Global 4-Vinyl Guaiacol (CAS 7786-61-0) Market Size, Share Analysis Report By Purity Level (Greater Than or Equal 98%, Less-than sign 98%), By Application (Food and Beverages, Pharmaceutical, Cosmetics, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169812

- Number of Pages: 393

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

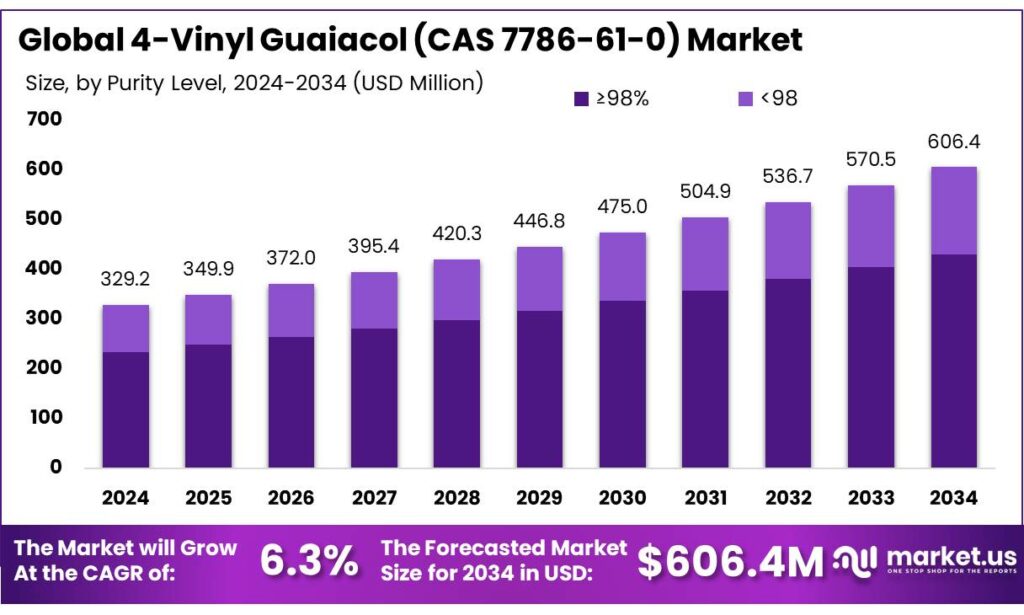

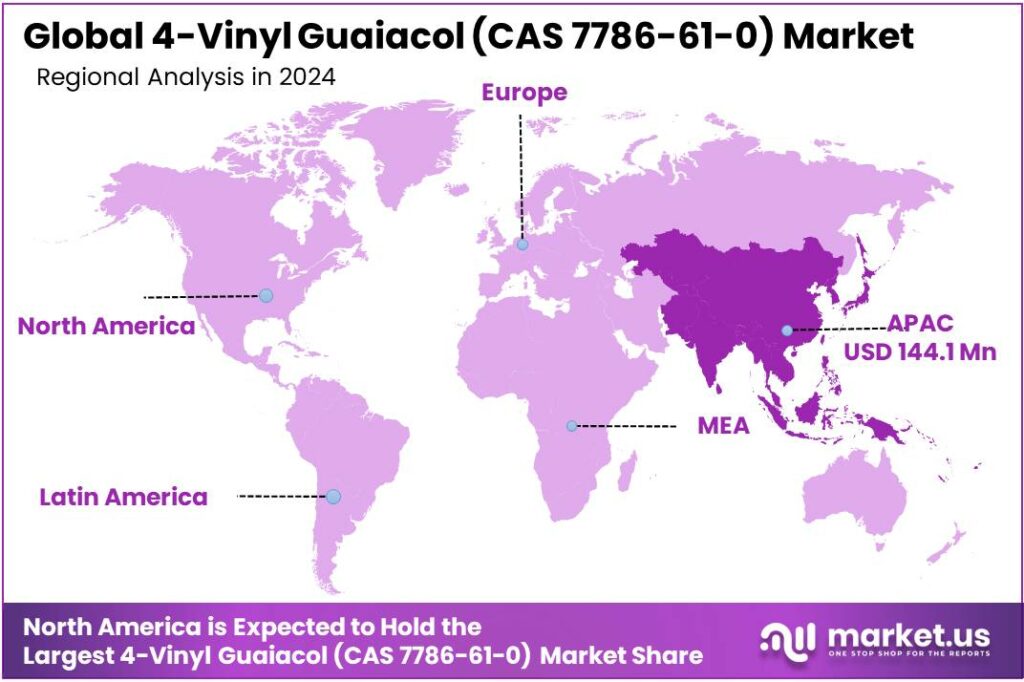

The Global 4-Vinyl Guaiacol (CAS 7786-61-0) Market size is expected to be worth around USD 606.4 Million by 2034, from USD 329.2 Million in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 43.80% share, holding USD 144.1 Million revenue.

