Global Acaricides Market Size, Share, And Business Benefits By Product (Organophosphorus Compounds, Organochlorine Acaricides, Carbamates, Plant Derivatives, Others), By Mode Of Action (Dipping Vat, Spray, Hand Dressing, Others), By Application (Agriculture, Animal Husbandry, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155773

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

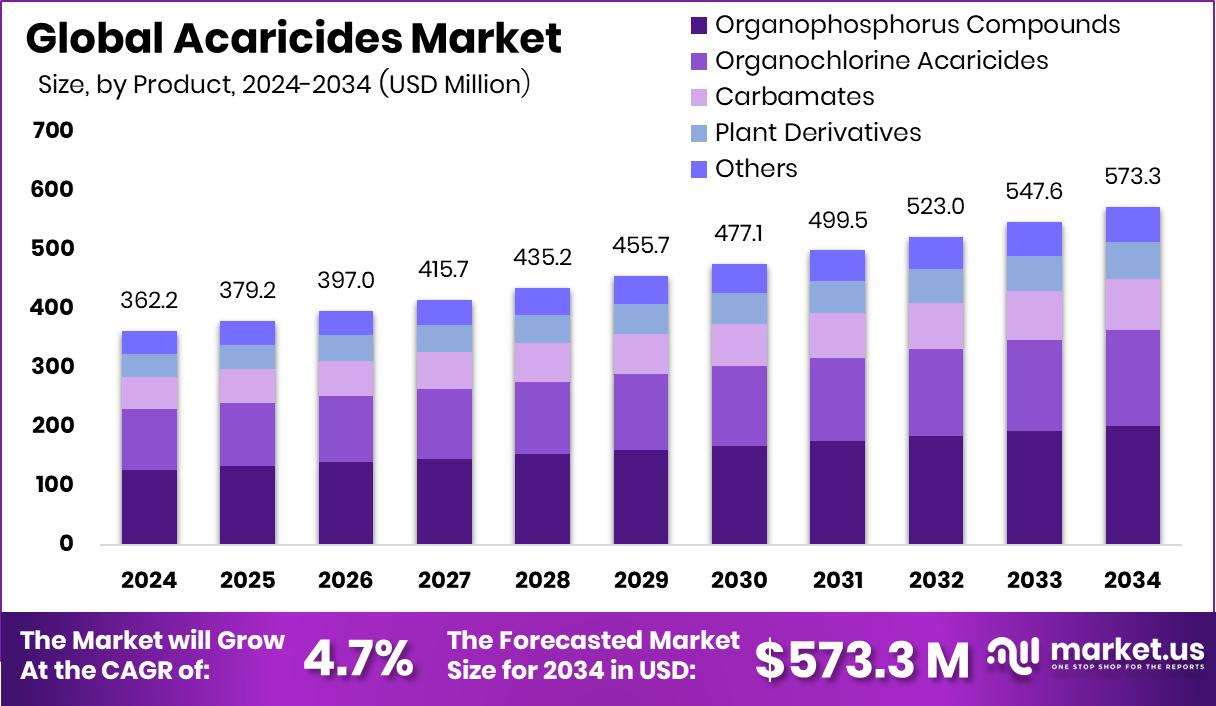

The Global Acaricides Market is expected to be worth around USD 573.3 million by 2034, up from USD 362.2 million in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034. Strong agricultural demand drives Asia Pacific’s 48.3% market growth.

Acaricides are chemical or biological substances used to control mites and ticks that affect crops, livestock, and sometimes human health. They play a critical role in agriculture by protecting plants from mite infestations, which can reduce yield and quality.

In animal husbandry, acaricides are essential for preventing tick-borne diseases that affect cattle, sheep, and pets. Because mites and ticks are widespread pests, acaricides have become a necessary input across both farming and veterinary practices.

The acaricides market refers to the global demand, production, and supply of these pest-control agents across the agriculture and veterinary sectors. It reflects the growing need for effective pest management solutions as farmers and livestock owners seek to safeguard productivity, reduce losses, and improve animal welfare. The market is expanding steadily as acaricides are adopted in both developed and emerging regions.

One of the strongest growth drivers is the rising pressure to increase food production. As global populations grow, farmers are relying more on pest control measures to protect crop yields from mite damage, ensuring a consistent food supply.

