Global 3-Methyl-1, 5-Pentanediol Market Size, Share Analysis Report By Form (Liquid, Solid), By Application (Polyurethanes, Solvents, Acrylate Monomer, Polyester, UV monomer, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169245

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

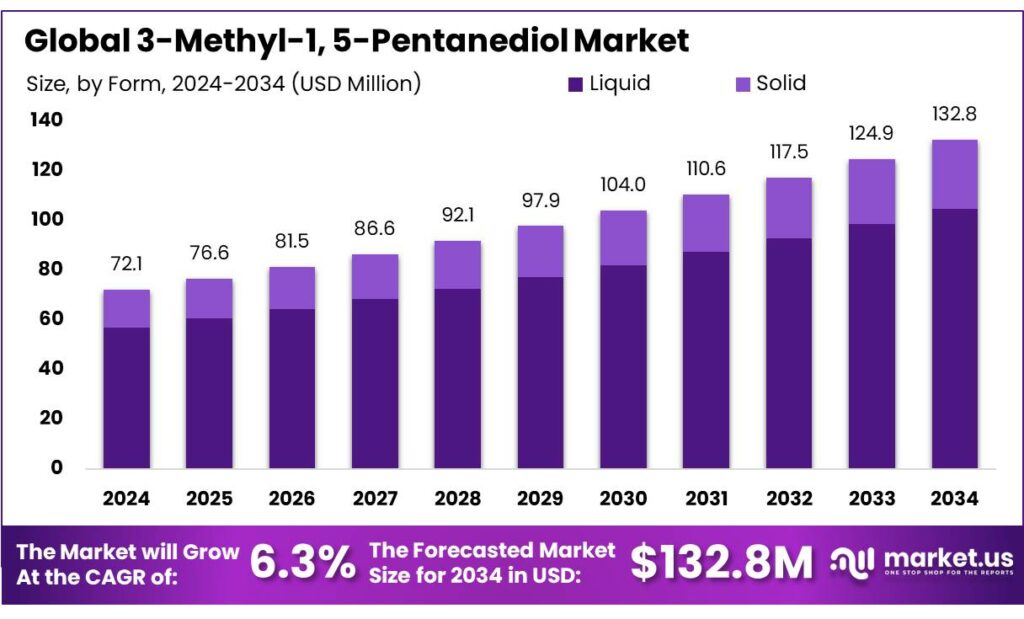

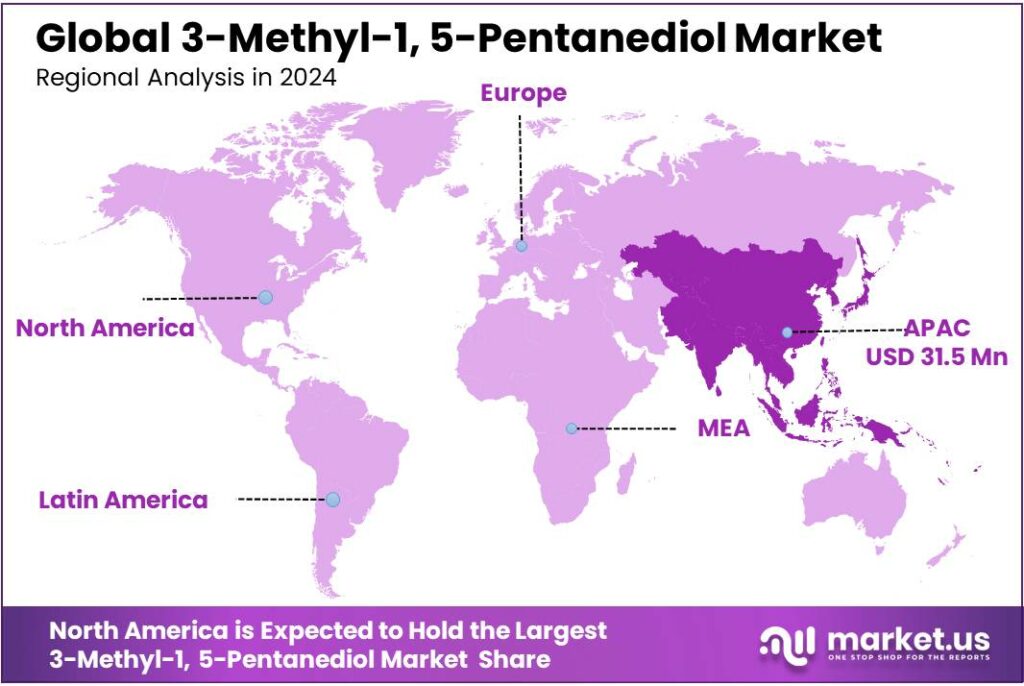

The Global 3-Methyl-1, 5-Pentanediol Market size is expected to be worth around USD 132.8 Million by 2034, from USD 72.1 Million in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 43.80% share, holding USD 31.5 Million revenue.

3-Methyl-1,5-pentanediol (3-MPD) is a specialty diol used mainly as a building block for polyurethanes, industrial coatings, adhesives and plasticizers. Its branched structure, with a methyl group in the middle of the carbon chain, gives polymers improved softness, transparency and compatibility compared with linear diols such as 1,6-hexanediol. This makes 3-MPD attractive in high-performance coatings, flexible films and elastomer systems where durability and aesthetics are critical.

In the current industrial scenario, 3-MPD sits inside the wider chemical value chain, which is the largest industrial energy consumer and the third-largest source of direct CO₂ emissions globally. The IEA notes that industry as a whole accounts for 37% of global final energy use, or about 166 exajoules (EJ) in 2022, underscoring how energy and emissions policy directly shape chemical investment decisions. As a niche diol, 3-MPD demand tracks trends in coatings, polyurethanes and engineered plastics rather than bulk commodity cycles.