4-Vinyl Guaiacol (4-VG, CAS 7786-61-0) is a phenolic flavour and fragrance ingredient with a characteristic clove-like, smoky aroma, widely used in food, beverage, cosmetic and pharmaceutical formulations. It is also registered as FEMA flavour no. 2675 with JECFA evaluation for use in foods, underlining its regulatory acceptance as a flavouring substance in global markets. Chemically, 4-VG (molecular weight 150.17 g/mol) is produced either by multi-step synthesis from vanillin or by decarboxylation of ferulic acid during fermentation and roasting processes, for example in corn ethanol streams, wheat beer, coffee and rice wine.

Industrial production is shifting from purely petrochemical or vanillin-based routes toward biotechnological pathways using agro-industrial residues rich in ferulic acid. Recent work shows efficient bioconversion of ferulic acid from hydrolysed lignocellulosic biomass into 4-VG via engineered bacteria and fungi, providing higher yields and cleaner product streams aligned with “natural flavour” positioning. This fits into the broader biorefinery context: lignocellulosic agricultural waste is estimated at about 1.3 billion tonnes per year globally, providing an abundant feedstock base for aromatics such as 4-VG.

Bioenergy and biofuel expansion is an important macro driver for 4-VG and related bio-aromatics because it creates large, centralized lignocellulosic processing hubs. Global biofuel demand reached 4.3 EJ (around 170,000 million litres) in 2022 and continues to rise.

- According to the World Bioenergy Association, ethanol output climbed to 116 billion litres in 2023, representing about 70% of liquid biofuels, and further to 118 billion litres in 2024 as the largest single biofuel stream. In transport, biofuels supplied about 4.73 EJ in 2023, nearly 90% of renewable energy use in the sector, supported by blending policies in at least 35 countries.

Key Takeaways

- 4-Vinyl Guaiacol (CAS 7786-61-0) Market size is expected to be worth around USD 606.4 Million by 2034, from USD 329.2 Million in 2024, growing at a CAGR of 6.3%.

- ≥98% held a dominant market position, capturing more than a 71.2% share.

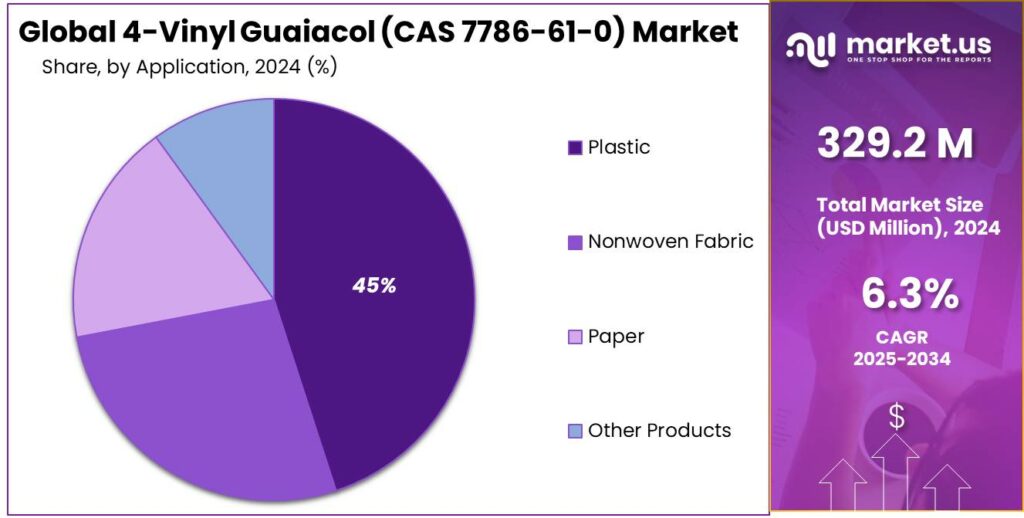

- Food and Beverages held a dominant market position, capturing more than a 41.3% share.

- Asia Pacific region held a commanding position in the 4-Vinyl Guaiacol market, accounting for roughly 43.80% of global demand and approximately USD 144.1 million.

