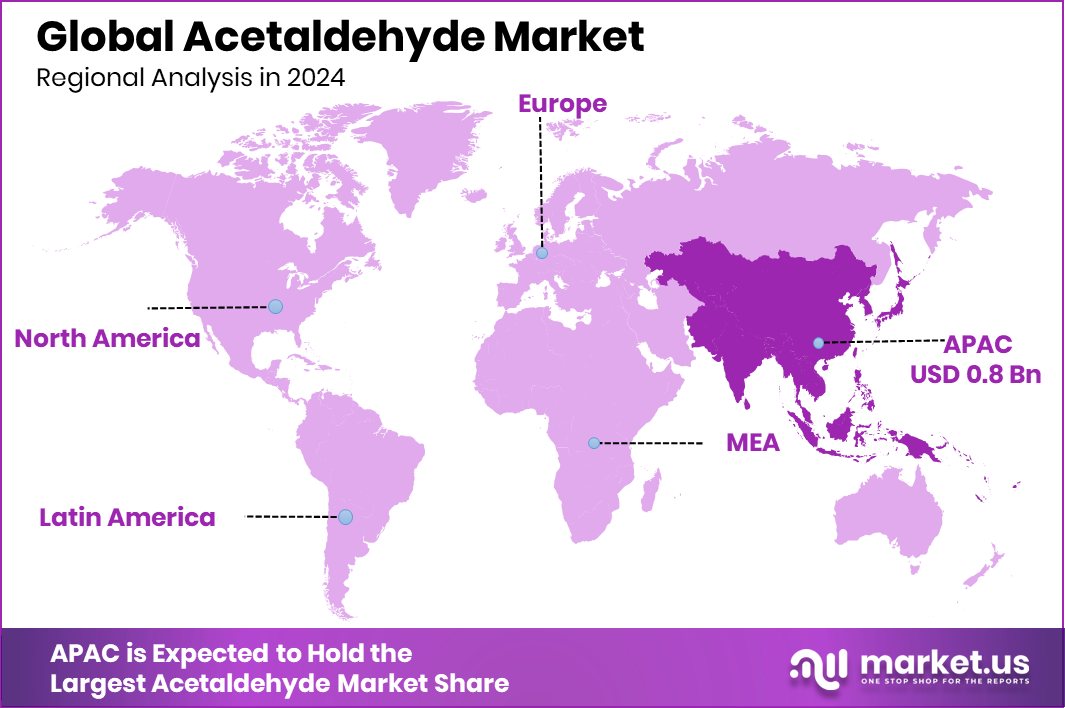

Global Acetaldehyde Market is expected to be worth around USD 3.0 billion by 2034, up from USD 1.8 billion in 2024, and grow at a CAGR of 5.1% from 2025 to 2034. Asia-Pacific dominated global demand with a 47.8% share and a USD 0.8 billion value.

Acetaldehyde is a colorless, flammable liquid with a pungent, fruity odor, commonly used as an intermediate in the production of various chemicals. It is naturally found in ripe fruits, coffee, and bread, and is also produced during fermentation. Industrially, acetaldehyde is synthesized mainly through the oxidation of ethanol or the hydration of acetylene.

The acetaldehyde market is steadily expanding due to its increasing demand across multiple industrial sectors, particularly in the chemical, food and beverage, and pharmaceutical industries. The versatility of acetaldehyde as a chemical intermediate continues to drive its consumption globally. In 2024 and beyond, its use in agriculture, especially in pesticide synthesis, is further boosting market growth as farming intensifies to meet rising food demand.

Growth factors include the strong demand for acetaldehyde-derived products such as pentaerythritol and pyridines, which are used in coatings, construction, and agrochemicals. Rising global urbanization and infrastructure investments are creating a steady need for such downstream products.

Demand is also rising from the food and beverage industry, where acetaldehyde is used as a flavoring agent. This demand is especially strong in processed food applications, reflecting consumer shifts toward convenience foods and packaged beverages.

Key Takeaways

- Global Acetaldehyde Market is expected to be worth around USD 3.0 billion by 2034, up from USD 1.8 billion in 2024, and grow at a CAGR of 5.1% from 2025 to 2034.