The demand is also driven by livestock health management. With ticks spreading diseases that can reduce milk, meat, and wool production, livestock farmers are turning to acaricides to protect their herds and sustain profitability. According to an industry report, the Government launches the 21st livestock census alongside a $25 million Pandemic Fund to strengthen animal health security and curb zoonotic diseases.

Key Takeaways

- The Global Acaricides Market is expected to be worth around USD 573.3 million by 2034, up from USD 362.2 million in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034.

- In the acaricides market, organophosphorus compounds dominate with a 34.7% share, ensuring effective pest management.

- Spray-based applications hold the lead with a 47.9% share, highlighting farmers’ preference for easy pest control methods.

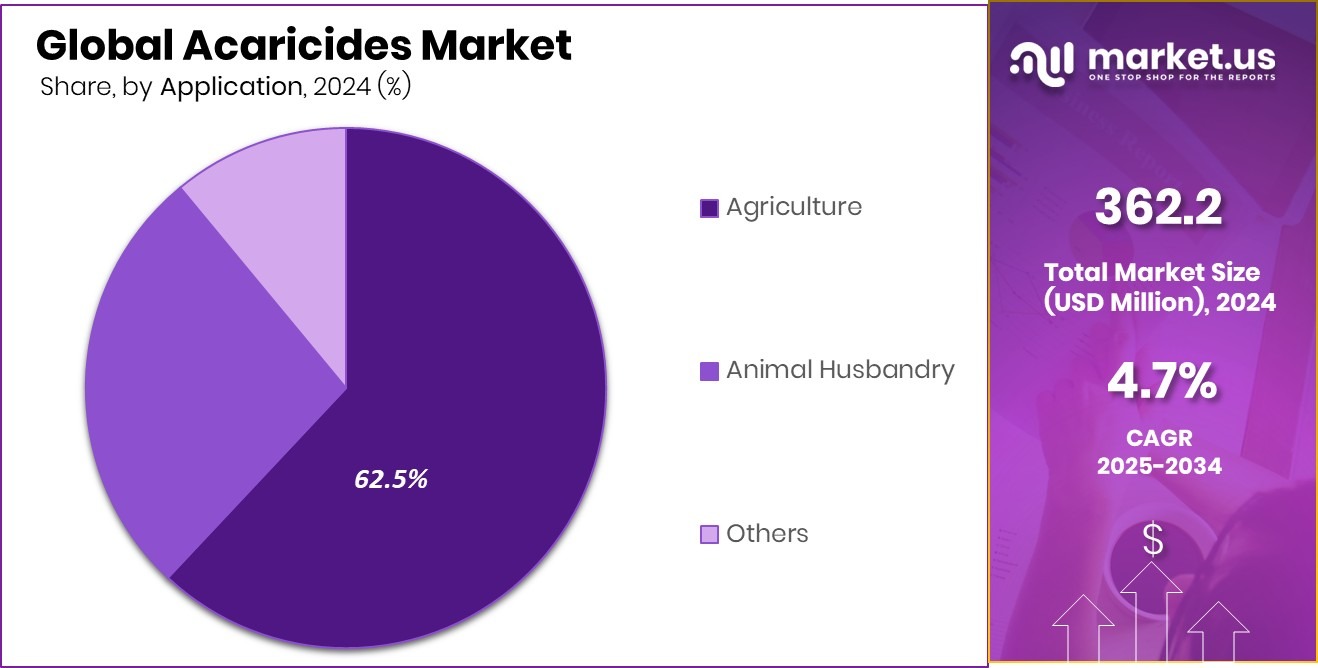

- Agriculture applications capture a 62.5% share, showing acaricides’ essential role in protecting crops from mite damage.