By Purity Level Analysis

≥98% purity leads with 71.2% as the preferred grade for high-precision applications.

In 2024, ≥98% held a dominant market position, capturing more than a 71.2% share. This high-purity band was favoured because it meets stringent specifications required by pharmaceutical, fragrance, and fine-chemical manufacturers; as a result, production and quality-control processes were concentrated on analytical testing, impurity profiling, and batch traceability to ensure compliance. Procurement strategies prioritized certified ≥98% lots to reduce downstream processing and safeguard product performance, and pricing reflected the premium for validated purity and documentation.

Manufacturing capacity and laboratory services were scaled to support repeat orders and short lead times. By 2025, the ≥98% segment continued to command the majority of demand, with incremental investment in process optimization and enhanced testing protocols to maintain supply reliability for regulated and high-value end uses.

By Application Analysis

Food and Beverages leads with 41.3% driven by rising demand for flavor enhancement.

In 2024, Food and Beverages held a dominant market position, capturing more than a 41.3% share. The segment benefited from the growing use of 4-Vinyl Guaiacol as a key aroma compound in baked goods, seasonings, malt-based beverages, and specialty brews where its natural clove-like profile enhances product differentiation.

Demand was supported by rising consumption of craft beverages and premium bakery items, prompting manufacturers to secure stable high-purity supply and adopt controlled-fermentation or enzymatic pathways for consistent flavour output. Regulatory acceptance for food-grade usage and preference for clean-label flavouring ingredients further strengthened adoption across large-scale and artisanal producers. By 2025, the Food and Beverages segment continued to grow steadily as brands focused on sensory innovation and reformulation to meet consumer interest in natural aroma compounds.

Key Market Segments

By Purity Level

- ≥98%

- <98%

By Application

- Food and Beverages

- Pharmaceutical

- Cosmetics

- Others

Emerging Trends

Fermented, Functional and Low-Alcohol Drinks Redefine 4-Vinyl Guaiacol Use

A clear latest trend for 4-Vinyl Guaiacol (CAS 7786-61-0) is its quiet move from a niche “clove note” in specialty beers into a broader toolkit for fermented, functional and low-alcohol drinks. As a phenolic flavour formed during cereal fermentation, 4-Vinyl Guaiacol (2-methoxy-4-vinylphenol) fits naturally into the new wave of products that want complex, smoky-spicy character but still claim traditional fermentation and clean labels. JECFA already lists it as a flavouring with “no safety concern at current levels of intake,” which gives formulators confidence to use it creatively.

- The International Food Information Council (IFIC) reports that more people were trying to consume probiotics and prebiotics in 2021 than just one year earlier, showing a clear uptick in interest. One IFIC-based analysis found that 32% of U.S. consumers say they are actively trying to consume probiotics, often through yogurt and other fermented products. Another summary of IFIC’s 2022 gut-health survey notes that among those who seek probiotics, around 25% commonly choose foods like kombucha, kefir and other fermented beverages. A more recent digest of the same research suggests that about 30% of Americans report eating fermented foods such as yogurt, kefir or kombucha at least once per week.

Brewing remains the most visible testing ground for this trend. The Brewers Association’s “Year in Beer” data show that the United States still had 9,736 small and independent breweries operating in 2024, even in a challenging year. Craft brewers produced 23.1 million barrels in 2024, about 3.9–4% less than 2023, but the number of producers and the diversity of styles remain high. At the 2024 Great American Beer Festival, judges evaluated 8,836 commercial beer entries plus additional ciders and collaboration brews, confirming how many recipes rely on subtle phenolic notes, including 4-Vinyl Guaiacol, to stand out in crowded categories.

Fast-moving piece of the trend is the explosion of no- and low-alcohol (NOLO) beer, where flavour has to carry the product in the absence of ethanol. AB InBev’s recent investment of about $3.9 million in a de-alcoholisation facility at its Magor brewery in the UK is a good illustration of this shift. Industry coverage notes that alcohol-free beers already account for roughly 2% of the UK beer market by volume and are expected to double by 2029, while AB InBev’s 0.0% beer sales grew 27% globally in a recent period. To keep familiar flavour in these beers, brewers lean on fermentation-derived phenolics, including 4-Vinyl Guaiacol, because they survive de-alcoholisation better than some delicate hop aromas and fit the “beer-like” expectation.