- In the acetaldehyde market, the oxidation of ethylene dominates with a 48.3% share due to efficiency and scalability.

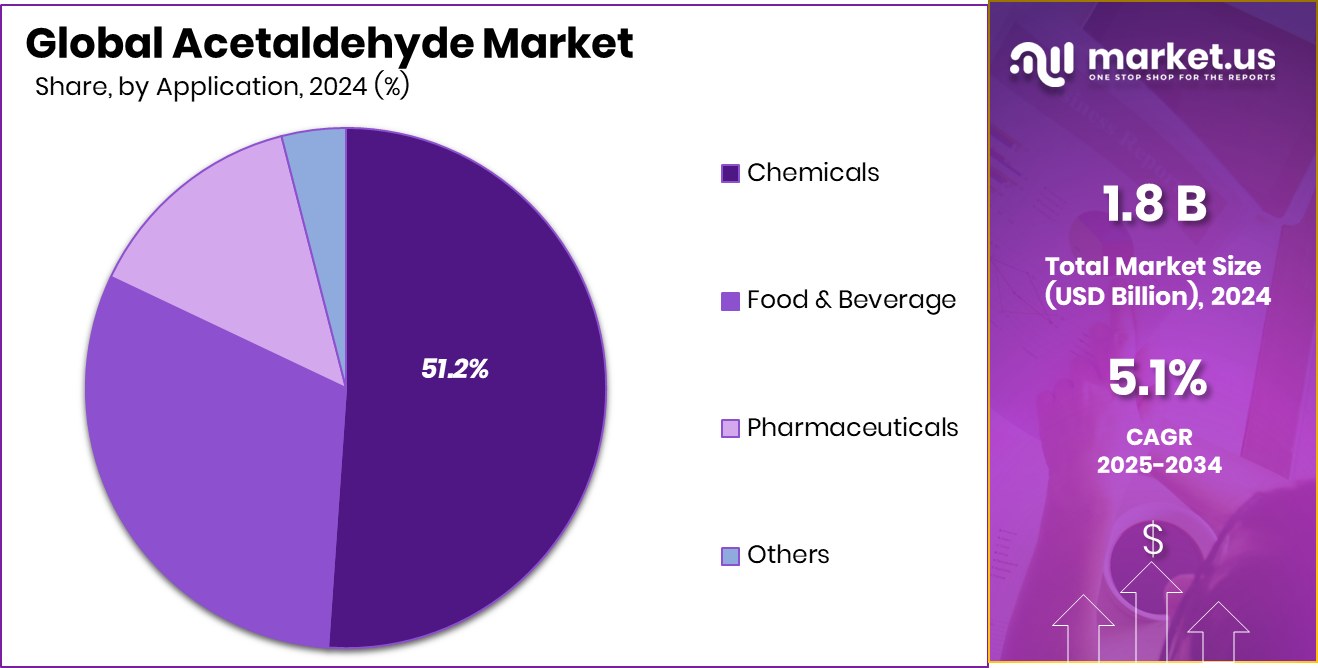

- The chemicals segment leads the acetaldehyde market, capturing a 51.2% share owing to high industrial consumption and demand.

- The acetaldehyde market in Asia-Pacific was valued at USD 0.8 billion in 2024.

By Process Analysis

Oxidation of Ethylene drives 48.3% of the Acetaldehyde Market production.

In 2024, Oxidation of Ethylene held a dominant market position in the By Process segment of the Acetaldehyde Market, with a 48.3% share. This process remains the most widely adopted method due to its efficiency, cost-effectiveness, and scalability in large-scale industrial production. The process involves the catalytic oxidation of ethylene using a metal catalyst, which provides higher yields and fewer by-products compared to other methods.

The preference for ethylene oxidation is further driven by its compatibility with continuous processing systems, which enhances operational efficiency and reduces energy consumption. In addition, the availability of ethylene as a raw material at an industrial scale further supports its dominance. Manufacturers continue to rely on this process to meet the increasing global demand for acetaldehyde and its derivatives.