A key demand driver is the expansion of coatings and polymer applications in automotive, construction and electronics. High-performance diols such as 3-MPD are used to formulate low-VOC, abrasion-resistant and weatherable coatings for vehicles, industrial equipment and building facades. Global motor vehicle production reached about 93.5 million units in 2023, according to OICA, providing a large installed base that requires OEM and refinish coatings. This sustained automotive output indirectly supports long-term demand for 3-MPD-based resins.

Energy-transition spending is another structural driver. Polyurethanes and advanced coatings are used in wind turbine blades, solar racks, electrical housings and infrastructure exposed to harsh outdoor environments. IRENA reports that global renewable power capacity reached roughly 4,448 GW in 2024, after a record 585 GW of new additions representing 15.1% annual growth and over 90% of net power expansion. As developers scale solar and wind assets, demand rises for corrosion-resistant, UV-stable coatings and elastomers where 3-MPD-modified polyols can improve durability.

Key Takeaways

- 3-Methyl-1, 5-Pentanediol Market size is expected to be worth around USD 132.8 Million by 2034, from USD 72.1 Million in 2024, growing at a CAGR of 6.3%.

- Liquid held a dominant market position, capturing more than a 79.2% share of the 3-Methyl-1,5-pentanediol market.

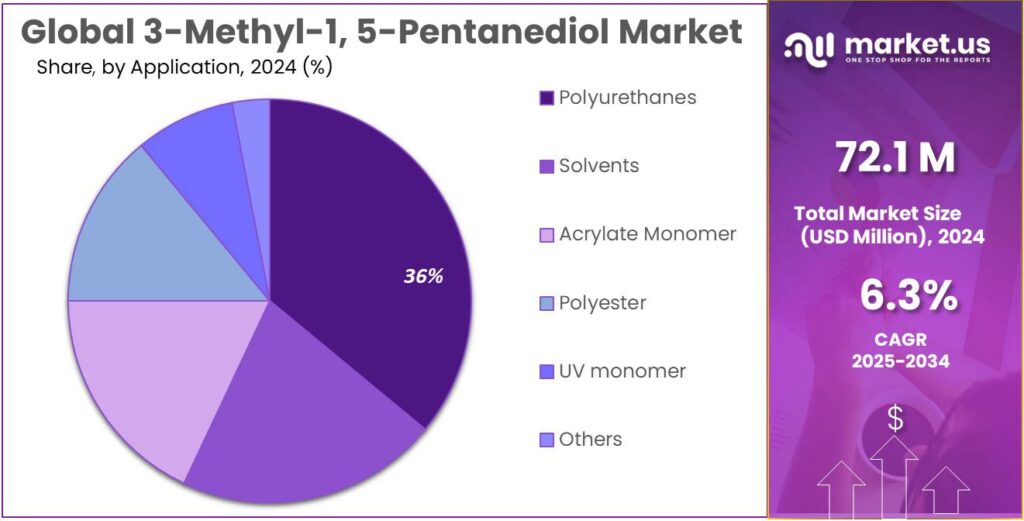

- Polyurethanes held a dominant market position, capturing more than a 35.7% share of the 3-Methyl-1,5-pentanediol market.