Drivers

Clean-Label Fermentation Flavours Driving 4-Vinyl Guaiacol Demand

A key force behind the growing use of 4-Vinyl Guaiacol (4-VG, CAS 7786-61-0) is the shift toward natural, fermentation-derived flavours in beer, bakery and broader food products. 4-VG is a clove-like, smoky phenolic molecule formed from ferulic acid during fermentation and is widely used to build the signature profiles of wheat beers, specialty lagers and roasted foods. As consumers look for labels that say “fermented” and “natural flavour” instead of synthetic aromatics, formulators prefer ingredients like 4-VG that can be directly linked to grain or corn-ethanol fermentation streams rather than petrochemical routes.

The beer industry gives a clear sense of scale. According to Kirin’s global survey, beer consumption reached about 187.9 million kilolitres in 2023, edging up 0.1% from the previous year as on-trade channels reopened and premium styles recovered. Visualizations based on the same data show that China, the US and Brazil together account for roughly 40% of this volume, underlining how global and diversified flavour needs have become. Within this base, phenolic wheat beers, Belgian styles and smoked or barrel-aged variants rely heavily on 4-VG to deliver the recognizable clove and spicy notes that consumers associate with authenticity.

Behind these beverages sits a massive grain system that also supports 4-VG’s bio-based positioning. The UN Food and Agriculture Organization reports that global primary crop output reached 9.9 billion tonnes in 2023, up 3% versus 2022, while cereal production alone increased by 61 million tonnes (about 2%) in the same year. In its cereals brief, FAO further notes that world cereal production is moving toward the 3.0 billion-tonne mark as forecasts are upgraded on the back of strong maize and wheat harvests.

Policy support for a low-carbon bioeconomy adds another layer to this demand driver. The European Commission’s new Bioeconomy Strategy notes that the EU bioeconomy was already worth up to €2.7 trillion in 2023, employing about 17.1 million people – roughly 8% of EU jobs – and explicitly highlights bio-based chemicals and advanced fermentation as focus areas. A related policy paper underlines that the bioeconomy represents around 5% of EU GDP today but is seen as part of a €6.6 trillion global opportunity as other regions roll out their own industrial plans.

Restraints

Strict Additive Scrutiny and Consumer Distrust Limit 4-Vinyl Guaiacol Use

A major restraint for 4-Vinyl Guaiacol (CAS 7786-61-0) is the combination of very strict food-additive regulation and rising consumer distrust of “chemical-sounding” ingredients. On paper, the molecule is well accepted: the Joint FAO/WHO Expert Committee on Food Additives (JECFA) evaluated 2-methoxy-4-vinylphenol in 2000 and concluded there is no safety concern at current levels of intake when used as a flavouring agent. Yet this positive opinion sits inside a regulatory system that is increasingly cautious and complex, which makes food companies conservative in how broadly they deploy phenolic flavourings like 4-VG.

The global food-additive safety framework itself shows how high the bar has become. WHO notes that food additives are always assessed for potential harm before approval, and that JECFA is the international body charged with evaluating their safety for use in foods traded worldwide. A recent review of JECFA’s work highlights that the committee has already assessed over 660 food additives, 105 enzymes and about 2,500 flavourings, together with numerous contaminants and veterinary drug residues.

- Regional rules add another layer of restraint. In the European Union, Regulation (EC) No 1334/2008 sets general conditions for the use of flavourings and establishes a Union list of flavouring substances that must be explicitly authorised before they can be used in foods. The European Food Safety Authority (EFSA) notes that more than 300 substances are authorised as food additives in the EU and are subject to ongoing re-evaluation as science advances.

At the same time, public concern about additives is rising, even when authorities emphasise that properly regulated additives are safe. WHO warns that unsafe food containing harmful chemical substances contributes to more than 200 diseases globally, reinforcing the political pressure to keep chemical risks very low. Surveys show that this concern strongly shapes purchasing behaviour. An International Food Information Council (IFIC) study reported that 54% of consumers say it is important that ingredients do not have “chemical-sounding names,” and 26% call this very important.

Opportunity

Bio-Based Flavour Valorisation in the Growing Grain and Biofuel Economy

One of the biggest growth opportunities for 4-Vinyl Guaiacol (CAS 7786-61-0) sits at the intersection of grains, biofuels and clean-label flavours. 4-VG is a clove-like phenolic note that can be produced from ferulic-acid–rich cereal streams or corn ethanol side-products, not only from petrochemical routes. As the world scales up grain processing and biorefineries, there is a clear opening to “upgrade” what used to be low-value residues into high-value, bio-based flavour molecules such as 4-VG.