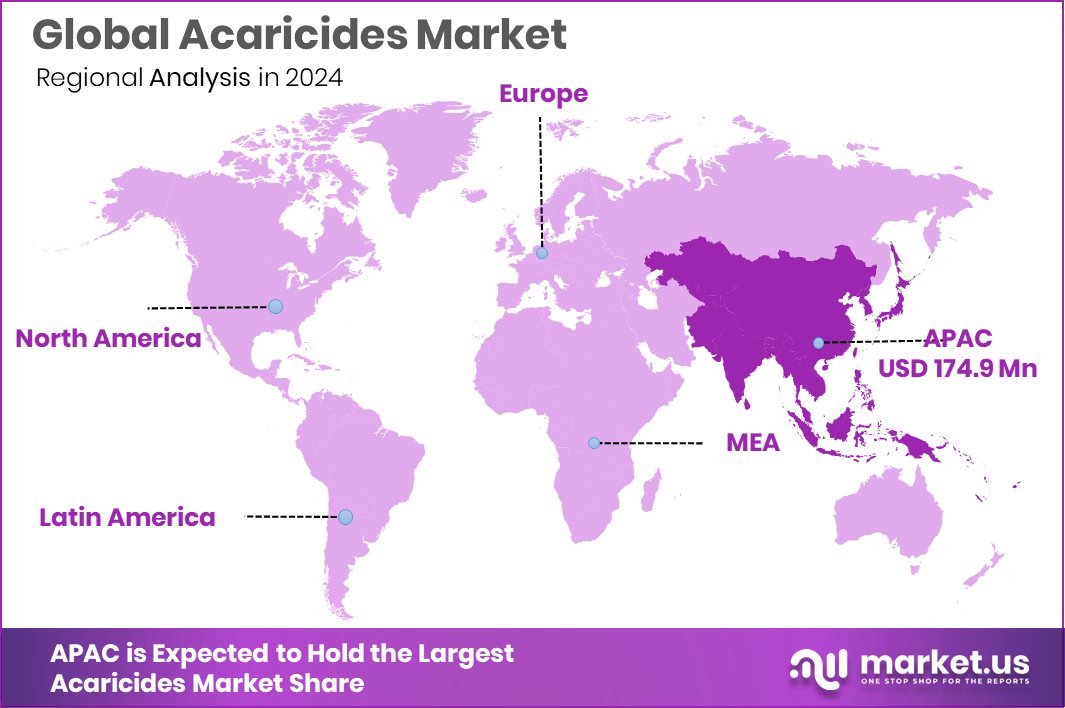

- The Asia Pacific acaricides market reached USD 174.9 million.

By Product Analysis

Organophosphorus compounds hold a 34.7% share, strengthening the acaricides market growth.

In 2024, Organophosphorus Compound held a dominant market position in the By Product segment of the Acaricides Market, with a 34.7% share. This leadership is largely due to its broad-spectrum effectiveness against a wide range of mites and ticks, making it a preferred choice for both crop protection and livestock health management.

Farmers and animal husbandry operators continue to rely on these compounds because they provide quick action and consistent results, ensuring higher productivity and safeguarding economic returns. Their widespread usage in agriculture, particularly in fruits, vegetables, and plantation crops, further strengthens their demand base.

The dominance of organophosphorus acaricides also reflects the rising need for reliable pest control solutions amid increasing incidences of mite resistance to older alternatives. The compound’s ability to disrupt pest nervous systems ensures strong control even in high-pressure infestations, positioning it as a critical tool in integrated pest management programs. Additionally, cost-effectiveness and ease of formulation make it more accessible across emerging agricultural markets.

Looking ahead to 2025, the demand for organophosphorus acaricides is expected to remain strong, especially in developing regions where agricultural expansion and livestock growth are driving higher acaricide consumption. While regulatory pressures on chemical residues may gradually shape usage patterns, this segment is projected to sustain its dominance in the near term.

By Mode Of Action Analysis

Spray mode dominates with 47.9%, highlighting farmers’ preferred acaricide application.

In 2024, Spray held a dominant market position in the By Mode of Action segment of the Acaricides Market, with a 47.9% share. The strong preference for spray formulations comes from their ease of application, uniform coverage, and ability to provide quick contact action against mites and ticks.

Farmers widely adopt spray-based acaricides in crop protection, as they can be applied directly to plant surfaces, ensuring effective penetration into leaves, fruits, and stems where mites usually thrive. This makes sprays highly reliable for securing yield quality in high-value crops such as fruits, vegetables, and plantation crops, where pest damage translates into significant economic loss.