- Asia Pacific (APAC) held a commanding position in the 3-Methyl-1,5-pentanediol market, registering a 43.80% share and representing approximately 31.5 million.

By Form Analysis

Liquid leads with a 79.2% share in 2024

In 2024, Liquid held a dominant market position, capturing more than a 79.2% share of the 3-Methyl-1,5-pentanediol market by form. This predominance can be attributed to easier handling, higher solubility in common solvents, and compatibility with widely used polyol and polymer processing techniques; such attributes have supported broad adoption across coatings, adhesives, and specialty polymer applications.

Supply chains and production processes were aligned to meet steady industrial demand, and formulation flexibility was used to tailor performance for end-use requirements. Given current application preferences and processing advantages, the liquid form is expected to remain the primary product choice into 2025, sustaining its lead in volume terms and continuing to influence downstream market dynamics.

By Application Analysis

Polyurethanes lead with a 35.7% share in 2024

In 2024, Polyurethanes held a dominant market position, capturing more than a 35.7% share of the 3-Methyl-1,5-pentanediol market by application. This strong share was driven by the diol’s ability to enhance flexibility, hydrolysis resistance, and long-term mechanical strength in polyurethane systems. These advantages supported rising use in coatings, elastomers, adhesives, and specialty foams, where consistent performance is required.

Industrial users favored its stable reactivity profile and formulation ease, strengthening its role in high-value polyurethane products. The segment is expected to maintain its lead into 2025 as demand for durable and weather-resistant materials continues to grow across construction, automotive, and industrial sectors.

Key Market Segments

By Form

- Liquid

- Solid

By Application

- Polyurethanes

- Solvents

- Acrylate Monomer

- Polyester

- UV monomer

- Others

Emerging Trends

Bio-Based, Low-Impact Packaging Chemistries Reshape How 3-MPD Is Used

One clear recent trend for 3-Methyl-1,5-Pentanediol (3-MPD) is its quiet move into the “next generation” of food packaging chemistries. Producers now position 3-MPD as a high-performance diol for specialty polyols and polyurethanes, valued for clarity, flexibility and good reactivity in coatings, adhesives and elastomers used around food. These properties make it a natural fit when formulators redesign laminating adhesives and coatings to be both tougher and more sustainable.

These material trends sit on top of a steadily expanding food system. The OECD-FAO Agricultural Outlook projects that global food consumption in calories will grow by about 1.3% per year over the next decade. More processed food, more trade and more ready-to-eat formats all translate into stronger demand for flexible packaging, coated metal and barrier cartons – exactly the areas where 3-MPD-containing polyurethanes are being optimised.

At the same time, rising concern about food waste is changing how packaging is judged. The UNEP Food Waste Index Report 2024 estimates that in 2022 the world wasted around 1.05 billion tonnes of food, about 19% of food available to consumers at retail, food service and household level. FAO data add that roughly 13% of food is lost earlier in the supply chain, before it even reaches stores. These numbers are driving a trend toward coatings and adhesives that extend shelf life and survive harsher logistics without failure.

Drivers

Rising Demand for Safe, High-Performance Food Packaging as a Key Driver

A major driving factor for 3-Methyl-1,5-Pentanediol (3-MPD) is the steady push for safer, more durable food packaging and food-contact coatings. 3-MPD is used in polyurethanes, coatings, adhesives, plasticizers and printing inks for films, lids and metal cans, where it improves flexibility, resistance to stains and moisture, and long-term stability. As food companies upgrade packaging for quality, shelf life and regulatory compliance, demand for such high-performance diols gains momentum.