The raw material base is moving in the right direction. The FAO reports that global primary crop output reached 9.9 billion tonnes in 2023, up 3% versus 2022, while world cereal production increased by 61 million tonnes or 2% in the same period, mainly on the back of maize. In its latest Cereal Supply and Demand Brief, FAO projects that world cereal production in 2025 will hit 3.003 billion tonnes, the first time global output is expected to exceed the 3-billion-tonne threshold.

- According to the World Bioenergy Association, biofuels consumption in transport reached 4.73 EJ in 2023, accounting for nearly 90% of all renewable energy used in the transport sector. The same report shows that ethanol remains the leading liquid biofuel, with global output of 118 billion litres in 2024, and that the United States and Brazil together supplied about 80% of that volume.

Policy frameworks are pushing in the same direction. The International Energy Agency notes that more than 80 countries now have policies that support biofuel demand, and that biofuels avoided about 4% of global road-transport oil use in 2022. Looking ahead, the IEA expects global biofuel demand to rise by 11% to 2024 and to continue growing strongly through 2030, with emerging economies accounting for much of the increase. When governments lock in long-term mandates and blending targets, they are indirectly building a more stable feedstock platform for bio-based co-products like 4-VG.

Regional Insights

Asia Pacific leads with 43.8% (≈ USD 144.1 Mn) as the primary regional market for 4-Vinyl Guaiacol.

In 2024, the Asia Pacific region held a commanding position in the 4-Vinyl Guaiacol market, accounting for roughly 43.80% of global demand and approximately USD 144.1 million in sales. This dominance was driven by a dense manufacturing base for flavours and fragrances, a large and growing food & beverage industry, and cost-competitive chemical production capacity that supports both domestic consumption and exports. Producers in the region concentrated investments in high-purity production lines (≥98% grades) and strengthened quality-assurance capabilities—such as enhanced impurity profiling and batch traceability—to meet the specifications of food-grade and fragrance customers.

Supply-chain efficiencies and proximity to upstream raw materials reduced lead times and enabled competitive pricing, which encouraged formulators and beverage manufacturers to secure local long-term contracts. Regulatory acceptance for food-grade flavouring agents and rising craft-beverage demand also supported uptake, while growing R&D activity around controlled-fermentation and enzymatic synthesis routes improved consistency and yield.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Symrise is a global leader in flavors and fragrances and supplies high-value aroma chemicals, R&D support, and application know-how to major food, beverage and fragrance customers. In 2024 the Symrise Group reported sales of approx. €4,999 million, reflecting continued investment in scent and taste technologies and strong demand for specialty ingredients. The company combines scale production with regulatory compliance, sensory science and tailored technical solutions—positioning it to supply consistent high-purity aroma compounds and to support global customers with formulation and stability expertise.

Synerzine is a specialist supplier of aroma raw materials for flavors and fragrances, supplying a broad portfolio of ingredients used in food, beverage and perfume formulation. In 2024 the company promoted a catalogue of 1,200+ aroma ingredients, emphasising kosher/halal options and technical application support for formulators. The business model targets niche and specialty aroma chemistries—such as phenolic notes—backed by application guidance, small-batch supply and fast technical response to R&D customers seeking unique sensory profiles.

Top Key Players Outlook

- Synerzine

- Cymit Química S.L.

- Scent

- Symrise GmbH & Co. KG

- Others

Recent Industry Developments

Symrise reported group sales of €4,999 million and EBITDA €1,033 million in 2024, reflecting strong commercial scale and the financial bandwidth to support technical service, small-batch sampling and traceability for specialty aroma chemicals.

Cymit Química operates from Barcelona with an estimated workforce of 11–50 employees and reported annual turnover in the €2–10 million range (latest 2024 filings), indicating a small but focused distributor profile that prioritises technical service and rapid order fulfilment.

Synerzine supplied offered 1,200+ aroma ingredients (2024) and drew on more than 44 years of market experience to provide documentation, quality systems and application guidance that meet food-grade and regulatory needs.

Report Scope

Report Features Description Market Value (2024) USD 329.2 Mn Forecast Revenue (2034) USD 606.4 Mn CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity Level (Greater Than or Equal 98%, Less-than sign 98%), By Application (Food and Beverages, Pharmaceutical, Cosmetics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Synerzine, Cymit Química S.L., Scent, Symrise GmbH & Co. KG, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  4-Vinyl Guaiacol (CAS 7786-61-0) MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

4-Vinyl Guaiacol (CAS 7786-61-0) MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Synerzine

- Cymit Química S.L.

- Scent

- Symrise GmbH & Co. KG

- Others