The stability of this production method also aligns with sustainability goals, as ongoing improvements in catalytic technologies are helping reduce emissions and waste generation. As regulatory pressure grows around chemical manufacturing processes, the oxidation of ethylene offers a favorable pathway that balances performance, yield, and environmental compliance, thereby solidifying its stronghold in the acetaldehyde production landscape.

By Application Analysis

Chemicals lead with a 51.2% share in the Acetaldehyde Market usage.

In 2024, Chemicals held a dominant market position in the By Application segment of the Acetaldehyde Market, with a 51.2% share. This substantial share reflects the extensive use of acetaldehyde as an intermediate in the production of various industrial chemicals.

Its widespread application in synthesizing compounds such as acetic acid, peracetic acid, pentaerythritol, and pyridine derivatives underscores its critical role in chemical manufacturing processes. The dominance of this segment is largely attributed to the consistent demand for these derivatives in industries including paints, plastics, synthetic resins, and agrochemicals.

The chemical industry’s reliance on acetaldehyde is further supported by its functional versatility, enabling it to serve as a key building block in both organic and inorganic synthesis. As industrial activities and infrastructure development continue to grow, especially in developing regions, the requirement for acetaldehyde-based chemical intermediates remains robust.

Key Market Segments

By Process

- Oxidation of Ethylene

- Oxidation of Ethanol

- Dehydrogenation of Ethanol

- Others

By Application

- Chemicals

- Food and Beverage

- Pharmaceuticals

- Others

Driving Factors

Rising Demand for Chemical Intermediates Drives Growth

One of the main driving factors for the acetaldehyde market is the rising demand for chemical intermediates. Acetaldehyde is a key raw material used in producing several important chemicals like acetic acid, pentaerythritol, and pyridines. These chemicals are widely used in industries such as paints, plastics, synthetic resins, and agrochemicals. As industrial activities expand, particularly in developing countries, the need for these downstream chemicals is increasing.

This trend directly supports the growth of acetaldehyde consumption. The chemical industry’s focus on large-scale, high-volume production further boosts demand. Since acetaldehyde plays a central role in many synthesis processes, its importance continues to grow, making chemical intermediates one of the strongest demand drivers for the global acetaldehyde market.

Restraining Factors

Health and Safety Concerns Limit Market Growth

A major restraining factor for the acetaldehyde market is growing health and safety concerns. Acetaldehyde is classified as a hazardous chemical due to its toxic and flammable nature. Prolonged exposure can cause respiratory issues, and skin irritation, and is also considered a potential carcinogen. These health risks have led to strict regulations on its production, handling, and transportation across various countries.

Industries using acetaldehyde must invest heavily in safety equipment and compliance procedures, which increases overall operational costs. This makes some manufacturers hesitant to expand or adopt acetaldehyde-based processes. As global focus on worker safety and environmental protection increases, these concerns continue to act as a barrier, limiting wider adoption and potentially slowing down market growth in sensitive regions.

Growth Opportunity

Shift Toward Sustainable Bio‑Based Acetaldehyde Production

A significant growth opportunity in the acetaldehyde market is the shift towards sustainable bio-based production. Traditional methods rely heavily on fossil-derived feedstocks, raising concerns about carbon emissions and environmental impact. However, innovations are enabling acetaldehyde production from renewable sources such as ethanol derived from biomass. This approach aligns with global sustainability goals and regulatory efforts to lower greenhouse gas emissions.

Transitioning to bio-based feedstocks also offers market differentiation and appeals to environmentally conscious customers. Moreover, bio-based production can potentially reduce reliance on non-renewable resources while leveraging existing ethanol supply chains in agricultural regions.

Latest Trends

Integration of Catalytic Advances in Production Processes

The latest trend in the acetaldehyde market is the integration of advanced catalytic technologies into production processes. New catalyst formulations and reactor designs are being adopted to enhance yield, reduce energy consumption, and minimize by-products. Improved catalytic systems allow for more precise control over reaction conditions, leading to higher selectivity and fewer emissions.