Global food systems are expanding, and that growth flows directly into packaging needs. The OECD-FAO Agricultural Outlook projects global agriculture and fisheries production to increase by about 1.4% per year over the coming decade, which means higher volumes of food moving through processing, logistics and retail chains. Each additional tonne of processed food typically requires multilayer films, coated metal, or laminated cartons that rely on polyurethane and polyester chemistries where 3-MPD can be a building block.

- The world is struggling with food loss and waste, which puts pressure on producers to improve packaging performance. FAO and the World Bank note that roughly one-third of food produced for human consumption is lost or wasted, equivalent to about 1.3 billion tonnes every year. UNEP’s Food Waste Index 2024 further estimates that in 2022 about 1.05 billion tonnes of food – roughly 19% of food available to consumers – was wasted at retail, food service and household level.

Regulation on food-contact materials is another strong push factor. In the European Union, Framework Regulation (EC) 1935/2004 and Commission Regulation (EU) 10/2011 set strict rules for plastics and coatings that contact food, requiring that materials do not transfer substances in amounts harmful to health or alter taste and composition. For adhesives and polyurethane systems specifically, industry guidance from the American Chemistry Council lays out how food-contact polyurethanes should meet these regulations.

Restraints

Strict Food-Safety Rules and Chemical Scrutiny Limit 3-MPD Growth

A major restraint for 3-Methyl-1,5-Pentanediol (3-MPD) is the rising global pressure on food safety and, with it, extremely cautious regulation of food-contact chemicals. Brand owners like the performance of 3-MPD in coatings, inks and adhesives for packaging, but every new monomer now sits under the same harsh spotlight as more famous chemicals such as bisphenols or phthalates. That makes companies think twice before switching to, or scaling up, any relatively new building block.

- The World Health Organization estimates that around 600 million people – almost 1 in 10 – fall ill every year after eating contaminated food, leading to about 420,000 deaths and the loss of 33 million healthy life years. In low- and middle-income economies, unsafe food also causes roughly US$110 billion per year in productivity losses and medical costs. With this kind of human and economic impact, regulators are under strong political pressure to minimise any extra chemical risk, even if a substance like 3-MPD is only used in tiny amounts in a coating layer.

Food-contact materials are now managed with very conservative toxicology benchmarks. A good example is bisphenol A, not because it competes directly with 3-MPD, but because it shows how fast safety lines can move. In 2023, the European Food Safety Authority cut the tolerable daily intake for BPA to 0.2 nanograms per kg body weight per day, a 20,000-fold reduction from the temporary value set in 2015. When one high-profile substance is tightened like this, authorities and NGOs become much more critical of all monomers and additives in plastics and coatings, including lesser-known diols.

Food recalls constantly remind the industry how costly any contamination issue can be. A recent analysis of over 35,000 food and beverage recalls handled by the U.S. FDA between 2002 and 2023 found that 91% were triggered by product contaminants such as allergens, microbes, chemicals or foreign objects, while only 9% were due to processing issues. Chemical contamination is grouped alongside the most serious causes and is often linked to Class I recalls. That reality makes brand owners very conservative: they prefer familiar chemistries with long safety histories, which slows down wider adoption of newer molecules like 3-MPD in food-packaging applications.

Opportunity

Low-Waste, Low-Plastic Food Systems as a Big Opening for 3-MPD

One of the clearest growth opportunities for 3-Methyl-1,5-Pentanediol (3-MPD) sits at the intersection of food security, waste reduction and sustainable packaging. 3-MPD is already used in polyurethanes, coatings and adhesives, where its branched structure brings softness, transparency and good compatibility to films and laminates used around food. As food systems expand and modernise, demand grows for these high-performance, food-contact materials.

Global food demand keeps rising, especially for processed and packaged products. The OECD-FAO Agricultural Outlook projects that global food consumption in calories will increase by about 1.3% per year over the coming decade. At the same time, the value of global food and agricultural trade reached USD 1.9 trillion in 2023, reflecting long, complex supply chains that rely heavily on robust packaging. This steady growth in traded and processed food quietly enlarges the addressable base for 3-MPD-modified resins.

At the same time, the world is waking up to how much food is being thrown away. UNEP’s Food Waste Index 2024 shows that in 2022 the world wasted about 1.05 billion tonnes of food at household, retail and food-service level, around 19% of all food available to consumers. UN Climate Change estimates that food loss and waste account for 8–10% of global greenhouse-gas emissions and cost roughly USD 1 trillion a year.