The popularity of sprays is also tied to their versatility, as they can be used with standard spraying equipment, making them accessible to both small-scale and large-scale farmers. In addition, the effectiveness of sprays in covering large field areas within a shorter time frame has further boosted their demand. The livestock sector also contributes to this dominance, as spray acaricides are commonly applied to animals to prevent tick infestations and protect herd health.

Looking toward 2025, the spray segment is expected to maintain its leading share, supported by increasing adoption in regions with expanding agriculture and livestock industries, where efficient and practical pest management methods remain a top priority.

By Application Analysis

Agriculture leads with 62.5%, making it the core acaricides market driver.

In 2024, Agriculture held a dominant market position in the By Application segment of the Acaricides Market, with a 62.5% share. This strong position highlights the critical role of acaricides in protecting crops from mites, which are among the most damaging pests affecting fruits, vegetables, cereals, and plantation crops.

Farmers increasingly rely on acaricides to safeguard yields and maintain crop quality, especially in regions where pest pressure is high and agricultural output is central to economic stability. With rising global food demand, effective crop protection has become a priority, driving consistent adoption of acaricides in farming practices.

The dominance of agriculture in this segment is also supported by the rapid growth of commercial farming, where large-scale cultivation demands reliable pest management solutions to minimize losses.

Acaricides not only improve crop productivity but also enhance export quality standards by reducing pest-related damages, a crucial factor for countries focused on agricultural trade. In addition, climate change and warmer weather conditions have expanded the prevalence of mite infestations, further increasing dependence on acaricide use.

Key Market Segments

By Product

- Organophosphorus Compounds

- Organochlorine Acaricides

- Carbamates

- Plant Derivatives

- Others

By Mode Of Action

- Dipping Vat

- Spray

- Hand Dressing

- Others

By Application

- Agriculture

- Animal Husbandry

- Others

Driving Factors

Rising Need for Food Security Boosts Acaricides

One of the top driving factors for the acaricides market is the rising global need for food security. With the world’s population growing rapidly, farmers are under constant pressure to produce more crops on limited land. Mite infestations pose a serious threat to crop yields, especially in fruits, vegetables, cereals, and plantation crops, as they damage leaves and reduce plant productivity. Acaricides help farmers protect crops effectively, ensuring better harvests and a steady food supply.

As demand for safe and quality food increases, the use of reliable pest control solutions like acaricides becomes essential. This rising focus on securing food production is strongly pushing the market forward, making acaricides a key tool in modern agriculture.

Restraining Factors

Strict Regulations on Chemical Residues Limit Growth

A major restraining factor for the acaricides market is the strict regulations on chemical residues in food and the environment. Many countries have tightened rules on the use of chemical pesticides, including acaricides, because of health and ecological concerns. Excessive use can leave residues on crops, contaminate soil, and affect non-target species, which creates pressure on farmers to reduce dependency on synthetic chemicals.

Governments and international trade bodies have set maximum residue limits (MRLs), and products failing to meet these standards face rejection in export markets. These regulatory hurdles not only increase compliance costs for producers but also limit the availability of certain chemical formulations, slowing down market growth despite the strong demand for pest control solutions.

Growth Opportunity

Growing Demand for Eco-Friendly Bio-Based Acaricides

A key growth opportunity for the acaricides market lies in the rising demand for eco-friendly and bio-based solutions. Farmers and livestock owners are increasingly aware of the harmful effects of chemical residues on food, animals, and the environment. This shift has opened the door for natural acaricides made from plant extracts, essential oils, and other biological sources.

These products are safer, biodegradable, and align well with the global move toward sustainable farming practices. Governments are also supporting eco-friendly pest control through subsidies and regulations that encourage lower chemical use. As consumers prefer organic and residue-free produce, the adoption of bio-based acaricides is expected to rise sharply, creating significant growth potential for this segment in the coming years.

Latest Trends

Adoption of Integrated Pest Management Driving Usage

One of the latest trends in the acaricides market is the growing adoption of Integrated Pest Management (IPM) practices. Instead of relying only on heavy chemical applications, farmers are combining biological control methods, cultural practices, and targeted acaricide use to manage mites more effectively. This approach reduces the risk of pest resistance, lowers chemical residues in food, and improves long-term soil health.