These advancements support the industry’s goals of operational efficiency and environmental compliance. Additionally, they help reduce manufacturing costs by lowering raw material loss and cutting down on purification steps. As companies aim to modernize their production infrastructure, the adoption of these catalytic improvements is becoming more widespread, signaling a shift toward smarter and greener acetaldehyde manufacturing methods.

Regional Analysis

In 2024, Asia-Pacific held a 47.8% share in the acetaldehyde market.

In 2024, Asia-Pacific emerged as the dominant region in the global acetaldehyde market, accounting for 47.8% of the total market share and reaching a valuation of USD 0.8 billion. The region’s leadership is supported by the presence of a strong chemical manufacturing base, rapid industrialization, and increasing demand for acetaldehyde-based applications across end-user industries. Countries like China, India, and South Korea are key contributors to this growth due to their expanding infrastructure, availability of raw materials, and favorable production economics.

North America and Europe follow, with moderate market shares, driven by established chemical sectors and regulated industrial standards. While North America benefits from technological advancements in chemical synthesis, Europe’s market is shaped by environmental regulations and a steady demand from the pharmaceutical and food industries.

The Middle East & Africa and Latin America represent smaller portions of the market but show potential for gradual growth, supported by increasing industrial development and foreign investment in chemical processing.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Arkema, Celanese Corporation, and Eastman Chemical Company remained prominent players in the global acetaldehyde market. Their strategic capabilities, technological proficiencies, and market positioning have significantly influenced regional and global supply dynamics.

Arkema has continued to leverage its specialized production processes to maintain a reliable acetaldehyde supply. The company’s investments in refining, oxidation, and hydration technologies have contributed to yield improvements and cost efficiencies. Arkema’s focus on maintaining high safety standards and operational reliability has strengthened its market presence, particularly in regions with stricter regulatory frameworks. Its integration across downstream applications—especially in specialty resins and advanced materials—has allowed the company to command steady demand from the industrial and chemical sectors.

Celanese Corporation has reinforced its leadership through process optimization and value-chain integration. The company’s emphasis on continuous-feed acetaldehyde production has streamlined its manufacturing operations, leading to lower per-unit costs and improved production consistency. Combined with strong market access in North America and Asia-Pacific, Celanese has achieved balanced geographic penetration.

Eastman Chemical Company has advanced its market position via technological adaptability and application diversification. The firm’s focus on enhancing catalyst performance and expanding production flexibility has improved operational efficiency. Eastman’s emphasis on high-purity grades for fine chemicals and performance materials has allowed it to differentiate within specialty sectors.

Top Key Players in the Market

- Arkema

- Celanese Corporation

- Eastman Chemical Company

- Honeywell International Inc.

- Jubilant Life Sciences

- Laxmi Organic Industries Ltd.

- LCY Chemical

- Lonza

- Sekab

- Solvay SA

- Sumitomo Chemical Co., Ltd

- Wacker Chemie AG

Recent Developments

- In December 2024, Arkema completed the acquisition of Dow’s flexible packaging laminating adhesives business for USD 150 million, a company with annual sales of approximately USD 250 million and five manufacturing sites across North America and Europe.

- In October 2024, Celanese introduced three sustainable engineering thermoplastics derived from multiple feedstocks. While these are downstream of its acetyl chain, the move indicates a strong investment in greener chemistry, indirectly strengthening the acetaldehyde value chain.

Report Scope

Report Features Description Market Value (2024) USD 1.8 Billion Forecast Revenue (2034) USD 3.0 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Process (Oxidation of Ethylene, Oxidation of Ethanol, Dehydrogenation of Ethanol, Others), By Application (Chemicals, Food and Beverage, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arkema, Celanese Corporation, Eastman Chemical Company, Honeywell International Inc., Jubilant Life Sciences, Laxmi Organic Industries Ltd., LCY Chemical, Lonza, Sekab, Solvay SA, Sumitomo Chemical Co., Ltd, Wacker Chemie AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Arkema

- Celanese Corporation

- Eastman Chemical Company

- Honeywell International Inc.

- Jubilant Life Sciences

- Laxmi Organic Industries Ltd.

- LCY Chemical

- Lonza

- Sekab

- Solvay SA

- Sumitomo Chemical Co., Ltd

- Wacker Chemie AG