Packaging itself is under heavy scrutiny. A UNEP/UN life-cycle report notes that packaging accounted for about 31% of global plastics use in 2019, with plastic dominating rigid and flexible food packaging formats. UNEP also highlights that annual plastics production and waste roughly doubled between 2000 and 2019 and could triple by 2060 on a business-as-usual path. In this environment, food brands are searching for coatings and adhesives that enable thinner layers, longer shelf life, and easier recycling. 3-MPD-based polyurethanes, which improve flexibility and transparency while maintaining strength, fit well with this redesign work.

Regional Insights

Asia Pacific leads with a 43.80% share, accounting for 31.5 Mn in 2024

In 2024, Asia Pacific (APAC) held a commanding position in the 3-Methyl-1,5-pentanediol market, registering a 43.80% share and representing approximately 31.5 million in market value; this dominance was underpinned by dense upstream chemical capacity and large, diversified downstream demand from polyurethane, coatings and adhesive manufacturers. Regional feedstock availability and lower per-unit production costs supported competitive pricing, while rapid expansion in automotive, construction and consumer-goods manufacturing drove steady off-take—particularly for polyurethanes where the diol is used to improve flexibility and hydrolysis resistance.

China, India and several Southeast Asian economies were principal consumption centers, with capacity additions and debottlenecking projects announced during the period that improved local supply security and reduced reliance on imports. Export flows from major APAC producers into neighboring markets were noted, enabling scale efficiencies and reinforcing the region’s role as a net supplier of specialty polyols and intermediates.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

LGC Limited is positioned as a specialist provider of high-purity chemical intermediates and reference materials that support niche segments of the 3-methyl-1,5-pentanediol value chain. Manufacturing and quality-control capabilities are leveraged to supply consistent, application-grade polyols for polyurethane and specialty polymer formulators. Technical support and batch traceability are emphasized to meet regulatory and performance requirements. Supply relationships with converters and targeted investments in analytical capacity have been used to sustain market presence and to support gradual product-line extension into higher-margin grades.

Kuraray India operates as a regional affiliate of a global specialty chemicals group, and its local manufacturing footprint is used to serve polymer, adhesive and elastomer customers with reliable material supply. Emphasis is placed on process reliability, regulatory compliance and customer application support to enable formulation development using 3-methyl-1,5-pentanediol derivatives. Close alignment with regional converters and aftermarket channels has been pursued to optimize logistics and reduce lead times. Incremental capacity planning and collaboration on product specifications have underpinned sustained commercial engagement in the APAC market.

Top Key Players Outlook

- LGC Limited

- KURARAY INDIA., LTD

- Others

Recent Industry Developments

In 2024, LGC supported the 3-Methyl-1,5-pentanediol value chain by offering high-purity grades and certified reference materials used by laboratories and specialty formulators; its product listings show the compound is available as a controlled, application-grade material for analytical and small-batch uses. The group’s full-year financials—total revenue £716.5m and strong operating cash flow of £152.8m—provided capacity to invest in analytical and synthetic chemistry capabilities that underpin reliable supply of niche intermediates. Cash holdings of £71.4m strengthened liquidity and enabled continued focus on quality, traceability and customer technical support in 2024.

In 2024, Kuraray India supplied specialty polyols and high-purity intermediates that supported niche demand for 3-methyl-1,5-pentanediol in polyurethane and technical polymer formulations; the company’s local manufacturing and technical support were used to shorten lead times for converters and formulators, improving responsiveness for small-batch and higher-purity orders. Operational focus was placed on quality control and regulatory compliance to serve automotive and industrial customers, while reported FY2024 revenue of INR 165.00 crore underpinned modest reinvestment in application support and supply-chain reliability.

Report Scope

Report Features Description Market Value (2024) USD 72.1 Mn Forecast Revenue (2034) USD 132.8 Mn CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Solid), By Application (Polyurethanes, Solvents, Acrylate Monomer, Polyester, UV monomer, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape LGC Limited, KURARAY INDIA., LTD, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  3-Methyl-1, 5-Pentanediol MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

3-Methyl-1, 5-Pentanediol MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- LGC Limited

- KURARAY INDIA., LTD

- Others