The use of acaricides within IPM ensures that they are applied in the right quantity, at the right time, for maximum effectiveness. Many agricultural extension programs and government initiatives are promoting IPM, and farmers are recognizing its benefits. This balanced and sustainable approach is becoming a major trend, reshaping how acaricides are applied globally.

Regional Analysis

In 2024, the Asia Pacific held 48.3% market share.

The acaricides market shows varied regional dynamics, reflecting differences in agricultural practices, pest prevalence, and regulatory environments. Asia Pacific emerged as the dominant region in 2024, holding a 48.3% share valued at USD 174.9 million, driven by its vast agricultural base and the increasing pressure to secure food supplies for its large population. Countries such as China, India, and Southeast Asian nations have witnessed rising incidences of mite infestations in high-value crops like fruits, vegetables, and tea, pushing strong demand for effective acaricide solutions.

In contrast, North America and Europe maintain steady growth due to advanced farming techniques and stringent regulatory frameworks that encourage integrated pest management practices. The Middle East & Africa, with its growing focus on crop protection in arid farming systems, and Latin America, supported by large-scale cultivation of export-oriented crops, are gradually adopting acaricides to enhance yields.

However, it is Asia Pacific’s dominance that stands out, supported by rapid agricultural expansion, climate-driven pest outbreaks, and increasing awareness among farmers regarding crop protection. The combination of rising food demand and higher pest management investments ensures that the Asia Pacific continues to lead the global acaricides market ahead of other regions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Bayer AG focused on advancing sustainable crop protection solutions, aligning its acaricide portfolio with the growing demand for effective yet environmentally safe products. The company’s emphasis on research and development positioned it strongly in addressing resistance management and meeting regulatory expectations.

BASF SE demonstrated its strength through integrated pest management solutions, combining chemical expertise with advanced formulation technologies. Its diversified crop protection segment continued to support farmers with reliable acaricides, reinforcing its position across both developed and emerging markets.

FMC Corporation built on its specialization in agricultural sciences, leveraging strong distribution networks to expand access to acaricides in key farming regions, particularly where rising mite infestations threatened crop productivity. Its focus on farmer-centric solutions helped sustain demand across diverse applications.

Nissan Chemical Industries, Ltd. contributed significantly by emphasizing high-quality formulations and precision chemistry. The company’s products gained traction in Asian markets, where agricultural intensity and pest pressures are particularly high. Its ability to cater to regional crop needs strengthened its competitive edge.

Top Key Players in the Market

- Bayer AG

- BASF SE

- FMC Corporation

- Nissan Chemical Industries, Ltd.

- STAR BIO SCIENCE

- NIPPON SODA CO., LTD.

- Nufarm

- Sumitomo Chemical Ltd.

Recent Developments

- In May 2024, FMC Corporation formed a multi-year research partnership with biotechnology firm AgroSpheres to co-develop novel bioinsecticide solutions using RNA interference (RNAi) technology. This collaboration aims to combine AgroSpheres’ encapsulation technology with FMC’s testing and commercial capabilities to create more effective and sustainable pest control products.

- In March 2024, BASF received an expanded label approval for Velifer® bioinsecticide/miticide, allowing greenhouse growers to apply it not only as sprays but also through dips and drench methods. This makes pest control more flexible and effective across more greenhouse crops like fruit and nut trees, vines, brambles, and bushberries. Velifer targets mites, thrips, aphids, mealybugs, and whiteflies, and is safe for beneficial insects like pollinators.

Report Scope

Report Features Description Market Value (2024) USD 362.2 Million Forecast Revenue (2034) USD 573.3 Million CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Organophosphorus Compounds, Organochlorine Acaricides, Carbamates, Plant Derivatives, Others), By Mode Of Action (Dipping Vat, Spray, Hand Dressing, Others), By Application (Agriculture, Animal Husbandry, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bayer AG, BASF SE, FMC Corporation, Nissan Chemical Industries, Ltd., STAR BIO SCIENCE, NIPPON SODA CO., LTD., Nufarm, Sumitomo Chemical Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global Acaricides MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Global Acaricides MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bayer AG

- BASF SE

- FMC Corporation

- Nissan Chemical Industries, Ltd.

- STAR BIO SCIENCE

- NIPPON SODA CO., LTD.

- Nufarm

- Sumitomo Chemical Ltd.